34 New Launches Most Likely To Have Developer Discounts

May 16, 2020

You might have seen this recent article on developer prices:

“Half of developers likely to cut prices of Singapore new launches.”

While it sounds like developers are going to be releasing developer discounts soon, a closer read reveals that these were just sentiments recorded by participants in the survey.

So according to the Real Estate Sentiment Index (Resi) published by the National University of Singapore Real Estate (NUS+RE), the index has hit a record low of 3.2 in the first quarter of 2020.

Which basically means sentiment is low, as any score below 5 indicates poor conditions.

But what about their expected outlook on prices?

Well, half of those surveyed expected new launch condo prices to be maintained over the next 6 months.

The other half predict that prices are likely to be substantially or moderately lower in the next 6 months.

And of that, about 54 per cent projected that new launch sale prices would decline by 2 to 5 per cent in 2020 – while 46 per cent think prices would decline by 5 to 8 per cent.

So you may be surprised to hear that developers in Singapore still managed to sell 277 new condo units in April despite the strict circuit breaker measures.

In other words, despite the severe limitations of closed showflats and no viewings – selling 277 units is no mean feat at all.

But on the other hand if you were to compare it to last April 2019, this has dropped by 62.4% from 737 units previously.

With the way the Covid-19 situation has been developing, the drop in sales volume is surprising no one.

Developments with developer discounts

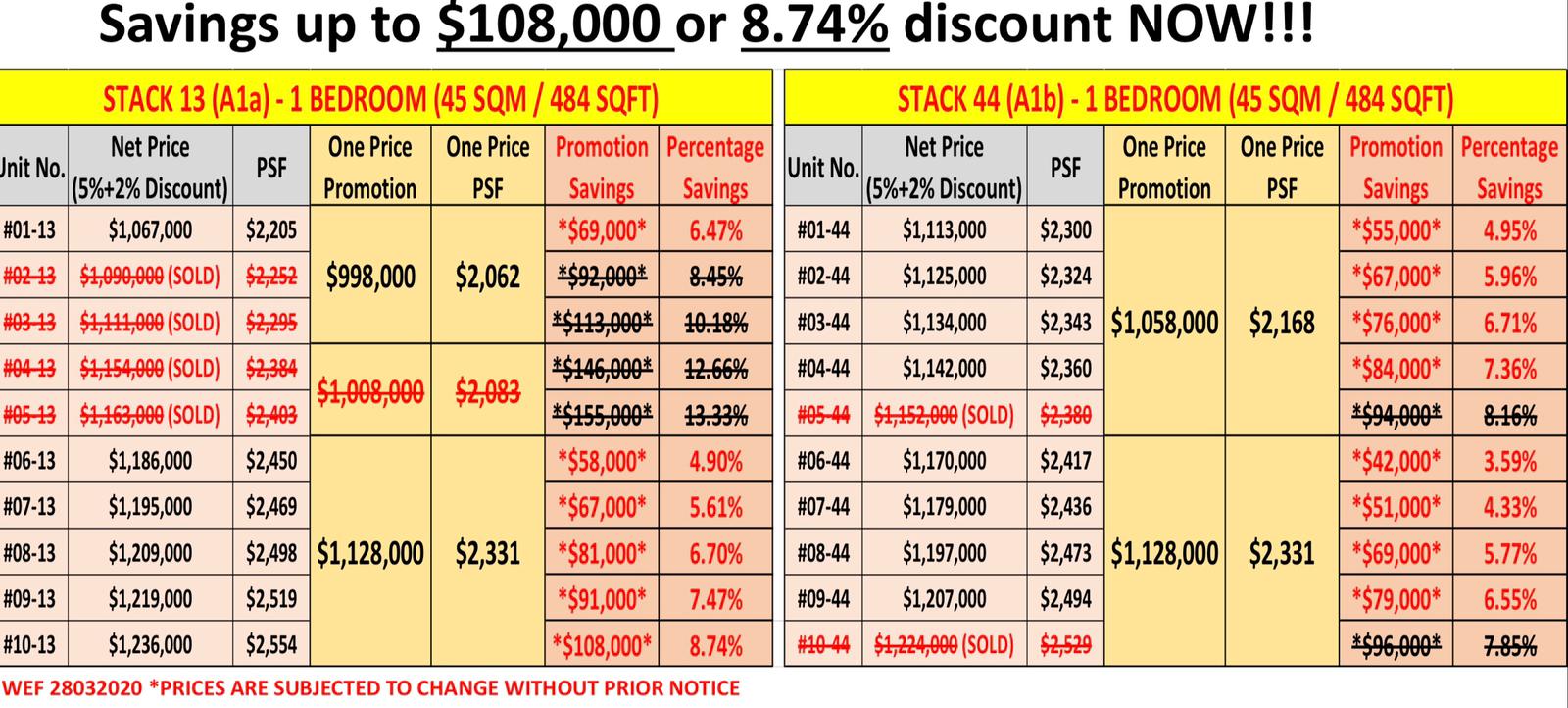

We’ve already started to see some early developer discounts from our new launch price list.

But if you’ve been looking for some really attractive developer discounts – that hasn’t really materialised yet.

Most of the discounts that we’ve seen so far are for “star buy” units, so units that are usually hardest to sell (bad facing, noisy, low floor) are being pushed out.

Developers have also been handed a helping hand from the Government, with listed Singapore developers getting exemption from the QC scheme, and a six month extension for the sale of housing units in terms of ABSD remission and QC scheme.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

5 Old But Freehold & Spacious 3 Bedroom Units

Old is gold, or so they say.

But moving forward, it is likely to expect to see some more developer discounts from certain new launches.

We’ve decided to identify those developments that are most likely to feature developer discounts soon, and we’ve set them apart based on a combination of factors:

- Large developments – more units, more liability come closer to TOP date

- High profit margin – more room for discounts

- Poor sales – developers need to sell 30% of a development before obtaining their loan to proceed with construction from the bank

Developments With High Profit Margin And Less Than 30% Take Up Rate

| Project Name | Current Selling Price | Launch | No of units | Take up rate | Est Margin |

| The Lilium | ~$2,100 | May 2019 | 80 | 1.30% | 30.75% |

| Petit Jervois | ~$2,800 | Nov 2018 | 55 | 3.60% | 47.85% |

| Urban Treasures | ~$1,950 | Nov 2019 | 237 | 8.90% | 21.06% |

| Meyerhouse | ~$2,600 | May 2019 | 56 | 8.90% | 26.72% |

| Sloane Residences | ~$2,800 | June 2019 | 52 | 9.60% | 30.80% |

| Wilshire Residences | ~$2,450 | Apr 2019 | 85 | 11.80% | 32.58% |

| Meyer Mansion | ~$2,750 | Sep 2019 | 200 | 17.50% | 44.97% |

| Haus on Handy | ~$2,900 | Jul 2019 | 130 | 17.60% | 24.07% |

| Van Holland | ~$2,950 | Jan 2020 | 69 | 20.30% | 33.66% |

| Nyon | ~$2,150 | Mar 2019 | 92 | 22.80% | 24.80% |

| Dunearn 386 | ~$2,500 | Jul 2019 | 36 | 22.90% | 32.46% |

| Uptown @ Farrer | ~$1,800 | Sep 2019 | 116 | 24.10% | 22.83% |

| The Iveria | ~$2,600 | Nov 2019 | 60 | 25.50% | 31.43% |

| Daintree Residence | ~$1,600 | July 2018 | 327 | 28.70% | 23.27% |

| RV Altitude | ~$2,900 | Jan 2019 | 140 | 29.30% | 28.67% |

*It’s worth noting that for Van Holland, The Iveria, and Meyer Mansion were all launched quite recently hence the lower take up rate.

**We’ve also taken out GuocoLand projects like the Avenir and Midtown Bay as traditionally they have a history of not doing much developer discounts for their projects.

Property Market CommentaryGuocoLand Developer Review: A Detailed Look And Analysis

by Reuben DhanarajLarge Developments With Less Than 30% Take Up Rate

Project Name | Current Selling Price | Launch | No of units | Take up rate | Est Breakeven | Est Margin |

| Treasure @ Tampines | ~$1,350 | Mar 2019 | 2200 | 49.10% | $1,113 | 20.04% |

| Parc Clematis | ~$1,600 | Aug 2019 | 1,765 | 41.90% | $1,312 | 22.94% |

| Avenue South Residence | ~$1,950 | Sep 2019 | 1125 | 44.10% | $1,641 | 18.77% |

| The Jovell | ~$1,200 | Sep 2018 | 428 | 28.00% | – | – |

| Riviere | ~$2,800 | May 2019 | 452 | 12.10% | $2,321 | 25.98% |

| Fourth Avenue Residences | ~$2,400 | Jan 2019 | 476 | 24.20% | $2,059 | 17.00% |

| Midwood | ~$1,600 | Oct 2019 | 570 | 5.00% | $1,598 | 3.13% |

| Dairy Farm Residences | ~$1,550 | Nov 2019 | 589 | 8.30% | $1,355 | 14.39% |

| Leedon Green | ~$2,700 | Jan 2020 | 672 | 6.60% | $2,444 | 11.42% |

*We’ve included Treasure @ Tampines, Parc Clematis, and Avenue South Residence despite all 3 having surpassed the 30% unit sold requirement mark to proceed – primarily because of the sheer number of units these developments have to move.

Small Developments With Less Than 30% Take Up Rate

| Project Name | Current Selling Price | Launch | No of units | Take up rate | Est Breakeven | Est Margin |

| Cuscaden Reserve | ~$3,500 | Sep 2019 | 220 | 2.10% | $3,131 | 9.71% |

| Pullman Residences | ~$2,750 | Nov 2019 | 348 | 2.40% | $2,503 | 9.87% |

| The Gazania | ~$2,000 | May 2019 | 250 | 9.60% | $1,856 | 11.64% |

| Juniper Hill | ~$2,800 | May 2019 | 120 | 10.40% | $2,502 | 12.31% |

| The Antares | ~$1,750 | Sep 2019 | 265 | 12.80% | $1,608 | 9.83% |

| The Hyde | ~$2,900 | May 2019 | 117 | 13.70% | $2,600 | 11.54% |

| Casa Al Mare | ~$1,500 | Aug 2018 | 49 | 28.60% | – | – |

| RoyalGreen | ~$2,700 | Oct 2019 | 320 | 19.30% | $2,643 | 3.63% |

| ParkSuites | ~$1,900 | Feb 2018 | 119 | 20.20% | – | |

| Coastline Residences | ~$2,600 | Apr 2019 | 140 | 20.80% | $2,150 | 15.72% |

Any developments that you feel we’ve missed out? Feel free to reach out to us at stories@stackedhomes.com or comment below!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are developers in Singapore offering discounts on new condos now?

Which types of new condo projects are most likely to have developer discounts?

How has the COVID-19 pandemic affected new condo sales in Singapore?

What is the current sentiment about property prices in Singapore?

Are there any government measures supporting developers during this period?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

61 Comments

Hi Sean, saw Daintree in the list with 23% margin and was wondering what about View at Kismis which is selling around 1650psf. Any views on this project? Appreciate it.

Hi Kelvin! Thanks for your question, will drop you an email on our views for View at Kismis 🙂

Hi Sean, would love to hear your views on view at kismis as well. Can you drop me an email to share as well?

Thank you so much in advance.

Hi Kelly, sure we’ll drop you an email. Thanks!

Hi Kelly, make it three 🙂 Thank you very much

Hi Andrew, will drop you an email too, thanks

Hi there,

Please share with me too, thanks Sean 🙂

Hey! Sure will drop you an email

Hey Sean thanks for the list. I’ve been looking at Meyer Mansion for some time (> 14 floor) but pricing is a little too high. Saw that the take-up rate quite low and the margins quite high, any thoughts on this project? Thanks.

Hi Choo Ting, indeed Meyer Mansion has been priced higher (avg $2800 psf) due to its proximity to the city centre. A more affordable and ready alternative would be Coastline Residences which is in the ballpark of $2500psf and will achieve TOP status earlier in end-2022 (vs 2024 for MM). Kindly contact me at 88036257 for more information.

Hi Choo Ting, will drop you an email with more info. Thank you.

Any chance of Dairy Farm Residences having discounts soon? Have been eyeing this for a while. Thanks.

Hi Oliver, dropped you an email. Thanks!

Hi Sean, I saw the markup % for Jadescape is more than 30%. What is your view on the appreciate over the next few years? Is the selling price tomorrow price?

Hi Terry, have dropped you an email. Thanks!

Interested to hear your view too. Thanks!

Any chance Parc Clematis will have discounts? What are your thoughts on this project?

Dropping you an email. Thanks!

Hi Sean, whats your opinion on Penrose and Clavon, which one do you think is a better buy and why ??

Sincerely appreciate your kind sharing.

Hi John, will drop you an email. Thanks!

Hi sean! Will like to hear your views about clavon too. Many thanks!

Hey Leanne! Thanks for your request! As we don’t have much info on Clavon yet, we’ll just be shortlisting it in our condo review pipeline 🙂

Thanks Sean. I didn’t see JadeScape in this list while i thought their estimated margin is high. Any reason?

Hey David. The reason it’s not there is that it’s >30% sold already 🙂

Hi Sean, do you think we should not buy now, wait for developer discount?

Hi Lyndy, we think of discounts as a bonus. It’s better to see developments based on value first. With discounts, it’s really a gamble – if you’re targeting a well-selling project that isn’t forced into the corner, how sure would you be that the developer will issue discounts and your choice unit would still be available by then?

Do you think there’ll be discounts for Leedon Green? The margin seems pretty low and they launched not long ago..

Hi Georgina, will drop you a PM on this. Thanks!

Hi Georgina, the developer has an ongoing promotion for selected units (different unit types, mid-floor and below) with a discount of about 2%. However, do note that when purchasing new condo developments, you will always get the best price when you buy it during the launch phase (and within a year of launch). At the same time, you have a bigger pool of units to shortlist and ultimately choose. You may have seen some developers offering say 5% discount for a development some years after launch but do not forget the earliest buyer had already bought them say 8-10% lower. Kindly contact me at 88036257 for more information.

Hey Sean,

I’m sorry if I miss it, but did you also do a list on projects approaching their 5 years time limit with good num of inventory left to sell?

Hey David! The list here includes projects that were launched in 2019/2020 so the ABSD deadline is still far for these. However, you can find a list of those reaching the ABSD deadline soon at https://sg.news.yahoo.com/developers-remain-upbeat-despite-2020-042156583.html

Sean would Fourth Ave do you think there’d be any more discounts soon? Thanks

Hi Seet. Will drop you an email. Thanks!

Hi Sean, I would love to know your valuable opinions about Fourth Avenue too. Thanks!

Hey Ling! About Fourth Avenue Residences – we quite like this development. Its leasehold nature gives it a more affordable quantum. In a sea of FH and landed-dominant area, Fourth Avenue Residences would position itself at an affordable price for a new full-facility condominium connected to Sixth Avenue MRT. These traits would contribute greatly as the value-retention factor for FAR despite its leasehold tenure

hi Sean, what is your opinion on Penrose? and any potential National Day discounts from developers?

Hi Victor! We really can’t tell much yet – we’d have to wait for it to launch first unfortunately.

Hi Sean,

What’s your view on The Gardens Residences?

Hey KC! Thanks for reaching out! I am not particularly excited about this project. Personally, it’s not as good a project compared to others like Affinity. Probably why there isn’t much buzz about it either. The unit layout is just not as good.

Hi Sean, may i get your views on Pullman Residences? Thanks

Hey! Sure, will drop you an email. Thanks!

Hi Sean, I was looking at the Hillview area when I cam across your article. Able to share more thoughts on the expected pricing trends for projects like Midwood, Dairy Farm Residences and Daintree residences? Thanks!

Hi Sean, can I get your opinion on whether Penrose or Forrett is a better buy? Am a young working couple

Hi Moch, it’s hard to say now without any pricing for Penrose. But whether it’s a better buy would depend on your objectives, surrounding condos, holding period etc They are also both in very different places so there’s location preferences you’d have to consider too.

Great post and thanks for sharing.Fascinating information I haven’t experienced such information in quite a long time. Keep blogging.

hi Sean,

i would like to ask your opinion on Forett. what do you think about this project? any capital gain in the next 10 years or more?

also, i realized that it is the biggest freehold project in 20/21 and how does that position Forett against other freehold properties in the region?

Dear Sean,

The current selling price for TREASURE@TAMPINES at S$1,350 psf as stated in your STACKED HOMES is not correct. I rang the agent and she said there is a range of prices from the lowest to the highest floor. Hence, you may state the psf is from ………or insert in the psf for every level. I did a quick calculation and noticed the total price difference can soar to S$100,000 for some levels.

It is appreciated if accurate information is provided and this also enhances the creditability of STACKED HOMES.

Thanks

Alvin

Hi Sean, what are your thoughts on Nyon?

Hi Lin! Thanks for your question. For this area, there’s just a lot of competition. You can see other new launches such as Amber Park and Coastline Residences coming up. From the project sales so far, you can see that the project wasn’t so well-received, which is usually an indication of whether a project is either overpriced or not a superior product in the area (as of today, only around 22% of the project is sold). So it would really depend on your objectives whether this project would make sense for you.

Hi Sean, don’t see anyone talking about the Linq, any thoughts on the $2.2K-$2.3K entry price at Beauty World area?

Hey! We think $2.2K – $2.3K is quite high, so if you’re entering at that price range, it’s really a longer-term hold here. Cluny Park Resi is a FH beside the MRT and already doing $2xxx psf, so to be honest we wouldn’t know how it would hold up in Upper Bukit Timah.

HI, I saw the take up rate of Nyon is quite low, but it does seem to be pricing on the lower end compared to new launches nearby. Any views on this project? Thanks!

Do you think that The Reef at King’s Dock will have direct developer discount? What is also your view of this property against other similarly priced properties?

Hi Sean, would like to hear your view on Jovell Vs Parc Komo in term of potential appreciation & chances of discount soon?

Hi Sean, though it’s last year’s article, I found it here as I am interested in Meyer Mansion. As your team pointed out, the margin rate is high and the take up rate is low – which indicates the higher chance of developer discount.

However, your team excludes the Avenir and Midtown Bay as they are from GuocoLand, while your team includes Meyer Mansion – which is from GuocoLand as well. Are there any reason your team treated Meyer Mansion differently with the Avenir & Midtown Bay?