Can Every HDB Flat Be A Valuable Nest Egg For Retirement? Not Everyone Agrees. Here’s Why.

March 27, 2023

We’ve heard some angry arguments bounding around lately, both for and against HDB flats as retirement assets. The root of this seems to be a recent incident when it was claimed that “Every HDB flat will be a valuable nest egg for retirement”. It set off a Reddit thread as well, with various people arguing why this seems increasingly unlikely (and some true believers who still hold on to it):

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Will your HDB flat provide for your retirement?

Redditor Pyrrylanion doesn’t agree, posting that:

“I think the idea of housing being a retirement asset and a long-term store of wealth is not feasible.

Retirement age today is 63 years. Let’s assume that the ordinary family BTO-ing for a flat gets it at 33 years old. If public housing is a store of wealth for retirement, it needs to hold it for over 30 years.

According to MAS’s inflation calculator, the compound average annual rate of inflation is 1.65% over the last 30 years.

If this rate holds through in the next 30 years, for a BTO to hold its value, it needs to appreciate by 63%. Sounds simple, right? As long as it keeps pace with inflation all is good, right?

No. Because public housing is held under a 99-year lease, the value of each flat will decline over that 30 years.

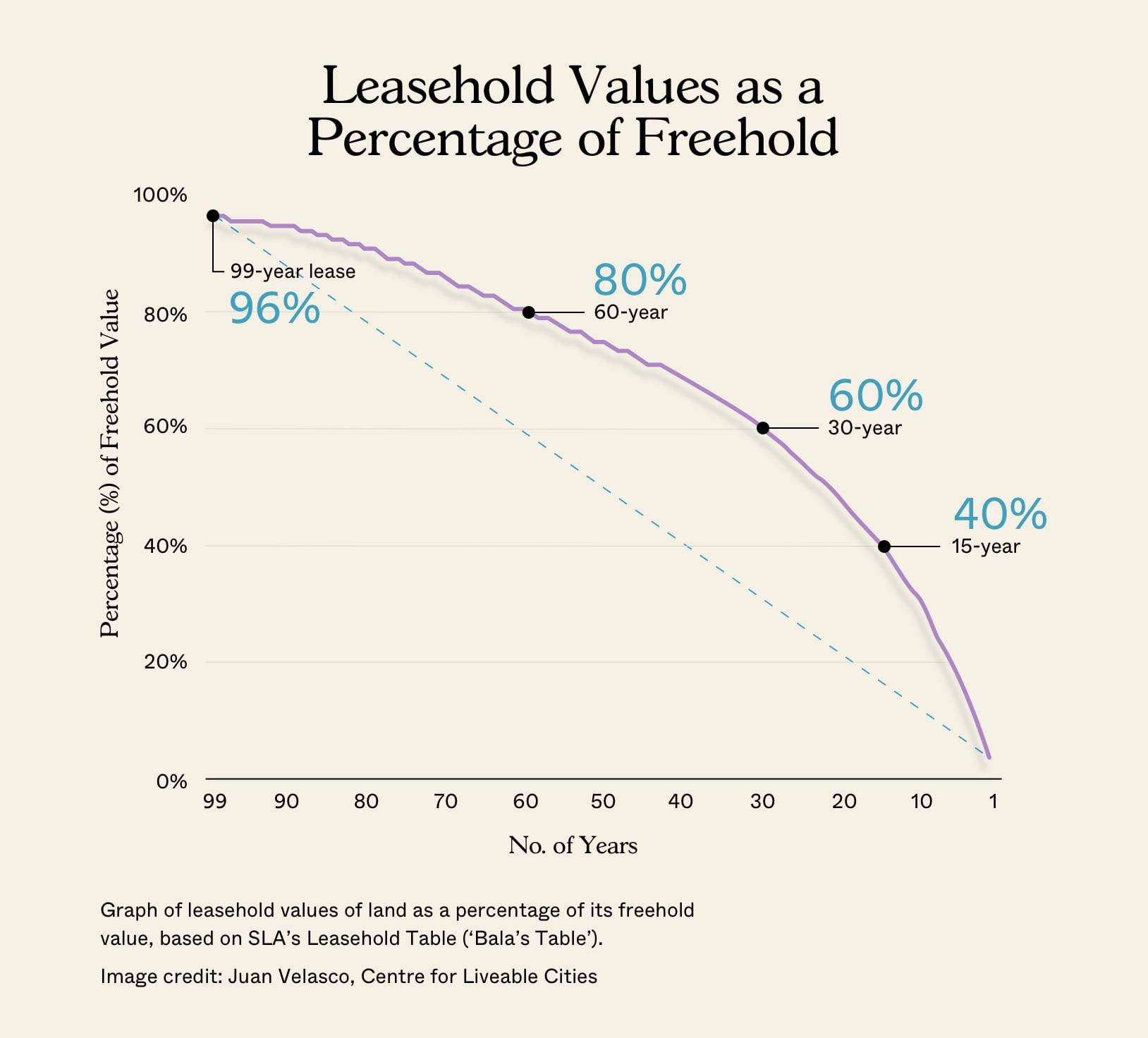

Using Bala’s curve/table, which estimates the value of a leasehold as a percentage of the value of a freehold, a leasehold with 69 years of lease left (30 years into the lease) retains about 85.4% of its value.”

Bala’s Curve, by the way, is a formula used to estimate the value of leasehold land, as a percentage of an equivalent freehold counterpart. It’s been in use since the British colonial administration, and we cover it in greater detail in this article.

But as Redditor Tinyredleaf points out:

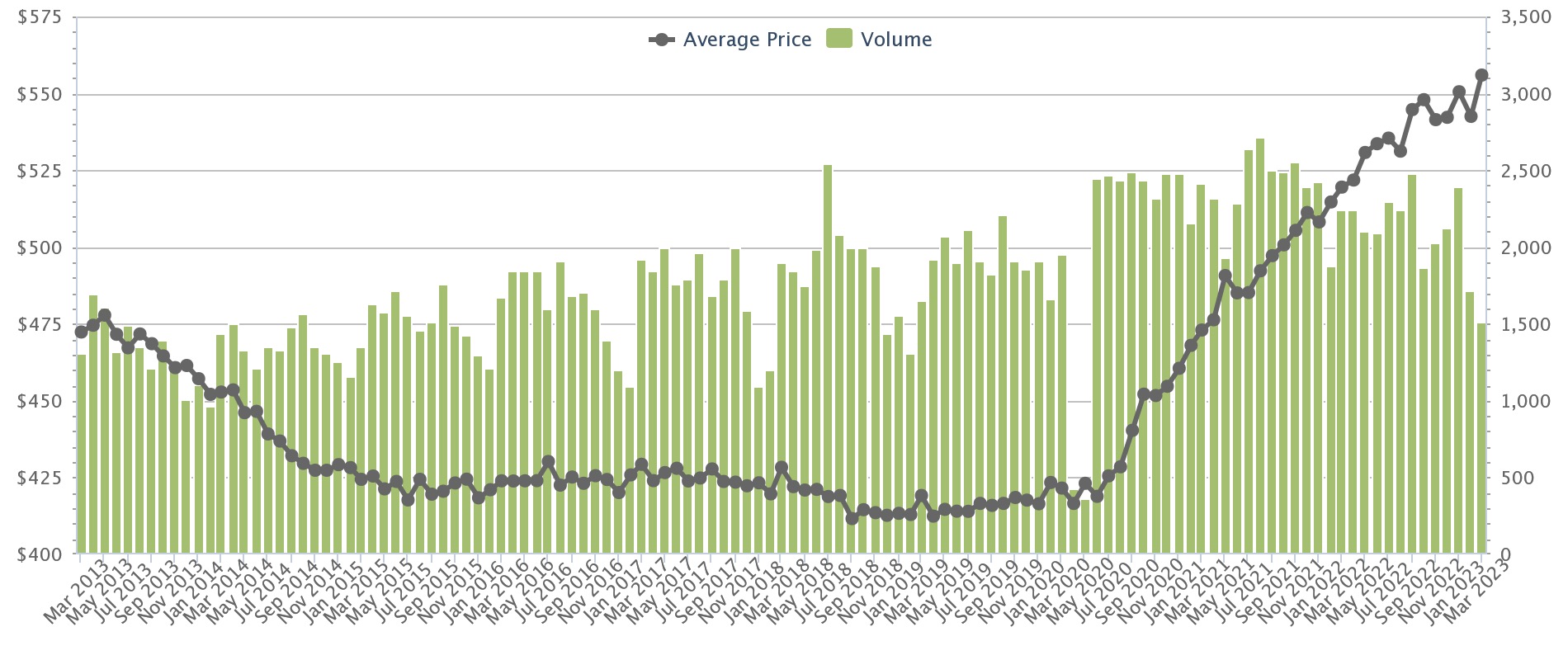

“Just look at the HDB Resale Price Index. Prices for HDB resale flats have mostly gone up over 30 years from 1990, dipping significantly only during the mid-90s and the early 2010s. In fact, the price of HDB resale flats has gone up by nearly seven times from 1990 (24.3) to 2022 (168.1). The base period was 2009Q1 (ie, index value 100).

People keep forgetting that the resale prices of HDB flats are not determined by the remaining lease value alone. Many other factors come into play, such as location, size of the flat, the physical condition of the flat, market demand (such as the desire to skip the BTO waiting time, or to live near parents), and supply fluctuations (as had been the case in the past three years due to pandemic-imposed labour shortages).

Yes, the value of the flat could eventually fall to absolute zero if the lease runs out, but even that is not a given, because no one knows for now whether the government would simply decide to extend the lease. In short, it’s not a simple linear equation, and it remains very fair to say that, in a 30- to 40-year time span at least, BTO flats are extremely likely to be very good-value assets.”

We have discussed some similar angles before, in this article where we explained why older flats don’t depreciate as fast as many might expect.

Other discussions focused on what it means to keep resale flat values high

As the original poster Kqapple notes:

“‘With your support, we will continue to keep this system running well, and we will deliver on our promise to Singaporeans for many more years to come.

The promise of keeping HDB prices sky high.”

Redditor Tear_Weak seems to feel it’s an old case of kicking the can down the road:

“HDB CANNOT and MUST NOT be a nest egg.

– You can only have one HDB. Once you sell your HDB to cash out, you have to buy another one to live in right? And if you sell high, you have to buy high. What money do you get back?

– When one generation sells their HDB high, they are screwing over the next generation of Singaporeans. The next generation has to sell even higher to the following generation. Your kids WILL GET SCREWED by overpaying for HDB.

– Finally, the generation that gets royally screwed is the one holding the HDB till the end of the 99th year. THEY WILL GET NOTHING BACK.

HDB is a ticking time bomb disguised as a blessing. It is highly irresponsible to perpetuate the lie that it is a “nest egg” when its value will be 0 at some point in the future.”

More from Stacked

Complete Guide To Getting Your Home Loan Approved This Month

So you’ve reset your SingPass, you’ve handed over three months of your payslip, you’ve filled in all the forms after…

This leads to another big question:

Homeownership, or retirement asset?

You can tell that there’s now a growing consensus, that HDB must choose between two mandates:

- Provide affordable housing

- Provide profitable housing

If HDB wants to ensure resale flats are profitable, for example (thus making them good retirement assets), it would involve many moves that are the opposite of what they’ve done.

HDB would need to build fewer flats, for instance, and they wouldn’t have taken actions like implementing the Mortgage Servicing Ratio or removing Cash Over Valuation back in 2013 (both moves that caused resale flat prices to fall for almost seven straight years).

Now this writer himself had assumed – wrongly it seems – that when HDB took its actions in 2013, it was a declaration that home ownership comes first. That is, the eventual resale gains would take a backseat to having more affordable housing.

Perhaps it comes down to how “valuable” is defined

We loathe definition debates, as they tend to break down into pointless semantics. But that’s an inevitable direction here: It boils down to what the government means, exactly, by “valuable.”

Valuable may not entail being able to sell for twice or three times the flat’s initial value. Likewise, there’s no specification on how many dollars make up a good “nest egg.”

A “valuable retirement asset” may just mean that, if you right-size to a 2-room flat, you could add a substantial amount to your retirement funds (semantics again: note that we only said a substantial amount, not that it would guarantee a happy retirement).

Perhaps it means old folks have an opportunity to rent out rooms for income; or use the Lease Buyback Scheme (LBS) to supplement CPF savings; or maybe we’re even counting on VERS to take off.

These possibilities don’t guarantee you’ll reach all your retirement aspirations – but you also can’t argue that they don’t make flats “valuable”.

There could have been some middle ground here. Instead of calling the flats a nest egg for retirement, we might have said the following:

Every flat can supplement your retirement, even with 30 or 40 years gone from the lease.

This claim is more empirically observable (see the link to our article above), without seeming like an over-promise.

Singapore is ultimately an affluent country, accustomed to a high standard of living. When we hear words like “valuable” and “nest egg,” few of us will define those words as, say, renting out a room so we can afford our economy rice this month.

Semantics aside, can HDB flats make you rich and comfortable upon retirement?

Our frank answer: probably not.

Singapore is an ageing country. At some point, the previous generation will pass on, and there will be a lot more HDB flats than there are buyers for them (remember, only Singapore citizens and some Permanent Residents can buy HDB flats; and no one can own more than a single HDB property).

We’re sure HDB will tweak its policies appropriately when the time comes – but there’s no changing the fact that, when it does come, resale flat values are bound to take a hit.

So the question is not whether your flat is valuable, but whether it’s sufficiently valuable to provide the retirement that makes you happy.

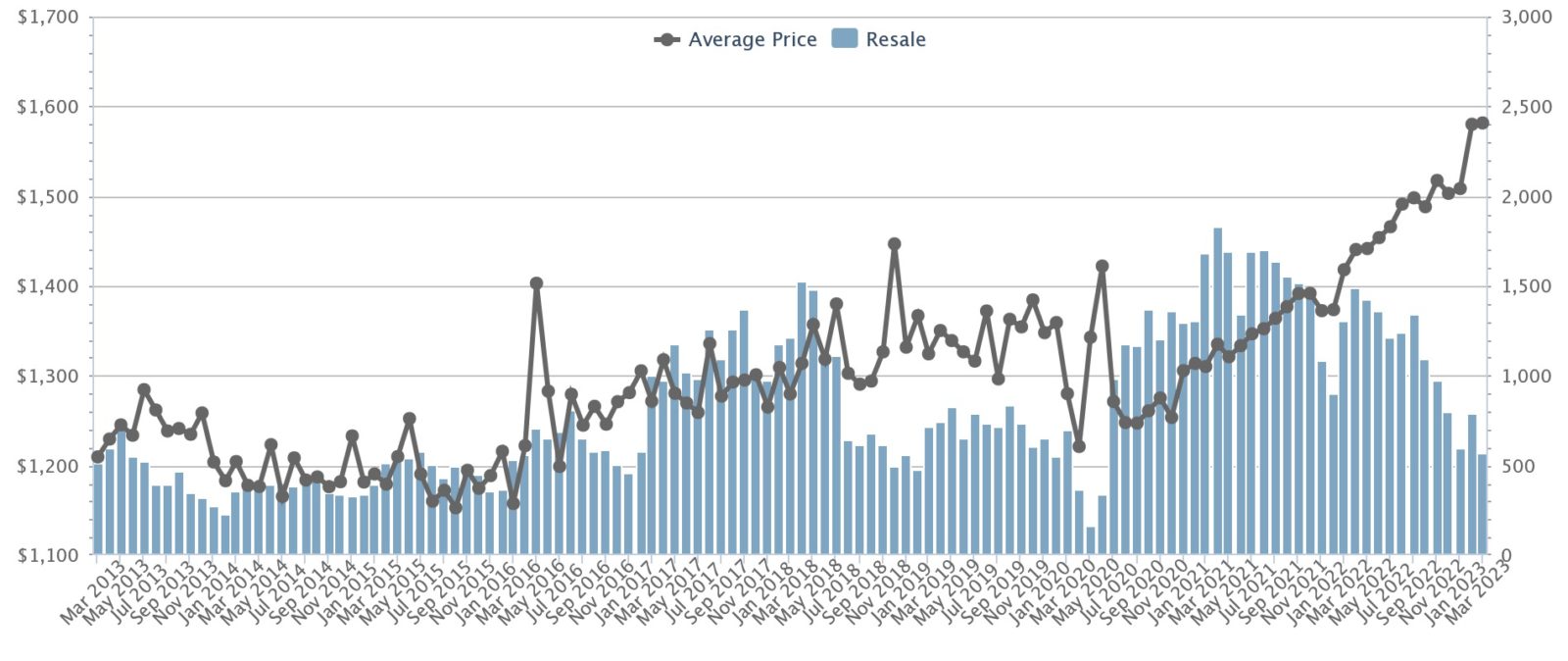

And it’s hard to deny that, for those who have upgraded to private property and can right-size from there, their retirement prospects are looking quite a bit brighter:

In any case, it is quite an odd move to use of overly optimistic word choices, as it seems to spark anger and or just irritation (at least when it comes to hot-button issues like housing, and at a time when home prices are at record highs).

Your flat is valuable, but probably not so valuable that you can ignore having to upgrade or invest elsewhere.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can HDB flats be a reliable way to save for retirement in Singapore?

Why do some people believe HDB flats are not good retirement assets?

How does leasehold property valuation affect the idea of flats as retirement assets?

What factors influence the resale value of HDB flats besides lease remaining?

Is it realistic to expect HDB flats to make you wealthy in retirement?

What should Singaporeans consider about using HDB flats as part of their retirement planning?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

5 Comments

Very well written on that last few paragraphs. Don’t forget that Lawrence Wong had on several occasions reminded Singaporeans to manage their expectations on the value of aging hdb and hdb WILL go to zero at the end of the lease.

Other than SERS and VERS (info’s not out yet on what VERS entails except it’s less generous than SERS), current options to monetise flats for retirement are lease buyback, renting out spare rooms, downgrading to smaller flat, things we won’t consider as ‘valuable nest egg for retirement’. They are at most, supplementary for retirement. PM Lee should stop using such overly optimistic words that sound like overpromises that come back to bite Pap in the ass. It’s irritating Singaporeans who can clearly see hdb for what it is – flats that will go to zero at the end of 99 year lease.

Hello Stacked team, I’ll just like to add that using indices like HDB resale index may be much less relevant for owners of HDB when planning for retirement. These indices tend to be cross sectional average (average of whole market pool, continuously new flat added, and old removed). In fact, a homeowner needs to look at longitudinal study (i.e. single project by project), which like likely be much more grim without any million dollar fresh btos pulling up the average.

Lawrence Wong said your HDB flat after 99 years from built date will be zero 00. How to be a good bird nest? Probably good for one generation. If you buy a resale flat with remaining lease of less than 30 years, then you are in trouble. I bought mine recently with 36 years remaining. Thanks goodness just nice because I’m now 70 years old. So cannot keep for my children. Maybe HDB should consider lease extension at subsidised rate for the elderly. This I would call giving us back the NATIONAL SERVICE. Thank you.

Hello Stacked team, I’ll just like to add that using indices like HDB resale index may be much less relevant for owners of HDB when planning for retirement. These indices tend to be cross sectional average (average of whole market pool, continuously new flat added, and old removed). In fact, a homeowner needs to look at longitudinal study (i.e. single project by project), which will likely be much more grim without any million dollar fresh btos pulling up the average.

You have rightly pointed out the hard truth, that HDB must choose between two mandates:

1) Provide affordable housing

2) Provide profitable housing