5 Upcoming New Launch Condos To Watch Out For In 2025 (One Is A 1,193-Unit Mega Development)

November 20, 2024

While there was a bumper crop of 6 new condos launched in early November, a large majority of the choice units have already been snapped up. If you’ve missed out on a good ballot number (or even if none of the current options appeals to you), more are coming up in 2025. Some are in pretty notable locations and here are some of the ones to pay attention to, if your house hunting is starting soon:

| Upcoming project | Location | Region | Tenure | No. of Units |

| ELTA | Clementi Avenue 1 | OCR | 99-year leasehold | 501 |

| Lentor Central Residences | Lentor Central | OCR | 99-year leasehold | 477 |

| Parktown Residence | Tampines Avenue 11 | OCR | 99-year leasehold | 1,193 |

| The Orie | Lorong 1 Toa Payoh | RCR | 99-year leasehold | 777 |

| Zion Road Parcel A | Zion Road | CCR | 99-year leasehold | 740 |

| Zion Road Parcel B | Zion Road | CCR | 99-year leasehold | 610 |

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

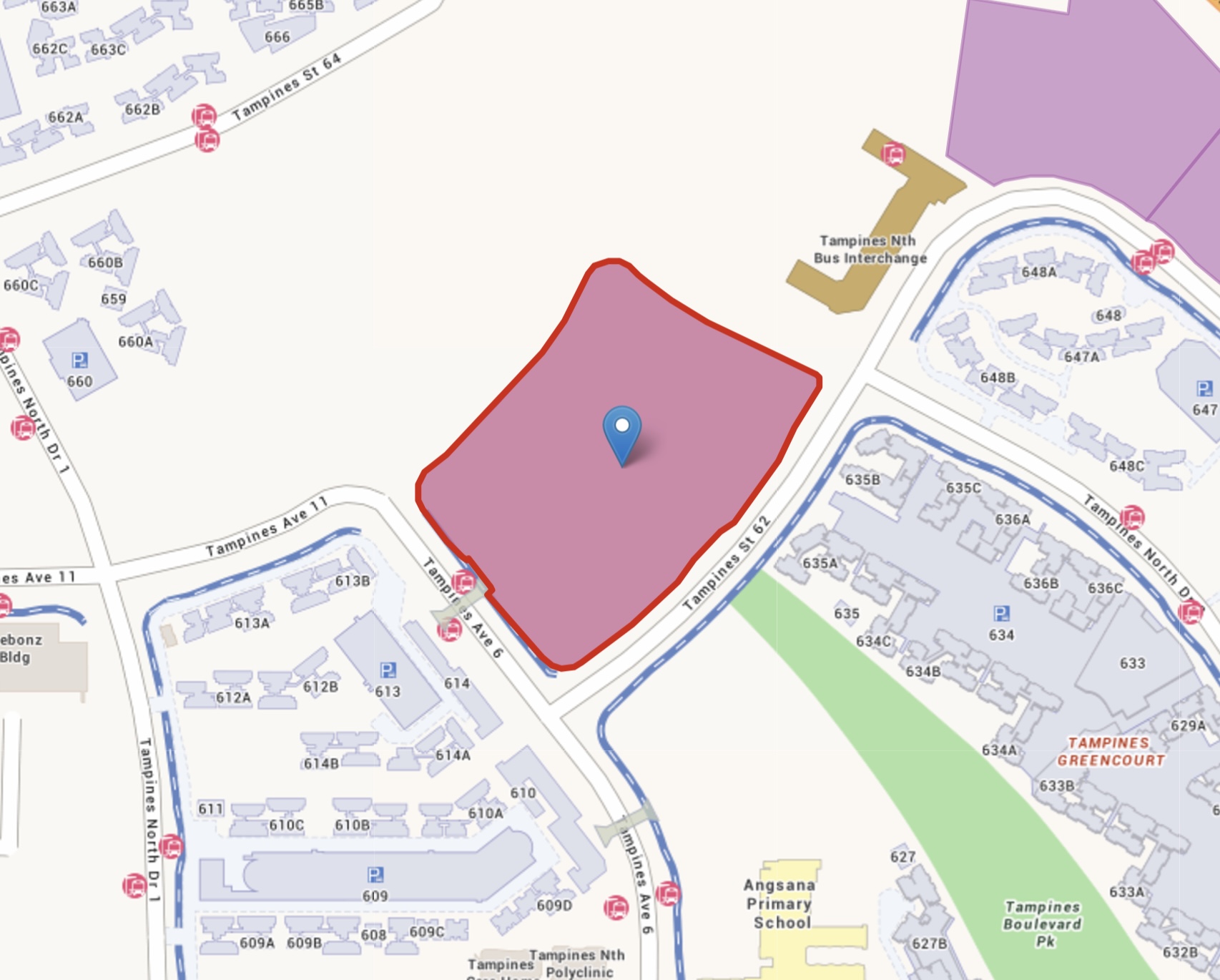

1. Parktown Residence

Parktown Residence will be the largest project in the first half of 2025, with 1,193 units (especially notable because Singaporeans love their mega-developments). Parktown is also an integrated project, the first of its kind in Tampines with a retail mall PARKTOWN Tampines, a bus interchange, a community club, a hawker centre, and direct connectivity to the upcoming Tampines North MRT station (CRL). This condo won’t be in Tampines Central though, but rather in Tampines North (near Tampines Avenue 11, just across from Angsana Primary School).

Tampines North is a relatively new township, quite distinct – but close to – Tampines Central. Most Singaporeans will know this area as the place where Tampines IKEA, Courts, and the Giant Hypermarket are clustered. The immediate surroundings of Parktown will be a rather new HDB enclave, which does include some amenities like coffee shops and an NTUC. As the area is quite new though, it may be a while before the whole slew of heartland amenities appear.

Note that URA planning shows potential for 17,000 new flats and 4,000 new private homes for the area in general, so what you see today is just the start. This bodes well for resale prospects, as there might be a sizeable number of HDB upgraders in future.

Parktown itself will add to the area’s amenities, being an integrated project. We don’t yet know what the commercial element is like, but it does mean the area has no shortage of conveniences: the cluster of IKEA, Courts, and Giant, along with the HDB enclave, presents a lot of options.

In any case Tampines North is just one stop from Pasir Ris MRT, which provides access to White Sands Mall and Pasir Ris Mall; from Pasir Ris interchange it’s just one stop to Tampines Central. There are also bus services that go from here to Tampines Central, if you don’t want to bother with changing trains.

The site was bought at S$1.206 billion or S$885 psf ppr in July 2023, and the 99-year leasehold plot spans a total site area of 545,511 sq. ft. Being a mega-development, facilities should be more extensive than usual. The developers are also three well-established names: a 50-50 joint venture between a UOL-SingLand consortium and CapitaLand Development.

As with many mega-devs, there’s also the likelihood of lower costs and maintenance fees; and we’ve heard that prices could even be around $1,9XX psf (note, this is just current speculation). This is lower than current new launches, where prices have typically exceeded $2,300 psf. The expected TOP is 2028.

For upgraders, this is definitely the East-side property to watch for next year.

2. ELTA

This mid-sized condo may be the pick of the bunch for 1H 2025 launches when it comes to school access. Elta is at Clementi Avenue 1, right next to the NUS High School of Maths and Science, and across the road from Nan Hua High School.

Elta is a mid-sized project with 500 units, and there’s a developed HDB enclave nearby. There are actually two Sheng Siong supermarkets in the direction of block 420A, while West Coast Plaza is also close by. West Coast is not the biggest mall, but it does provide retail, dining, and a Cold Storage for daily needs. Clementi Ave 2 Shopping Centre, an HDB-run retail hub, is also within the vicinity.

Elta does seem quite far from MRT stations though, so it’s likely you’ll need a bus connection to get to Clementi MRT and the adjoining Clementi Mall. Nonetheless, we expect high demand due to the school access, and because Clementi Mall isn’t actually too far away, even if you need a bus.

That being said, do note that Clavon and Clement Canopy are neighbouring condos that are still new (Clavon will be closer in age). This could provide some competition for tenants or at the point of resale, due to the similar advantages of location and being so close in age.

The expected price for Elta is in the range of $2,5XX psf or more.

More from Stacked

Pinetree Hill Review: 88% Land For Facilities + Unblocked Views In Ulu Pandan

Let me just start by saying that Ulu Pandan is not typically a place that would come to mind for…

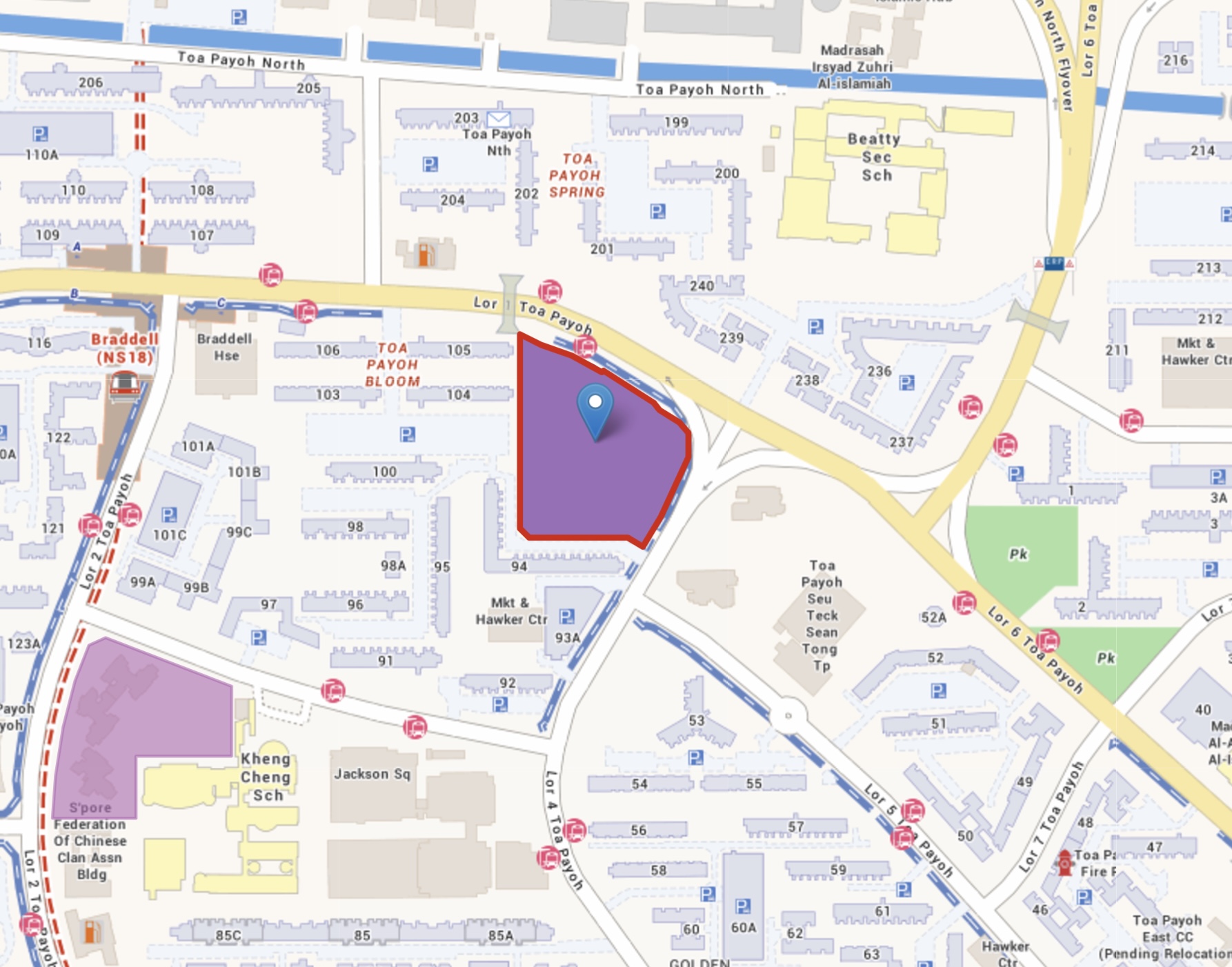

3. Orie

One of the better-located condos to date, Orie is within walking distance of Braddell MRT (NSL). This RCR project is one stop from Bishan or Toa Payoh in either direction, both of which are major hubs. Junction 8 Mall in Bishan, as well as the Toa Payoh Hub, mean almost any amenity you need is nearby.

Alternatively, the surrounding HDB enclave is mature and has a good range of coffee shops, minimarts, bakeries, etc. Orie is also near the Toa Payoh West Market & Food Centre, so you have a sizeable hawker centre and grocery options nearby.

The Orie is a big development with 777 units, and it’s likely to ride the wave of pent-up demand. There hasn’t been a new launch here since GEM Residences back in 2015, and surrounding condos like Trevista and Trellis Towers are much older (built in 2011 and 2000 respectively).

Due to the convenient RCR location, the estimated price tag is looking steep, at around $2,7XX psf. In spite of that, we expect quite a bit of interest – the ageing HDB enclave could provide a slew of long-awaiting upgraders.

4. Lentor Central Residences

Next to the already-launched Lentor Modern, this mid-sized (477-unit) project benefits from proximity to its neighbour. Lentor Modern is integrated, so Lentor Central Residences will also benefit from any retail or dining in its fellow project. Likewise, there’s close walking access to Lentor MRT (TEL).

Lentor Central is also surrounded by Lentor Hillock Park, providing a decent greenery view, as well as park space for families. There’s also direct bus access from here to Yio Chu Kang MRT (NSL), which is about two stops from Bishan.

The main concern with Lentor is the sheer number of launches we’ve seen, in a relatively short time; and competition could be intense between all the recent projects here. So while it is an up-and-coming area, it may not be as attractive to landlords, or to more investment-oriented buyers if you are looking for an early exit.

For this project, a lot will come down to how well it measures up against its peers, in particular Lentor Modern (which is arguably the “rock star” project of this area). So we’ll have to wait for more information and see how it differentiates itself.

From what we’ve heard, there are expectations of a price point of about $2,1XX psf for this project.

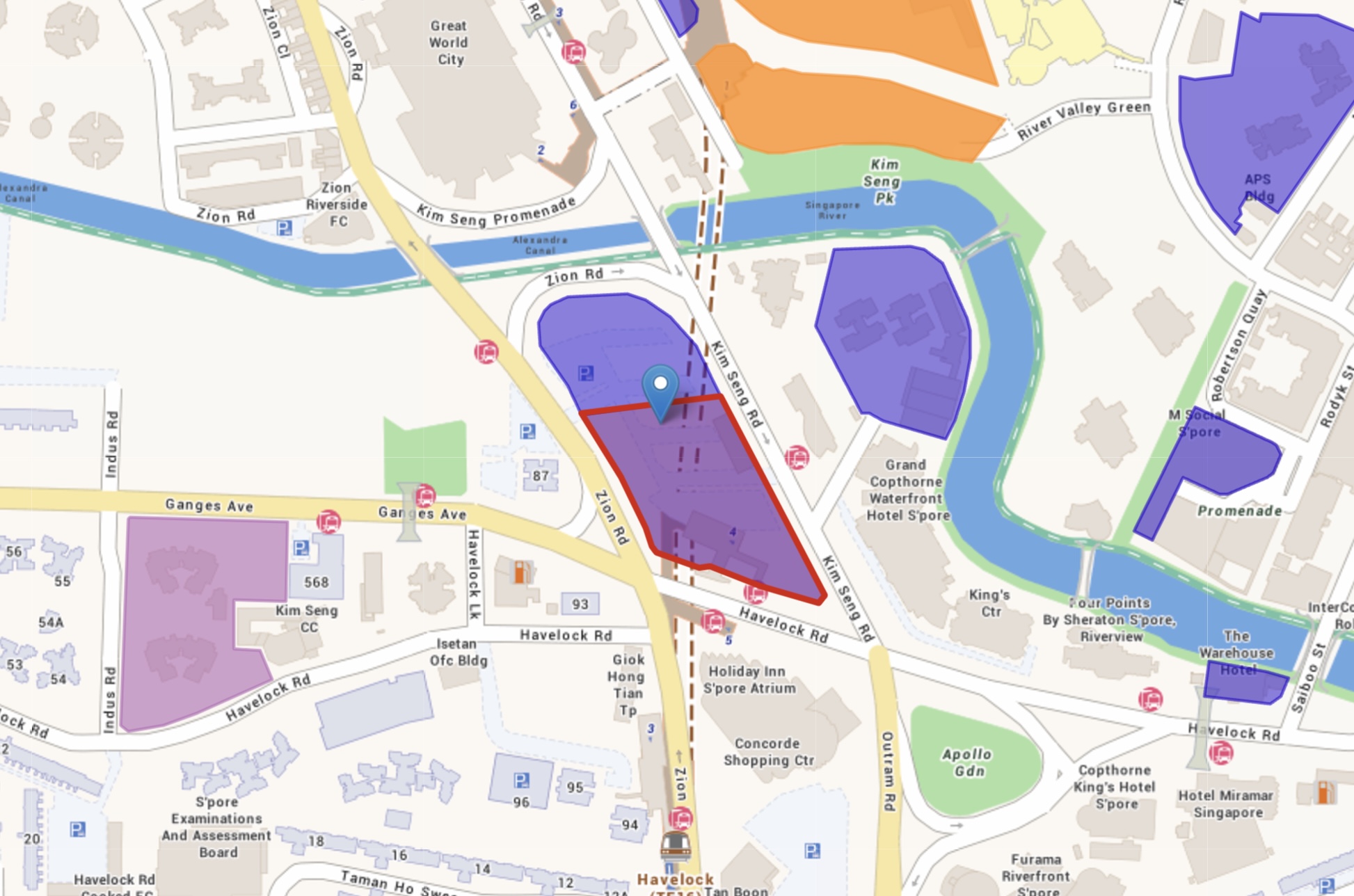

5. Zion Road Parcels A and B

These neighbouring plots have a strong location, but the Government may be unhappy about the low winning bids.

In April, Parcel A drew a joint bid (headed by CDL) for $1.1 billion, which translated to around $1,202 psf. This was sub-par for the prime Zion Road location. The reason mainly came down to a requirement for a new type of long-stay service apartment, which developers have been quite reluctant to take on. Recalcitrant bids aside, Parcel A is next to Great World City Mall, as well as the Great World MRT station (TEL). This is just one stop from Orchard Road, so whatever condo appears here is bound to be in the luxury segment. Shopping and dining options are abundant here, and another major draw will be proximity to the Alexandra Park Connector, and the view of the Singapore River.

In short, we wouldn’t get our hopes up over a lower launch price, just because the bid was lower; nothing this close to Orchard comes cheap. We’d still expect to see something in the range of $2,7XX psf.

CDL has mentioned that, for parcel A, the likely project will be mixed-use, with 740 residential units, 290 long-stay service apartments, and a retail podium.

The nearby Parcel B didn’t have the requirement for long-stay service apartments. This parcel was won by Allgreen, at a price of over $730 million (about $1,304 psf), with the higher price point showing just how much developers don’t want to be involved in the service apartment game. We’re expecting about 610 new units here, with locational advantages similar to Parcel A. More details are still to come – but the project here is likely to benefit from the same retail podium of its neighbour.

The performance of the condos here will be closely watched, as market analysts are curious as to whether we’ll see a recovery in the CCR. As we’ve pointed out in this article, the CCR has taken a hammering of late, with a combination of 60 per cent ABSD on foreigners, plus ever-present fears of an increasingly volatile economy in 2025.

Strong demand for the Zion Road parcel projects might signal a turnaround, while a muted performance would suggest that recovery is still far off.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

2 Comments

I found your insights on the upcoming new launch condos exciting! The prospect of the 1,193-unit mega development is particularly intriguing. It’ll be interesting to see how these projects cater to the evolving needs of buyers in 2025. Thanks for sharing this valuable information! Looking forward to more updates.

can give me a call at 98731069