Can Resale Condos Maintain Their Momentum For The Rest Of 2021?

July 15, 2021

First-time buyers and upgraders were hit by more bad news, for end-June 2021. It was expected that a return to Phase Two (Heightened Alert) might cool prices a bit, and buyers aiming at the resale market were hoping new launches like Canninghill Piers / Irwell Residences might siphon off some demand.

But SRX flash estimates – as well as word on the ground – suggest that’s not happening. In fact, resale condo prices even managed to creep up slightly, even with the June setback:

What’s happening in the resale condo market?

SRX flash estimates show that year-on-year, resale condo prices are probably up around 6.8 per cent. The Outside of Central Region (OCR) has seen the biggest price increases, and is now up 7.1 per cent year-on-year. The Core Central Region (CCR) and Rest of Central Region (RCR) have mostly kept in tandem, with prices up 6.2 per cent and 6.5 per cent respectively.

The brief return to Phase Two in June did slow sales, with volumes falling from 1,727 in May to 1,510 units. However, overall prices still rose by around 0.1 per cent, month-on-month.

Realtors and analysts we spoke to said the results were less dramatic than what we saw in April this year – at the time, resale condo volumes hit an 11-year high.

However, this has to be viewed in light of the return to Phase Two viewing restrictions between May and June. It’s possible that, without this setback, resale condo volumes would have continued to climb.

Top resale condo transactions for June 2021

- Sculptura Ardmore (CCR)

- Regency Suites (RCR)

- ClementiWoods (OCR)

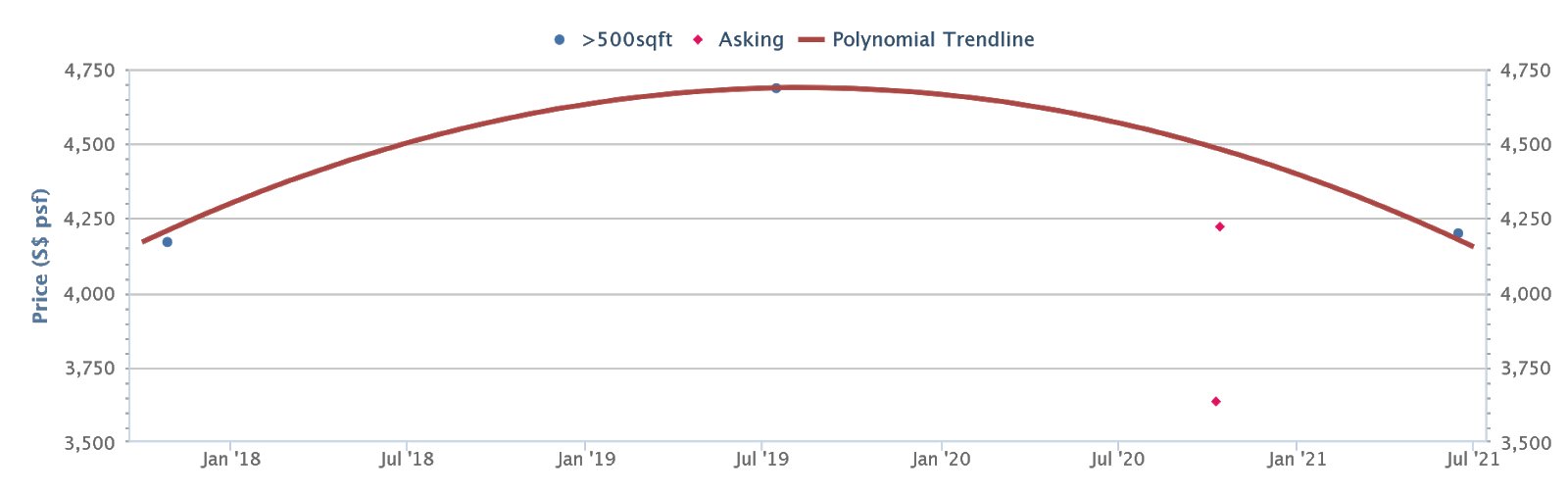

1. Sculptura Ardmore

Location: Ardmore Park (District 10)

Developer: Convenson Pte. Ltd.

Lease: Freehold

TOP: 2014

Number of units: 34

Top transaction:

| Date | Unit Size | Price PSF | Quantum |

| 15 Jun 2021 | 4,704 sq. ft. | $4,200 | $19,756,800 |

This is the only transaction for Sculptura Ardmore since 2019 (probably because this is one of the most expensive developments in the entire country). No round-trip transactions have been recorded.

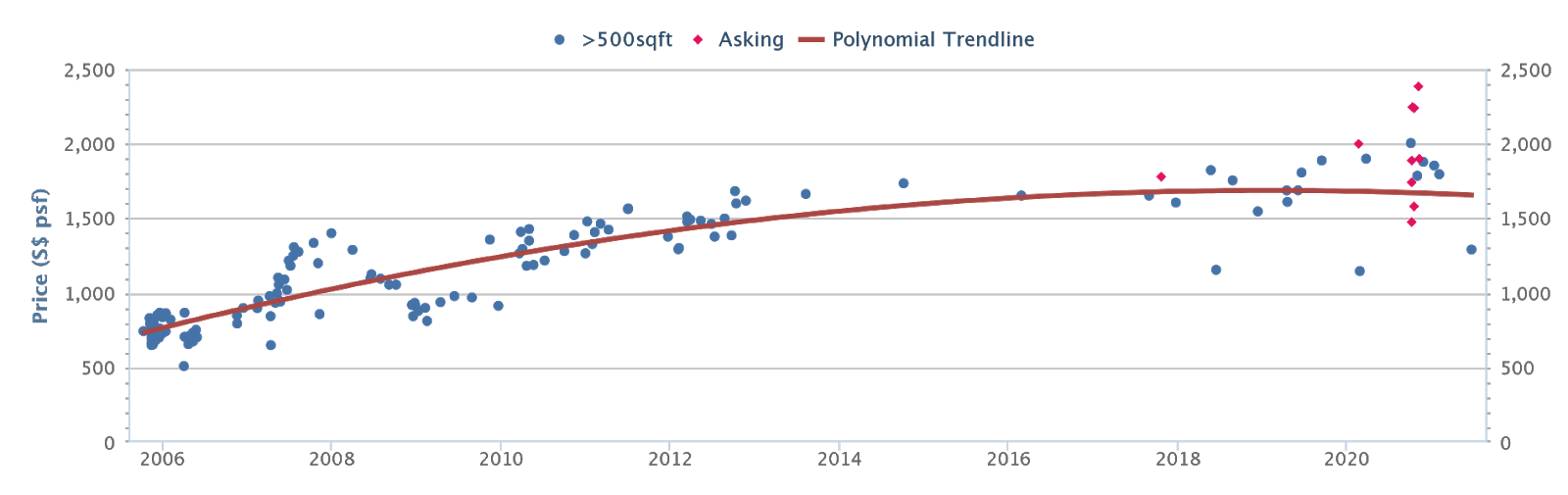

2. Regency Suites

Location: Kim Tian Road (District 3)

Developer: Regency One Development Pte. Ltd.

Lease: Freehold

TOP: 2008

Number of units: 84

Top transaction:

| Date | Unit Size | Price PSF | Quantum |

| 21 Jun 2021 | 4,413 sq. ft. | $1,292 | $5,700,000 |

Recent prices indicates a price range of $1,292 to $1,797 psf, with an average of $1,545 psf. There have been 81 profitable transactions and three unprofitable transactions.

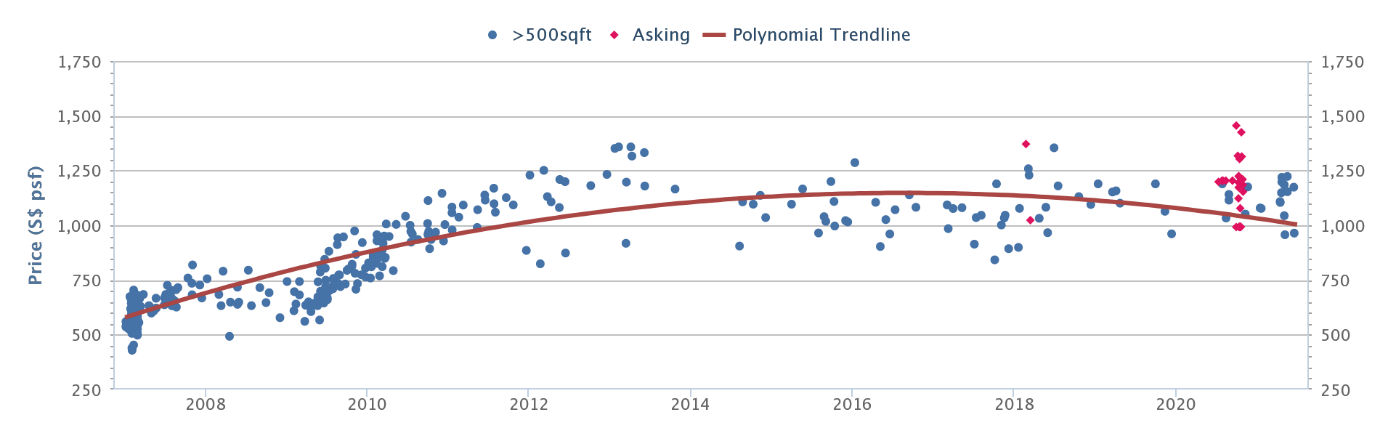

3. Clementi Woods

Location: West Coast Road (District 5)

Developer: FCL Loft Pte. Ltd.

Lease: 99-years

TOP: 2010

Number of units: 240

Top transaction:

| Date | Unit Size | Price PSF | Quantum |

| 18 Jun 2021 | 2,874 sq. ft. | $964 | $2,770,000 |

Recent prices indicates a price range of $957 to $1,223 psf, with an average of $1,117 psf. There have been 211 profitable transactions and six unprofitable transactions.

Key reasons why resale condos are likely to continue their momentum:

- The wide price gap between new and resale condos in 2021

- More buyers prefer larger homes

- Construction delays from Covid-19

- An en-bloc surge could push resale prices even higher

1. The wide price gap between new and resale condos in 2021

As of end-June 2021, Square Foot Research showed the average price of a resale condo was $1,355 psf. At the same time, new launch condos average $1,923 psf. This is a price gap of about 34.6 per cent.

In June 2020, however, the average price of a resale condo was $1,421 psf, whereas the average price of a new launch condo was $1,699; a price gap of just around 17.8 per cent.

While this isn’t the best method to judge by (it’s very dependent on the price points of the new projects launched that month), it does still go some way to illustrate the gap.

Note that the discrepancy is partly due to the large number of low quantum, high-price-per-square foot units; such as small units in projects like The M and Irwell Residences. Regardless, the large price gap may be unpalatable to buyers; and the benefits of a smaller quantum are mitigated by the next key issue:

2. More buyers prefer larger homes

| Size of property | 2020Q2 | 2020Q3 | 2020Q4 | 2021Q1 |

| 90 to under 100 sqm | 11.27% | 11.10% | 8.64% | 10.54% |

| 100 to under 120 sqm | 13.01% | 16.61% | 18.34% | 17.29% |

At present, the largest buyer demographic consists of HDB upgraders. Their presence has been especially felt in the OCR, so we’re not surprised that it’s OCR resale condos that have also seen the biggest price gains.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

ComfortDelGro has submitted the top bid of $38 million to develop a new multi-storey driving centre on Lorong Bistari in…

For HDB upgraders, there’s a strong preference for larger homes; and this is where resale condos shine. As you can see from the linked article, older resale condos – such as those from the 1990’s – even have two-bedders that go past 1,000 sq. ft.

Unfortunately for developers, this may work against recent new launch offerings. As we mentioned in point 1, a lot of recent condos have traded space for better amenities, or a more central location; a trade-off that the dominant group of buyers seems unwilling to accept.

As such, most of the new launches won’t be able to do much to tempt buyers away from the resale market.

Property Picks7 Affordable 4-Bedroom Condos For $1.1 Million Or Cheaper (For Bigger Families)

by Ryan J. Ong3. Construction delays from Covid-19

Condos under development, just like BTO flats, come with a higher risk of delays right now. A labour crunch, along with supply difficulties, means buyers may end up with an additional wait of six months or more for their condo.

This is a major issue for HDB upgraders, who are transitioning between their flat and the new condo. Construction delays mean higher (temporary) accommodation costs, and these families will prefer something they can move into right away.

This is undoubtedly the biggest reason for the push in resale prices. People want a bigger home, and they are willing to pay to move in quicker.

4. An en-bloc surge could push resale prices even higher

Many developers have depleted their land banks, and Government Land Sales (GLS) sites have put out a relatively small supply (there’s only space for around 2,000 new homes on the confirmed list).

This could pressure developers into collective sale deals, and a repeat of the en-bloc fever in 2017. As before, this is likely to push up resale condo prices; or at least prevent them from falling back to pre-pandemic levels in 2018.

However, any en-bloc surge is likely to be more modest than in 2017, given the economic uncertainty – and construction difficulties – following Covid-19.

Is there any chance of resale condo prices falling this year?

Realtors raised only two possibilities when we asked; and both were purely speculative.

The first is the possible impact of new cooling measures or loan curbs. Even though MAS has clarified they don’t feel the current property market is overheated, cooling measures are not entirely off the cards. New cooling measures almost always see home prices fall, at least as a momentary, knee-jerk reaction.

However, this will be a double-edged sword for resale condo buyers as well. While it may cause prices to fall, increased stamp duties or tighter loan curbs could more than makeup for any potential savings.

The second possibility is a further weakening of the rental market, also in light of Covid-19. If landlords feel that foreign tenants are not returning, this could push some of them into liquidating their rental assets. This will increase the supply of resale condos and potentially slow the rising prices.

However, realtors noted that such a phenomenon will mainly affect high-quantum, prime region condos. OCR condos are usually owner-occupied, so this may not help upgraders or first-time buyers (these groups almost always buy OCR condos).

This puts upgraders and first-time buyers in a rough spot

Setting aside new launch condos (where prices are even higher), the outlook is rough for buyers. Prices are high right now; but if they’re already 6.8 per cent from the start of the year, it’s frightening to think how much higher they’ll be by end-2021.

At this point, buyers might either consider resale flats*, or waiting out this crazy year. Sellers hold all the cards right now. Whatever your decision, stick to the basic guidelines: watch if monthly costs exceed 30 per cent of your monthly income.

It’s better to be prudent and have to wait for another year (or three), than to get in over your head.

*Prices also at an eight-year high

For more in-depth looks at these properties and news on trends in the Singapore private property market, follow us on Stacked. We provide reviews of new and resale condos alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will resale condo prices continue to rise in 2021?

What are the main reasons resale condo prices are expected to stay strong?

Could resale condo prices fall this year due to market changes?

Why are HDB upgraders driving demand for resale condos?

How might construction delays from Covid-19 affect the resale condo market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments