I think now we can be sure the rejected bid for Marina Gardens Crescent wasn’t an isolated event.

I’m talking about the one lonely bid that was made for a prime central site, which got turned down for being too low. And to reinforce that it wasn’t a fluke, we’re now seeing the same weak bids in River Valley and Upper Thomson.

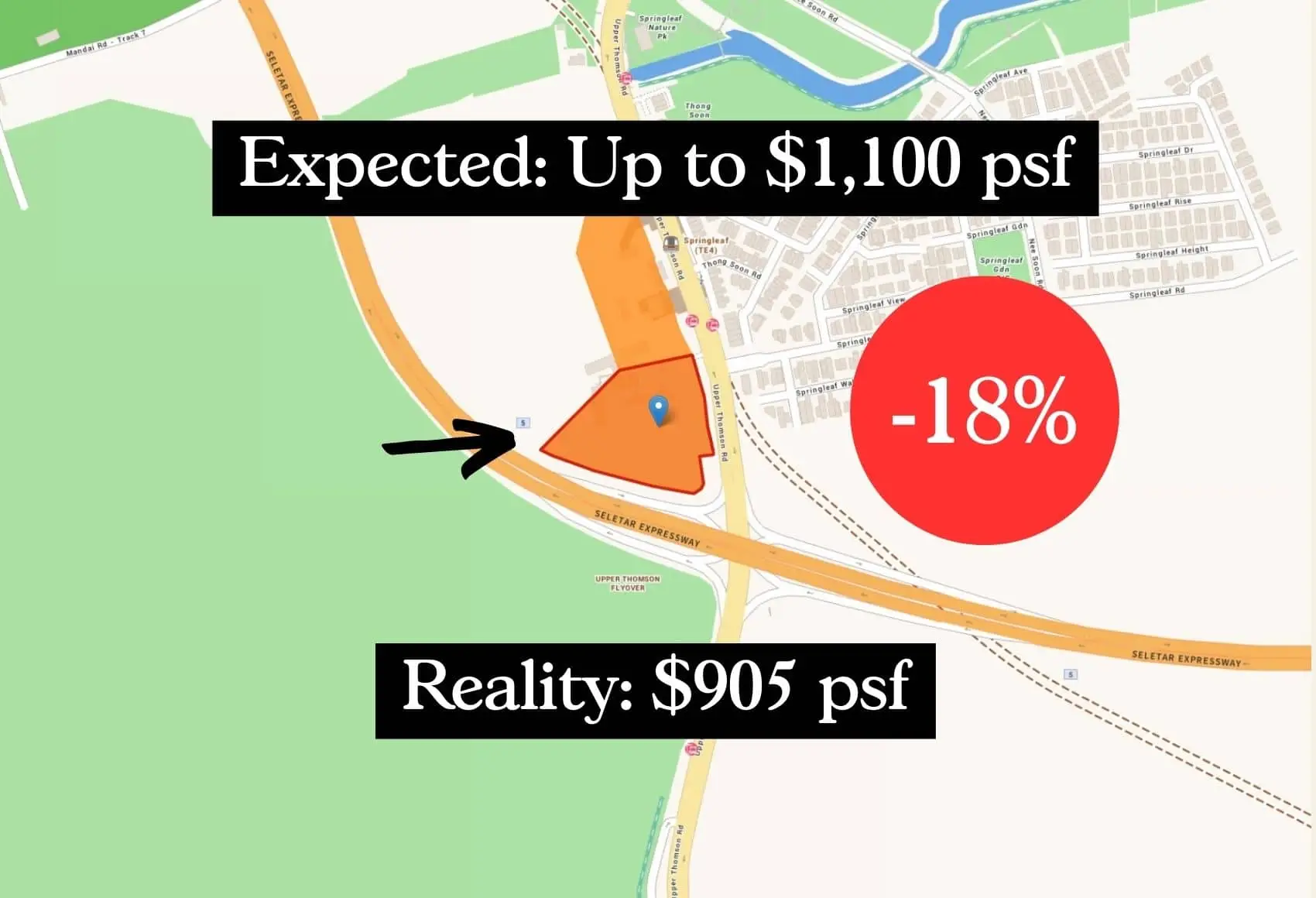

GuocoLand and Hong Leong were the only bidders for a land parcel near Springleaf MRT station, along Upper Thomson Road, for a bid price of $779.6 million (approx. $904.60 psf). This was way below projections of around $1,000 to $1,100 psf. I do wonder if the sales numbers of condos like Lentoria (19 per cent sold at launch) might have played a part here, in addition to growing developer worries. This was altogether unsurprising, given that GuocoLand already has such a major stranglehold in the area.

Meanwhile, CDL and Mitsui Fudosan were also the sole bidders for a land parcel along Zion Road for $1.1 billion (this is a very big site, which can yield around 1,000 residential units). That works out to roughly $1,202 psf, also below the projected $1,300 to $1,700 psf.

Coupled with the low number of bids, we can see a general trend of developers shrinking back – particularly from high-profile areas like River Valley and Marina Bay. The most obvious factor would be recent cooling measures, which raised ABSD to 60 per cent for foreigners; prime region properties are much more dependent on this buyer demographic compared to the OCR.

There are other factors besides that of course; issues range from higher construction costs (we’ve been the fourth most expensive country for construction since last year), financing issues stemming from a higher interest rate environment, and wider global issues. But the CCR is arguably the worst hit, when you add the cooling measures on top of these.

There are also other upcoming land parcels that are more palatable in terms of size at River Valley Green, and the new GFA harmonisation rules (read here for more) may also have been factors for the lower bids.

The weak demand here seems strange too, when you consider that in 2017, the Jiak Kim Street GLS site (now Riviere) was hotly contested with 9 bidders and at a high of $1,733 psf ppr. Perhaps the not-very-great performance of Riviere was something of a deterrent – the developers had to resort to price discounts in 2020 and the final average price of $2,819 psf was surely not one they had in mind when they first bought the site. After all, the initial prices at launch were close to $3,000 psf.

All of which leads me to wonder: why release these land parcels now?

I’m sure the Government has a good reason for it; but putting up land parcels in areas like River Valley probably aren’t going to draw very high bids. It seems a bit of a waste, at a time when developers show so little interest. And it’s not as if it provides a shot at cheaper homes (even at lower land prices, there’s nothing in these prime districts that the average Singaporean is likely to even consider buying).

More from Stacked

5 Key Consequences Of Rising Mortgage Rates In 2022

The median interest rate for home loans is set to double in as little as six months, and it would…

It’s also unfortunate, as it comes just at the time when prime areas like Orchard are trying to reinvent(?) renew(?) themselves.

We’re going for more balanced neighbourhoods these days, with a mix of event spaces, play spaces, etc. rather than outmoded concepts like “Orchard is just for shopping” and “City Hall is just for bank offices.” And I think it’s the CCR that has been slowest to progress in this “rebalancing,” in contrast to its OCR counterparts like Jurong, or RCR equivalents like Beach Road and Paya Lebar.

If developers were putting more new mixed-use projects (and Marina was a white site, see what that means here), that could help to accelerate the transformation of the area. Certainly, River Valley could do with more character than “that place with rich people’s houses.”

Perhaps given the nature of CCR properties, which tend to have a high quantum and are slower to move, we should maybe consider other concessions to developers: perhaps not cheaper land prices, but a longer deadline compared to the usual five-year ABSD time limit. This will provide more lead time to find local buyers, and perhaps bring back developer interest via the lower risks involved. Just for the CCR though.

Meanwhile in other property news…

- Is it always a good idea to pay more for a good view? The owner-occupiers are already hand waving this and going “meh,” but consider the perspective if you have investment goals.

- Wow, the only thing higher than that loft ceiling must be the maintenance costs. But not always, if you’re smart with a double-volume unit like this one.

- New condos with big price discounts: check out the comparison between these two, for an insight.

- Has it been a while since you’ve bought a property? Here are some changes you can expect to see in development styles.

Weekly Sales Roundup (25 March – 31 March)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KLIMT CAIRNHILL | $5,480,000 | 1432 | $3,828 | FH |

| WATTEN HOUSE | $4,996,000 | 1539 | $3,246 | FH |

| MIDTOWN MODERN | $4,808,000 | 1808 | $2,659 | 99 yrs (2019) |

| GRAND DUNMAN | $3,712,000 | 1432 | $2,593 | 99 yrs |

| PINETREE HILL | $3,690,000 | 1464 | $2,521 | 99 yrs |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NORTH GAIA | $1,183,000 | 969 | $1,221 | 99 yrs (2021) |

| THE LAKEGARDEN RESIDENCES | $1,188,600 | 527 | $2,254 | 99 yrs |

| THE ARDEN | $1,239,000 | 657 | $1,887 | 99 yrs |

| HILLHAVEN | $1,381,420 | 678 | $2,037 | 99 yrs (2023) |

| LUMINA GRAND | $1,390,000 | 936 | $1,484 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| AALTO | $4,900,000 | 1959 | $2,501 | FH |

| PANDAN VALLEY | $4,625,000 | 4381 | $1,056 | FH |

| CUSCADEN RESERVE | $3,709,000 | 1163 | $3,191 | 99 yrs (2018) |

| DUCHESS CREST | $3,660,000 | 2088 | $1,753 | 99 yrs (1995) |

| ONE DRAYCOTT | $3,400,000 | 1346 | $2,527 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES AT ORCHARD | $2,035,000 | 1378 | $1,477 | 99 yrs (2007) |

| EON SHENTON | $1,838,000 | 753 | $2,439 | 99 yrs (2011) |

| 76 SHENTON | $1,820,000 | 969 | $1,879 | 99 yrs (2007) |

| V ON SHENTON | $948,000 | 474 | $2,002 | 99 yrs (2011) |

| ROBIN RESIDENCES | $979,000 | 409 | $2,393 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PANDAN VALLEY | $4,625,000 | 4381 | $1,056 | $2,325,000 | 15 Years |

| THE TRUMPS | $2,428,000 | 1432 | $1,696 | $1,632,733 | 17 Years |

| COTE D’AZUR | $2,550,000 | 1270 | $2,008 | $1,600,000 | 17 Years |

| DUCHESS CREST | $3,660,000 | 2088 | $1,753 | $1,551,120 | 14 Years |

| AALTO | $4,900,000 | 1959 | $2,501 | $1,471,700 | 13 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SUITES AT ORCHARD | $2,035,000 | 1378 | $1,477 | -$505,000 | 12 Years |

| EON SHENTON | $1,838,000 | 753 | $2,439 | -$142,000 | 11 Years |

| 76 SHENTON | $1,820,000 | 969 | $1,879 | -$95,200 | 14 Years |

| V ON SHENTON | $948,000 | 474 | $2,002 | -$85,000 | 12 Years |

| ROBIN RESIDENCES | $979,000 | 409 | $2,393 | -$39,000 | 8 Years |

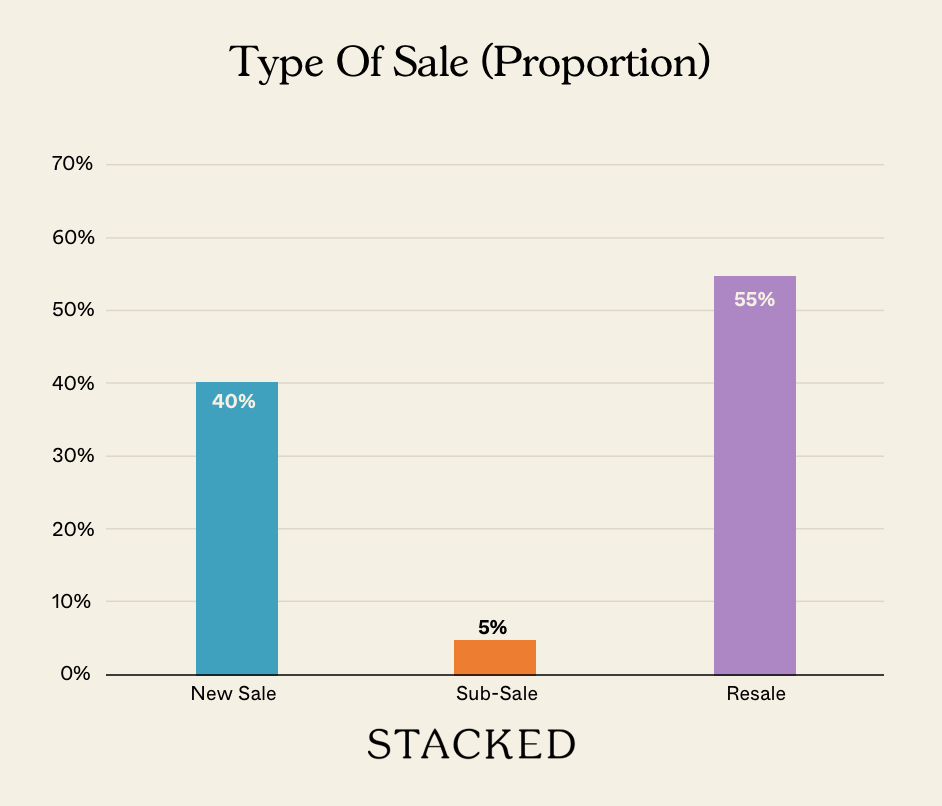

Transaction Breakdown

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are new launch condos likely to become cheaper soon?

Why are developers bidding less for land in prime districts like River Valley and Marina Bay?

Does the current land bidding trend mean new condos in prime areas will be more affordable?

What factors are affecting the demand for new condos in high-profile areas?

Are there any suggestions for encouraging developer interest in prime district land parcels?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

1 Comments

So does this Mean Cheaper New Launch Condos Soon?