How The Inevitable Decline Of Petrol Stations May Affect Your Property In Singapore

November 26, 2023

We tend to overlook petrol stations, when it comes to analysing real estate.

The humble petrol kiosk is not something we look for, when scouting out the surroundings of a condo; and most brochures would never bother to mention these. However, petrol stations have been a bigger amenity than we give them credit for.

Case-in-point: a certain condo along Upper Changi Road, which back in the early ‘00s, was super under-developed. At the time there wasn’t even an MRT station nearby; so whenever it was late at night, or travelling was too much, the only recourse was the petrol station’s convenience store. I ate so many Polar cakes and curry puffs from there, the station attendant is the face I’ll associate with my inevitable diabetes.

And over the past few years, some petro stations have become even more useful. Some have a 24 hour fast food drive through, while others have bubble tea or even a bigger mart with fresh produce.

Then there’s the ATM issue as well. I bet more than a few Singaporeans have been caught in a cab with no cash, and needed to swing by an ATM in a petrol station. For some landed enclaves, where you typically need a pack mule and a week of supplies to walk to civilisation, the nearest petrol station may also be the best way to withdraw cash.

But consider this: over the next few decades, these overlooked little islands of convenience are going to start vanishing.

Singapore is going car-lite. There will be fewer parking spaces, more pedestrian-friendly towns, and COE rates that are less affordable than colonising Mars. Already, URA is allowing residential developments near town, or MRT stations, to cut down on the number of car lots.

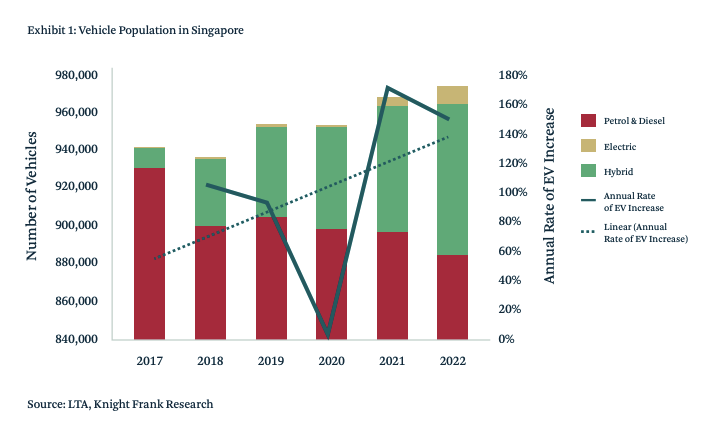

Besides this, there’s the rise of Electric Vehicles (EVs) to contend with. There were 3,000 stations last year, a 50 per cent increase from 2021; and the number is set to grow. In condos today, it’s becoming a norm to have EV charging stations, and these are being installed in older condos too. MND has already foreseen this development, and expects the eventual repurposing of petrol kiosks.

There’s also ongoing efforts by URA to decentralise Singapore. Our neighbourhood malls, along with fringe-region offices, will mitigate the need to travel to Orchard or Raffles Place. All of this will likely reduce demand for even Private Hire Vehicles.

Let’s also not forget hybrid work models, which reduce the need for work commutes; and the increasing number of jobs that are on a Work From Home basis. Without the need to rush to the office, why buy a pricey car?

So it’s unsurprising that, in the first two months of 2023, car sales are already down 7.7 per cent, while new car registration is down by almost a quarter. So to wit: fewer cars, plus more EVs = fewer petrol stations needed.

Repurposing petrol stations to benefit nearby properties

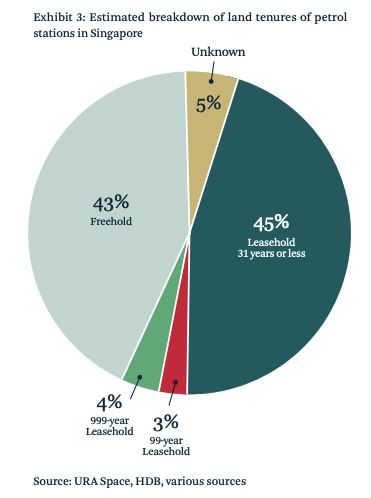

Today in Singapore, there are currently over 180 petrol stations in Singapore. According to a Knight Frank study, 56 per cent are on private land while the rest are tendered out by various Government agencies (which would typically have 30-year tenures). Here’s the estimated breakdown of tenures:

So altogether, it is estimated there may be about 4 million sq. ft. of land that’s now in use over the 180 plus petrol stations – that’s quite a lot of space that can be used more efficiently in the future.

The wonder of petrol stations is that, quite often, they’re already in strategically vital spots. Many are near key points of landed enclaves, which are typically areas starved of amenities; but at the same time, the residents in these places don’t want a giant mall disturbing the peace.

More from Stacked

Singapore’s Most Expensive Neighbourhoods Are Changing—4 Buyer Trends That Prove It In 2025

Back in the 2000s or earlier, buying a Core Central Region (CCR) condo was only a serious comment if it…

So get rid of the fuel pumps, expand the already existing convenience store (perhaps into a cluster of multiple small shops), and that would add more amenity to residents living nearby. Petrol stations can also serve as parcel pick-up points, clusters of ATMs, places for students (living nearby) to study, etc.

It’s quite likely, however, that many of these small land parcels will just be considered remnant land, and sold off as extensions of existing land parcels to interested parties. The same Knight Frank publication noted a petrol station at Ang Mo Kio Ave. 3, which had its lease expire in May 2023; it was suggested this land parcel could be blended with low-rise factories in the area, and the entire amalgamation sold as one plot (once the factories are also defunct.) Another petrol station at 355 Commonwealth Ave. will expire in 2025, and this can be merged with the parcel of older HDB blocks nearby.

My take? Let’s add some greenery to it, put up a few park benches, and have more family picnic spots scattered throughout the city. This is especially needed in the CBD area, where there’s more glass and concrete than there is grass.

And if you are interested in a Chatgpt/Dalle version, here’s what they’ve envisioned the future of petrol stations in Singapore to look like:

This may even get future property buyers to notice the (former) petrol kiosks, and factor them in as small bonuses. Sometimes, when two properties are tied on your shortlist, it’s the accumulation of little things like these that make a difference.

Meanwhile in other property news:

- Want an HDB flat with a big balcony? Check out some of the best options we’ve found.

- Before you buy at the showflat, be sure to ask the right questions. Sometimes, a 10-minute conversation can save you from years of regret.

- Freehold shophouses and landed homes will never be the cheapest option – but what say you to an average of $3.4 million? Ceylon Road may be as low as the price can get for now.

- Jadescape was a good project, most of us knew that; but few of us saw the $1 million+ profit that this condo brought someone. What makes it so awesome?

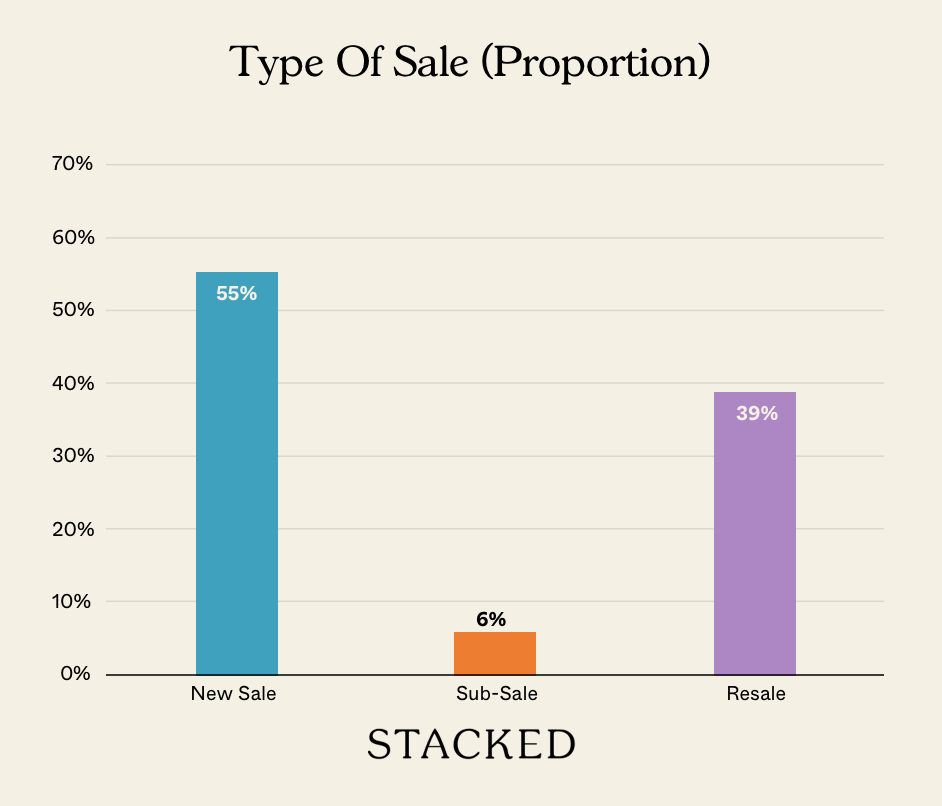

Weekly Sales Roundup (13 November – 19 November)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $14,245,000 | 4080 | $3,484 | FH |

| KLIMT CAIRNHILL | $4,940,000 | 1432 | $3,451 | FH |

| THE RESERVE RESIDENCES | $3,829,627 | 1625 | $2,356 | 99 years |

| PINETREE HILL | $3,524,000 | 1464 | $2,407 | 99 years |

| PARQ BELLA | $3,467,000 | 1787 | $1,940 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LAKEGARDEN RESIDENCES | $1,328,000 | 592 | $2,243 | 99 years |

| GRAND DUNMAN | $1,376,000 | 581 | $2,367 | 99 years |

| HILLOCK GREEN | $1,428,000 | 657 | $2,175 | 99 years |

| THE MYST | $1,500,000 | 678 | $2,212 | 99 years |

| PULLMAN RESIDENCES NEWTON | $1,582,700 | 463 | $3,419 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CLIVEDEN AT GRANGE | $9,800,000 | 2842 | $3,449 | FH |

| BOTANIKA | $7,600,000 | 2906 | $2,615 | FH |

| GRANGE INFINITE | $7,350,000 | 2680 | $2,742 | FH |

| THE MORNINGSIDE | $5,200,000 | 2411 | $2,157 | FH |

| CLEMENTI PARK | $4,780,000 | 3068 | $1,558 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $638,000 | 431 | $1,482 | 99 yrs (2011) |

| VIBES @ EAST COAST | $645,000 | 344 | $1,873 | FH |

| QUBE SUITES | $660,000 | 431 | $1,533 | FH |

| RESIDENCES @ SOMME | $737,000 | 463 | $1,592 | FH |

| TERRASSE | $738,000 | 506 | $1,459 | 99 yrs (2010) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE MORNINGSIDE | $5,200,000 | 2411 | $2,157 | $3,635,000 | 21 Years |

| CLEMENTI PARK | $4,780,000 | 3068 | $1,558 | $1,980,000 | 6 Years |

| WILKIE 87 | $2,400,000 | 1432 | $1,676 | $1,490,000 | 20 Years |

| KERRISDALE | $1,938,000 | 1259 | $1,539 | $1,291,000 | 21 Years |

| PARC PALAIS | $2,142,000 | 1335 | $1,605 | $1,150,200 | 27 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CLIVEDEN AT GRANGE | $9,800,000 | 2842 | $3,449 | -$1,753,710 | 16 Years |

| REFLECTIONS AT KEPPEL BAY | $1,932,300 | 1130 | $1,710 | -$390,400 | 13 Years |

| STELLAR RV | $1,075,000 | 538 | $1,997 | -$59,600 | 11 Years |

| ICON | $1,130,000 | 581 | $1,944 | -$50,000 | 10 Years |

| E MAISON | $931,000 | 667 | $1,395 | $38,554 | 6 Years |

Transaction Breakdown

Follow us on Stacked as we enter the new year: it’s bound to be an interesting 2024, as more condos get finished, and the housing supply issue resolves (I hope).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How might the decline of petrol stations impact property values in Singapore?

What are some future uses for former petrol station sites in Singapore?

Why are petrol stations considered important amenities in Singapore?

How is Singapore planning to adapt to the rise of electric vehicles regarding petrol stations?

What factors are contributing to the decline of petrol stations in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments