Why Developers Are Now Building for Families in Singapore’s Most Expensive Districts

August 25, 2025

The Core Central Region (CCR) was once viewed as an enclave for the very wealthy, or for foreigners with deep pockets. Orchard Road was the designer shopping stretch, Tanglin was the diplomatic enclave, River Valley was old-money residential…and whilst it hasn’t totally disappeared, the vibe is definitely changing. From recent launches to the predictable effects of policy moves, we’re seeing more Singaporeans and PRs move back into the heart of the city – and whether you’re a home owner or investor, it’s definitely a shift to keep a close eye on. Here are the signs:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. We can see the signs in the launch calendars and showflat conversations

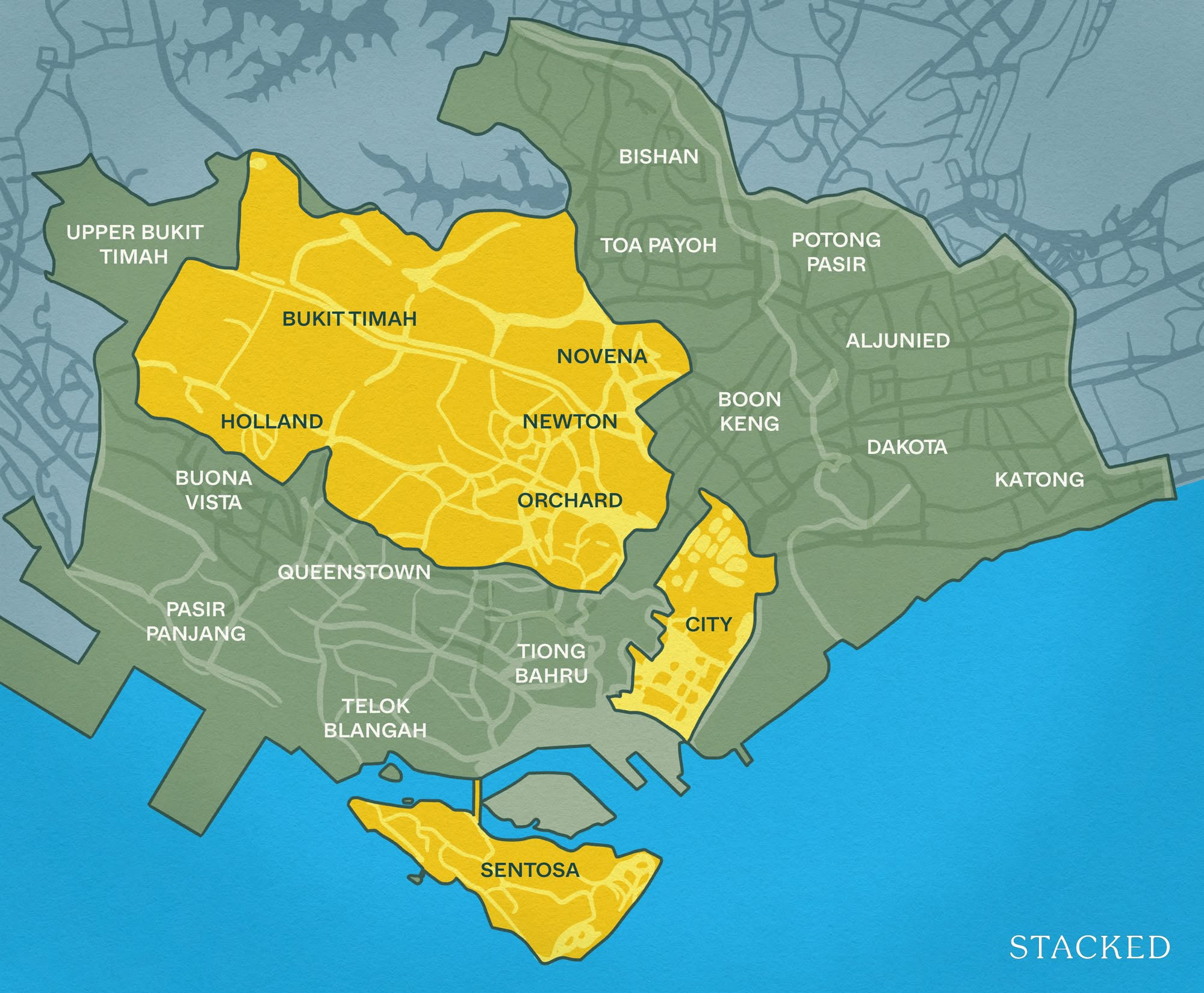

In April 2023, the Singapore government raised Additional Buyers Stamp Duty (ABSD) rates to 60 per cent. Whilst the policy applies to the entire country, it was understood even then that the Core Central Region (CCR) was the primary target. Simply put, foreign buyers are less common in the Rest of Central Region (RCR), and are unicorns in the Outside of Central Region (OCR) heartlands.

This created a highly specific and targeted effect. In the OCR and (in the case of wealthier Singaporeans) the RCR, Singaporeans and PRs continue to compete with each other for private homes. But in the CCR, a notable gap appeared as foreigners cleared out – and in an ironic twist, the availability of new launches became higher in the CCR than in the heartlands.

It shows up clearly in the launch calendar. The bulk of new projects for the remainder of 2025 are CCR-based. We’ve already seen headline launches like River Green, and more are on the way: Penrith in Queenstown, Zyon Grand near Great World, and Newport Residences in Tanjong Pagar (formerly Fuji Xerox Towers). For the first time in decades, you don’t need to obsess over whether a CCR launch is accessible or has amenities nearby – almost all of them are, by default, plugged directly into MRT stations, malls, or both.

We can also see it in how buyers are now splitting hairs in ways they would have considered odd before. A recent example is a buyer who decided on River Green instead of Promenade Peak, despite both being near Great World MRT station, just because River Green is technically District 9 and Promenade Peak is District 3 (they felt the former was more recognisably prestigious).

Another shift in the conversation is the concern over school proximity and whether friends or family will remain in touch. While school proximity has always been a concern, it’s become a far more prominent issue recently, precisely because CCR’s new launches tend to have fewer Primary schools nearby. As for being near friends and family, it seems buyers are just now starting to realise the drawbacks of the CCR – in more “choreographed” areas like Marina Bay, or more commercially-centred areas like Clarke Quay, there’s a much weaker sense of community.

The nature of these concerns and the resulting conversations hints at pure owner-occupancy creeping back into the prime areas.

2. Even developers have pivoted to owner-occupancy for CCR projects

When viewing River Green, we asked why there was no outright mention of the clear rental benefits. River Green has compact (low quantum) units, and is connected to Great World MRT station; under other market conditions, this would immediately be assumed to cater to landlords – if not totally, then at least to a high degree.

But the developer’s marketing didn’t emphasise that at all – instead the developer focused on inclusivity (e.g., easy access for the disabled, pool and bathroom areas that are easy to use even for the wheelchair-bound), and issues like sustainability.

We saw the same thing with the almost-CCR Promenade Peak*: this is a project that can easily draw investors or landlords, for the same reasons as River Green.

This is also evident from the layouts designed by developers. In prior years, developers tended to build larger and more lavish units in the CCR; this was on the assumption that luxury home buyers are not as price-sensitive (and we can’t say developers were wrong, as many of them did sell).

More from Stacked

First-time home seller: Don’t sell your home without reading these 5 pricing strategies

If you are a first-time home seller, pricing your home can be a tricky thing to do. If you are…

But given that Singaporeans are uncomfortable pushing past $1.8 million to $2 million (or up to $2.5 million if they’re upgrading from another private property), developers have started to scale down the sizes. Some developers outright refuse to mention price per square foot in any official marketing materials or statements, and will instead focus on the overall price.

On the downside, this does result in smaller family homes in the CCR, with some families needing to make two with two-bedders or 2+1 layouts. It’s as yet uncertain how these small units will fare on the resale market, and most buyers are aware of that. But we can see that sales were at a feverish pace anyway, because the buyers are more focused on own-stay benefits than on financial gain.

*Again, Promenade Peak is so close to the CCR boundary that its RCR status is more of a technicality.

3. The URA Draft Master Plan show a major pivot in the CCR

A good example of this is the new Village Square centred around Newton MRT. Besides the name itself being a giveaway, the planned 5,000 homes are meant to turn this formerly transit-heavy zone into a green and community-focused precinct. This is a sharp departure from previous decades. In the past, the idea of Newton being a community/family area would have been strange – it was often dismissed as the traffic jam area on the way to town.

Over at Orchard, a plot above Orchard MRT has been zoned as a premium white site, slated for a vertical village (there’s that word again) combining about 1,000 private residences with retail and offices. This is part of the ongoing effort to convert Orchard into a live-work-play node.

We’re also seeing over 80,000 new public as well as private homes across central locations like Pearl’s Hill, Bukit Timah Turf City, and Greater one‑north; and in each instance, the emphasis is on integrated amenities and walkability. In short, we’re seeing URA plan out the CCR neighbourhoods in a way we used to see in the heartlands: a lot of talk about being car-lite, park-connectors, access to balanced outdoor and indoor activities, etc.

For those who have been in the Singapore property market for a long time, it’s downright uncanny: these are the same terms once used to sell heartland towns like Sembawang or Yishun. Today, they’re being applied to Orchard, Newton, River Valley, etc. That signals that the CCR is being recast not as an exclusive enclave, but as accessible neighbourhoods.

For decades, the CCR carried a reputation for being aloof

Luxury projects for the ultra-wealthy, or speculative playgrounds for overseas investors. That image isn’t gone yet, but it is being reshaped. Developers are now incentivised to cater to real homeowners, and URA is reimagining the central districts as lived-in neighbourhoods instead of swanky (but sometimes quite empty) prestige zones.

Whether this ultimately makes the CCR more inclusive and vibrant, or whether it risks diluting the “exclusive” aura that once defined it, is still an open question: but what’s certain is that Singaporeans and PRs are no longer just visitors or investors in these districts – they’re moving in, raising families, and reshaping what it means to live in the city centre.

We could even speed up the process greatly by fixing the insane rental rates that are plaguing the commercial scene, especially in high-rent areas like the CCR.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why are more families in Singapore choosing to live in the city’s most expensive districts now?

How has the government’s policy affected property development in Singapore’s core central region?

Are developers now building smaller homes in Singapore’s prime districts?

What changes are happening in the planning and development of Singapore’s city centre districts?

How is the perception of Singapore’s central districts changing among residents and investors?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Singapore Property News Taking Questions: On Resale Levies and Buying Dilemmas

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments