With the constant inflation of BTO flats with every new release from HDB, young people like myself get more hard-pressed and wish that we could turn back time and submit those application forms much earlier in our lives.

I will always be eternally envious of my peers who got their BTO when they were 19, and got their keys before they turned 25. The same group are having children, paying much smaller mortgages, and truly living the Singaporean dream.

It always pays to be part of the early market (or so it seems). And with positive stories of young people BTO-ing earlier, youngsters today started playing the housing lottery as soon as they could in hopes of reaping the same benefits.

Especially with the new policy of allowing only 2.5% initial downpayments (if you take an HDB loan), more young adults are incentivised to submit their applications early as it is now an even lower commitment and risk. But with the moving market, the constant change of housing policies, and the variables of being in our prime, should we actually BTO early or wait till later?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The alleged benefits of getting early BTOs

Flipping BTOs for profit or upgrades is a well-known hustle in Singapore. With the resale flat market exploding post-COVID, it is not uncommon for those who have met their MOP to sell their flats and move to condos or bigger resales.

Many real estate ‘advisors’ have been urging homeowners to sell their flats due to the upcoming salary cap for potential resale buyers, with ads containing sweeping statements like “The end is near!!” starting to target me on Facebook.

If you’re not the house-flipping type, just the alleged difference in mortgage payments was thought to be a huge incentive in itself. The misconception is that the earlier you buy, the “cheaper” the BTO prices. But 99.co has shown that prices of BTOs did remain quite stable (depending on location) in the last few years of releases.

Another common assumed benefit of early BTOs was thought to be bigger spaces. As the need for space becomes more pressing, many of the young population have expressed concerns about the upcoming downsizing compared to their childhood home.

This has been debunked in our previous article. We’re likely biased as we’re comparing the sizes from literally our parents’ generation over 2 decades ago, so it’s not an objective take. BTO sizing has been relatively standardised in the last few years, so BTO-ing a few years earlier wouldn’t translate to getting larger homes directly.

What’s going to change in the future

Flipping properties in the future would become a tougher endeavour with the upcoming policy HDB is planning to roll out: The future introduction of a salary cap for Plus and Prime resale flats.

When this policy makes its debut, it’ll restrict some resale market buyers to two main groups: A middle-class population who wouldn’t be able to afford overly high resale prices in sought-after locations, or those who are downsizing their lifestyle due to retirement or job changes.

There is already a lot of speculation in the market, and many property agents are encouraging homeowners to sell their HDB and upgrade to a condo before such a policy comes to fruition and the benefits of selling a resale flat at uncapped prices can’t be reaped anymore.

It would be interesting to see how this would domino effect into the private property market when it happens. If rolled out, this policy is likely to make the overall property market less liquid and it would affect prices and affordability of luxury developments down the line. Which brings me to my next point…

The importance of financial readiness

Everything said and done, whether you should apply for your BTO is a very personal decision that you should make being very informed about your financial health. If you are not financially ready, applying for a BTO flat because of the low down payment is a very bad idea.

I will flesh out other risks a bit later in the article. But first, let’s talk about the economics of housing purchases.

In an ideal world, you and your future spouse will have to constantly bring in a fixed income to comfortably pay off the mortgage each month on top of having living expenses for the next 25 years (assuming you took the full loan tenure). That is a freakishly long time if you think about it, just right before our retirement age.

A lower down payment means a higher loan capital to pay off and higher interest compounding, and that will result in higher monthly mortgage payments overall. If you are in a situation where you just make barely enough to cover the mortgage and have modest savings, your retirement would be at risk with improper planning.

The biggest risk, however, is making the downpayment at the start to “lock in” your HDB only to find yourself short of the remaining amount at key collection. Even if you can manage to make that downpayment, your income might not be enough if the mortgage payments are high.

Notice how there is a lot of speculation in my overall explanation. So let’s run the numbers to compare a young couple buying the flat early with less down payment, vs. a slightly older couple buying a flat later in life with more cash on hand.

For a simpler comparison, let’s just use the median price for BTO releases of 3-room units in Kallang/Whampoa. We’ll look at a case where a couple buys in their early 20s vs someone in their late 20s who has more money for the downpayment.

| Using HDB Loan | Couple in early 20s | Couple in late 20s |

| Flat price (median) | $420,000 | $420,000 |

| Down payment on hand | 20% | 40% |

| Down Payment | $84,000 | $168,000 |

| Monthly mortgage (HDB Loan) from key collection | $1,524 | $1,143 |

| Total interest paid | $121,299 | $90,974 |

| Difference in interest payments | $30,325 | |

Perhaps this is because Kallang/Whampoa is already an expensive area, but I was pleasantly surprised to see that there wasn’t much disparity in the BTO price range even with the gap. But we’ve already established that BTO prices have been quite constant in the last decade.

Anyway, down to the actual analysis, you can see that one of the consequences of buying earlier means forking out the bare minimum downpayment of 20% by key collection and that results in higher monthly mortgage payments and an overall higher total interest payment.

When you make a purchase later, you should have more savings to stuff into the downpayment pool (I did a forecast with 40%), which effectively lowers your loan amount and thus results in a lower monthly mortgage and lesser overall interest payments.

It is important to note that with this projection, the couple that committed more would only save $30.3k in interest despite putting down $84k more in down payments. So at this point, it’s important to ask yourself what you value more, a lower monthly downpayment per month, or more money on hand so you can spend it on renovations or use it to kick-start your investing journey.

And so, from the projection alone, I cannot tell you what’s better. You need to think about what makes the most sense for your situation.

This is where sentiments start coming in. Which we will get to later.

The new SDS Program

The Staggered Downpayment Scheme (SDS for short) is a scheme designed to make it easier for people to afford a BTO by reducing the high upfront capital requirement to book a flat. The most recent change to the policy targets young couples such as those who are still studying and do not have the savings for a downpayment.

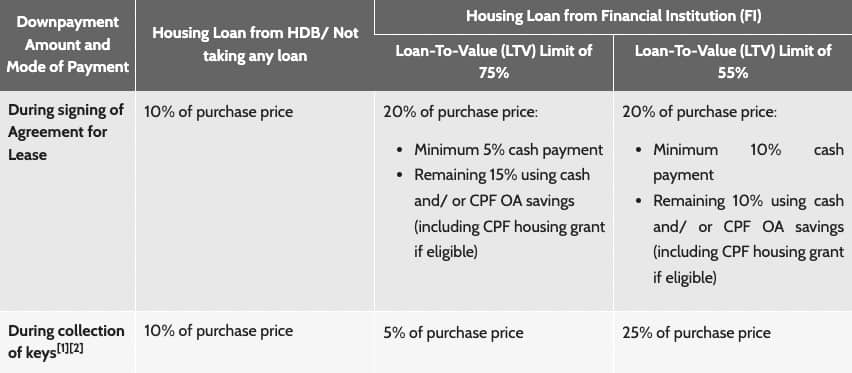

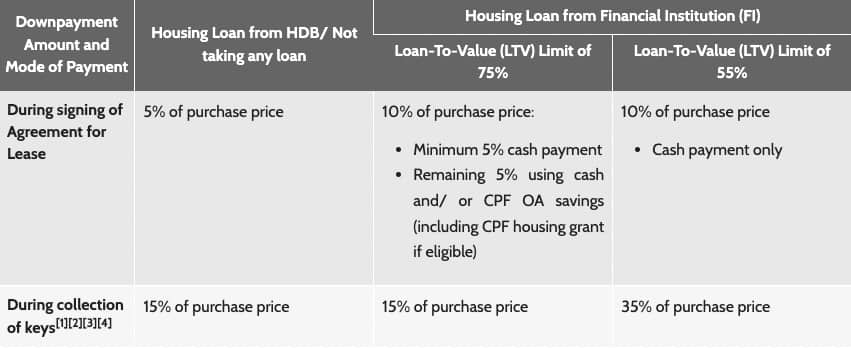

Without the SDS, if you are taking a loan from HDB, you’ll need to put up 10% of the purchase price during the signing of the Agreement for Lease with HDB and another 10% upon key collection.

With the SDS, you’ll only have to put up 5% of the purchase price (bank loan) and 15% upon key collection.

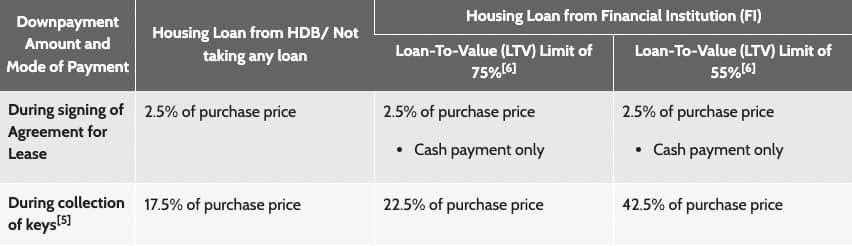

The latest enhancement to the SDS allows young couples eligible for deferred income assessment to pay just 2.5% of the purchase price at the Agreement for Lease signing, and the remaining 17.5% upon key collection!

In all 3 cases, the downpayment is still 20% with an HDB loan at key collection – but the enhanced SDS lets those without an income put up just 2.5% when booking the flat. For a $420,000 flat, this is just $10,500.

Anyway, back to the topic: let’s run the numbers for couples who decide to purchase the same 3-room BTO with the new minimum down payment requirement vs the higher down payment requirement.

In this example, we’ll use an HDB loan which is probably the best loan to take as a young couple without much of an income (not to mention today’s interest rate environment).

| Using Bank Loan | Couple buying with the enhanced SDS | Couple buying without SDS |

| Flat price (median) | 420,000 | 420,000 |

| Down payment on hand | 2.5% | 10% |

| Down Payment | $10,500 | $42,000 |

| Remaining Amount | $73,500 | $42,000 |

| Amount to save over 4 years per month | $1,531 | $700 |

| Monthly mortgage (25-year loan, 2.6%) from key collection | $1,524 | $1,524 |

| Total interest paid | $121,299 | $121,299 |

Since the downpayment is still 20% at key collection, there is no difference in the monthly mortgage or interest paid in the 25-year loan.

Rather, the shocking difference is the amount this young couple is expected to save over a 4-year period (4 years since that’s about the time it takes for a BTO to be completed).

Depending on your financial situation, this new policy might become a liability to you, especially if you’re not in a high-earning category. With this example, a couple would need to save around $1,500 a month together before key collection to make the cut.

This would be doable with CPF contributions from both parties, but you can imagine how it could become financially stressful if one of you becomes temporarily unemployed or if something bad happens.

Worst still is the couple who is still studying. Perhaps it’s another 2 years to graduate, then 2 years to work. In these 4 years, the couple has to save close to $750 per month each just to put the downpayment when it’s time to move in.

And these funds are best scurried away in a low-risk instrument like a savings account or government bonds since they cannot afford to put the capital at risk, resulting in low-interest earnings.

If the young couple applied for the income to be deferred (since they’re still studying), it may not be enough later on to cover the remaining amount, putting them in a tight spot even if they managed to save up the downpayment.

The approximate $800+ difference monthly between both the young and older couple might mean an inability to save less for things like emergency funds, renovation plans, and it can prevent luxuries like travelling. So it might not be an ideal lifestyle for some.

Does accessibility to a BTO flat improve with lower down payments? Yes.

Does that mean it might be a good idea to do it? Perhaps not.

All that said and done, there are also non-financial risks when it comes to getting a BTO flat early. I mentioned sentiment earlier in the article, but what I meant is that there are emotional and personal aspects to public housing purchases that should be addressed before actually committing together.

Betting on your relationship

Since BTOs are reliant on two people tying the knot, it is an understatement to say that you’re gambling on your lifelong relationship choice for the housing purchase. From a 2020 analysis, 3.1% of couples split up before getting their keys. While this might not be a huge number, anything that isn’t 100% means that there is always a risk.

It is also important to note that the long waiting time for BTO flats has been known to cause stress and put strains on a relationship. When you are a young couple with love that has not fully bloomed and matured yet, this is one of the first hard tests you’ll have to endure and overcome together.

Many turn to resale flats if they can afford it to avoid this, and I don’t blame this group. If money can solve the problem, money is the source of the problem in the first place.

So make sure that you both are financially and emotionally ready before you commit to this journey together. Remember, paying the penalty when you give up your flat, or worse, divorce after getting the flat, is far, far more expensive than the ‘savings’ you think you’ll have BTO-ing early.

Overseas careers & self-improvement

You’ll never know what the future holds, and that too goes for your career. While many Singaporeans will stay in our local nests, there are situations where overseas job opportunities will present themselves to a select few.

Having a BTO flat that you have mortgage payments on will make it very difficult for you to relocate to a new country, and you don’t want to be in a situation where you miss out on a once-in-a-lifetime chance because of commitments you chose to take on in your youth.

I’ve known many young Singaporeans who gave up their overseas opportunities because of their BTO flat, which became a blow to their careers down the line. You do not need to go overseas to have a successful career, that much is clear, but it is in the dreams of many young Singaporeans to attain that limited-edition achievement.

Singaporeans are also big practitioners of self-improvement, with many of us doing part-time universities to further our education. Many of my peers would not have been able to afford further education if they had gotten their BTO flats earlier. The pursuit of knowledge is arguably an important step to self-improvement and career advancement, so young couples will also have to choose wisely which comes first.

Could have gotten a better location if you waited

“Eh, where you going to BTO ah?”

Heard this conversation starter before? I bet so.

Location, location, location… Whilst Singapore is small, there are prime locations that are sought-after ideals by the younger population. The reality is that those who BTO-ed earlier picked their locations based on affordability and housing grants instead of those ideals.

Which is financially smart, don’t get me wrong. Don’t feel bad if you did that because you did good.

But when you are older, you’ll be equipped with more developed careers and much better salaries (that hopefully doesn’t hit the cap). You’ll essentially have more money, and that means you can go baller and pick prime districts like Toa Payoh, Bishan, and Kallang/Whampoa.

You wouldn’t have to live in a developing estate that needs time to mature and is far from the city centre.

If location is important to you lifestyle-wise, it would be wise to wait a little longer so you can afford better.

With that, this article comes to its close. There is a magnitude of considerations before jumping into BTO applications; I am well aware that actually successfully balloting for a unit is a struggle in itself, which pushes young couples to jump in and apply earlier to “test their luck”, but it would overall just be wiser to focus on building your downpayment pool and investing in yourself instead of spending time (and money) playing the housing lottery.

When you plan your finances right, you’ll have more choices available to you down the line. My peers (we’re in our late twenties now) have much higher budgets now than when we were still in our entry-level jobs, and many managed to get their BTOs in dream locations or even resale flats due to their improved financial situation.

At the end of the day, it’s all about personal planning. We’ve crunched the general numbers, but you should crunch your personal numbers and have a serious talk with your partner to see what makes sense for you.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Melody Koh

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments