8 Practical Things You Need To Know Before Starting Your Renovation In 2023

June 6, 2023

With so many new launch projects being completed in 2023, Interior Design (ID) firms are already braced for a deluge of projects. But you know who else should be getting ready for a lot of calls? CASE, because one of the hot spots between consumers and businesses is renovations (we’d say it’s just a little bit under weddings and spa packages, in fact). Sometimes it’s a failure to communicate; other times it’s just a shady ID firm. Here’s what to know before you start any renovation project in 2023:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Always complete the checks for defects before starting any reno works

If you have bought a new launch condo, always complete the checks for defects before starting any reno work. There is a Defects Liability Period (DLP) in which you have typically up to a year to report any defects that the developer will need to rectify.

However, once renovation starts, the developer can dispute whether a particular defect is their fault. They can argue that cracks in tiles, leaks, or other issues were caused by your renovations, rather than being a quality issue.

For new launches, for example, your handover documents may specify that you’re waiving the defects-free period, if you begin renovations before reporting any issues.

This is not exclusive to private housing. If you buy a BTO flat, for instance, all newly completed HDB flats are covered by a 1-year Defects Liability Period effective from the date of key collection. However, you do have to report any defects within 1 month of key collection and before your renovation works begin. If you instruct the ID firm to begin work before then, any subsequent defects will be contestable.

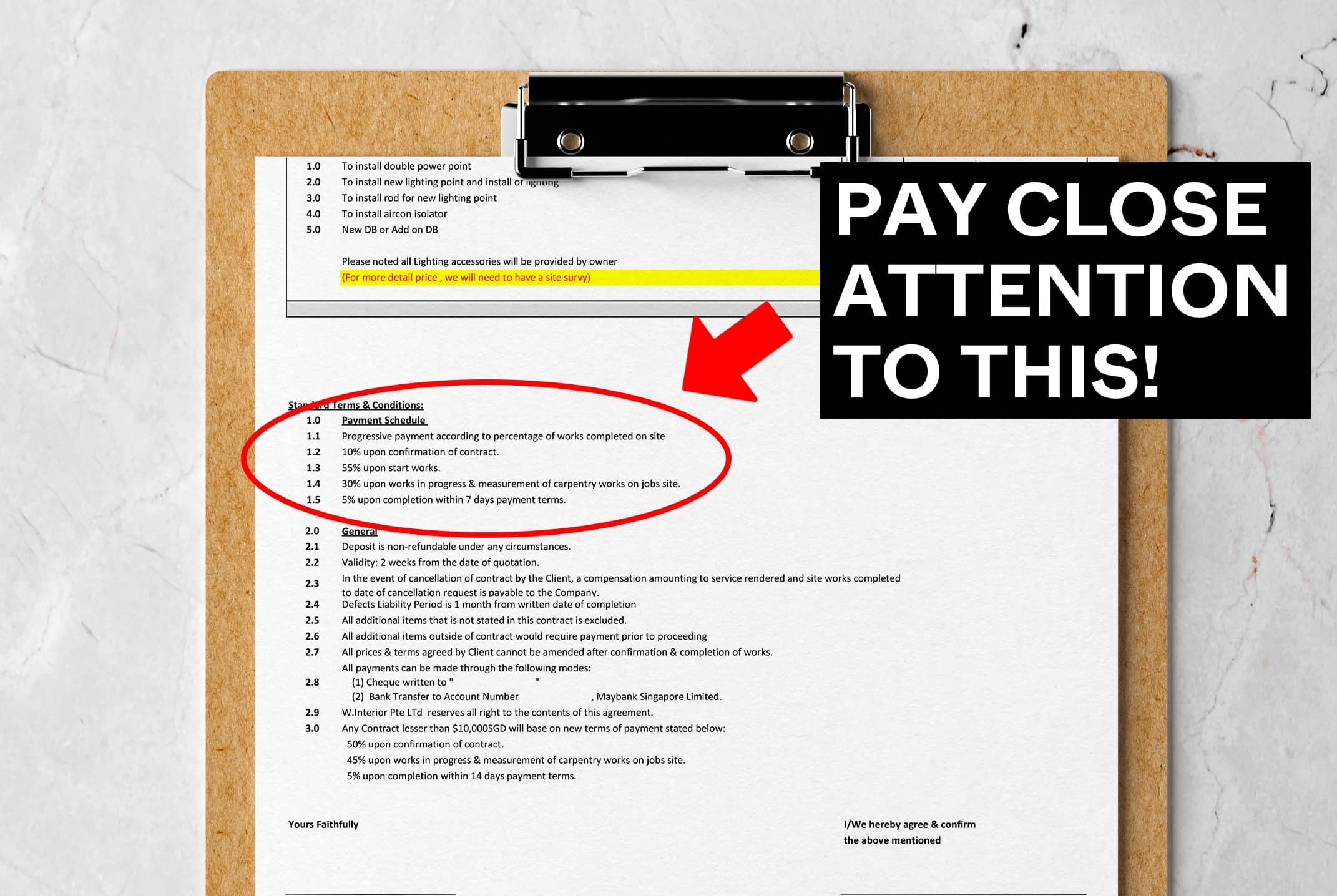

2. Plan to pay progressively, and set observable milestones

Even if you’re offered a discount, don’t ever pay for your renovations upfront. (We’ve detailed this more in this checklist before you hire any Interior Designer). This is to avoid the risk of an ID firm/contractor failing to finish the job, but still running off with your money. While rare, there have been cases of ID firms closing shop and disappearing overnight.

While that is the worst-case scenario, it also prevents you from losing the bargaining power on your end if things go south or there are too many problems with the renovation works at the end. Once you’ve already paid for the majority of the renovation, there’s little incentive for the contractor to fix issues timely (or at all), if they have other timelines to meet.

Instead, set fixed milestones such as:

- Completion of flooring

- Completion of cabinetry

- Ceiling and walls painted

And so on and so forth. This ensures that, if your renovation work is stopped partway through for any reason, you would only have paid for work done.

3. Try to avoid non-bank financing, even if it’s offered

Some firms have tie-ups with non-bank lenders, or have in-house credit. We presume these are all legally done (we’re not in a position to comment on the law), but even so you may want to think twice.

From word on the ground, we’ve heard that some of these lenders are quite confusing or opaque about their loans. Some, for instance, use a resting interest rate, and unlike a bank, they may not tell you the Effective Interest Rate (EIR). In any case, this can all lead to paying much more than you’d expect.

It’s generally best to save up and avoid using loans altogether – try to cover your renovation costs with your sale proceeds.

An important note on credit systems with installments:

Some furniture stores (we won’t name them) have package deals where they do up your whole kitchen, living room, bedroom, etc. all at once. These may come with installment payments. In most such cases, the entire cost is charged to your credit account first, and then you make installment payments on it later.

This means if something happens partway through, you cannot just stop paying – your credit company has already paid the full amount, and you need to pay them back.

Likewise, because the full amount is charged, you may reach your credit ceiling sooner than expected.

4. Ensure you have accommodations during delays

Renovation works tend to take longer than expected, even with the most experienced IDs. In severe cases (e.g., one reno firm is fired and another has to take its place), delays can stretch from days to weeks, or weeks to a whole month. This can result from many issues that are hard to control, such as delays in key material arriving, manpower issues, or MCST approval to begin renovation.

This means you should have contingency plans – such as living with your in-laws for a while, or warehousing for your bulkier items.

Reno-related delays affect landlords the most. If the tenant can’t move in because renovations are delayed, you may need to make up for it by discounting the rent, getting the tenant another room to stay, etc.

5. Don’t use an under-the-table contractor, especially if they have no insurance

One common trait among these “unofficial” contractors is the lack of licensing and insurance.

Usually, damage from reno projects isn’t covered by your insurance. For example, if the contractor drills a hole where he shouldn’t, and the pipes burst, even your neighbour may be affected. Resulting damages can be claimed – but it may have to come from the contractor’s insurer, and not yours.

At that point, you can write any number of angry letters or take your contractor to court; but if they simply don’t have the money, that still leaves you holding the repair bills/liability.

6. Highlight your unit’s weak spots for your designer to overcome

If your unit is facing the MRT track, heavier drapes can block some of the sound and vibration. If you have an older condo with big bay windows, a designer can turn it into a full-blown reading nook or study area. If you have a lot of void strata space (vertical space), a designer could devise methods like decks or floating shelves to make use of it.

Mitigating these negatives will be more important, when it comes time for resale. Whatever you perceive as a negative, future buyers are likely to see as well – so you want to demonstrate the problem is fixable.

7. Ask your designer how perennial your chosen style is

Some styles are quite niche, like urban industrial styles with cement screed and naked light bulbs everywhere; or styles that go deep into a particular theme or genre (e.g., 1950s art deco or French Rococo).

A good designer can give you a heads-up when you’re heading in a very niche direction. Unless the unit will be your forever home – or your home for several decades – niche styles are better avoided. They narrow the unit’s appeal during resale, and require subsequent buyers to do more extensive work.

More generic styles, such as Minimalist or the ever-popular Scandi look, tend to help more at resale.

8. Make sure you’ve used reno-specific financing before turning to others

Reno loan rates as of 2023 should be around 4.48 to 4.88 per cent. This will almost always be cheaper than personal loans, lines of credit, credit cards, etc.

Reno loans are capped at $30,000 or six months’ of your income, from almost every bank. If you use financing, make sure you’ve tapped this full amount first, before resorting to other, pricier loans.

There are also some homeowners who elect to use interest-free loans. For these cases, you need to estimate if your renovation can be fully paid off in six months (because interest-free loans will revert to the normal rates if you don’t pay them off by then).

If you have any doubts about the reno project you’re about to pay for, do reach out to us at Stacked. In the meantime, check out our reviews of new and resale condo unit layouts, to see what might fit your dream home.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments