Do Spacious Units (Above 1,800 Sqft) Perform Better? We Analyse 26 Years Of Data

January 13, 2022

If our top 10 articles of 2021 are anything to go by, there’s definitely a trend of interest in bigger homes in Singapore. Jumbo flats, HDB maisonettes, and bigger older apartments, just to name a few.

And with the emergence of Omicron, it seems inevitable that working from home (WFH) will continue for the foreseeable future, even though the Ministry of Health recently announced that 50% of employees will be allowed to return to the office.

While this is a respite for some of us who are facing “Zoom fatigue” from hours of video chats, there are employers who are likely to offer WFH as a perk to win the war for talent as reported by CNBC in Nov 2021. This translates to a need for more living space, as homes now need to fulfil more functions than before. For many, it’s a place for our children to study, a place to exercise, and a place to work. And of course, it’s also where we try to leave it all at the proverbial doorsteps to unwind and relax.

So although buying a bigger home is almost a need today, many are still naturally curious to know if bigger homes are a good investment.

Against this backdrop, we examined the transaction data from the past 26 years to see how larger private homes have appreciated in comparison with their smaller counterparts and whether it makes financial sense to invest in one.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Notes on this review

Before we present our findings, we wish to highlight a few points on how we conducted this review –

- The scope of the data includes units that were transacted between 1995 and Nov 2021, covering developments that were built from 1953 to 2021 and spans 161,262 transactions across all the key regions (i.e. OCR, RCR, and CCR).

- 5 size categories Size categories (i.e. “Typical 1BR“, “Typical 2BR“, “Typical 3BR“, “Typical 4BR+” and “Spacious“) were used for this study to differentiate unit sizes based on present day standards. For example, a typical 3 bedroom unit today would range from between 936 sqft to 1,184 sqft as shown below:

- Typical 1 bedroom – units that are 646 sqft and smaller;

- Typical 2 bedroom – units that are between 647 and 926 sqft;

- Typical 3 bedroom – units that are between 927 and 1,184 sqft;

- Typical 4 bedroom + – units that are between 1,185 and 1,799 sqft; and

- Spacious – units that are 1,800 sqft and above.

- Our data includes a small percentage (~6%) of units with private enclosed spaces (PES). However, we have included them as there are buyers who also prefer the extra space in the PES.

Disclaimer: Our data is limited to transactions and their sizes, as such, assumptions on unit sizes had to be made above. However, we acknowledge that older developments have 1 bedroom units as large as 800 – 900 sqft. We believe that our categorisation here is sufficient to surface any trends which are useful enough for this study.

Key findings

We gathered some key findings based on the insights we gleaned from the data and have summarised them as follows:

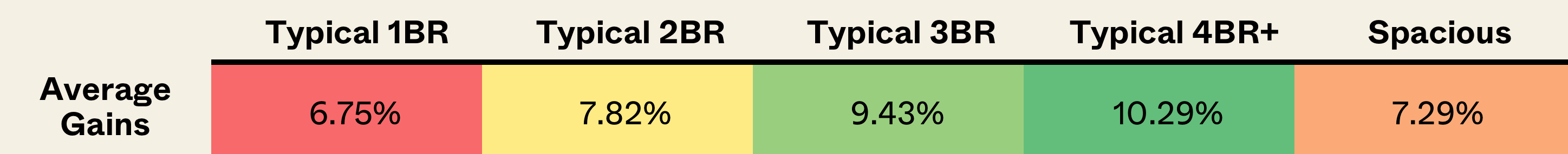

- Appreciation of larger units generally outperformed their smaller counterparts.

- Appreciation for larger units is slightly better in the Outside Central Region (OCR) and Rest of Central Region (RCR).

- Appreciation is generally correlated with holding period (i.e. longer holding period translates to better appreciation).

- Appreciation for units built earlier perform better, although we felt that inflation is a key reason for this.

- When looking at houses bought within the last 10 years, the gains from spacious units are no longer there.

#1 – Appreciation of larger units generally outperformed their smaller counterparts

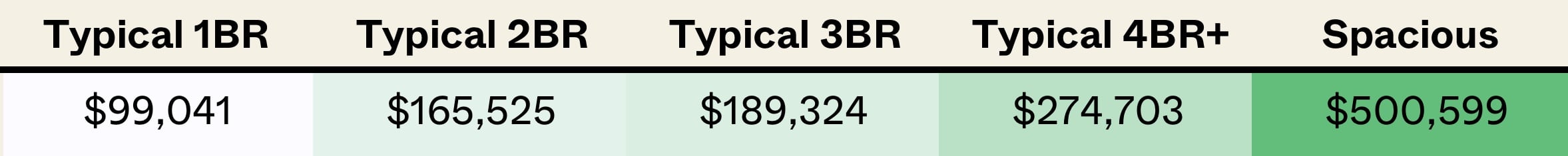

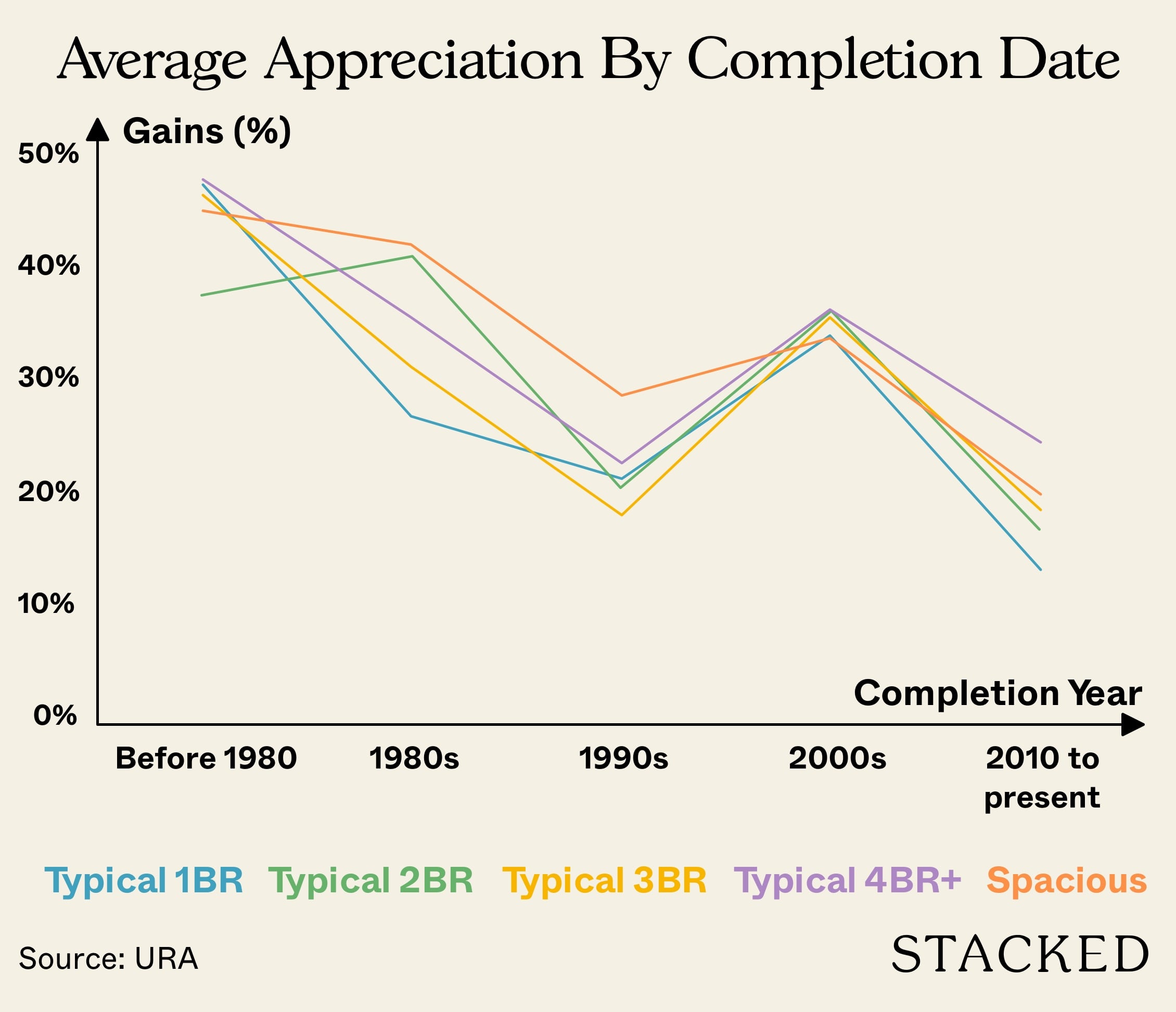

As highlighted in our earlier article on the appreciation of ground to high floor units, larger units do appreciate better especially in recent years, where living space has become a premium as the lines of work and personal activities become increasingly blurred. This trend is observed for the developments in our study as shown in Tables 1 and 2 below.

This is not surprising, as larger units tend to have a bigger pool of prospective buyers which can include a diverse range of family nucleus (e.g. couples with no children, multi-generational families or even investors).

#2 – Larger units in OCR and RCR appreciates slighty better

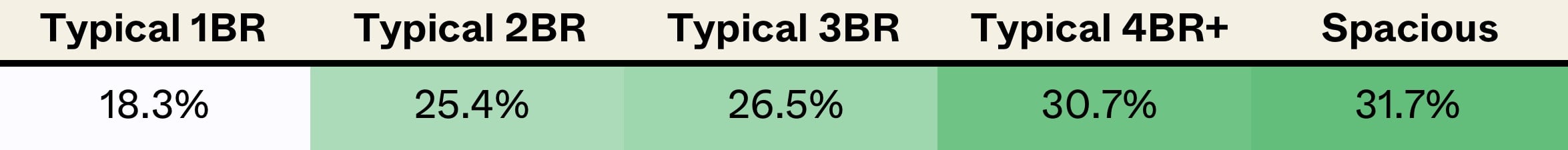

In geographical terms, we saw houses in the OCR and RCR appreciating better for the larger units (i.e. 3BR and above) as shown in Table 3. In fact, the appreciation for the Core Central Region (CCR) actually outperforms the OCR and RCR for the smaller units.

While this seems contradictory to our findings in our earlier article, we believe that the difference here is twofold. One is the increasing gentrification of suburban regions. And two is the decentralisation of the central business district into regional centres in recent years (which was the scope of our data (i.e. last 4 years of transactions) that was previously covered here. Thus, we felt that the appreciation for the OCR should continue to lead the RCR and CCR in the future. This is especially so since foreigners who typically prefer houses in the CCR are now subject to heftier additional buyer’s stamp duty (ABSD) of 30%, which curbs their purchasing power.

Another reason for our bullish sentiment for houses in the OCR and RCR is that houses in the CCR have typically been more expensive than the former and are showing no signs of abating. This would have priced out prospective (local) buyers and resulted in a positive spillover effect on houses in the OCR and RCR.

#3 – Appreciation is generally correlated with holding period

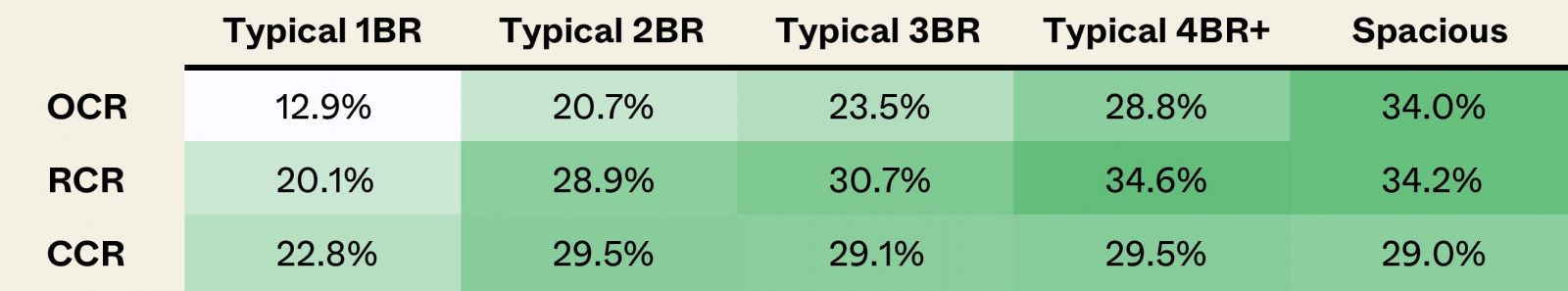

Besides location, another trend that we observed is the direct relation of the appreciation to the holding period as indicated in Table 4 below, which coincides with the conventional wisdom for investment that “time in the market is better than timing the market”.

Property Investment InsightsIs This A Bad Time To Buy A Property? We Analyse 264 Transactions From The 2013 Peak To Find Out

by Ryan J. OngFor those of you who are eagle-eyed, you might have noticed the U-shaped recovery in average gains for the 1-bedroom unit after the 10th year. As we did not manage to find conclusive evidence to explain this anomaly, it could be due to the fact that these units represent the lowest barrier of entry for investors, and thus are attractive to those who are banking on potential en-bloc without risking too much of their capital.

More from Stacked

Analysing 10 Years of District 15 Boutique Condo Transactions: Insights Into What Drives Profitability

In Singapore’s property market, boutique condos have always divided opinion. Some buyers are drawn to their exclusivity, low density, and…

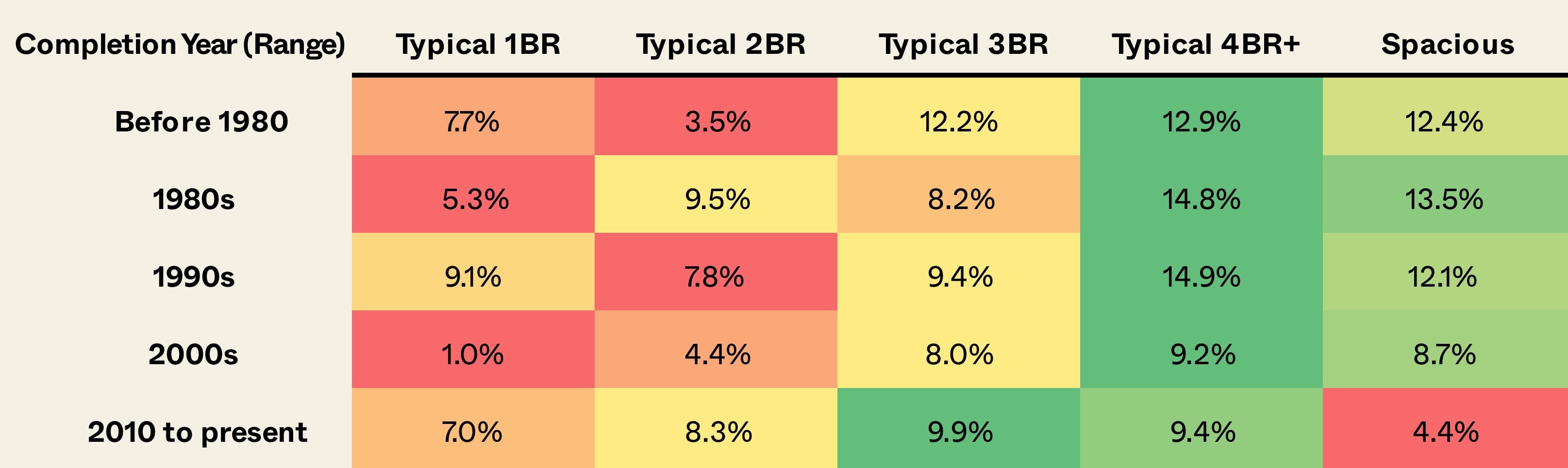

#4 – Appreciation for units built earlier perform better

Similar to the above, a longer holding period means that houses that were built earlier have a better appreciation than their newer counterparts (please see Figure 1 below). This is natural due to the enhancement of the house’s values arising from ongoing developments, gentrification, and urbanisation. Another key reason would be inflation. This is perhaps why buying properties has been viewed by many Singaporeans as a good hedge against inflation, since the value of properties is believed to rise faster than the prevailing inflation rate.

On a related note, the appreciation for older houses would benefit the first couple of owners more than the subsequent ones, given the likelihood of lower prices that the former paid for their purchases.

#5 – When looking at houses bought within the last 10 years, the gains from spacious units are no longer there

So far, our analysis has focused on transactions within the size category range (as defined in the notes section) over the past 26 years. Since looking over a longer time period may not paint the most accurate picture (changing cooling measures, and economic conditions), we decided to look over a shorter time frame.

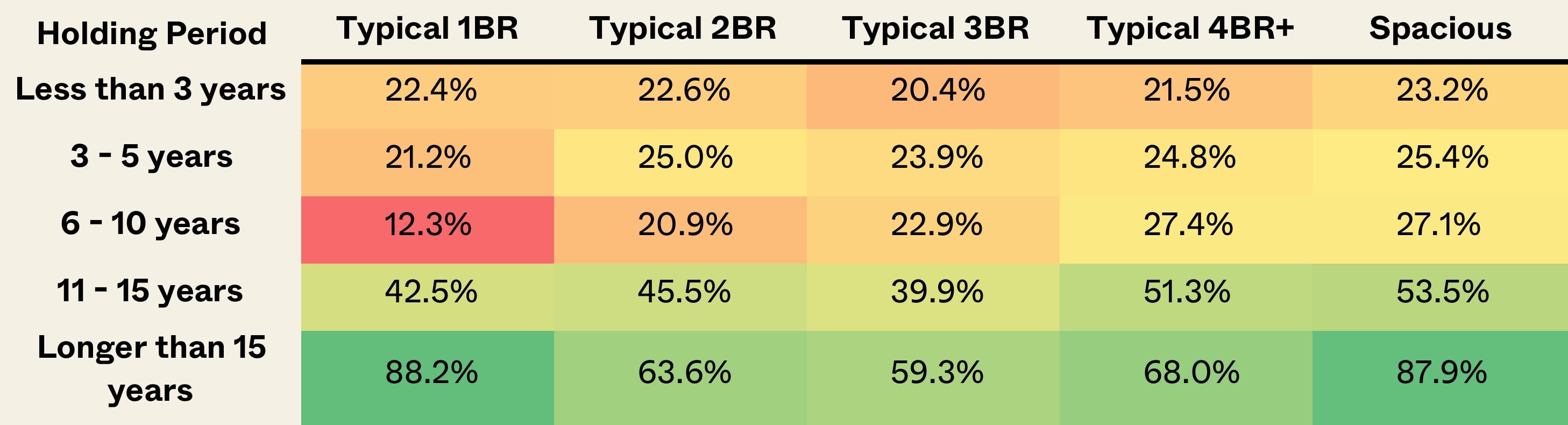

As such, if we narrow our scope to just transactions over the past 10 years (2011 – 2021), you’ll find that while bigger units tend to outperform their smaller counterparts, spacious units no longer take the lead.

One reason why this could be the case is that many of the transactions in the past 10 years within the spacious categories could have come from newly-built condos. These large units above 1,800 sqft in size will have a large proportion of their square footage taken up by space allocated to PES areas, outdoor rooftop terraces, or lofts. Likewise, these units tend to be lifestyle products and could have a much smaller target audience, limiting its upside potential in an era (2011 onwards) where buyers feel the pinch of ever-increasing property prices.

Spacious units in older developments tend to include more of the internal space, where homeowners are able to build partition walls and turn them into useful real estate as compared to those outdoor spaces or PES areas.

| Completion Year (Range) | Typical 1BR | Typical 2BR | Typical 3BR | Typical 4BR+ | Spacious |

| Before 1980 | 5 | 18 | 33 | 84 | 41 |

| 1980s | 10 | 46 | 85 | 145 | 176 |

| 1990s | 26 | 315 | 696 | 1,042 | 178 |

| 2000s | 269 | 703 | 1,440 | 2,359 | 413 |

| 2010 to present | 5,957 | 4,951 | 4,258 | 3,760 | 957 |

| Total | 6,267 | 6,033 | 6,512 | 7,390 | 1,765 |

Indeed, if you were to look at the volume of units transacted, it shows that more than half of the units transacted under the spacious category go to those built from 2010.

Here’s what the breakdown in terms of gains looks like over the past 10 years:

From here, you can see that while bigger units such as the typical 4BR+ and spacious category tend to outperform, it’s clear that the typical 4-bedroom size wins – suggesting that in recent times, there could be a cap on the performance of a unit as the size gets bigger. In other words, there seems to be a sweet spot.

You can also see the paltry 4.4% gain for spacious units in condominiums built from 2010 to present times – suggesting that these newer spacious unit types may not have as much upside potential, which may be down to the unit layout.

Another reason could be that the new and large units were priced and sold close to or at the property market peak of 2013 leaving little room for appreciation, especially if we consider the high purchase price which limits their target audience.

On the contrary, older projects tend to have fared much better.

This could suggest that if you are aiming for a large unit type, perhaps look for one that is in an older development where the layout could be more efficient or features fewer lifestyle elements (such as outdoor rooftop terraces and the like).

That said, do also conduct your due diligence to avoid the pitfalls that we shared in our separate article here on buying older condos.

Conclusion

This study revealed that larger houses do appreciate better in the long run, as it caters more for the own stay demographic, and when average unit sizes are trending down, the luxury of interior living space becomes even more in demand. This is even more apparent for older developments, especially if we limit our scope to purchases in the past 10 years. However, do consider the age of the property, given that properties’ prices tend to stagnate as they age.

As with all property purchases, you and/or your family’s objective should be the key impetus for the intended purchase. Many buyers prefer to have the best of both worlds where they want a spacious house for their own stay and room for capital appreciation.

While such properties do exist, they are not easy to come by as there is often a need to compromise on either price (for newer developments with higher price tags) or remaining lease (for older developments with more spacious layouts). Thus, it would be better to discuss with your family and prioritise their needs, while also being mindful of the financial obligations that will come along from purchasing a home.

Should you require any guidance with your property purchase, do feel free to reach out to us for a non-obligatory discussion.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Do larger homes in Singapore appreciate more than smaller ones?

Are spacious units in Singapore a good investment compared to smaller units?

Does the location of a property affect its appreciation, especially for larger units?

How does the age of a property influence its appreciation in Singapore?

Has the trend of appreciation for large units changed in the last decade?

Ian Tan

Ian is a property enthusiast who finds himself constantly learning about this art and uses data to educate himself on property investment. When not analysing property data, Ian can be found shooting hoops, eating healthily and reflecting on himself, so that he can continue pursuing his aspirations for as long as his mind and body allow.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments