6 New Launch Condos In Singapore This Weekend… Which Is The Hot Favourite?

November 3, 2024

Watch out for the “surge in private home transactions” news report soon.

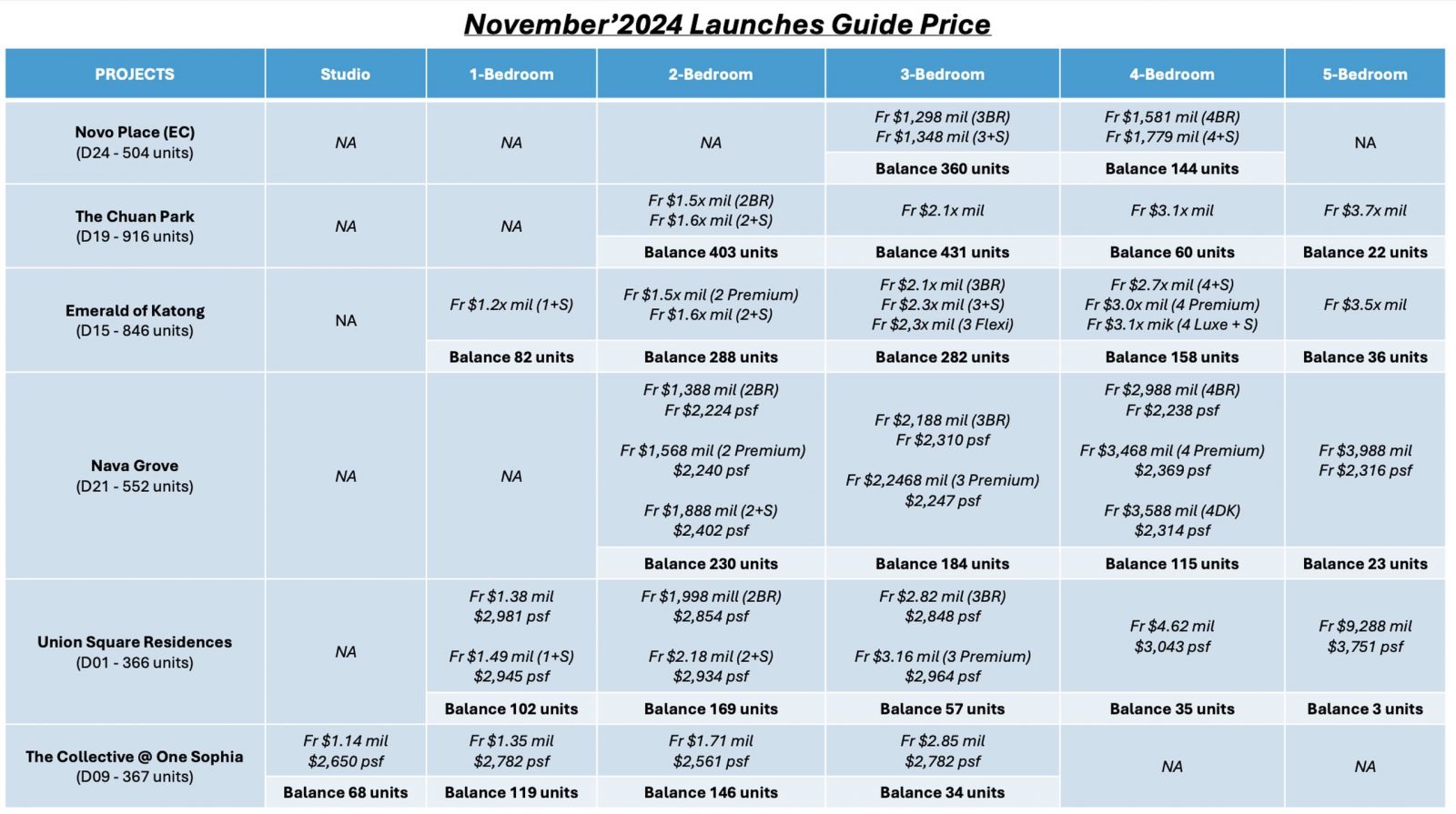

Every quarter, the local media will publish a story on private home transactions; often one that sensationalises how high or low they are, while completely ignoring the number of new launches. In light of that, I’m expecting another “OMG the private property market is going crazy” report this quarter. The reason: six new launches this November. Here’s a brief rundown, Nava Grove in D21, Union Square Residences in D1, The Collective @ Mount Sophia in D9, Novo Place in D24, and probably 2 of the most anticipated ones, Chuan Park in D19 and Emerald of Katong in D15. And if you haven’t heard, there were reportedly 2 hour long queues just to get into the show flat at Chuan Park – a combination of its mega development status, a public holiday, and being the first to launch.

Maybe the rush is just to avoid the Chinese New Year period, when the market goes into a bear-like state of hibernation. But the timing is appropriate, because you won’t see anything scarier than these prices on Halloween (that is for those who haven’t been house shopping for awhile).

For newcomers to the property market in 2024, or those who planned their upgrade five years ago, you might want to sit down for this. You’ll notice that with the exception of the new EC (Novo Place), there’s no longer a family-sized three-bedder for less than $2.1 million; the absolute lowest you’ll find is the basic three-bedder at Emerald of Katong; and I’d expect those to be snapped up pretty fast.

In any case, it’ll be interesting to see the final sales numbers after launch weekend. It’s hard to say if launching all 6 at a time is a good strategy (if anything, I highly doubt that if the developers had their way, they would have wanted such a situation), but if we were to look at it positively the buzz it generates could have created more interest for some of the less known new launches.

Given the “lottery” like ballot basis to secure a good unit, it’s probably that agents would be telling their buyers to just put down cheques for multiple developments – to see which one would hit.

I also think we’ll see a funny situation where the more affluent private buyers move fringeward, while HDB buyers move core-ward

Due to the private home prices, softening rental market, and ABSD hike on foreigners, it’s quite likely we’ll see private home buyers drift to the fringe. We might see a movement from the CCR out toward the RCR and OCR.

Conversely, the number of million-dollar flats keeps rising. Perhaps some upgraders now see older, prime region flats as a more practical choice than a $2.1 million+ fringe region condo. There’s also Prime housing schemes, which could see some lucky BTO buyers moving closer to the city centre.

More from Stacked

Are Property Valuations A Hidden Culprit In Rising Property Prices?

An often overlooked, but important, element of home loan financing is the valuation. For anyone buying a resale private property,…

So I wouldn’t be surprised if, in an odd quirk, condo buyers started shifting out to the fringe regions, while HDB buyers moved to retake more city areas or city fringe regions.

It’s not a bad thing, and I also hope the new prime housing will increase the allotment of rental housing or 2-room flats, so more lower-income residents can live near the city centre. The city centre is where demand for their work is higher. The CBD or Orchard, for example, has more need for cleaners, service workers, etc. than a fringe part of Sengkang. Being a prime area, it also means there’s a shot at higher earnings (although that probably requires government intervention). It’s good for the businesses there, and good for the workers who can live near there.

It’s one of the great ironies – not unique to Singapore – that people who most need to live near the city centre are often the ones who can least afford it.

Meanwhile in other property news…

- The new GFA harmonisation rules are great for buyers; but they can seriously distort your perspective, if you go on a price per square foot basis. This is very important to know for buyers today.

- A five-room home designed for family planning, with some clever concepts that could be “borrowed” even for smaller units.

- Novo Place is the first ever EC to appear in Tengah. If you believe in first mover advantage, this project is the epitome of it.

- Are there still three-bedder condo units below $1 million? To be frank, very few. But there are some resale ones that are $970,000 or below.

Weekly Sales Roundup (21 October – 27 October)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MEYER BLUE | $6,285,000 | 1905 | $3,299 | FH |

| KLIMT CAIRNHILL | $5,078,400 | 1432 | $3,547 | FH |

| PINETREE HILL | $3,876,000 | 1464 | $2,648 | 99 yrs (2022) |

| THE RESERVE RESIDENCES | $3,403,100 | 1335 | $2,550 | 99 yrs |

| LENTOR MANSION | $3,244,000 | 1485 | $2,184 | 99 yrs (2023) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $1,013,000 | 474 | $2,139 | FH |

| LENTORIA | $1,313,000 | 538 | $2,440 | 99 yrs (2022) |

| TEMBUSU GRAND | $1,399,000 | 527 | $2,652 | 99 yrs (2022) |

| THE LAKEGARDEN RESIDENCES | $1,411,200 | 592 | $2,384 | 99 yrs (2023) |

| HILLOCK GREEN | $1,534,000 | 624 | $2,457 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CUSCADEN RESERVE | $14,100,000 | 3757 | $3,753 | 99 yrs (2018) |

| LEEDON RESIDENCE | $7,500,000 | 2669 | $2,810 | FH |

| REGENCY PARK | $4,825,000 | 2250 | $2,145 | FH |

| ROBIN RESIDENCES | $4,700,000 | 1830 | $2,568 | FH |

| PARC PALAIS | $4,100,000 | 2799 | $1,465 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $660,000 | 431 | $1,533 | 99 yrs (2011) |

| NATURA@HILLVIEW | $700,000 | 441 | $1,586 | FH |

| EUHABITAT | $720,000 | 527 | $1,365 | 99 yrs (2010) |

| TREASURE AT TAMPINES | $784,000 | 463 | $1,694 | 99 yrs (2018) |

| HILLION RESIDENCES | $805,000 | 463 | $1,739 | 99 yrs (2013) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PARC PALAIS | $4,100,000 | 2799 | $1,465 | $2,900,000 | 22 Years |

| LEEDON RESIDENCE | $7,500,000 | 2669 | $2,810 | $2,600,000 | 9 Years |

| THE SHELFORD | $3,080,000 | 1184 | $2,601 | $2,033,634 | 22 Years |

| THE METROPOLITAN CONDOMINIUM | $3,050,000 | 1733 | $1,760 | $1,690,100 | 18 Years |

| HOLLAND MEWS | $2,718,000 | 1270 | $2,140 | $1,668,000 | 20 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY RESIDENCES | $2,420,000 | 1055 | $2,294 | -$436,880 | 15 Years |

| SEASUITES | $1,080,000 | 667 | $1,618 | -$65,000 | 12 Years |

| THE ROCHESTER RESIDENCES | $1,350,000 | 872 | $1,548 | -$18,112 | 17 Years |

| ILLUMINAIRE ON DEVONSHIRE | $968,000 | 441 | $2,193 | $12,000 | 14 Years |

| AURA 83 | $808,000 | 484 | $1,668 | $14,200 | 12 Years |

Transaction Breakdown

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the new condo launches in Singapore this weekend?

Why is there a surge in private home transactions in Singapore?

Are there affordable three-bedroom condos available in Singapore now?

How might the new launches affect the property market in Singapore?

What recent trends are seen in Singapore's property resale market?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments