My Experience As A First-Time Property Buyer Overseas: 5 Important Lessons I’ve Learned

July 25, 2024

Buying property is an activity that you’ll want to do your homework on before committing. It’s already difficult to ensure that you’re making a sane decision buying in Singapore, so you can imagine how much more careful you’ll need to be when you’re looking at property in a country you’re barely acquainted with.

I read many French property blogs, highlighted list after list of their warnings and their experiences, and did my best to follow the storytellers’ advice and take in their reflections.

Despite being really well-prepared, I ended up not being prepared for the most part.

The reality is that no amount of homework you do can prepare you for the real experience. Properties overseas are full of unique circumstances to navigate, and there’s no template you can follow when viewing the place, making an offer, and getting a loan.

France isn’t Singapore. While getting a property here technically has fewer hurdles than back home, it was still quite an experience with many lessons.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Lesson #1: Don’t bother buying directly from sellers

One of the main advantages of buying directly from sellers instead of going through an agency is the fact that prices are usually a lot cheaper as sellers don’t know how to appraise their property, and you don’t need to pay an agent fee, which saves you a few thousands in the already expensive process.

When I was first looking at property, I just went to browse property listings in Leboncoin (France’s equivalent to Carousell), many sellers posted their properties there and generally, there were good deals to be found from time to time.

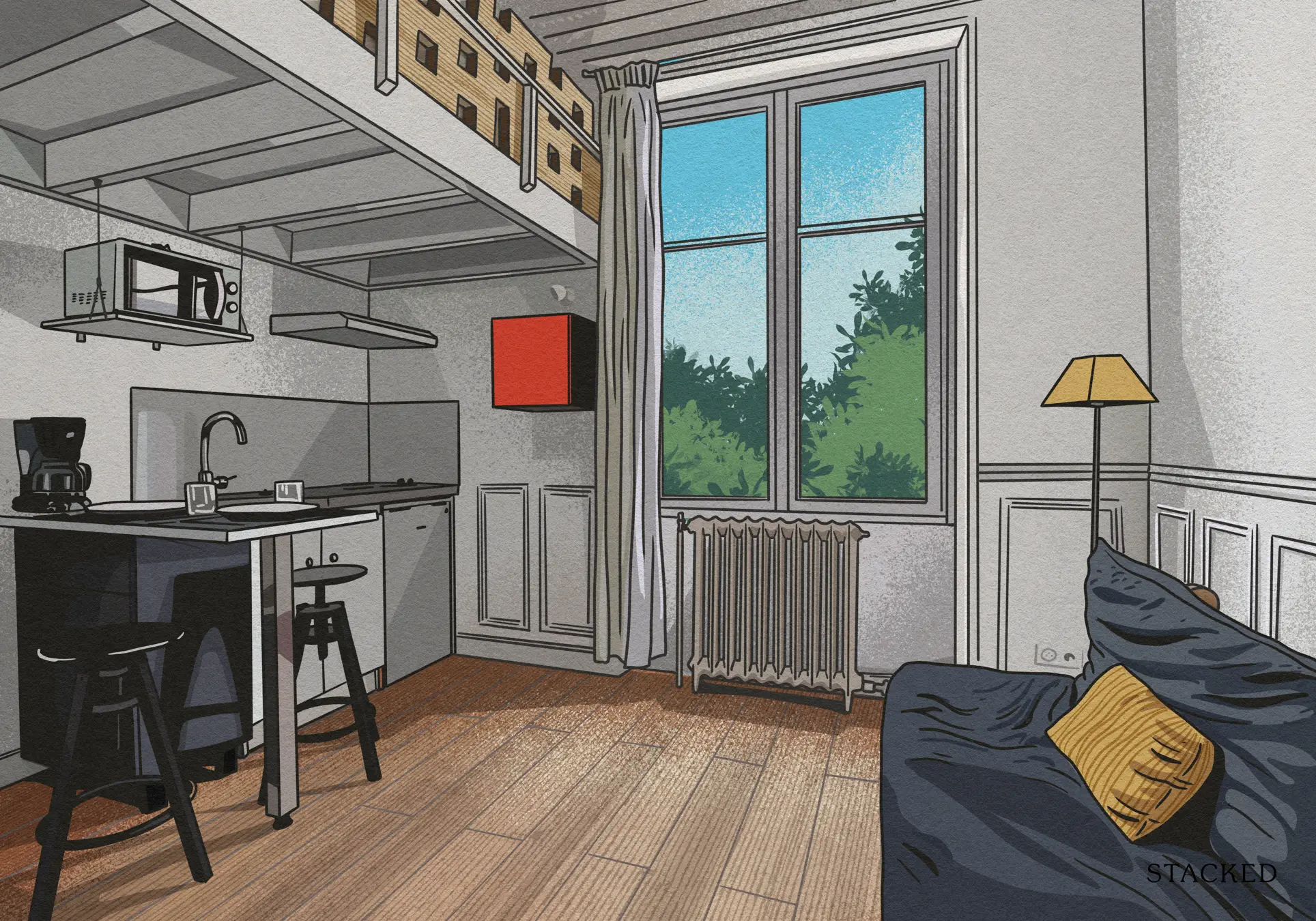

A small studio apartment popped up one day that I thought was interesting, it was minutes from my boyfriend’s place of work at that time, and not very expensive. We contacted the seller and arranged for a viewing.

When we went down, it was her tenant who greeted us, which should have been the first red flag. He was basically not renting the place anymore as he was moving elsewhere, and Miss lazy landlord decided that she wanted to get rid of the place instead of finding a new tenant.

We decided that we would want to buy it. It was a great starter home, and didn’t cost much. We texted her to let her know we were interested, and made an offer.

We got ghosted. I was particularly upset because she ended up making that studio into an AirBnB, in the middle of nowhere in France. It was truly an “Ok Boomer” moment for me, because 6 years on, she barely had 100 guests bookings there.

I found out much later that more than 65% of direct sales end up in failure due to the sellers’ lack of commitment. Most of the time, sellers just list their property for free to get an estimate of interest, ego-surfing if you will, but won’t sell unless the price is well above their expectations.

It is a very different dynamic when sellers go to an agency. Sellers who seek the assistance of the agency generally want the sale to go through, and the agency’s job is to vet both the profiles of the seller and buyer, and appraise the property accurately so both parties get the best outcome. The fixed fee you pay is how they make money.

The holistic customer service a legitimate real estate agency provides is worth the extra fees. I will never buy property in France without a good agency backing the property and the seller moving forward.

Lesson #2: Be careful buying from notaries or bankruptcy sales

I’m always on the hunt for good deals, and one of the best ways to get dirt-cheap property is to take a look at bankruptcy sales that are usually available directly from notary offices, newspapers, and some auction platforms.

For the right property, this might be worth the effort, but my experience after going to some viewings and seeing the process for these deals made me think twice.

Bankruptcy sales are usually handled by notaries; these are lawyers who do specific administrative papers for property transfers. What this means is that they don’t give a hoot about customer service, they just want to get rid of the property and close their cases because they don’t make a cent from the sale.

Getting an appointment with them is a difficult task; they’re not real estate agents, and their actual day job of handling paperwork is a bigger priority than showing you properties.

When you do view the properties, a lot of information is withheld from you. It’s usually unintentional since notaries aren’t salesmen, but you’ll usually get very little information about the neighbourhood, the building, the rental market, and every cherry on top you’ll normally get with an agent.

You’ll be shown a property and it’s an “If you like it, make an offer. If not, whatever” sort of attitude. Notaries also couldn’t care less about disclosing hidden major flaws in the property, they usually only reveal the legal minimum (like no asbestos and lead), so buying a bankruptcy sale is really a curveball where you might open a can of worms down the line about its real condition during your ownership.

It just wasn’t worth the trouble for me. So I personally didn’t do it.

You can still buy from bankruptcy sales if you want, but if you’re a first-time overseas investor, I would strongly advise against it.

Lesson #3: Don’t change your job before you get a bank loan

Admittedly, this was probably really obvious, but as a seasoned Singaporean job hopper, I thought France would be like HDB giving out loans based on yearly tax statements instead of current employment contracts. I thought changing my job for a higher salary would have worked better in my favour.

More from Stacked

Why Kingsford Hillview Peak Underperformed—Despite Its MRT Location And “Good” Entry Price

In this Stacked Pro breakdown:

It absolutely screwed with my chances of getting a loan. Even though I didn’t have a single gap between job changes, and I have a higher salary now, the bank wants full assurance that I won’t be fired before my probation period ends. The tech layoffs also did not instil confidence.

They were happy to be flexible about it as I was earning decent dough, but I had to awkwardly request (or beg) my new employer to write a very weird letter stating their non-legally binding intention to ensure I would successfully pass probation.

Ultimately, this wasn’t enough to prove to the banks I was good to loan to. My profile was already not ideal since I was considered an expatriate/foreigner, so the notice period, regardless of my history of passing all my notice periods, got me a ‘No’ at most of the banks I went to. It was a very long, painful, and stressful process, because I made my offer right when I was job-switching and the sudden bank rejection had me scrambling for a solution.

Was I stupid? Yes. But I learned from it.

If I’d passed my probation period already, getting a loan agreement would have been easier, and getting the actual loan would have been confirmed as soon as I deposited my salary into the bank as verification of funds, which essentially takes a month or so.

I ended up shopping around and took a personal loan from Singapore, which irritates me a little because my purchase was supposed to be an experiment of a Singaporean getting a property completely within a foreign system, so this tints my victory. But losing the apartment I took months to find was going to be dumber, so here I am.

Lesson #4: Find out your affordability as soon as possible

You would be able to calculate your affordability using online calculators and your own general estimate, but if you’re buying property overseas, I recommend going to a licensed mortgage broker or a bank to get an accurate simulation and assessment before you start looking at property, because knowledge is power.

I was relying on my own calculations of affordability which were far, far lower than my maximum borrowing power. It made me look poor, and very few agencies were willing to deal with me before because they thought I was just another barely surviving working-class peasant (I am, but still).

When I got my maximum borrowing power assessed, their attitude changed. It didn’t matter that I was still looking at a very low-cost property, agencies started prioritising me because it was almost a certainty that I could get the loan to finalise the purchase. I became a star profile they wanted to sell to.

Another benefit of finding out my maximum borrowing power was the ability to plan my finances a bit better for multi-property ownership. I was able to better allocate funds and make future projections based on my maximum affordability. Worst and best case scenarios were fleshed out more easily with this knowledge.

Lesson #5: I wish I knew more French

My French is terrible, and that’s the understatement of the year. When purchasing my first property and liaising with my agent, the banks, and my notary, I had to trouble everyone to speak English in order to deal with me.

All the administrative paperwork and documents are in French (obviously), so I had to hire an expensive legal translator to be present whenever I was signing important documents. Even so, I still had to use every square inch of my brain to process the documents by myself before signing legally binding papers in a foreign language.

I expected myself to purchase property only when I’m more settled, but life happens, and sometimes you just find something magical accidentally like I did and you cannot wait until you can understand baguette language to take action.

I should have taken French a lot more seriously and I count myself extremely lucky that the people who were part of this deal were extremely nice and bilingual, which aren’t common traits you find together. I also had my boyfriend help a bit during verbal agreements.

With this lesson you can be sure I’ll take my language studies a lot more seriously from now on. I got lucky this time round, but not knowing the language well can have many repercussions and definitely increases your chances of being inconvenienced or even getting scammed.

I’m not buying a second property until I pass an advanced level of French. And I don’t recommend anyone purchasing an overseas property unless they understand the native language, because even with a licensed translator, legal documents are binding and complex. So it’s best not to fool around with that.

—

With all the hurdles and stories that come with buying property overseas, these were the most memorable. While every country’s property dynamics and markets are different, I think the principles of getting a good outcome for yourself remain the same.

If you want to be successful in your overseas property hunt, you basically need to know the local language, have a stable credit profile, plan your finances, and watch out for potholes and risks. With the right amount of due diligence and homework, you too can confidently own a place of your own off the shores of sunny Singapore.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is it better to buy property directly from sellers or through an agency in France?

What should I know about purchasing property from bankruptcy sales or notaries in France?

How does changing jobs affect getting a mortgage in France?

Why is it important to determine your property affordability early in the overseas buying process?

How crucial is knowing French when buying property in France?

Melody Koh

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.Need help with a property decision?

Speak to our team →Read next from Overseas Property Investing

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

Overseas Property Investing This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

0 Comments