I’m Looking To Upgrade From An HDB To Condo For $1.5 Million. Should I Get A Freehold 3 Bedder Or Dual Key Condo?

April 29, 2023

Hi Stacked Homes

I have enjoyed reading your articles and liked your insights in property. Thanks for doing this great work that helps in making decisions.

We are a family with 2 children (elder daughter is 15 yrs, and younger son is 3 yrs). We are currently staying in HDB and would like to upgrade to a condo.

Some of our requirements for new home are

– freehold condo

– 3 bedrooms plus utility room

– Accessibility should be good (preferably near to mrt and bus stops)

– preferably near to good schools

Our budget is around 1.5M and below are some of the areas where there are FH units available in this budget range

– Boon Keng – Mar Thama road (Beacon Heights, Riviera 38 etc)

– District 15 (boutique developments)

– Flora road, flora drive (Avila Gardens etc)

– Upper Changi (Changi Court, Changi Green)

– Pasir Ris (eg: Ris Grandeur)

1) We would like to seek your opinion on

– How do you rate above areas considering their growth potential

– Which area and property has good potential (Enbloc potential if any) based on our budget and requirements

2) Do you think it is a better approach to sell 500K of investments and increase the budget to 2M to buy a freehold 4 bed dual key unit (eg: Trilive) as it gives rental income?

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hey there,

Thanks for reaching out to us and we’re glad to hear that our content has been of help.

We can see that you have multiple criteria to meet which can be difficult to decide what to prioritise here given the budget of $1.5m. To address this concern, we’ll need to tackle each point and ultimately narrow down what is important to you here.

To do this, we’ll address each concern by covering:

- The performance of the various districts and projects

- Future integration in the different areas you mentioned

- Considerations when buying a dual-key unit

- Considerations for en bloc

- Projections on the two options – buying a $1.5M 3 bedder or a $2M 4 bedder dual key

To be frank, it’s always difficult when you mix your own-stay criteria together with investment potential. Very often, what you want in a property may not really be what would do well as an investment property. For example, you may like boutique projects because they are more private and exclusive, but these tend to not do as well because of the limited transactions and lack of awareness in the resale market.

So generally, the best thing to do would be to keep things separate. Trying to find a property that’s for own stay yet has good investment potential often means that you would end up achieving neither.

Also, an issue here is the limit of your budget. Today, getting a freehold condo that’s within $1.5 million dollars, but still having good access to transport and preferably near a good school doesn’t really leave you much options.

The question on dual-key units and en bloc also adds to the complication, as these can be seen as separate needs altogether which we’ll explain later in this piece. However, we can understand the appeal of dual-key units. As highlighted yesterday, it is one way to “avoid” the ABSD if you are looking to buy a second property for investment.

Let’s start off by looking at how the freehold and 999-year leasehold properties in the districts that you’ve picked out have performed as compared to the overall market. We will also include some of the developments that you have mentioned.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

District and project performance

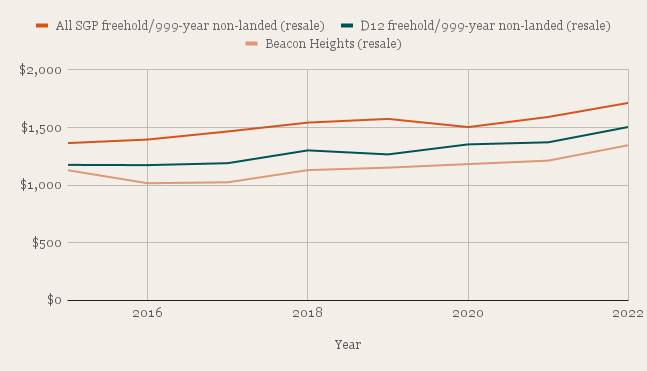

District 12 (Boon Keng) – Beacon Heights (212 units)

| Year | All SGP freehold/999-year non-landed (resale) | YoY | D12 freehold/999-year non-landed (resale) | YoY | Beacon Heights (resale) | YoY | No. of transactions |

| 2015 | $1,365 | $1,176 | $1,130 | 3 | |||

| 2016 | $1,396 | 2.27% | $1,174 | -0.17% | $1,017 | -10.00% | 7 |

| 2017 | $1,466 | 5.01% | $1,191 | 1.45% | $1,025 | 0.79% | 16 |

| 2018 | $1,543 | 5.25% | $1,302 | 9.32% | $1,131 | 10.34% | 13 |

| 2019 | $1,575 | 2.07% | $1,267 | -2.69% | $1,152 | 1.86% | 6 |

| 2020 | $1,504 | -4.51% | $1,354 | 6.87% | $1,183 | 2.69% | 8 |

| 2021 | $1,592 | 5.85% | $1,372 | 1.33% | $1,213 | 2.54% | 12 |

| 2022 | $1,714 | 7.66% | $1,505 | 9.69% | $1,347 | 11.05% | 12 |

| Annualised | – | 3.31% | – | 3.59% | – | 2.54% | – |

From the table we can see that based on the annualised growth rate over the last 7 years, Beacon Heights isn’t performing as well as the rest of District 12 and also the overall market.

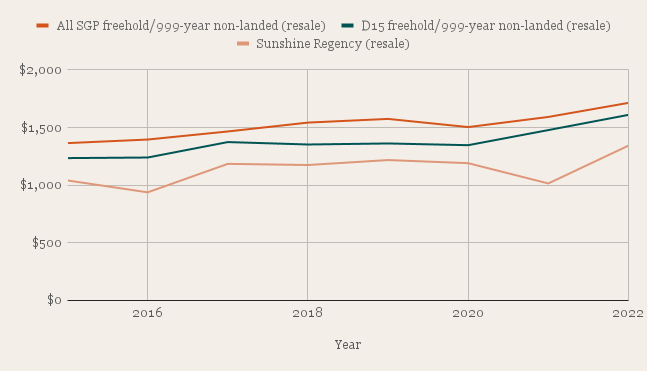

District 15 – Sunshine Regency (33 units)

| Year | All SGP freehold/999-year non-landed (resale) | YoY | D15 freehold/999-year non-landed (resale) | YoY | Sunshine Regency (resale) | YoY | No. of transactions |

| 2015 | $1,365 | $1,235 | $1,041 | 1 | |||

| 2016 | $1,396 | 2.27% | $1,240 | 0.40% | $938 | -9.89% | 1 |

| 2017 | $1,466 | 5.01% | $1,374 | 10.81% | $1,185 | 26.33% | 3 |

| 2018 | $1,543 | 5.25% | $1,353 | -1.53% | $1,175 | -0.84% | 1 |

| 2019 | $1,575 | 2.07% | $1,362 | 0.67% | $1,218 | 3.66% | 2 |

| 2020 | $1,504 | -4.51% | $1,347 | -1.10% | $1,191 | -2.22% | 1 |

| 2021 | $1,592 | 5.85% | $1,478 | 9.73% | $1,015 | -14.78% | 2 |

| 2022 | $1,714 | 7.66% | $1,610 | 8.93% | $1,343 | 32.32% | 1 |

| Annualised | – | 3.31% | – | 3.86% | – | 3.71% | – |

We picked Sunshine Regency as an example purely because there are units available on the market and they match your budget and requirements. Even though the project is performing better than the overall market, the annual transaction volume is low which could result in prices being more volatile as you can see from the graph and table above.

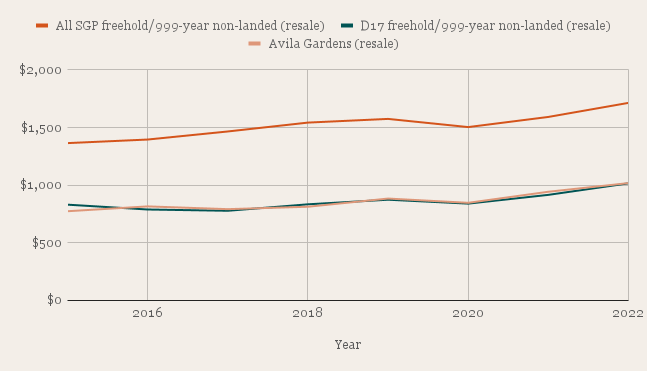

District 17 (Flora Road/ Drive) – Avila Gardens (347 units)

| Year | All SGP freehold/999-year non-landed (resale) | YoY | D17 freehold/999-year non-landed (resale) | YoY | Avila Gardens (resale) | YoY | No. of transactions |

| 2015 | $1,365 | $831 | $774 | 2 | |||

| 2016 | $1,396 | 2.27% | $789 | -5.05% | $816 | 5.43% | 4 |

| 2017 | $1,466 | 5.01% | $778 | -1.39% | $792 | -2.94% | 14 |

| 2018 | $1,543 | 5.25% | $834 | 7.20% | $813 | 2.65% | 15 |

| 2019 | $1,575 | 2.07% | $874 | 4.80% | $884 | 8.73% | 8 |

| 2020 | $1,504 | -4.51% | $840 | -3.89% | $847 | -4.19% | 11 |

| 2021 | $1,592 | 5.85% | $916 | 9.05% | $943 | 11.33% | 23 |

| 2022 | $1,714 | 7.66% | $1,016 | 10.92% | $1,018 | 7.95% | 12 |

| Annualised | – | 3.31% | – | 2.91% | – | 3.99% | – |

From the table, we can see that Avila Gardens is performing better than properties in District 17 as well as the overall market.

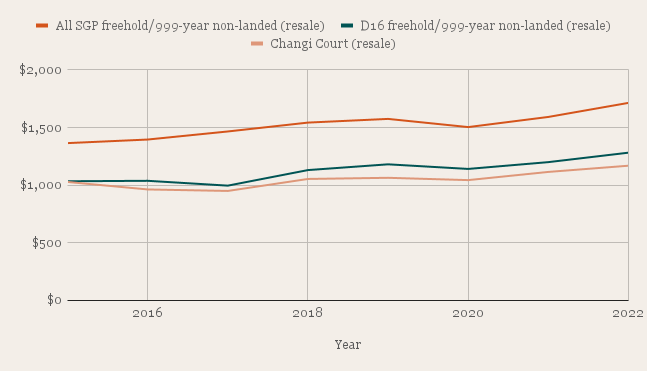

District 16 (Upper Changi) – Changi Court (297 units)

| Year | All SGP freehold/999-year non-landed (resale) | YoY | D16 freehold/999-year non-landed (resale) | YoY | Changi Court (resale) | YoY | No. of transactions |

| 2015 | $1,365 | $1,034 | $1,028 | 1 | |||

| 2016 | $1,396 | 2.27% | $1,038 | 0.39% | $963 | -6.32% | 7 |

| 2017 | $1,466 | 5.01% | $996 | -4.05% | $950 | -1.35% | 18 |

| 2018 | $1,543 | 5.25% | $1,131 | 13.55% | $1,054 | 10.95% | 16 |

| 2019 | $1,575 | 2.07% | $1,181 | 4.42% | $1,064 | 0.95% | 6 |

| 2020 | $1,504 | -4.51% | $1,141 | -3.39% | $1,044 | -1.88% | 6 |

| 2021 | $1,592 | 5.85% | $1,200 | 5.17% | $1,115 | 6.80% | 18 |

| 2022 | $1,714 | 7.66% | $1,282 | 6.83% | $1,169 | 4.84% | 7 |

| Annualised | – | 3.31% | – | 3.12% | – | 1.85% | – |

Looking at the annualised growth rate, prices at Changi Court are moving much slower than other properties in District 16 and the overall market.

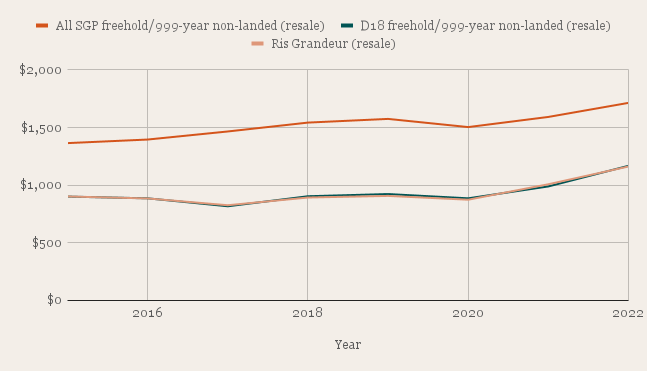

District 18 (Pasir Ris) – Ris Grandeur (453 units)

| Year | All SGP freehold/999-year non-landed (resale) | YoY | D18 freehold/999-year non-landed (resale) | YoY | Ris Grandeur (resale) | YoY | No. of transactions |

| 2015 | $1,365 | $901 | $902 | 12 | |||

| 2016 | $1,396 | 2.27% | $886 | -1.66% | $885 | -1.88% | 10 |

| 2017 | $1,466 | 5.01% | $817 | -7.79% | $826 | -6.67% | 21 |

| 2018 | $1,543 | 5.25% | $904 | 10.65% | $893 | 8.11% | 14 |

| 2019 | $1,575 | 2.07% | $923 | 2.10% | $907 | 1.57% | 8 |

| 2020 | $1,504 | -4.51% | $886 | -4.01% | $874 | -3.64% | 9 |

| 2021 | $1,592 | 5.85% | $989 | 11.63% | $1,008 | 15.33% | 19 |

| 2022 | $1,714 | 7.66% | $1,168 | 18.10% | $1,162 | 15.28% | 8 |

| Annualised | – | 3.31% | – | 3.78% | – | 3.68% | – |

We can see from the graph and table that the growth rate of Ris Grandeur is almost on par with that of other projects in District 18 and slightly better than the overall market.

Typically, the growth rate for different projects is influenced by a range of factors, such as location, consumer demand, and competition. However, as a general guideline, it is often wise to choose a project that is moving in line with the overall market. This means that the project is experiencing growth trends that are consistent with broader economic indicators and market trends.

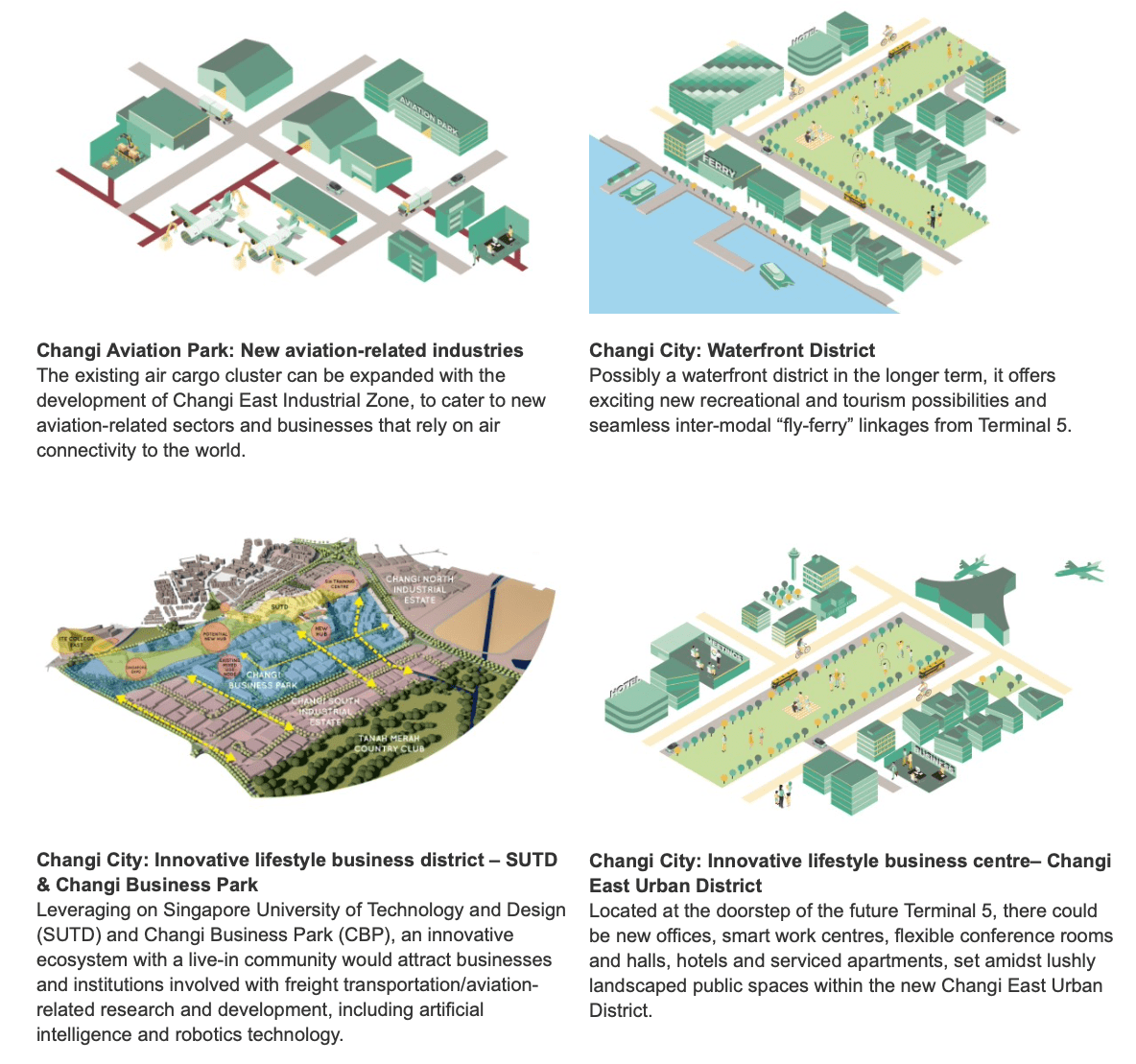

One major factor that impacts the growth rate of a condo is the future development of an area. Development can take many forms, such as improved transportation infrastructure or the development of new business and commercial hubs. Let’s now take a look at whether there are any upcoming transformations planned for the areas you’ve picked out.

Future Development

District 12 (Boon Keng)

Although there are no major transformation plans for now, the highly-priced HDBs in Boon Keng do help to support the prices of the private properties in the area. From the URA Masterplan, we can see that there are 3 vacant land plots in the vicinity of Beacon Heights.

Plot 1 – Earmarked for residential properties

Plot 2 – Earmarked for Educational institution

Plot 3 – Reserve site (specific use of which has yet to be determined)

The development of Plot 1, whether it be in the form of HDB flats or a condominium, can possibly bring about positive effects on the surrounding properties. If HDB flats are built on the plot, besides the price support that they’ll provide, it could create a potential pool of buyers in the future from upgraders who wish to continue staying in the same area.

Similarly, the presence of a new condominium which is likely going to be priced higher given the higher land costs today could also help to stimulate or support the growth rates in the surrounding developments. This is however dependent on numerous factors which we have previously written about here.

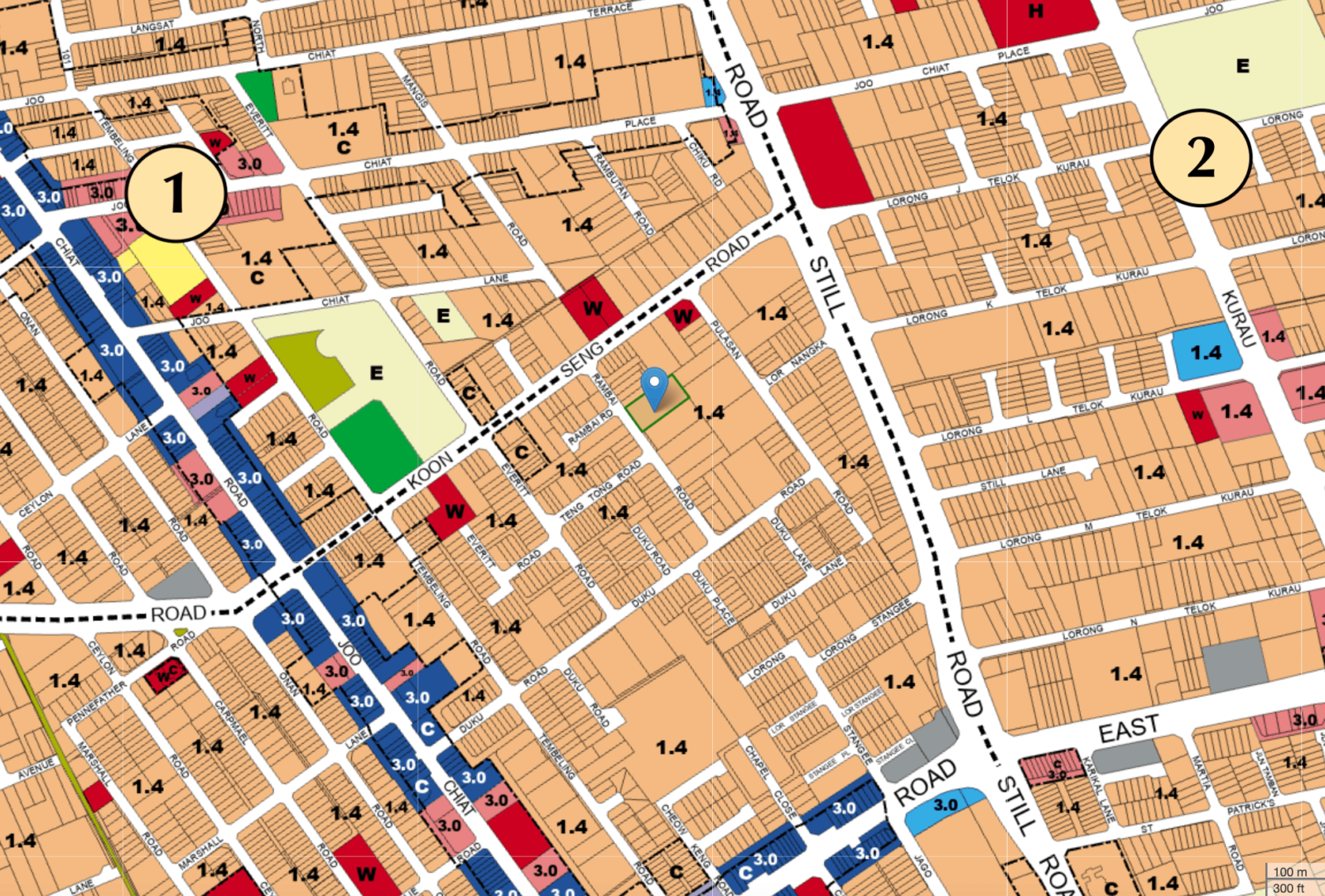

District 15

Most of the Telok Kurau and Joo Chiat areas where the boutique developments are situated are almost fully developed. There are just 2 empty plots in the area.

Plot 1 – Reserve site (specific use of which has yet to be determined)

Plot 2 – Earmarked for Educational institution

While boutique developments can be attractive in their own right, they may not always yield the same level of returns as mid-sized or larger developments. And this is made worse in areas where there is a high concentration of similar boutique projects. When there are a large number of similar developments in the vicinity, it can be difficult for individual projects to stand out and attract buyers or renters especially since boutique projects are often designed to serve a specific niche market or target demographic.

Given the high level of competition in the area, it is possible that even if a small mall were to be constructed on the reserve site, it may not result in a significant increase in property prices.

District 17 (Flora Road/ Drive)

Flora Road/Drive is a small area situated between Tampines, Pasir Ris and Changi and may stand to gain from the developments of these areas. We can see that in the vicinity of Avila Gardens, there are at least 4 empty land plots to be developed.

Plot 1 – Earmarked for residential properties

Plot 2 – Earmarked for Business 2 (clean industry, light industry, general industry, warehouse, public utilities and telecommunication uses and other public installations)

Plot 3 and 4 – Reserve site (specific use of which has yet to be determined)

At the moment, the area may not be the most accessible but with the upcoming Loyang MRT station that is slated to complete in 2030, accessibility will be improved.

Besides the huge residential plot which could potentially help to generate growth in the area, the development of Plot 2 could also have positive effects such as an increase in job opportunities and economic activity, which could lead to an increase in demand for housing.

With more people working in the area, the number of individuals looking to rent close by may also go up. Rental rates can have an impact on the potential return on investment for a condo, which can in turn influence its market value. However, the development of a light industrial area may also lead to an increase in noise and pollution which could potentially make the area less attractive to some homebuyers.

District 16 (Upper Changi)

There are a lot of upcoming development in terms of businesses but the URA also has plans to construct residential properties around Upper Changi MRT station, as part of a broader plan to add homes closer to jobs and have a better mix of public and private housing islandwide.

Plot 1 and 4 – Earmarked for residential properties

Plot 2 – Earmarked for Business Park (Changi Business Park)

Plot 3 – Earmarked for Educational institution

Plot 5 – Reserve site (specific use of which has yet to be determined)

As with District 17, the development of a business park will increase economic activity in the area which can potentially lead to an increase in demand for nearby residential properties in the form of rental or purchase. The downside of constructing and operating a business park is that it can result in increased traffic, noise, and pollution which could negatively affect the quality of life for nearby residents.

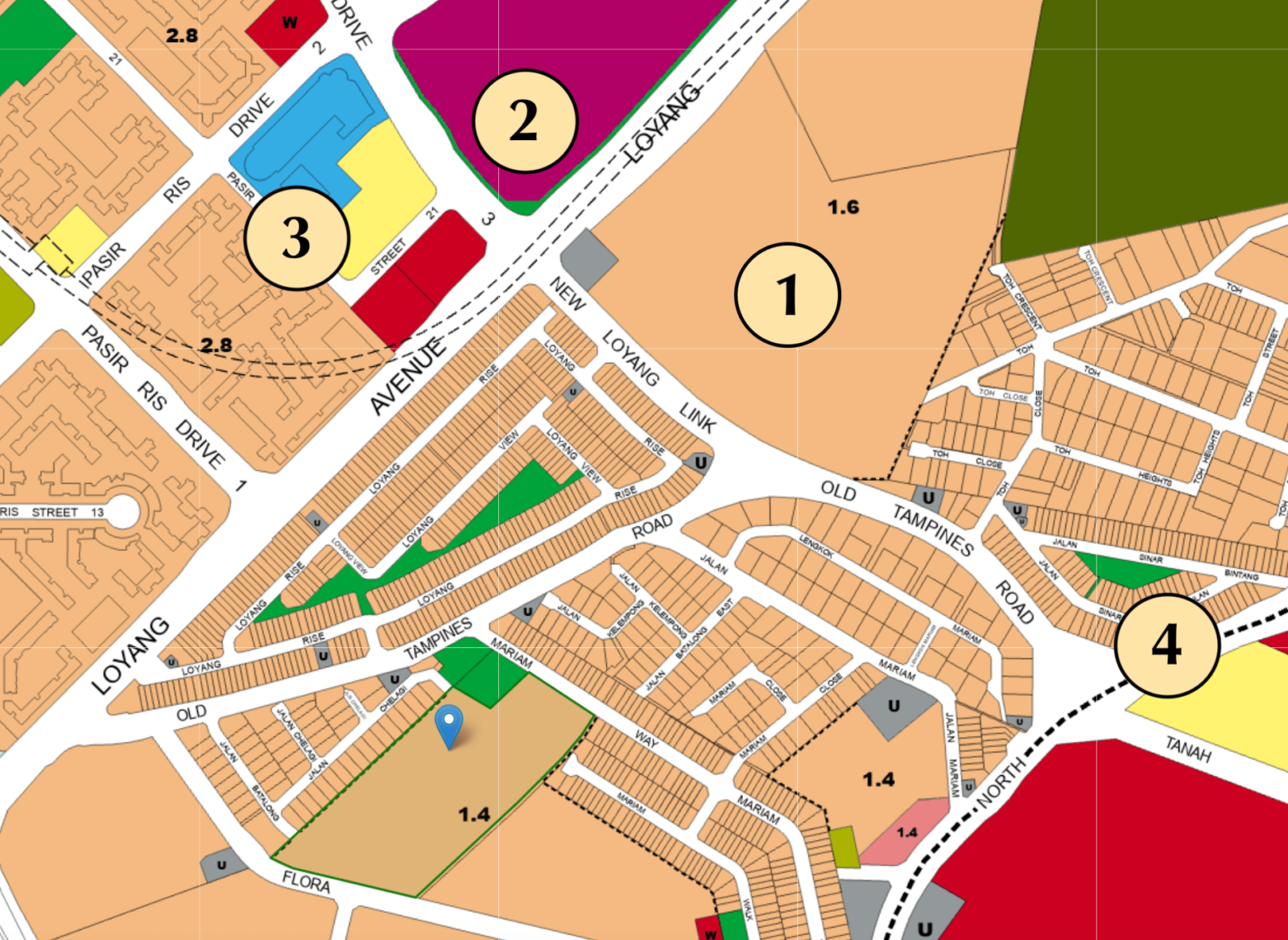

District 18 (Pasir Ris)

We can see from the HDB illustration that there is quite a bit of rejuvenation planned for the Pasir Ris area.

Plot 1 and 2 – Earmarked for residential properties

Plot 3 – Reserve site (specific use of which has yet to be determined)

The town centre will be transformed into a mixed-used development integrated with a bus interchange. The new shopping mall will be more than double the size of White Sands which will greatly increase retail options for residents in the area. There are also a handful of reserve sites and these are parcels of land that have been set aside for future development. If these reserve sites are developed into residential or commercial properties, they’ll potentially bring about positive effects to the area.

One example of this is the recent Pasir Ris 8. Most people couldn’t fathom a Pasir Ris condo going for prices past $2,000 psf. While it is an integrated development, the higher prices of such condos provide a higher anchor now for the rest of the estate. The fact that Pasir Ris 8 sold exceptionally well is telling of the demand and desirability in the area.

Now that we have a better understanding of the future integration plans in the different locations, let’s discuss your other consideration of purchasing a dual key unit.

Should you buy a dual key unit?

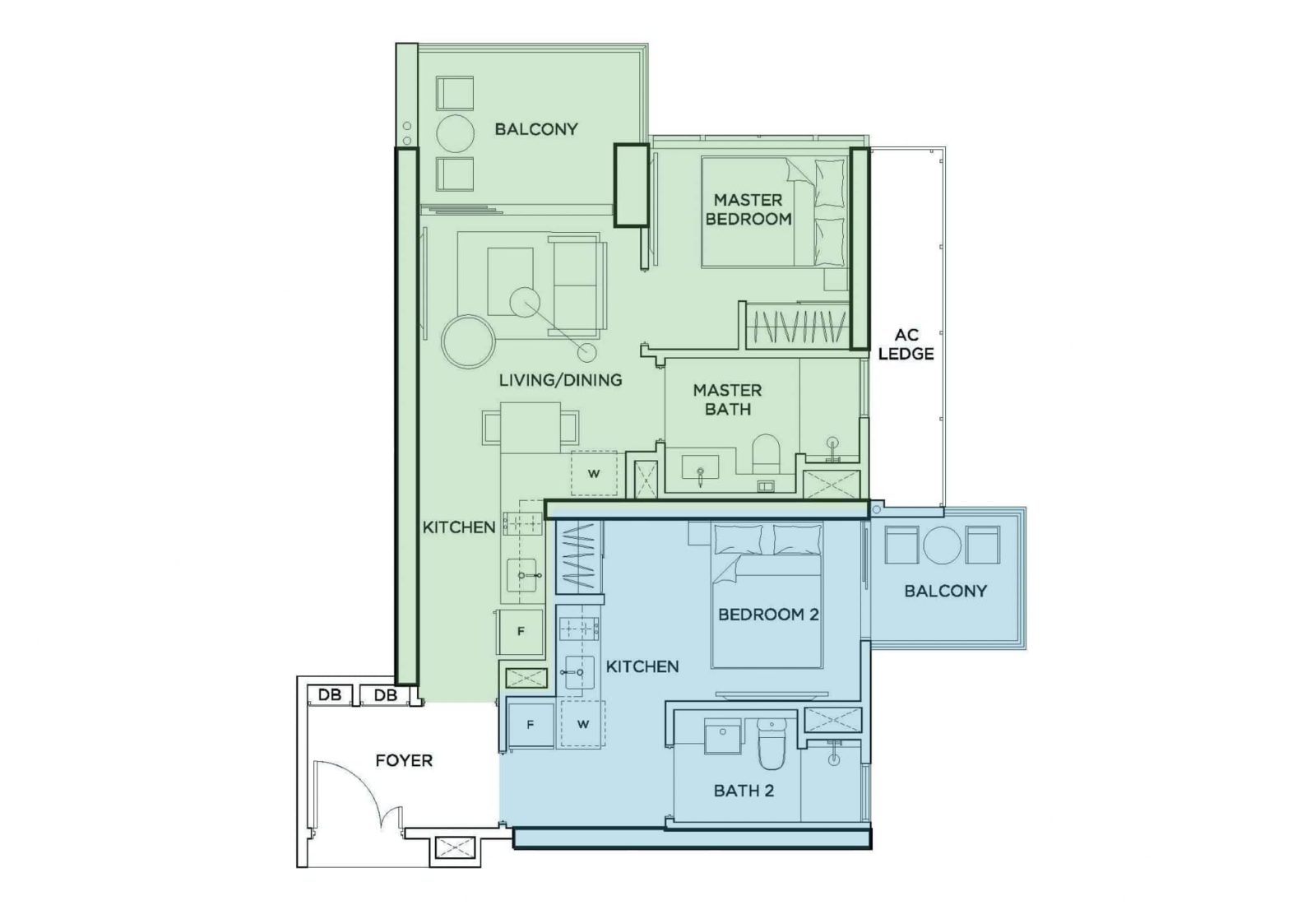

A dual key unit contains two separate living spaces, each with its own entrance, but sharing a common foyer.

There are pros and cons to buying a dual key unit which we have touched on here, so we aren’t going to delve into the details.

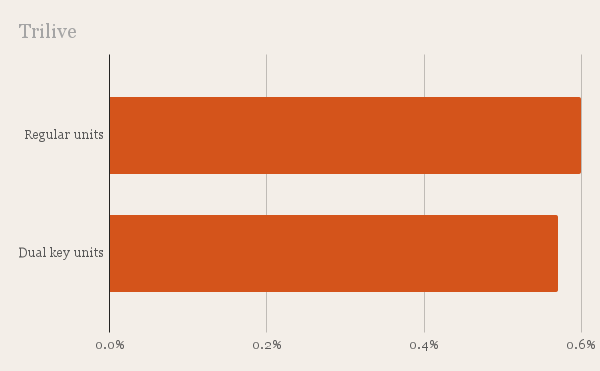

Since returns were a focus of your question, we’d like to highlight that regular units tend to perform better than dual key units in terms of growth rate alone – at least in terms of capital gains.

We also talked about that in the article linked above too, and if we were to look at the annualised growth rate for Trilive, which you’ve picked out, we can see that regular units are performing slightly better than dual key units.

Given the nature of dual key units, some owners may have collected rental returns during this period and thus, may not have been so sticky on their desired selling price.

However, it is important to note that dual key units may not be suitable for every family or individual, as they require a level of proximity and shared space that not everyone is comfortable with. For example, some landlords/tenants do not wish to see each other. Even with a separate unit, you’ll still open the same main door due to the shared foyer space.

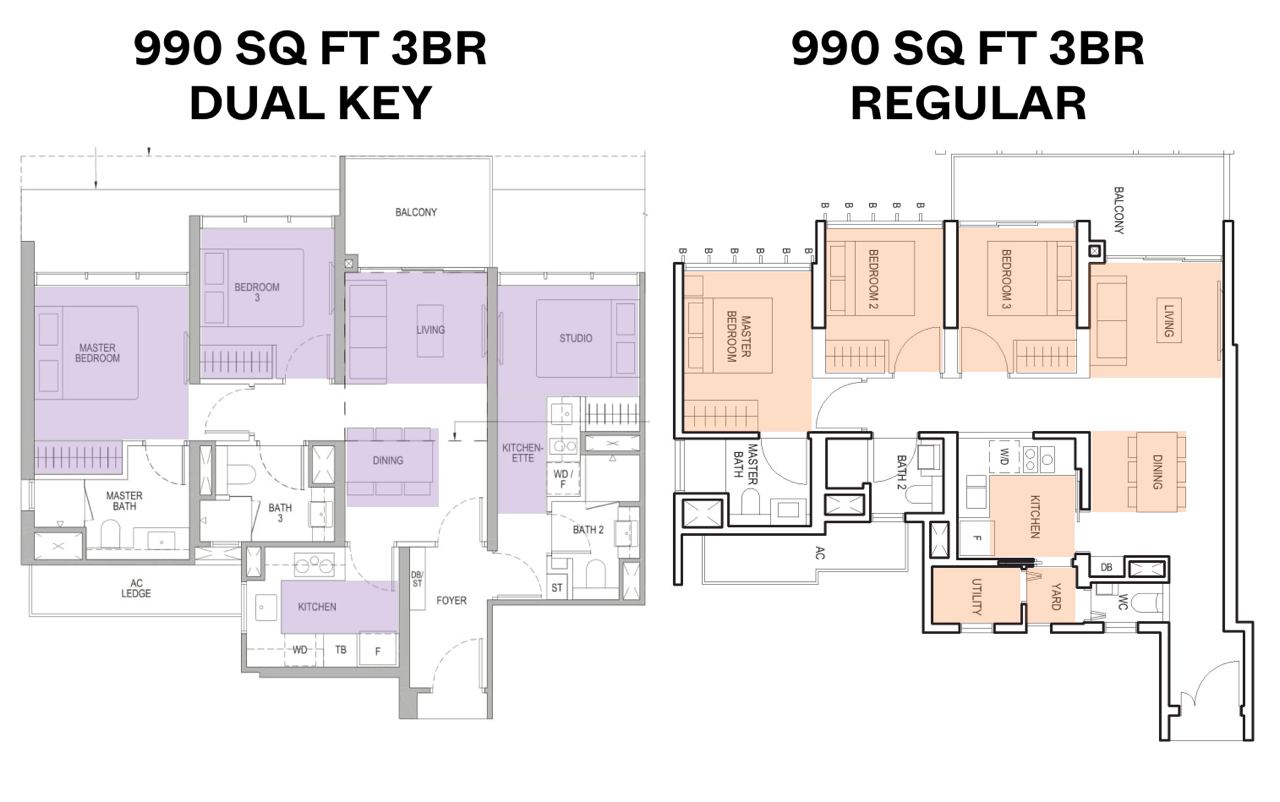

Bear in mind that the pool of buyers looking to purchase dual key units may not be as large as that of regular units too. Dual key units appeal to those looking at rental income while wanting a place to stay without having to buy 2 properties, or multi-gen families looking at greater privacy. These subsets of buyer profiles are quite niche compared to buyers looking at a proper own-stay unit.

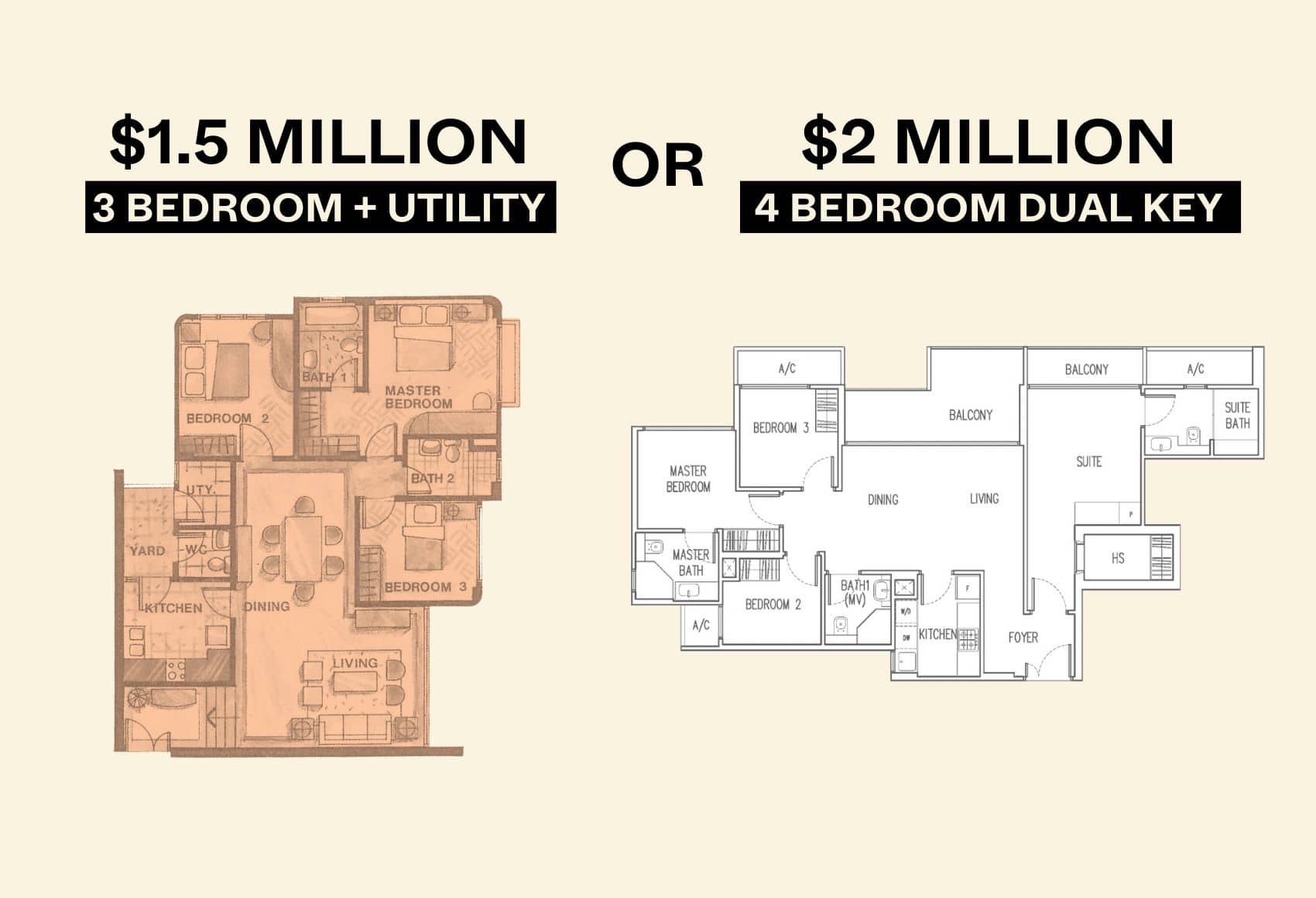

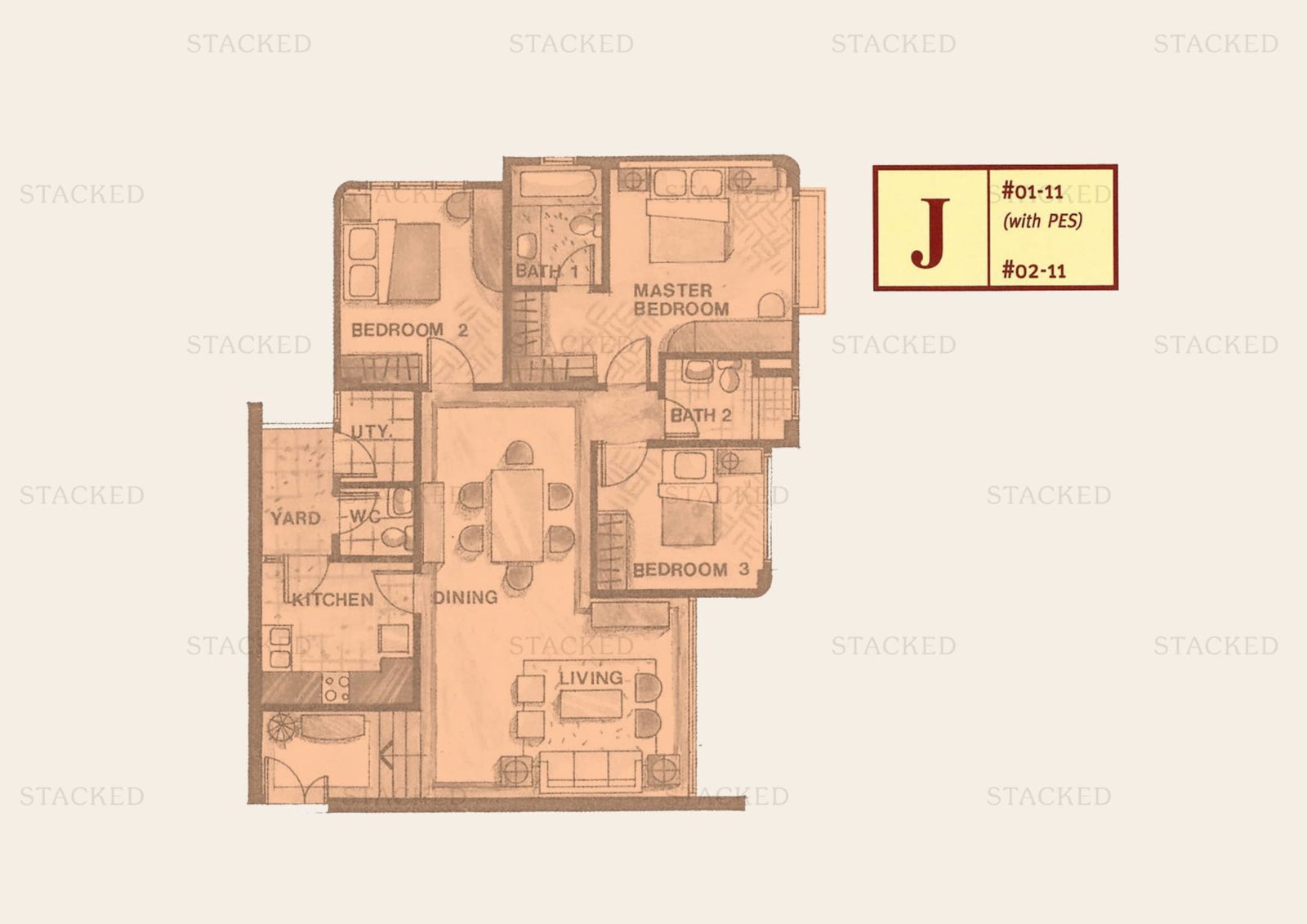

For example, a family could consider a more practical 3-bedroom with a yard and utility room versus a compact 3-bedroom unit with a separate studio unit to rent out. The extra space that could’ve gone towards a utility room/WC/yard instead goes towards a foyer space and an extra kitchen which could be wasteful to a family if they do not prioritise rental income.

In short, when it is time to sell, your buyer pool may be limited.

The fact that a large majority of the units in a development like Trilive (182 out of 222 units) are dual key units could potentially amplify the challenge of reselling the property.

But with rental returns in mind, should you consider increasing your budget to $2m for a dual-key unit then?

Let’s do some simple projections to compare the two options you’re weighing.

Projections

Seeing as you’re looking to purchase a freehold property and your kids are still young, we presume that you’re intending to stay in this property for an extended amount of time.

In our projections, we will use a holding period of 15 years. For this calculation, we will use the annualised growth rate of the overall freehold and 999-year leasehold non-landed properties which is at 3.31% as sort of the average of how the property might play out over the long term.

Option 1: Buy a freehold 3-bedroom unit at $1.5M and keep $500K in investments

We will assume a 75% loan of $1.125M at a 4% interest with a 30-year tenure. Total costs include interest expense, buyer stamp duty, property tax and maintenance fees which we have set at $350/month.

| Period | Total Cost | Total Gains | Profit |

| Starting point | $44,600 | $0 | -$44,600 |

| Year 1 | $95,419 | $49,650 | -$45,769 |

| Year 2 | $145,432 | $100,943 | -$44,488 |

| Year 3 | $194,604 | $153,935 | -$40,669 |

| Year 4 | $242,902 | $208,680 | -$34,222 |

| Year 5 | $290,290 | $265,237 | -$25,053 |

| Year 6 | $336,731 | $323,667 | -$13,064 |

| Year 7 | $382,187 | $384,030 | $1,843 |

| Year 8 | $426,616 | $446,391 | $19,775 |

| Year 9 | $469,979 | $510,817 | $40,838 |

| Year 10 | $512,230 | $577,375 | $65,145 |

| Year 11 | $553,325 | $646,136 | $92,811 |

| Year 12 | $593,217 | $717,173 | $123,956 |

| Year 13 | $631,857 | $790,562 | $158,705 |

| Year 14 | $669,193 | $866,379 | $197,186 |

| Year 15 | $705,172 | $944,706 | $239,534 |

We will assume an ROI of 7% annually for your investments – this is just slightly under the average returns of the S&P500 – and that’s if we don’t count dividends.

| Period | Investment amount | Profits |

| Starting point | $500,000 | 0 |

| Year 1 | $535,000 | $35,000 |

| Year 2 | $572,450 | $72,450 |

| Year 3 | $612,522 | $112,522 |

| Year 4 | $655,398 | $155,398 |

| Year 5 | $701,276 | $201,276 |

| Year 6 | $750,365 | $250,365 |

| Year 7 | $802,891 | $302,891 |

| Year 8 | $859,093 | $359,093 |

| Year 9 | $919,230 | $419,230 |

| Year 10 | $983,576 | $483,576 |

| Year 11 | $1,052,426 | $552,426 |

| Year 12 | $1,126,096 | $626,096 |

| Year 13 | $1,204,923 | $704,923 |

| Year 14 | $1,289,267 | $789,267 |

| Year 15 | $1,379,516 | $879,516 |

Total profit after 15 years: $239,534 + $879,516 = $1,119,050

Option 2: Buy a freehold 4 bedroom dual key unit at $2M

We will also assume a 75% loan of $1.5M at a 4% interest with a 30-year tenure. Total costs include interest expense, buyer stamp duty, property tax, maintenance fees which we have set at $450/month and agency fees payable every 2 years. For the rental of the studio, we are using a conservative amount of $2,300/month.

| Period | Total Cost | Total Gains | Profit |

| Starting point | $72,084 | $0 | -$72,084 |

| Year 1 | $137,787 | $93,800 | -$43,987 |

| Year 2 | $204,898 | $189,791 | -$15,107 |

| Year 3 | $268,405 | $288,046 | $19,641 |

| Year 4 | $333,230 | $388,640 | $55,409 |

| Year 5 | $394,358 | $491,650 | $97,291 |

| Year 6 | $456,708 | $597,155 | $140,447 |

| Year 7 | $515,259 | $705,240 | $189,981 |

| Year 8 | $574,927 | $815,988 | $241,061 |

| Year 9 | $630,688 | $929,489 | $298,801 |

| Year 10 | $687,451 | $1,045,833 | $358,382 |

| Year 11 | $740,189 | $1,165,115 | $424,926 |

| Year 12 | $793,806 | $1,287,431 | $493,625 |

| Year 13 | $843,269 | $1,412,882 | $569,613 |

| Year 14 | $893,478 | $1,541,572 | $648,094 |

| Year 15 | $939,395 | $1,673,608 | $734,213 |

Total profit after 15 years: $734,213

Based on the projection above, buying a $1.5M 3 bedder and continuing to invest the $500K will yield considerably higher gains over 15 years. This is, however, highly dependent on how your investments fare.

Investing the $500K provides diversification and greater liquidity. In case of emergencies, the funds can be withdrawn more easily. However, the stability of the investment may vary depending on the type of investment.

In our example, we’ve considered the stock market which is definitely on the higher end of the risk spectrum. What if, in 12-15 years you decide you need the money for other reasons, but a recession hits and the market plunges? As such, you might want to consider a mix of investments that is safer which can reduce your returns.

On the other hand, the property market can be seen as a more stable product today given the multiple levers the government can use to maintain a stable market.

The downside is having to handle a tenant as well as the maintenance that comes with it which may not be worth the trouble for you as compared to generating returns from cash. Interest rates could also go higher which would reduce your returns further, though the contrary can happen too.

Dual key vs en bloc potential

You mentioned in your question that en bloc potential is something you’re considering too.

This does contradict with your desire to buy a dual key unit as developments with dual key units tend to be newer, so their en-bloc potential is reduced (the first dual-key condo Caspian reached its TOP in 2012, just 11 years ago.

If your focus is on en bloc potential, you could be better off looking for an old (past 20 years) condo that has a large space that has not yet maximised the potential of its land area. It’s also great if the development is in a growth area and has a good narrative to push (e.g. close to an upcoming MRT, with future growth potential).

As with older properties, these types of developments tend to have large units, so while they are more affordable on a $PSF level, their overall price could still be quite high. For example, it was not uncommon to see 2-bedroom units at 900 sq ft back then, but today, this is typically a compact 3-bedder.

Thus, an old condo with a utility room (such as the one below from Casa Pasir Ris) could be in the range of 1,200 sq ft onwards which could easily bust your budget if it’s greater than $1,250 psf.

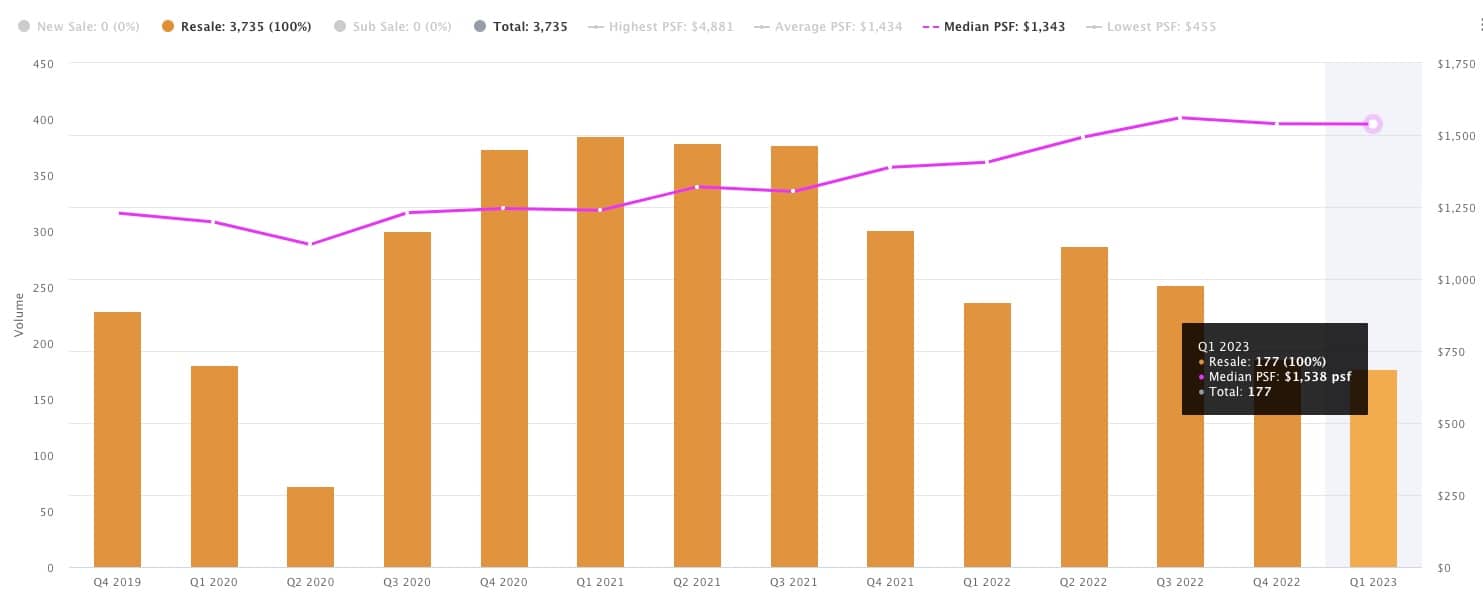

Here’s a look at the median $PSF for projects greater than 20 years old that’s 999-year/freehold:

At $1,538 PSF (as indicated in Q1 2023), a 1,200 sq ft unit would cost $1,845,600 which is well beyond the $1.5m budget. Of course, this is just a median price, but it is indicative of how limited your options would be here.

To concur, a quick search on PropertyGuru shows that there are only a handful of properties that meets your criteria.

Another thing to consider when having en bloc potential in mind is competition. As what we mentioned, the District 15 Telok Kurau area has many small boutique developments. This makes it hard to identify which has better en bloc potential given they are all so similar, and we wouldn’t want to be banging on en bloc if that’s the case.

Similarly, if you look at the Flora Road area, there are several condos around the same age category. To hope that your development could reach a consensus to go en bloc, agree on a price, and actually get a buyer is quite a stretch when there are other developments in the area too. Thus, unless you really have no exit strategy or timeline requirements, we should always see en bloc as a bonus and not make sacrifices elsewhere in the hopes of exiting this way someday.

So what should you do?

As mentioned, it’s quite difficult to meet all of the criteria that were mentioned given the property market high we’re in today.

We think it’s best to prioritise this based on your preferred location based on personal preferences as this is more of an own-stay purchase than an investment. It will make it easier to shortlist developments that are closer to all your criteria and perhaps you’d be more comfortable not meeting some of them given the quality of life improves for you.

In terms of projects to pick this boils down to a suitable layout and whether the development itself meets your needs. For example, if you’re particular about facilities, then this is something you should take note of too. On the capital appreciation side of things, we’d pick a project that is at least in line with the overall market trends which is a sign that it hasn’t stagnated.

We’d also really ask ourselves how much of a priority is a freehold condo at this point. Are you looking for one because you are intending it to be an asset you want to hand to your kids in the future, or is it because of your fears over a leasehold property and its tenure? Freehold properties being a better investment over a leasehold one is not a guaranteed conclusion, and you may be able to find something that is more suitable for your family at your budget if you can open it up to leasehold properties.

Another approach could be to consider the primary schools that you’d like to live near first and see which freehold options suit your budget. Unless the school moves, the development you pick would likely continue to remain relevant and help protect its resale value in the long run. From your list, it didn’t seem that this was a priority but you might surprise yourself since it does help to narrow down your options quickly.

Among the selected areas, Changi and Pasir Ris have development plans already in motion, whereas it is uncertain when the development of the vacant plots in the other areas will happen, making it difficult to predict their impact on the area. That being said, these are the two places that have a better chance of capital appreciation versus places like the Joo Chiat area which sees many small boutique developments around, with little potential for future integration.

As to whether or not a dual key unit is better, this one is really a mixed bag. A dual key unit can be advantageous since you can live in it while renting out a part of it, killing two birds with one stone. However, reselling a dual key unit may be more challenging than selling a regular unit in the future since the buyer pool is smaller.

Assuming similar growth rates, the first option of buying a $1.5M 3 bedder and continuing to invest the $500K will yield better returns than buying a $2M dual key unit and renting out the studio. It’ll also provide greater liquidity and saves the hassle of having to manage a tenant.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

1 Comments

Thanks for the article. One major note to make for SP500 vs Dual key is that the $500k surplus is not sitting around in cash. Buying a 2m dual key gives 4x leverage. Given the loan for the property in the analysis, I assume it’s not bash basis, so a fairer comparison, we should model based on a cash loan to raise and invest $500k in SP500 for comparison. Alternatively, assuming the buyer really does has $500k cash surplus available, then when buying the $2m dual key, they shouldn’t be borrowing max (pay same as regular +500k cash, so interest is same as 1.5m purchase), for an apple to apple comparison. Feel free to contact me if I’m unclear. Thanks!