Here’s The Next Mega Development: Why This Dunman Road Site Could Attract Developer Bids Of $1.3 Billion

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Property developers are plagued by depleted land banks this year; so it’s not surprising we’ll see more competition for GLS sites. However, the upcoming Dunman Road site is likely to come with a daunting price tag – at potential prices of over $1 billion, it’s only the boldest developers who might go for it. Here’s what’s special about the site:

Table Of Contents

- A site large enough for a mega-development

- Why is it likely to cost over $1.3 billion?

- Dunman Road site is very well located:

- 1. Dakota MRT in short walking distance

- 2. Multiple good schools nearby (some within walking distance)

- 3. Close proximity to the Paya Lebar hub

- 4. Lots of places to eat

- 5. Can face the lower density area toward Poole Road

- The Dunman Road site will be closely watched, by en-bloc hopefuls

A site large enough for a mega-development

| Site Area | 25,234.3 m2 |

| Land Use Zoning | Residential |

| Maximum Gross Floor Area | 88,321 m2 |

| Maximum Building Height | 64 m SHD |

| Estimated Number Of Housing Units | 1,040 units |

| Lease | 99 years |

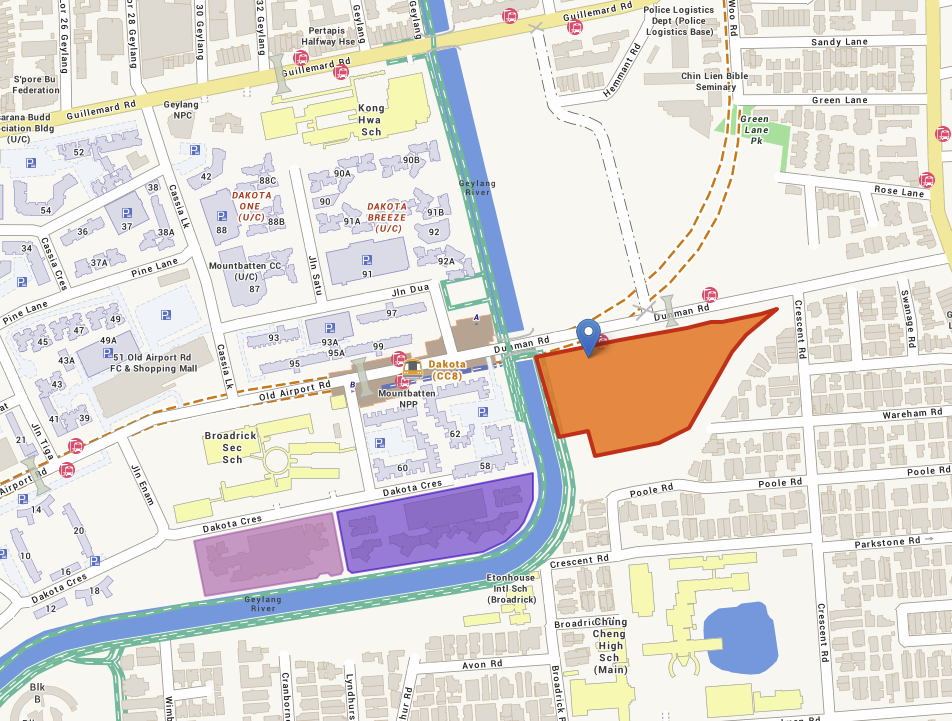

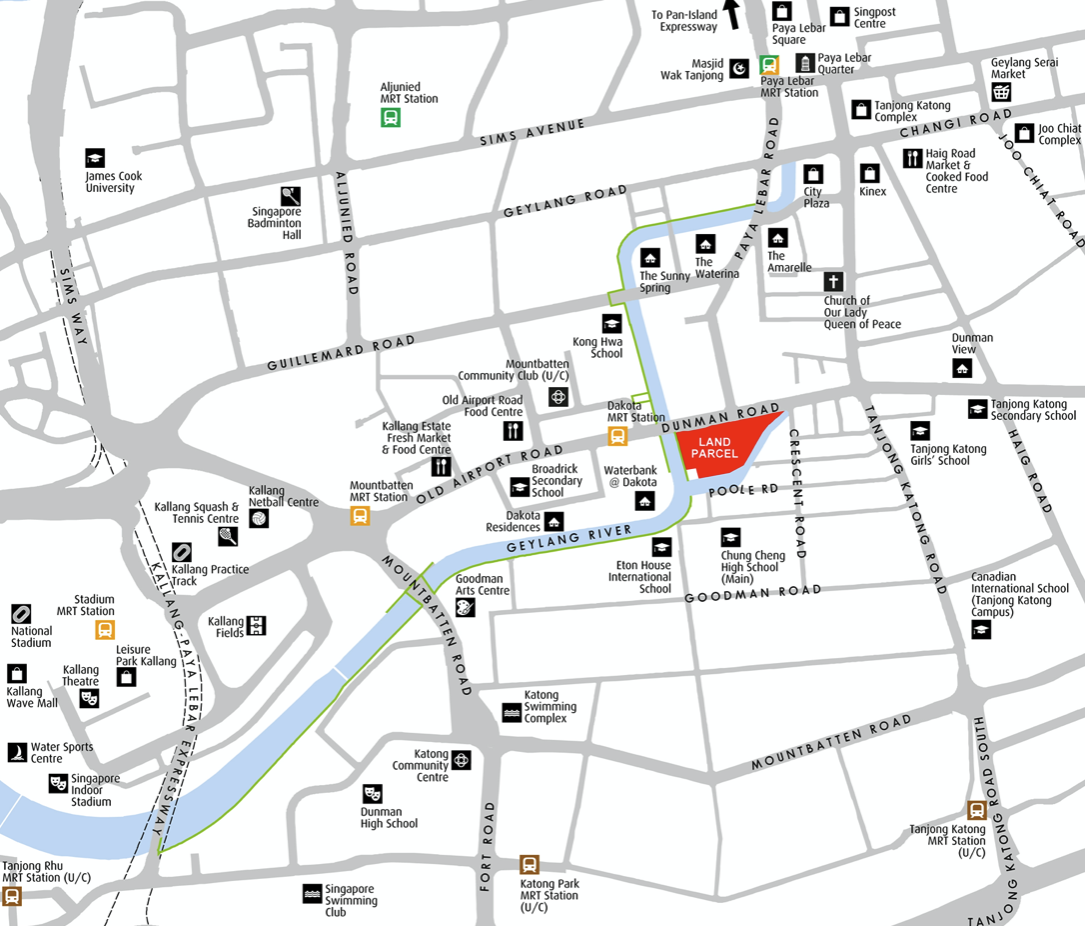

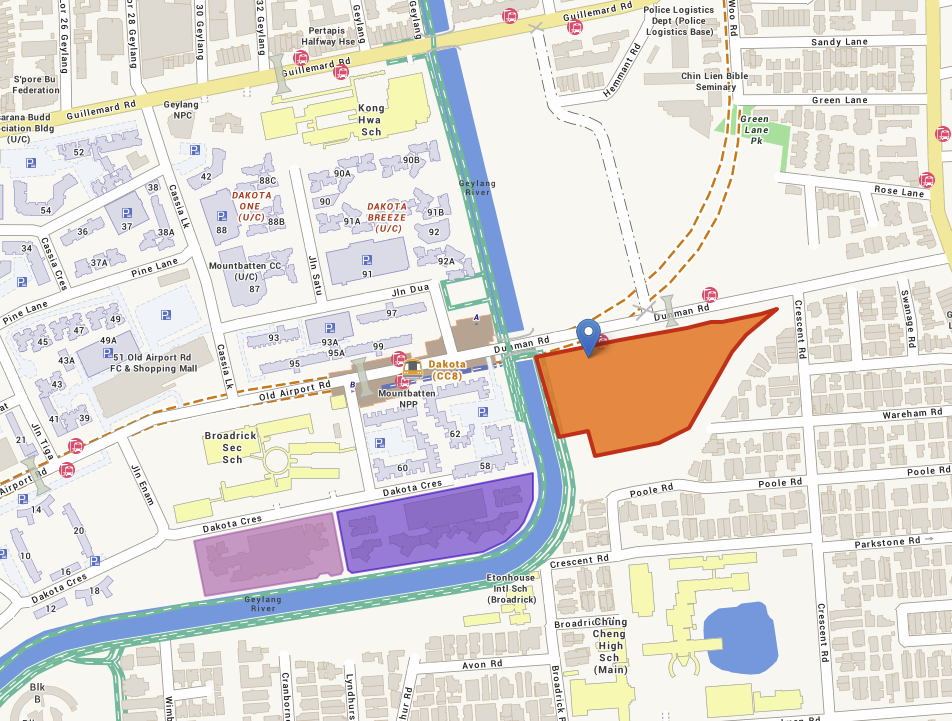

This massive plot is about 25,234 sqm, with a Gross Floor Area (GFA) of around 88,321 sqm. It’s located between Dunman Road and Poole Road, and right next to the Geylang River.

This is right across the river from the Dakota Crescent HDB estate, where Old Airport Road connects to Dunman Road. This is close to where the old Guillemard army camp used to be (the camp is already in the process of being demolished, and will be long gone before any new development is finished).

A land plot this huge could yield around 1,040 new homes; sufficient to give mega-development status to any condo here.

Why is it likely to cost over $1.3 billion?

So far, no analyst has estimated a price point below $1,250 psf for the plot, with most saying a price of about $1,300 to $1,400 is realistic. Any condo that gets built here is expected to see a price of about $2,300+ psf, which is a bit steep for the typical HDB upgrader.

Nonetheless, some could also see this as a reasonable price point, as the Dunman Road site is very well located:

- Dakota MRT in short walking distance

- Multiple good schools nearby (some in walking distance)

- Close proximity to the Paya Lebar hub

- Lots of places to eat

- Can face the lower density area toward Poole Road

Note that we have seen GLS sites go for over a billion dollars before; one of the most recent being the Jalan Anak Bukit white site. But that was at $1.028 billion, less than the hefty price tag we’re seeing at Dunman Road.

1. Dakota MRT in short walking distance

Dakota MRT, on the Circle Line, is just a few short minutes’ walk from the land plot (around five to six minutes at our estimate). This train station is just one stop away from Paya Lebar MRT station, which is both a commercial hub (see below), as well as a connecting station to the East-West Line (EWL). This would place residents around six stops from Raffles Place, after changing lines in Paya Lebar.

Next to Waterbank at Dakota (a leasehold condo completed in 2013), any condo built here will likely have the best accessibility by public transport, for this stretch of Dunman Road.

2. Multiple good schools nearby (some within walking distance)

Broadrick Secondary School is the closest to the plot and should be within five to seven minutes’ walk. Chung Cheng Secondary is also roughly within a 10-minute walk.

Meanwhile, other schools within the one-kilometre priority enrolment range include Geylang Methodist Primary, Tanjong Katong Primary, Tanjong Katong Girls’, and Dunman High.

The mix of many nearby schools, along with green spaces along the Geylang River and MRT access, add quite a bit of family appeal.

More from Stacked

How Much Must You Earn To Pay Off Your Property By 50?

Here’s a thought that will make any Singaporean heart turn cold: working past 50 to pay off a housing mortgage.…

3. Close proximity to the Paya Lebar hub

This is probably one of the bigger selling points. Paya Lebar Quarter (PLQ) is a major commercial hub, with grade A office spaces, large malls, and most of the amenities a resident could need.

The issue with PLQ is the high urban density and traffic, along with prices that have climbed significantly with new development. As such, a common alternative has been to find areas near PLQ, but not within the hub itself.

The quick sales at Parc Esta (sold out and set to be finished this year) demonstrate this – a lot of buyers were drawn to the fact that it’s in Eunos, one train stop from PLQ. We do think the Dunman Road plot offers a similar advantage.

Due to the proximity to both PLQ and the town area, any condo on this plot could also be a viable rental asset.

4. Lots of places to eat

The Dunman road plot is, by happy coincidence, caught between two major foodie havens. The first is the Old Airport Road Food Centre, as well as the other small eateries scattered around the area; the other is the stretch along Tanjong Katong Road, which has an eclectic mix of everything from late-night hot pot to upscale restaurants.

While they’re too far to comfortably walk, we note there’s a bus stop just in front of the land plot. You should be able to use most of the bus services to head down just two or three stops, to get to the foodie areas.

5. Can face the lower density area toward Poole Road

The side facing the Geylang river looks out at the old Dakota Crescent HDB blocks, but the developer could also make use of the facing toward the Poole Road area. This is a lower density, landed enclave, which may make for a less “busy” or impeded view.

In any case, the overall area is not as packed as you might expect, from an area so close to the city. It will be affected by how well the developer spaces out the blocks though, as a 1,000+ unit mega-development can quickly feel cramped if the space isn’t handled well.

The Dunman Road site will be closely watched, by en-bloc hopefuls

The interest (or lack thereof) in the Dunman Road site has some significance to the en-bloc scene.

Developers have been hesitant to take on larger land plots, due to the Additional Buyers Stamp Duty (ABSD) time limit. A developer that cannot complete and sell a development within five years will be saddled with the hefty ABSD tax, which is a percentage of the land price… and a $1.3 billion price tag means truly hair-raising stamp duty fees.

On top of this, the December 2021 cooling measures raised the ABSD for developers: they now pay 35 per cent of the land price, of which only 30 per cent is remissible (assuming they meet the five-year timeline).

This has crushed en-bloc hopes in some larger developments, as developers are taking on significant risk with these. Although on the plus side, mega-developments have been doing well too, with the majority fully sold, if not, close to being sold out.

While the Dunman Road site is not an en-bloc sale, it will likely be taken as a signal as to how ready developers are, to commit to building large properties. If they’re willing to cross the billion-dollar mark for the Dunman Road site (and there’s significant competition), then perhaps they’re also willing to consider an en-bloc for larger ageing condos.

For more on the situation as it develops, follow us on Stacked. We also provide in-depth reviews of new and resale condos alike, so you can make a well-informed property decision.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

Singapore Property News The Trick to Seeing Through a Condo Showflat (Most Buyers Never Do This)

Singapore Property News So Is The 99-1 Property Split Strategy Legal Or Not?

Singapore Property News Higher 2025 Seller’s Stamp Duty Rates Just Dropped: Should Buyers And Sellers Be Worried?

Singapore Property News They Paid Rent On Time—And Still Got Evicted. Here’s The Messy Truth About Subletting In Singapore.

Latest Posts

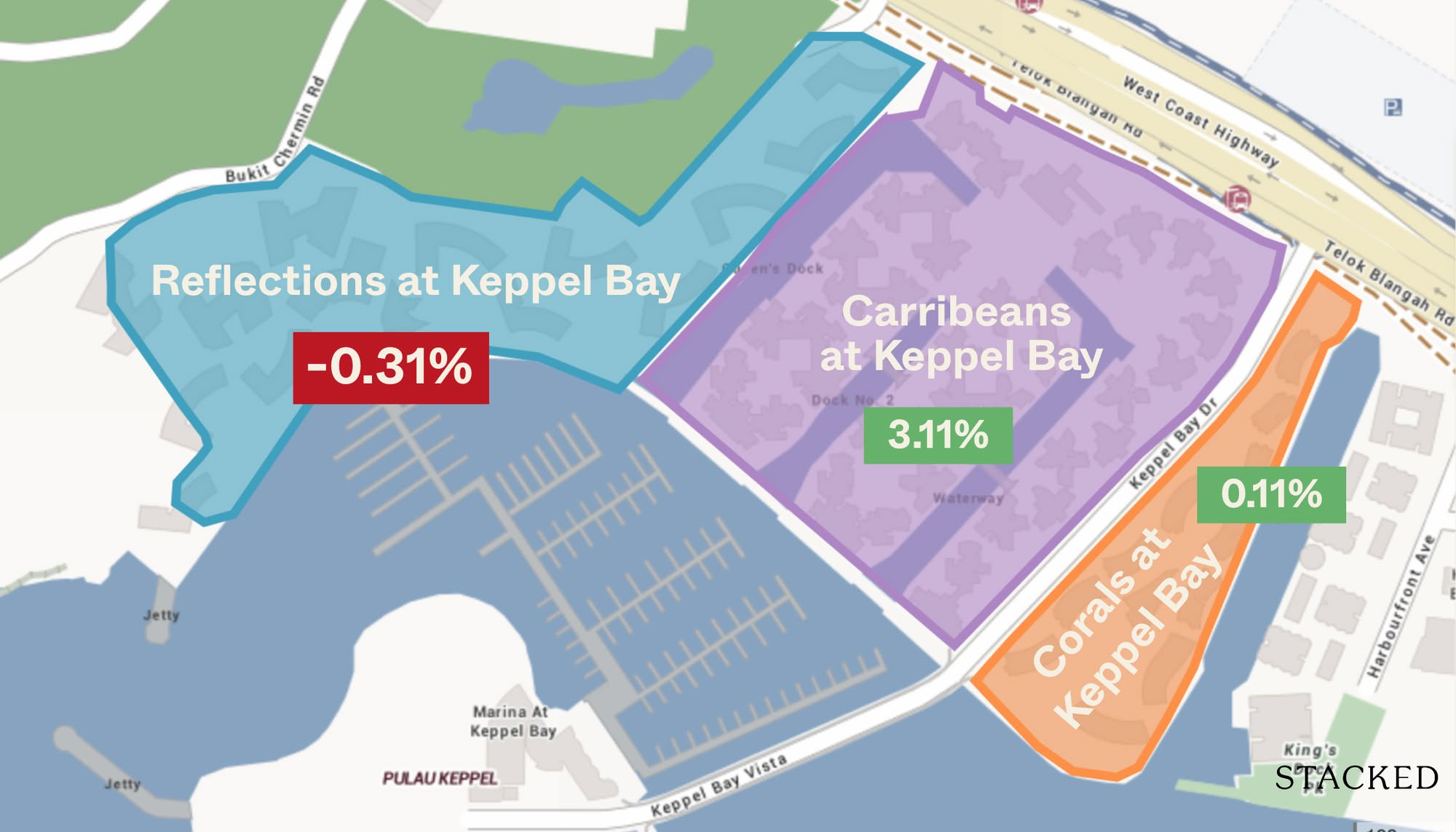

Pro 7 Reasons Reflections at Keppel Bay Underperformed—Despite Its Iconic Design and Prime Waterfront Location

New Launch Condo Analysis This New River Valley Condo Starts At $1.2M: And It’s Cheaper Than Some City-Fringe Launches

New Launch Condo Analysis This New 376-Unit Condo In Sembawang Might Be The Best Pick For Young Families: Here’s Why

Landed Home Tours Where To Find Freehold Semi-D Landed Homes From $4.4m: Touring Gilstead Road

Overseas Property Investing Can You Really Buy A House In Italy For €1? Here’s What Singaporeans Should Know

On The Market 5 Cheapest 5-Room HDB Flats Near MRT Stations From $550k

Pro Why Seletar Park Residence Underperformed—Despite Its District 28 Location And Large Unit Sizes

On The Market Inside A Luxury Waterfront Home at The Residences At W Singapore Sentosa Cove

New Launch Condo Analysis Singapore’s Tallest New Condo Comes With the Highest Infinity Pool: Is The 63-Storey Promenade Peak Worth A Look?

Property Market Commentary We Tracked The Rise Of Million-Dollar HDB Flats By Estate — And The Results May Surprise You

Editor's Pick LyndenWoods Condo Pricing Breakdown: We Compare Its Pricing Against Bloomsbury Residences, Normanton Park & One-North Eden

Property Market Commentary 2-Bedder vs 2+Study Units: Which Condo Layout Has Better Returns Over The Last Decade?

Homeowner Stories Does The “Sell One, Buy Two” Strategy Still Work In 2025? 3 Real Stories From Singapore Homeowners

Editor's Pick Where $4 Million Semi-Ds Sit Next To $40 Million GCBs: Touring First Avenue In Bukit Timah

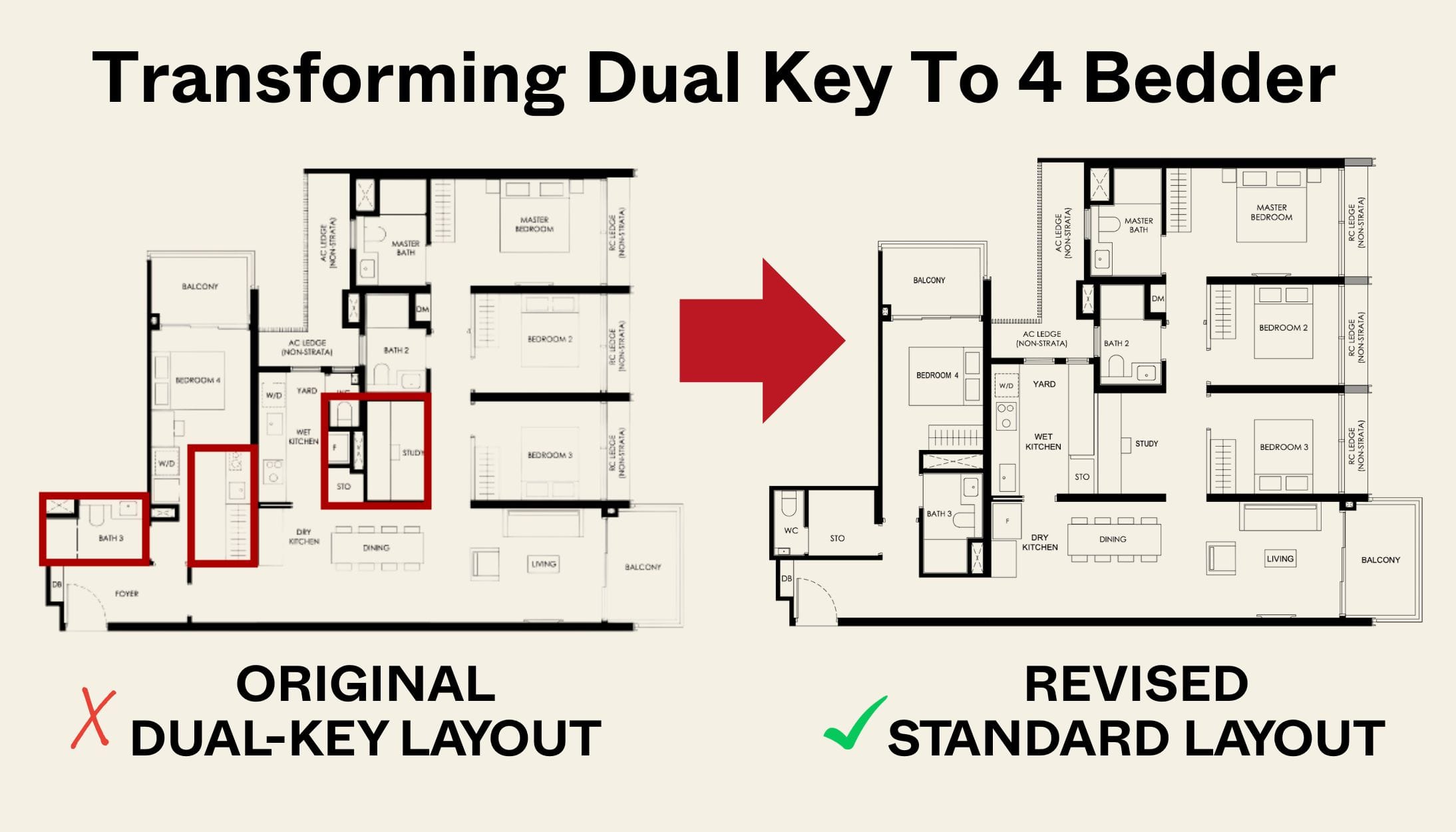

New Launch Condo Reviews Transforming A Dual-Key Into A Family-Friendly 4-Bedder: We Revisit Nava Grove’s New Layout