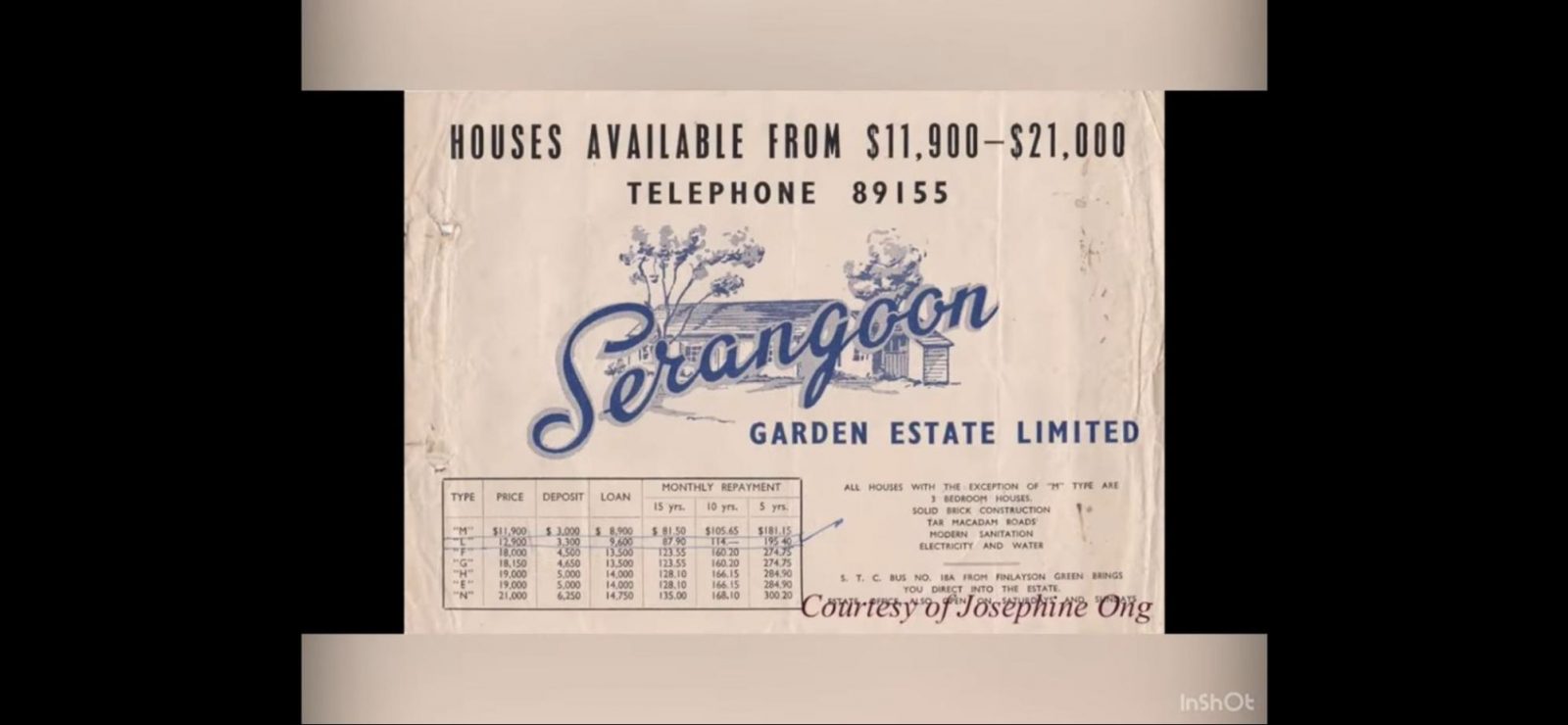

Here’s How Much Landed Homes Used To Cost In Singapore (We Found An Actual Advertisement)

August 5, 2024

You’ve probably heard landed homes used to be cheap in Singapore; but maybe you didn’t realise just how cheap:

As a point of comparison, average landed home prices (resale) in District 19, where Serangoon Gardens is located, was $1,853 psf as of July this year. Assuming a size of around 2,000 sq. ft., which is typical of landed homes near the Chomp Chomp area, that’s a quantum of around $3.7 million.

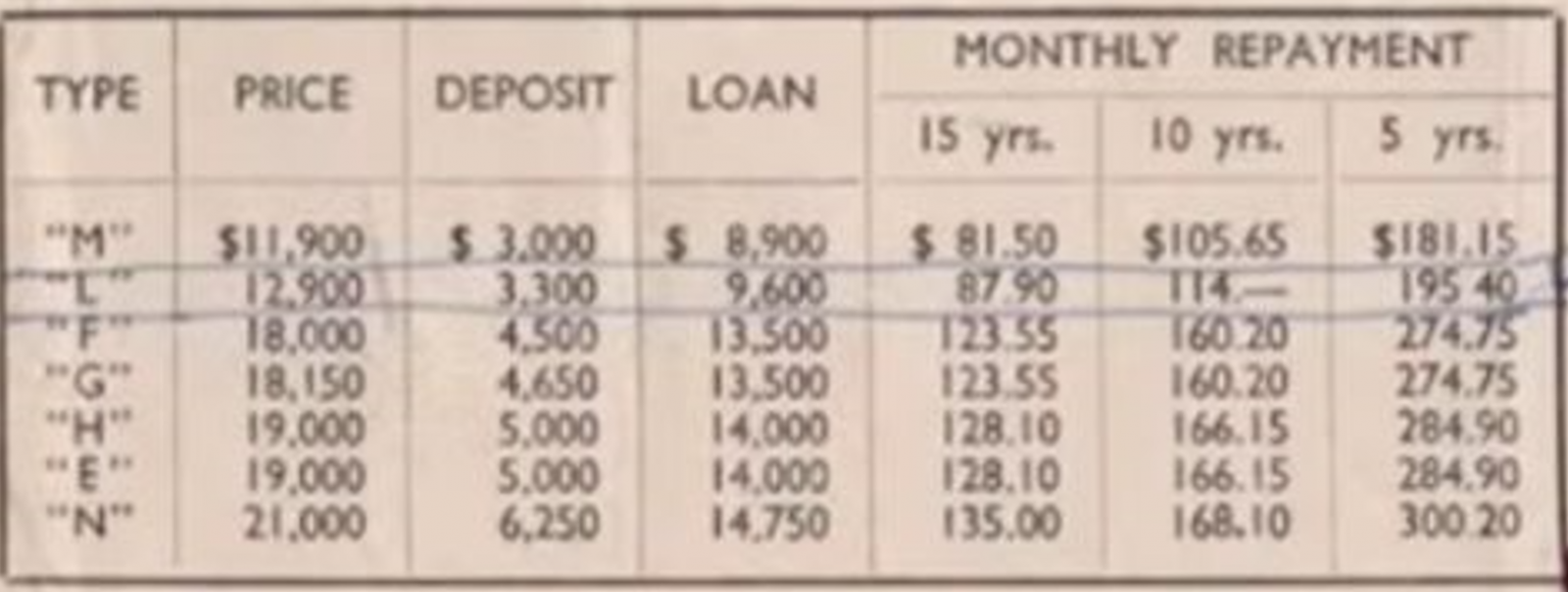

Of course, we need to take into account inflation and other factors; but notice the loan tenures: the idea of paying off a property in 15 years today is mainly in the realm of HDB flats. Most homeowners today take 20 to 25 years to pay off a private property; in some cases even longer.

As a purely anecdotal point of reference, I happen to know my grandfather’s income in 1963 – 65 was around $210 a month (an administrative job in some kind of shipping firm).

The smallest unit on the 15-year plan would be close to 40 per cent of his income: a tight stretch, but not impossible. Also, remember this would be on a single income – it was arguably possible for this sole breadwinner to purchase a landed home.

This isn’t some overarching claim that life was easier back then: I don’t know how much education, healthcare, food, etc. cost in that era, which would all be added factors. But it does suggest that – affordability wise – landed housing was less exclusive compared to today. Still far from cheap, but perhaps on par with buying a mid-range condo in 2024.

It’s also nice how the ad gives such exact numbers

Wouldn’t it be a dream if you could look at a property ad today, and immediately see the payment figures?

We’ve lost the ability to do this, because today there are no perpetual fixed-rate mortgages from banks. Even if you opt for a fixed-rate loan, it’s only really “fixed” for a certain number of years; after that, it reverts back to a floating rate. For that reason, we can’t accurately project how much you’ll pay each month for the loan, or the total interest you’ll end up paying. It all depends on how the rates change over time.

And while HDB loans are much less prone to change, they’re not actually fixed either. They’re set to 0.1 per cent above the CPF interest rate (so 2.6 per cent), and CPF interest rates are reviewed quarterly. So they’re not actually fixed, they just haven’t changed in a long time; but it’s the closest we have to a fixed rate.

That being said, some older folks I spoke to claimed those advertisement numbers were never reliable. The market was less regulated back then, and many of these ads allegedly used lower figures to lure in prospects. If that’s true, then I guess some things never change.

Speaking of giving people the right numbers…

There’s a whole bunch of articles we have planned, which we haven’t been able to execute; and some of these are the ones I’m always asked about. We have ideas like:

- Working out how much more resale properties really cost to renovate

- Finding cheap walk-ups with great layouts (floor plans are almost impossible to find for the older ones)

- A video where I knock on the doors of expensive houses and ask people what they do for a living.

- Check out all the famous haunted houses in Singapore on Halloween, and work out how much they’re worth.

- Find the projects with the greatest amount of wastage in terms of giant air-con ledges, planter boxes, etc.

- Best and worst en-bloc sales in Singapore (you’re not required to publicly announce en-bloc sales outside of the project by the way, so some collective sales happen quietly and without wider awareness)

- Find the real history and some floor plans for the mysterious Tan Tong Meng Tower

You can probably see why some of these are tough to do. No one likes to give access to a house if we’re going to say it’s considered haunted, for example; and information on older properties like walk-ups, Tan Tong Meng Tower, etc. is near impossible to find, as they date back to the ‘70s and ‘80s. Any documentation has long since vanished. And as for things like renovation, giving you even ballpark figures is tough, due to the huge discrepancies in what people consider to be “basic” renovations.

More from Stacked

How Well Do Regional Centre Properties Compare Against The CBD?

A short while back, we put out an article explaining how the Bugis – Beach Road area (district 7) has…

But on the off-chance you feel you have an unusual property, or insight into any unique real estate projects, I’d be super grateful to hear from you! Do reach out to us at Stacked.

Meanwhile in other property news…

- New launch is better than resale? That’s what you may be told, but how true are the more common claims?

- Here are some “new” condos…which were actually built quite a while ago, but they’re still on developer sales!

- Pasir Ris has a whole vibe of its own. I think it’s a resort masquerading as a residential town; and this experience of living at the Seastrand explains it.

- Freehold landed homes near Mayflower MRT? You can get them for $3.8 million or below.

Weekly Sales Roundup (22 July – 28 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $4,945,000 | 1539 | $3,213 | FH |

| PINETREE HILL | $4,788,000 | 1733 | $2,763 | 99 yrs (2022) |

| GRAND DUNMAN | $4,477,000 | 1787 | $2,506 | 99 yrs (2022) |

| THE RESERVE RESIDENCES | $4,133,463 | 1625 | $2,543 | 99 yrs (2021) |

| 19 NASSIM | $3,986,170 | 1109 | $3,595 | 99 yrs (2019) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $1,019,000 | 474 | $2,152 | FH |

| HILL HOUSE | $1,320,000 | 431 | $3,066 | 999 yrs |

| HILLHAVEN | $1,485,850 | 678 | $2,191 | 99 yrs (2023) |

| GRAND DUNMAN | $1,494,000 | 549 | $2,721 | 99 yrs (2022) |

| LENTORIA | $1,588,000 | 700 | $2,270 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE DEVONSHIRE | $7,020,000 | 2400 | $2,925 | FH |

| THE SOLITAIRE | $5,250,000 | 2250 | $2,334 | FH |

| THE ORANGE GROVE | $4,900,000 | 2153 | $2,276 | FH |

| THE VERMONT ON CAIRNHILL | $4,500,000 | 1711 | $2,629 | FH |

| FLORIDIAN | $3,880,000 | 1679 | $2,311 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ISUITES @ TANI | $665,000 | 420 | $1,584 | 999 yrs (1883) |

| KINGSFORD WATERBAY | $725,000 | 484 | $1,497 | 99 yrs (2014) |

| SIMS EDGE | $745,000 | 409 | $1,821 | FH |

| SUITES @ PAYA LEBAR | $750,000 | 398 | $1,883 | FH |

| NINE RESIDENCES | $780,000 | 549 | $1,421 | 99 yrs (2013) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CITY SQUARE RESIDENCES | $2,900,000 | 1496 | $1,938 | $1,930,240 | 19 Years |

| COTE D’AZUR | $2,720,000 | 1313 | $2,071 | $1,808,240 | 22 Years |

| FLORIDIAN | $3,880,000 | 1679 | $2,311 | $1,630,000 | 15 Years |

| ONE DEVONSHIRE | $7,020,000 | 2400 | $2,925 | $1,470,000 | 12 Years |

| THE SOLITAIRE | $5,250,000 | 2250 | $2,334 | $1,450,000 | 6 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| WALLICH RESIDENCE | $1,800,000 | 646 | $2,787 | -$488,800 | 3 Years |

| THE ORANGE GROVE | $4,900,000 | 2153 | $2,276 | -$150,000 | 13 Years |

| VISIONCREST | $2,900,000 | 1227 | $2,363 | -$92,000 | 17 Years |

| THE BERTH BY THE COVE | $2,460,000 | 1625 | $1,514 | -$40,000 | 16 Years |

| SPOTTISWOODE SUITES | $1,070,000 | 441 | $2,425 | -$31,000 | 11 Year |

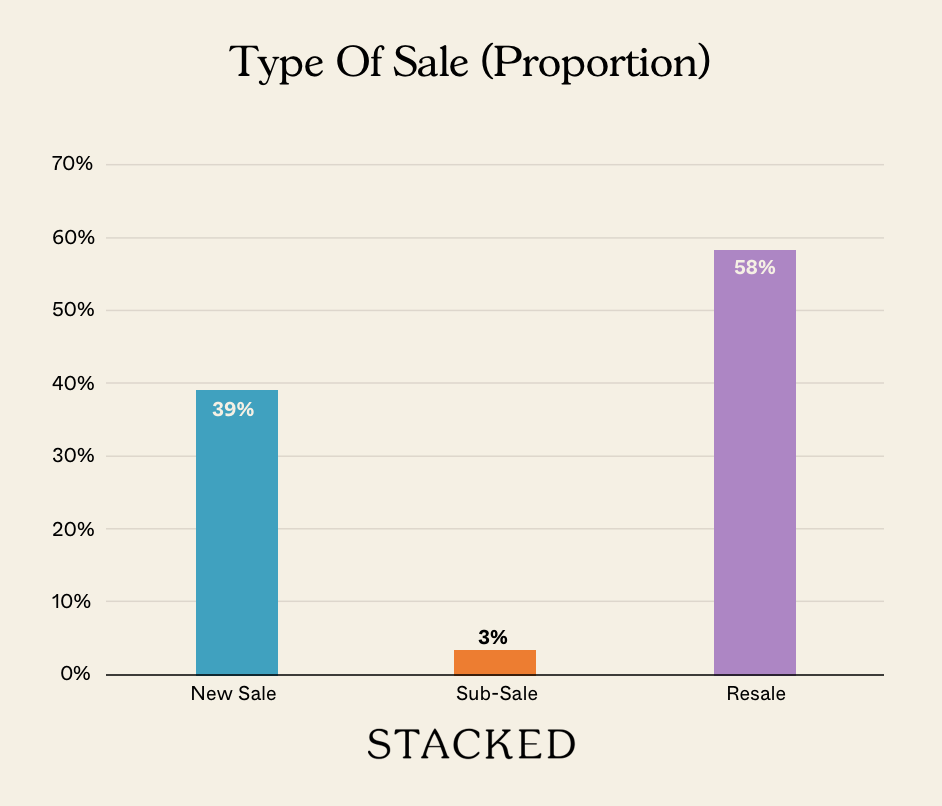

Transaction Breakdown

Follow us on Stacked for reviews of new and resale properties, and on what’s happening in the Singapore property market

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How much did landed homes in Singapore cost in the past?

Were landed homes more affordable in Singapore's past?

Why can't we see exact payment figures for property loans today like in the past?

Are HDB loans fixed or variable?

Did property advertisements in the past always show accurate prices?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

0 Comments