The Stacked Guide for Foreigners Buying Property in Singapore

August 31, 2020

Singapore private property is both literally and metaphorically a safe port in the storm. This may be one of the few countries where demand for luxury properties can climb to 11-year highs, precisely because of economic downturns.

But despite its size, Singapore’s property market is segmented, with different property types operating at their own speeds. In addition, the Singapore government is unabashedly interventionist, and has an active hand in controlling property prices. So if you’re considering a real estate investment in Singapore, here are some of the key issues you need to consider:

- Property restrictions for foreigners

- Stamp duties and taxes

- Local financing options

- Enclaves and districts

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Property restrictions for foreigners

Foreigners can buy most commercial properties – such as offices, retail stores, or hotels – without restriction. With regard to residential properties, foreigners cannot usually buy the following:

- HDB flats

- Land zoned for residential use

- Shophouses zoned for residential use

- Semi-detached houses

- Bungalows

- Strata landed housing (unless the landed housing is within a condominium development, and planning approval for the landed housing was granted before 3rd April 2012)

- Accommodations such as workers’ dormitories (unless the accommodation is registered as a hotel)

- Places of worship

For the most part, foreigners are restricted to private, non-landed properties, common examples being condominiums and walk-up apartments*.

*As a common point of confusion, note that many Singaporeans – including real estate professionals – sometimes also refer to apartments and condo units as “houses”.

However, there are some exceptions

The most notable exception to restrictions is Sentosa Cove. Foreigners are allowed to purchase landed properties here, without any special approval.

But for any landed property on the mainland (as described above), you’ll need to get approval from the Singapore Land Authority’s Land Dealings Approvals Unit (LDAU). Approval is based on your overall economic contribution to the country.

(If you need help with this, message us on Stacked and we can find the right experts to guide you).

In addition, take note of a special “sandwiched” class of condominium called an Executive Condominium (EC). These properties count as HDB properties for their first 10 years only; after that they’re fully privatised. Foreigners are free to purchase EC units at that point.

2. Stamp duties and taxes

One of the most widely advertised facts about Singapore property is the lack of capital gains tax, and inheritance tax. This is true, but there are additional stamp duties for foreigners.

Chief among these is the Additional Buyers Stamp Duty (ABSD). This is a tax of 20 per cent of the purchase price or market value of your property, whichever is higher. So if you purchase a property with a price of $2 million, and a market value of $1.8 million, the ABSD would be $400,000.

(For new properties bought directly from the developer, the sale price is taken to also be the market value).

At present, some foreign property buyers may opt for ABSD remission, depending on the status of existing Free Trade Agreements (FTAs). At the time of writing these are citizens and permanent residents of:

- Iceland

- Liechtenstein

- Norway

- Switzerland

- United States of America (citizens only)

Purchasing the property as an entity (e.g. via a company that you set up), incurs an ABSD of 25 per cent, so this is not usually an advisable move.

Editor's PickAdditional Buyer’s Stamp Duty (ABSD): A Comprehensive Guide

by Reuben DhanarajWhile Singapore has no capital gains tax, there is a Sellers Stamp Duty (SSD) that applies within the first three years of acquiring a property. The SSD is 12 per cent if you sell the property within the first year of acquiring it, eight per cent on the second year, and four per cent on the third year. As such, Singapore is not an ideal location for investors looking to flip properties.

Recurring property taxes are the same for foreigners as for locals; we have a more thorough guide to taxes and stamp duties in this earlier article.

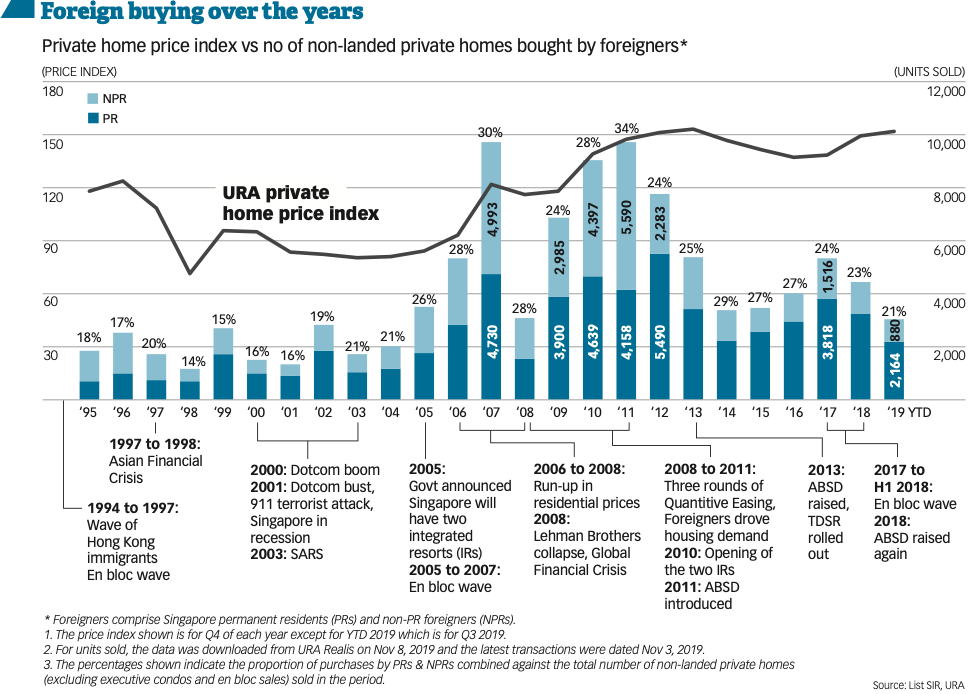

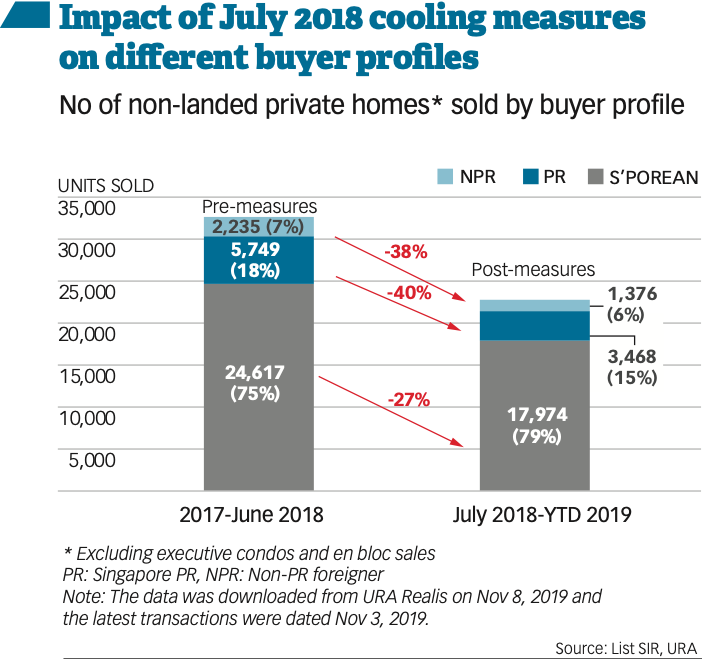

As stable as the Singapore property market may be – it’s also worth noting the influence that the Singapore Government has on the property market. An example would be the July 2018 cooling measures – you can clearly see the impact on foreigners buying property in Singapore here.

3. Local financing options

If you choose to obtain a mortgage from a local lender, take note that there are no perpetual fixed rate home loans in Singapore.

The “fixed rate loans” offered by banks typically have a fixed rate for three to five years only, after which they revert back to floating rates. A common point of confusion is the term “semi-fixed” – within a local context, this refers to a process of refinancing from one fixed loan package to another, when the fixed interest duration ends.

For Singapore banks, the maximum Loan To Value (LTV) ratio is usually 75 per cent of the property price or market value, whichever is lower (for new properties, the selling price is taken as the market value).

The LTV may be further reduced if the loan tenure exceeds 30 years, or the loan tenure plus your age would exceed 65. It can also be reduced based on the bank’s estimation of your credit, or the nature of the property you buy.

For leasehold properties, be aware that most banks will not grant loans if the lease has only 30 or fewer years remaining. Banks also don’t provide financing for properties bought on trust (e.g. properties held by a trustee for your children.

Home loans in Singapore are usually pegged to:

- The Singapore Interbank Offered Rate (SIBOR), which is the median interest rate among 12 major local banks

- A specific tranche of a bank’s fixed deposit (meaning that the bank would have to raise its fixed deposit to raise your home loan rate)

- An internal board rate set by the bank

For commercial properties, the Swap Offer Rate (SOR) is sometimes used; this is based on the exchange rate between the Singapore dollar and US dollar.

At the time of writing, the home loan rate in Singapore averages 1.3 per cent per annum. You can contact us on Facebook, to find out the cheapest bank (the rates change every month).

4. Enclaves and districts

Singapore districts are based on postal codes; there are 28 districts in all.

The Core Central Region (CCR) is the city centre, which includes parts of districts 1, 2, 6, 9, 10, and 11. The very core of the CCR, however, is considered to be districts 9, 10, and 11.

The city fringe, also known as the Rest of Central Region (RCR), includes districts 3, 4, 5, 7, 8, 12, 13, 14, 15, and 20.

The fringe regions, also known as the Outside of Central Region (OCR), includes districts 16, 17, 18, 19, 21, 22, 23, 24, 25, 25, 27, and 28.

Districts 16, 17, and 18 constitute Singapore’s eastern planning region, while Districts 19, 26, 27, and 28 are considered north-east.

Districts 21, 22, and 23 constitute the country’s western planning region.

Districts 24, 25, and 27 make up the country’s north planning region.

The most established expatriate / foreigner enclaves in Singapore are:

- Boat Quay, Robertson Quay, and Clark Quay (Districts 1, 6, and 9 respectively)

- Holland Village (District 10)

- Katong (District 15)

- Sentosa (District 4)

- Tanglin (District 10)

It’s a good idea to get a sense of which district fits you, before you begin hunting for property

For foreigners buying property in Singapore, Singapore’s districts can have very different vibes, even if they’re nearby. For example, Katong (District 15) is less dense, and has a more historical / hipster vibe, than Tampines (District 18), which is a major business hub also on the East Coast.

Check out our (upcoming) Neighbourhood of the Week guides on Stacked Homes, as well the most in-depth reviews of properties in each area. You can also contact us with any questions about real estate in Singapore.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments