5 Dirty Truths About The Singapore Property Market You Should Know About In 2024

May 27, 2024

While regulations on property agents have been tightened, there are a lot of players in this industry – from mortgage brokers down to the developers themselves. Everyone has a vested interest in something, and some of the deals between them are hard to detect. It’s also true that not all of these directly impact buyers and sellers (the most common defence that’s used to justify them), but you may still be affected in small ways. Here are some of the things going on right now:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Landlords holding onto rental deposits

One of the biggest issues for people renting in Singapore is the aftermath once the rental tenure is done. Often, if the tenancy agreement isn’t done clearly enough, many grey areas can be argued over. For example, regarding issues of wear and tear or things that weren’t documented before the tenancy agreement was signed.

Disputes often arise over the condition of the property and the responsibility for repairs. Tenants might find themselves unexpectedly liable for damage they consider normal wear and tear, such as minor scuff marks on walls, small scratches on floors, or slight discoloration of kitchen countertops due to regular use. Without explicit clauses in the tenancy agreement defining what constitutes acceptable wear and tear, landlords might argue that these issues require repairs or replacements.

A common problem is when items like plumbing fixtures, appliances, or air conditioning units, which may naturally deteriorate over time, are deemed the tenant’s responsibility to fix or replace. If these items weren’t thoroughly documented in their original condition before the tenancy started, the tenant could be unfairly blamed for pre-existing issues.

The biggest challenge, however, is the control landlords have over the rental deposit. In Singapore, landlords keep the rental deposit and have the discretion to deduct amounts for repairs or replacements first. This can sometimes be very unfair as they might obtain inflated repair quotes because they don’t perform cost comparisons—after all, it’s not their money being spent. They might also seize the opportunity to repair or replace items that don’t genuinely need it, just to refresh their property at the tenant’s expense.

For example, a landlord might decide to replace an entire carpet due to a small stain, using a premium service to do so, even if a simple cleaning would suffice. Similarly, they might choose to repaint the entire apartment over a few minor scuff marks or replace an ageing appliance that was already nearing the end of its useful life when the tenant moved in.

As such, the tenant is often at a disadvantage in these situations. The process of reclaiming the security deposit can be cumbersome and time-consuming and really, the only recourse here would be the Small Claims Tribunal (SCT). Sometimes the effort required to challenge unfair deductions is simply not worth it, especially if you have already moved out of the country. The logistical difficulties of handling disputes from abroad often result in tenants abandoning their claims, allowing landlords to retain more of the deposit than is justifiable.

Can anything be done? Well, in some other countries, the rental deposit is handled by a reputable third party instead. There are also companies that look to make the rental process easier and fairer by documenting the place thoroughly before (and helping with the TA).

2. Property valuations

We’ve spoken about this before, but in a nutshell, you may be surprised to learn that property valuations in Singapore aren’t always a very straightforward case.

For example, sometimes property valuations can be pushed up if the bank is trying to increase their market share – so they can afford to be a little more “relaxed” in the property value to get you as a customer. We can understand why valuing property can be difficult sometimes (especially for smaller condos where transactions are sparse), but it still seems a little disconcerting that you can get a higher property value just from shopping around.

Another unusual practice in Singapore is how banks determine property values for new launches. When a developer sets the initial selling price for a new property, banks automatically accept this price as the property’s value when granting loans. This means that if a developer sets an exorbitantly high price at the launch, buyers can still obtain a loan for that amount, even if only a few units are sold.

However, if the developer later drops the prices significantly a few months after the launch, the banks will then use this lower price as the new property value. While it doesn’t really impact anyone (other than the earlier buyers), it is a strange concept to wrap your head around.

More from Stacked

A DIY Condo Renovation Journey: How A Creative Couple Self-Designed Their Home (And Furniture)

When Jo Ann (@home.by.teo) first saw their would-be home, you could say it was already love at first sight.

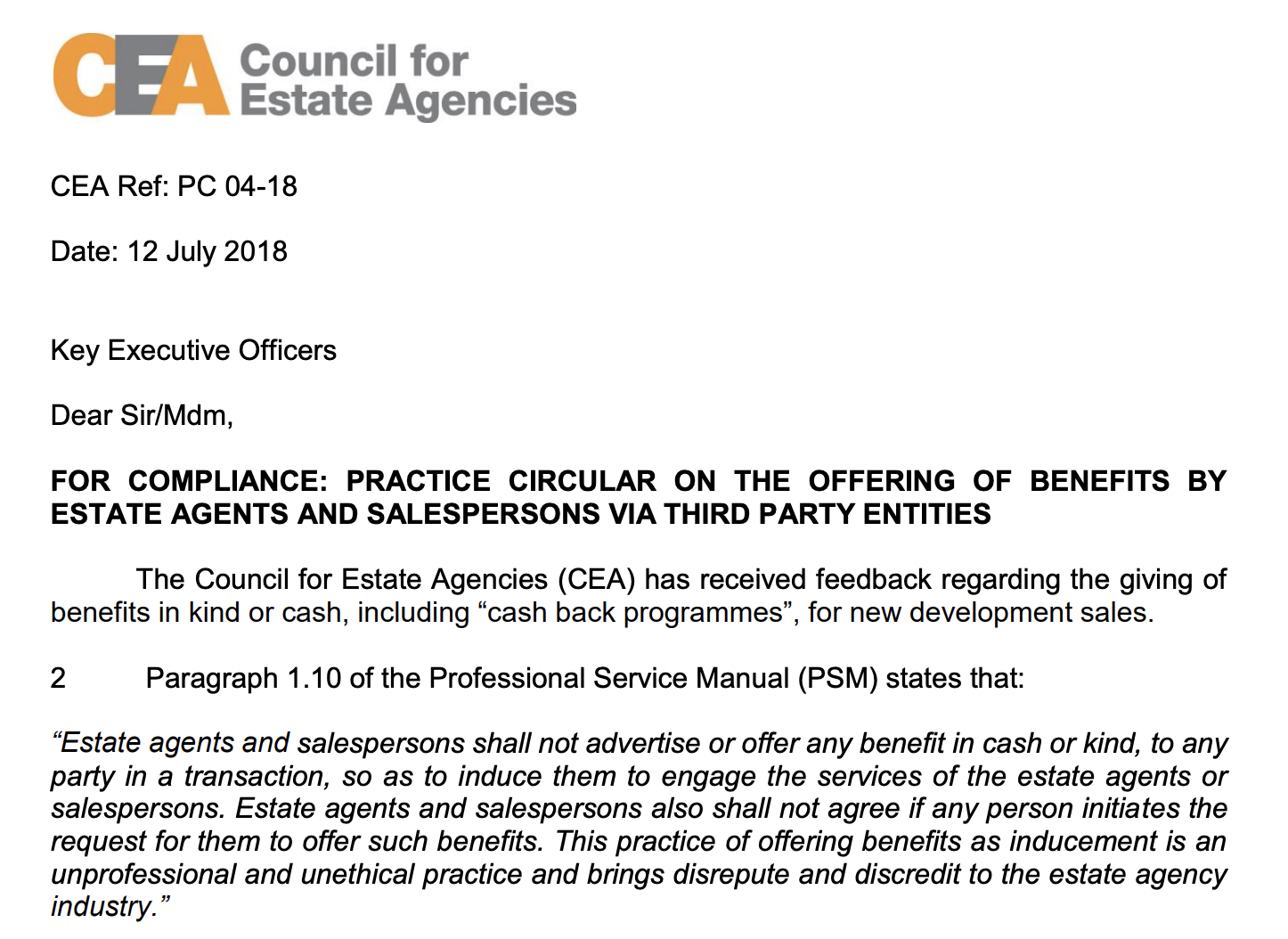

3. Agents paying some of the commissions to buyers

Some property agents agree to give part of their commission to a buyer, to close a sale. This typically happens for new launches given their higher commissions, and usually involves more exotic, hard-to-move units like penthouses. If a project is close to its ABSD deadline, for instance, and there’s only one or two penthouses to move, an agent’s commission can end up being as high as eight per cent or more.

Realtors aren’t the only ones making this arrangement happen: some buyers, who are clued in on this, even actively ask the agents for such deals. The kickbacks from the agent are easy to disguise (e.g., they can even come from the agent “purchasing” something from the buyer’s unrelated business).

This may seem like a win-win arrangement, but it isn’t for the wider market. For starters, it creates a distorted sense of price movements in the wider market. Too much of this activity makes property prices appear to surge, as the kickbacks aren’t reflected in the transaction history.

Given that both the buyer and the agent may be in on it, however, it’s tough to spot these arrangements; neither party has an incentive to inform the authorities unless the relationship goes south.

4. Agents refusing to pass on offers because they feel it’s too low

In one of the cases we’ve heard of lately, a buyer found their condo was unusually slow to sell. They only found out what was happening after a buyer’s agent managed to call them directly and ask if they would lower their asking price by $55,000.

The curious part was, that the offer was already above the price they had instructed their agent to accept. This was how they discovered the agent hadn’t been fully conveying all the offers to them; the agent wanted a higher commission from the sale and didn’t ask for permission to raise the price.

You might be wondering what the harm is, as in the end they got paid more for their unit; but time is crucial to some sellers. You would probably be angry if you had to rent a home for another six months, because your agent wanted to push things and get a higher fee; not to mention issues like your children’s school enrolment (you may not be able to get the new address o time), or your ABSD deadline if upgrading.

5. Agents refusing to co-broke, thus delaying your home sale

This is probably the aggravating issue in the property market right now; and what makes it worse is how some rules are openly flaunted. Because the seller’s agent has to split their commission with a buyer’s agent (co-broking), many simply refuse to pick up the phone when another agent calls. They only want to deal directly with buyers.

CEA has already specified this is illegal, and property agencies tell it to their realtors all the time. But it still happens regularly, as it’s just too hard to detect. This also has a very direct impact on buyers and sellers:

Buyers’ agents struggle to get their clients better options, while sellers may be losing out on much better offers. It also drags out the amount of time it takes to sell a home, which can result in serious opportunity costs. Unfortunately, there’s not much that can be done, unless penalties get harsher or the authorities commit more to investigations.

Ultimately, if your realtor is taking an unusually long time to transact – or is making some odd suggestions, like kickbacks – it may be a sign you need to switch. Even if the shenanigans seem to be in your favour, remember that someone willing to do these things probably shouldn’t be high on your ladder of trust.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are common issues with rental deposits in Singapore's property market?

How are property valuations determined in Singapore, and can they be manipulated?

Do property agents sometimes give part of their commission to buyers?

Why might property agents refuse to pass on offers from buyers?

What issues arise from agents refusing to co-broke in property transactions?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments