10 Shocking Loss-Making Condo Transactions Since 2017 (The Last Market Bottom)

June 29, 2022

Conventional wisdom will point at the property market cycle and tell you that 2017 was the best time to buy in the last 5 years. After all, it was the lowest point in the residential property price index and for most people who bought during that period, they would be happily sitting on some paper gains by now.

But, as with anything, there are always going to be losers as well. As much as 2017 was a good time to buy, buying the wrong unit or paying the wrong price can still affect your outcome quite drastically.

In this piece, I’ll be introducing 10 properties that were bought in 2017 and sold over the past few years that have made the biggest losses.

Table Of Contents

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Deriving The Data

For this particular list, we looked at properties that were bought in 2017 and were sold anytime after that.

We particularly picked out the top 10 highest loss margins (8-37%) with a considerable quantum loss ($283,171 – $3,950,000).

Disclaimer: These are based on actual transactions, not $PSF changes. I guess there might be certain reasons why some properties perform underwhelmingly. Not to mention, the effects of the pandemic might have played a part in affecting the demand and value.

Here are the 10 worst loss-making developments for those who bought in 2017 over the past 5 years.

| Project | Sell Price | Buy Price | Bought | Sold | Size (sqft) | $PSF | Loss ($) | Loss (%) | Annualised |

| REIGNWOOD HAMILTON SCOTTS | $6,850,000 | $10,800,000 | 27/8/17 | 12-Jul-21 | 2,756 | $2,486 | -$3,950,000.00 | -37% | -11% |

| THE SAIL @ MARINA BAY | $1,880,000 | $2,800,000 | 27/8/17 | 8-Oct-20 | 1,259 | $1,493 | -$920,000.00 | -33% | -12% |

| THE PEAK @ CAIRNHILL II | $1,705,200 | $2,338,000 | 15/3/17 | 15-Mar-22 | 904 | $1,886 | -$632,800.00 | -27% | -6% |

| ARDMORE THREE | $5,250,000 | $5,860,155 | 12/5/17 | 7-Feb-22 | 1,744 | $3,011 | -$610,155.00 | -10% | -2% |

| MARINA COLLECTION | $5,900,000 | $6,426,707 | 15/8/17 | 25-Jun-21 | 3,412 | $1,729 | -$526,707.00 | -8% | -2% |

| THE CREST | $2,760,000 | $3,159,000 | 13/10/17 | 25-Mar-21 | 1,636 | $1,687 | -$399,000.00 | -13% | -4% |

| THE TRILINQ | $4,500,000 | $4,881,708 | 27/10/17 | 14-Oct-21 | 4,446 | $1,012 | -$381,708.00 | -8% | -2% |

| OUE TWIN PEAKS | $3,400,000 | $3,763,480 | 25/1/17 | 19-Jun-20 | 1,399 | $2,430 | -$363,480.00 | -10% | -3% |

| TIVOLI GRANDE | $1,320,000 | $1,650,000 | 27/8/17 | 9-Apr-20 | 1,528 | $864 | -$330,000.00 | -20% | -8% |

| 6 DERBYSHIRE | $936,000 | $1,219,171 | 4/12/17 | 28-Sep-20 | 517 | $1,812 | -$283,171.00 | -23% | -9% |

Loss #1: Reignwood Hamilton Scotts

Location: 37 Scotts Road, District 9

Developer: Sardinia Properties Pte Ltd

Lease: Freehold

Completion: 2012

Number of Units: 56

Unit Loss: 37% / $3,950,000

Average Price (2022): $3,510.5 psf

Profitable Transactions: 4

Unprofitable Transactions: 5

Key Points:

Reignwood Hamilton Scotts is definitely one of the most unique developments in Singapore. It offers residents a luxe complex and finishing – just see the ensuite sky garage accessible from each unit itself. For those who love their cars more than anything else in the world, this is certainly one for you. And it’s safe to say, staying here does give a certain pressure to have a nice car – it takes a brave soul (or a truly rich person) to buy such an expensive unit only to display an ordinary car.

Furthermore, it is complemented by the prestigious postal code along Scotts Road in Orchard and offers superb amenities and lifestyle choices in its vicinity. I also love how private the development is – there are only 56 luxe units here.

The development also offers residents a 45-m lap pool, gym, concierge service, and breakfast service (provided at the dining area on the first floor).

Despite its positives, one glance at the price chart for Reignwood Hamilton Scotts tells us of the big variances in pricing since it was built. In March 2012, the average price psf was at $3,221 and almost 10 years later, the average price psf in Nov 2021 was recorded at $3,266.

There are various explanations for this, one of which could be that the high-end market has been increasingly saturated over the years with new launches like Park Nova and Boulevard 88. In this sector of the market, the sky’s the limit and it’s just the newest and shiniest that will attract such buyers. And so while Reignwood Hamilton Scotts still looks good for its age, it is no longer the newest kid on the block either.

It does also occupy a very niche audience – one who really loves his/her cars. But the issue is at those price points, a landed home is also very much within reach for these buyers. And so the novelty of having a car go up and down a car lift (I don’t suppose these move very quickly), can get tiresome faster than you think.

Lastly, while it is in a central location, it isn’t quite the crème de la crème either in terms of its immediate location. Ardmore, Angullia Park, and the Nassim area are still seen as a more prime location where private developments are concerned.

Even for a rich owner, experiencing a near 40% loss (bought at $10.8 million and sold at $6.85 million) must still be a bitter one to swallow.

Loss #2: The Sail @ Marina Bay

Location: 6 Marina Boulevard, District 1

Developer: Glengary Pte Ltd

Lease: 99-years

Completion: 2008

Number of Units: 1,111

Unit Loss: 33% / $920,000

Average Price (2022): $1,925 psf

Profitable Transactions: 113

Unprofitable Transactions: 90

Key Points:

Right off the bat, The Sail @ Marina Bay has a really distinct location in the lovely heart of Downtown Singapore that offers residents unique waterfront living. Complemented by green pockets of space at The Lawn, you are in high-end company when your nearest shopping location is the iconic The Shoppes at Marina Bay Sands.

At the time of launch, the live-work-play concept was being pushed out by URA to rejuvenate life within the CBD even after working hours – so the area is set to become even more liveable in the future. If you’ve traversed the waterfront during weekends, it is quite an increasingly busy and vibrant spot.

This idea was bought in by many real estate investors at that time, mainly because it seemed straightforward to assume that renting out a unit to expats working in the neighbourhood would be a no-brainer. The high demand would then equate to an upswing in value.

However, the price chart over the past 6 years shows that the development has seen a generally straight line, contrary to popular belief.

You should know that there are quite a number of competitors around like Marina Bay Suites, Marina Bay Residences, One Shenton and Wallich Residence that are newer and would be more attractive at this point.

Note that The Sail is a 99-year lease development, which investors will keep in mind of its eroding tenure.

The pandemic would have also dealt a big blow to The Sail mainly due to the change in lifestyle. People were working from home at that time and living and working within the CBD would not be that much of a selling factor anymore (although this perhaps isn’t as applicable today).

Also, let’s not forget that The Sail has endured a bit of a shaky history, with disputes over its rubbish chute system, and complaints of water leaks.

This isn’t one of the huge units either like a penthouse, so to lose nearly a million over a 3 year period (bought at $2.8 million, sold at $1.88 million) is still quite a chunk of change.

Loss #3: The Peak @ Cairnhill II

Location: 61 Cairnhill Circle, District 9

Developer: T G Development Pte Ltd & TEE Development Pte Ltd

Lease: Freehold

Completion: 2015

Number of Units: 60

Unit Loss: 27% / $632,800

Average Price (2022): $1,886 psf

Profitable Transactions: 0

Unprofitable Transactions: 1

Key Points:

Another unit in Singapore’s golden District 9, The Peak @ Cairnhill II offers residents a convenient location, luxurious facilities and great amenities for all ages.

You probably can’t get more central than being a 5-minute drive away from Orchard MRT. Schools like Anglo-Chinese School (ACS) and Singapore Chinese Girls’ School (SCGS) are close by enough from the development, making it a great spot for families to buy or rent. Not to mention for the expats – the area is great when considering convenience to the CBD.

Despite the great offerings, The Peak @ Cairnhill II saw a sharp drop in its prices since late 2019 and it has been at an all-time low ever since.

This last unit that was recently transacted at a loss is definitely a thorn in the side of the current owners there. It’s going to be tough for the other units to get anywhere close to the price they bought at when the most recent transaction is at $1,886 psf (and everyone else has bought between $2.4 – $2.9k).

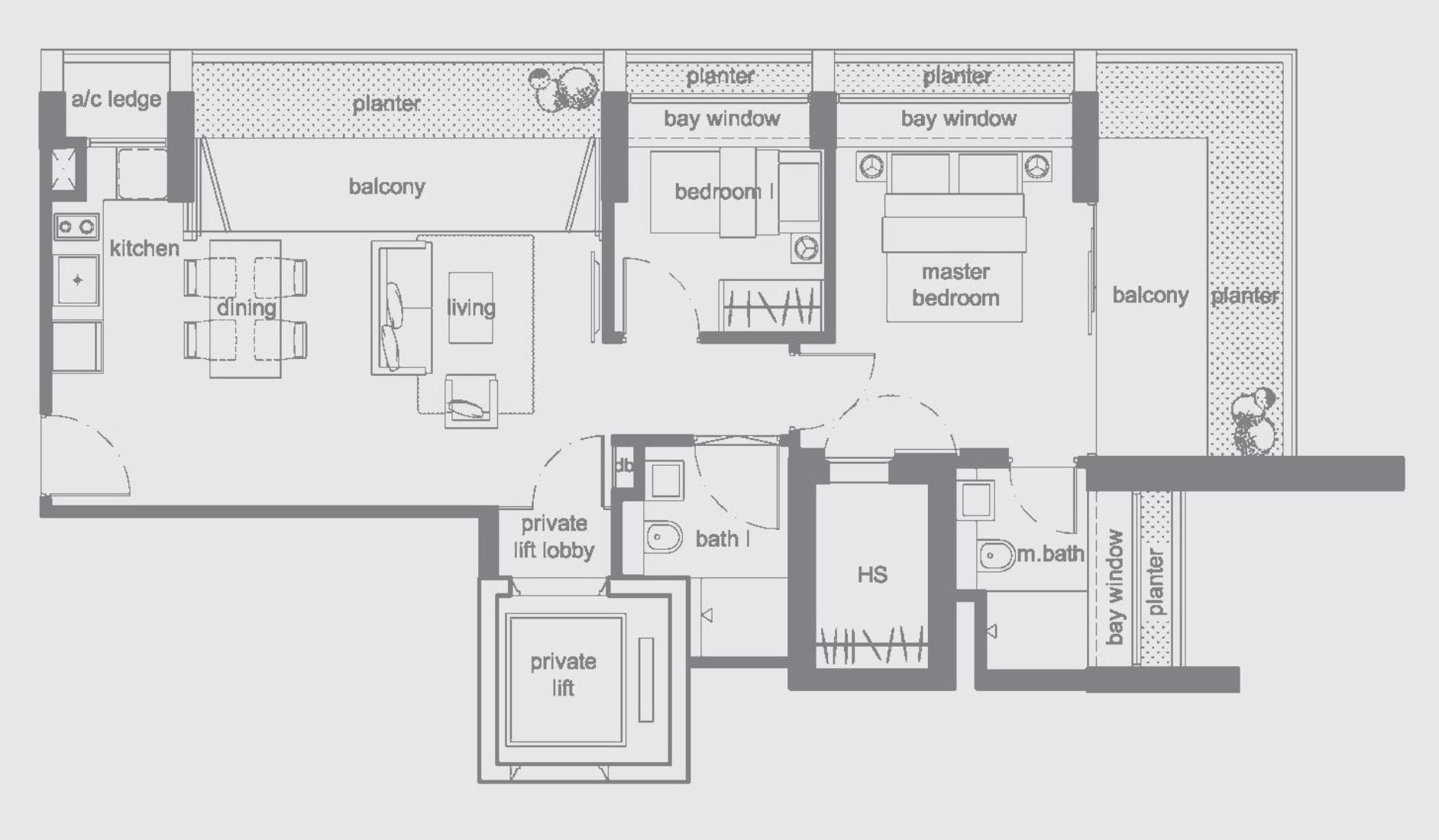

The other potential issue is that all the units there are 2 bedroom units as well, which means this development will always attract a niche audience. While it does come with the luxury of a private lift, the multiple planters and bay windows surrounding it will mean that the interior space will be smaller than the advertised 904 sq ft. The smaller common bedroom here will be another limitation too.

Loss #4: Ardmore Three

Location: 3 Ardmore Park, District 10

Developer: Botanica Pte. Ltd.

Lease: Freehold

Completion: 2014

Number of Units: 84

Unit Loss: 10% / $610,155

Average Price (2022): $3,011 psf

Profitable Transactions: 1

Unprofitable Transactions: 2

Key Points:

Located in the prime Ardmore Park area, the neighbourhood has a generally good reputation among luxury buyers and the performance of Ardmore Park itself is typically used as an indication of how the high-end market is performing. It boasts of a great central location in D10, has good facilities and is slightly away from the hustle and bustle of Orchard.

As you might expect for a development of this calibre, there are only 84 exclusive units and along with the rest of the area, it is freehold as well.

However, the chart shows that the project last had its peak price in 2017 and its prices have not reached their previous peak ever since.

Like The Peak @ Cairnhill II, Ardmore Three only offers one type of unit – 3 bedrooms. They all range above 1,700 sq ft and are very generous in terms of size. This does pose the same issue as it is in general, and given the range of options at this price point, this will definitely have been a limiting factor.

More from Stacked

How Much Do Industrial Areas Really Impact Condo Prices? A Case Study Of Bishan And Yishun

In this Stacked Pro breakdown:

Loss #5: Marina Collection

Location: 17 Cove Drive, District 4

Developer: Lippo Marina Collection Pte Ltd

Lease: 99-years

Completion: 2011

Number of Units:

Unit Loss: 8% / $526,707

Average Price (2022): $1,788 psf

Profitable Transactions: 2

Unprofitable Transactions: 11

Key Points:

This next development is located in Sentosa, which as you probably know by now has had many units that have sustained losses over the past few years. But for those who love the waterfront lifestyle, this does offer great frontage over the Marina. It is also right next to One Degree 15 Marina Club, so you do have additional lifestyle benefits right here.

The project offers general amenities, such as a gym, lap pool, playground and swimming pool with low-rise buildings (only 4 levels!).

However, it is located rather deep in Sentosa and residents without private transportation might find it a hassle to travel out of the development due to the lack of public transportation in the area.

The project only offers a bigger layout to residents, ranging from 3 bedrooms to dual-key units with 5 bedrooms and penthouses with 6 bedrooms. Even just the 4-bedders offer a whopping 2,185 sqft, while the biggest penthouse is 4,693 sqft.

Once again, this development would be more suitable for bigger families, rather than couples or individuals. This would be impactful when it comes to the selection of renters.

From the chart, we can see prices drop in 2013. I’d assume that the increase in ABSD introduced in January 2013 had its toll on the project’s performance. The location might also be inconvenient for families without a car and there is a lack of schools nearby.

Not to mention, the 99-year leasehold would be offputting for many and some might prefer the newer launches that are more accessible to other amenities (like Corals at Keppel Bay).

That said, this particular buyer may count him/herself fortunate, as more than half of the 11 unprofitable transactions here have made losses ranging from $1 to 2 million. This is one of the later units sold though, which is quite remarkable given that the buyer would probably have been aware of the past performance of the area thus far.

Loss #6: The Crest

Location: 105 Prince Charles Crescent, District 3

Developer: Wingcrown Investment Pte Ltd

Lease: 99-years

Completion: 2017

Number of Units: 469

Unit Loss: 13% / $399,000

Average Price (2022): $1,892 psf

Profitable Transactions: 17

Unprofitable Transactions: 15

Key Points:

Located in the central yet out of the busy city area Alexandra neighbourhood, its address offers residents a touch of serenity. I also like the low-density buildings and how the design of each layout offers a beautiful planter space where residents can hone their green thumbs.

Fun fact: these planters are not included in the total size of the unit, so essentially you get bonus ‘extra’ space.

I like how the design blends in very well with its natural surroundings, what with the massive parcel of green space that is the Southern Ridges being just a 4-minutes drive away. Location-wise, it is a 5-minute drive away from Robertson Quay and an 8-minutes drive away from Marina Bay. Orchard Road and Tanglin are also within a 10 minutes drive away.

However, for folks without a car, the next nearest MRT station is a good 11 minutes walk away, which is honestly, not the most convenient if you have to walk every day.

Surrounding the project is an unblocked view of Singapore’s low-density good class bungalow district.

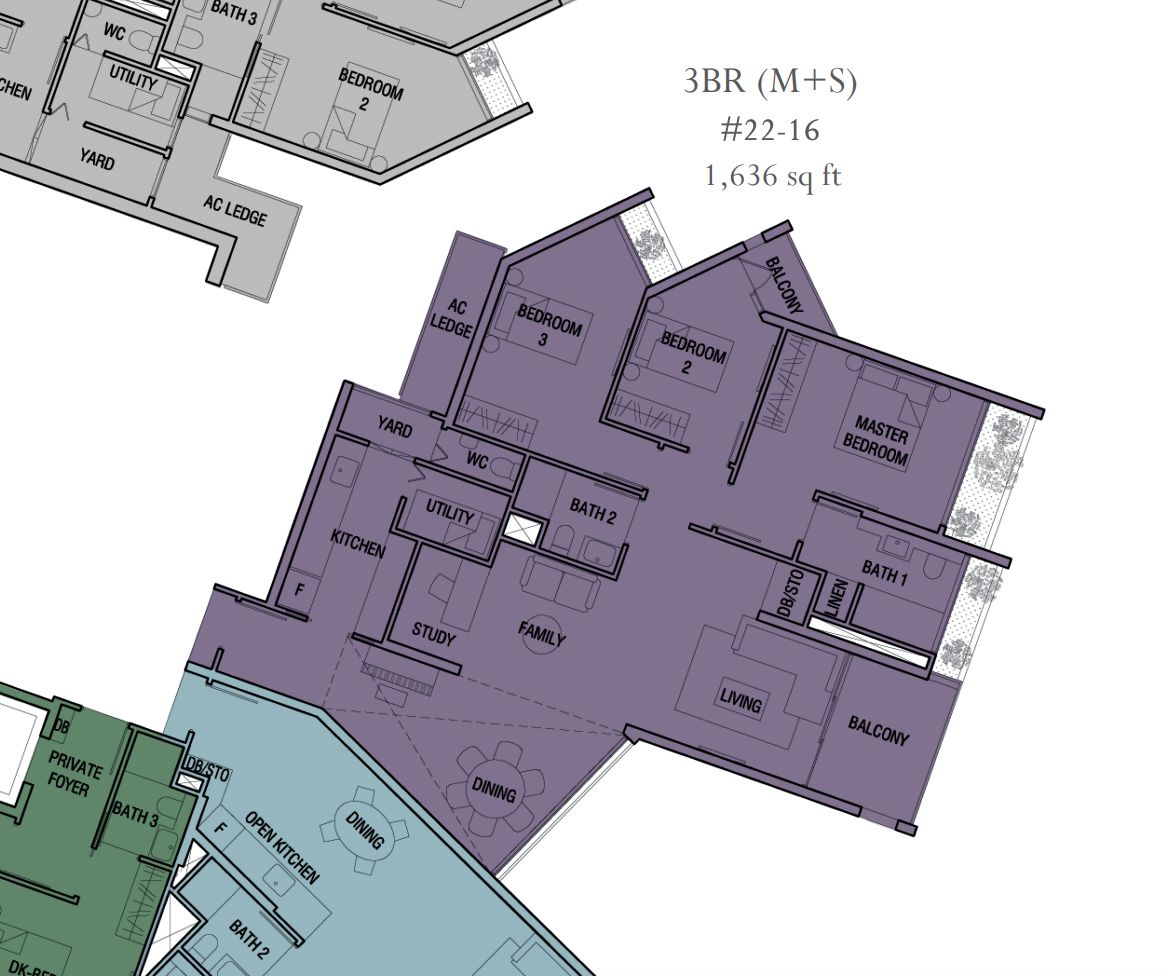

The design of the facade is pretty unique, with fractal planning to maximise wind and natural light, creating a myriad of views from multiple directions. With that being said, the unusual facade would translate to an even more unusual unit floorplan.

Looking through the different brochures to find this particular floor plan was a challenge in itself, and you can just imagine the variances of different sizes and layouts. This does represent a problem for future buyers to get a good comparison of pricing between the different units, due to the huge variety.

While some designers may be up for the task of creating a harmonious design, not everyone would like the awkward angles of spaces like the dining, and common bedrooms.

Despite the number of unprofitable transactions pertaining to this unit, the average price psf for the project seems to be seeing a gentle upward trend for the past 7 years. It’s worth noting that Wing Tai, the developer, acquired the land above its valuation and was made to sell their units slightly above the average price of neighbouring condos.

Condo ReviewsThe Crest Condo Review: Giant Pool + Bigger Than Usual Units

by Reuben DhanarajLoss #7: The Trilinq

Location: 28B Jalan Lempeng, District 5

Developer: Clementi Development Pte Ltd

Lease: 99-years

Completion: 2017

Number of Units: 755

Unit Loss: 8% / $381,708

Average Price (2022): $1,567 psf

Profitable Transactions: 102

Unprofitable Transactions: 10

Key Points:

Located in one of Singapore’s mature estates, The Trilinq offers a modern city fringe living. Its neighbourhood and proximity to key locations are one of the major draws of this development.

Just a 5-minutes walk from Clementi MRT station, a quick 18 minutes train ride gets you into the city. Driving is made convenient with the AYE, where you can expect to arrive at the CBD in about 18 minutes as well. As the icing on the cake, URA announced further plans in the Masterplan to improve commercial nodes, connectivity and green spaces of the neighbourhood.

For families who have schooling children, education choices are abundant within the area. Popular schools like the National University of Singapore, Nan Hua Primary School, Nan Hua High School and Clementi Primary School are very conveniently accessible.

To give it a little more credit, the resale performance of this project has been generally pretty good. It did endure a bit of a rocky start in the early days, but generally, those who picked it up in the later years of 2016/17 would have done well for themselves selling in 2021/22.

As such, this unit in itself is very much an outlier due to it being the penthouse unit. At a size of 4,446 sq ft, it is a large one – and at a price point of over $4 million, not many buyers would want to plunge that sum into an area like Clementi (as convenient as it is).

Loss #8: OUE Twin Peaks

Location: Leonie Hill Road, District 9

Developer: Cove Development Pte Ltd

Lease: 99-years

Completion: 2015

Number of Units: 462

Unit Loss: 10% / $363,480

Average Price (2022): $2,368 psf

Profitable Transactions: 2

Unprofitable Transactions: 32

Key Points:

This next condo is a 99-year leasehold situated along Leonie Road. It does have quite an iconic design, as it is designed by the renowned Bill Bensley (who was the one behind Capella Ubud and the eye-catching JW Marriott Phu Quoc).

Reuben has written about it extensively here, so I won’t go much into detail this time.

Taking a look at the charts, there was a sudden decline in prices in 2016, and this was mainly due to the deferred payment schemes offered by the developer and the discounts that were subsequently pushed to entice further purchases.

It has had a promising start but its continuously declining performance shows that it has moved past its heydays.

Loss #9: Tivoli Grande

Location: 126 Koon Seng Road, District 15

Developer: KS Development Pte Ltd

Lease: Freehold

Completion: 2014

Number of Units: 82

Unit Loss: 20% / $330,000

Average Price (2022): $1,372 psf

Profitable Transactions: 26

Unprofitable Transactions: 13

Key Points:

A freehold condominium located at the sunny East Coast, it is designed as a simple low-rise development that has its location as the main attraction. It is conveniently located minutes away from East Coast Park and 3 other MRT stations – Eunos MRT, Paya Lebar MRT and Kembangan MRT stations.

I love the area too and find it conducive for everyone. Driving into the CBD takes less than 15-minutes through the ECP highway, and students have convenient access to schools like Haig Girls’ School, Telok Kurau Secondary, CHIJ (Katong) Primary school. It’s a good all-rounder.

The newly renovated i12 Katong Mall and Dunman Food Centre offer a myriad of eating options and lifestyle options for residents too.

Looking at its performance in the market, it does seem like it maintained a generally average performance over the past decade.

The subpar performance could be due to the many new competitive launches in the neighbourhood over the past 10 years that curbed the unit of any potential capital upswings.

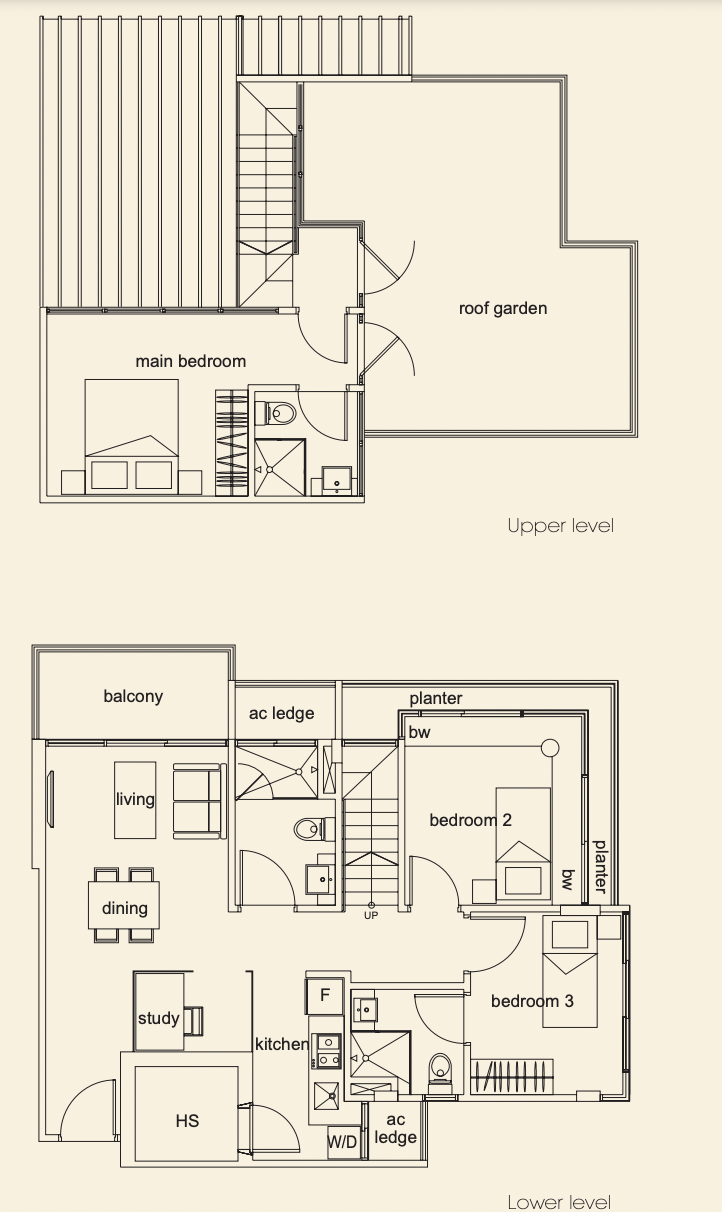

It does seem like the bigger 3 bedroom penthouse units at Tivoli Grande aren’t as well received. I would chalk it down to the overuse of bay windows and planters, and the sizeable roof garden – which contributes to the overall space (communal areas like living and dining) feeling quite small.

Loss #10: 6 Derbyshire

Location: 6 Derbyshire Road, District 11

Developer: Fantasia (Novena) Pte Ltd

Lease: Freehold

Completion: 2017

Number of Units: 168

Unit Loss: 23% / $283,171

Average Price (2022): $2,163 psf

Profitable Transactions: 4

Unprofitable Transactions: 5

Key Points:

Located in Novena, 6 Derbyshire is a freehold condominium that offers lofts, 1, 2 and 3 bedroom units. Its premium postal code is complemented by great amenities such as schools, shopping malls and great accessibility.

The development combines the charm of living in an eco-friendly yet modern lifestyle, with spacious and functional units. In general, it is squarish and I like that there’s no redundant usage of space.

That said, one major drawback is that it is located so close to the CTE expressway. Noise pollution would be a great problem for many if a serene apartment is what the buyer is looking for.

There are also many competitors within the neighbourhood, such as Derbyshire Heights, Fyve Derbyshire and Pasadena.

Bought in Dec 2017 for $1.219 million, it was sold in Sept 2020 for $936,000, representing a loss of $283k. It’s quite a stunning loss, especially for a small unit of just 517 sq ft. Its high purchase price of $2,360 (especially in the slower market in 2017) does make it harder for it to be registering any sort of profit, and the recent prices of the development at $2,100+ psf is a clear indication of the market acceptance of its price point.

For more curated property picks and updates, follow us at Stacked. Tune in to our in-depth reviews of new and resale units, investment guides and opinion pieces to make a more informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are some examples of condo units bought in 2017 that lost a significant amount of money when sold?

Why did some condo units bought in 2017 experience large losses when sold later?

Which condo development bought in 2017 had the highest loss percentage?

How did the pandemic impact the condo market for units bought in 2017?

Are there particular locations or types of condos more prone to losses bought in 2017?

What lessons can be learned from these loss-making condo transactions since 2017?

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

2 Comments

Thanks for the article. This is very interesting!