Freehold Doesn’t Always Mean It’s Better: A Case Study Between Jardin And Gardenvista

November 9, 2021

Let’s start with a scenario.

Condo A – freehold, nearer to an MRT station, and new.

Condo B – leasehold, further away from an MRT station, and 6 years older in age.

Now, based on these characteristics, which development do you think would have performed better in the resale market?

I’d bet that 99 per cent of you would choose Condo A, and I wouldn’t blame you for that.

After all, those are the characteristics that most people would look out for in their “ideal” development.

But as we’ve said many times, every development is different, and the real-world usage of a condo is something that many people tend to overlook.

Things like the vibe of the place, the views, the floor plans, and even down to perhaps miniscule details like the entrance of a condo all can play a bigger role than you might think when it comes down to the resale market.

In today’s piece, we will look at why one development was more unprofitable than the other over the past 5 years.

Let me introduce both in greater detail.

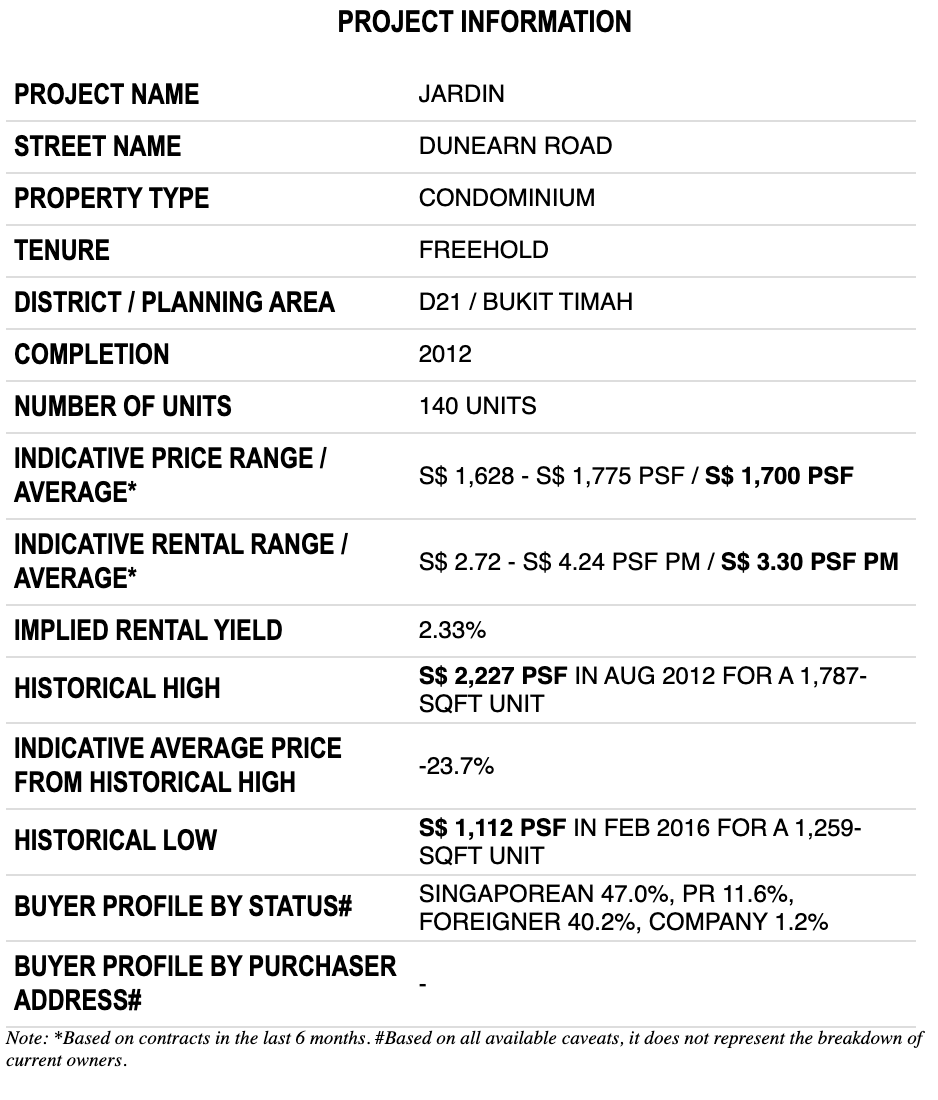

Jardin is a freehold development in District 21 (Bukit Timah) that was built in 2012. It has 140 units and is located across the road from Bukit Timah Plaza. Most units here have a north-south facing.

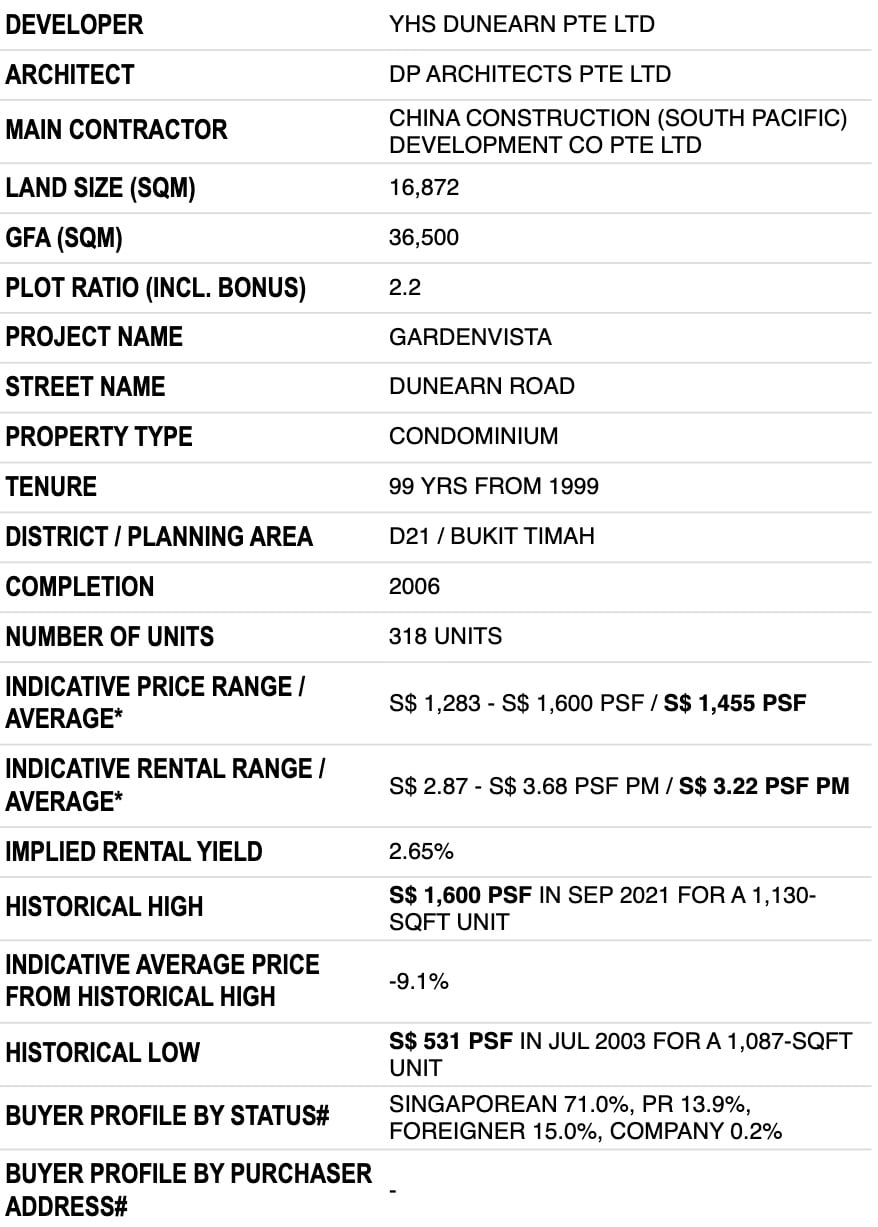

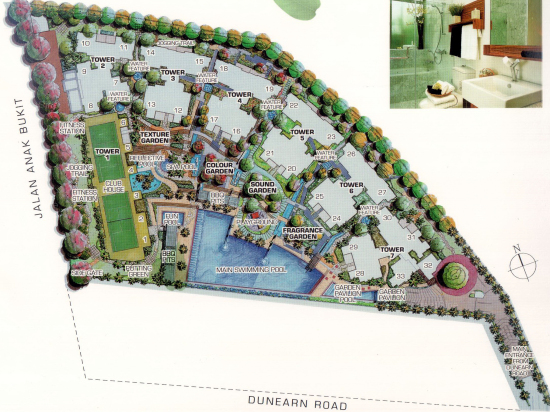

Gardenvista is an older 99-year leasehold development (by 6 years) right next to Jardin. It has 318 units with many units having an east-west facing.

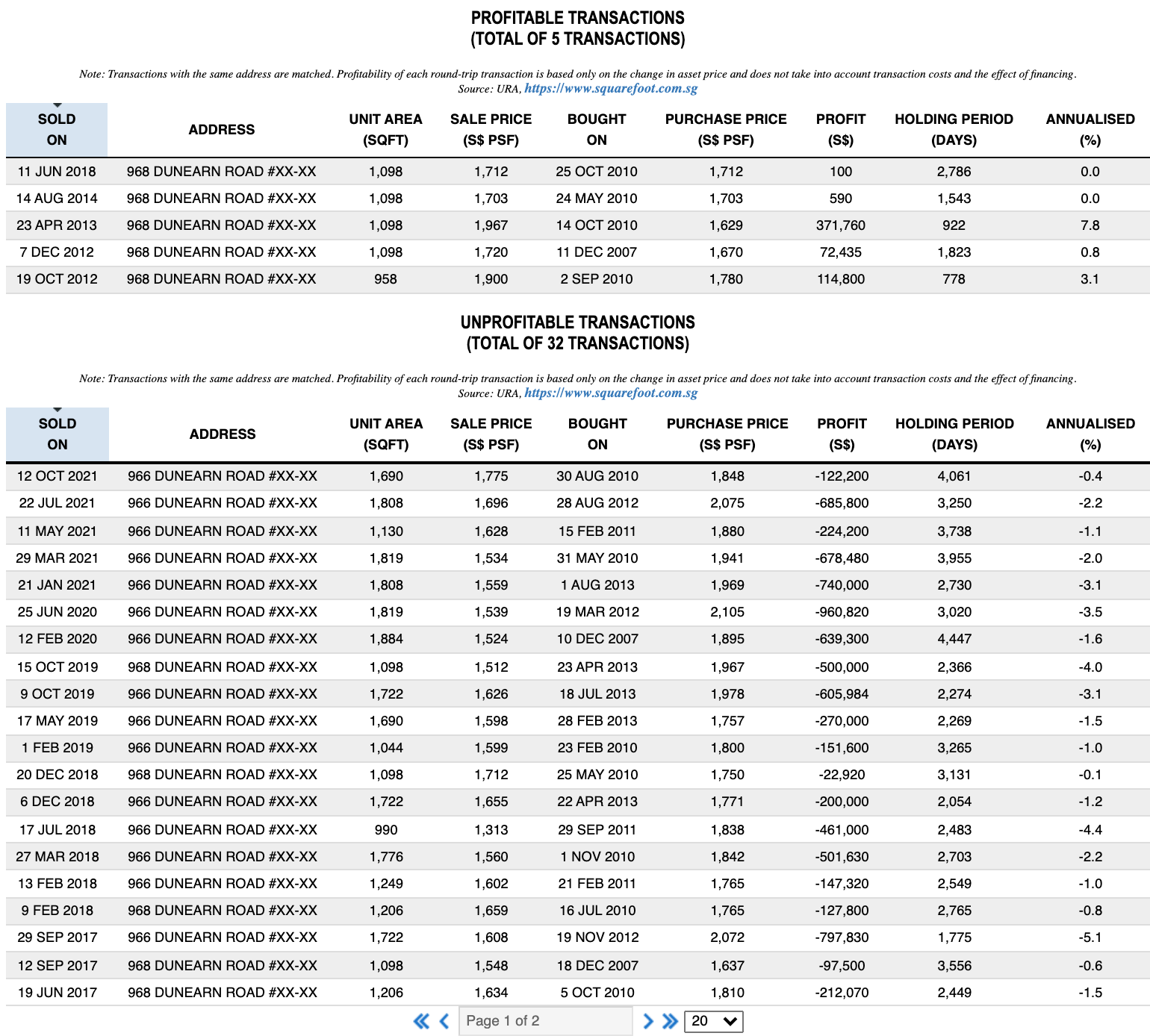

Here’s what their performance in the past 5 years looks like:

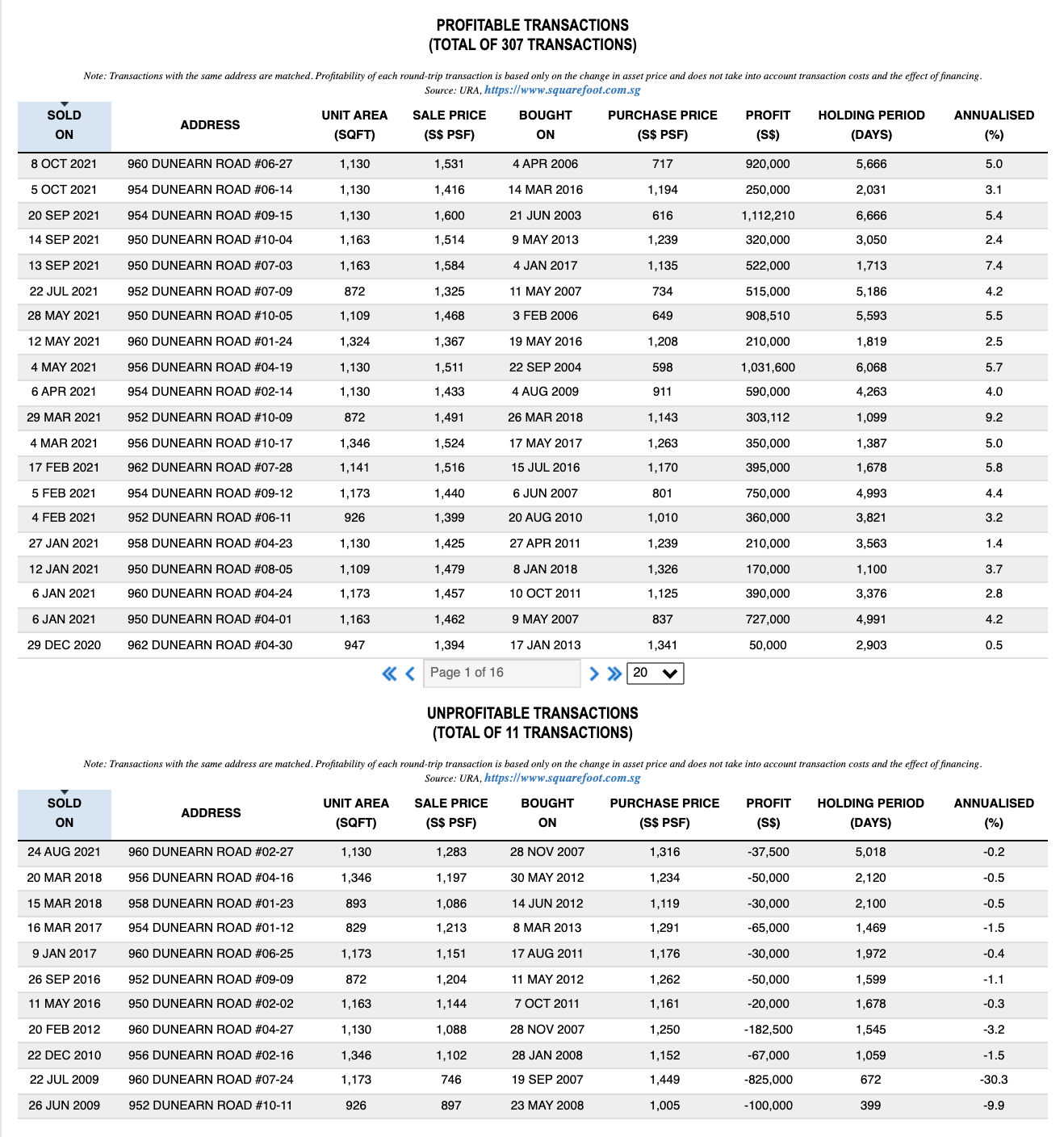

Let’s compare that to Gardenvista.

As you can see, despite Jardin being a newer plus a freehold development, the contrast between both developments is significant in the resale market. Clearly, Jardin being freehold here has not helped its case much and it just goes to show that buying freehold doesn’t always guarantee that you’ll make money – it just better weathers the depreciation effect since the land value is not pegged to a limited lifespan.

Now, let’s go through a few of the reasons why we think Jardin has performed the way it has.

1. Developer priced too high

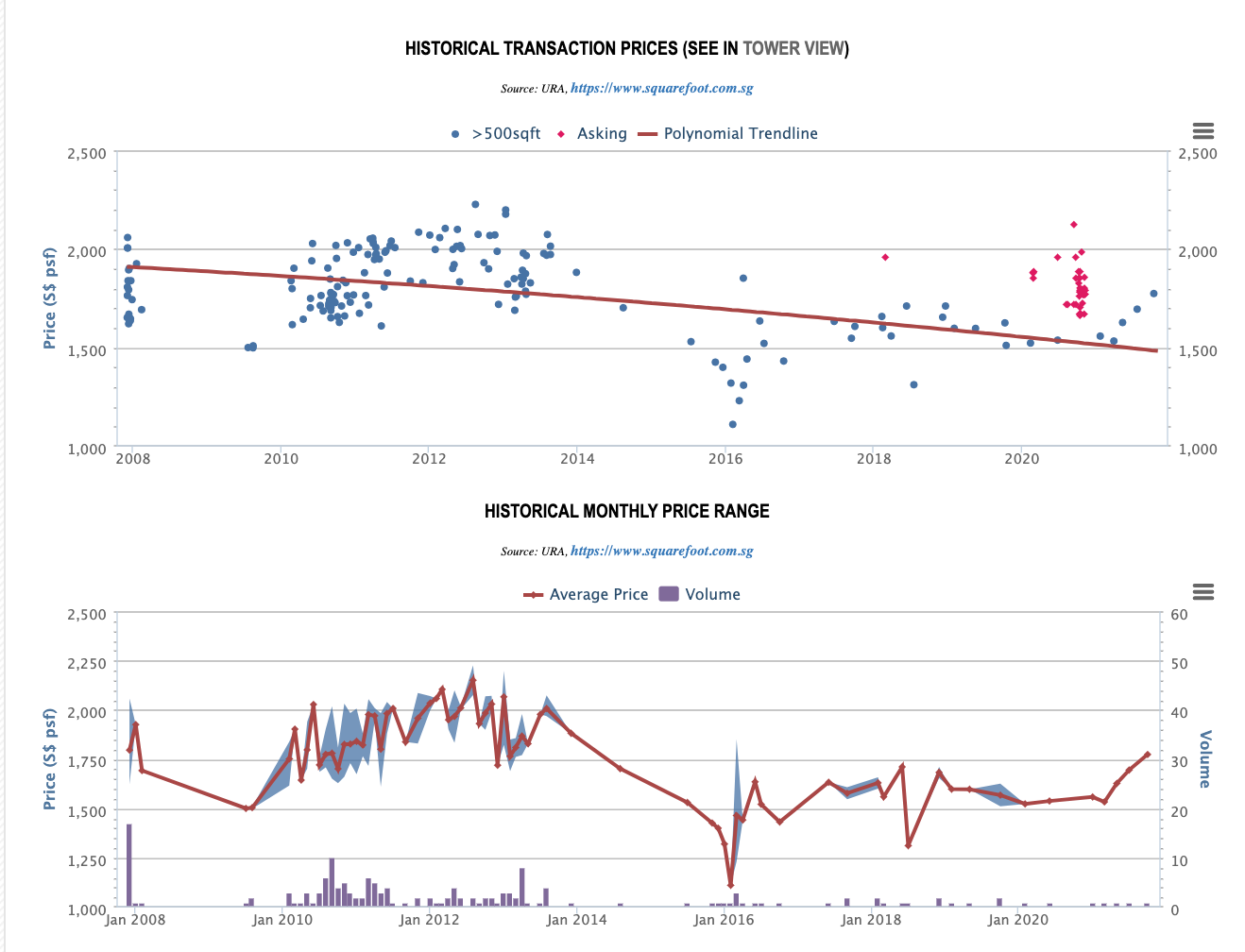

Jardin was launched in December 2007 at the peak of the market. Sales were slow, as Jardin only managed to sell 19 units in the first 3 months. Amazingly, the next sale was nearly one and a half years later in July 2009.

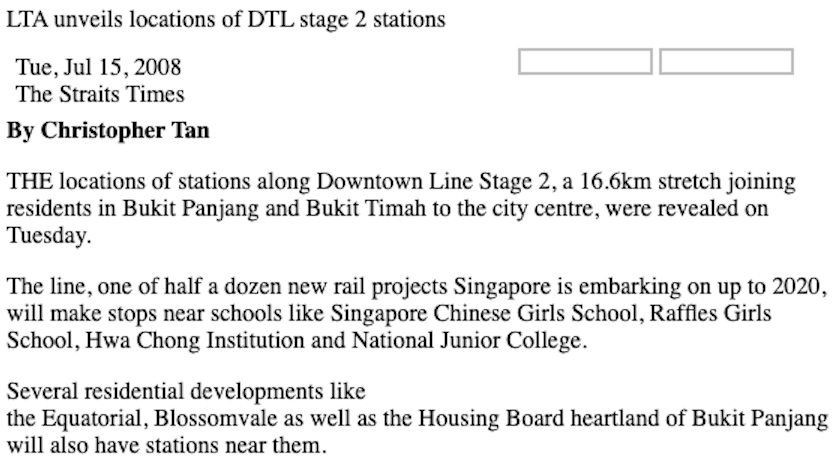

A point worth noting here is that the Downtown Line MRT announcement came out on 27 April 2007 (announcement of station locations on 15 July 2008. So lesson learned: if you are buying a property when the information is already priced in, then don’t be expecting too much in terms of capital gains.

It’s from this example too that we can see why a new launch condo should never be seen as a sure win. While what new launches do offer is an increased likelihood of mispricing since it’s set at the discretion of the developer and not secondary market forces. So it’s important to know that this mispricing can go both ways – it’s either priced too low (e.g. High Park Residences), or too high (as in the case with Jardin). It’s also largely dependent on market conditions and whether the developer manages to stage its price up over time successfully.

2. Locational attributes

On the surface, Jardin is actually located in a good location if judged by conventional methods. It’s walking distance to the MRT station, Bukit Timah Plaza and KAP Mall are both just opposite, and you can walk to Ngee Ann Polytechnic too.

But on the ground, the situation is quite different.

First, you are flanked between 2 major roads as well as the Bukit Timah Sevenmile Flyover – so there’s traffic noise to contend with.

Next, the ever-going construction since 2008 (the Downtown line MRT), and now with the construction of Mayfair Modern and Mayfair Gardens. So that’s a drag not just on the traffic congestion during peak hours, but the noise as well.

So while Jardin may have a better location on paper, Gardenvista actually benefits here as it has the advantage of being blocked from the road noise by Jardin.

Finally on a minor note, drivers coming home would likely have to break traffic laws if they were to drive home from the direction of town. This is because of the double white lines at the entrance of Jardin, leaving you with a small zone from which to filter. So you either have to be a very skilled driver to cut in after the u-turn, or do it the proper way and head down Jalan Anak Bukit to make a u-turn.

That being said, Gardenvista faces this issue too – but it is somewhat less of an annoyance when you don’t have that leeway to take the shortcut like Jardin.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

This New Pasir Ris EC Starts From $1.438M For A 3-Bedder: Here’s What You Should Know

It has been more than a decade since Pasir Ris last saw an Executive Condo (EC) launch, so when Qingjian…

Like I said, it’s a small point that could just be a bugbear for some people.

3. Slim piece of land

Jardin was built in 2012, so it is still considered to be a relatively new development. As such, talks of development potential in the future may be premature at this point.

Still, it is worth noting that it is sat on a narrow strip plot of land – so the potential for redevelopment in the future would likely be lower than a more regular plot like Gardenvista.

Property Investment Insights13 Condos With The Most Unprofitable Transactions (By Region)

by Ryan J. Ong4. Poor layouts despite the large size

This is probably one of the biggest reasons why Jardin has performed the way it has – and that all boils down to the layout of the units.

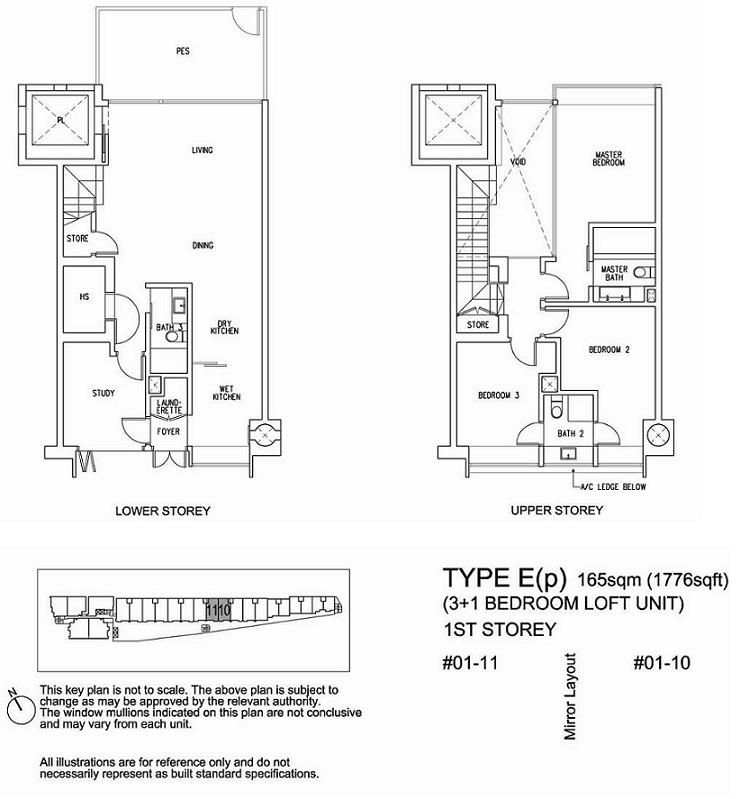

Like the Tennery, Jardin has quite a number of loft units.

Now don’t get me wrong, I’m not saying that loft units are bad – it’s just that it will always be attractive to a very niche range of buyers.

Perhaps its down to expectations, but let’s say you’ve come across this 3 bedroom + study unit at Jardin for sale. On paper, that 1,776 square feet sounds enticingly spacious, doesn’t it?

You’d probably head to the viewing excitedly, as it seems like you’ve found a hidden gem.

But in person, your expectations will be dashed as the layout makes it feel like a much smaller space instead.

This is down to a number of reasons:

- The void, staircase, and private lift taking up the sqft of the unit

- It’s set over two floors, so you don’t feel the size as much as you would on a single loading unit

- The void space should make the space feel bigger, but it is a rather narrow strip that doesn’t do much

Here are some photos:

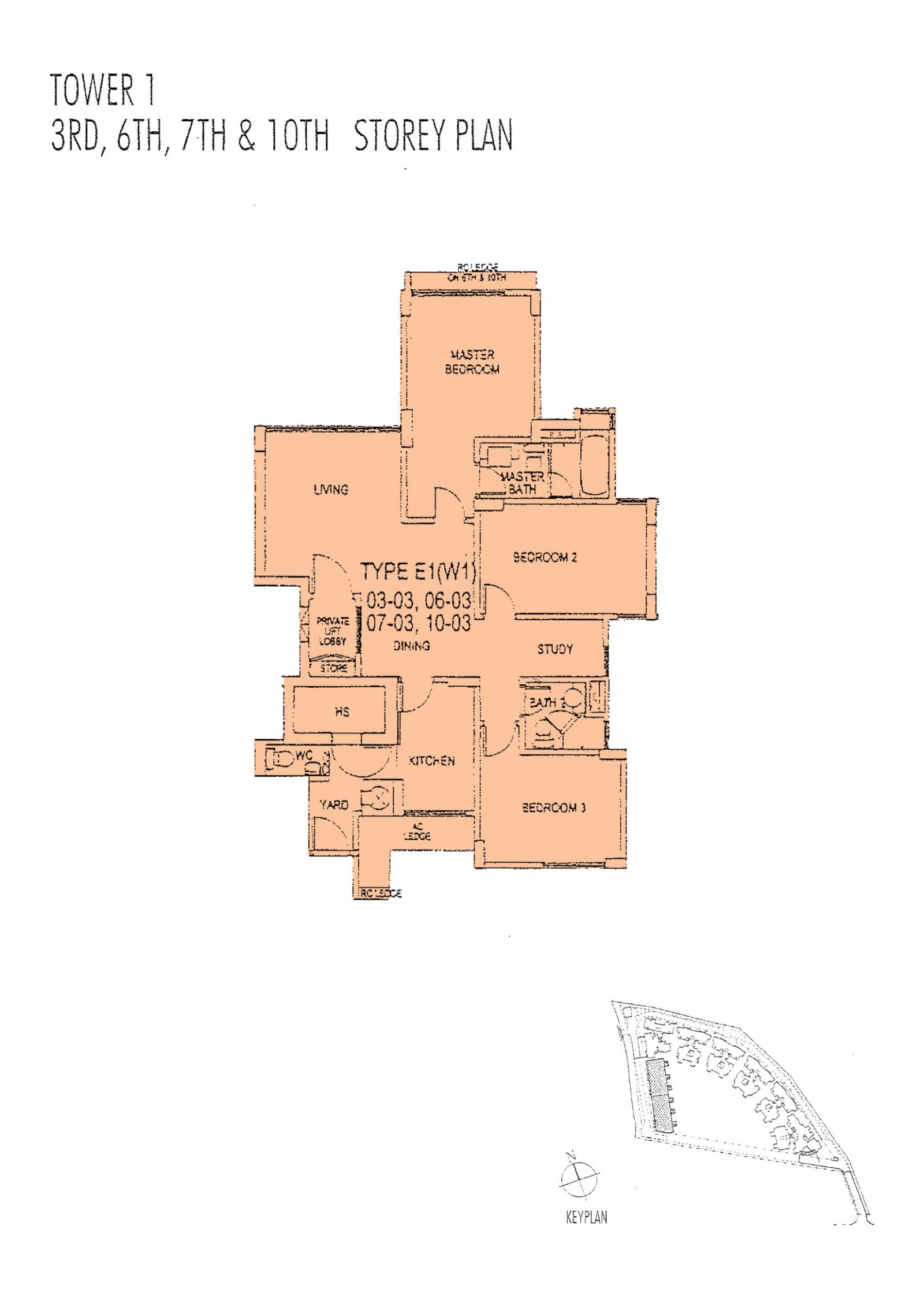

So in comparison, a family looking for a 3 bedroom unit would prefer Gardenvista given its more affordable quantum wise due to not just the tenure, but its layout being more efficient with less wasted space.

Gardenvista 3+study (1,163 Sqft)

5. Demographic of buyers

The Jardin currently has quite a large proportion of foreign owners (40%).

Just like the example of the Tennery, with investors, this could play a factor in the resale market as well.

More often than not, you’ll find that projects with more foreigners tend to have lesser staying power.

That is, if the intention is to head back to their home country in the future, they may be more inclined to let go of their property – even if it’s at a loss to suit their timeline.

That is, if the intention is to head back to their home country in the future, they may be more inclined to let go of their property – even if it’s at a loss to suit their timeline.

Contrast this Gardenvista, where the proportion of local homeowners is much higher (70%), most would need to sell at a reasonable price in order to upgrade or fund for retirement, so the mindset is quite different.

6. Facilities

Personally, I really like the rooftop swimming pool at Jardin. It’s sizeable, and offers a nice view towards Bukit Timah. But arguably Gardenvista has the advantage of a wider pool plus 2 tennis courts – a more diverse set of facilities that buyers would appreciate.

Final Words

Looking at these factors presented, you can see why a property cannot be compared in such a binary way – freehold > leasehold. So the next time you’re told to buy a property simply because it’s freehold, ask yourself if the premium on that tenure is too much, and consider the development’s competitors in the surrounding area too!

Ultimately beyond the hard numbers, you should always consider the liveability aspects of a purchase. A condo can be freehold and next to an MRT station, but these may not mean much to it being a proper home to live in. Traffic noise, congested roads, and a poorly conceived layout can all be detrimental to the actual liveability of a development. As small and seemingly inconsequential as it may seem, these things can add up.

For more on issues affecting property investment, or in-depth reviews of new and resale properties, follow us on Stacked. If you’re pondering the future gains of your property purchase, do reach out to us for a proper consultation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Does freehold property always perform better in the resale market?

Why did Jardin, a freehold condo, perform poorly in resale over five years?

How does location affect the value of condos like Jardin and Gardenvista?

What impact do unit layouts and design have on property resale?

How do buyer demographics influence the resale prospects of condos like Jardin and Gardenvista?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

11 Comments

Jardin is a terrible property. Its long and narrow, with weirdo layouts as you pointed out. It’s like the Linear in UBT road. Rather unlivable. Gardenvista isn’t great either, since it’s right next to the humongous flyover. Skip mayfair modern too, psf too high and dodgy developer. Go for Blossomvale. Best buy there.

have a friend who bought garden vista. his unit faces the huge flyover and the traffic noise is annoying if the windows are open. on top of that, it has west sun from living to bedrooms. double whammy. facilities wise, they are bit old and dated but the pool is huge and nice.

I lived in one of those. My 2 cents.

Jardin is a very nice development and feels much higher end than GV. The view from the rooftop swimming pool goes all the way to MBS. However, the issue is that most larger units are facing GV, with no view. The ones with a view of rifle range road are smaller (one or two bedder), which are not popular (too large for a one/two bedder). The non-loft units are located at the junction of the flyover and dunearn road and roadworks and noise have been persistent. ALL the units face the west sun. In other words, it is hard to find a good stack at the development.

GV is much better in terms of space. The pool is huge and located far from the units, offering privacy (for both swimmers and residents). Everyone in the pool has their own space. The rooftop tennis courts offer a view of Bukit Timah hill, which is great (except in the evenings where bats would swoop around the courts). Compared to the condos in the area, GV is (in my opinion) is the nicest in terms of layout, public spaces, and maintainence.

However, the freeholder of GV is Far East. Residents may have difficulty a collective sales in future.

In 2003 master plan, Jardin and GV plots were actually one plot.

I believe FEO owns the freehold title of GV. If that’s really the case, then GV will definitely have issue to go enbloc in my own opinion as the “landlord” of the land to top up the lease will theoretically be FEO.

So with that in mind; this 2 plots owners are actually both FEO, so the price strategy and future of GV actually still lies with FEO as the decaying lease may be to the advantage of FEOz

FEO do not own the FH rights to Gardenvista. The plot is a regular 99 years plot.

Jardin and Garden both sits on former YHS land. The land had a mix of freehold and lease hold plot in different locations.

A private landswop deal was done to carve out a freehold portion and a leasehold portion. it makes development easier.

Garden was developed by YHS before it was acquired by FEO.

To find out owner of the land, you can head to SLA to buy the information for a few dollars. Especially if you want to avoid buying ‘carved out’ leasehold plots from FH land holders

Disclosure, i own a unit in Jardin(1st owner), but am renting a smaller unit in Gardenvista since i’m staying alone. Points raised in the post are valid, but with PSF of mayfair already in the low 2000 range, i’m confident Jardin will catch up in the future.

If not, i’ll just keep it for the rental.

My concerns are not with the unprofitable transactions for Jardin at the moment, i’m more concerned about future redevelopment for Garden if it goes enbloc. I’m going to be wedge between the road and a construction site. 1BR sizes in garden now is close to 870 sqft. it’s huge. Some of the newer developments are cramping 3BR into 900 ish. I can’t imagine how many more units the new developer will cramp into the current garden plot.

Anyway, it’s unlikely that will happen within the decade. i’m confident i can offload and cashout with a small profit by then.

Traffic noises are still bearable with the doors and windows closed in Jardin, i’ve never had issues sleeping nor have i been woken up by traffic before. The convenient location more than make up for the negatives highlighted.

The only bug bear i have is the car access. The main road went from 2 way, to 1 way, and now back to 2 way again, and i still have to make a loop down Jalan anak bukit to access Jardin.

Ever since this article has been published, price of Jardin continues to be suppressed. However, for potential tenants looking to rent an apartment in the area, most of them will choose Jardin and pay an even higher rent. This is because the units do look more Arthas then the rest. So for anyone looking for a slightly better rental yield, Jardin may be a potential choice especially since it is freehold and does not depreciates like GV or the other units nearby.

Is Gardenvista a state land? ie after 99 years, it goes back to gov or it belongs to Fareast?