Will We See Million Dollar HDBs In Non-Mature Estates Soon? A Closer Look At The Narrowing Gap

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Amid the backdrop of rising HDB prices, one fact has begun to stand out: resale flats in non-mature estates have to “narrow the gap”. One of the transaction records for non-mature flats, in March 2021 was in Punggol; this was when a 5-room flat sold for $910,000. In fact, there have been 41 transactions in non-mature estates this year, that have gone beyond $800,000. Here’s a look at what’s going on:

| Town | Flat Type | Size | Model | Lease Commenced | Price |

| Punggol | 5 Room | 147 | Premium Apartment Loft | 2012 | $910,000 |

| Hougang | Executive | 138 | Apartment | 1997 | $892,888 |

| Choa Chu Kang | Executive | 182 | Premium Maisonette | 1998 | $890,000 |

| Hougang | Executive | 135 | Apartment | 1997 | $888,000 |

| Hougang | Executive | 146 | Maisonette | 1992 | $885,000 |

| Bukit Batok | Executive | 165 | Maisonette | 1997 | $880,000 |

| Hougang | Executive | 156 | Maisonette | 1992 | $880,000 |

| Bukit Batok | Executive | 165 | Maisonette | 1997 | $878,000 |

| Hougang | Executive | 148 | Maisonette | 1992 | $868,000 |

| Jurong East | Executive | 145 | Maisonette | 1998 | $868,000 |

| Yishun | Executive | 181 | Apartment | 1992 | $868,000 |

| Hougang | Executive | 135 | Apartment | 1997 | $865,000 |

| Yishun | Multi-Generation | 179 | Multi Generation | 1987 | $860,000 |

| Yishun | Multi-Generation | 171 | Multi Generation | 1987 | $860,000 |

| Hougang | 5 Room | 112 | DBSS | 2014 | $860,000 |

| Bukit Panjang | Executive | 125 | Premium Apartment | 2003 | $858,888 |

| Jurong East | Executive | 145 | Maisonette | 1998 | $850,000 |

| Hougang | Executive | 147 | Maisonette | 1992 | $850,000 |

| Bukit Panjang | Executive | 142 | Maisonette | 1999 | $850,000 |

| Bukit Batok | Executive | 149 | Apartment | 1995 | $838,888 |

| Woodlands | Executive | 174 | Apartment | 1995 | $835,000 |

| Jurong East | Executive | 143 | Apartment | 1998 | $832,000 |

| Jurong East | Executive | 142 | Maisonette | 2000 | $830,000 |

| Jurong East | Executive | 145 | Maisonette | 1998 | $828,000 |

| Yishun | Executive | 164 | Apartment | 1992 | $828,000 |

| Jurong East | Executive | 142 | Maisonette | 2000 | $826,000 |

| Bukit Panjang | Executive | 131 | Apartment | 2002 | $825,889 |

| Jurong East | Executive | 141 | Maisonette | 2000 | $825,100 |

| Woodlands | Executive | 189 | Apartment | 1994 | $822,888 |

| Hougang | Executive | 141 | Apartment | 1999 | $822,000 |

| Woodlands | Executive | 189 | Apartment | 1994 | $818,000 |

| Woodlands | Executive | 189 | Apartment | 1994 | $818,000 |

| Hougang | 5 Room | 142 | Model A-Maisonette | 1984 | $817,000 |

| Jurong East | Executive | 144 | Apartment | 1998 | $815,000 |

| Woodlands | Executive | 179 | Apartment | 1995 | $810,000 |

| Woodlands | Executive | 179 | Apartment | 1994 | $810,000 |

| Hougang | 5 Room | 115 | Premium Apartment | 2016 | $810,000 |

| Hougang | Executive | 142 | Apartment | 1997 | $810,000 |

| Woodlands | Executive | 189 | Apartment | 1994 | $810,000 |

| Hougang | Executive | 150 | Maisonette | 1984 | $805,000 |

| Hougang | Executive | 145 | Maisonette | 1988 | $805,000 |

The price gap between mature and non-mature estates

To get a sense of the price gap, we compared average flat prices in mature estates versus non-mature ones. We compared prices between Q1 2016, and Q1 2021.

The mature estates comprised:

- Ang Mo Kio

- Bedok

- Bishan

- Bukit Merah

- Bukit Timah

- Central Area

- Clementi

- Geylang

- Kallang / Whampoa

- Marine Parade

- Pasir Ris

- Queenstown

- Serangoon

- Tampines

- Toa Payoh

The non-mature estates were:

- Bukit Batok

- Bukit Panjang

- Choa Chu Kang

- Hougang

- Jurong East

- Jurong West

- Punggol

- Sembawang

- Sengkang

- Tengah (Note that Tengah has been omitted, as it’s a new town and there’s no transaction data)

- Woodlands

- Yishun

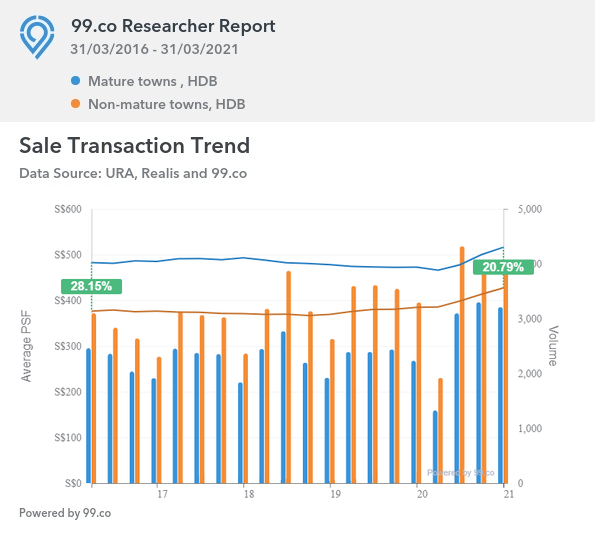

Overall gap in price per square foot

In Q1 2016, the average price for flat price (all sizes) was $482 psf in mature towns, and $376 psf in non-mature towns; a gap of about 28.1 per cent.

By Q1 2021, the average flat price for mature towns was at $516 psf, whereas non-mature towns averaged $427 psf. This is a gap of about 20.8 per cent, so non-mature estates have caught up.

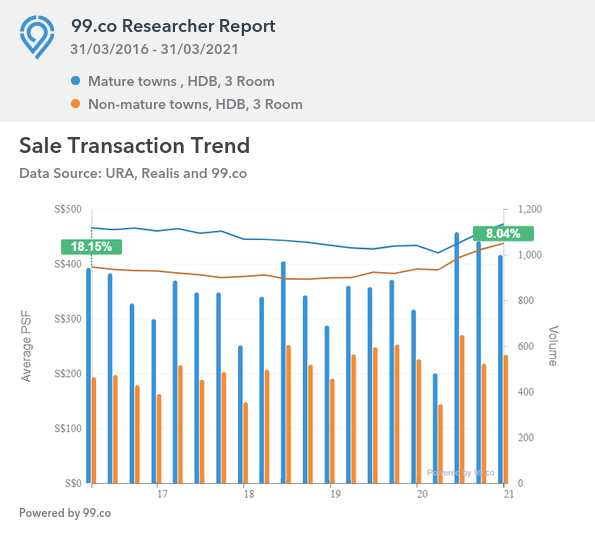

Price gap for 3-room flats:

3-room flats in mature estates averaged $465 in Q1 2016, while non-mature counterparts averaged $394 psf. This was a gap of about 18.1 per cent.

As of Q1 2021, 3-rooom flats in mature estates averaged $472 psf, while non-mature counterparts averaged $437 psf. This is a gap of about eight per cent.

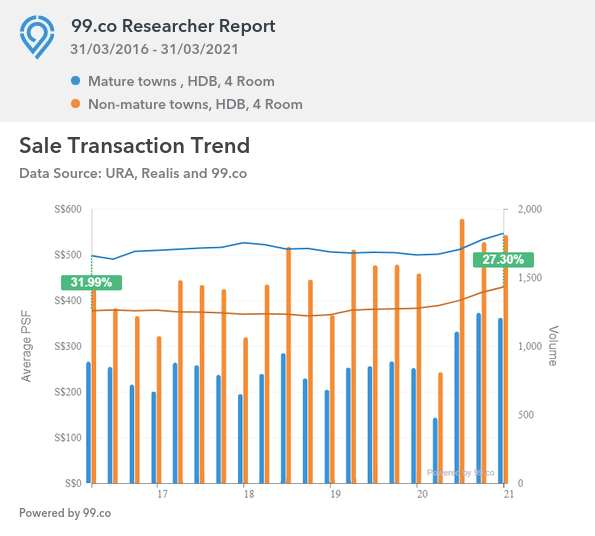

Price gap for 4-room flats:

4-room flats in mature estates averaged $497 in Q1 2016, while non-mature counterparts averaged $377 psf. This was a gap of about 32 per cent.

As of Q1 2021, 3-rooom flats in mature estates averaged $546 psf, while non-mature counterparts averaged $429 psf. This is a gap of about 27.3 per cent.

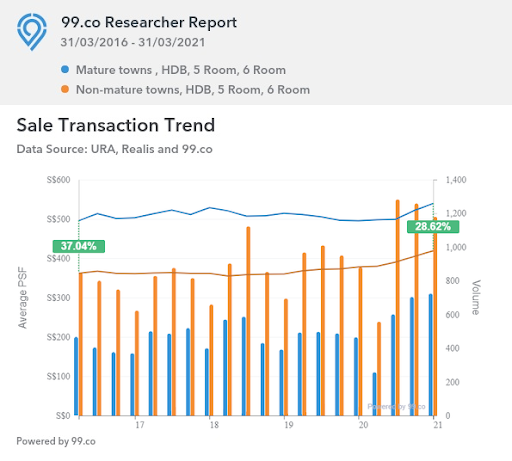

Price gap for 5-room flats:

5-room flats in mature estates averaged $496 in Q1 2016, while non-mature counterparts averaged $362 psf. This was a gap of about 37 per cent.

As of Q1 2021, 3-rooom flats in mature estates averaged $539 psf, while non-mature counterparts averaged $419 psf. This is a gap of about 28.6 per cent. Again, that gap between non-mature and mature estates has closed up.

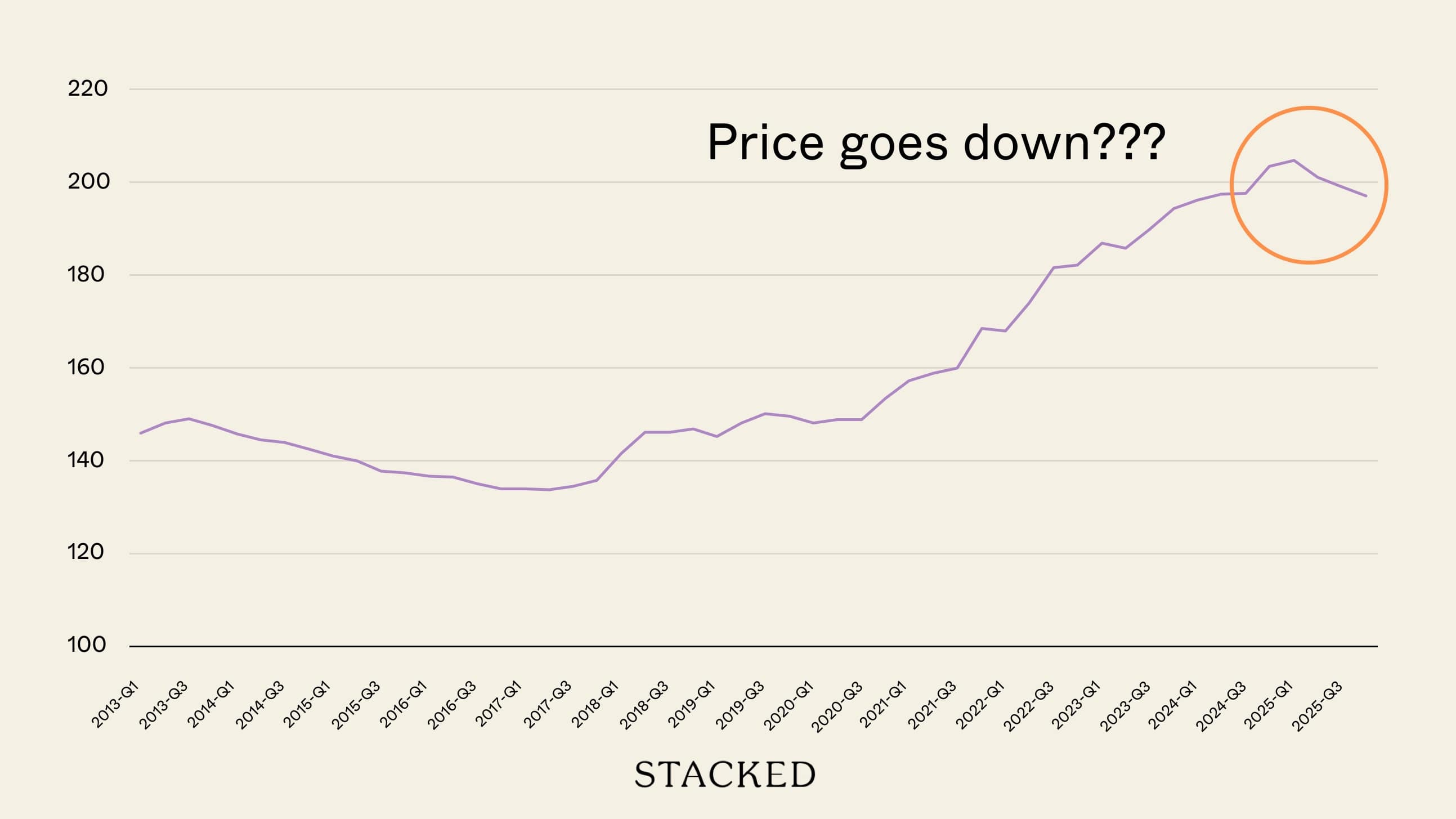

Speaking to realtors on the ground, the common consensus was that – although flat prices everywhere have been rising – it’s non-mature estates that have gained the most. One of them explained that:

“It’s not surprising there are, yet again, more million-dollar flats in Queenstown and Pinnacle at Duxton and so forth. What is surprising is that, in the past 30 years, there have only been about 15 (resale flat) transactions in non-mature towns that have reached a quantum of $900,000. Five of these were between 2019 and 2021, which is also about the same time we’re seeing (resale) flats recover from seven years of declining prices. So the past year and a half has been a defining moment for non-mature towns. There’s a recovery, but the recovery is sharper in non-mature estates.”

What’s helping to narrow the price gap?

Some of the key reasons are:

- Ongoing decentralisation

- Improved public transport infrastructure

- Covid-19 construction delays

- An asset-progression mindset

1. Ongoing decentralisation

Punggol is benefitting from the upcoming Punggol Digital District, which will bring schools, offices, and new retail / entertainment to the area. Woodlands has its own counterpart, the Woodlands North Corridor, which will transform it into a new regional centre. Jurong East, meanwhile, is often seen as being “non-mature” in name only; the transformation of the Jurong Lake District has made it the retail powerhouse of Singapore’s west-end, with malls like Jem and JCube.

As Singapore continues to decentralise, living near the traditional CBD becomes less meaningful. As such, we’ll see increased demand for homes – or even potential rental assets – in the fringe regions of Singapore.

Home buyers and investors focused on the long term have a good reason to consider areas like Woodlands and Sembawang now; buying and moving in while prices are still low.

2. Improved public transport infrastructure

The mature / non-mature estate divide was stark in the 1990’s, when the MRT network had only the North – South and East – West lines. The LRT didn’t exist till 1999. In those days, large swathes of non-mature estates were cut off from the train network, so home buyers were willing to pay larger premiums for rail access.

Today however, most neighbourhoods have multiple MRT stations. Areas that aren’t directly connected to the MRT network are also supplemented by the LRT, such that the mature / non-mature divide has diminished.

Coupled with the creation of new business hubs (see point 1), flats in non-mature areas are no longer as inconvenient as they used to be.

(Except maybe for Tengah, which is the newest and still has a long way to go. Sorry, Tengah residents).

3. Covid-19 construction delays

It’s not a coincidence that the spike in resale flat demand happened toward the height of the pandemic. Even as we write this, 85 per cent of BTO developments are facing construction delays of six to nine months.

This is due to shortages in supply and labour, which means the interior design industry isn’t spared either. The delays in build time plus renovation could mean up to another year, for some home buyers.

Also keep in mind that the Minimum Occupancy Period (MOP) of five years starts from key collection, not from the time the flat is bought. As such, those buying a BTO flat might end up waiting as long as eight or nine years before they can sell.

This long delay is driving some buyers to switch from the BTO market to the resale market.

Editor's PickHow Hot Is the Singapore Property Market In 2021? Here’s My Experience From 3 Cases On The Ground

by Stuart

4. An asset progression mindset

Realtors told us that many buyers still see their first flat as a stepping stone, toward eventual private property ownership. These buyers tend to favour resale flats, despite the higher price tag.

The main reason is the long delays before they can sell (see above). Buyers intent on asset progression often worry about rising private property prices, which historically appreciate faster than resale flat prices.

However, these buyers also tend more toward cheaper flats in non-mature areas. Apart from having greater room for appreciation, these buyers don’t mind having fewer amenities – after all, they’re intending to stay for only around five years (after which the area will hopefully be more built up, and they can net a nice return).

For home buyers in 2021, this means a higher chance of having to pay Cash Over Valuation (COV), even for flats in non-mature areas

The COV refers to the amount paid over the flat’s actual valuation (e.g., if the selling price is $400,000 while the valuation is $380,000, the COV is $20,000).

COV had been almost extinct after 2013, with measures taken to drive it down – this is why COV prices are no longer revealed by HDB. However, realtors on the ground inform us that COV has been creeping back onto the property scene; and without available data, there’s no real way to tell how high it’s climbed.

As COV is not covered by the home loan, resale flat buyers today should be prepared to save up. Even with a 90 per cent HDB loan, you may have to pay anywhere from $10,000 to $30,000 on top of your down payment.

Let us know which HDB towns you’re interested in, and we can try to help. In the meantime, you can find the latest in-depth reviews of new and resale properties alike on Stacked.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Trends

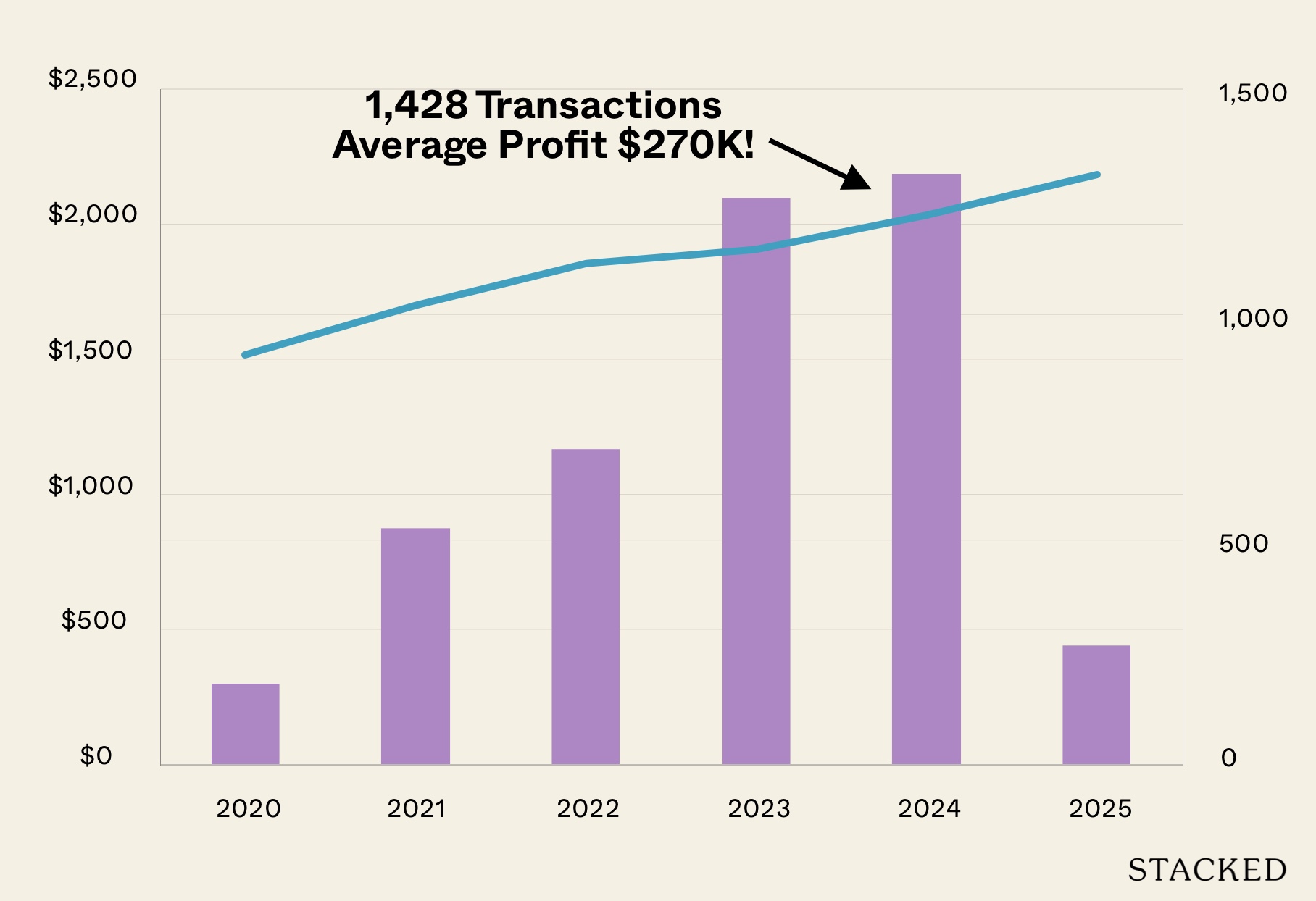

Editor's Pick Condo Profits Averaged $270K In 2024 Sub Sales: Could This Grow In 2025?

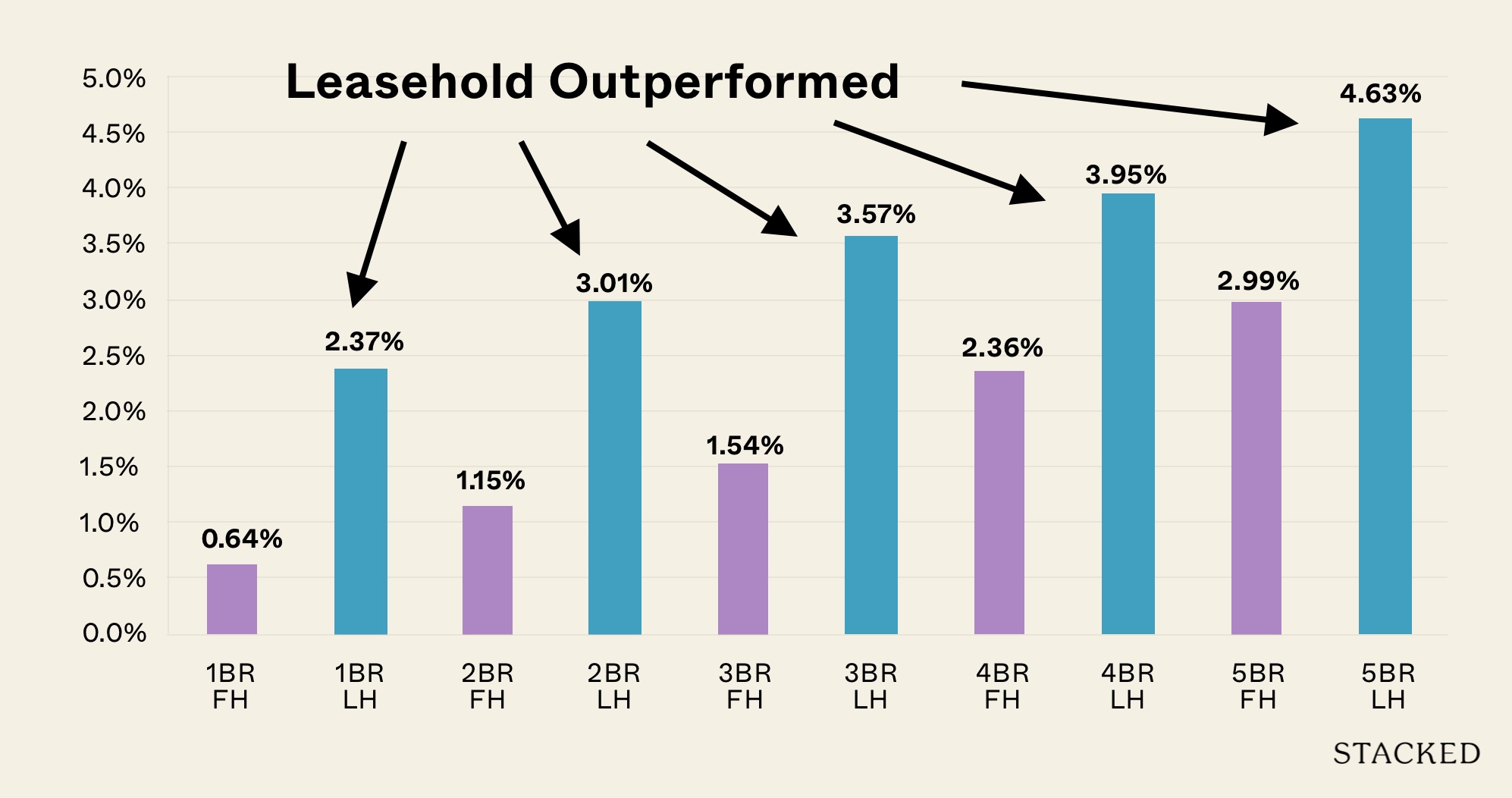

Property Trends Should You Buy A Freehold Or Leasehold Condo In 2025? Here’s The Surprising Better Performer

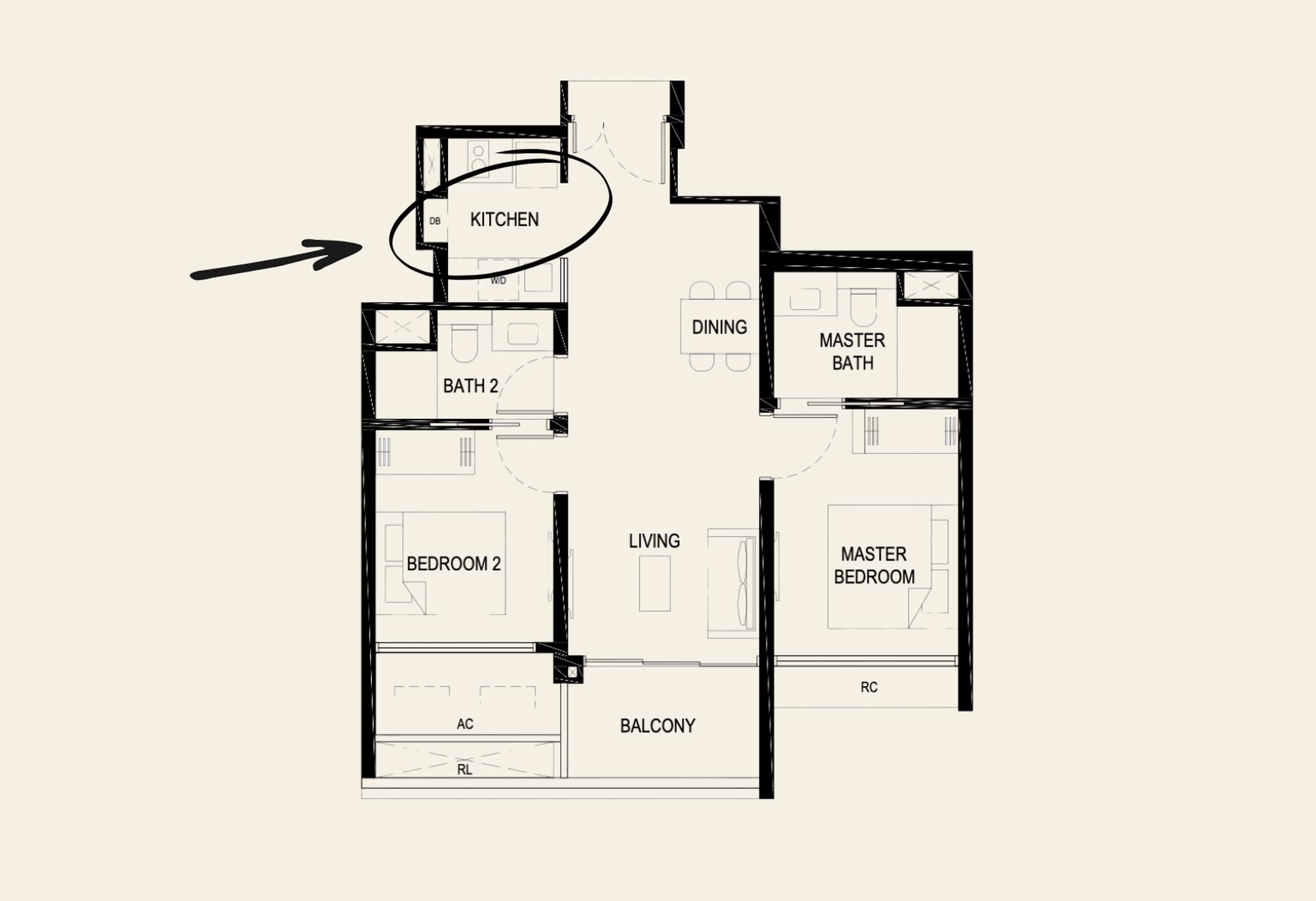

Property Trends How Condo Kitchen Preferences Have Changed In 2025

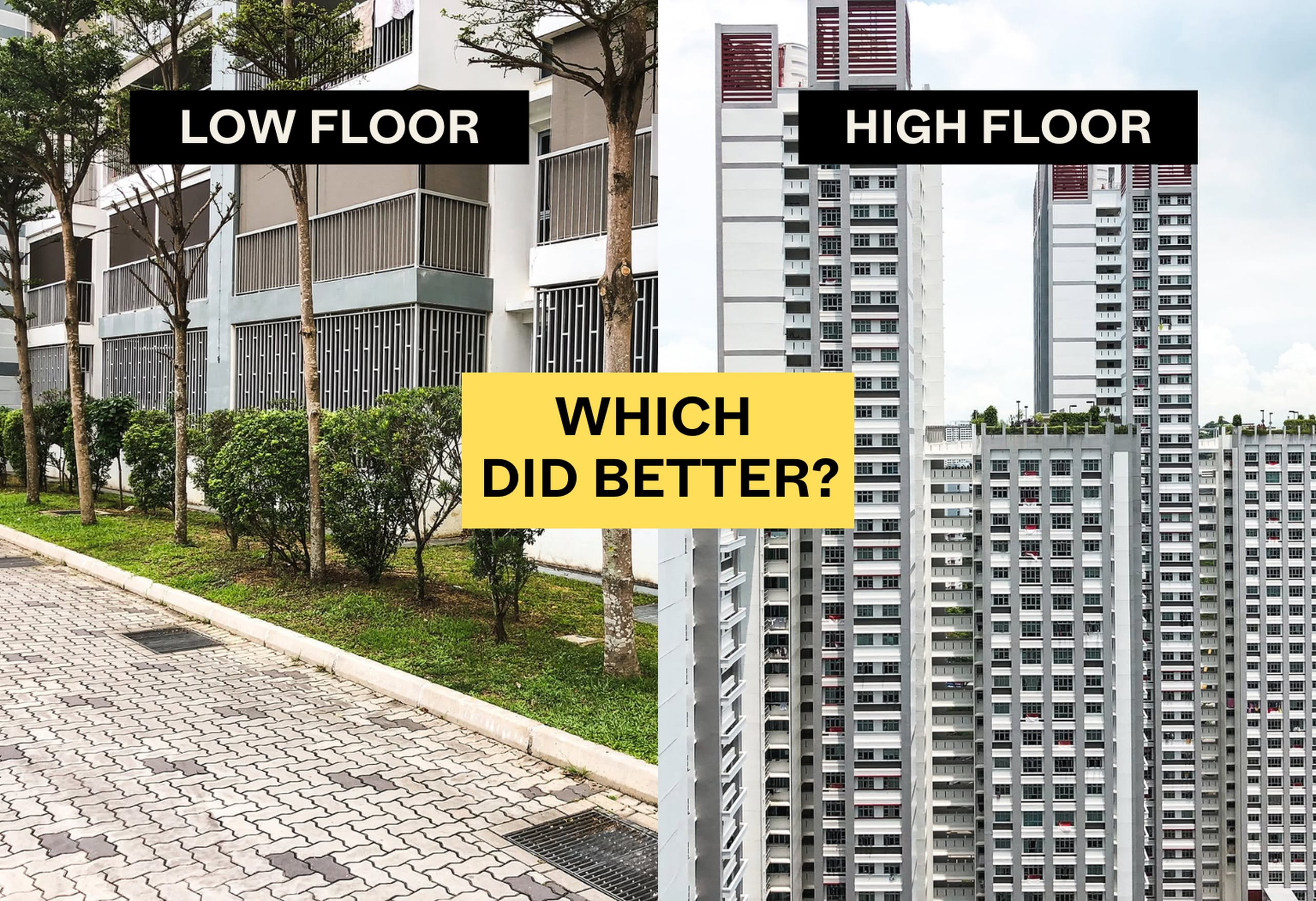

Property Trends Do High-Floor HDB Flats Appreciate More In Value? The Data May Surprise You

Latest Posts

Editor's Pick The Worst Property I Ever Bought (And Why We’re Launching Paid Property Content)

Pro We Analysed 8 Years Of 1-Bedroom Condo Data In Central Singapore: Here’s What Investors Should Know

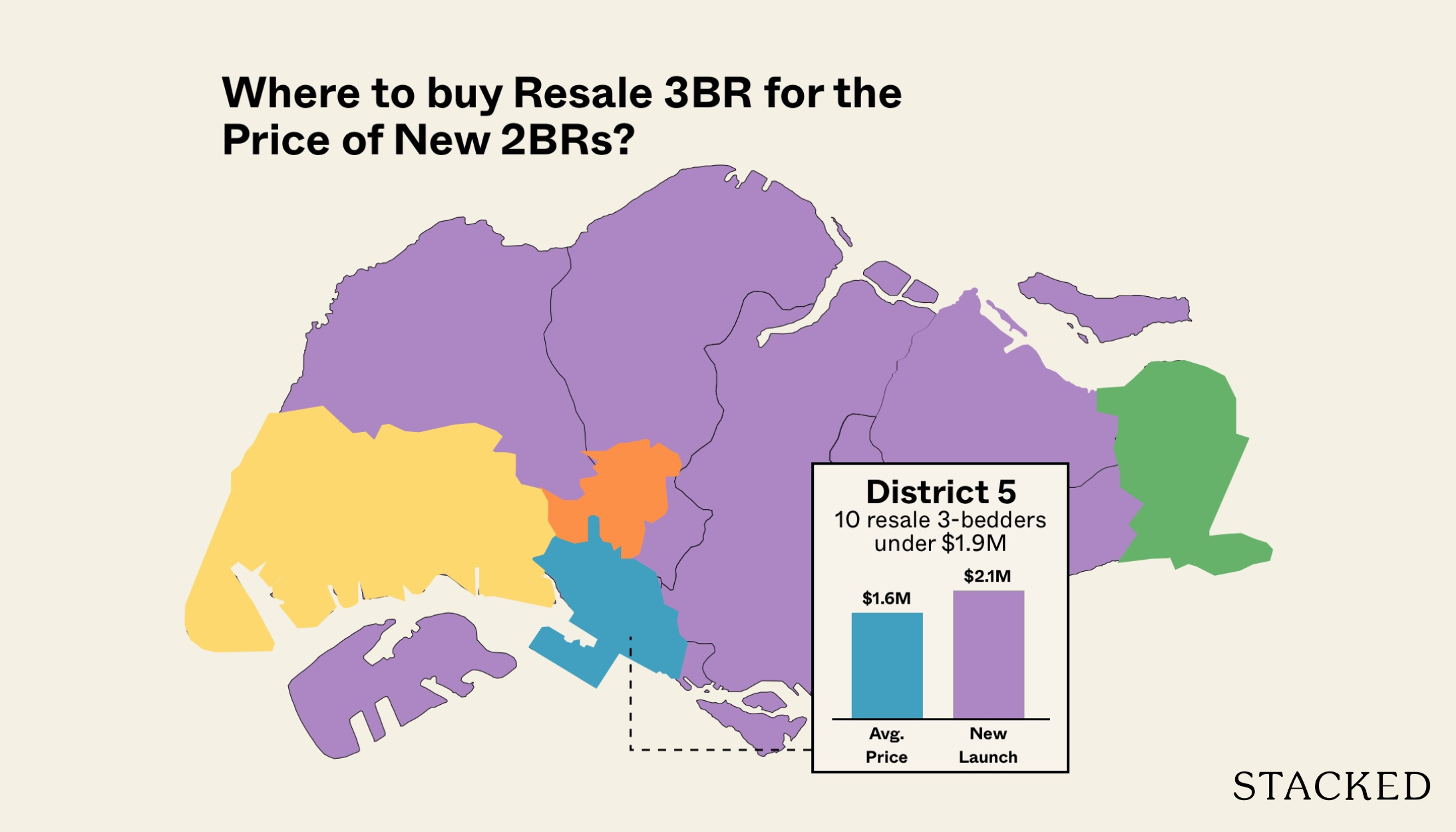

Pro Where You Can Buy A Resale 3-Bedder For The Price Of A New 2-Bedder In 2025

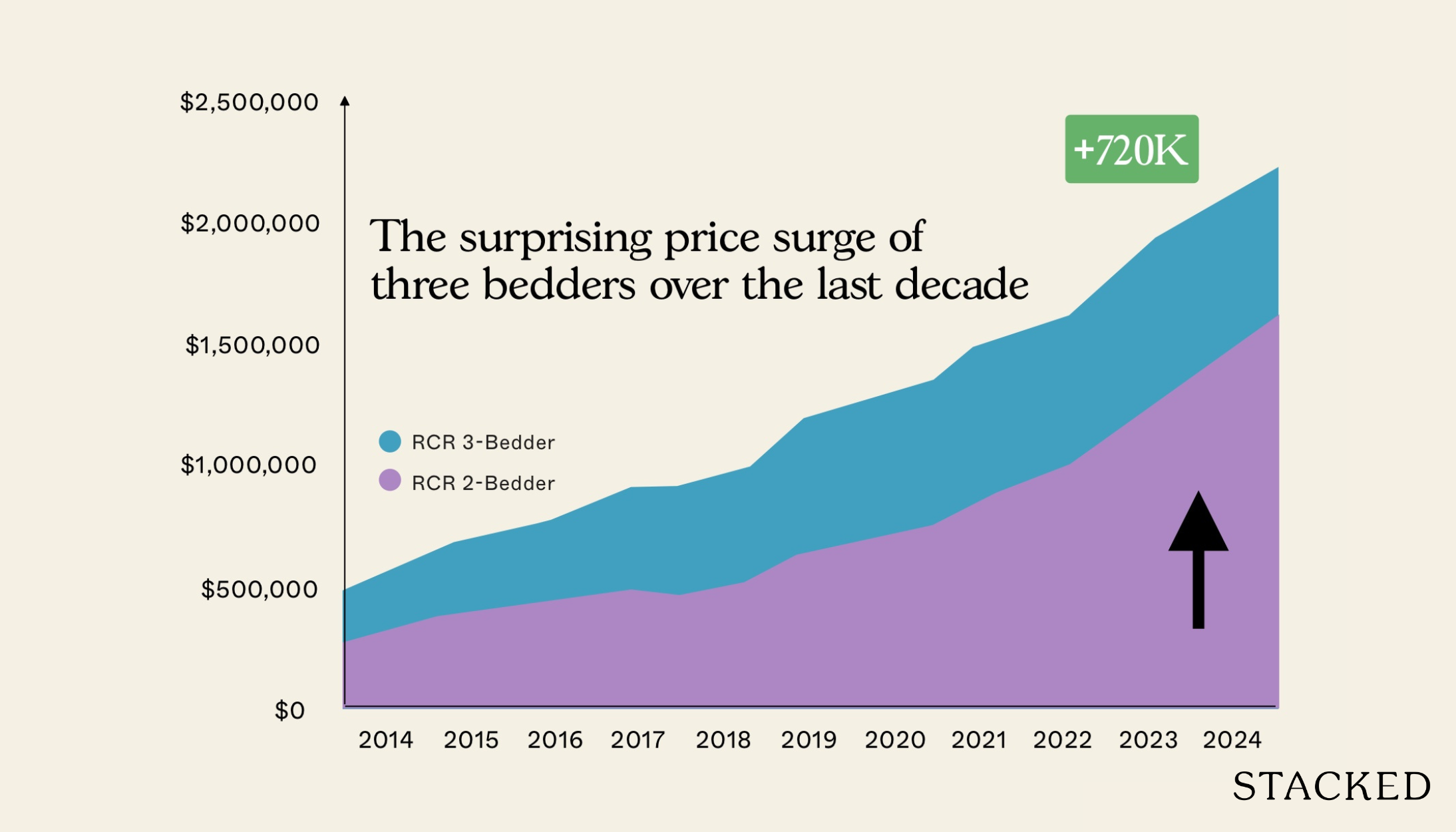

Pro Why 3-Bedders May Be The Smarter Investment (Over 2-Bedders) In 2025: Here’s The Breakdown

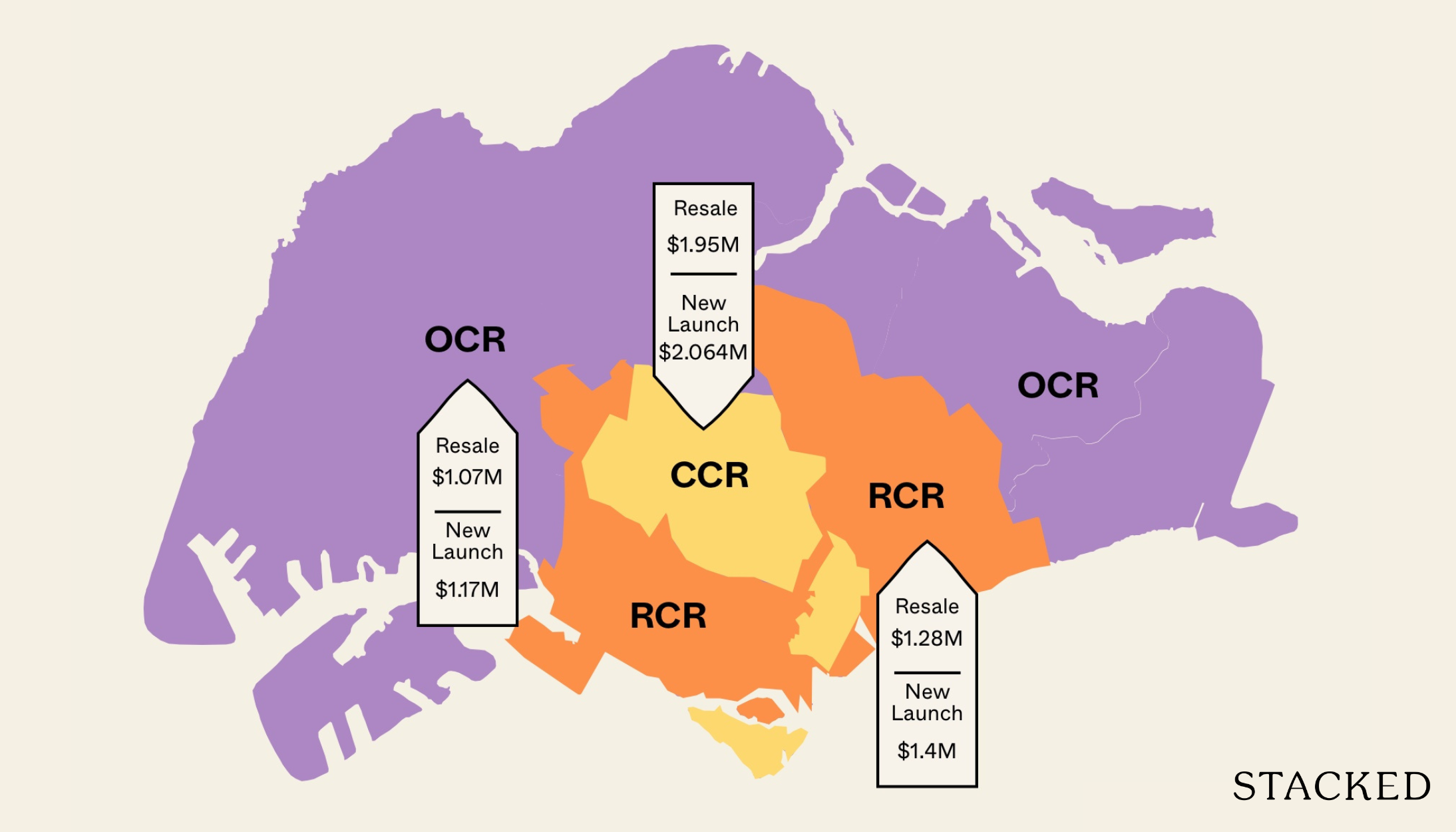

Pro Which Singapore Regions Offer The Best Value For Two-Bedder Condos Today? (Resale vs New Launch)

Property Market Commentary What DIY Property Buyers In Singapore Might Miss Out On (And Why It Matters)

Editor's Pick Why This Singapore Homeowner Wakes At 5AM To Commute – And Has Zero Regrets

Editor's Pick Can Singapore Property Prices Come Down In 2025?

Editor's Pick Touring Rare Freehold Conservation Shophouses In Cairnhill (From $7 Million)

Editor's Pick “We Treated Our Flat As A Liability” How One Couple Paid Off Their HDB In 15 Years

Property Market Commentary Slower Sales At One Marina Gardens And Bloomsbury Residences: A Sign That Buyer Sentiment Is Cooling?

On The Market 5 Cheapest 4-Room HDB Flats Near An MRT From $468k

Homeowner Stories Why This Architect Chose A Dual-Key Condo (Even Though He Was Set On A BTO)

Investor Case Studies How We Made $270k From A $960k Condo Bought During COVID: A Buyer’s Case Study

Homeowner Stories The Hard Truth About Buying A Home With Your Partner In Singapore (Most People Don’t Talk About This)

Oh, so you guys are moving into the HDB market now eh? OK. cool.