13 Oldest Apartments In Singapore (From 1966): Do They Still Appreciate?

December 20, 2023

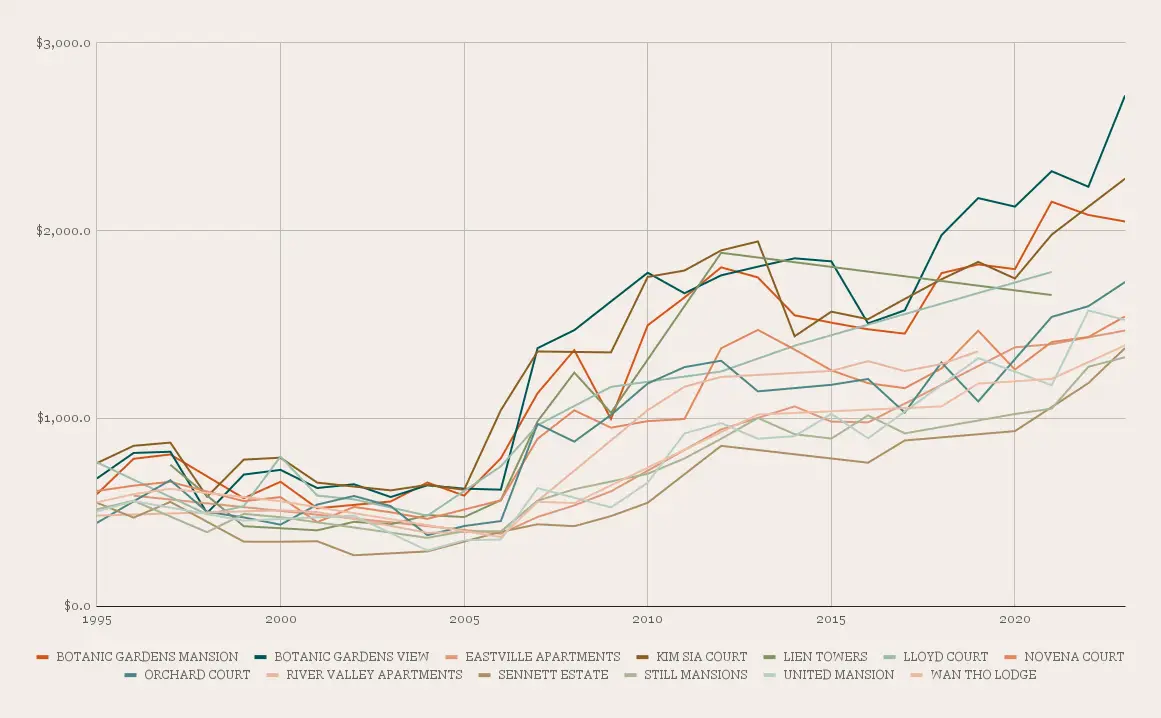

Do old condos in Singapore still appreciate in value? A while ago, we looked at the typical age of developments before they go en-bloc; and we concluded that it’s rare for private non-landed projects to last beyond their 40s. But a venerable few projects still stand, having been completed in the ‘60s and ‘70s. This left us to wonder: if even very old HDB flats can still find buyers and appreciate, is it true that old condos in Singapore still appreciate too? We looked at some of the oldest ones we could find, and checked out the top performers:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A quick note on classifications like “condo”

In strict technical terms, there was no “condo” before 1974. Beverly Mai, built in 1974, is officially Singapore’s first-ever condo development.

There are, however, non-landed private properties that predate the condo classification, which include apartments such as walk-ups. While the term “non-landed private homes” is the most technically correct, we’ll still refer to them as “condo” since that’s loosely used for private developments in Singaporean lingo.

Singapore’s oldest* condos and their performance

| Project Name | Tenure | Year Built | Planning Region | Planning Area |

| EASTVILLE APARTMENTS | Freehold | 1966 | Central Region | Geylang |

| WAN THO LODGE | Freehold | 1966 | Central Region | Toa Payoh |

| STILL MANSIONS | Freehold | 1967 | East Region | Bedok |

| UNITED MANSION | Freehold | 1968 | East Region | Bedok |

| SENNETT ESTATE | Freehold | 1968 | Central Region | Toa Payoh |

| ORCHARD COURT** | 99 yrs from 01/07/1973 | 1970 | Central Region | River Valley |

| BOTANIC GARDENS MANSION | Freehold | 1970 | Central Region | Tanglin |

| NOVENA COURT | Freehold | 1970 | Central Region | Novena |

| BOTANIC GARDENS VIEW | Freehold | 1970 | Central Region | Tanglin |

| KIM SIA COURT | Freehold | 1970 | Central Region | Newton |

| LLOYD COURT | Freehold | 1970 | Central Region | River Valley |

| LIEN TOWERS | Freehold | 1970 | Central Region | Tanglin |

| RIVER VALLEY APARTMENTS | Freehold | 1970 | Central Region | Tanglin |

All of the oldest projects we found (from ‘66 to ‘70) were freehold projects except one: that would be Orchard Court. Orchard Court is a curious mixed-lease property, dating back to 1973. For that reason, we gave it a special mention below.

Top performers among the oldest non-landed residential homes:

1. Botanic Gardens Mansion

Botanic Gardens Mansion is one of the rare properties that – despite being next to a hospital (Gleneagles) – is still considered a peaceful and quiet area. Hospital or not, this project is next to the UNESCO World Heritage Botanic Gardens, along one of the best stretches of Cluny Road.

Even if there’s an occasional ambulance in the night, this is a prestigious low-density enclave, that comes close to the feel of landed living. Now couple this with large unit sizes of over 1,700+ sq. ft., and a small unit count of 112, and it’s easy to grasp the appeal.

Also, a quantum of around $3.6 million to $3.8 million may not be cheap – but it can be considered an appealing price to some, with regard to the location. Keep in mind that, from this project, you can simply walk to Tanglin Mall and the Nassim Hill/Cuscaden area.

And while it’s likely that anyone who lives here can afford to drive, public transport access is excellent: you can walk to Napier MRT (TEL), which is just two stops away from Orchard.

If there is one major drawback though, it’s the lack of schools in priority enrolment distance; but this is true of almost every other private property in this area. Also, beyond security, there are no facilities to speak of (and not every car park lot has shelter).

This project is next to Botanic Gardens View, below.

2. Botanic Gardens View

This project is next to the Botanic Gardens Mansion above, and has the same locational advantages. Both projects are the same age, with this one having slightly more units (146 units). Beyond the bigger piece of land (and some garden space), another difference here is the car park lots are completely unsheltered.

As both projects are so close, it will come down to preferences over interiors and layouts for buyers.

3. Eastville Apartments

Eastville Apartments’ performance was probably due to the gentrification of Joo Chiat.

While the area was a bit sleazy in the 2000s, with a growing number of massage parlours and seedy bars, it has since been cleaned up. It’s now part of the Katong lifestyle stretch, close to malls like i!2 Katong and the family-friendly pubs and restaurants along East Coast Road. This is a huge boon to residents at Eastville, who are just a short walk from the main stretch of Joo Chiat/Katong.

More from Stacked

This Rare 999-Year New Launch Condo Is The Redevelopment Of Robertson Walk. Is Robertson Opus Worth A Look?

For long-time patrons, the redevelopment of Robertson Walk (once a familiar destination in this part of town) may feel bittersweet.…

The surroundings are also mostly landed, low-density housing; but this may be partly offset by a place of worship right across from the project. As the streets here are narrow, it can get crowded at times when religious services are being held. At other times though, this is as peaceful as any landed enclave.

As with most low-density areas, accessibility is not a strong suit. There’s no MRT station in walking distance, so you’ll probably have to walk toward Joo Chiat and catch one of the many buses that ply the route (Eunos MRT is the nearest).

On the flip side, this landed area is not sparse in terms of amenities; and the feel is best described as an “east side version” of Tiong Bahru. There are plenty of eateries nearby, and the relative proximity of i12 Katong, Katong Village, and Parkway Parade means an almost overabundance of supermarkets to choose from.

Overall, great for homeowners who are easties; but investors may be put off by the sheer number of competing boutique condos in this vicinity.

4. Kim Sia Court

Kim Sia Court may be the most affordable property on Orchard Road that you may not have heard of. It’s located between Scotts Square and Mount Elizabeth Hospital, just behind Lucky Plaza.

Most units are generously sized, and upward of 1,000 sq. ft; and as of this year, units of 1,400+ sq. ft. were shown to transact at just $3.05 million. Before you call that expensive though, remember this property is on the Orchard shopping belt. Besides access to all the amenities on Orchard Road, this also means walking access to Orchard MRT (NSL, TEL).

But now the downside: this property is in desperate need of a facelift, and looks like an absolute relic of the past. If your expectation of an Orchard Road condo is slick and ultramodern, look elsewhere. Also, due to its location (i.e., near a major junction on Orchard Road, Lucky Plaza and a hospital), this project will be off-putting to those who drive.

This one may be of interest to landlords, more so than home buyers; but we do note that Raffles Girls Secondary is within priority enrolment distance. The only school in enrolment distance, we should point out.

5. Special Mention: Orchard Court

It’s unusual to find leasehold properties in this neck of the woods; and perhaps because of this, Orchard Court has a notable price discrepancy with nearby projects. This development has mixed tenures (a mix of 99-year and 999-year leases), although the project as a whole dates back to 1973.

Recent transactions, for 1,400+ sq. ft. properties, have ranged between $2.4 million to $2.6 million, which are affordable for this area. However, this is due to the advanced lease decay (99-year lease from 1973) being priced in. Do note that, with 50 years on the lease, some banks may not give full financing for those units that are 99-year leasehold; and the need for a higher cash outlay may also explain the lower asking prices for those units.

Age aside, this is a strong location that’s equidistant from the Somerset (NSL) and Dhoby Ghaut (CCL, NSL, NEL) MRT stations. Numerous major malls, including Plaza Singapura and Orchard Central, provide almost any amenity the residents could need. There’s also some extra prestige from being so close to the late Minister Mentor’s house on Oxley, as well as being near the Istana.

The low price point (within the context of Orchard), coupled with high rentability, will draw interest from landlords. Tenants, after all, don’t care about the remaining lease; and they’ll still be paying Orchard-area rates (or close to it).

For those who don’t mind older properties – or even enjoy refurbishing old homes – a desirable location may be more affordable than you think. Just be sure you understand the implications of buying an older property, from its maintenance issues to its impact on financing. But if you’re concerned if old condos in Singapore still appreciate, then the answer is simple – yes, especially with its freehold tenure due to the land value.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do old apartments in Singapore still increase in value over time?

What is the significance of Orchard Court among old Singapore condos?

Are there any old condos in Singapore that are considered top performers?

What are some advantages of living in older condos like Botanic Gardens Mansion?

Are there any challenges associated with owning or buying old condos in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

1 Comments

>> ldest Apartments In Singapore (From 1966): Do They Still Appreciate?<<

Short answer. YES. It’s Freehold LAND.