A Penrose Condo Case Study: How to Price Your New Launch Sub Sale Unit Smartly

January 29, 2024

Have you ever heard of “sub sales” in real estate? These are transactions where a property is sold before it’s even completed, and they make up a surprisingly small portion of the market. This rarity often leads to many questions and myths: What exactly does selling a home in this phase entail? And if you’re aiming for profit, how do you set a price for a property that’s not yet finished and unseen by potential buyers?

To give you a look at how a sub sale is considered, and the kind of numbers you can expect, here’s a good case study in the form of Penrose:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A rundown on Penrose

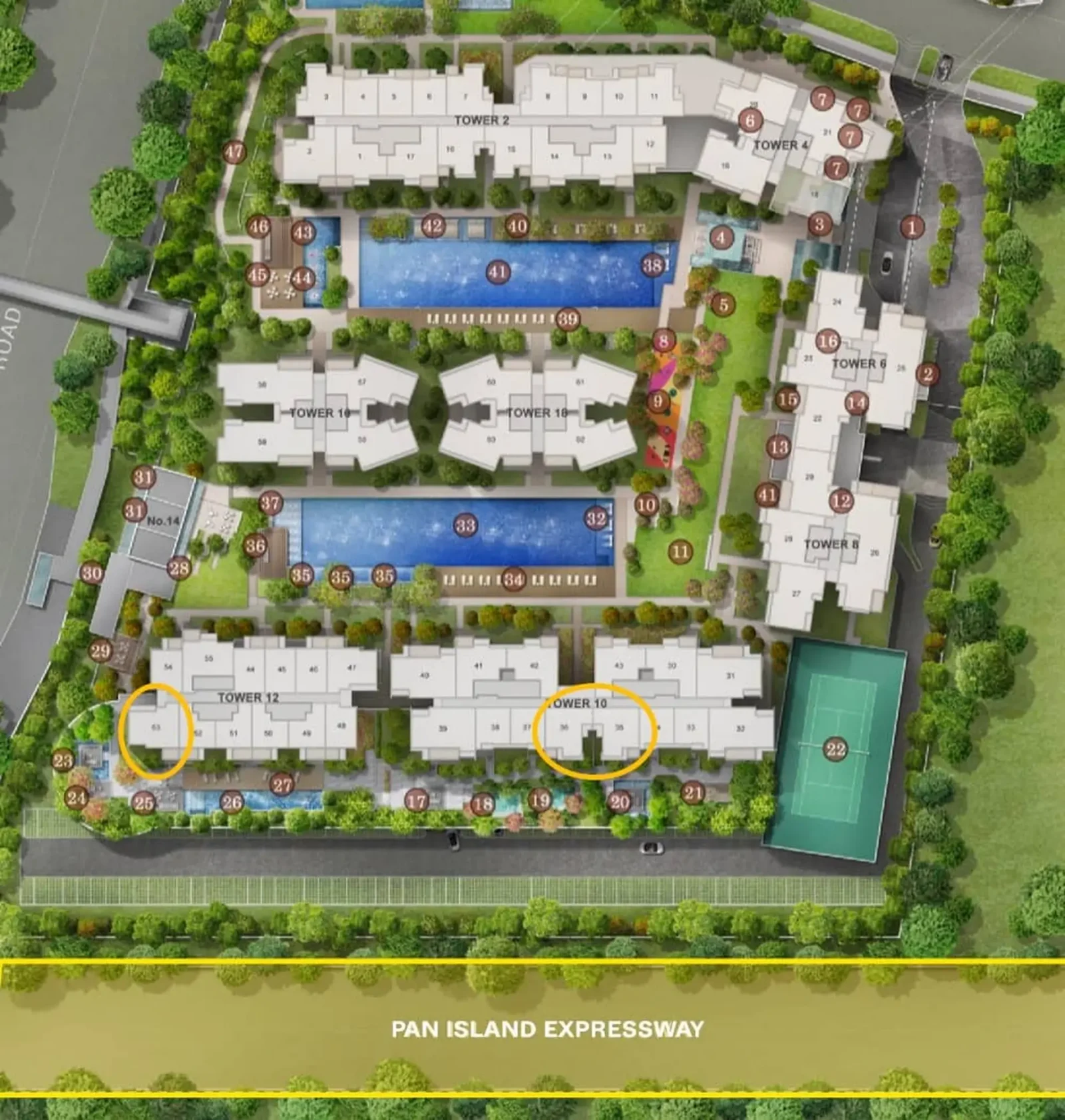

Penrose is a leasehold condo in District 14, which launched on 27th September 2020. The 566-unit project should be completed sometime in 2024, but as there are already multiple sub sale transactions recorded; this makes it a suitable case study.

(For a full, in-depth review of The Penrose, see here)

From the early numbers, all the buyers of Penrose should be very contented with their purchases as the profits from these are good – each unit has made an average of $340,000 so far.

For our case study, we are looking at Block 20, Unit #11-01. This is a 2-Bed, 1-Bath unit with the following cost:

Purchase Price: $967,000

Buyers Stamp Duty: $23,610

Down Payment: $241,750

Loan Quantum: $725,250

As an aside, note that at this stage the Sellers Stamp Duty (SSD) period would be over; otherwise, our considerations would be substantially different (for details on the SSD, see here).

The first step, get the bank’s valuation

Getting the bank valuations is the first thing to do, as this will give you a guide on how to start pricing for the unit.

In the case of this Penrose unit, the highest valuation we got back was $1.3 million – which was a higher-than-expected figure (at least, as of early January 2024). A higher figure is certainly better as it means that buyers will be able to finance the purchase accordingly.

Next, determine the competition within the project

To refine the price further, we will need to determine the level of competition within the development. Certainly, for a new project, there would be an influx of new listings the moment the Sellers Stamp Duty (SSD) period is up. And as obvious as it sounds, the bigger the development, the more competition you would expect.

As always, the supply and demand dynamics come into play here. If you are the only listing of the type available, you are in scarce supply and can command better pricing. Having more competition means more supply, and unless you can price your unit well (you bought at the lowest price), you will find it harder to stand out if not priced accordingly.

These are the other units that were available, at the same time of the transaction:

Found Sub Sale Listings at The Penrose (all types): 138

2-Bed, 1-Bath Layouts: 18 units

2-Bed, 2-Bath Layouts: 20 units

1-Bed, 1-Bath Layouts: 29 units

3-Bed, 3-Bath Layouts:: 66 units

Last seen transactions

| CONTRACT DATE | ADDRESS | TYPE OF SALE | UNIT AREA (SQFT) | TYPE OF AREA | PRICE (S$PSF) | PRICE (S$) | PURCHASER ADDRESS |

| 24 NOV 2023 | 30 SIMS DRIVE #03-34 | SUB SALE | 1,066 | STRATA | 1,924 | 2,050,000 | PRIVATE |

| 23 NOV 2023 | 30 SIMS DRIVE #07-31 | SUB SALE | 710 | STRATA | 1,950 | 1,385,000 | PRIVATE |

| 30 OCT 2023 | 26 SIMS DRIVE #10-22 | SUB SALE | 1,055 | STRATA | 2,010 | 2,120,000 | PRIVATE |

| 24 OCT 2023 | 22 SIMS DRIVE #17-10 | SUB SALE | 646 | STRATA | 1,935 | 1,250,000 | PRIVATE |

| 24 OCT 2023 | 26 SIMS DRIVE #03-21 | SUB SALE | 1,044 | STRATA | 1,863 | 1,945,000 | HDB |

| 16 OCT 2023 | 20 SIMS DRIVE #11-08 | SUB SALE | 958 | STRATA | 1,879 | 1,800,000 | PRIVATE |

When it comes to determining the right price for sub sale, we try to look at past sub sale transactions with similar characteristics. Our closest match here is the transaction on 24th October:

| CONTRACT DATE | ADDRESS | TYPE OF SALE | UNIT AREA (SQFT) | TYPE OF AREA | PRICE (S$PSF) | PRICE (S$) | PURCHASER ADDRESS |

| 24 OCT 2023 | 22 SIMS DRIVE #17-10 | SUB SALE | 646 | STRATA | 1,935 | 1,250,000 | PRIVATE |

| 24 OCT 2023 | 26 SIMS DRIVE #03-21 | SUB SALE | 1,044 | STRATA | 1,863 | 1,945,000 | HDB |

This 646 sq. ft. unit is transacted within a similar stack as our case study unit (although it’s admittedly higher and on the 17th floor). Following The Penrose layout, we could determine both units would face the same direction. Note the transaction amount of $1.25 million, or roughly $1,935 psf.

Looking back on the original developer pricing

| CONTRACT DATE | ADDRESS | TYPE OF SALE | UNIT AREA (SQFT) | TYPE OF AREA | PRICE (S$PSF) | PRICE (S$) | PURCHASER ADDRESS |

| 26 SEP 2020 | 22 SIMS DRIVE #16-10 | NEW SALE | 646 | STRATA | 1,528 | 987,000 | PRIVATE |

| 26 SEP 2020 | 22 SIMS DRIVE #18-10 | NEW SALE | 646 | STRATA | 1,539 | 994,000 | PRIVATE |

| 26 SEP 2020 | 22 SIMS DRIVE #17-10 | NEW SALE | 646 | STRATA | 1,534 | 991,000 | PRIVATE |

| 26 SEP 2020 | 22 SIMS DRIVE #06-10 | NEW SALE | 646 | STRATA | 1,468 | 948,000 | PRIVATE |

| 26 SEP 2020 | 22 SIMS DRIVE #08-10 | NEW SALE | 646 | STRATA | 1,480 | 956,000 | PRIVATE |

| 26 SEP 2020 | 22 SIMS DRIVE #11-10 | NEW SALE | 646 | STRATA | 1,497 | 967,000 | PRIVATE |

Next, we can also look back at the prices these units were bought from the developer.

Note that units #11-10 in the list were bought at the same price as our case study unit. Looking at how the prices move between floors, we can see a “floor jump” price of around $3,000 to $4,000. However, this is at a very early stage, and prices are lower the earlier you buy.

Once we reach TOP, it’s a lot more difficult to say if the floor jump price would widen or narrow. If you decide that the project could command a significantly higher price once built because the views are much better in real life, and the price difference during the new launch sales is below what you value it to be then yes, the gap could widen.

Still, for Penrose given there aren’t many transactions yet we can’t fully expound on this properly.

As such to further reinforce our estimates, we’ll look at a comparable condo project, and its 2-bed, 1-bath units.

Comparisons to nearest comparables, Sims Urban Oasis and Parc Esta

First, let’s look at Sims Urban Oasis, which is next door to Penrose. This is also a leasehold project, although it’s a much bigger mega-development (1,024 units), and is older (TOP in 2017). So the main advantages Penrose has against this is being newer, and a more efficient and contemporary layout.

One thing to note is that, apart from a few dual-key units, all the units at Sims Urban Oasis are 2-bed, 1-bath (624 to 667 sq. ft.), which helps a bit with comparisons.

| CONTRACT DATE | ADDRESS | TYPE OF SALE | UNIT AREA (SQFT) | TYPE OF AREA | PRICE (S$PSF) | PRICE (S$) | PURCHASER ADDRESS |

| 29 NOV 2023 | 2 SIMS DRIVE #09-08 | RESALE | 624 | STRATA | 1,802 | 1,125,000 | HDB |

| 23 NOV 2023 | 6 SIMS DRIVE #12-23 | RESALE | 786 | STRATA | 1,807 | 1,420,000 | PRIVATE |

| 23 NOV 2023 | 2 SIMS DRIVE #18-17 | RESALE | 667 | STRATA | 1,819 | 1,213,888 | HDB |

| 7 NOV 2023 | 2 SIMS DRIVE #07-13 | RESALE | 667 | STRATA | 1,795 | 1,198,000 | PRIVATE |

| 2 OCT 2023 | 10 SIMS DRIVE #17-42 | RESALE | 667 | STRATA | 1,750 | 1,168,000 | PRIVATE |

| 20 SEP 2023 | 12 SIMS DRIVE #04-55 | RESALE | 700 | STRATA | 1,729 | 1,210,000 | HDB |

| 19 SEP 2023 | 12 SIMS DRIVE #05-55 | RESALE | 700 | STRATA | 1,758 | 1,230,000 | PRIVATE |

| 7 JUL 2023 | 12 SIMS DRIVE #01-47 | RESALE | 710 | STRATA | 1,665 | 1,183,000 | PRIVATE |

| 30 JUN 2023 | 2 SIMS DRIVE #17-08 | RESALE | 624 | STRATA | 1,922 | 1,200,000 | PRIVATE |

| 26 JUN 2023 | 2 SIMS DRIVE #05-13 | RESALE | 667 | STRATA | 1,750 | 1,168,000 | HDB |

| 26 JUN 2023 | 2 SIMS DRIVE #15-17 | RESALE | 667 | STRATA | 1,693 | 1,130,000 | PRIVATE |

| 1 JUN 2023 | 12 SIMS DRIVE #15-46 | RESALE | 614 | STRATA | 1,447 | 888,000 | PRIVATE |

| 31 MAY 2023 | 8 SIMS DRIVE #04-28 | RESALE | 786 | STRATA | 1,667 | 1,310,000 | HDB |

| 8 MAY 2023 | 2 SIMS DRIVE #17-03 | RESALE | 624 | STRATA | 1,826 | 1,140,000 | PRIVATE |

| 26 APR 2023 | 2 SIMS DRIVE #19-03 | RESALE | 797 | STRATA | 1,622 | 1,292,000 | PRIVATE |

| 31 MAR 2023 | 6 SIMS DRIVE #15-23 | RESALE | 786 | STRATA | 1,766 | 1,388,000 | PRIVATE |

| 30 MAR 2023 | 12 SIMS DRIVE #02-55 | RESALE | 700 | STRATA | 1,715 | 1,200,000 | PRIVATE |

| 9 MAR 2023 | 2 SIMS DRIVE #08-15 | RESALE | 624 | STRATA | 1,730 | 1,080,000 | HDB |

| 7 MAR 2023 | SIMS DRIVE #08-13 | RESALE | 667 | STRATA | 1,723 | 1,150,000 | HDB |

| 3 MAR 2023 | SIMS DRIVE #14-17 | RESALE | 667 | STRATA | 1,708 | 1,140,000 | PRIVATE |

| 13 FEB 2023 | 12 SIMS DRIVE #04-53 | RESALE | 710 | STRATA | 1,710 | 1,215,000 | HDB |

As this project is next door to Penrose, we expect relatively similar performance in the resale market. Sims Urban Oasis was the first major private project in the area, which sold for $1,350 psf during its initial launch in 2015. It took around four years to come to an average of $1,500 psf, and when Penrose launched in 2020, it was actually priced below the average at Sims Urban Oasis.

From the above table, transaction volume is healthy at Sims Urban Oasis. Stacks 35, 36, and 53 are the only ones facing the PIE. This is more comparable to our Penrose case study, as that unit also looks out on the highway.

We will leave out stacks 35 and 36, and focus on 53, and the other two stacks have had no transactions since 2022.

Rather, we’ll look at the fourth-floor unit in Stack 53, which transacted at $1.215 million this year (about $1,710 psf). This is the last entry on the table. At $1,710 psf, this is lower than what we would expect.

Perhaps this is due to issues regarding units facing the PIE, or due to transactions withheld due to Sellers Stamp Duty (SSD); but the transactions here show the advantages of Penrose as possibly being a better development.

Next, we’ll be looking at Parc Esta.

To further refine the prices, sometimes you would have to look at similar comparables, even if further away. From speaking to buyers, one comparison that typically comes up would be Parc Esta.

Parc Esta is a leasehold project in the same district, albeit closer to Eunos MRT. Parc Esta received its TOP in 2022. You can see the full review for Parc Esta here.

| CONTRACT DATE | ADDRESS | TYPE OF SALE | UNIT AREA (SQFT) | TYPE OF AREA | PRICE (S$ PSF) | PRICE (S$) | PURCHASER ADDRESS |

| 28 NOV 2023 | 902 SIMS AVENUE #11-11 | RESALE | 743 | STRATA | 2,168 | 1,610,000 | PRIVAT E |

| 24 NOV 2023 | 908 SIMS AVENUE #02-36 | RESALE | 635 | STRATA | 2,071 | 1,315,000 | PRIVAT E |

| 24 NOV 2023 | 914 SIMS AVENUE #09-65 | RESALE | 452 | STRATA | 2,323 | 1,050,000 | HDB |

| 22 NOV 2023 | 914 SIMS AVENUE #04-68 | RESALE | 958 | STRATA | 2,156 | 2,065,000 | HDB |

| 20 NOV 2023 | 902 SIMS AVENUE #02-11 | RESALE | 743 | STRATA | 1,986 | 1,475,000 | HDB |

| 9 NOV 2023 | 908 SIMS AVENUE #12-37 | RESALE | 635 | STRATA | 2,204 | 1,400,000 | HDB |

| 8 NOV 2023 | 906 SIMS AVENUE #13-29 | RESALE | 635 | STRATA | 2,236 | 1,420,000 | HDB |

| 27 OCT 2023 | 904 SIMS AVENUE #08-19 | RESALE | 527 | STRATA | 2,228 | 1,175,000 | PRIVATE |

| 16 OCT 2023 | 908 SIMS AVENUE #13-36 | SUB SALE | 635 | STRATA | 2,173 | 1,380,000 | PRIVATE |

| 12 OCT 2023 | 912 SIMS AVENUE #04-57 | SUB SALE | 743 | STRATA | 2,138 | 1,588,000 | HDB |

| 6 OCT 2023 | 908 SIMS AVENUE #12-39 | SUB SALE | 1,227 | STRATA | 2,266 | 2,780,000 | HDB |

| 2 OCT 2023 | 910 SIMS AVENUE #04-45 | SUB SALE | 635 | STRATA | 2,086 | 1,325,000 | PRIVATE |

| 28 SEP 2023 | 902 SIMS AVENUE #01-10 | SUB SALE | 527 | STRATA | 1,981 | 1,045,000 | PRIVATE |

| 20 SEP 2023 | 914 SIMS AVENUE #07-61 | SUB SALE | 743 | STRATA | 2,154 | 1,600,000 | PRIVATE |

| 19 SEP 2023 | 908 SIMS AVENUE #07-36 | SUB SALE | 635 | STRATA | 2,130 | 1,352,800 | PRIVATE |

| 8 SEP 2023 | 902 SIMS AVENUE #13-10 | SUB SALE | 743 | STRATA | 2,181 | 1,620,000 | HDB |

| 7 SEP 2023 | 914 SIMS AVENUE #11-64 | SUB SALE | 904 | STRATA | 2,157 | 1,950,000 | PRIVATE |

| 30 AUG 2023 | 906 SIMS AVENUE #06-28 | SUB SALE | 635 | STRATA | 2,154 | 1,368,000 | HDB |

Parc Esta is priced higher, but this is due to the easier MRT access. There’s also the advantage of not facing a highway (in any direction), and it’s nestled in the middle of a mature estate (Eunos). As such, we believe the price at Penrose should trail slightly behind this development.

Looking at the prices, we see their 2-bed, 1-bath units range between $1.315 million to $1.38 million, while the 2-bed, 2-bath units are between $1.475 million to $1.62 million. For Penrose to appreciate to these same levels, we would expect to first see Parc Esta move to a higher quantum range, and then Penrose might follow. As a result, you can say that the prices at Parc Esta represent a ceiling in the prices that Penrose would be able to attain (barring further redevelopment or land intensification in the immediate area).

As an interesting aside, it wouldn’t have been much different a year ago

| CONTRACT DATE | ADDRESS | TYPE OF SALE | UNIT AREA (SQFT) | TYPE OF AREA | PRICE (S$ PSF) | PRICE (S$) | PURCHASER ADDRESS |

| 7 NOV 2022 | 910 SIMS AVENUE #15-44 | SUB SALE | 635 | STRATA | 2,173 | 1,380,000 | PRIVATE |

| 18 OCT 2022 | 908 SIMS AVENUE #15-37 | SUB SALE | 635 | STRATA | 2,181 | 1,385,000 | HDB |

| 13 OCT 2022 | 908 SIMS AVENUE #11-37 | SUB SALE | 635 | STRATA | 2,078 | 1,320,000 | PRIVATE |

| 21 SEP 2022 | 908 SIMS AVENUE #05-36 | SUB SALE | 635 | STRATA | 2,160 | 1,372,000 | PRIVATE |

Prices during the market peak of 2022 are still quite similar to what we’re seeing today. For those who decided not to sell back then, and waited till 2023, there’s been no significant improvement.

Two more questions to help with the decision

Two of these can’t be seen from the data. First off, what are the seller’s plans for selling the unit?

In some cases, it’s very straightforward (e.g., a change in financial situation that causes them to back out). In other cases, more number-crunching may be involved. If it’s purely about profit though, then the seller (assuming they still need a home) will have to factor in the cost of renting, the cost of the next unit they’ll buy, etc.

The other is the speculative question that no one can truly answer: if you wait for another $X in profit (whatever that desired amount may be), how much longer will it take? A sub sale transaction might be an opportunity to realise profits much sooner, and sometimes the timing is what matters.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

0 Comments