Can’t Afford The Property You Want In 2023? Here Are 4 Things You Can Do

January 5, 2023

One of the common complaints we’ve been hearing is about buyers priced out of the property market in 2022. This is no longer just the case for first-time home buyers either: we even hear the same complaint from HDB upgraders, who have come to realise the unfortunate reality of an exuberant market: even though you sell high, you’ll probably end up having to buy high as well. For readers who are in the same situation, here are some steps you can consider:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. If you’re refused a loan due to your income, try a bigger cash outlay or fixed deposit options

It’s possible that, if you qualified for a home loan a few years ago, you may no longer do so in 2023. The cause may be the floor rate used to calculate the Total Debt Servicing Ratio (TDSR), which has been set at four per cent as of September last year.

Here’s a quick example of how it may matter:

Say you and your co-borrower earn a combined $12,000 per month. Using a bank loan for a condo, your monthly home loan repayment would be capped at 55 per cent of your monthly income, or $6,600.

You were initially planning on a condo purchase of $1.8 million. The minimum down payment would be $450,000 (25 per cent), while you take a total loan of $1.35 million paid over 25 years.

The loan package is quoted at three per cent per annum. This would set monthly loan repayments at roughly $6,400 per month, which you would normally qualify for.

However, the new floor rate means the bank must use an assumed interest rate of four per cent, regardless of the real interest rate. This would raise your monthly repayment to about $7,125, and you no longer qualify.

To fix this, you need to make a bigger down payment, so that the monthly loan repayment decreases.

If you decrease your loan amount to $1.21 million, for example, the monthly loan repayment would fall to around $6,400 so you’d qualify. However, it comes at the cost of an added $140,000 to your initial cash outlay.

Some mortgage brokers, however, have told us there could be other ways besides a bigger down payment.

Some banks are willing to treat your income as being higher, if you can commit to a sizeable fixed deposit (e.g., if you commit to a $160,000 fixed deposit for the duration of your loan, the lender may be able to count your income as being $1,000 higher).

These policies vary between banks, and we understand that such deals are not publicised – you’ll usually need to discuss it with the mortgage banker, or go through a mortgage broker.

It’s true that either way, you’ll need more cash in hand; but the idea of committing to a fixed deposit may be more palatable to some people right now, as we’re entering a higher interest rate environment.

In the meantime, if you’re resigned to waiting to save up more, remember to adjust your targets accordingly.

If you’ll have problems meeting the TDSR, remember to plan for more than the minimum 25 per cent down payment, when setting your target sum. This is especially true if you have variable income (e.g., you work in the gig economy), as your assessed income will be treated as being 30 per cent lower.

We’re sure none of our readers are sneakily under-declaring their income, right? Because if you do, keep in mind it can be much harder to pass the TDSR framework.

2. Check the projects that are one kilometre away from your first choice

If you’re priced out of everything you’ve shortlisted, but really need a home, try roving a bit further out. Sometimes, a distance of just one more kilometre can make a significant difference in price; particularly if the original target was near a key amenity like a mall or MRT station.

There’s no denying you’ll cause yourself some inconvenience – it could mean you need to bike to the MRT station instead of walk, for example. But from experience, most people are quick to adapt to this small degree of difference.

You’ll also find that, in most newer condos, there will be shuttle services that largely negate the difference in distance. For example, some buyers have found that the older condos in the Bayshore area have regular services that go to Bedok or Tanah Merah MRT station; and the sheer price difference may make these older condos a viable alternative to new launches like Sky Eden at Bedok, or Sceneca Residence.

For the sake of around eight to 10 minutes on a shuttle bus, this is a disparity of around $1,600 psf, versus the two newer launches at over $2,000 psf.

Of course, as always, judging affordability solely by psf isn’t always accurate. Older condos would typically come with bigger floor plates as well, so the resulting quantum may not always be cheaper in the favour of the older condo.

Homeowner StoriesMy Biggest Regrets After Buying A New Launch Condo: We Share 5 Most Common Regrets Homebuyers Have

by Sean Goh3. Check if different payment schemes work better for you

At a time when monthly loan repayments are rising, the Progressive Payment Scheme (PPS) is worth keeping in mind. As we detailed in our previous article, it can be quite some time (up to the point of completion) before you’re paying the entire monthly loan amount. For some buyers, this can be preferable to buying resale condos, where you need to pay a minimum of 25 per cent of the price upfront.

The catch is that new launches are expensive, and are always priced higher than existing resale counterparts. So while payments may be more comfortable at the start, keep in mind that you could still be paying more.

As a bonus, the PPS adds a layer of safety at a time when the construction industry is volatile. Due to uncertainties from the war in Europe, developers run the risk of delays – but under the PPS you won’t end up paying more until the specific construction phases are complete.

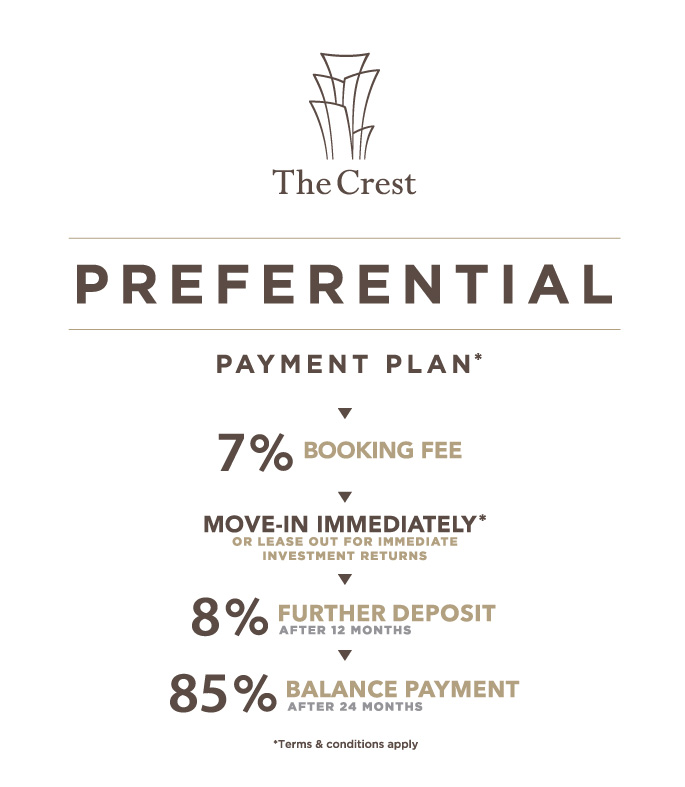

There is also the Deferred Payment Scheme (DPS), which is not always available. This may sometimes be offered for new launch properties, which are completed but not yet sold. The DPS requires 20 per cent down payment, and can allow you to wait for as long as two years before monthly loan repayments begin*.

We’re less inclined to highlight this as a solution though, as units sold under this scheme tend to be priced at a premium. It’s also risky from a financial perspective, as your income situation may change two years from now – if you subsequently cannot secure a loan for the unit, then the 20 per cent you’ve paid is forfeit; and some other penalties may apply.

*The terms can vary between different projects, so check the fine print!

4. Consider buying without renovating, if that would help with the costs

If you have money set aside for renovations, consider using it for your down payment instead. Remember there’s no rule that you must renovate right away. If you can find a resale unit where the renovations are new (e.g., done within the past five years), consider buying it first and living with the existing set-up.

You can then save up for a while, and get around to renovating it later. Remember that the longer you wait in a property boom, the higher the price may climb.

The downside is that this may rule out some of the older – and hence much cheaper – resale flats. It’s a bit of a balancing act: you want a unit where the renovations are recent enough to be liveable, but not so new that there’s a premium attached.

One example to watch out for is five-year-old resale flats. While these may save you some renovation costs, the premium attached – in the form of Cash Over Valuation (COV) – may be difficult to justify.

We explained in this earlier article why these flats can command exceptionally high prices.

Do also consider that while buying a newly renovated unit may cost more, because the reno is effectively factored into the house price – you are essentially able to take a loan for it. In contrast, buying a cheaper home that needs significant renovation may mean that you may have to come out with more cash to pay for the renovation. Remember, the maximum home renovation loan you can take is $30,000 (unless you take up more than one with a different bank).

Finally, if buying would stretch your finances too far, don’t be afraid to rent first

In a pricey market with rising interest rates, you can set aside old beliefs like “renting is wasting money.” 2023 is turning out to be a volatile year: combined with the Sellers Stamp Duty (SSD), and a 15-month wait-out to buy resale flats after selling a private home, it will be tough to offload any properties that become a liability.

If you need to, err on the side of caution and rent. We know it’s painful given the high costs in the rental market at the moment, but it still beats a bad buy at a property peak.

Stay with us on Stacked as we seek solutions in the 2023 market, and remember you can reach out to us directly for any help you need.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments