August 2021 HDB BTO: Can You Afford A Flat In Queenstown Or Jurong East?

March 3, 2021

August 2021 will be one of the most exciting and contested HDB launches to date, for one reason: two of the HDB towns involved are Queenstown and Jurong East. These are two of the most popular neighbourhoods; and with only a handful (610 + 560 flats) up for grabs, it’s bound to be oversubscribed.

So for both new flat buyers and those seeking resale properties, we’re taking a special look at public housing in these two hot spots:

Upcoming BTO flat offerings for 2021

We’ve done a full review of the BTO launch sites for May 2021 and will do so for August 2021, so do follow us for updates later in the year. In the meantime, however, we’re taking a special look at Queenstown and Jurong East, as these are likely to be the main hotspots for the year.

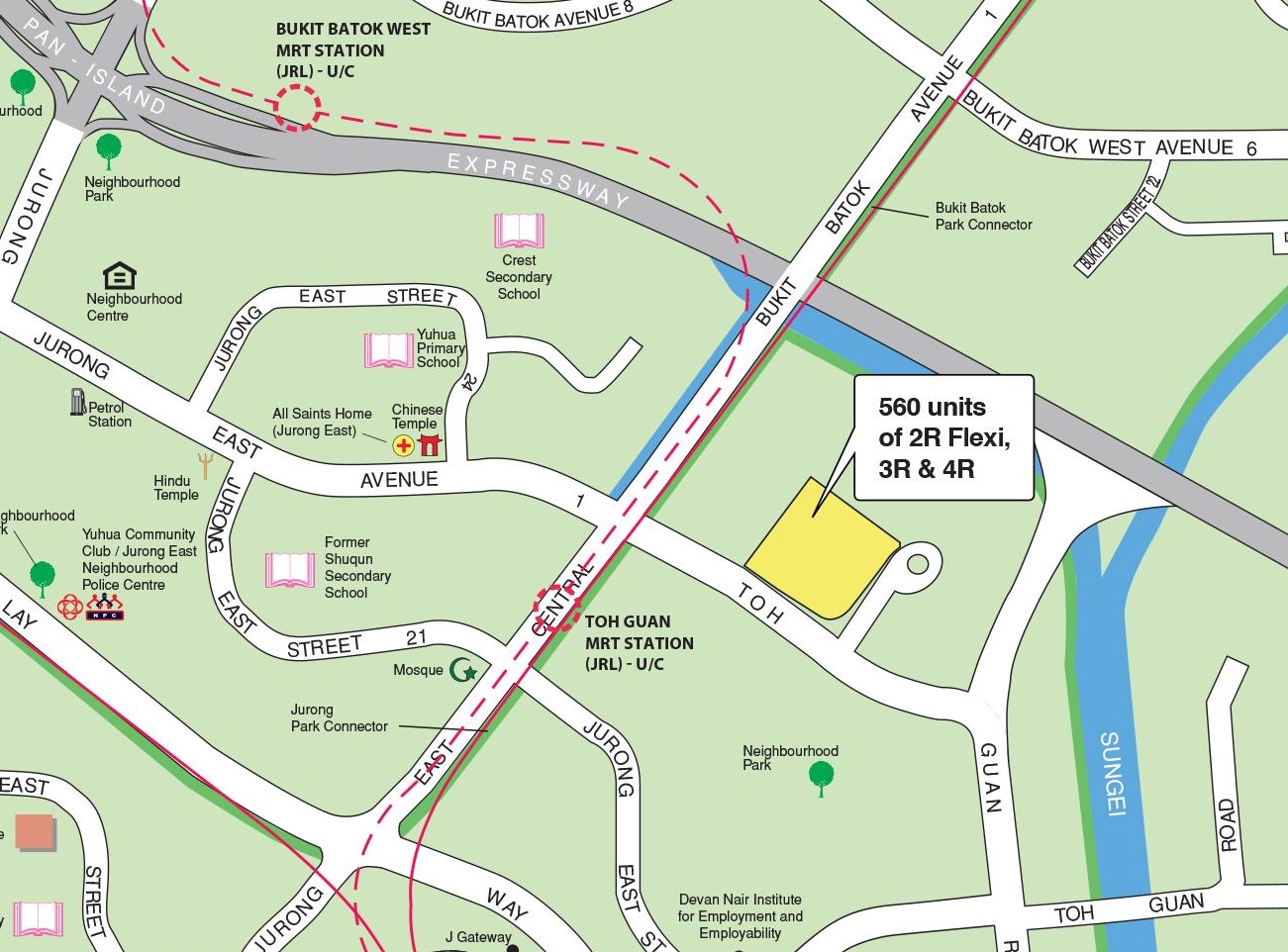

A snapshot of the Jurong East launch:

There are only 560 flats available in the August 2021 launch, consisting of a mix of 2-room, 3-room, and 4-room flats (we will provide a more concise breakdown when it becomes available).

The site is along Toh Guan Road, close to where it intersects with Jurong East Central and Bukit Batok Avenue 1. The key highlight here is the proximity to Toh Guan MRT station, which is just across Toh Guan Road. This station will be on the upcoming Jurong Region Line (JRL), and is just a stop away from the heart of Jurong East.

Unfortunately, Toh Guan station will only be ready in 2028; so even after the flats are built, residents will have to wait for a while to get access. The good news is that even without the train station, the launch site is only around 1.2 kilometres to Jurong East MRT. From there, you’re within walking distance to JCube, JEM, Westgate, IMM, and so forth. That’s not a comfortable walking distance – but it’s okay if you cycle, and probably just around 12 minutes by bus. (We based the bus timing on service 52, from the bus stop before Seventh-Day Adventist Church to before Jurong East Station).

Note that despite its transformation in recent years, Jurong East is still classified as a non-mature town. This is the first time we’ve seen BTO launches in Jurong East since 2011.

We will be taking a more in-depth view of this site, along with the other upcoming launch sites, as further information becomes available; do follow us for updates.

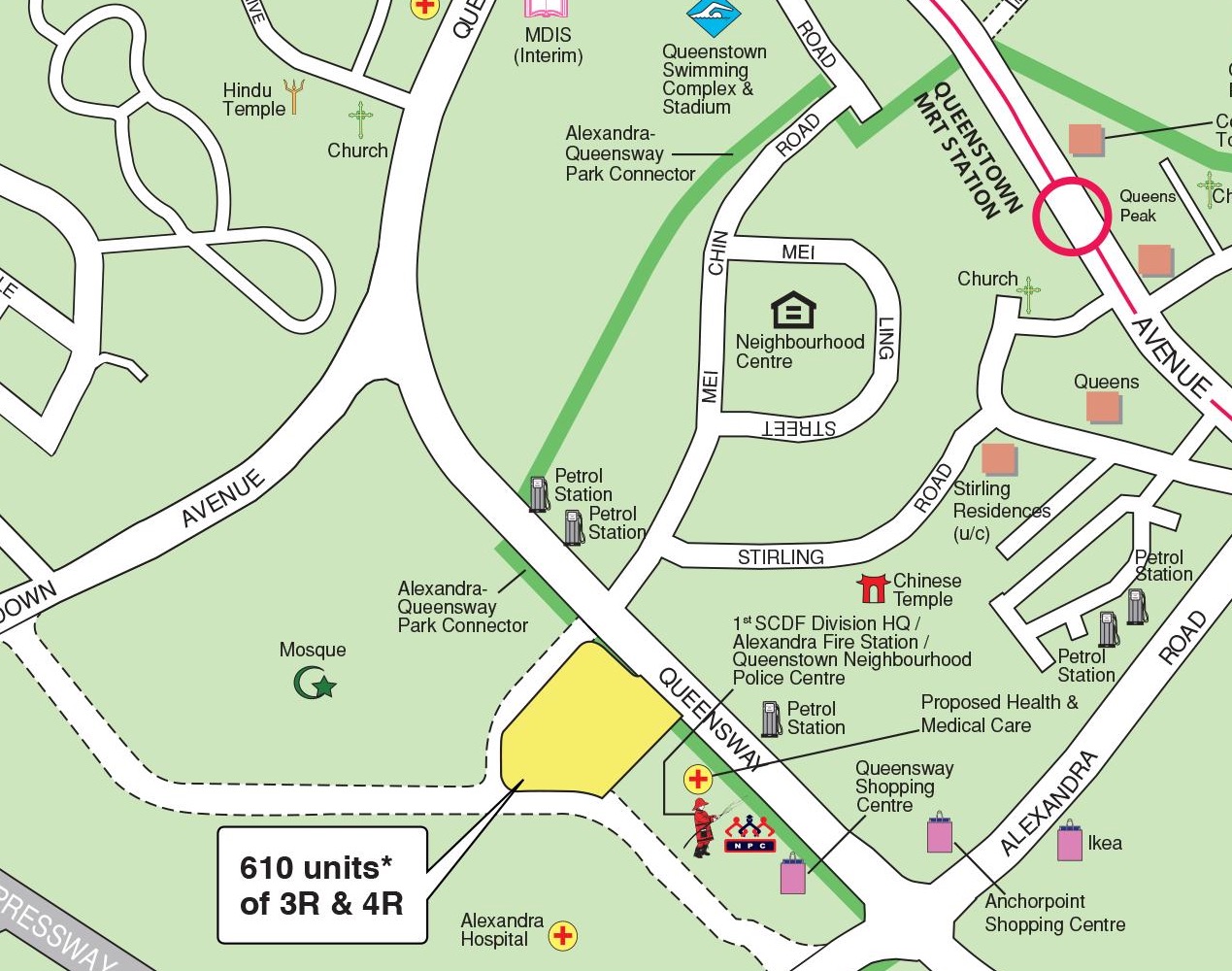

A snapshot of the Queenstown launch site:

The Queenstown site has 610 flats available, but the mix is more limited; there are only 3-room and 4-room units. This site is across the road from Queensway Shopping Centre, and it’s within one kilometre to the famous Mei Ling Street (Mei Ling Street accounts for a disproportionate number of million-dollar resale flats).

The site is also within walking distance to IKEA Alexandra and Alexandra Mall; a rough estimate of the distance is around 330 metres.

Unfortunately, this site is not close to the MRT station; Queenstown MRT is the closest and it’s just over 1.2 kilometres away. However, we’re sure most buyers will feel the proximity to IKEA, Queensway, and other such amenities more than compensate for it.

How much are the flats here likely to cost?

As the last BTO launches in these areas were almost a decade ago, they don’t provide a good indicator of likely flat prices. Nonetheless, these were the new launch prices from the last exercises:

Jurong East (Teban View)

September 2011 launch

| Flat size | Price Excluding Grants | Price with Grants | Resale counterparts in Sept. 2011 |

| 3-room | From $219,000 | From $158,000 | $324,188 (38.7% higher) |

| 4-room | From $361,000 | From $271,000 | $421,899 (15.1% higher) |

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The River Vista @ Kallang Review: Great Riverfront Views But Lack Of Immediate Surrounding Amenities

When you think of waterfront HDBs, newer estates like Punggol and Sengkang may come to mind. With so many built…

Queenstown (Ghim Moh Edge)

November 2012 BTO Launch

| Flat size | Price Excluding Grants | Price with Grants | Resale counterparts in Nov. 2012 |

| Studio | From $113,000 | N/A | N/A |

| 3-room | From $310,000 | From $280,000 | $424,728 (31% higher) |

| 4-room | From $450,000 | From $435,000 | $671,765 (39.5% higher) |

Given the time that’s passed, the flat prices today will be higher. For the sake of today’s buyers, as well as those who may need to get a resale flat (these flats are bound to be over-subscribed), here are the current resale flat prices:

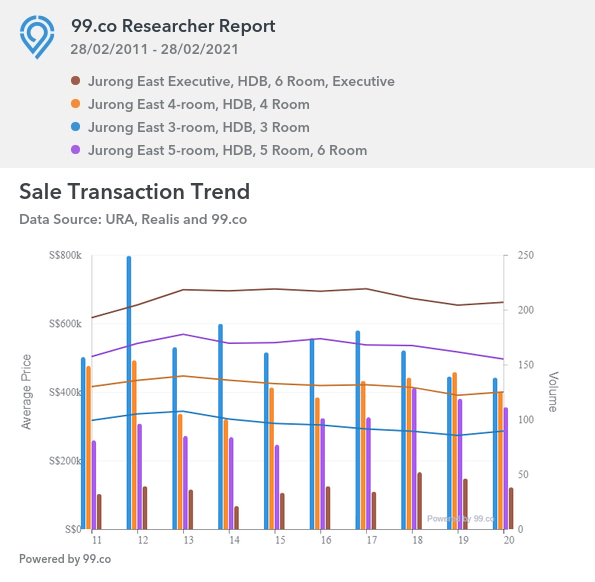

Jurong East resale flat prices

Flat Size | Average. Price PSF | Average Price |

| 3-room | $379 | $286,045 |

| 4-room | $391 | $400,152 |

| 5-room | $380 | $495,952 |

| Executive | $421 | $661,474 |

How much do you need to pay at resale prices?

The following is based on a full HDB loan, at 2.6 per cent interest and a 25-year loan tenure. Grants have not been included:

| Minimum down payment (Can be in cash or CPF) | Buyers Stamp Duty | Est. monthly loan repayment | |

| 3-room | $28,604.50 | $3,921 | $1,167.93 |

| 4-room | $40,015.20 | $6,605 | $1,633.83 |

| 5-room | $49,595.20 | $9,479 | $2,024.98 |

| Executive | $66,147.40 | $14,444 | $2,700.82 |

The following is based on a full bank loan, at the current average rate of 1.3 per cent per annum, for 25 years:

| Minimum cash down payment | Rest of down payment (in cash or CPF) | Buyers Stamp Duty | Est. monthly loan repayment | |

| 3-room | $14,302.25 | $57,209 | $3,921 | $838 |

| 4-room | $20,007.60 | $80,030.40 | $6,605 | $1,172 |

| 5-room | $24,797.60 | $99,190.40 | $9,479 | $1,453 |

| Executive | $33,073.70 | $132,294.80 | $14,444 | $1,938 |

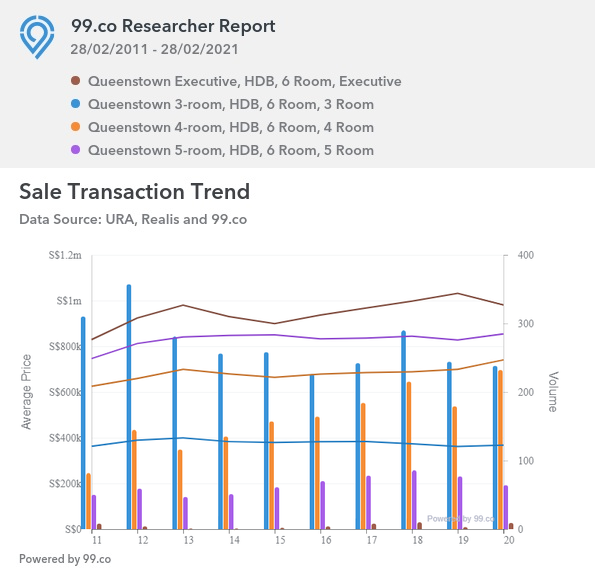

Queenstown resale flat prices

Flat Size | Average. Price PSF | Average Price |

| 3-room | $525 | $367,132 |

| 4-room | $771 | $740,449 |

| 5-room | $685 | $854,396 |

| Executive | $613 | $981,000 |

Property Market CommentaryNeighbourhood Of The Week: Queenstown (District 3)

by Ryan J. OngHow much do you need to pay?

The following is based on a full HDB loan, at 2.6 per cent interest and a 25-year loan tenure. Grants have not been included:

| Minimum down payment (Can be in cash or CPF) | Buyers Stamp Duty | Est. monthly loan repayment | |

| 3-room | $36,713.2 | $5,614 | $1,499 |

| 4-room | $74,044.90 | $16,813 | $3,023 |

| 5-room | $85,439.60 | $20,232 | $3,488.50 |

| Executive | $98,100 | $24,030 | $4,005 |

The following is based on a full bank loan, at the current average rate of 1.3 per cent per annum, for 25 years:

| Minimum cash down payment | Rest of down payment (in cash or CPF) | Buyers Stamp Duty | Est. monthly loan repayment | |

| 3-room | $18,356.6 | $73,426.40 | $5,614 | $1,075 |

| 4-room | $37,022.45 | $148,089.80 | $16,813 | $2,169 |

| 5-room | $42,719.80 | $170,879.20 | $20,232 | $2,503 |

| Executive | $49,050 | $196,200 | $24,030 | $2,874 |

Bear in mind that reported prices don’t factor in Cash Over Valuation (COV)

We have more on this in a previous article. In desirable locations like Queenstown and Jurong East, there’s a greater probability that you’ll have to pay COV. This is any amount which exceeds HDB’s accepted valuation of the flat. As it’s not covered by either a bank or HDB loan, it has to be paid in cash.

For example, if your seller’s price is $770,000 for a 4-room flat in Queenstown, but the official valuation is $745,000, then you would have to cover the excess of $25,000 in cash.

This is not applicable to BTO flats, only to resale flats.

Whether new or resale, the general rule when purchasing your flat is “5-3-3”

This means the total cost of the flat ideally should not exceed five times your combined annual income. Remember, this is not enforced, it’s just a very conservative guideline.

More importantly, the monthly loan repayment cannot exceed 30 per cent of your combined monthly income. This is enforced under the Mortgage Servicing Ratio (MSR). If your monthly loan repayment would exceed 30 per cent of your combined monthly income, you must either make a bigger down payment or extend the loan tenure (if possible). Failing that, you need to pick a cheaper property.

Finally, you should have sufficient capital to cover 30 per cent of the property cost. In general, we suggest having at least six months of the mortgage saved up; this allows you to service the loan in the event of lost or diminished income.

For further updates on the BTO launch locations and prices, follow us on Stacked. We’ll bring you more in the coming week.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can I afford a flat in Queenstown or Jurong East during the August 2021 BTO launch?

What are the main factors to consider when buying a flat in Queenstown or Jurong East?

How much do I need for the down payment if I buy a resale flat in Queenstown or Jurong East?

What is Cash Over Valuation (COV), and do I need to pay it in Queenstown or Jurong East?

What are the loan options and monthly payments for buying a resale flat in these areas?

Are there any restrictions or guidelines I should follow when purchasing a flat in these locations?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from BTO Reviews

BTO Reviews February 2026 BTO Launch Review: Ultimate Guide To Choosing The Best Unit

BTO Reviews October 2025 BTO Launch Review: Ultimate Guide To Choosing The Best Unit

BTO Reviews July 2025 BTO Launch Review: Ultimate Guide To Choosing The Best Unit

BTO Reviews We Review The July 2025 BTO Launch Sites (Bukit Merah, Bukit Panjang, Clementi, Sembawang, Tampines, Toa Payoh, Woodlands)

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

2 Comments

Why do you keep plugging Jurong property? The three worst places to buy in singapore are: Yishun, woodlands, and jurong. Okay, make it fourth la. Yishun, Woodlands, Sembawang and Jurong. But some consider Sembawang same as Woodlands. Or Yishun. Whatever it is, I suggest, don’t buy Jurong. The chocolate burning smell is a turn-off , for one.