I Have $500k In Cash And Make $182k A Year. Which 3-Bedroom Condo Near A Good School And MRT Should I Buy?

January 6, 2023

Hello,

I always love to see your articles because they are very informative.

I am currently staying with my husband, 20 month old child and a helper at a 3 bedroom condo at OCR. The condo is owned by my husband.

We are planning to purchase another 3 bedroom unit under my name at RCR, preferably near a good school and MRT. We plan to stay at the unit for the long term. We hope that the unit will have a good appreciation potential.

I am in my early 30s, with an annual income of 182k. We prepare 500k cash to purchase the unit, if needed we might stretch it to 600k. I have CPF OA of around 150k.

Based on our budget, our top 3 choices are:

The reserve residences

D’Leedon

Sky vue

Please kindly do a review on these 3 projects and do provide your wise opinions on any other alternative choices.

Thank you.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

Thanks for reaching out! It’s always good to hear how our content has been helpful to you.

Given your child’s current age, we presume that when you say you’re planning to stay for the long term, it is at least until your child finishes primary or secondary school (which is a holding period of around 11 – 15 years).

And while there is no official list of top schools in Singapore (remember the famous phrase every school is a good school), there are a few lists of schools that are ranked based on their popularity which we believe many parents regard seriously. We understand the importance of giving children the best possible education but do note that sometimes buying a property based on its proximity to a good school might limit your options.

Let’s start by doing up your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

| Description | Amount |

| Maximum loan based on a monthly fixed income of $15,100 and assumed age of 32 | $1,739,576 (30 years tenure) |

| CPF funds | $150,000 |

| Cash | $500,000 |

| Total loan + CPF funds + Cash | $2,389,576 |

| BSD based on $2,389,576 | $80,183 |

| Estimated affordability | $2,309,393 |

Now that we have a better idea of your budget, let’s take a closer look at the 3 developments you’re considering.

The Reserve Residences

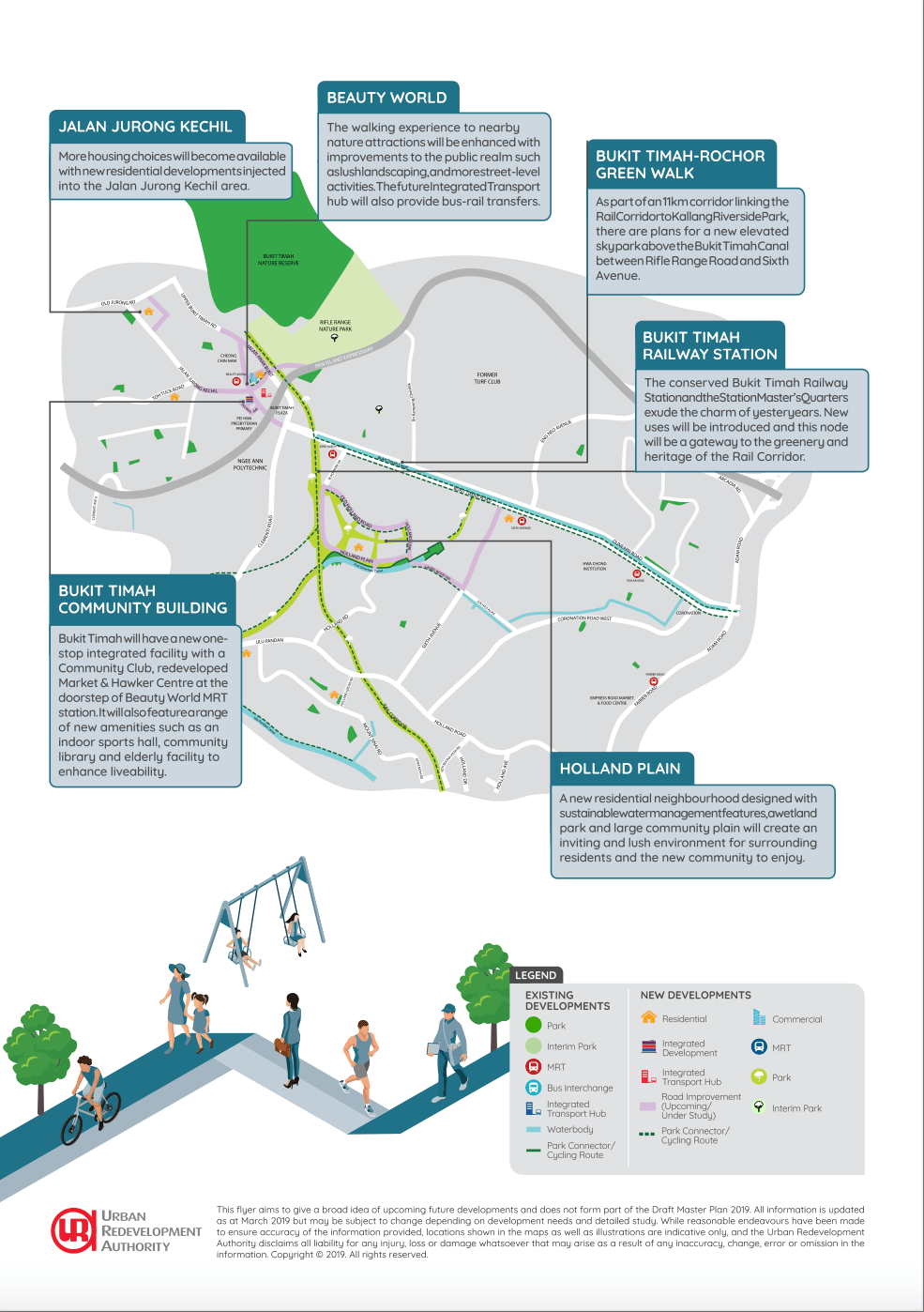

The Reserve Residences is an upcoming 99-year leasehold mixed development that will be directly linked to the Beauty World MRT station and also the Beauty World Bus Interchange which is under construction. It is estimated to have 845 units ranging from 1 to 5 bedrooms as well as service apartments.

As you can see, there will be a lot of upcoming changes to the area, and having more shops and retail amenities through the Reserve Residences and The Linq @ Beauty World will definitely be a boost. Especially with projects like Daintree Residence, View at Kismis, Forett, Verdale, Mayfair Modern, and Mayfair Gardens that are close to being completed, there will certainly be a need for more to support these upcoming units.

Given that it is an integrated development, it has excellent accessibility to public transportation. Besides the mall that is going to be built right downstairs, there are also numerous other malls and eateries within walking distance so you’re well covered in terms of food and basic necessities.

Renowned school within 1KM of the development: Pei Hwa Presbyterian Primary

Do note though that the area around Pei Hwa is pretty dense, and competition for places because of proximity will be high.

Pricing

The development isn’t launched yet so we do not have the exact/indicative prices but we’ll do a rough estimate based on the new freehold mixed development located beside The Reserves Residences – The Linq @ Beauty World:

| Project | Breakeven land cost PSF | Average PSF sold | Developer’s profit margin |

| The Linq | $1,863 | $2,378 | 28% |

Based on this profit margin, the estimated PSF will be $2,122.

However, we must note that Forett 3 bedroom prices are going for $2.2/2.3 million, which would again point to a likely higher price at The Reserve Residences.

Also, there is no information on the unit sizes yet either, so assuming 1,000 sq ft for a 3 bedder, you are likely looking at a minimal price of $2.1M, although it’s likely going to be higher as Far East Organization has a reputation for pricing their projects at a premium. Do also note that these prices are purely estimates and are not definitive.

Capital appreciation upside

Disclaimer: While the following points showcase the possibilities/hindrances for capital appreciation, everything boils down to price and how the market performs moving forward. No one can claim to predict where the market is headed over the short term, but we can certainly see the factors that could put your development at a better chance for growth.

Upper Bukit Timah transformation:

Typically when there is a transformation happening in an area, it will increase convenience and adds value to the surrounding properties. Besides the various rejuvenation plans for the Bukit Timah area, there is also another plot of land where the Beauty World MRT station is, that is earmarked for a mixed-used development. We have seen with several new launches that they helped to boost prices of other projects in the vicinity but this is also dependent on other factors such as the supply of condominiums in the area, age of the property, etc.

As you most probably already know by now, with land and construction costs on the rise, the next development is expected to cost more. This may or may not have an adverse effect as buyers might rush in to purchase The Reserve Residences due to fear of missing out and the developers could use this to their advantage and price the units higher, so it is important to do a proper comparative analysis.

Average PSF of new launches in the vicinity:

| Project | Average PSF | Tenure | Launch year |

| The Linq | $2,378 | Freehold | 2020 |

| Forett at Bukit Timah | $2,140 | Freehold | 2020 |

| Verdale | $1,845 | 99 years | 2020 |

| View at Kismis | $1,727 | 99 years | 2019 |

| Daintree Residence | $1,881 | 99 years | 2018 |

Brand new lease and same starting point as neighbours:

One benefit of buying a new launch is that you have a brand new lease which is great considering your plans to stay for the long term. Also, if it is priced correctly by the developer, you’ll be buying in at a similar price range as your neighbours who will be your future competitors when you plan on selling the place. We would add that this is seen more as loss mitigation than it is price appreciation.

D’Leedon

D’Leedon is a 99-year leasehold development in District 10 that obtained its TOP in 2014. Its lease started in 2010, making it 13 years old, and is a mega project that sits on a 78,043 sqm land plot with a whooping 1,715 units of 1 to 4 bedrooms spread across seven 36-storey tower blocks. This iconic condominium was designed by the internationally renowned and award-winning Zaha Hadid Architects. We have also done a review of the project which you can read here.

It’s conveniently located just a 7-minute walk away from the Farrer Road MRT station as well as the Empress Road Market & Food Centre. For those who drive, it will take you less than 15 minutes to get to the CBD and also the Orchard shopping belt.

It’s worth pointing out that the area will be adding a lot of new units soon, this is due to projects like Hyll on Holland, Wilshire Residences, Leedon Green, One Holland Village Residences, and Van Holland.

Renowned school within 1KM of the development: Nanyang Primary School

Pricing

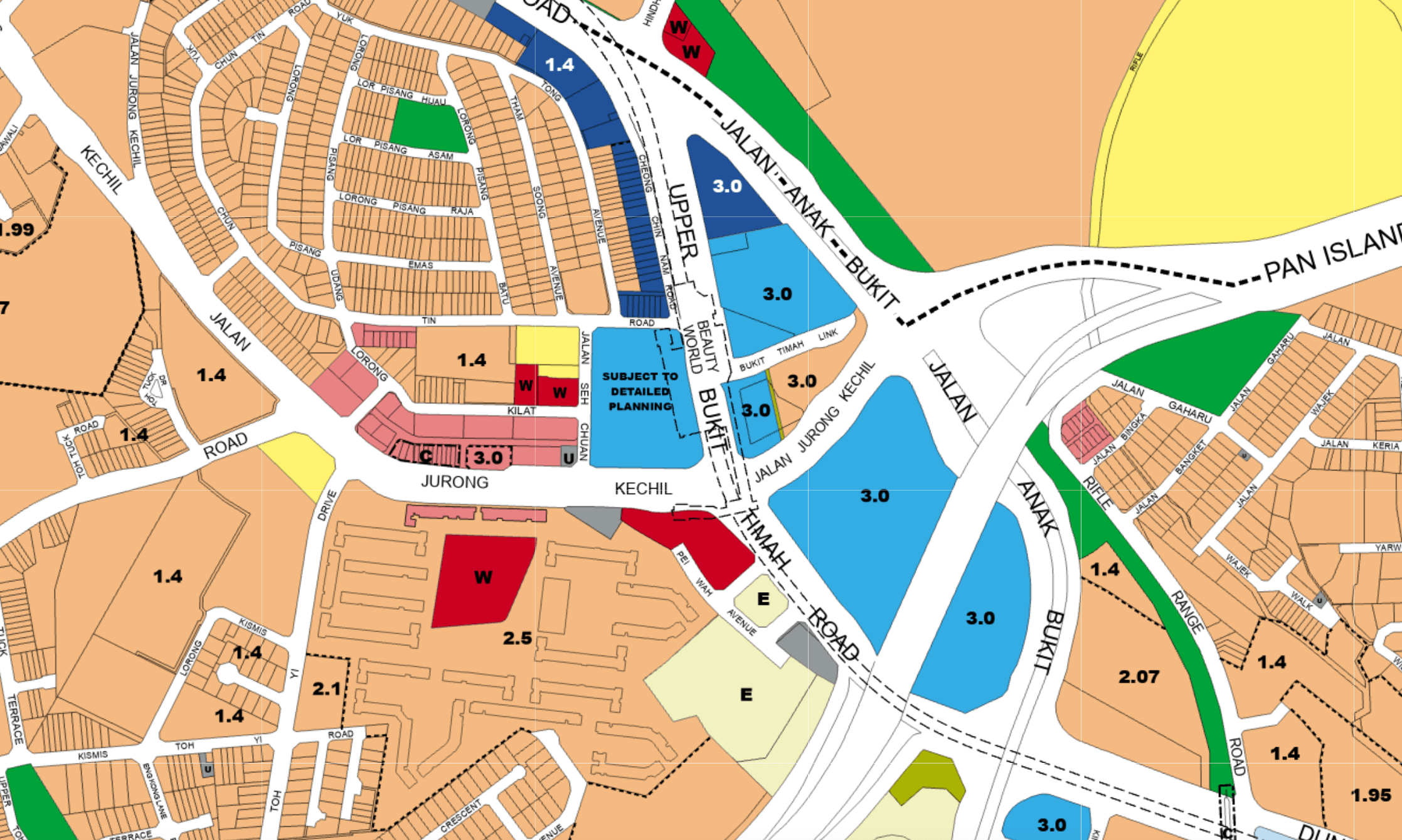

The 3 bedders at D’Leedon range from 1,076 – 1,873 sq ft. With a budget of $2.3M, you will most likely be looking at units that are below 1,300 sq ft.

These are some of the recent 3 bedroom transactions below $2.3M:

| Date | Size (sqft) | PSF | Price | Level |

| Nov 2022 | 1,216 | $1,891 | $2,300,000 | #04 |

| Sep 2022 | 1,238 | $1,780 | $2,202,888 | #05 |

| Aug 2022 | 1,033 | $1,682 | $1,738,000 | #13 |

| Aug 2022 | 1,216 | $1,855 | $2,256,666 | #29 |

| Jun 2022 | 1,184 | $1,790 | $2,120,000 | #26 |

| Jun 2022 | 1,216 | $1,809 | $2,200,000 | #22 |

Floorplan

These are some of the layouts for 3 bedrooms units under 1,300 sq ft:

Frankly, the layouts at D’Leedon are not always the most efficient. Due to the configuration of the towers, certain parts of the units are not regularly shaped which may make it slightly challenging for furniture arrangement. The units also come with bay windows in the bedrooms and a planter box on the balcony which some may deem as a waste of liveable space.

For a family of 3 and a helper, this layout should meet your needs but as your plan is to stay for the long term and if you’ve intentions to expand your family, it may not be sufficient further down the road given there is no helper’s room.

Capital appreciation upside

Lower entry price compared to other developments in the area:

As the majority of the developments in the area are freehold, they generally command a premium in their pricing. Since D’Leedon is a 99-years leasehold project, it naturally will have a lower PSF. Although a lower PSF does not necessarily always mean a lower price, it is true for the case of D’Leedon.

Here is a comparison of similar 3 bedroom transactions in the neighbouring projects (From June – December 2022):

| Project | Tenure | Completion year | Avg size (sq ft) | Avg PSF | Avg price | No. of transactions |

| Leedon Green (Under construction) | Freehold | Est. 2023 | 1,016 | $2,954 | $3,002,429 | 14 |

| D’Leedon | 99 years | 2014 | 1,427 | $1,827 | $2,609,378 | 20 |

| Spanish Village | Freehold | 1987 | 1,636 | $1,975 | $3,230,000 | 2 |

We can see that the newer developments have a much higher PSF, so even though the units are smaller in size for Leedon Green, the overall quantum is higher. That said, it’s not that significant a jump, that you may see competition from Leedon Green in the future – especially so if the project looks better than it does in renders, and buyers are generally attracted to newer projects (plus it is freehold after all).

But generally, 99-year leasehold projects tend to perform better than freehold ones in the short run as there is usually a higher transaction volume which helps to support the appreciation.

Currently though, there are no other direct competitors (in terms of pricing and age), so the demand and prices for D’Leedon should continue to hold up.

Sky Vue

Sky Vue is another 99-year leasehold development in District 20 which obtained its TOP in 2016. Its lease started in 2013, making it 10 years old. With 694 units, it’s a big project consisting of 1 to 4 bedroom units spread across two 37-storey tower blocks.

It is ideally situated just a 4-minute walk away from Bishan MRT station and Junction 8. There are also numerous eateries located at the bus interchange and nearby HDB blocks so there is no lack of food options. For outdoor lovers, the development is a short walk away from Bishan-Ang Mo Kio Park.

Renowned school within 1KM of the development: Catholic High School

Pricing

The 3 bedders here range from 1,141 – 1,259 sq ft. These are some of the recent transactions:

| Date | Size (sqft) | PSF | Price | Level |

| Sep 2022 | 1,141 | $1,665 | $1,900,000 | #09 |

| Jul 2022 | 1,141 | $1,928 | $2,200,000 | #32 |

| Jun 2022 | 1,141 | $1,918 | $2,188,000 | #24 |

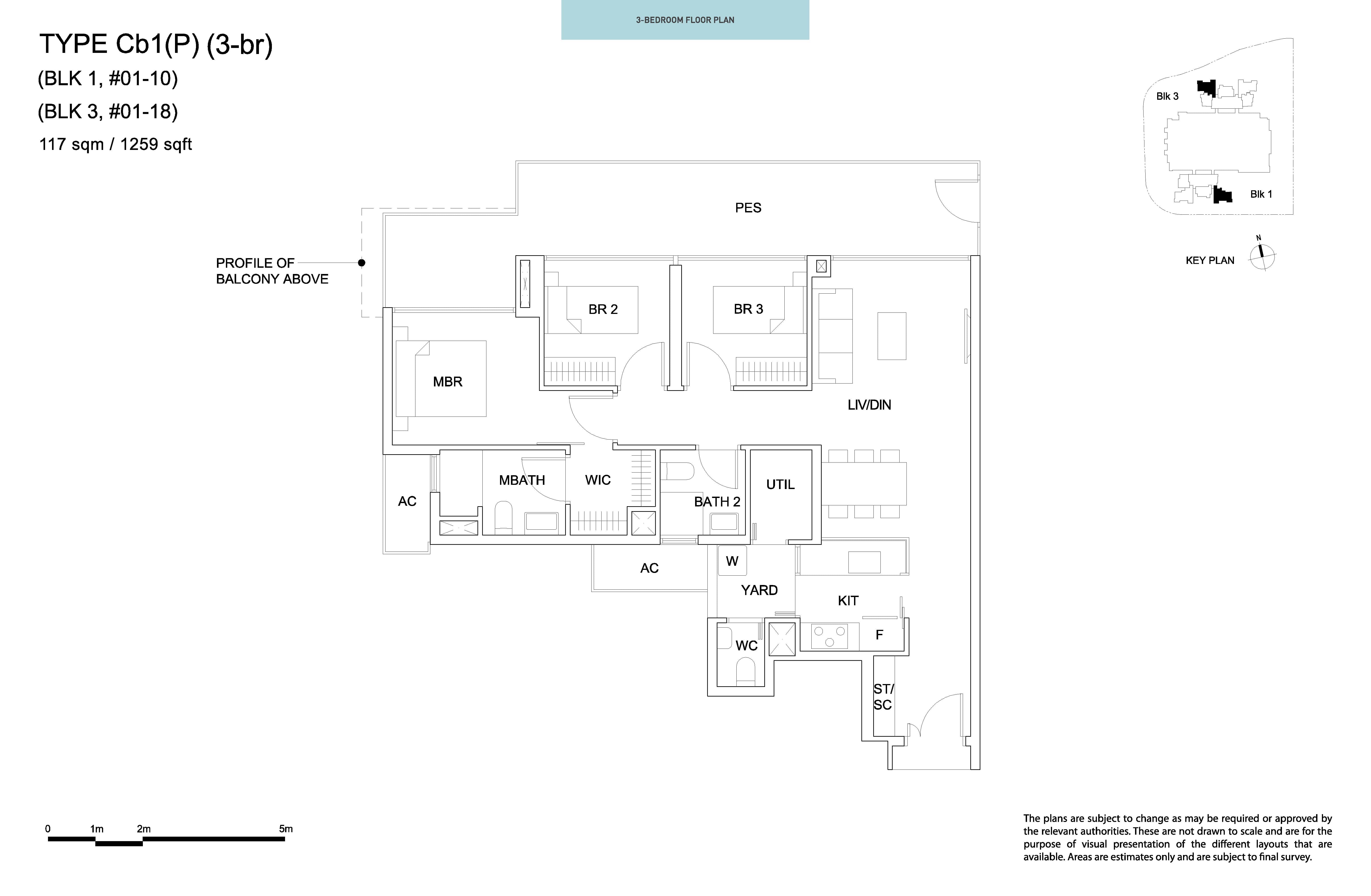

Floorplan

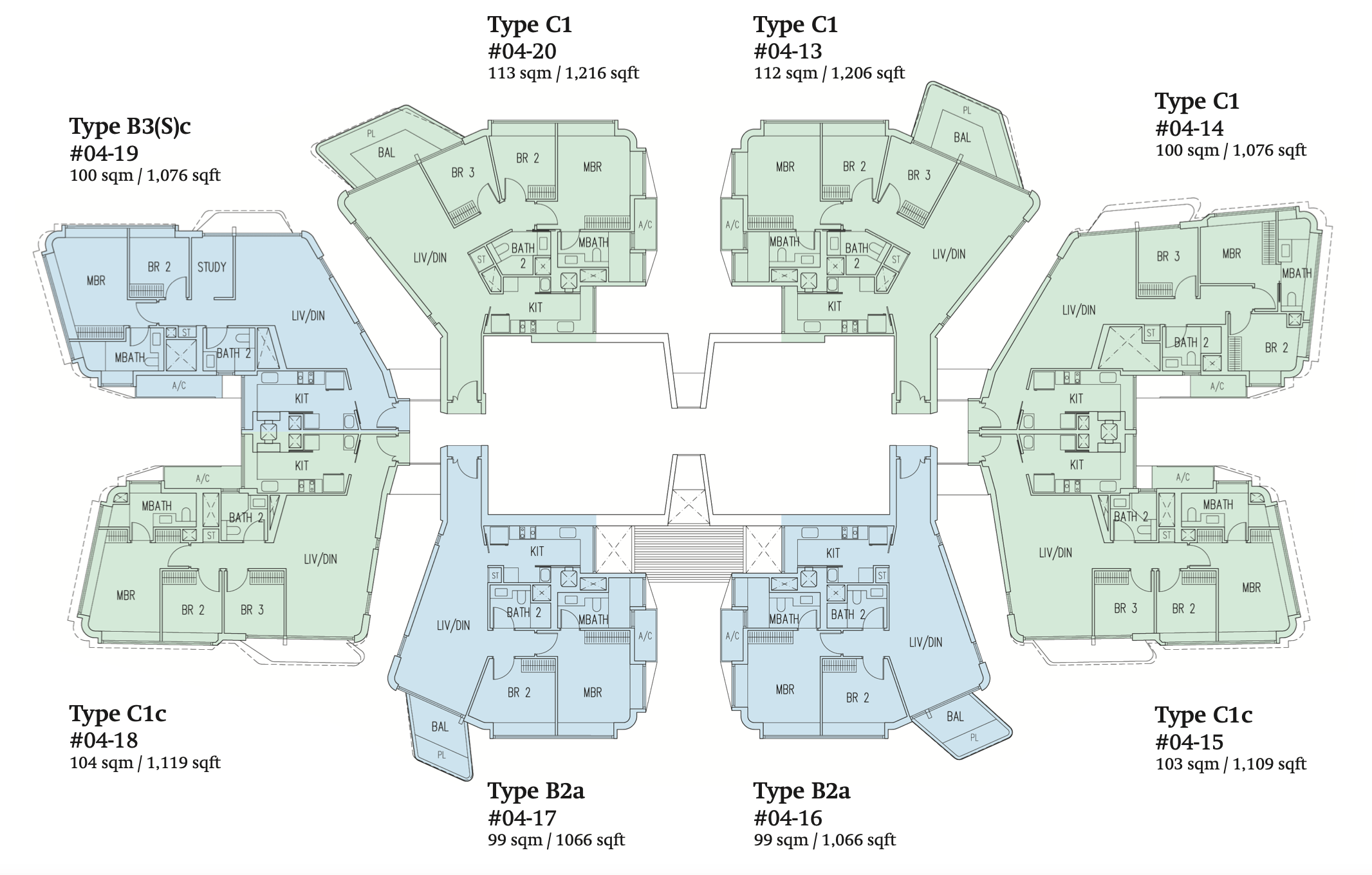

There are only 2 layouts for the 3 bedders, either with two balconies (one in the living and one in the master bedroom) or with a PES that stretches across all the bedrooms and living room.

1,141 sq ft is a good size for a 3 bedroom unit however when you fit in two balconies and a walk-in closet, certain areas undoubtedly have to be compromised. The two common bedrooms can comfortably fit a single bed but might be too cramped for a double bed. The kitchen is also pretty compact but it comes with a yard, WC, and utility room which is great for families like yours who have a helper.

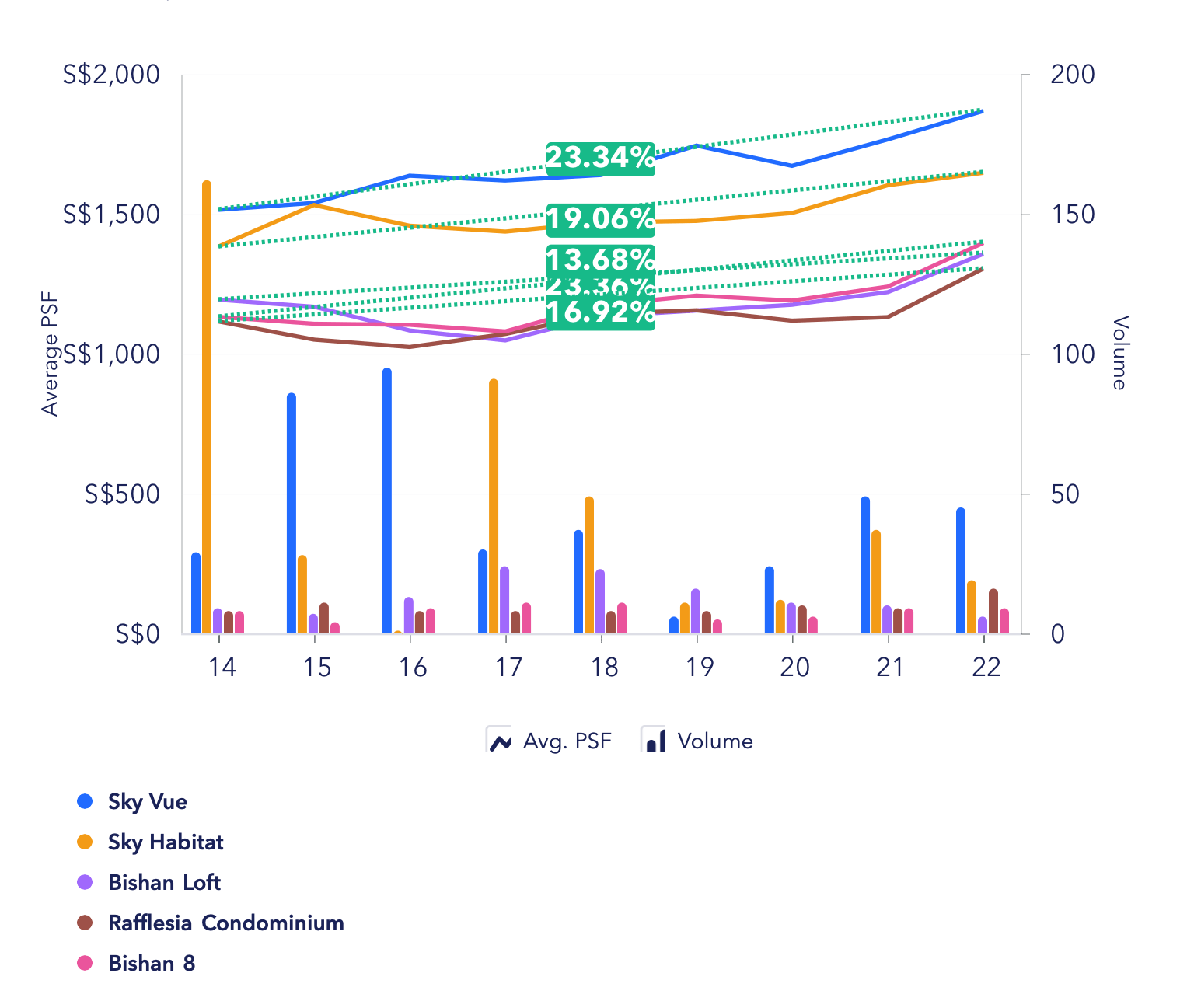

Capital appreciation upside

Youngest development in the area:

There is only a small handful of private condominiums in Bishan and among them, Sky Vue is the youngest at 10 years old. With lease decay concerns when purchasing a leasehold property, buyers typically gravitate towards younger developments.

Here is a comparison of the 3 bedroom transactions in the neighbouring projects (From June – December 2022):

| Project | Tenure | Completion year | Avg size (sqft) | Avg PSF | Avg price | No. of transactions |

| Sky Vue | 99 years | 2016 | 1,141 | $1,837 | $2,096,000 | 3 |

| Sky Habitat | 99 years | 2015 | 1,300 | $1,796 | $2,320,000 | 4 |

| Bishan Loft | 99 years | 2003 | 1,378 | $1,379 | $1,900,000 | 1 |

| Rafflesia Condominium | 99 years | 2002 | 1,231 | $1,383 | $1,700,300 | 6 |

| Bishan 8 | 99 years | 2000 | 1,163 | $1,418 | $1,648,500 | 4 |

Given its prime location and limited supply of condominiums, the price of these developments in Bishan is holding up pretty well even for the older projects.

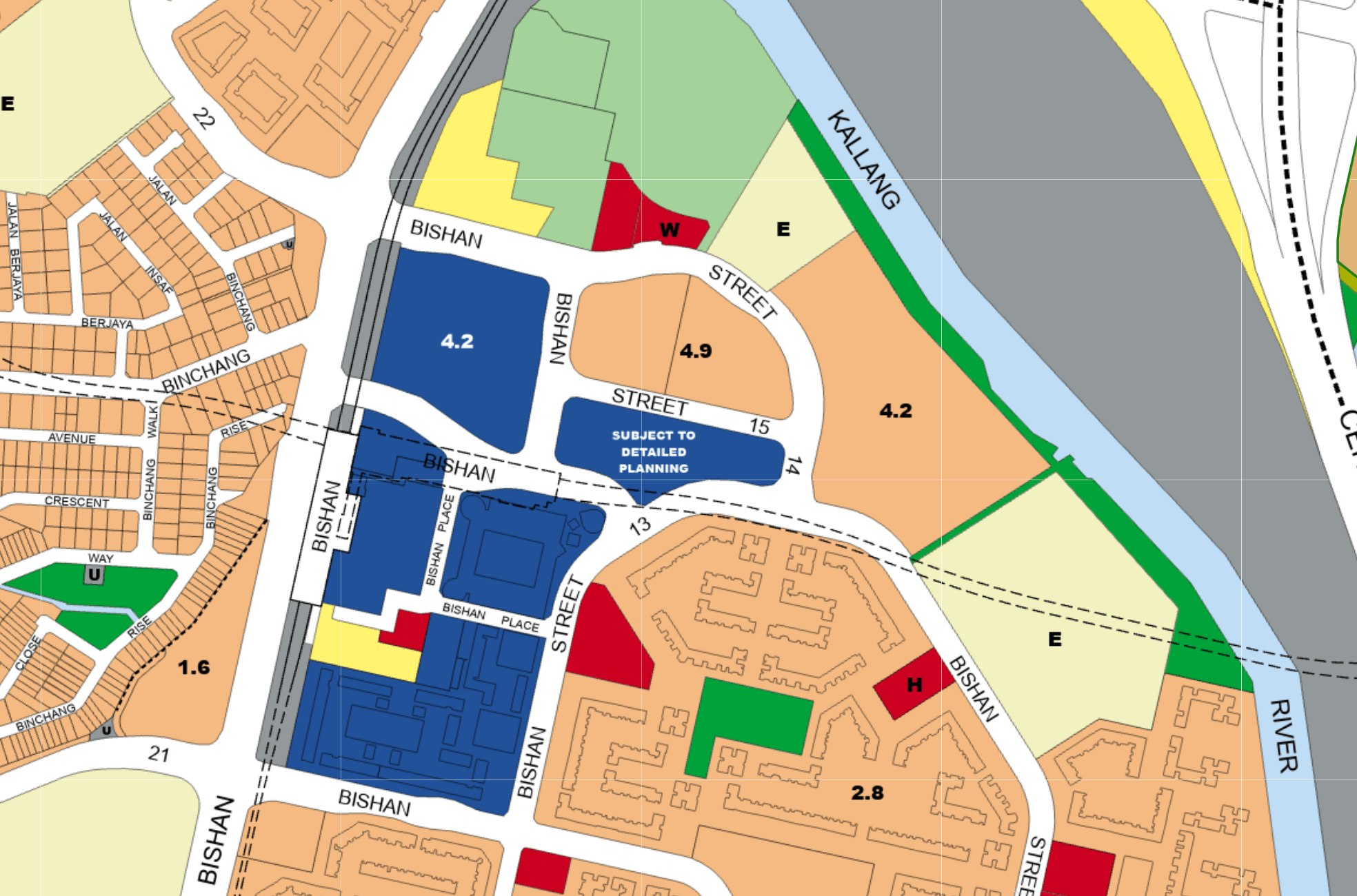

If we were to look at the URA Masterplan, the empty plots in front and on the left of Sky Vue (in blue) have been earmarked for commercial properties, which could contribute to better value preservation for the project and even potentially help to push prices up.

HDB upgraders:

HDB upgraders generally prefer to purchase developments in an area they’re already familiar with. On top of that, Sky Vue is also anchored by the high prices that the nearby HDB flats are selling for. There are also 2 BTO clusters in the vicinity that are expected to complete in 2025 and 2026.

Average HDB resale price for 3Q2022:

| 1-room | 2-room | 3-room | 4-room | 5-room | Executive | |

| Bishan | – | – | * | $640,000 | $855,000 | $1,045,000 |

Proximity to renowned schools:

Just like yourself, there are buyers who prioritise being close to popular schools. Besides Catholic High School, Sky Vue is also in close proximity to Raffles Institution (Secondary and Junior College).

Alternative option:

Thomson Impressions

Thomson Impressions is a 99-year leasehold development that obtained its TOP in 2018. Its lease started in 2015, making it 8 years old. It is on the lower end of a mid-sized project with 283 units made up of 1 to 4 bedroom types and also 5 landed houses.

It is located just 8 minutes’ walk away from Bright Hill MRT station and under 15 minutes to Upper Thomson MRT station as well as Thomson Plaza and the eateries along Thomson Road. It is also a stone’s throw from the Bishan – Ang Mo Kio Park.

Renowned school within 1KM of the development: Ai Tong School

Pricing

These are some of the recent 3 bedroom transactions:

| Date | Size (sqft) | PSF | Price | Level |

| Dec 2022 | 1,055 | $1,943 | $2,050,000 | #15 |

| Nov 2022 | 1,195 | $1,770 | $2,115,000 | #08 |

| Jul 2022 | 1,055 | $1,837 | $1,938,000 | #06 |

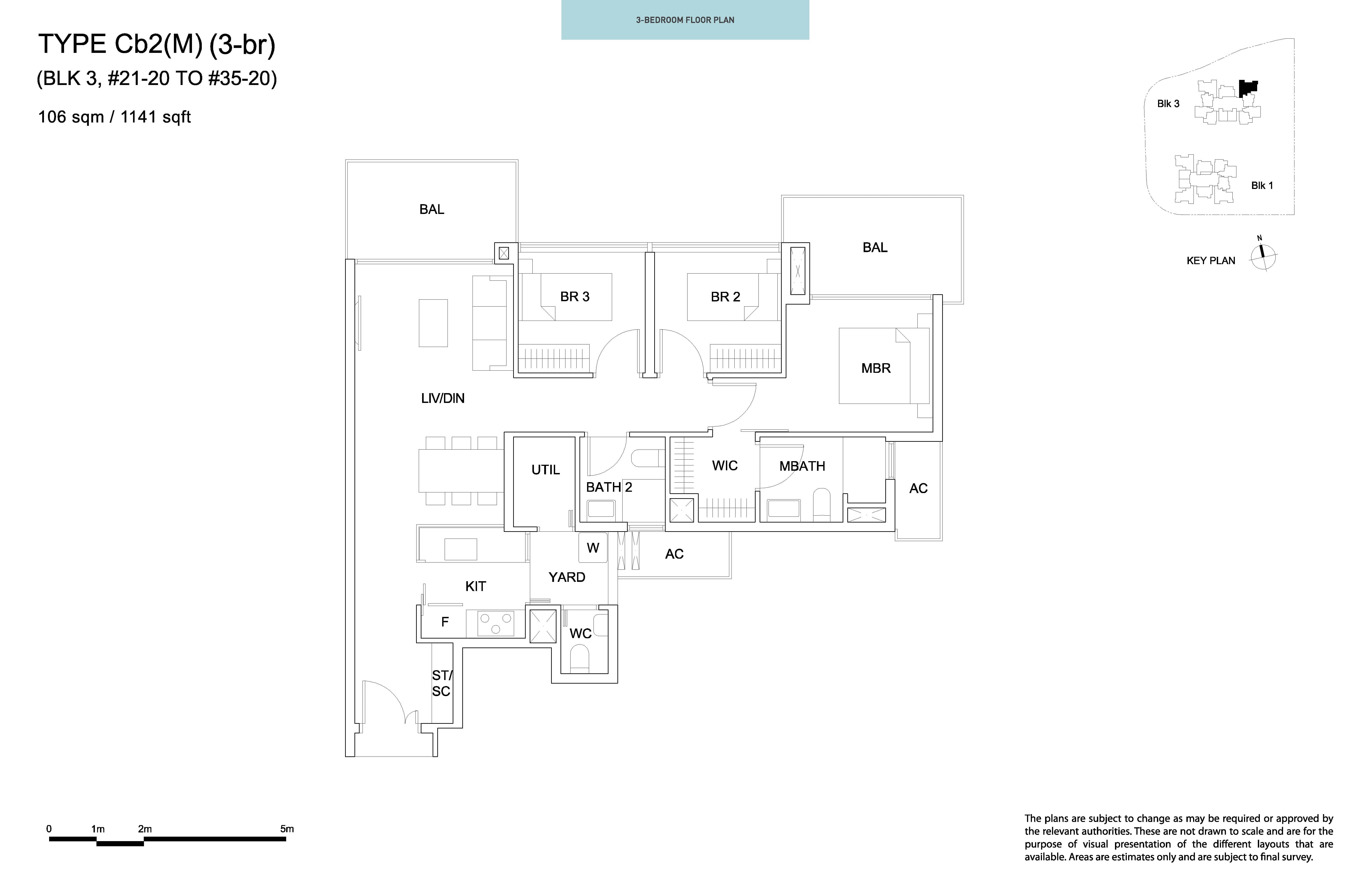

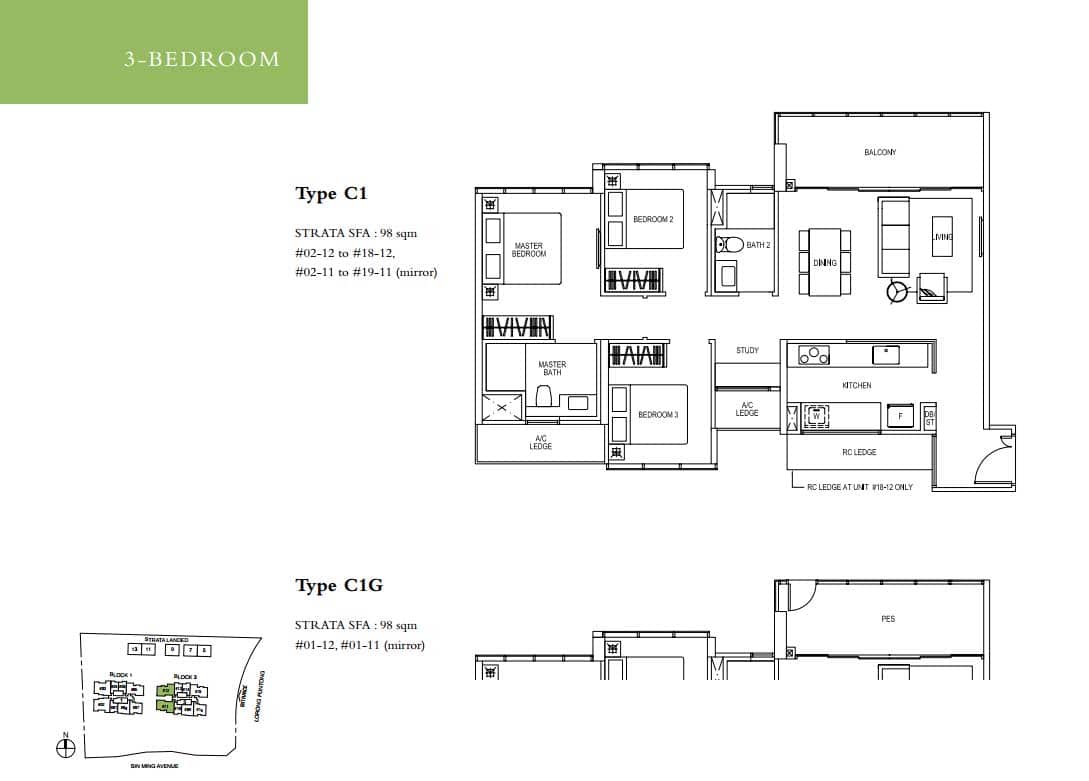

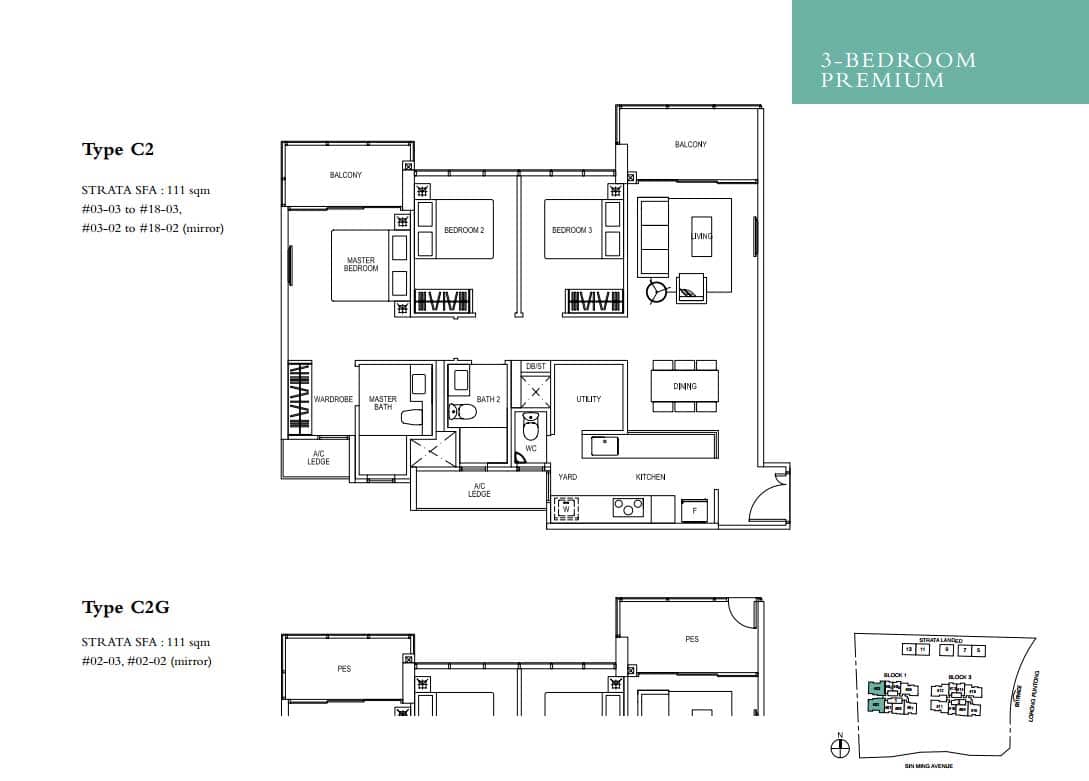

Floorplan

One major reason we picked Thomson Impressions is due to its floor plan. There are 2 layouts and sizes for the 3 bedders at Thomson Impressions, at 1,055 and 1,195 sq ft. Both of which are very efficient with little wastage of space. Bedrooms are all well-sized and regularly shaped so it’s easy to arrange your furniture. The 1,195 sq ft unit comes with a utility room and WC which will be suitable for your family profile.

Capital appreciation upside:

Youngest development in the area:

As most of the freehold projects in the area are older, their unit sizes are much bigger thus increasing their overall quantum. Among the 99-year leasehold projects, Thomson Impressions is the youngest one at 8 years old.

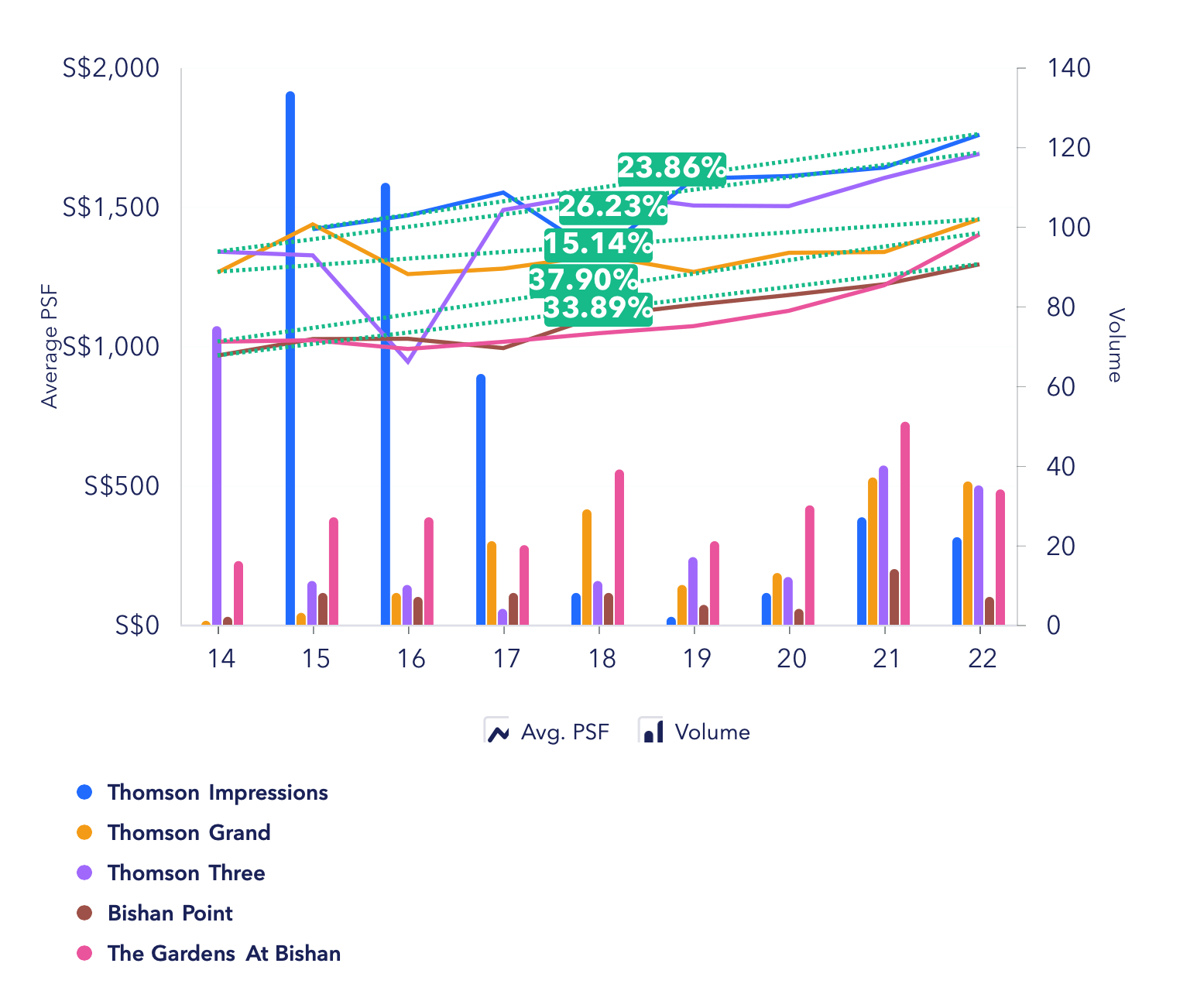

Here is a comparison of the 3 bedroom transactions in the neighbouring projects (From June – December 2022):

| Project | Tenure | Completion year | Avg size (sqft) | Avg PSF | Avg price | No. of transactions |

| Thomson Impressions | 99 years | 2018 | 1,102 | $1,850 | $2,034,333 | 3 |

| Thomson Three | 99 years | 2016 | 1,068 | $1,806 | $1,929,500 | 4 |

| Thomson Grand | 99 years | 2015 | 1,449 | $1,492 | $2,144,700 | 10 |

| Bishan Point | 99 years | 2005 | 1,270 | $1,400 | $1,778,000 | 1 |

| Gardens at Bishan | 99 years | 2004 | 1,211 | $1,496 | $1,811,889 | 10 |

We can see from the graph above that the projects in the vicinity are all performing fairly well. You’ll notice that the older developments actually appreciated at a higher rate than the newer ones over the last 9 years. Even so, as your plan is to stay for the long term, we will suggest looking at the younger developments due to concerns of lease decay and also, based on the performance of the older projects, there is still room for growth.

Conclusion

Let’s quickly summarise the 4 developments.

With The Reserve Residences set to be a further boost to the Beauty World rejuvenation, we can definitely see its appeal. Also, since you do have an alternative place to stay, purchasing a new launch would be less taxing financially for the first couple of years while the building is under construction, giving you more time to save up. But without any firm indicative pricing or information on the units, it’s hard to give any advice now on whether or not it is going to be a good buy.

For D’Leedon it is in a prime location but we are not the biggest fan of its layout. Seeing as it has one of the more affordable entry prices in the area, we believe demand from buyers who are priced out of the freehold developments will flow here and prices will continue to hold as long as there is a significant price gap between the freehold and leasehold projects.

As for Sky Vue, the layout of the unit will be able to meet the needs of your family especially if you’re planning to have another child. Given the limited supply of private condominiums in the area, we can see that even the older developments like Bishan Loft, Rafflesia, and Bishan 8 which are all above 20 years old are still performing well. The high-value HDBs in the estate also help to support the prices of these developments.

Finally, we picked out Thomson Impressions as a viable possibility as it meets your requirements of being near a good school with good connectivity and we believe there is still room for growth. Just as with the Bishan area, the older projects are also performing really well here. Out of the newer projects in the area, Thomson Impressions has one of the more efficient and well-planned layouts which suits your family profile. Given that it’s only 8 years old, we are not too concerned with the lease decay issue even if you’re planning to stay for the next 11 – 15 years.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

1 Comments

g