I’m 32 With A Budget Of $950k: Which Of These 2-Bedroom Condos In Tampines Is Best As A Rental Investment?

February 11, 2023

Dear stacked homes,

I would like to seek your kind advice on housing matters.

I am 32 and married. I do not own any existing properties and have a budget of 950k. Have sought an IPA to confirm that I would be able to take up the necessary loan for a budget of 950k.

I am considering to buy a 2 bedder unit from one of these developments – the Alps Residence, Waterview, Vue 8, Stratum.

I am able to fund the downpayment of 5% in cash, and 20% with cpf, with some leftover in the cpf for potentially 1 year worth of repayment of monthly loan.

The main purpose of purchasing the house would be wanting to be independent and have my own unit, be it for investment or future personal stay/ a safety net to fall upon in case my marriage doesn’t work out.

i am unsure if my plans are tenable, but at the moment, I am considering the following –

1) purchase a unit with existing tenancy and let it continue to run, however it is noted that existing rental fees may not cover/ May just be enough to cover monthly repayment of loan, with a possibility of a loss due to payment for maintenance.

Given the high interest rates, could you pls provide me with some guidance and advice on whether the plan could work out and if so, which development (not limited to the above-mentioned 4 would be a potential choice please.

If the above is not a good idea, what would you suggest for me to consider/do ?

Thank you and look forward to hearing your advice on the matter!

Regards

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hey there,

Thanks for writing to us.

Things like a failed marriage are not something anyone wants to plan for but it never hurts to have a safety net just in case.

In considering your situation, we’ll focus on a few important points:

- What is the cost breakdown and loan required for a $950,000 property?

- How rentable are they? We’ll look at their respective location to see which development is more appealing

- What are the latest prices and rental rates for the shortlisted developments?

- What is their unit mix like?

- What is their capital appreciation like in the past few years?

- What other developments could you consider?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Let’s start by taking a look at the costs breakdown for a $950K property:

| Description | Amount |

| Property value | $950,000 |

| 5% cash downpayment | $47,500 |

| 20% CPF downpayment | $190,000 |

| 75% loan | $712,500 |

| Monthly repayment at 4% interest with a 30-year tenure | $3,402 |

| BSD | $23,100 |

Next, let’s project what rent you could get for such a property. In this case, we’ll use a 2.5% rental yield to be conservative even though we’re seeing 3-4% yields today (but feel free to adjust as you see fit).

Based on a purchase price of $950K, at a 2.5% yield, the rent will be $1,979 which is $1,423 short of the monthly mortgage at $3,402. This is before taking maintenance and agent fees into consideration.

In terms of cash flow, here’s the top-up you need on a 2.5%/3.5% yield based on the different levels of interest rates.

| Interest Rate | Mortgage Payment | Rental (2.5%) | Rental (3.5%) | Cash Top-Up (2.5%) | Cash Top-Up (3.5%) |

| 4% | $3,758 | $1,979 | $2,771 | $1,779 | $987 |

| 3.50% | $3,564 | $1,979 | $2,771 | $1,585 | $794 |

| 3% | $3,376 | $1,979 | $2,771 | $1,397 | $606 |

| 2.50% | $3,194 | $1,979 | $2,771 | $1,215 | $423 |

The cash top-up can be a concern here. Even with a rental yield of 3.5%, you’ll still find yourself having to top up in cash/CPF at what we think is a realistic long-term interest rate of 3%. This doesn’t even include agent fees and property tax.

Here’s what the cashflow would look like over the next 5 years:

| Cash Out | Cash In | Cashflow | ||

| Year | Mortgage Payment | Fees (Stamp Duty, Agent Fees, Taxes) | Rental Income | Net Cash Flow |

| 1 | $38,388 | $32,085 | $38,004 | -$32,470 |

| 2 | $38,388 | $8,985 | $38,004 | -$9,369 |

| 3 | $38,388 | $6,420 | $28,500 | -$16,308 |

| 4 | $38,388 | $8,985 | $28,500 | -$18,873 |

| 5 | $38,388 | $6,420 | $28,500 | -$16,308 |

| Total | $191,942 | $62,895 | $161,508 | -$93,330 |

We’ve assumed a constant interest rate loan of 3.5%, a rental yield of 4% in the first 2 years (given the strong rental market today), and 3% in the next 3 years.

You can see that within 5 years, you’ll be down over $90,000 in cash assuming you do not use your CPF to make any of these payments. Of course, it could be less if you utilise your CPF for mortgage payments and the Buyers Stamp Duty. What matters here is that you’re fully aware of the net position you could find yourself in in a couple of years should you decide to use cash only.

This brings us to our next point: If cashflow is an issue for you today, you may want to adopt the wait-and-see approach. After all, we are operating in a high-interest rate environment today alongside high property prices.

This is especially true if you do not have an urgent need to purchase the property right away.

One concern we do have with the wait-and-see approach is that property prices, especially for newer developments, are constantly moving upward with the increased land and construction costs. So the actual savings may not be much if property prices go up while you wait for interest rates to come down.

We cannot be certain when interest rates will come down but looking at historical data, high-interest rate periods usually last no longer than 4 years. With the current hot rental market, the rent might be able to cover a good portion of your monthly repayment even with the high interest.

It may not last forever though, as the rental market also operates in a cycle – this is why we assumed a conservative rental yield of 2.5% even though we’re seeing upwards of 3+ to 4% today.

Now that we’ve looked at the financials and projected forecast, let’s run through the projects you’ve shortlisted!

Location

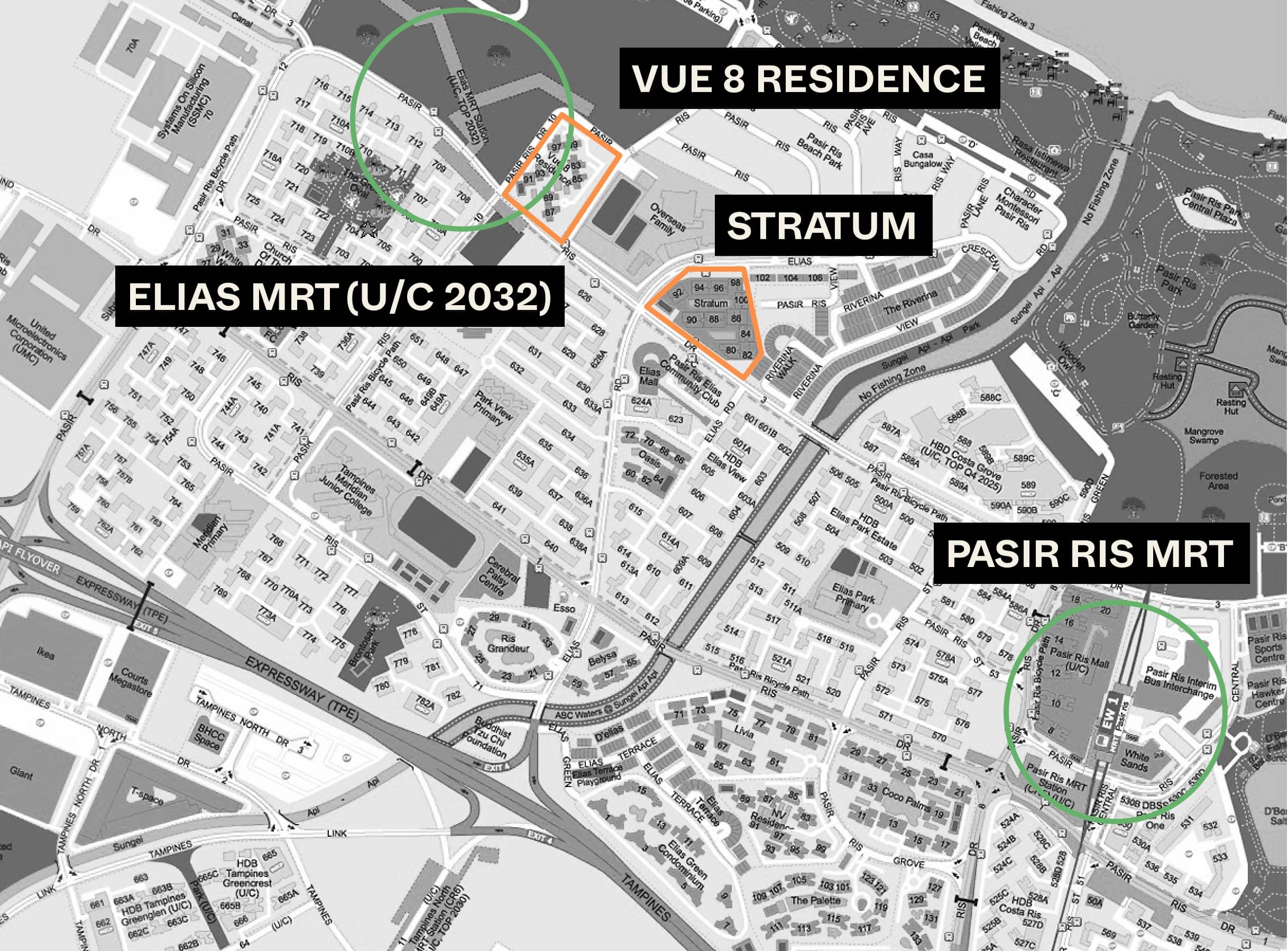

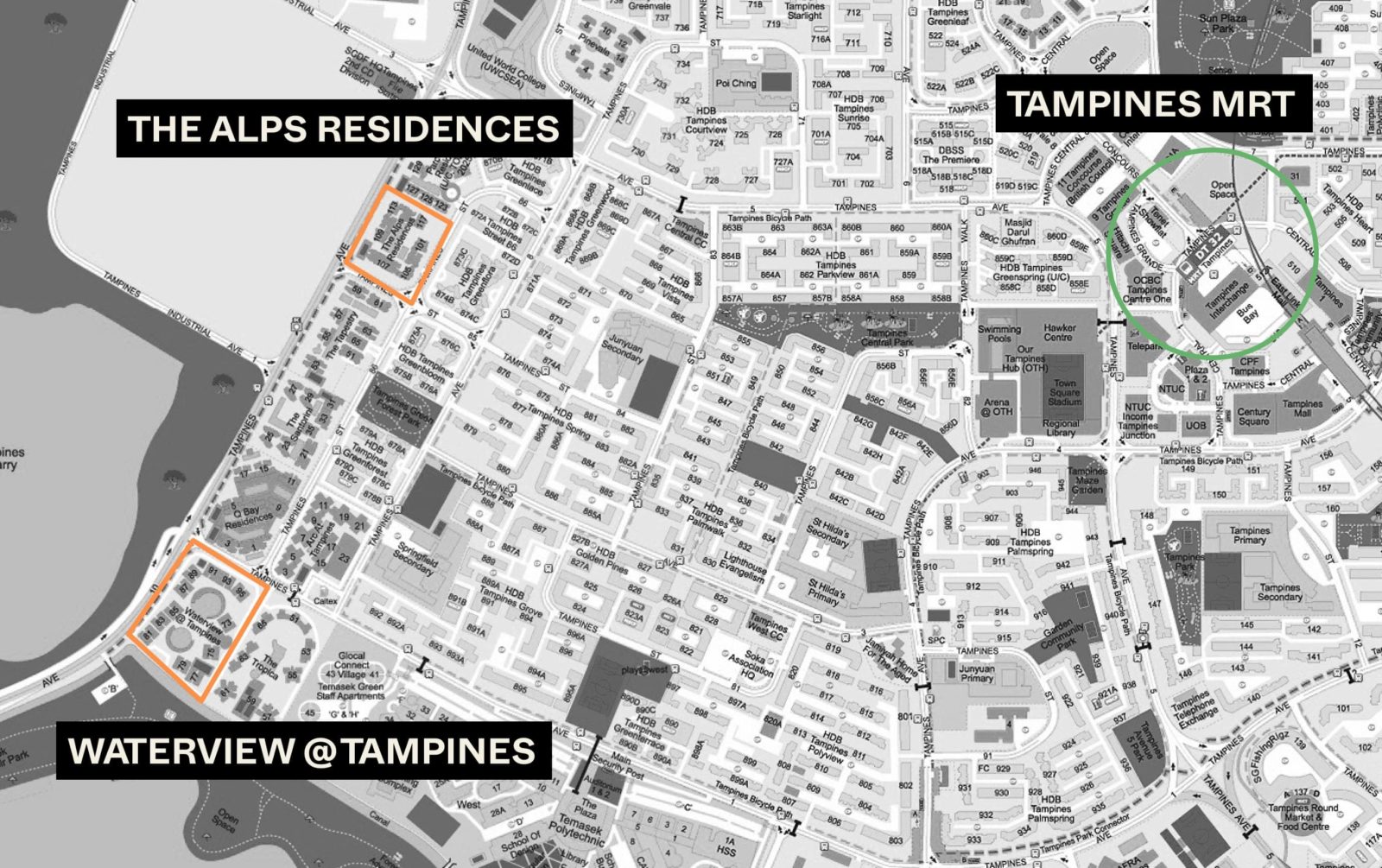

We noticed that all 4 developments you’ve picked out are situated in District 18 which we’re presuming is an area you’d prefer to live in if you have to move into the property someday. We’ll start off by looking at their locality and project details.

Shortlisted projects in Tampines:

Shortlisted projects in Pasir Ris:

Immediately, you’ll see that none of the shortlisted projects are desirable for renting out by traditional definition: being near an MRT. However, this may not be a big deal as renters in the vicinity may be working in the area. One notable point is Vue 8 Residence – with the upcoming Elias MRT (2032), renters may find the noise and construction of the site to be quite undesirable, however, it does increase the chances of capital appreciation and price defensiveness once the MRT is built.

Now let’s look at the developments in detail.

The Alps Residences

The Alps Residences is a mid-sized development made up of 626 units of 1 – 5 bedders. It has a 99-year lease which started in 2015 making it 8 years old, and it obtained its TOP in 2019.

It takes slightly over 20 minutes to walk from the project to Tampines MRT station which is far from being within walking distance, but there are buses that will take you there in approximately 15 minutes. You can find everything you need at the 3 shopping malls surrounding the MRT station – Tampines 1, Tampines Mall, and Century Square, as well as at Our Tampines Hub. There is also a Sheng Siong Supermarket and a food court located at the HDB cluster just across the street.

Pricing

These are some of the recent 2-bedroom transactions:

| Date | Size (sq ft) | No. of bedrooms | PSF | Price | Level |

| Jan 2023 | 700 | 2 | $1,358 | $950,000 | #13 |

| Nov 2022 | 689 | 2 | $1,333 | $918,000 | #08 |

| Nov 2022 | 700 | 2 | $1,286 | $900,000 | #02 |

| Nov 2022 | 689 | 2 | $1,234 | $850,000 | #01 |

| Oct 2022 | 700 | 2 | $1,289 | $902,000 | #05 |

| Oct 2022 | 700 | 2 | $1,358 | $950,000 | #06 |

| Oct 2022 | 689 | 2 + S | $1,277 | $880,000 | #04 |

| Oct 2022 | 700 | 2 | $1,315 | $920,000 | #15 |

On average, prices of 2-bedders here go for around $908,750.

Rental Transactions

| Lease Start | Size | Bedrooms | Monthly Rent |

| Dec 2022 | 600 TO 700 | 2 | $3,600 |

| Dec 2022 | 600 TO 700 | 2 | $2,900 |

| Dec 2022 | 600 TO 700 | 2 | $3,600 |

| Dec 2022 | 600 TO 700 | 2 | $3,200 |

| Dec 2022 | 600 TO 700 | 2 | $3,000 |

| Nov 2022 | 600 TO 700 | 2 | $3,800 |

| Nov 2022 | 600 TO 700 | 2 | $3,900 |

| Nov 2022 | 600 TO 700 | 2 | $3,200 |

| Oct 2022 | 600 TO 700 | 2 | $3,100 |

| Oct 2022 | 600 TO 700 | 2 | $3,800 |

| Oct 2022 | 600 TO 700 | 2 | $3,500 |

The average rent for a 2-bedroom unit in Q4 of 2022 is $3,418 putting it at around a 4.51% rental yield for a $908,750 unit.

Unit Mix

| Bedroom type | Area (sq ft) | No. of units | % Mix |

| 1 room | 441 – 506 | 116 | 18.53% |

| 1+1 room | 495 – 506 | 66 | 10.54% |

| 2 room | 689 – 700 | 183 | 29.23% |

| 2+1 room | 689 – 689 | 54 | 8.63% |

| 3 room | 936 – 1,087 | 179 | 28.59% |

| 4 room | 1,410 – 1,410 | 22 | 3.51% |

| 4 room penthouse | 1,668 – 2,088 | 3 | 0.48% |

| 5 room penthouse | No Data | 3 | 0.48% |

2-bedroom units make up close to 30-38% of the project here which is the majority in this project’s case.

Waterview

Waterview is another 99-year leasehold development that is located just 1 km away from The Alps Residences so they pretty much share the same amenities and transport links. It is also a mid-sized project with 696 units of 2 – 4 bedroom types. It obtained its TOP in 2014 while its lease started in 2010, making it 13 years old.

Pricing

These are some of the recent 2-bedroom transactions:

| Date | Size (sq ft) | No. of bedrooms | PSF | Price | Level |

| Jan 2023 | 786 | 2 | $1,171 | $920,000 | #11 |

| Dec 2022 | 786 | 2 | $1,171 | $920,000 | #14 |

| Nov 2022 | 926 | 2 | $1,067 | $988,000 | #02 |

| Nov 2022 | 926 | 2 | $1,262 | $1,168,000 | #13 |

| Oct 2022 | 926 | 2 | $1,132 | $1,048,000 | #10 |

| Oct 2022 | 786 | 2 | $1,120 | $880,000 | #02 |

| Oct 2022 | 786 | 2 | $1,145 | $900,000 | #08 |

Rental Transactions

| Lease Start | Size | Bedrooms | Monthly Rent |

| Dec 2022 | 700 TO 800 | 2 | $3,950 |

| Dec 2022 | 700 TO 800 | 2 | $3,000 |

| Nov 2022 | 700 TO 800 | 2 | $3,100 |

| Nov 2022 | 700 TO 800 | 2 | $3,550 |

| Nov 2022 | 700 TO 800 | 2 | $2,800 |

| Nov 2022 | 700 TO 800 | 2 | $3,300 |

| Oct 2022 | 700 TO 800 | 2 | $2,650 |

| Oct 2022 | 700 TO 800 | 2 | $2,900 |

| Oct 2022 | 700 TO 800 | 2 | $3,300 |

Based on the transacted prices, you will likely be looking at the smaller 2-bedroom units which do not come with a study. The average rent for a 786 sq ft 2 bedroom unit in Q4 of 2022 is $3,172 while the average price for the 786 unit is $900,000, making it around a 4.23% yield.

Unit Mix

| Bedroom type | Area (sq ft) | No. of units | % Mix |

| 2BR | 786 – 1,184 | 308 | 44.25% |

| 3BR | 1,109 – 1,733 | 304 | 43.68% |

| 4BR | 1,195 – 4,155 | 65 | 9.34% |

| 5BR | 3,584 – 3,778 | 11 | 1.58% |

| 6BR | 4,456 – 4,768 | 5 | 0.72% |

| NA | 3 | 0.43% |

Like The Alps Residences, 2-Bedroom units also make up a majority of the units here, with 3-bedroom units not trailing far behind.

Vue 8 Residence

Vue 8 Residence is on the lower end of a mid-sized project with 463 units consisting of 1 – 6 bedroom types. It has a 99-year lease starting in 2012 and obtained its TOP in 2017.

The development is a 23-minute walk from Pasir Ris MRT station which isn’t exactly a daily walkable distance, especially with Singapore’s heat and humidity, but as always there are numerous buses that will take you there. The future Elias MRT station will be located right next to the project but it is estimated to only be completed in 2032. For basic necessities, Elias Mall and Pasir Ris West Plaza are both an 8-minute walk away. For outdoor lovers, Pasir Ris Park is just a 6-minute walk from the project.

Pricing

These are some of the recent 2-bedroom transactions:

| Date | Size (sq ft) | No. of bedrooms | PSF | Price | Level |

| Dec 2022 | 797 | 2 | $1,224 | $975,000 | #03 |

| Nov 2022 | 797 | 2 | $1,237 | $985,000 | #07 |

| Sep 2022 | 893 | 2 | $1,287 | $1,150,000 | #02 |

Rental Transactions

| Lease Start | Size | Bedrooms | Monthly Rent |

| Dec 2022 | 700 TO 800 | 2 | $3,600 |

| Dec 2022 | 700 TO 800 | 2 | $3,800 |

| Oct 2022 | 700 TO 800 | 2 | $2,400 |

| Oct 2022 | 700 TO 800 | 2 | $3,500 |

Based on the transacted prices, you will likely be looking at the smaller 2-bedroom units. The average rent for 2 bedders ranging from 700 – 800 sq ft in Q4 of 2022 is $3,325, putting the rental yield for a $950K unit at 4.2%.

Unit Mix

| Bedroom type | Area (sq ft) | No. of units | % Mix |

| 1 room | 474 – 646 | 26 | 5.62% |

| 2 room | 700 – 1,087 | 117 | 25.27% |

| 3 room | 1,033 – 1,259 | 145 | 31.32% |

| 4 room | 1,238 – 1,776 | 126 | 27.21% |

| 4 room dual key | 1,,615 – 1,690 | 13 | 2.81% |

| 4 room penthouse | 1,873 – 2,239 | 12 | 2.59% |

| 5 room | 1,701 – 1,948 | 13 | 2.81% |

| 5 room penthouse | 2,325 – 2,723 | 10 | 2.16% |

| 6 room penthouse | 3,391 – 3,391 | 1 | 0.22% |

Unlike the previous two developments, Vue 8 Residence’s 2-bedroom units do not make up a majority of the units here. In fact, the 3 and 4-bedroom units make up more in terms of proportion, albeit slightly.

Stratum

Stratum is another 99-year leasehold development with its lease starting in 2012 while it obtained its TOP in 2016. It is also on the lower end of a mid-sized condominium with 380 units of 1 – 4 bedders, with 110 units being 2 bedroom types. The project is located just 600m away from Vue 8 Residence so they share the same amenities and transport links.

Pricing

These are some of the recent 2-bedroom transactions:

| Date | Size (sq ft) | No. of bedrooms | PSF | Price | Level |

| Jun 2022 | 947 | 2 | $1,101 | $1,042,800 | #01 |

| Mar 2022 | 775 | 2 | $1,146 | $888,000 | #05 |

| Mar 2022 | 775 | 2 | $1,135 | $880,000 | #04 |

| Mar 2022 | 883 | 2 | $969 | $855,000 | #01 |

On average, the 775 sq ft unit costs around $884,000. However, this was almost a year ago, so prices are very likely higher today.

Rental Transactions

| Lease Start | Size | Bedrooms | Monthly Rent |

| Nov 2022 | 700 TO 800 | 2 | $3,500 |

| Oct 2022 | 700 TO 800 | 2 | $3,100 |

| Oct 2022 | 700 TO 800 | 2 | $4,000 |

| Oct 2022 | 700 TO 800 | 2 | $3,500 |

Based on the recent transactions, you will likely be looking at the 2 bedders under 900 sq ft. There weren’t any rental contracts recorded in the last quarter of 2022 that were between 800 – 900 sq ft, so we’ll just average out those between 700 – 800 sq ft.

Unfortunately, there also weren’t enough 2-bedroom units transacted to showcase those in Q4 of 2022, so the rental yield calculated could be inflated in this case.

From the above transactions, this results in an average of $3,525 which translates to a rental yield of 4.78% for an $884K unit. Of course, we expect this to be lower given the likely higher prices today. Even if we priced it at $950,000 (which is a 7.4% increase in a year!), the yield is still pretty high at 4.45%.

Unit Mix

| Bedroom type | Area (sq ft) | No. of units | % Mix |

| 1 room | 437 – 593 | 95 | 25.68% |

| 2 room | 711 – 960 | 105 | 28.38% |

| 3 room | 1,099 – 1,412 | 80 | 21.62% |

| 3 room penthouse | 1,628 – 1,714 | 15 | 4.05% |

| 4 room | 1,315 – 1,812 | 30 | 8.11% |

| 4 room dual key | 1,455 – 1,853 | 18 | 4.86% |

| 4 room penthouse | 1,746 – 1,768 | 6 | 1.62% |

| 5 room | 1,595 – 2,016 | 8 | 2.16% |

| 5 room penthouse | 2,016 – 2,262 | 11 | 2.97% |

| 6 room penthouse | 2,446 – 2,446 | 2 | 0.54% |

In Stratum’s case, the 2-bedroom units make up a majority of the units here followed by 1-bedroom units.

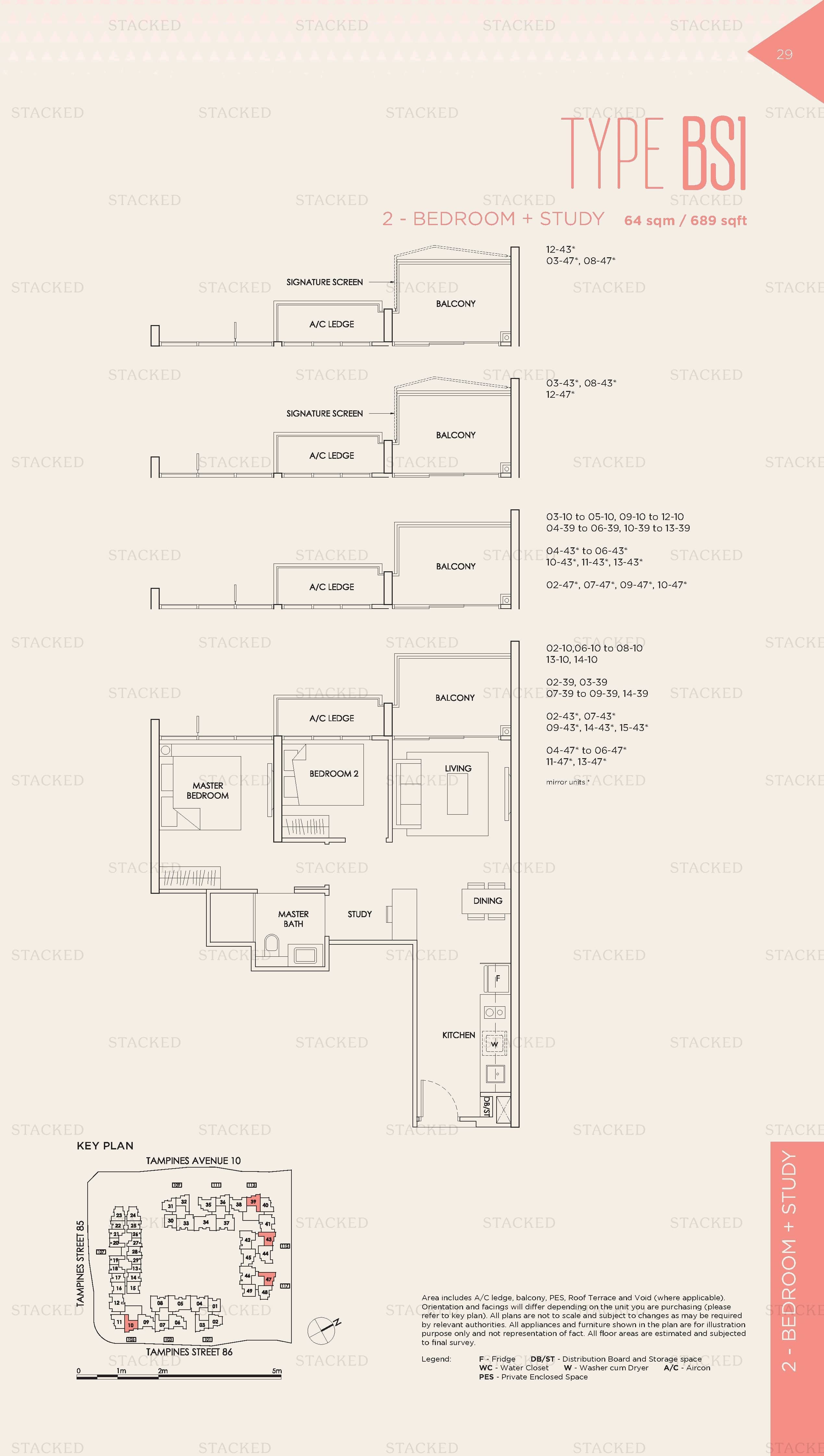

Another factor in the reliability and also desirability of a home is the layout. Let’s take a closer look at what’s on offer.

Layout analysis

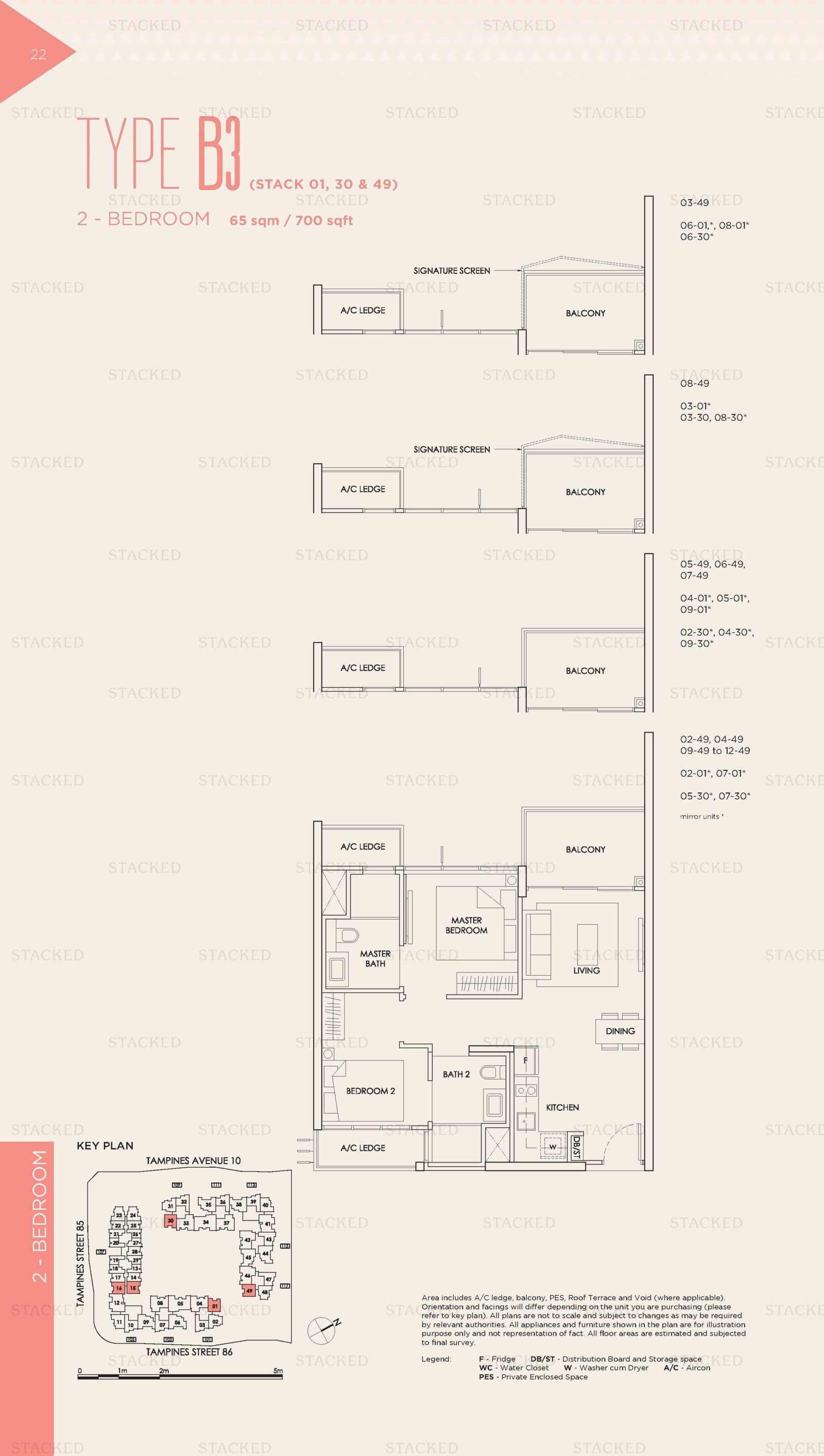

The Alps Residences

There are 4 stacks of these 2 + Study units which come with only 1 bathroom. The typical target audience for such units is investors, single buyers, or couples. But generally, individuals who are buying for their own stay purposes would prefer to have 2 bathrooms especially if there are 2 or more people staying in the unit.

The unit is decently sized and the layout is functional. It is regularly shaped so furniture placement will be easy. A single bed might be a better fit for Bedroom 2 or else it may feel rather cramped.

The 2 bedroom units come in 2 sizes, 689 and 700 sq ft, with a few different layouts. We picked out this particular one as both bedrooms are of a good size and have an attached bathroom. The L-shaped kitchen is also a better utilisation of space and feels roomier as compared to a straight narrow kitchen.

In terms of location, these stretch of developments along Tampines Street 86 are the closest condominiums to Tampines MRT station that comprise 2 bedroom units (other than Treasure at Tampines which is still under construction):

- Q Bay Residences

- The Santorini

- The Tapestry

Parc Central Residences which is the new EC that’s coming up right beside The Alps Residences also does not have any 2 bedders. Seeing that The Alps Residences is the second newest project in the area after The Tapestry, and with its comparatively more affordable entry price for its 2 bedders, prices should continue to hold up in the short to medium term.

The empty plots of land right behind The Alps Residences have been earmarked for Business 2 purposes. This may or may not be a good thing since newer launches could have the potential to positively/negatively impact the demand for surrounding resale condos in the long term, so the zoning may imply greater stability due to the limiting of residential supply in the area.

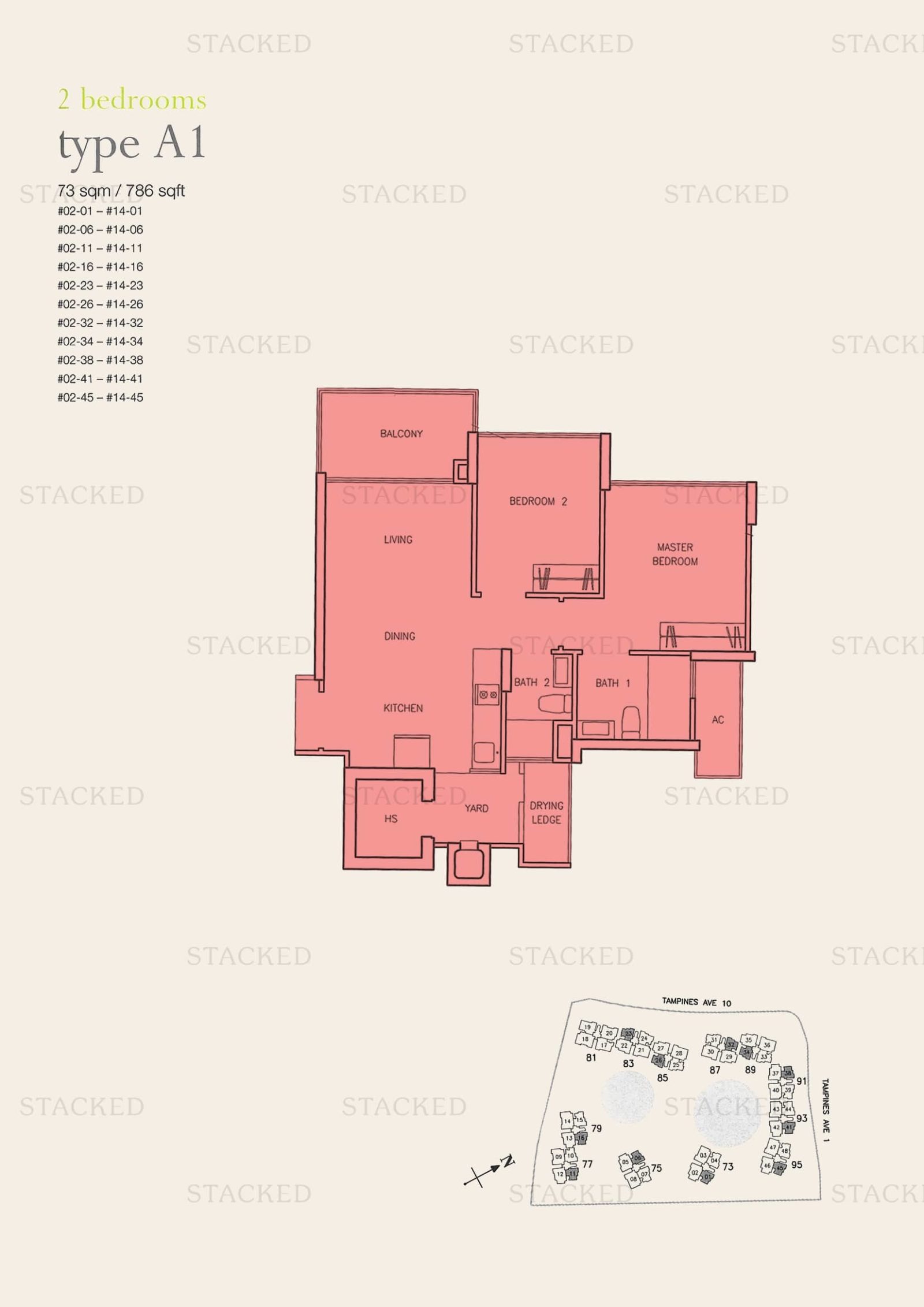

Waterview

786 sq ft for a 2 bedder is no doubt a good size in today’s context. The position of the kitchen makes it possible to enclose it for those who do regular heavy cooking. Attached to the kitchen is a yard and the drying ledge – a very useful unit attribute so that you wouldn’t have to dry the laundry on the balcony which can be unsightly. Having the yard also leaves ample space for a washer and a dryer which is pretty essential when it comes to tenants renting, especially if they’re renting a room each and not a whole unit.

There is also a home shelter which is great for storing miscellaneous household items and minimising clutter in the home. The bedrooms are both well-sized and can comfortably fit a double bed.

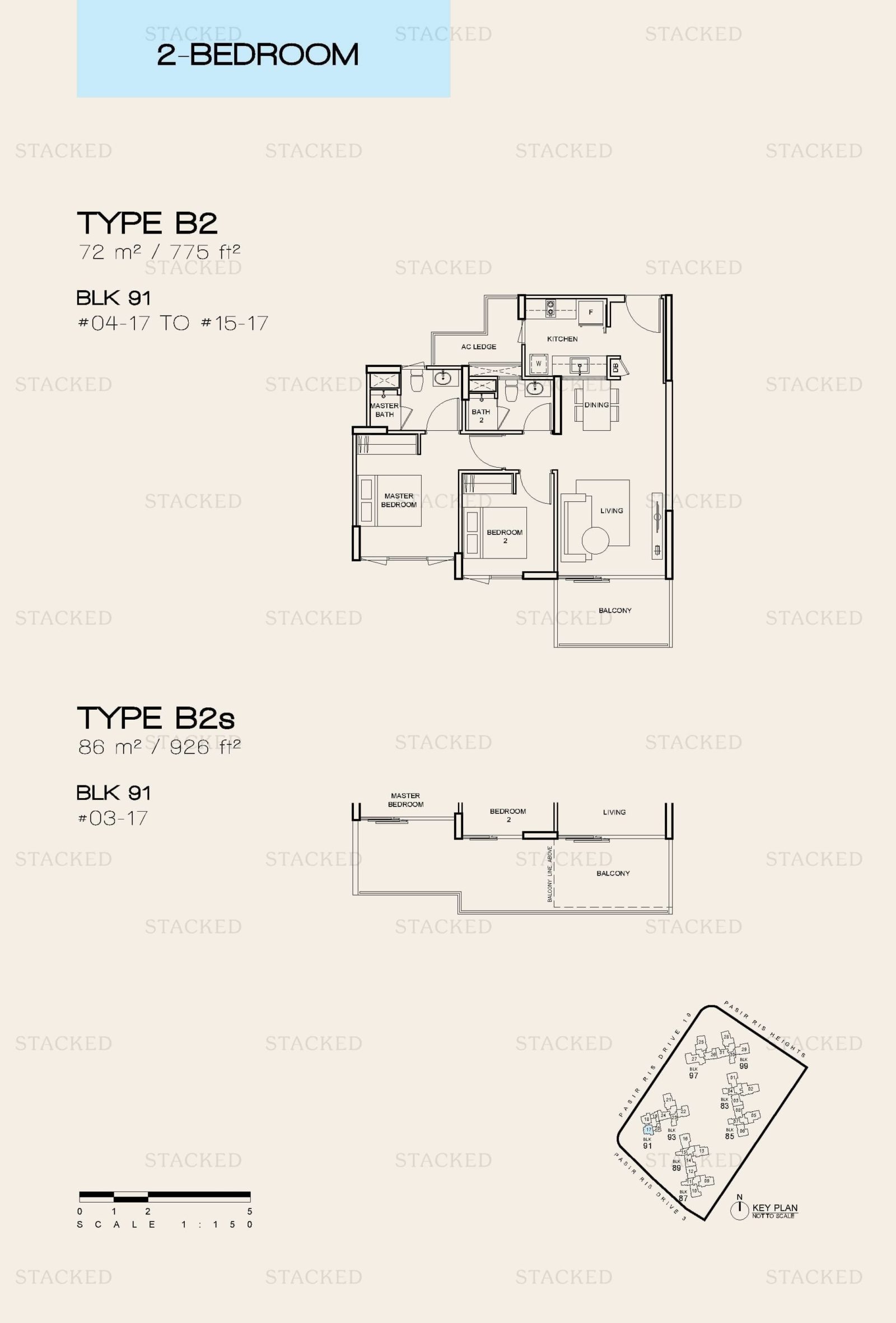

Vue 8 Residence

The 2 bedrooms at Vue 8 Residence come in a few sizes and floor plans but of the smaller units, this particular one comes with an enclosed kitchen (that is ventilated too) which is great if tenants don’t wish to smell each other’s heavy cooking. There is also a small area in the kitchen to stack a washer and dryer.

It is a well-sized unit with an efficient layout too. The living and dining areas are nicely separated with the dining being able to fit a 4 seater table.

Both bedrooms are also spacious enough to fit a double bed and still have a good amount of space to move around.

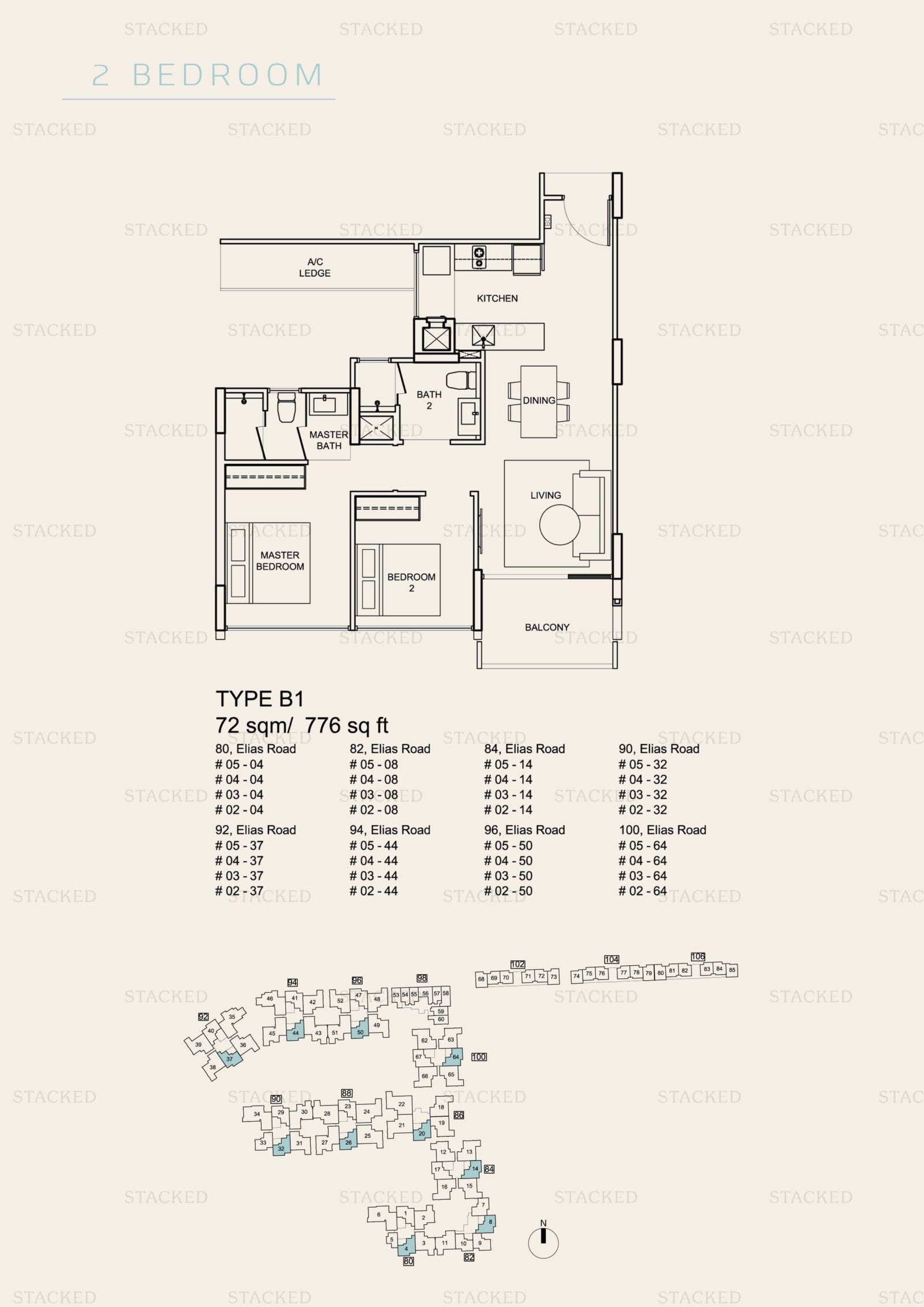

Stratum

The 2 bedders at Stratum come in several sizes but their layouts are generally the same. The only difference is in the size and number of balconies. Its layout is pretty similar to that of Vue 8 Residence, however, there are some slight differences.

While the position of the kitchen makes it possible to enclose it for those who do regular heavy cooking, some renovation works may be required which translates to costs to you. And as a plus point, it is ventilated too.

There’s also no allowance indicated in the floor plan for a washer and dryer, and without a service yard, this could make doing the laundry difficult for your tenants.

Capital Appreciation

| Tenure From: | 2010 | 2012 | 2012 | 2019 |

| Year | WATERVIEW | STRATUM | VUE 8 RESIDENCE | THE ALPS RESIDENCES |

| 2020 | $1,017 | $1,035 | $1,099 | $1,243 |

| 2021 | $1,042 | $1,074 | $1,117 | $1,273 |

| 2022 | $1,130 | $1,209 | $1,280 | $1,342 |

| Annualised (%) | 5.39% | 8.11% | 7.90% | 3.92% |

In the above table, we only looked at performances between 2020 – 2022 to avoid accounting for new launch $PSF. We wanted to look at how prices behaved on the secondary market – so only resale and sub-sale transactions were accounted for. As such, we had to limit our timeframe to the past 3 years.

From here, you’ll see that in terms of annualised returns, performances vary from 3.92% to 8.11%.

It is likely that Stratum and Vue 8 Residence saw the greatest annualised returns due to the launch of Pasir Ris 8. The announcement of phase 2 of the Cross Island Line on 10 March 2020 could have also contributed to both developments’ performance.

Aside from that, all four developments are pretty much similar in that their location is not considered ideal when it comes to transportation. In terms of age, Waterview, Stratum and Vue 8 Residence are quite similar given their tenures are only 2 years apart. The only exception is The Alps Residences which has a recent lease start year of 2019.

Rental Yield Summary

The rental yields for all 4 developments are pretty comparable ranging from 4.2% – 4.78%

| Projects | 2BR Rental Yield (Q2 2022) |

| The Alps Residences | 4.51% |

| Waterview At Tampines | 4.23% |

| Vue 8 Residence | 4.20% |

| Stratum | 4.45% – 4.78% |

From the rental yields, The Alps Residences and Stratum seem to have the better return – though we’d caution that this was based purely on the last quarter of 2022.

Other condos to consider

If we are talking about the rentability of a property, its closeness to public transportation and amenities are major factors that we should take into consideration.

An alternative project you can consider is CityLife @ Tampines which is one of the closest projects within walking distance to Tampines MRT station.

Out of its 514 units, only 27 are 2 bedders, so there is a very limited supply which could be better for rentability.

The Tampines Trilliant which is located just right next to CityLife @ Tampines does not have any 2 bedders too, putting 2 bedders in CityLife in a better position when it comes to competition.

This will keep demand up for the 2 bedroom units which will in turn result in prices holding up.

Conclusion

As you’ve mentioned the purpose of purchasing this property is both for investment and as a safety net that you can move into in the event your marriage does not work out. Buying a property that’s purely for investment is different than buying one for own stay purposes. If you’re planning to stay, it has to meet your lifestyle and emotional needs whereas if it’s for investment, it’ll just depend on which property can potentially give you the best returns.

Again, seeing that the 4 developments you’ve picked out are all located in District 18, we will assume this is an area you’d like to live in, in the worst-case scenario. As such, we can’t say that this will give you the best returns, as you are limited by the choice of location.

If we were to look at the performances and current rental yields of these 4 developments, The Alps Residences and Stratum stand out – but overall, they all return pretty decent yields of over 4%.

We reckon that the differences in performance and rental are just a reflection of the short-term performance (e.g. the greater appreciation could’ve been a result of both the launch of Pasir Ris 8 and the announcement of the new MRT station).

But in the long run, all four projects are fundamentally similar, and it really depends on the price point that you manage to buy in.

Moreover, the overall quantum for a 2-bedroom project is not sizeable (less than $1 million), as such, any marginal gains over each other wouldn’t translate to significant overall capital appreciation.

As such, we’ll go for a project that has pretty decent yields (to minimise the cash top-up required) and one that is suitable for long-term holding (as you don’t have an exit horizon now).

Out of the four, our pick would be The Alps Residences for its age given you have no specific exit horizon. It has a decent yield today and even in 10 years time, it would only be 14 years old compared to the others which would be closer to 18-20 years old.

Another interesting consideration would be Vue 8 Residence given its proximity to the upcoming Elias MRT which could add to its price defensiveness in the long run despite its older age.

Finally, you might also want to dive deeper into the resale Executive Condominiums that were suggested earlier. We would suggest speaking to an agent to share more with you about these projects and whether they’re suitable in meeting your objectives.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments