Is Singapore’s Property Market Slowing Down? What Top Developers Are Hinting

July 30, 2023

When buyers spy developer caution, they know their time is coming.

If you are looking out for a home and want to get an insight into the market, one of the best ways is to look at what the developers are doing.

Most developers have their nose to the metaphorical and literal ground. They know, with an almost high level of accuracy, when sales are going to slow (those who don’t, won’t remain in the business for long).

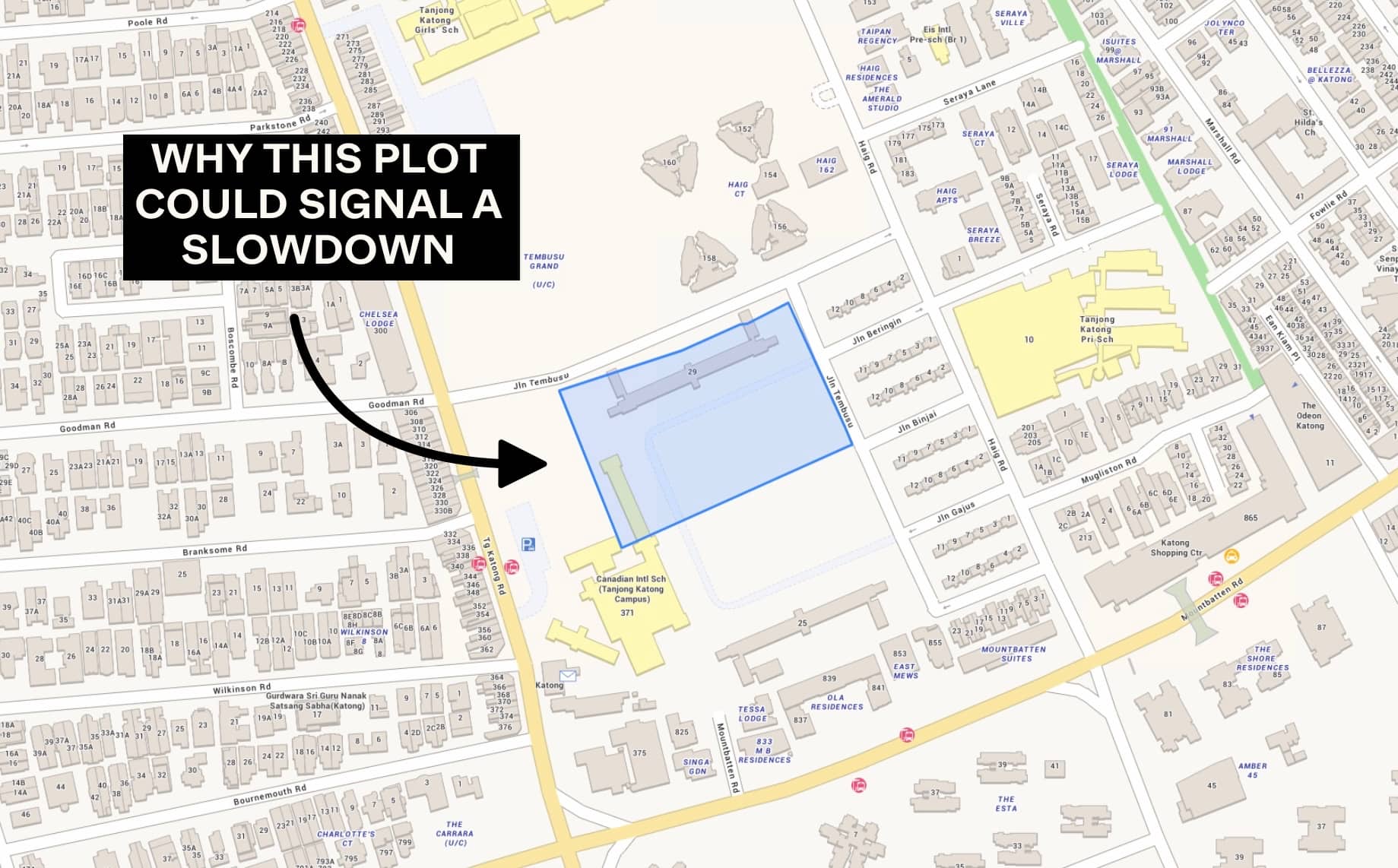

So when only two developers bid for a land plot at Jalan Tembusu (and the winning bid only being 18 per cent lower than Tembusu Grand, or 21 per cent lower than Grand Dunman), it’s worth paying attention to.

That’s not to say that the Jalan Tembusu plot is a bad one. The venerable Chung Cheng High School is close to it, as is Tanjong Katong Girls School, currently the best school in the universe*. It can yield 840 homes, which is on the larger end of projects, and it’s even near the upcoming Tanjong Katong MRT station.

I’ve looked up and down the map for issues, visited the spot myself, and seen nothing that would suggest it’s bad for a residence.

And yet developers – who are likely land-starved as the 2017 en-bloc parcels are all redeveloped and sold – still played it cautious.

There are obvious reasons, such as the current trio of Grand Dunman, Tembusu Grand, and The Continuum, that have yet to sell out. Buyers in the area currently still have a lot of choice, although with where sales are at – there is an upper limit of what buyers are willing to pay in these areas.

Besides, there is also the new definition of GFA, in which AC ledges will now be included as part of the GFA. While this means that spaces will be more efficient (no more oversized air-con ledges), this would also affect the overall margins.

Developers may be buying at a cheaper land cost, but add in the above and don’t expect this new plot to be launched at a discount either.

Now follow this up with the Marina Bay land plot, that we covered in this article, where there was a very clear difference in value over the land between Kingsford and GuocoLand. There also seems to be little interest from local developers in the Marina area, with the last Marina plot only receiving a sole bid from IOI Properties Group (a Malaysian developer).

You can also see this from the Pine Grove GLS site, where it was keenly contested – but all by local developers.

Perhaps it’s because some of them – like the big Chinese developers – have deeper pockets and can take bigger risks. But it could very well be that local developers know their market, and are quicker to sense the storm (and let’s not forget the impact of the 60 per cent foreigner ABSD).

Instead, all the interest (seven bidders) has gone into the Tampines Street 62 land plot, for Tenet EC. This is the developer equivalent of seeking safe havens because ECs are low-hanging fruit. The subsidised pricing makes them among the easiest properties to sell on the market, especially now when more HDB upgraders are priced out and need an intermediary rung between flats and fully-private condos.

All of this means a change is in the air. Home prices, which have been on an upward trajectory since after Covid, is reaching the very limits of what the market can tolerate. That, at least, is good news for home buyers who have yet to catch a break.

More from Stacked

A Wave Of New HDB Resale Supply Is Coming In 2026: Here’s Where To Find Them

With the prices of some two-bedders in new launch projects this year priced from $1.8 million, it’s unsurprising that more…

*Objectively true because this writer once taught there.

Meanwhile in other property news…

- Check out the new TMW Maxwell, which offers maximum flexibility and efficiency with its “transformer” units. I swear, this is the most Millennial thing I’ve seen since Chye Seng Huat Hardware.

- These HDB flats are above 1,300 sq. ft., but still under $600,000. There’s hope for resale buyers yet.

- On the topic of resale flats, some HDB estates have surprisingly seen price declines instead. If you don’t have a spare kidney to sell, maybe these are the right places to start looking.

- Interest rates are the high-blood pressure of the financial world. Silent killers. A $1 million home can rack up $300,000 in interest repayments, after just 10 years. Here’s how.

Weekly Sales Roundup (17 – 23 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANNINGHILL PIERS | $8,648,000 | 2788 | $3,102 | 99 yrs (2021) |

| BOULEVARD 88 | $4,941,600 | 1313 | $3,763 | FH |

| KLIMT CAIRNHILL | $4,900,000 | 1432 | $3,423 | FH |

| MIDTOWN MODERN | $4,877,000 | 1808 | $2,697 | 99 yrs (2019) |

| GRAND DUNMAN | $4,351,000 | 1690 | $2,575 | 99 years |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| GRAND DUNMAN | $1,129,000 | 452 | $2,497 | 99 years |

| THE MYST | $1,151,000 | 517 | $2,228 | 99 yrs (2023) |

| LENTOR HILLS RESIDENCES | $1,324,000 | 581 | $2,278 | 99 years |

| THE ATELIER | $1,508,000 | 549 | $2,747 | FH |

| MIDTOWN BAY | $1,612,600 | 484 | $3,329 | 99 yrs (2018) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ARDMORE PARK | $12,800,000 | 2885 | $4,437 | FH |

| SHELFORD VIEW | $7,500,000 | 5134 | $1,461 | FH |

| CAPE ROYALE | $5,783,000 | 2508 | $2,306 | 99 yrs (2008) |

| THE TRILLIUM | $4,600,000 | 1798 | $2,559 | FH |

| AVALON | $4,300,000 | 1765 | $2,436 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NESS | $613,000 | 388 | $1,582 | FH |

| GRANDVIEW SUITES | $620,000 | 420 | $1,477 | FH |

| THE PROMENADE@PELIKAT | $668,000 | 452 | $1,478 | FH |

| HAIG RESIDENCES | $668,000 | 452 | $1,478 | FH |

| PALM ISLES | $725,000 | 560 | $1,295 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ARDMORE PARK | $12,800,000 | 2885 | $4,437 | $4,000,000 | 6 Years |

| AVALON | $4,300,000 | 1765 | $2,436 | $1,840,000 | 7 Years |

| HILLVIEW GREEN | $2,400,000 | 1528 | $1,570 | $1,755,000 | 17 Years |

| THE PETALS | $4,188,888 | 4402 | $951 | $1,488,888 | 3 Years |

| RIO VISTA | $2,310,000 | 2271 | $1,017 | $1,483,500 | 22 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MON JERVOIS | $1,702,000 | 893 | $1,905 | -$415,000 | 6 Years |

| THE SAIL @ MARINA BAY | $3,100,000 | 1647 | $1,882 | -$400,000 | 11 Years |

| SKYSUITES@ANSON | $1,430,000 | 700 | $2,044 | -$110,000 | 8 Years |

| THE ASANA | $1,490,000 | 570 | $2,612 | -$84,000 | 5 Years |

| AVANT RESIDENCES | $803,000 | 527 | $1,522 | -$3,800 | 5 Years |

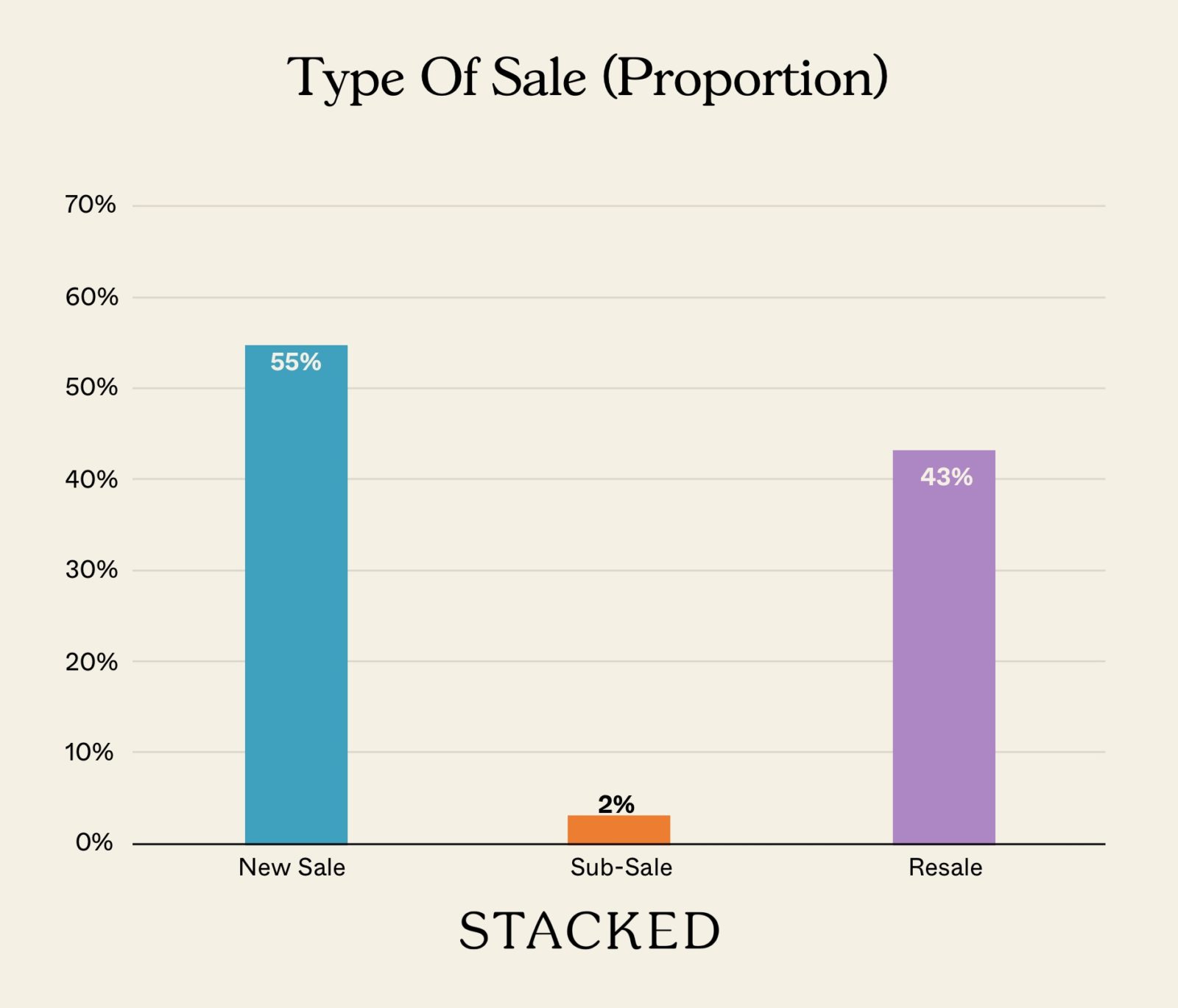

Transaction Breakdown

My Interesting Links Of The Week:

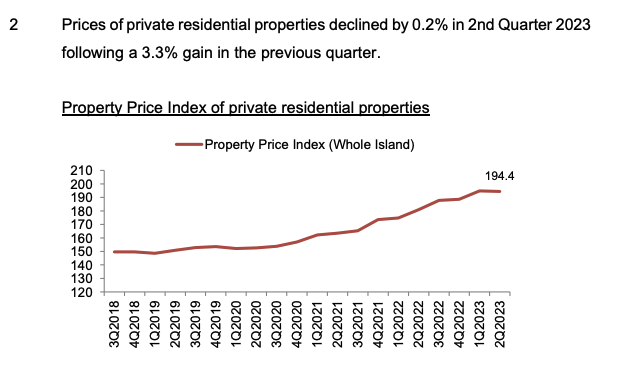

- Private housing prices fell by 0.2 per cent

Finally, private home prices have fallen since the first quarter of 2020 (basically when Covid-19 first started).

I guess this is what most people would have expected, given the onslaught of cooling measures in September 2022, and April 2023. This is also likely due to the crop of new condos being completed this year, which would introduce more supply to the resale market.

Interestingly when you look by region, prices in the CCR and RCR have fallen, but the OCR shows a price increase of 1.2 per cent in the second quarter (although it has registered a slower increase compared to the previous 1.9 per cent).

Just like what we’ve been seeing from the land bids, there are signs that the market is cooling.

- Turning HDB void decks into libraries and gardens

I mentioned this recently, about how it was a pity that we weren’t doing more with our HDB void decks.

Besides newer developments such as Alkaff Oasis, most void decks in Singapore aren’t well utilised at all.

But as shown in this Bloomberg piece, some residents have managed to transform these areas into really nice spots.

Take this one with wall art and vertical planters:

Or this cosy library at Holland Village, where there are over 7,000 books:

It really shows how much a void deck can really add to a space and community when done right. Any more such examples? Feel free to send it over, I would love to see more.

Follow us on Stacked for news and updates on the Singapore property market. We’ll help you make more informed decisions on your home.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is Singapore’s property market slowing down now?

Why are developers bidding cautiously for land in Singapore?

What does the low interest from local developers in Marina Bay land plots suggest?

How are HDB flats being transformed to improve community spaces?

What recent trends are seen in private housing prices in Singapore?

What is the significance of the Tampines Street 62 land plot bidding activity?

Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

0 Comments