How Bad Is The Price Gap Between New Launch And Resale Condos? An Analysis of 13 OCR Districts (Part 1)

February 19, 2021

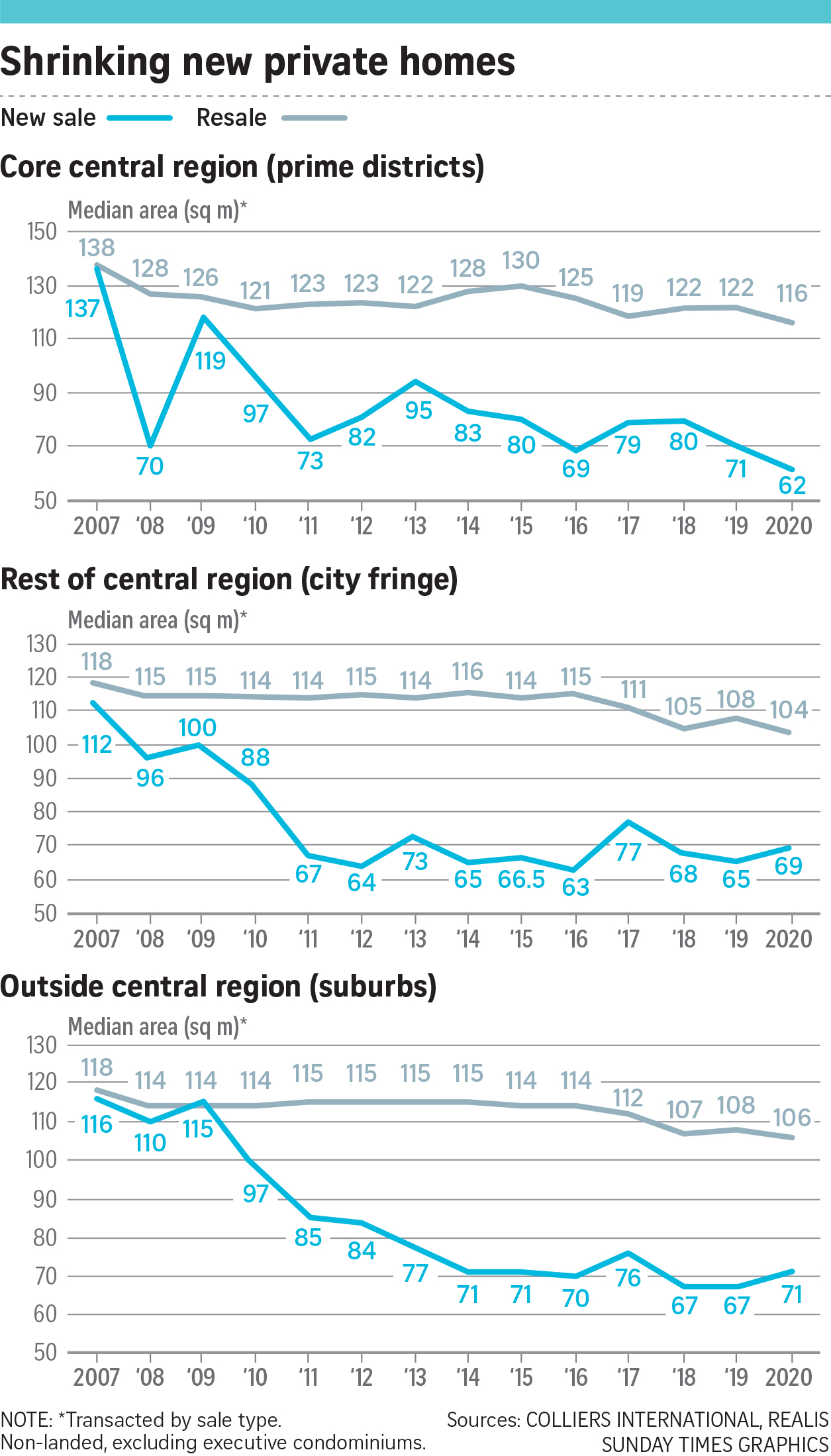

“Price gap between new and resale units in this region (OCR) stands at 47%, widest in 25 years”

With such a statistic, there’s only going to be two trains of thoughts here. One, new launches are overpriced. Or two, resale units are undervalued.

The truth is, comparing new launch and resale prices on a psf basis isn’t always the most accurate way of looking at things (we’ve done that before) – mainly because it does not take actual affordability into account.

Let me illustrate.

For example, let’s say District 5 has an average psf of $1,000 for new launch, and resale condos are at $500, this would mean that the price gap between the two is at $500, or 50%.

In an ideal scenario, all homes (whether it is a new launch or resale) start from the same size level playing field. But we know that’s not truly the case in reality as generally older resale condos are of a bigger size.

Case in point:

Going back to our example of District 5, a 2 bedroom unit at an older resale condo at a size of 1,000 square feet will be priced at $500,000, while a new launch at 700 square feet would be priced at $700,000. So yes, while there is still a price gap, it isn’t nearly as wide as the 50% gap if you were to compare it by psf.

So in that vein, we wanted to see more accurately if the price gap in these OCR districts are really as reported – from an overall quantum perspective.

The key thing to note is that the disparity is wider in some districts than others; and where the gap is significant, it may be possible to conclude that a resale condo is simply the rational choice (from an investment perspective). We’ve compiled the following, to show you which districts show the bigger price gap between new and resale.

As usual, here was our methodology for gathering the data.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Methodology to determine bedroom sizes (resale)

Resale – Using rental data from URA, we first filtered those with no ambiguity in sizes – that is, based on rental transactions over the last 5 years, a particular unit size had a consistent number of bedrooms recorded.

For those with the same unit sizes and differing bedroom counts, most were x bedrooms + study, as such, some were counted as 2 or 3 bedrooms if it were a 2-bedroom study unit. To improve efficiency, we determined the proportion of bedrooms-to-size and sorted it from the highest proportion first and used that figure to determine the number of bedrooms for that unit size in the development.

Units without any information in bedroom sizes were excluded.

Methodology to determine bedroom sizes (new launch)

We referred to the floor plans and unit size distribution for each new launch unit to determine the number of bedrooms. Those with +study are treated without the study, so a 2-bedroom + study unit falls under 2-bedroom. Penthouses were excluded from the study.

Transaction data used: January 2019 – December 2020. Sub sale transactions were excluded.

As only OCR is considered here, all transactions within “Central Region” were also excluded.

13 Districts and their quantum price gaps:

- District 5 (Buona Vista, Pasir Panjang)

- District 14 (Geylang, Paya Lebar)

- District 15 (Katong, Marine Parade)

- District 16 (Bedok)

- District 17 (Changi, Loyang)

- District 18 (Tampines, Simei, Pasir Ris)

- District 19 (Punggol, Sengkang)

- District 20 (Bishan, Ang Mo Kio)

- District 21 (Upper Bukit Timah, Clementi Park, Ulu Pandan)

- District 23 (Hillview, Dairy Farm, Bukit Panjang, Choa Chu Kang)

- District 26 (Mandai, Upper Thomson)

- District 27 (Sembawang)

- District 28 (Seletar)

In order to prevent things from getting too lengthy, I have decided to split the article into two and will be showcasing the first 7 districts here today.

1. District 5 (Buona Vista, Pasir Panjang)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $861,655 | $760,327 | 527 | 536 | $1,632 | $1,426 | 6 Years | 13% | 14% |

| 2 | $1,189,621 | $1,087,508 | 742 | 941 | $1,601 | $1,165 | 14 Years | 9% | 37% |

| 3 | $1,545,286 | $1,487,654 | 991 | 1307 | $1,561 | $1,149 | 14 Years | 4% | 36% |

| 4 | $1,994,168 | $1,884,568 | 1314 | 1639 | $1,516 | $1,172 | 11 Years | 6% | 29% |

| 5 | $2,441,128 | $2,827,500 | 1626 | 2255 | $1,495 | $1,253 | 12 Years | -14% | 19% |

Notable factors:

District 5 has become a property hotspot, mainly thanks to the presence of the One-North tech and media hub. This area includes Fusionopolis, Biopolis, the A Star Research Labs, and the presence of ST Engineering and start-ups at the JTC LaunchPad.

In addition to this, a number of educational institutes, such as INSEAD, are also in this area. All of this has led to growing demand for accommodation, particularly among foreign workers in the tech sector.

Up until recently however, there haven’t been many residential options in the One-North area; One-North Residences was the only one, with many tenants choosing to live in the Buona Vista area.

This has recently been remedied with the emergence of two new developments: the first is the Normanton Park mega-project, which was one of the top-selling developments this year (this project alone accounted for 600 transactions in January 2021); the second is the smaller One-North Eden.

Given the combination of high demand and limited supply (up till now), developers knew there wouldn’t be an issue moving units here. That said, we’re not sure if the price gap will continue to widen over the next few years, given that Normanton Park with its 1,800+ units has significantly raised supply.

Aside from the 1 bedroom units here, you can see that the psf price gap isn’t the most accurate representation of the prices in the district. In actual fact, that gap is actually quite small when it comes to the 2, 3, and 4 bedroom units. For those thinking that 5 bedroom new launch units are the ones to go for here, do bear in mind that we only had 2 resale transactions to go by here (Carabelle and The Parc Condominium), so some would say that is too small a sample size to rely on. But you can see from the average size of these units (2,255 sqft) versus the average 1,626 sqft of the new launch how much that size disparity comes into play here.

2. District 14 (Geylang, Paya Lebar)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $913,670 | $657,068 | 467 | 512 | $1,952 | $1,293 | 7 Years | 39% | 51% |

| 2 | $1,294,655 | $921,365 | 687 | 823 | $1,893 | $1,134 | 12 Years | 41% | 67% |

| 3 | $1,560,681 | $1,258,141 | 922 | 1218 | $1,696 | $1,037 | 16 Years | 24% | 64% |

| 4 | $1,911,228 | $2,097,926 | 1149 | 2106 | $1,658 | $1,012 | 28 Years | -9% | 64% |

It’s not surprising to see District 14 on the list, given that it’s one of the most transformed areas in Singapore. Paya Lebar Quarter (PLQ) is one of the newest business hubs in Singapore; it is also one of the most desirable, as it straddles both central Singapore and the island’s east-end.

PLQ includes several new malls, such as the revamped SingPost Centre and Paya Lebar Square, and about one million square feet of Grade A office space.

One of the highlight developments in 2020 was Parc Esta, which is located just across the road from Eunos MRT station. As mentioned in our review, the developer capitalised on the proximity to Paya Lebar MRT (one train stop away) to good effect.

Penrose also launched in District 14 last year. This development held strong investor attention from the start, and also capitalised on proximity to Paya Lebar. Meanwhile The Antares, located close to Mattar MRT station, was seen as a possible alternative by some investors; there was a lot of buzz about its one-bedder units, some of which started from under $800,000 – a good deal for a city fringe condo.

Besides the number of strong new launches, do note there are condos in the less-polished areas of Geylang that are not easy sales (it’s difficult to get financing in or close to the red-light areas). These could pull down the average resale price for the district, and make for stark contrast between themselves and the new D14 arrivals.

Ultimately, what most people would be drawn here to is that high price gap (both psf and quantum) for 1 bedroom units in District 14. But that can be reasonably explained as the resale condos in the area with 1 bedroom units are still considered relatively new, with an average age of just 7 years. That and the average sizes between both being quite similar is quite congruent with the large price gap.

It is the same story with the 4 bedroom units here, where the psf price gap really shows how wide of the mark it can be as the quantum price gap is the complete opposite result. This too can be easily explained with the fact that average resale sizes are at 2,106 sqft, as compared to a new launch of 1,149 sqft – that’s nearly double! Undoubtedly, the age of the resale plays a part here too, as these are the oldest on this list at an average of 28 years.

Property Picks16 Condos Within 1km Of Popular Primary Schools In The East ($1.5 million Budget)

by Matthew Kwan3. District 15 (Katong, Marine Parade)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $1,054,657 | $697,172 | 554 | 505 | $1,904 | $1,392 | 10 Years | 51% | 37% |

| 2 | $1,359,096 | $1,122,044 | 697 | 948 | $1,930 | $1,205 | 17 Years | 21% | 60% |

| 3 | $2,143,420 | $1,511,421 | 1147 | 1287 | $1,872 | $1,192 | 19 Years | 42% | 57% |

| 4 | $2,626,049 | $2,129,220 | 1386 | 1862 | $1,863 | $1,167 | 19 Years | 23% | 60% |

The widening price gap in District 15 only partly due to the launch of recent luxury offerings. Meyer Mansion comes to mind, along with the Peranakan-inspired Nyon.

However, there’s been quite a lead-up to the present; the price gap was already becoming noticeable with new launches starting from 2018. Since that time, Amber Park, Amber 45, Coastline Residences, Meyer House, etc. have all contributed to mounting new launch prices; the most recent addition being Liv@MB (formerly Katong Park Towers). New condo prices are rising for projects in the range of the East Coast Road stretch from Katong to Joo Chiat, which has become increasingly gentrified.

In particular, the area around Meyer Road is a low-density housing enclave, known for its exclusivity. Many of the existing developments here are older, dating back to the 1990’s – coupled with the arrival of luxury condos like Meyer Mansion or Meyer House, and you can probably see why there’s a growing price gap.

It’s also from here that you can see just how much that extra size factors into the price gap at District 15. Take the 1 bedroom for example, the average new launch size at 554 sqft is even bigger than the average resale size of 504 sqft. Couple that with the fact that the new launch psf is higher and you can easily see why that quantum price gap of 51% is as such.

4. District 16 (Bedok)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 2 | $894,000 | $1,034,132 | 549 | 951 | $1,629 | $1,097 | 18 Years | -14% | 48% |

| 4 | $1,915,868 | $1,815,007 | 1244 | 1611 | $1,539 | $1,135 | 16 Years | 6% | 36% |

| 5 | $2,231,999 | $2,450,000 | 1453 | 2540 | $1,536 | $964 | 6 Years | -9% | 59% |

Grandeur Park Residences, which launched in 2017, finished its last few sales in 2019 to 2020. Grandeur Park Residences is close to the Tanah Merah MRT station; this is ideal for investors looking to capture tenants working at Changi airport, or Changi Business City.

An important change is the sale of a land plot along Tanah Merah Kechil road. This upcoming development will also introduce some much-needed retail amenities in the area; and it’s almost certain to be priced significantly higher than the older surrounding condos (much like Grandeur Park Residences was).

But while being near the Tanah Merah MRT station improves rentability, the growing price gap may give some buyers pause. There are already plenty of condos close to Tanah Merah MRT (see the above linked article); and we feel investors may start looking at resale options, given the price difference.

There’s also the fact that the aviation industry is worst-hit by Covid-19, which could mean a diminished tenant pool.

Back to the data, District 16 is definitely one of the prime examples that does not show the full picture if you were to look at the psf price gap alone. Of course, one could point out that this is based on the only new launch in the area – Grandeur Park Residences, but perhaps it does go to show that it was priced quite well.

Like the others, a big component of it is due to the difference in sizes. Especially for the 2 bedroom units, where the average resale condo in District 16 comes in at 951 sqft, as compared to the 549 sqft new launch unit. Admittedly, there was only 1 new sale transaction to compare to – most 2 bedroom units should actually be bigger.

You can see that same gap in the 5 bedroom units, where the average resale is sized at 2,540 sqft, in comparison to the 1,453 sqft new launch unit. But perhaps what’s most surprising here is the relatively new age of the resale condos at 6 years.

5. District 17 (Changi, Loyang)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $716,690 | $547,566 | 499 | 510 | $1,436 | $1,082 | 8 Years | 31% | 33% |

| 2 | $975,482 | $844,435 | 690 | 961 | $1,410 | $889 | 14 Years | 16% | 59% |

| 3 | $1,306,415 | $1,135,317 | 966 | 1377 | $1,349 | $838 | 15 Years | 15% | 61% |

| 4 | $1,854,300 | $1,381,282 | 1334 | 1585 | $1,387 | $875 | 11 Years | 34% | 59% |

District 17 saw the price gap widen on the back of two notable projects. The first was The Jovell, which saw a decent pick-up in sales (the take-up rate was only 25.7 per cent in December 2019, but was at 42.8 per cent by December 2020).

At the time of its launch in around 2018, The Jovell was the first condos in over five years in the Flora Drive area; the (few) nearby developments tend to be much older. As such, the price gap is not surprising.

Parc Komo is also in District 17, and had already sold out around half its 276 units by December 2020. Parc Komo is mixed-use and introduces a retail element, which has been lacking in its immediate neighbourhood; this helps to justify a much higher price point than existing resale projects. That said, Parc Komo is still one of the most competitively priced freehold condos in Singapore.

So when it comes to the price gap, there is quite a stark difference when it comes to the data. When it comes to the 2 and 3 bedroom units, the quantum and psf price gap varies greatly mainly because of the difference in sizes between the new sales and the resale condos. It ties in too with the average older resale age of 14 and 15 years respectively.

6. District 18 (Tampines, Simei, Pasir Ris)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $662,130 | $606,796 | 464 | 501 | $1,428 | $1,216 | 5 Years | 9% | 17% |

| 2 | $892,951 | $845,509 | 638 | 866 | $1,400 | $988 | 10 Years | 6% | 42% |

| 3 | $1,268,129 | $1,093,576 | 970 | 1205 | $1,307 | $918 | 11 Years | 16% | 42% |

| 4 | $1,678,859 | $1,393,765 | 1286 | 1470 | $1,306 | $960 | 10 Years | 20% | 36% |

| 5 | $2,083,110 | $1,974,767 | 1725 | 2045 | $1,207 | $995 | 7 Years | 5% | 21% |

Fingers will likely point at The Ryse Residences, for driving up prices in the Pasir Ris Central area. The Ryse is an integrated development; it’s three minutes’ walk to the MRT station, and newer than many surrounding condos.

But remember that The Ryse follows right after Coco Palms as well. Coco Palms launched in 2014. Back then Coco Palms’ higher price point was also easy to justify; it’s within a six-minute walk of the MRT station, and was one of the best located condos in the neighbourhood.

So Pasir Ris has had two condos, back-to-back, that both crept closer to the MRT station; and the latest one has a retail component too. This is what likely widened the price gap with older counterparts.

As for the Tampines side of this district, the price gap takes little explanation. A slew of strong launches like Treasure at Tampines, The Tapestry, The Alps, The Santorini, etc. have all contributed to the disparity. While many of these date back to before 2020, note that they have a cumulative effect leading up to the current price disparity: each new launch tends to price itself higher than existing developments, so several consecutive new launches over the years can end up in a very large price gap. That said, there’s now an abundance of condo options in the Tampines area, so we’d expect the gap to narrow in the near to mid-term.

But if you look at the quantum price gap, it does again tell a different story as for all unit types it isn’t actually as high as the psf price gap. This is quite surprising too as the average resale age is quite low in comparison as well. You can see this too in the differences in sizes between the new launch and resale – the gap isn’t as big due to the newer age of the resale condos overall. So comparatively it is quite easy to pick out, the new launches for the 2 and 5 bedrooms in this district are pretty competitively priced.

7. District 19 (Punggol, Sengkang)

| # Bedrooms | New Sale Price (Quantum) | Resale Price (Quantum) | New Sale Size (sqft) | Resale Size (sqft) | New Sale ($PSF) | Resale ($PSF) | Resale Age (Average) | % Quantum Gap | % $PSF Gap |

| 1 | $767,600 | $650,975 | 503 | 492 | $1,530 | $1,344 | 7 Years | 18% | 14% |

| 2 | $1,053,989 | $988,591 | 679 | 879 | $1,553 | $1,154 | 9 Years | 7% | 35% |

| 3 | $1,399,704 | $1,258,336 | 960 | 1194 | $1,465 | $1,062 | 12 Years | 11% | 38% |

| 4 | $1,918,231 | $1,580,453 | 1261 | 1493 | $1,526 | $1,063 | 10 Years | 21% | 43% |

| 5 | $2,282,981 | $2,280,000 | 1628 | 1828 | $1,405 | $1,231 | 7 Years | 0% | 14% |

A slew of new projects in District 19, over the past three years, have pushed prices up significantly. Sengkang Grand Residences, The Florence Residences, Affinity at Serangoon, Riverfront Residences, The Lilium…and you can throw The OLA into the mix, if you want to consider ECs.

It’s a bit of shock to the system for District 19 which, if you’ll recall, has been considered a low-priced, affordable district for many years. The introduction of one new launch after another, coupled with the historically lower resale prices for this district, explains the growing price gap psf wise.

Looking at the 1 bedroom units, the new launch ones are understandably higher priced due to the overall bigger size and higher psf. What is surprising to see here is that the 2 and 5 bedroom units are again, quite competitively priced for the new launch units. And perhaps even more so given the relatively new age for the resale condos – especially for the 5 bedroom units at just 7 years. So despite the smaller size, you can see why a new 5 bedroom unit in District 19 would make more sense to buyers.

The significant price gap between new and resale units may simply be due to the number of recent launches

Around 60 new condo launches were seen in 2019, and about 42 are expected for 2020/21. These mostly stem from the en-bloc fever of 2017, which saw an unusually high number of collective sales. As each new launch sells out, developers become increasingly confident, and are more willing to price their projects higher.

The price gap will probably narrow as the slate of new launches runs out, and resale condo owners gradually raise their prices as well. But for now, buyers with an investment mindset may want to seriously compare some resale alternatives.

(If you’re just buying a home though, buy what’s comfortable. This is less of an issue to you, if you won’t be selling and chasing gains for a long time to come).

Either way, we hope this article has gone some way into helping you decide between a new launch and resale condo, and spotting some areas where a new launch or resale condo may make more sense in terms of its pricing.

You can follow us on Stacked for part 2, and for in-depth reviews of some of the condos mentioned above.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the current price gap between new and resale condos in the OCR region?

Why is comparing price per square foot not always an accurate way to evaluate condo prices?

How does the size difference between new and resale condos affect the perceived price gap?

Which districts show the biggest price gap between new and resale condos?

What factors contribute to the widening price gap in districts like 15?

How does the age of resale condos impact their prices compared to new units?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments