Analysing Unprofitable Condos: 6 Reasons Why The Lanai Has Performed Poorly (District 23)

June 3, 2022

With the last unprofitable condo analysis being done in the East (Urban Vista, for those wondering), this time I’ve decided to look to the West for another on our list of 13 unprofitable condos.

I know it has taken some time (I’ve only finished The Tennery and Stellar RV so far), but bear with me! 4 down and just 9 more to go.

Updated 07 June 2022

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The Lanai Background Information

Here’s some background information to know:

Location: Hillview Avenue

Developer: Far East Organization

Lease: 999-years from 1885

Completion: 2014

Number of units: 214 units

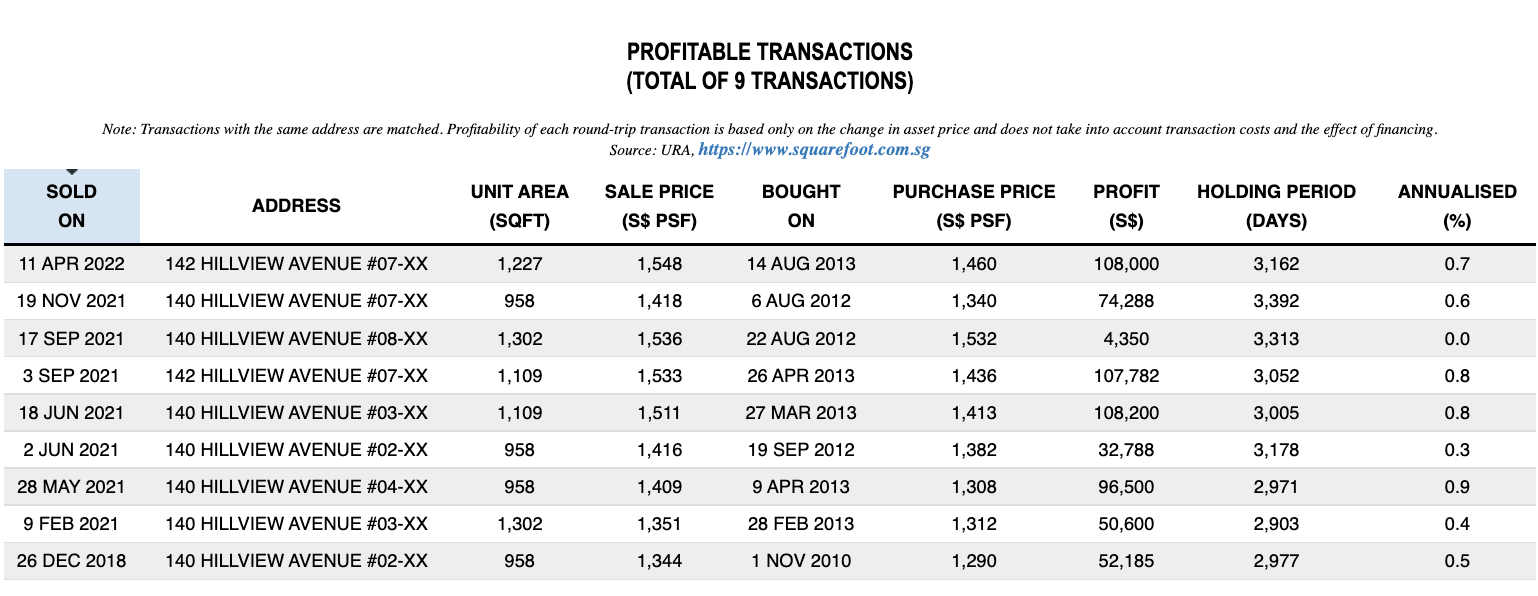

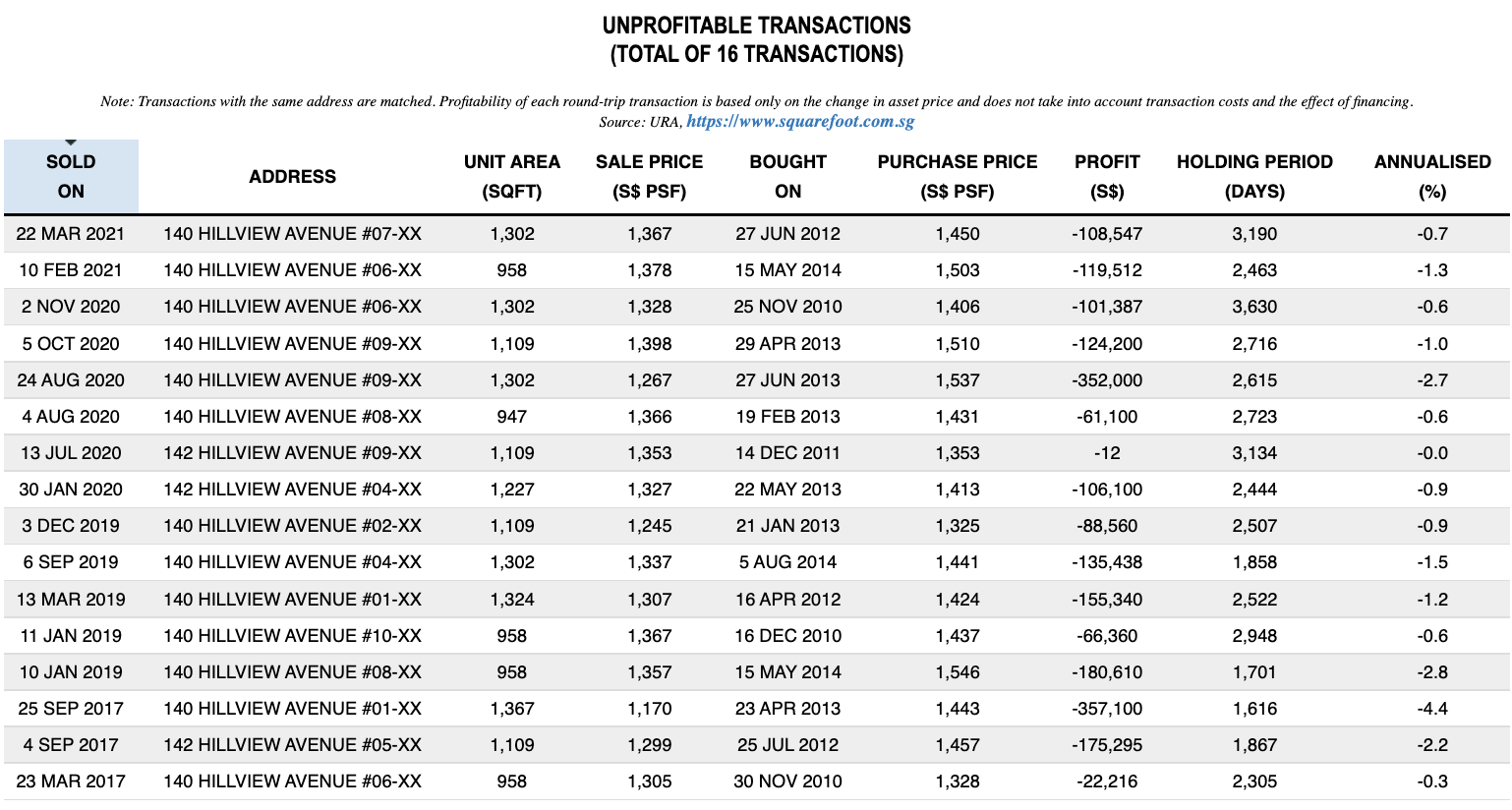

Profitable transactions: 9

Unprofitable transactions: 16

The average profit so far has been $70,521, while the average loss is nearly double at $134,611.

Like the other unprofitable condos that you’ve seen so far, it is much of the same story here. Aside from the 3 transactions that have recorded just slightly over $100,000 of paper profits, the rest (well, one was at $96k) would probably only register a slight gain if not a loss if you were to account for the usual transaction costs (lawyer fees, agent fees, and interest cost).

In fact, it was only due to the recent rise in prices over 2021/22 that The Lanai has recorded 8 profitable transactions out of the 9. If you see the table, these 8 transactions only came in, in early 2021. Likewise, the last time we wrote the unprofitable piece in early 2021 as well, The Lanai only had 1 profitable transaction as compared to 14 unprofitable ones!

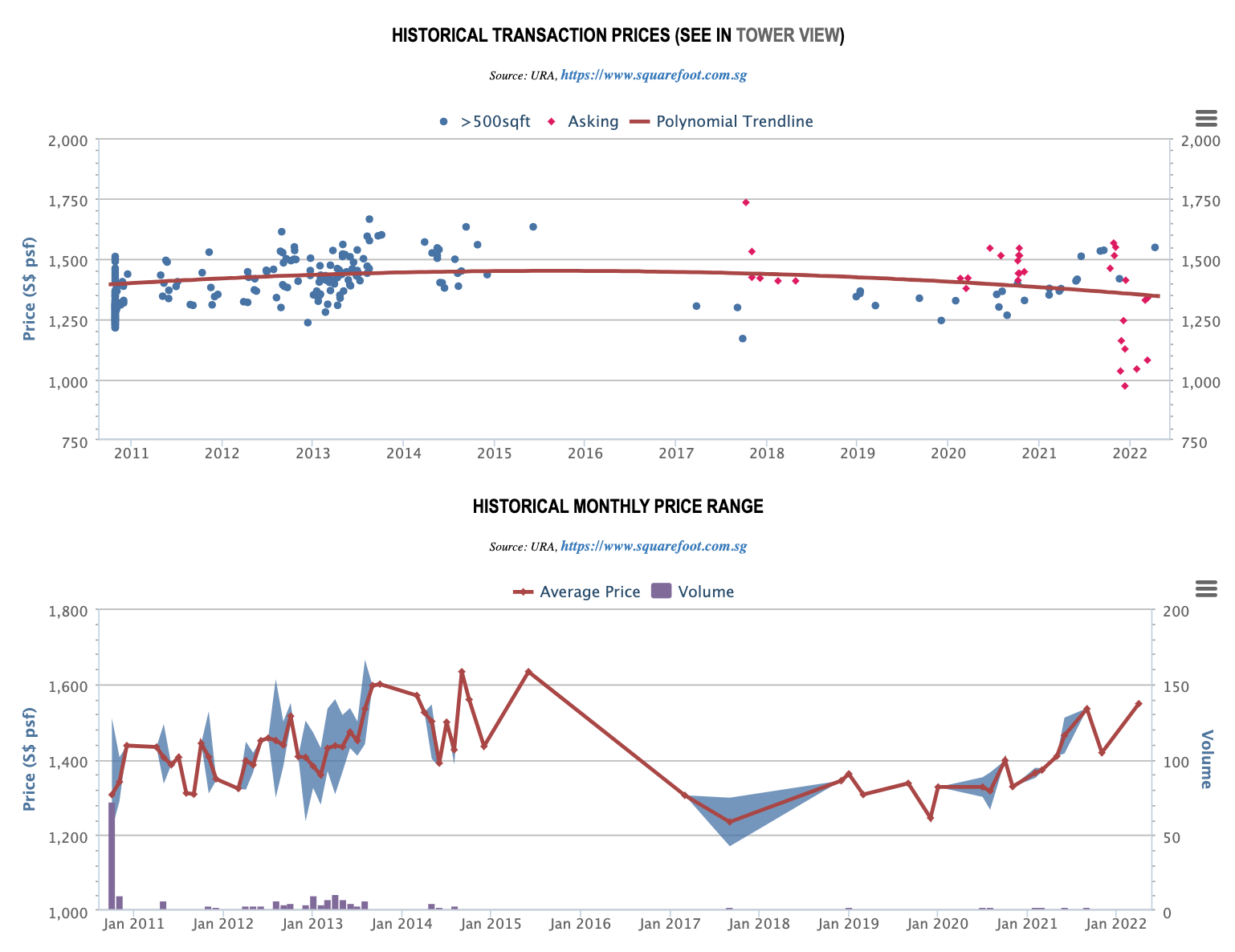

And so as of the time of writing, The Lanai has an average transaction price of $1,548 PSF. While this is an increase from its launch prices of around $1,361 PSF in 2010, it is worth noting that there was only a single transaction at $1,548 PSF in the last 6 months and not an average of a few transactions. This is as compared to an average PSF of $1,430 PSF over the whole of 2021.

Now let’s look at some of the reasons why The Lanai has performed the way it has.

1. Launch prices were too high

First, let’s take a look at the launch prices of The Lanai, as that is usually a telling sign of a condo’s resale performance.

Priced too high during launch? It may take more than several years for the prices to recover, especially if bought during the peaks of the property cycle.

Like quite a few projects launched by Far East Organization during that era (The Tennery was another), The Lanai was, shall we say, priced very optimistically.

It’s not like anybody should be surprised, as they were known to always price their projects at a higher price point than everyone else.

So just how much higher was The Lanai priced?

Here’s a comparison on a PSF basis.

| Project | Launch year | Units | Prices in 2010 | PSF% difference | Current average price |

| The Lanai | 2010 | 214 | $1,361 PSF | $1,548 PSF | |

| The Petals | 2000 | 270 | $714 PSF | 90% | $1,054 PSF |

| Hillview 128 | 1999 | 90 | $725 PSF | 88% | $1,087 PSF |

| Hillview Residence | 2000 | 98 | $748 PSF | 82% | $1,236 PSF |

| Natura @ Hillview | 2012 | 193 | $1335 PSF (2012) | 2% | $1,324 PSF |

Do note that surrounding The Lanai are lots of older freehold projects like Montrosa, Merawoods, The Amston, Hillview Regency, Hillview Green, and Hillbrooks (there are still a few more). But given they are all either built earlier than the year 2000, or 99-year leasehold, I chose not to put them in so as we have enough comparisons to go by.

As you can see at that point in time in 2010, the prices at The Lanai were significantly higher than the surrounding resale projects.

Granted, The Lanai was by far the newest entrant to the area as even back in 2010, the “newer” surrounding developments were all 10 years older and above.

To be sure though, at a PSF difference of 80 – 90% difference, it was a huge step up to ask for.

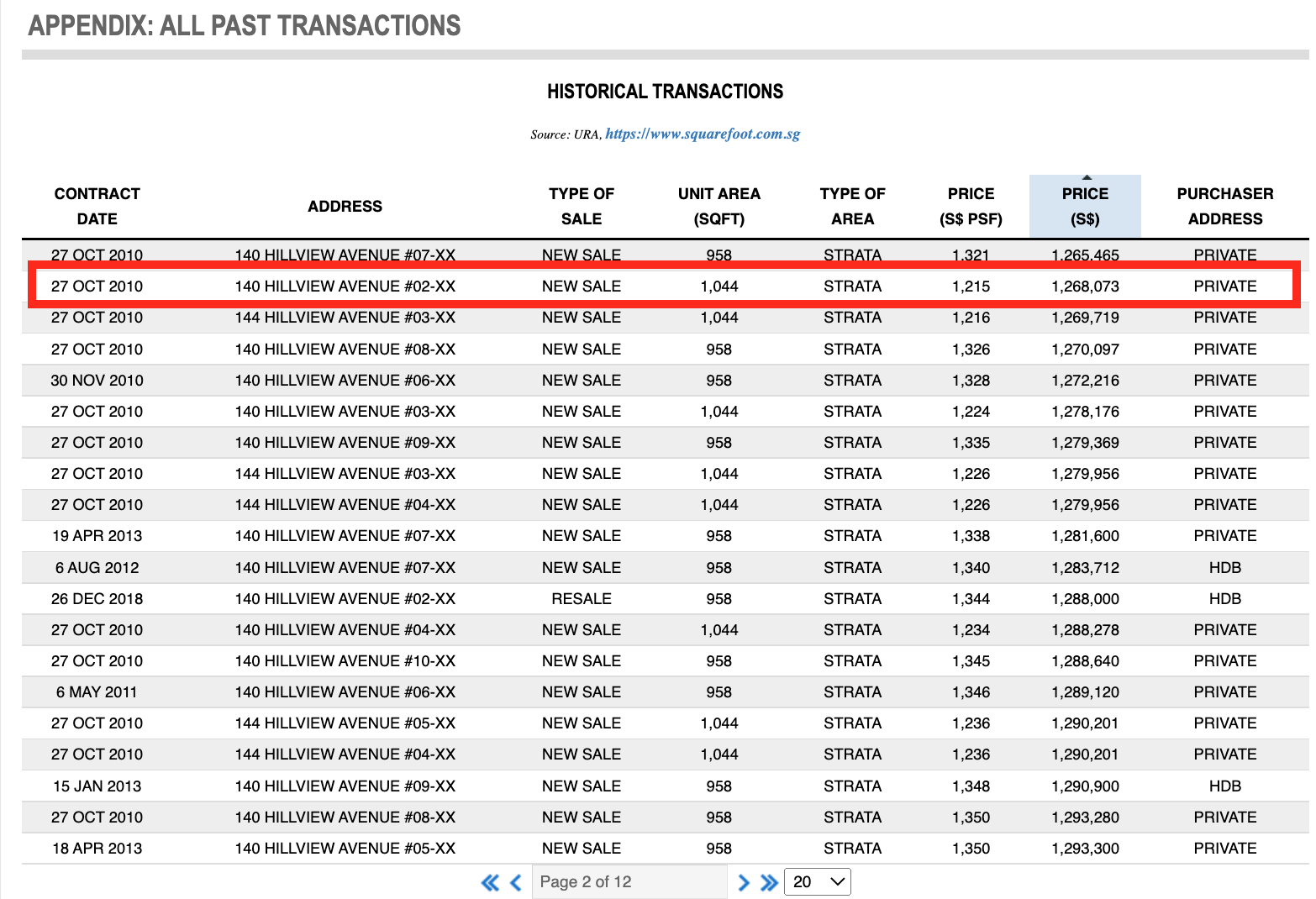

So it was no surprise that The Lanai took 4 years to sell all 214 units, with the highest price still reaching $1,633 PSF in December 2014! Remember, developers back then had the luxury of all the time in the world, as they didn’t have the pressure of any ABSD.

And it certainly shows.

Natura @ Hillview launched 2 years later with a similar number of units and was priced at $1,335 PSF, a slight 2% less than the launch prices of The Lanai. Plus, the fact that Natura @ Hillview was mostly small units (which usually would be priced at a higher PSF) just showed how the area was still not ready for such prices at that point in time.

Next, let’s look at the comparison on a quantum basis.

First up, the 2 bedroom units.

| Project | Size range | Quantum (in 2010) |

| The Lanai | 947 – 1,142 sq ft | $1,195,925 – $1,288,640 |

| The Petals | 1,023 – 1,195 sq ft | $753,000 – $850,000 |

| Hillview 128 | Nil | Nil |

| Hillview Residence | Nil | Nil |

Hillview Residence and Hillview 128 doesn’t have 2 bedroom units, so we will obviously not be including them in the comparison here.

Despite the smaller size of the 2 bedroom units at The Lanai, you can see that the overall quantum is still quite a big jump. For the smaller 2 bedroom unit, you are looking at a difference of $442k – that’s a big amount to swallow even considering a 10 year age gap.

Now let’s look at the 3 bedroom units, where we have 2 more to compare with.

| Project | Size range | Quantum (in 2010) |

| The Lanai | 1,044 – 1,453 sq ft | $1,268,073 – $1,787,555 |

| The Petals | 1,259 – 1,905 sq ft | $885,000 – $1,320,000 |

| Hillview 128 | 969 – 1,163 sq ft | $640,000 – $800,000 |

| Hillview Residence | 1,238 – 1,507 sq ft | $900,000 – $1,110,000 |

Again, you can see that the huge PSF difference and comparable unit sizes here mean that the overall prices at The Lanai in comparison to the closest nearby competition are quite glaring.

The Petals and Hillview Residence were both built in 2010, so the unit sizes here are similar. So while the price difference of around $360k is smaller than the 2 bedroom comparison above, a 30% increment is still quite hard to justify.

It’s worse for the comparison between Hillview 128 and The Lanai due to the smaller unit size at Hillview 128. Mind you, it isn’t that much smaller, but The Lanai is nearly double the price here!

Not to mention, while Hillview 128 has just 90 units – it still offers a swimming pool and tennis court, so you can’t say there’s a significant tradeoff here either despite it being a smaller development!

Overall though, the resale condos in the district at that time in October 2010 were transacting at $690 PSF on average while new launches averaged $1,276 PSF.

And so at $690 PSF, this is nearly half of the launch prices at The Lanai – which at nearly double the price is quite a staggering difference.

As for new launches, while on the surface, the average of $1,276 PSF seems to be quite close to The Lanai’s prices, a deeper look shows that 72 out of the 89 new launch transactions that month were actually due to The Lanai.

More from Stacked

This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

For long-time patrons, the redevelopment of Robertson Walk (once a familiar destination in this part of town) may feel bittersweet.…

Take that out, and the average new launch price in the district drops to $1,146.

The high prices that The Lanai was asking back in 2010 are even more apparent in today’s context. In 2019, Midwood was launched from $1.015 million for a 2 bedroom unit, $1.420 million for 3 bedrooms, and $1.999 million for the 4 bedroom units. And even then, it wasn’t selling well during the initial launch.

Compare this to the prices at The Lanai in 2010 and you can see why those prices were definitely high back then.

Of course, the sizes at Midwood are smaller, and the PSF is higher, but the overall quantum is where you can see how The Lanai was overpriced even nearly 10 years ago in 2010.

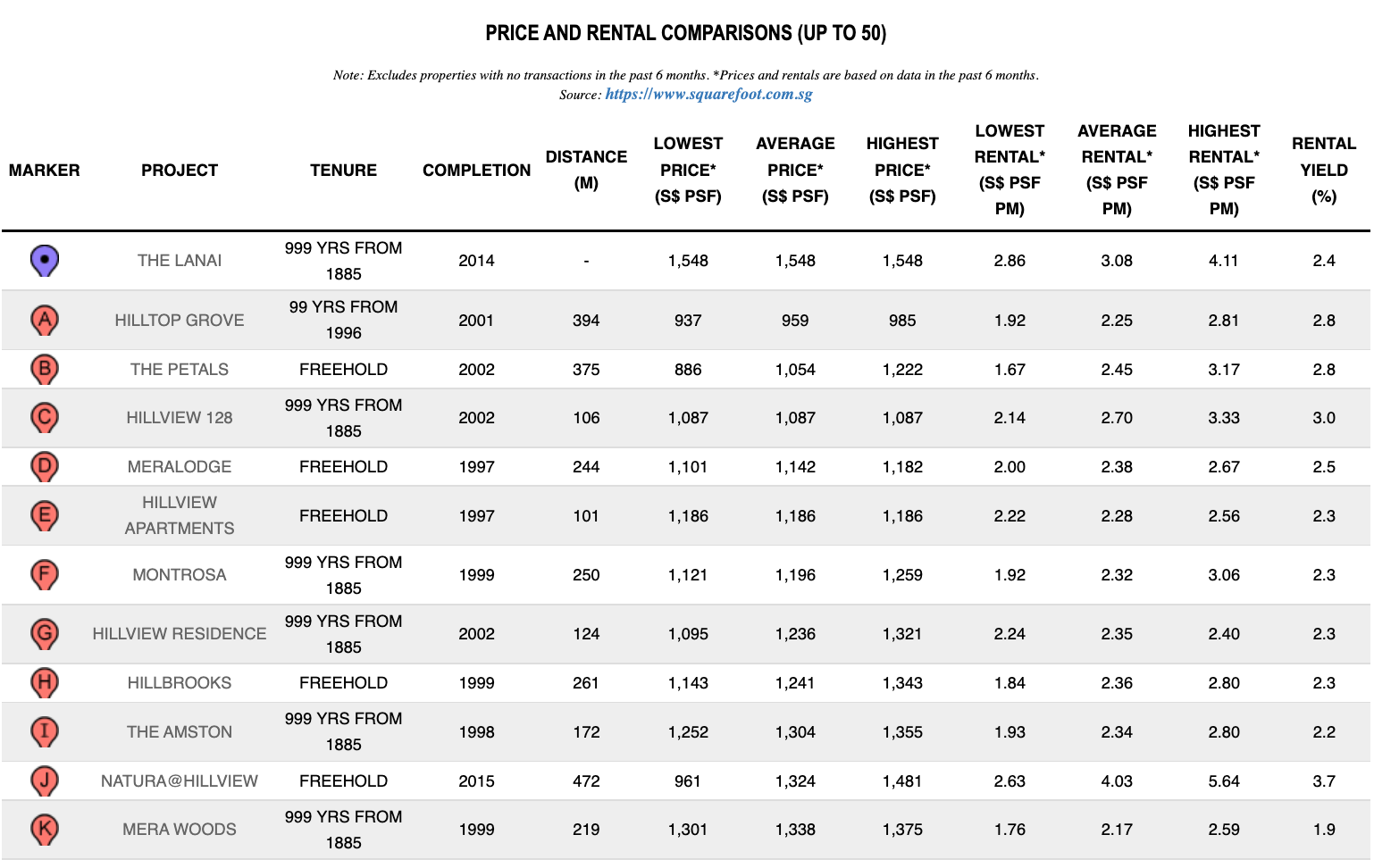

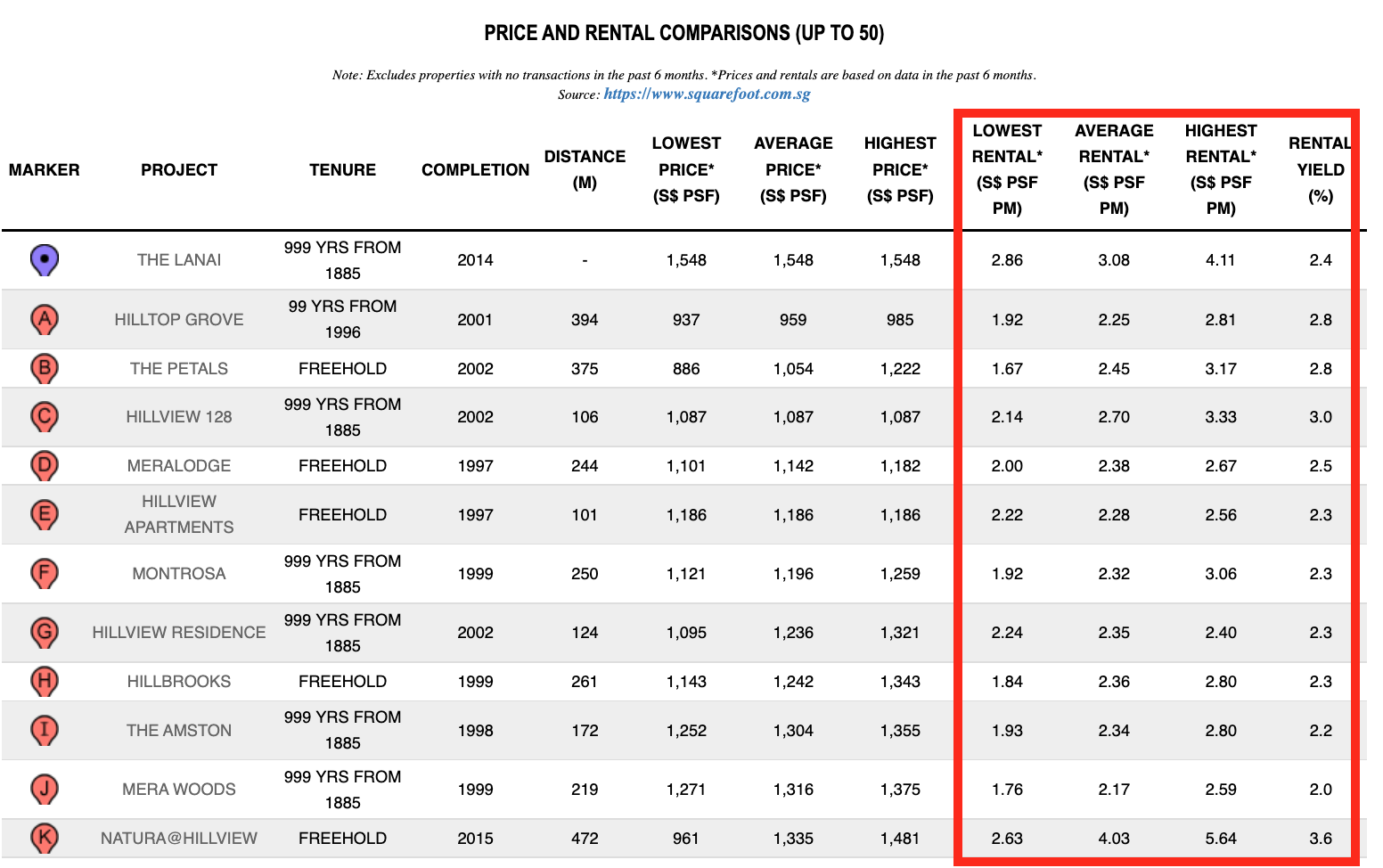

2. Rental yield isn’t fantastic

Next up, let’s look at the rental yield at The Lanai.

Sometimes while the price of development may be considerably higher than the surrounding, it may still be justified if the rental yields are good too.

In the case of The Lanai though, because of the high quantum, the rental yield was on the lower side at a 2.4% gross yield.

It isn’t the worst, but compared to the nearest developments like Hilltop Grove (2.8%), The Petals (2.8%), and Hillview 128 (3%), it doesn’t fare well considering it is quite a fair bit newer.

The closest competitor in terms of age is Natura @ Hillview which was built in 2015 but has a much better rental yield of 3.6%. This is because it is a project with small unit sizes, which caters more to a rental investment than it does for own stay. Just as a point of interest, it has one of the smallest 3 bedroom units in Singapore – just 635 sq ft!

3. Future and current competition is stiff

As mentioned above in the Hillview area alone, I counted 38 resale and new launch projects as competition in the area. And so, as a buyer who is looking at staying there, you do have a huge selection of condos to choose from.

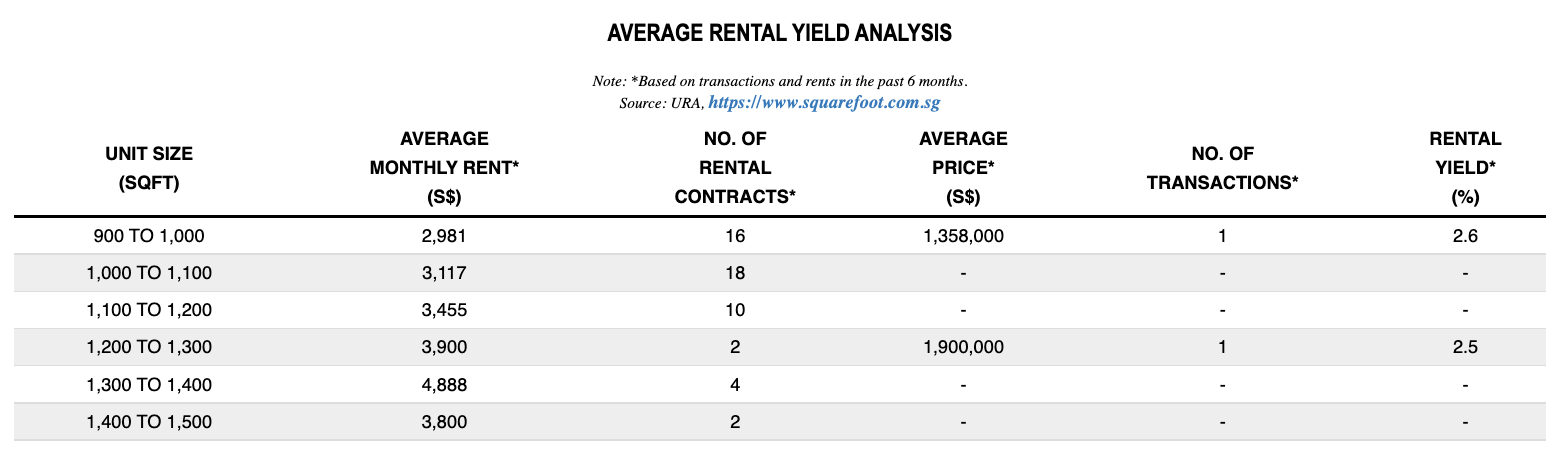

Here’s a detailed look at the 3-bedroom transactions in the past 6 months for developments 1 km from The Lanai:

| Project Name | Tenure | Completion | Average | Minimum | Maximum | Average $PSF | Min Area (sqft) | Max Area (sqft) |

| Natura@Hillview | Freehold | 2015 | $880,000 | $880,000 | $880,000 | $1,386 | 635 | 635 |

| Regent Heights | 99 yrs from 07/11/1995 | 1999 | $917,453 | $820,000 | $1,065,000 | $852 | 1,023 | 1,173 |

| Hills Twoone | Freehold | 2016 | $982,500 | $900,000 | $1,065,000 | $1,383 | 710 | 710 |

| Hillview 128 | 999 yrs from 12/10/1885 | 2002 | $1,135,000 | $1,135,000 | $1,135,000 | $1,087 | 1,044 | 1,044 |

| Hillview Regency | 99 yrs from 20/06/2000 | 2005 | $1,158,222 | $880,000 | $1,350,000 | $1,034 | 969 | 1,195 |

| Hilltop Grove | 99 yrs from 12/06/1996 | 2001 | $1,202,296 | $1,188,000 | $1,218,888 | $966 | 1,238 | 1,249 |

| Montrosa | 999 yrs from 12/10/1885 | 1999 | $1,419,333 | $1,400,000 | $1,450,000 | $1,221 | 1,152 | 1,184 |

| Hillview Apartments | Freehold | 1997 | $1,430,000 | $1,430,000 | $1,430,000 | $1,142 | 1,206 | 1,302 |

| Hillbrooks | Freehold | 1999 | $1,526,250 | $1,402,500 | $1,650,000 | $1,224 | 1,098 | 1,410 |

| Hillview Residence | 999 yrs from 12/10/1885 | 2002 | $1,667,500 | $1,570,000 | $1,850,000 | $1,236 | 1,249 | 1,690 |

| Midwood | 99 yrs from 01/10/2018 | Uncompleted | $1,688,458 | $1,456,000 | $1,755,000 | $1,712 | 893 | 990 |

| Hillview Green | 999 yrs from 19/05/1883 | 1998 | $1,713,500 | $1,388,000 | $1,918,000 | $1,295 | 1,173 | 1,475 |

| Mont Botanik Residence | Freehold | Uncompleted | $1,715,367 | $1,689,800 | $1,730,000 | $1,811 | 947 | 947 |

| Parc Palais | Freehold | 1999 | $1,740,000 | $1,360,000 | $1,880,000 | $1,336 | 1,227 | 1,389 |

| Chantilly Rise | Freehold | 1998 | $1,750,000 | $1,750,000 | $1,750,000 | $1,213 | 1,442 | 1,442 |

| The Amston | 999 yrs from 12/10/1885 | 1998 | $1,780,000 | $1,780,000 | $1,780,000 | $1,355 | 1,313 | 1,313 |

| Merawoods | 999 yrs from 12/10/1885 | 1999 | $1,820,000 | $1,750,000 | $1,860,000 | $1,353 | 1,346 | 1,346 |

| Summerhill | Freehold | 2002 | $1,836,000 | $1,520,000 | $2,300,000 | $1,467 | 1,001 | 1,550 |

| Symphony Heights | Freehold | 1998 | $1,838,000 | $1,838,000 | $1,838,000 | $1,303 | 1,410 | 1,410 |

| Hume Park II | Freehold | 1997 | $1,870,000 | $1,520,000 | $2,220,000 | $1,362 | 1,238 | 1,485 |

| The Lanai | 999 yrs from 12/10/1885 | 2014 | $1,900,000 | $1,900,000 | $1,900,000 | $1,548 | 1,227 | 1,227 |

| Glendale Park | Freehold | 2000 | $1,930,000 | $1,910,000 | $1,950,000 | $1,508 | 1,249 | 1,313 |

| Hillview Heights | Freehold | 1996 | $1,947,500 | $1,835,000 | $2,060,000 | $1,442 | 1,270 | 1,432 |

| The Hillside | Freehold | 2001 | $2,025,000 | $1,900,000 | $2,150,000 | $1,382 | 1,302 | 1,647 |

| Hillington Green | 999 yrs from 19/05/1883 | 2002 | $2,084,600 | $1,880,000 | $2,588,000 | $1,318 | 1,356 | 2,347 |

| Hume Park I | Freehold | 1995 | $2,200,000 | $2,200,000 | $2,200,000 | $1,390 | 1,582 | 1,582 |

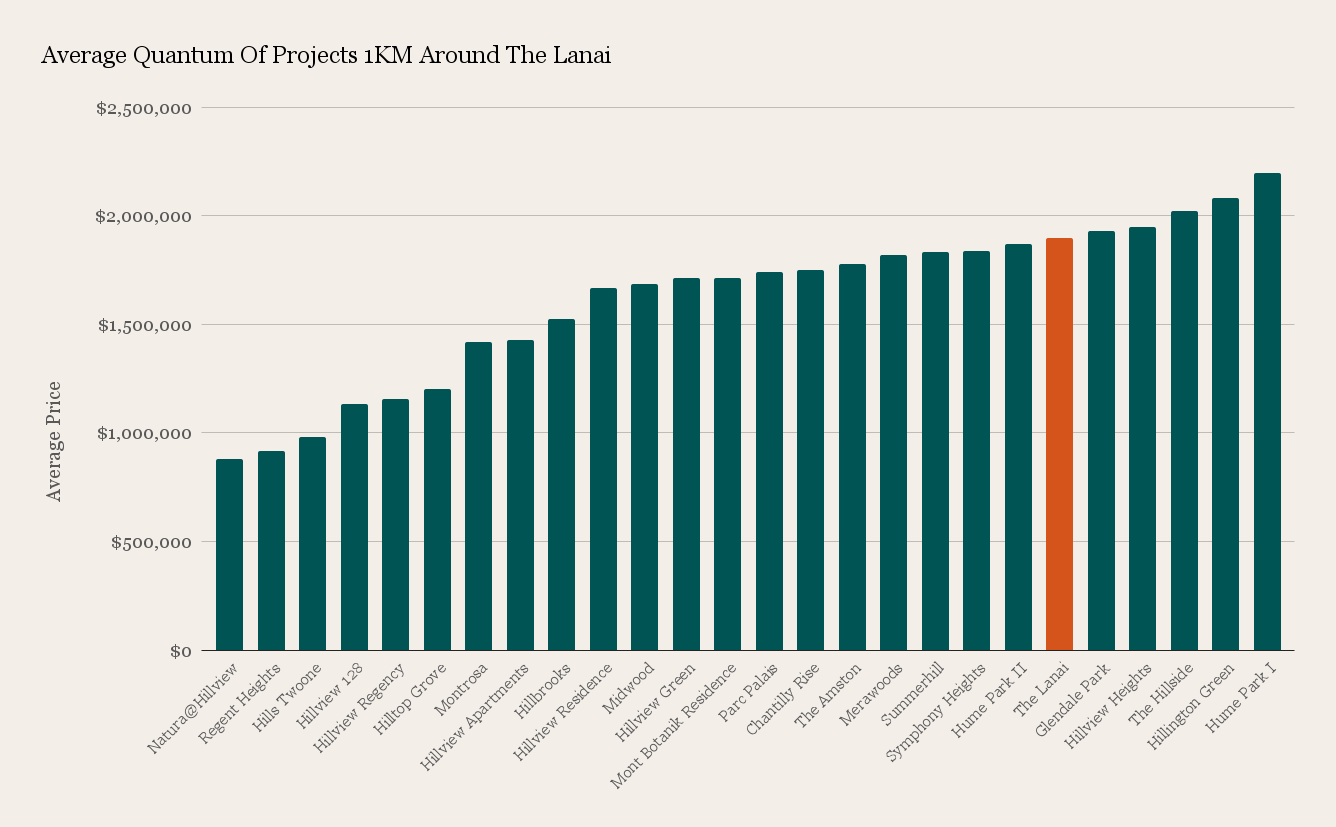

It’s a pretty long list, but you’ll quickly see that the 3-bedroom today ranks as one of the more expensive ones in terms of quantum:

You can see that The Lanai is the highest priced considering its more inconvenient location. Glendale Park, Hillview Heights, The Hillside, Hillington Green, and Hume Park I are all better located, as they are closer to the MRT station.

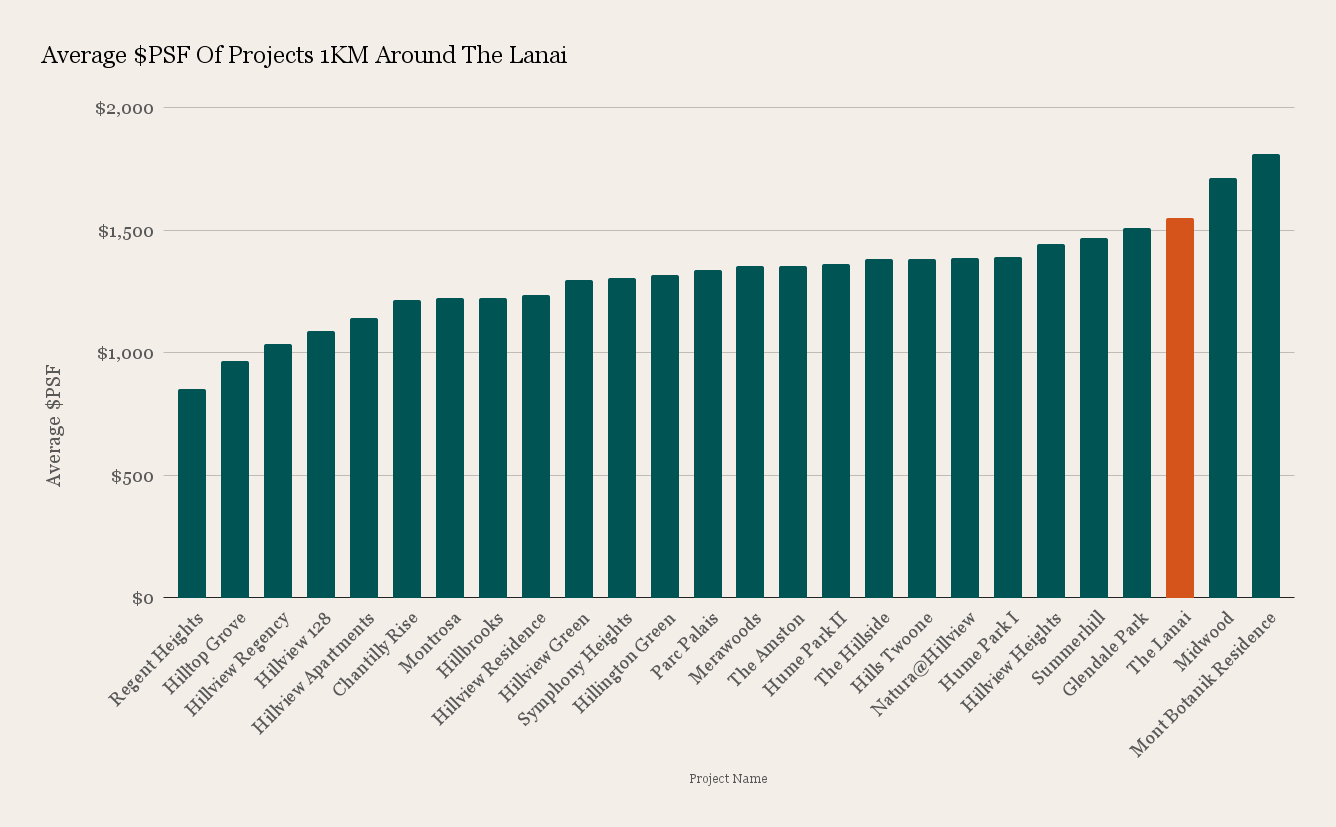

This is even more apparent if we consider its $PSF relative to surrounding competitors:

Aside from Midwood and Mont Botanik Residence (which are both new launches in recent years), The Lanai is the highest prices as well in terms of psf.

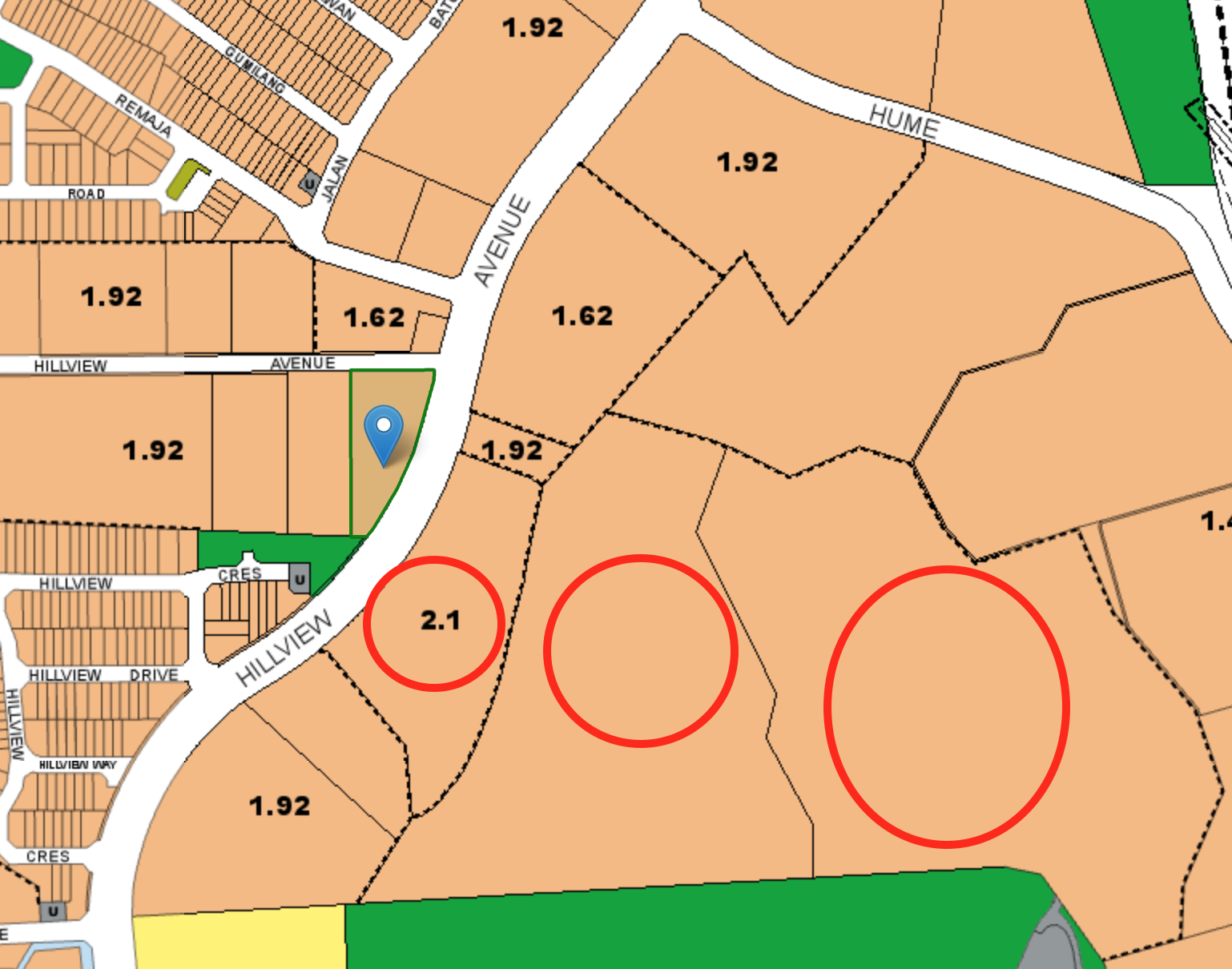

Also, in the northern part of Hillview Avenue and directly opposite the development, there are quite a few residential plots slated for future residential use though it may take some time for all to be fully developed.

This could in return pose as stiff competition over the years and remember, by then The Lanai will be an older resale; which may be less ideal for a certain group of buyers. Of course, on the flip side, it could raise the prices of resale developments around – but all this would depend on the supply and future offerings by developers in the future so far with the launch of Midwood, prices haven’t really moved much for The Lanai.

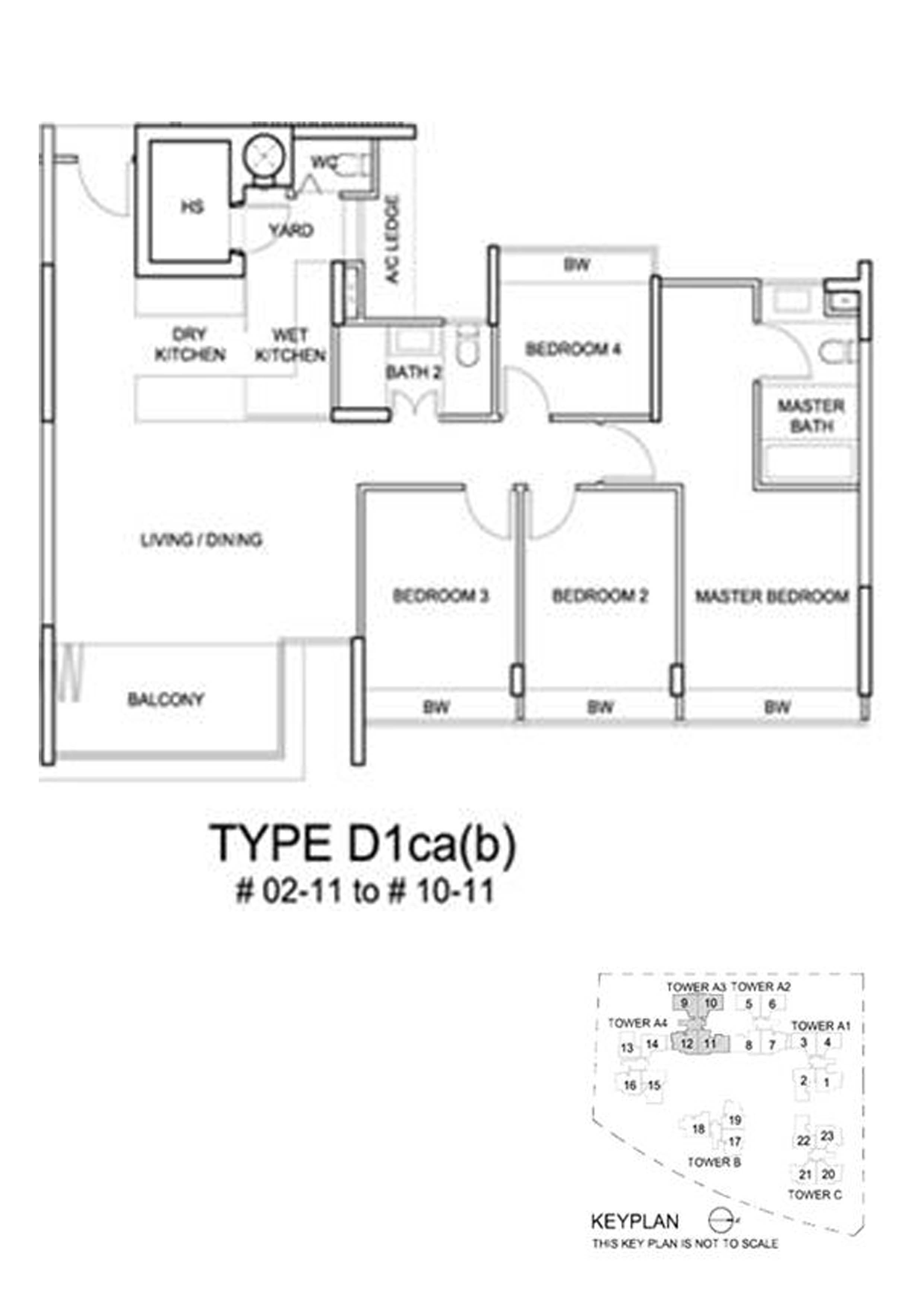

4. There’s inefficiency in the unit layout

One of the major points of a development that doesn’t do well in the resale market is usually down to unit layouts. Sometimes they just don’t translate well in real life, and what you see in the show flat as compared to reality can be very different.

The unit offerings here are a mix of 2 to 4 room units. With a higher percentage of 3 and 4-bedders and the lack of 1 bedder unit mix, the target market here is quite clearly for own stay profiles.

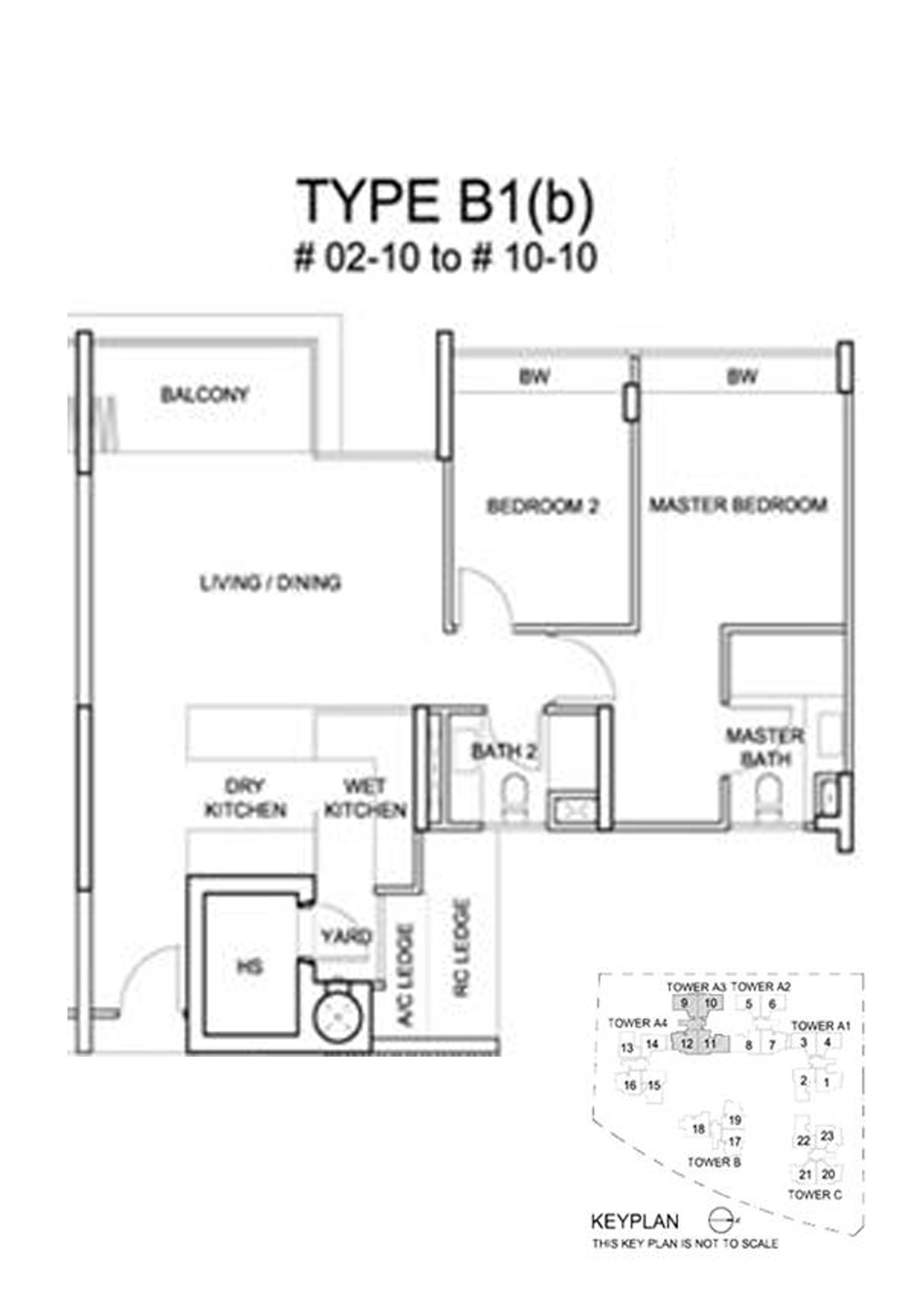

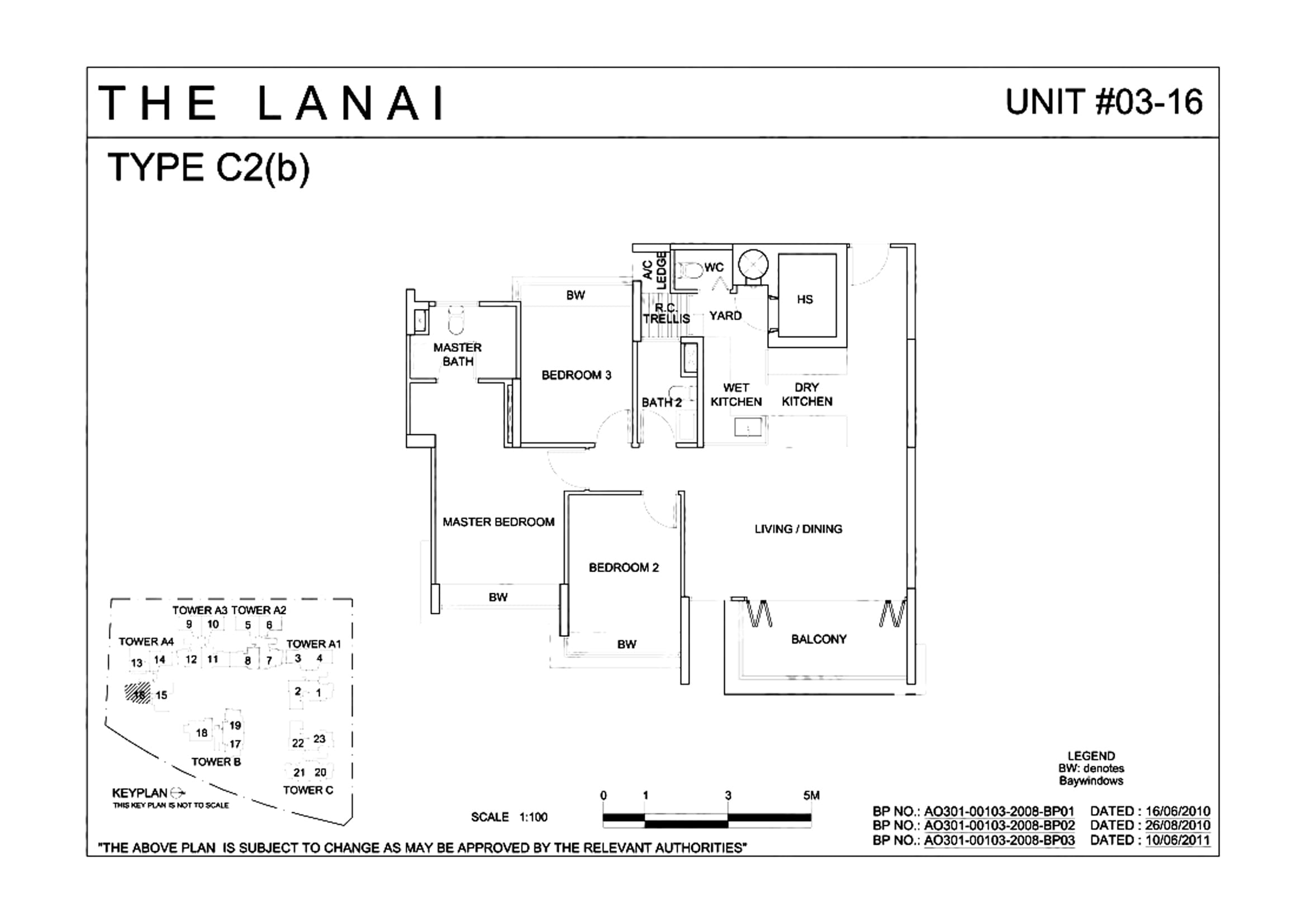

With spacious unit sizes that range from 947 sq ft – 1,151 sq ft for the 2 bedder units, it is relatively large for a new launch in today’s market.

But despite the good unit sizes of The Lanai, unfortunately, the units here are inefficient in terms of layout.

First, it comes with bay windows and an in-unit household shelter. While this may be useful to some to most it takes up space. It also has a wet and dry kitchen – a rarity for a 2 bedder unit mix. Frankly, it’s a luxury to have, and for most profiles looking at 2 bedroom units, quite unnecessary save for the prime regions perhaps.

That said, the unit comes with a proper yard, which is great for laundry.

5. It’s away from amenities

Located in the centre along Hillview Avenue, the area does currently suffer from a lack of amenities. For basic shops and supermarkets, these will be located more than 800m away at Hillv2 and The Railway mall. It is walkable yes, but not convenient for all.

To be fair, this may not entirely be a big reason, it does come into play more when you do have 38 other condos in the area to compete with.

Property Investment Insights13 Condos With The Most Unprofitable Transactions (By Region)

by Ryan J. Ong6. The site layout

I do think that the developer has managed to offer a good range of facilities here including a few swimming pools and a tennis court. However, it comes at the expense of packed and rather closed residential blocks as the distance between blocks isn’t something too great. Privacy would be an issue, especially for inner-facing stacks.

Most of the units here face direct east and West sun, and is less ideal for most homebuyers especially since the target buyers are mostly own stay profiles.

Final words

That said, all isn’t doom and gloom with regards to The Lanai with further upgrades to the area in the form of more amenities from Dairy Farm Residences or the Jalan Anak Bukit GLS integrated development.

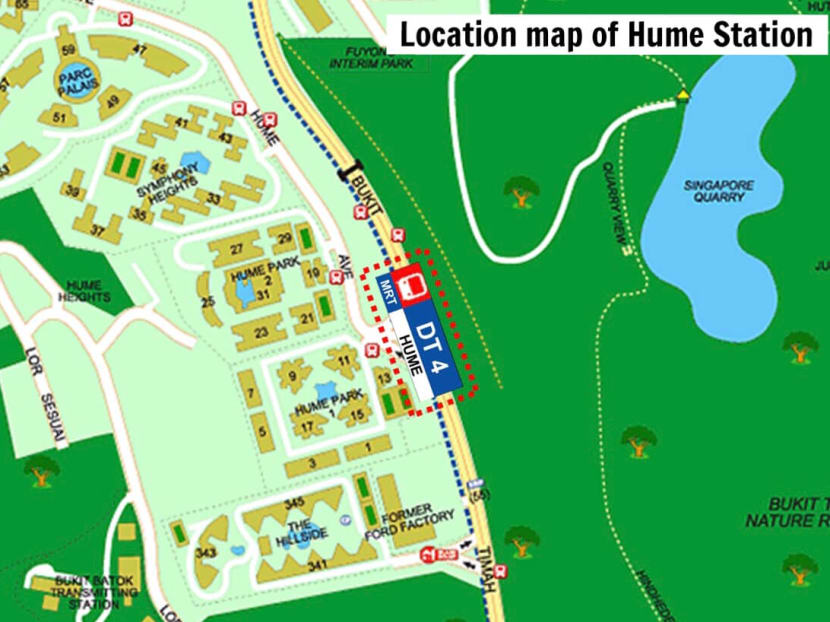

There is also further improvement in terms of public transportation connectivity with the opening of the DTL Hume MRT station, which is slated to open sometime in 2025. However, residents of The Lanai may not benefit much from it at all considering the steep uphill climb and slightly longer time it takes to reach the station.

For more on issues affecting property investment, or in-depth reviews of new and resale properties, follow us on Stacked. If you’re pondering the future gains of your property purchase, do reach out to us for a proper consultation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why has The Lanai condo performed poorly in resale value?

Was The Lanai overpriced when it launched?

How does rental yield at The Lanai compare to nearby developments?

What are some issues with the unit layouts at The Lanai?

How does The Lanai's location impact its resale value?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

7 Comments

Wrong info. Hilltop Grove is not freehold.

Also, you can’t compare Hillview 128 (apartment ) vs Lanai (condo). there is a stark difference between the 2 in terms of built, design and amenities. Go visit both and you can tell the diff.

And hume park I is not close to any MRT station at the moment. It’s at the other end of the neighbourhood. (it will be next to the new Hume station in about 3 years time ). I do agree Lanai was way overpriced back in 2010. And again, you can’t compare Lanai to Natura which is those apartment with mickey mouse units. Its like comparing Kancil to Mercedes.

oh wow, guys. you gotta do a bit better on your research. lanai to new hume station is a longer walk than to hillview station, and it’s a steep uphill trek along hume avenue for almost 500m (until symphony heights condo). The walk to hillview station is shorter and it’s a level road save for a short distance of 100m slope, starting from the hv rounadbout.