10 Upcoming GLS Sites In 2025 (Including 3 EC Sites): Which Sites Hold The Most Promise For Buyers?

December 9, 2024

Given the recent increased demand for new launches (and how many units were quickly sold), it seems reasonable to conclude that there are still a healthy number of buyers out there looking for their next home.

So besides the upcoming new launch condos in 2025, another way to keep track of what is coming up is with the Government Land Sales (GLS). If you’ve been waiting to see what’s up next, they’ve just announced 10 confirmed, upcoming GLS sites for the first half of 2025, and three of them are Executive Condominium (EC) sites (this is likely to yield 5,030 new private homes).

These are the details we have so far:

Where are the 10 sites?

- Senja Close (EC site)

- Woodlands Drive (EC site)

- Sembawang Road (EC site)

- Lakeside Drive

- Dunearn Road

- Chuan Grove

- Upper Thomson Road Parcel A

- Dorset Road

- Telok Blangah Road

- Hougang Central

| Location | Estimated No. of Residential Units | Site Area (ha) | Proposed GPR | Estimated Commercial Space (m2) | Estimated Launch Date |

| Senja Close (EC) | 295 | 1.01 | 3 | 0 | Mar 2025 |

| Woodlands Drive 17 (EC) | 420 | 2.52 | 1.7 | 0 | Apr 2025 |

| Lakeside Drive | 575 | 1.39 | 3.6 | 1,000 | Apr 2025 |

| Dunearn Road | 370 | 1.34 | 0 | Apr 2025 | |

| Chuan Grove | 505 | 1.45 | 3 | 0 | May 2025 |

| Sembawang Road (EC) | 265 | 1.9 | 1.4 | 0 | May 2025 |

| Upper Thomson Road (Parcel A) | 595 | 2.44 | 2.2 | 2,000 | Jun 2025 |

| Dorset Road | 430 | 1.05 | 3.5 | 0 | Jun 2025 |

| Telok Blangah Road | 740 | 1.36 | 4.7 | 0 | Jun 2025 |

| Hougang Central | 835 | 4.68 | 2.5 | 40,000 | May 2025 |

Interesting sites that have our attention so far:

While more details are forthcoming, here are some of the interesting ones so far, starting with the EC sites:

1. Senja Close (EC site)

This is likely to be a smaller EC, with an expectation of about 295 units. The site isn’t near any MRT station, but Jelapang LRT seems to be within walking distance. This goes to Choa Chu Kang MRT station (NSL), which is also next to Lot One Mall.

While it is a rather fringe location, it doesn’t seem too inconvenient. We noticed the Senja Hawker Centre is very close, and there are a good number of eateries and heartland amenities nearby (including a Sheng Siong in the HDB cluster). Greenridge Shopping Centre, and HDB-run mall, are also quite nearby, so day-to-day needs like groceries are met.

It’s not the most exciting location, but it’s also reasonably convenient. If you’re the sort who doesn’t like having to travel out of your neighbourhood, this may work for you.

2. Woodlands Drive (EC site)

This site is next to the Singapore Sports School (although note that this will move to Kallang), and it’s one of the more accessible locations in Woodlands. About 420 units are expected here. This is one of the rare ECs that will be within walking distance to an MRT station; in this case Woodlands South (TEL). This is just one stop from the Woodlands MRT station proper, where residents will have access to Causeway Point Mall.

For those who are less familiar with the location, this plot is close to the recent popular launch of Norwood Grand. As such, if you were just priced out of some of the units there, this EC development could be one of interest.

The HDB-run Vista Point mall also appears to be within walking distance; and school proximity is excellent. In addition, Innova Primary, Woodgrove Primary and Secondary, Christchurch Secondary, and Woodgrove Secondary all seem likely to be within one kilometre.

ECs with close proximity to MRT stations are always popular, so we expect the EC here to be in high demand.

3. Sembawang Road (EC site)

Some people may be surprised by the number of ECs the government decided to cluster in Sembawang. There are an expected 265 units for this site; but aren’t Parc Canberra, The Visionaire, The Brownstone, and Provence Residence enough already? Those are all ECs too!

Then again, this site is further from the Canberra MRT station (NSL) than those above. The developer will likely try to capitalise on the proximity to the Sembawang Hot Spring, which the other ECs are further away from. There are also nearby amenities like Sembawang Shopping Centre or the famous hawker centre at Chong Pang – these look a bit too far to walk, but it’s just a short bus ride (assuming the condo gets a stop).

More from Stacked

Parc Canberra vs Provence Residence: What Happens When Two ECs Are Side-by-side?

Even before the last units at Parc Canberra had been sold, Provence Residence launched (selling just over half its total…

It’s okay for those who love greenery and park spaces, but it doesn’t strike us as particularly exceptional for now.

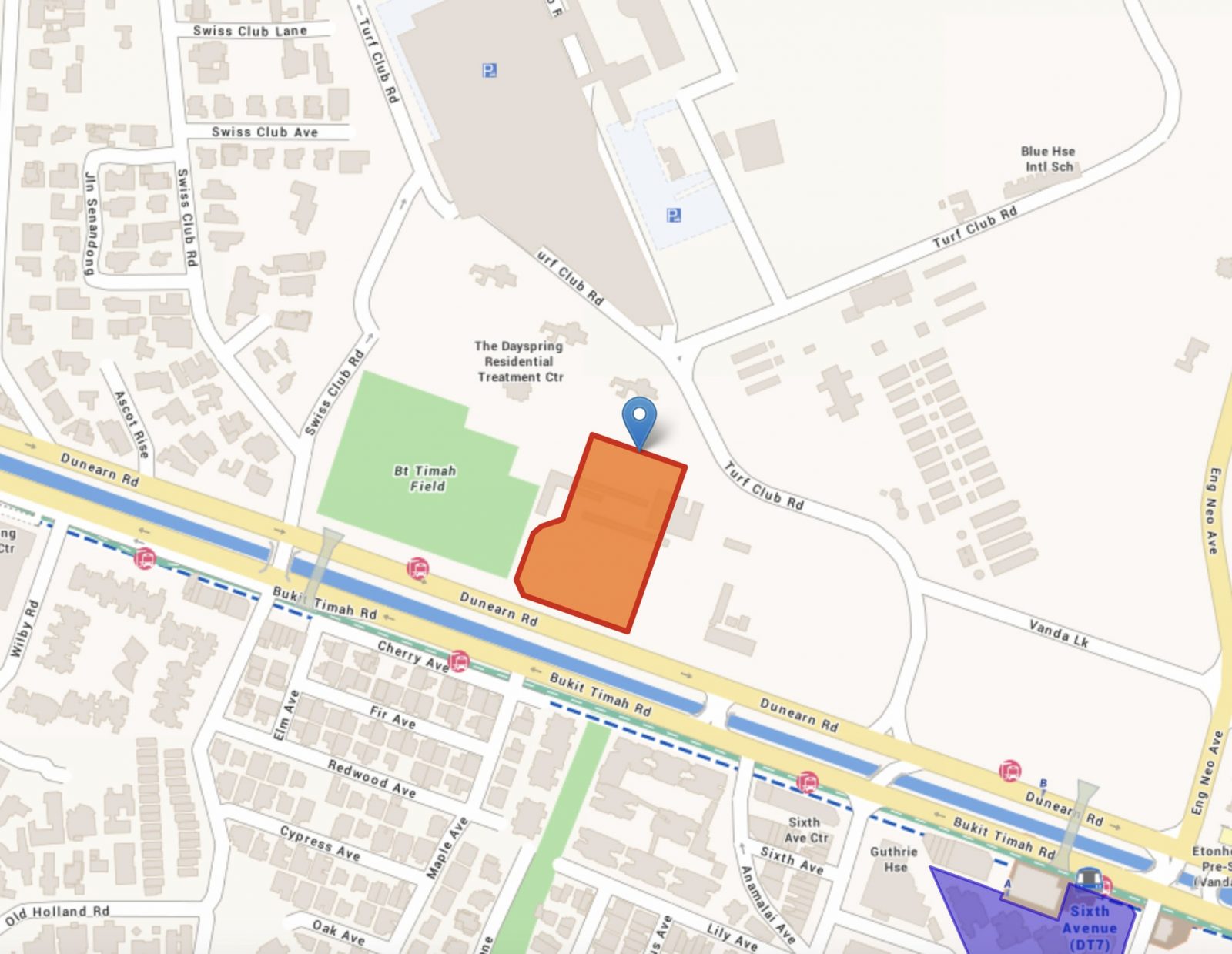

4. Dunearn Road

This site is interesting because it’s the first chunk of the former Turf City to be sold. We’ve talked about this before, but this will also be the location of the first HDBs to be built in Bukit Timah in 40 years. There will be about 15,000 to 20,000 public and private homes built over 20 to 30 years, and this will be served by the Sixth Avenue Downtown Line MRT station as well as another upcoming Cross Island Line station.

Being in Bukit Timah, this will be a pricey location, situated across from a landed enclave.

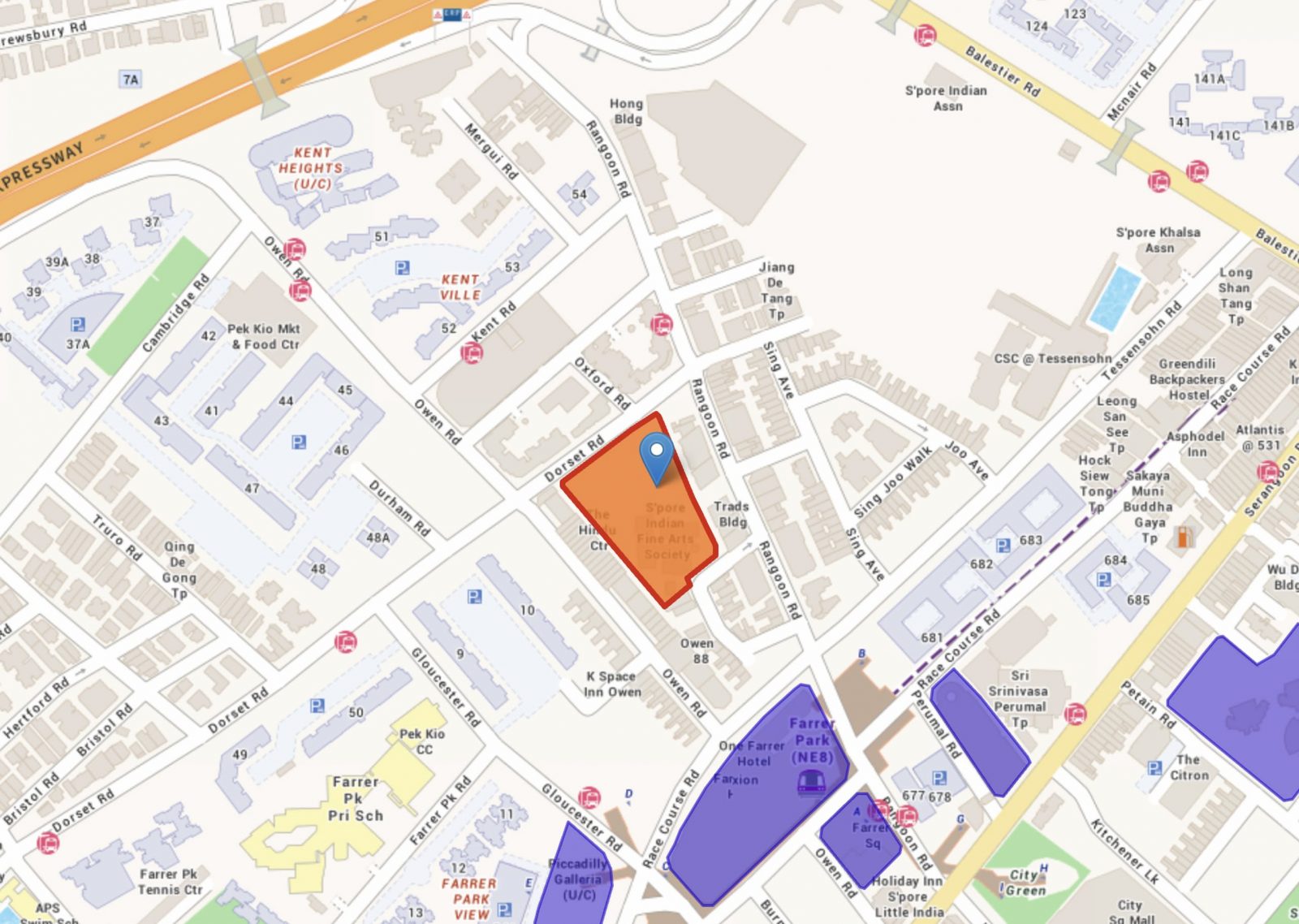

5. Dorset Road

Another prime location land parcel, this one appears close to Farrer Park MRT station (NEL). This provides good access to City Square Mall, as well as Little India just one stop away.

The Pek Kio Market & Food Centre is just a short walk away; and this being so close to town, there’s no lack of entertainment, retail, and dining. It doesn’t seem like family-condo material though, as this is a very heavily built up and urban area; and traffic even close to Little India can get quite bad.

We’d expect a project here to be inclined toward rental or investment prospects. It will, in any case, not be a cheap location – it’s very accessible, and close to the city centre.

6. Telok Blangah Road

This is the first chunk of land to be sold off from the former Keppel Golf Course. It looks quite close to Telok Blangah MRT station (CCL), and the view is going to be amazing: like Reflections at Keppel Bay nearby, the waterfront will be a major part of the appeal.

Like Turf City, the 48-hectare former Keppel Golf Course site will kickstart the transformation of the Greater Southern Waterfront area and will yield about 9,000 new homes, including about 6,000 public housing units.

The location will provide good access to Harbourfront Centre and VivoCity. Coupled with its city fringe location, this will probably be a hotly contested land parcel. Any project here is likely to be in the luxury category.

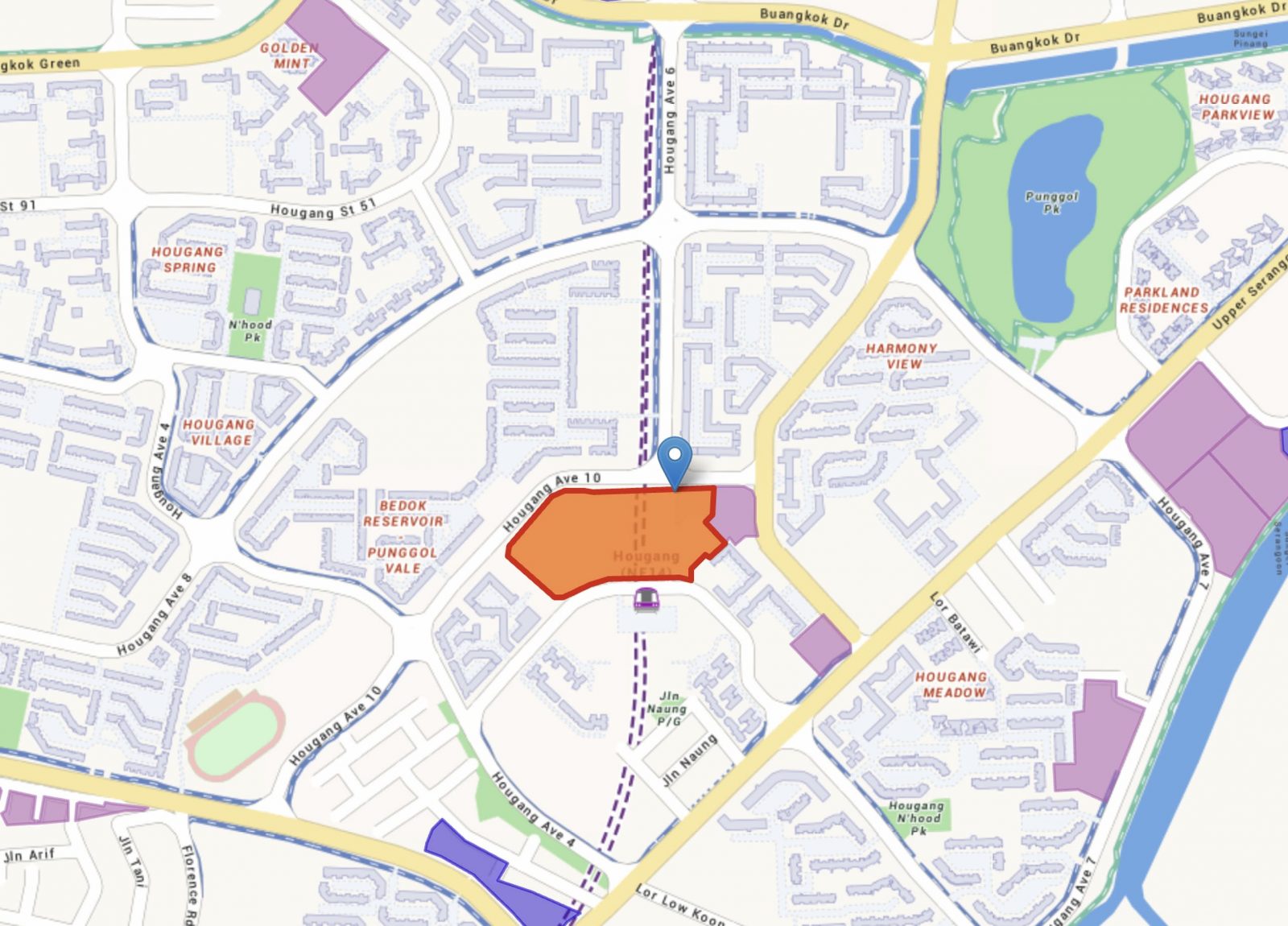

7. Hougang Central

This site will be for an integrated development, connected to Hougang MRT station (NEL). The proximity to Serangoon, as well as Hougang itself being a mature area, is sure to draw demand. The surroundings are packed with amenities already, and an integrated development will just add more to the food, retail, and entertainment.

It’s also been a while since we’ve had a condo launch in this part of Hougang (at least, since Florence Residences). Given how much the nearby flats have appreciated, there’s bound to be a slew of HDB upgraders, who would love to keep their current, convenient whereabouts. We’d expect this to be one of the contested sites when the bidding starts.

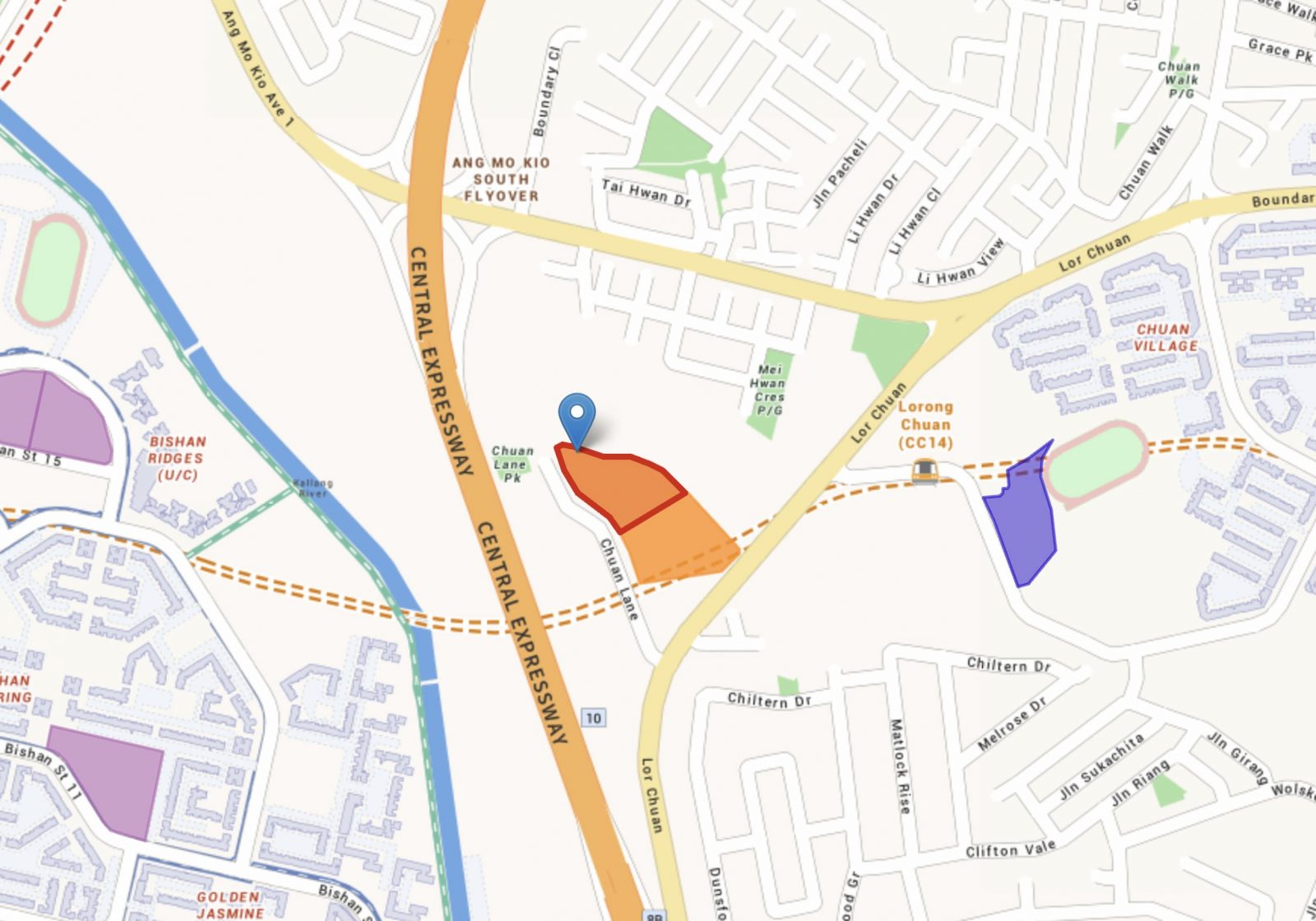

8. Chuan Grove

This site is within close walking distance to Lorong Chuan MRT station (CCL), and we’ve already seen the proven demand for Chuan Park. We’re likely to see a repeat of high demand, as there may not be another launch in this area after these two; not for some time to come.

Besides a good number of potential HDB upgraders nearby, we would expect demand due to the proximity of Serangoon. NEX Megamall, Chomp Chomp, etc. are just a short hop away, making this a very convenient location.

Those who missed their shot at Chuan Park will definitely want to keep an eye on this plot.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments