Is A $1.3M Budget Enough For A Freehold 2-Bedroom Condo In 2024 (A Closer Look At Noma)

December 13, 2024

Hi Ryan,

Lovely to e-meet you! I’m a new subscriber of yours and love your deeply insightful property content that can be easily understood, even for users like me who are new in this property purchase journey.

I am looking to make my first property purchase and came across Stacked through search engine and also a Medium article mention.

I’m in my early 30s and just got married this year, hoping to move into a new place in the next year or so. I’m currently leaning towards a new or resale condominium purchase, looking to stay and as a property investment. I was wondering would you be able to recommend some of the upcoming good condominium launches for 2 bedroom and 1 or 2 bathroom(s), within an estimated $1.3M budget?

Could I also have your thoughts on Noma – whether it would make a good resale condo purchase (freehold, built year 2023, just slightly below $2k psf, in relatively close proximity to mrt stations, schools, eateries and supermarket/grocery stores, potential to sell to HDB upgraders in the vicinity in the future; however a small condo development with only 50 units and wondering if Macly Group is a notable developer)? If you could share any additional potential upsides or downsides that I should consider as well it would be tremendously helpful.

Thanks so much and looking forward to hearing from you!

Hi,

Thanks for reaching out and we are happy to hear that our content has been useful for you.

From the prices of recent new launches, finding a 2-bedroom unit at $1.3M may prove challenging. Executive Condominiums (ECs) may be an option if your combined household income does not exceed $16,000 per month. That said, most recent EC launches primarily feature 3- and 4-bedroom units, which could be outside your budget.

As such, if moving within the next year is a priority, resale properties are likely your best option. The resale market also offers a wider range of choices within your affordability.

We won’t be providing specific recommendations without understanding your preferences regarding location, property size, holding period, or other priorities. Since you’ve expressed interest in NoMa, we’ll take a closer look at this development. Let’s begin with a brief overview of the project.

NoMa is a freehold boutique development with 50 units comprising 1-, 2-, and 4-bedroom layouts. Completed in 2023, it enjoys a prime location within a 15-minute walk to four MRT stations: Dakota, Mountbatten, Aljunied, and Paya Lebar. The area is well-served by a wide range of amenities, including shopping malls, hawker centres, and other conveniences to meet everyday needs. For families, the project is located within a 1km radius of the renowned Kong Hwa School.

Next, let’s explore its prices and trends.

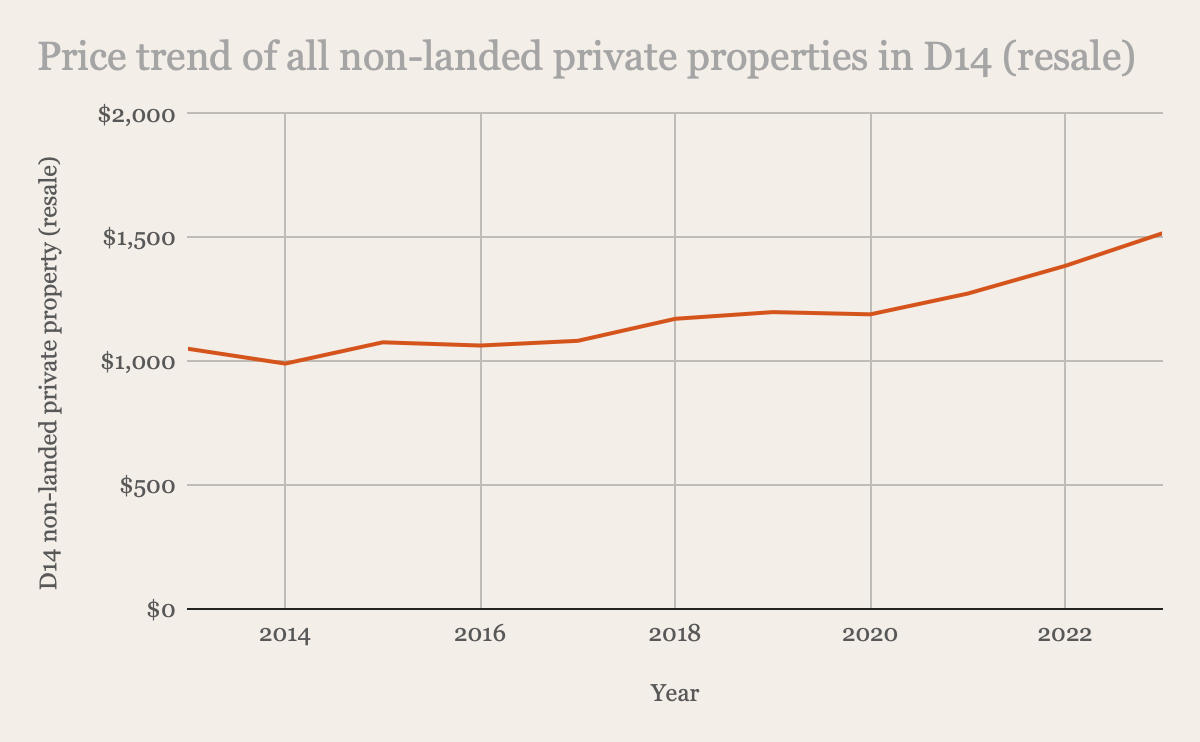

| Year | D14 non-landed private property (resale) |

| 2013 | $1,051 |

| 2014 | $991 |

| 2015 | $1,077 |

| 2016 | $1,064 |

| 2017 | $1,083 |

| 2018 | $1,172 |

| 2019 | $1,199 |

| 2020 | $1,190 |

| 2021 | $1,274 |

| 2022 | $1,386 |

| 2023 | $1,518 |

| Average growth rate | 3.87% |

When compared to the 10-year average growth rate of 2.9% for all non-landed private properties in Singapore, District 14 (D14) as a whole appears to be outperforming the national average.

Given that NoMa is a relatively new development, we’ll examine its performance since its launch. To date, prices have increased at an average annual growth rate of 1.75%. However, it’s worth noting that this assessment is based on only one sub-sale transaction this year, so this is still not conclusive for now:

| Date | Unit | Type of Sale | Area (Sq Ft) | $PSF | Price |

| 2 Jan 2024 | 333 Guillemard Road #02-XX | Sub Sale | 850 | 1,764 | $1,500,000 |

| 18 Oct 2020 | 333 Guillemard Road #02-XX | New Sale | 850 | 1,618 | $1,375,632 |

With just 50 units anyway you will expect transactions to be rare here.

To provide more context, let’s compare the performance of freehold boutique developments near NoMa with larger projects in the area. For boutique projects, we’ll focus on developments within a 200m radius of NoMa, while for mass-market comparisons, let’s look at The Sunny Spring and The Waterina.

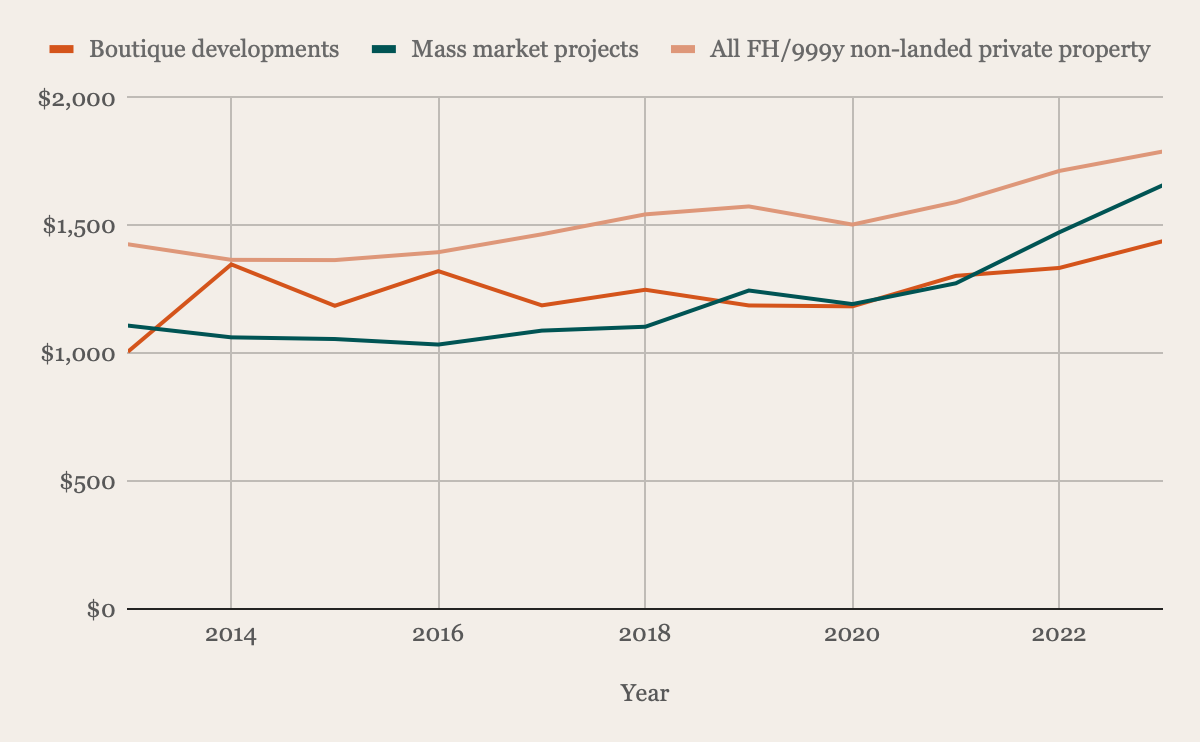

| Year | Boutique developments | Mass market projects | All FH/999y non-landed private property |

| 2013 | $1,006 | $1,109 | $1,427 |

| 2014 | $1,348 | $1,063 | $1,366 |

| 2015 | $1,186 | $1,056 | $1,365 |

| 2016 | $1,322 | $1,035 | $1,396 |

| 2017 | $1,188 | $1,089 | $1,466 |

| 2018 | $1,249 | $1,104 | $1,544 |

| 2019 | $1,187 | $1,246 | $1,575 |

| 2020 | $1,184 | $1,193 | $1,504 |

| 2021 | $1,303 | $1,274 | $1,592 |

| 2022 | $1,334 | $1,474 | $1,714 |

| 2023 | $1,439 | $1,658 | $1,790 |

| Average growth rate | 4.35% | 4.34% | 2.37% |

From the data, you can see that the average growth rate over the last decade for both boutique and mass-market developments in D14 is on par and outperforms the overall growth rate of freehold and 999-year leasehold non-landed properties across Singapore. However, their price trends tell a different story. While larger developments tend to follow a steady trajectory aligned with the overall market, boutique developments show more erratic price movements.

As we’ve said before, one reason for the fluctuating price trends in boutique developments is their smaller pool of units, resulting in fewer transactions. This is even more so for freehold projects, as buyers often purchase these for long-term holding. Transaction data shows no consistent pattern in price movement, with fluctuations largely influenced by the type of units sold. For instance, in years where 1- or 2-bedroom units dominate sales, the average price per square foot (psf) is higher, as these unit types typically command a higher psf. Conversely, in years where larger units are sold, the average psf tends to dip. Given the limited transaction volume, such variations can exaggerate price movements, making it harder to gauge the true performance of boutique developments.

Another factor influencing boutique developments is their unit mix. Many boutique projects predominantly feature smaller units, which sometimes caters to investors due to their lower entry price. Investors are generally less emotionally attached to their properties compared to homeowners. They might sell quickly at a lower price if they identify better opportunities elsewhere, especially if they’ve already gained returns through rental income. In boutique developments with low transaction volumes, even a single sale at a lower price can significantly impact the overall price trend.

This volatility highlights the importance of choosing a boutique development with a balanced unit mix. Developments that include a higher proportion of larger units which are generally favoured by owner-occupiers, tend to exhibit more stable pricing. Owner-occupied units are typically held for longer periods and are less prone to abrupt price drops, providing better price resilience.

In a previous article we did on the profitability of boutique developments, we found that projects with at least five transactions between 2014 and 2023 had an average annualised gain of around 3.57%, comparable to the broader private property market. However, the range of gains and losses was notably wide, meaning the “average” gain doesn’t fully reflect the variability within this property segment. Having said that, larger units within boutique developments consistently showed better performance, mirroring trends observed across other property types.

| Size Category | Average Profit | Average % Profit | Average Annualised Returns (%) |

| Less Than 500 sq ft | $80,619.02 | 12.81% | 2.44% |

| Less Than 900 sq ft | $147,930.82 | 15.34% | 2.92% |

| Less Than 1,400 sq ft | $272,479.32 | 20.69% | 3.91% |

| More Than 1,400 sq ft | $489,416.63 | 21.84% | 4.27% |

| Grand Total | $227,220.66 | 17.80% | 3.39% |

District 14, in particular, houses over 180 boutique developments (defined as having fewer than 100 units), making a comprehensive comparison of all these projects impractical. To keep the analysis focused, we’ve chosen to compare some of the newer freehold projects in the vicinity of NoMa.

| Project | Completion year | No. of units | Unit mix | No. of resale/sub sale transactions from Jan 2024 | % of transactions to no. of units | Avg price PSF from Jan 2024 | Avg 2-bedder price from Jan 2024 | Annualised growth rate from launch |

| NoMa | 2023 | 50 | 1, 2, 4 | 1 | 2% | $1,764 | $1,500,000 | 1.75% |

| Arena Residences | 2023 | 98 | 2, 3 | 8 | 8% | $2,075 | $1,282,500 | 2.54% |

| 33 Residences | 2021 | 27 | 2, 3 | 1 | 4% | $1,619 | $1,220,000 | 0.13% |

| Pavilion Square | 2018 | 42 | 1, 2 | 2 | 5% | $1,608 | – | 0.71% |

| Rezi 3two | 2017 | 65 | 1, 2, 3 | 3 | 5% | $1,564 | $690,000 | 0.04% |

While these developments are relatively close to one another and share the advantage of a freehold tenure (which diminishes the impact of lease decay on pricing), there is still a notable difference in their average price psf.

Among the developments compared, Arena Residences stands out. It has the highest percentage of units sold relative to its total number of units, the highest average psf, and the highest annualised growth rate since its launch. These factors suggest a stronger demand for Arena Residences, which could indicate higher liquidity or greater market appeal.

We are not recommending that you purchase Arena Residences; rather, this comparison is intended to help you better understand how NoMa fares in relation to its neighbouring projects.

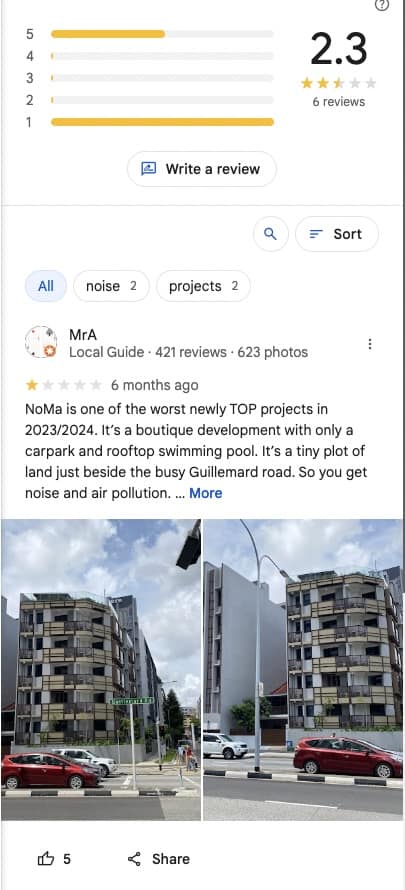

On a final note, NoMa does suffer from some negative feedback based on user submissions on Google Reviews. While they’re unverified, the reviews can still influence future buyers who would make the same search to understand what people there think of the project. It must be said that it may not be a full representation of how all the residents feel.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

In Summary

NoMa’s accessibility and its convenient location make it an suitable place to call home. However, as a relatively new development completed just a year ago, with only one sub-sale transaction, it’s difficult to assess the project’s long-term performance accurately. Regardless, the poor rating (unverified) of the development warrants greater scrutiny of the place beyond a cursory glance from the outside before making a decision.

With the high saturation of boutique developments in the area, it takes a unique selling point for a project to truly stand out. As seen in our comparison of nearby developments, even though they share similar proximity to amenities, their performance varies significantly.

The volatility of boutique development prices poses another risk. Their prices have been historically erratic, with significant growth only occurring during the pandemic market boom. This lack of a consistent price trend makes it difficult to predict future values and plan a reliable exit strategy.

This isn’t to say that boutique developments should be ruled out altogether. Ultimately, the success of any project—whether boutique or mass-market—hinges on its appeal and ability to attract buyers. The key distinction lies in the likelihood of success: with a mass-market condo, you cast a wider net, increasing the chances of stable demand and consistent performance.

Ultimately, what you should for opt depends on how much of a priority you place on whether this property is for investment or your own stay. If it fulfils your requirements as a location (near work, near parents) then it’s hard to say that this would be a bad purchase for you.

However, if you are looking for something more towards an investment and are less particular on the own stay objectives, our general advice leans towards purchasing in a larger development, where there is typically more price stability due to a balanced mix of unit types and a broader investor-to-homeowner ratio. Price trends in larger developments tend to be less volatile, offering a more secure investment.

With a budget of $1.3M for a 2-bedroom unit, you have a good range of resale options, depending on your preferred location. We recommend consulting a property agent for a more detailed analysis to help you make an informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments