Orchard Road’s Most Unlikely $250 Million Property Is Finally Up for Sale — After 20 Years

January 21, 2026

For the first time in over 20 years, Cuppage Terrace, the long-established hangout spot (and some might say mini-Japan) between Centrepoint and Orchard Point, is up for grabs. The valuation for this cluster of 17 adjoining Peranakan conservation shophouses is $250 million.

To some extent, this was expected. It was foreshadowed by the collective sale launch of a part of The Centrepoint just two weeks earlier, specifically, the rear block of Centrepoint is on the market at a guide price of $418 million. That part of the development, which comprises residential units and part of the mall’s retail component, is right next to Cuppage Terrace.

Taken together, the nearly back-to-back marketing of both properties points to a potential wide-scale shift (and perhaps repricing) of this niche section of Orchard Road. While The Centrepoint is a more typical redevelopment opportunity, Cuppage Terrace is different: it’s a conserved enclave, whose appeal emerged organically and over the years.

This sale coincides with a rising market for retail properties

The stretch of properties that make up Cuppage Terrace consists of 17 conserved Peranakan-style shophouses. They sit on a total land area of about 28,986 sq ft and have a combined floor area of 50,891 sq ft, including substantial outdoor refreshment areas.

These 99-year leasehold properties have about 62 years left on their lease, and the stretch is zoned for commercial use. At present, the ground-floor units are fully leased to F&B operators.

At a guide valuation of $250 million and total floor area, that works out to roughly $4,900 psf. CBRE is the exclusive marketing agent for the sale of Cuppage Terrace.

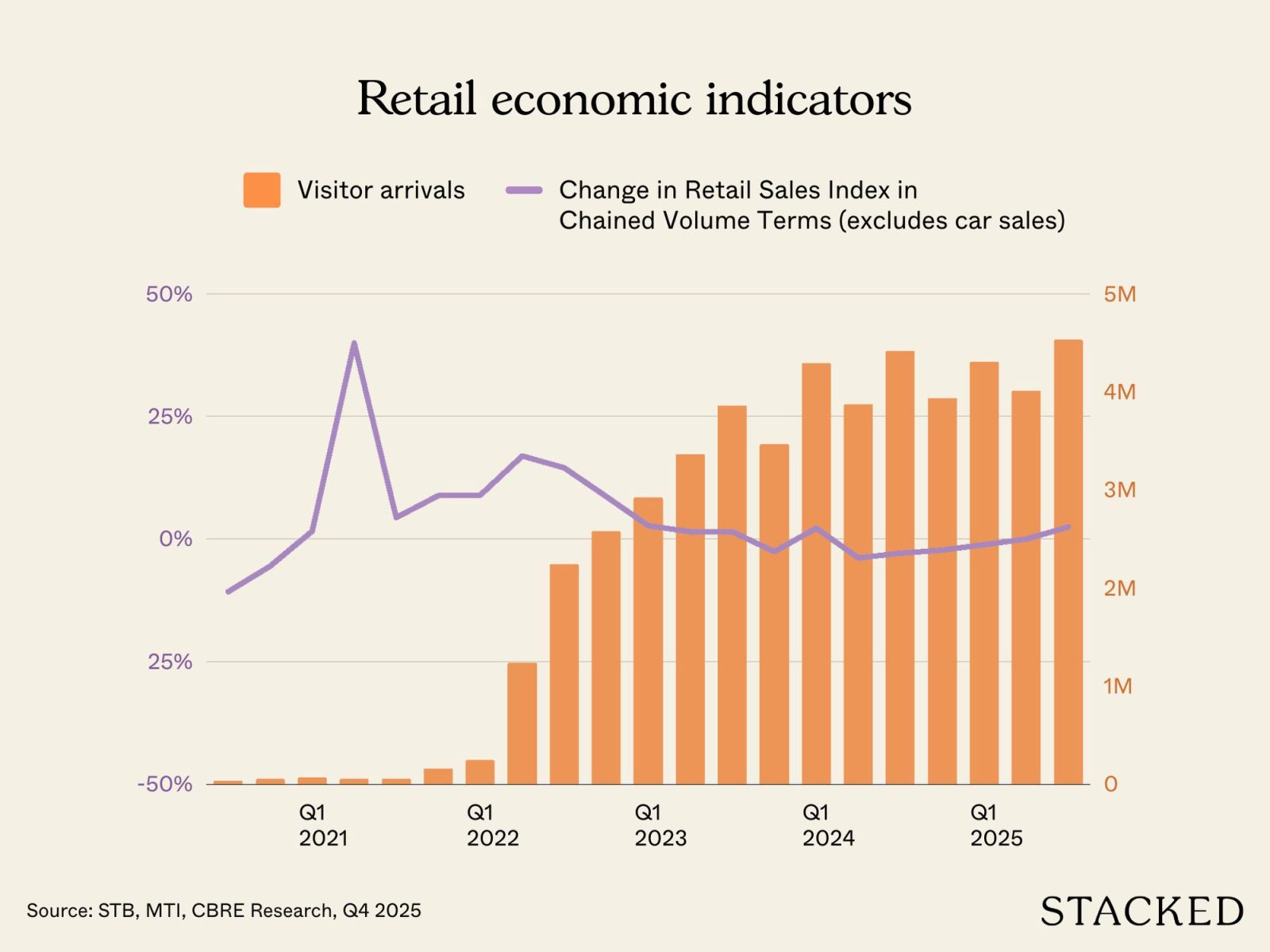

The timing for this sale isn’t coincidental. First, the appeal of commercial assets like Cuppage Terrace is supported by retail market trends.

According to CBRE, prime islandwide retail rents rose 0.5% q-o-q in 4Q2025, while the full-year growth last year was 2.4%. This is pushing retail rents above pre-pandemic levels for the first time since 2019. Orchard Road itself recorded a yearly rental growth of around 2% in 2025.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

While CBRE expects rental growth to moderate to about 1 – 2% in 2026, demand has been strongest for well-located, F&B-led retail clusters with established footfall. That’s precisely the segment that street-facing enclaves like Cuppage Terrace fall into.

Second, it won’t escape notice that upgrades or repositioning of The Centrepoint could enhance footfall in Cuppage Terrace. The Centrepoint is right next door, and any improvement to it will be a potential upside for Cuppage Terrace.

An enclave on Orchard Road that we don’t want to lose

Beyond the investment narrative, Cuppage Terrace has a distinctive place in the broader identity and urban landscape of Orchard Road.

Many Singaporeans either know it or remember it, as a familiar hangout – a place for after-work drinks, late dinners, or casual nights out. From long-established names like Acid Bar to clusters of izakaya-style Japanese eateries, this area is markedly different from the more commercial and luxury retail stretch further past Centrepoint.

This contrast has helped it remain relevant and popular for decades, even as the Orchard Road shopping belt evolved. The concentration of F&B here has turned it into a lifestyle / social destination, which stands out from the rows of commercial malls that dominate the area.

This attraction is also why the ground floors remain fully leased, and why the area continues to draw a steady after-work and late-night crowd.

Will S$250 million be considered expensive?

At a guide valuation of S$250 million, Cuppage Terrace will inevitably prompt questions about pricing. But the valuation should also be read in context with URA’s ongoing efforts for the area.

The government’s current intent is to reposition Orchard Road as a more diverse live-work-play destination, rather than a retail strip. As such, we can expect that planning guidelines will increasingly emphasise active street fronts, pedestrian-friendly environments, and a stronger mix of lifestyle uses – all of which are qualities that Cuppage Terrace already embodies.

In the past, Cuppage Terrace was arguably an anomaly, but today it’s a good early example of the kind of urban experience Orchard Road needs to cultivate. It’s much more difficult to choreograph a lifestyle stretch between malls than to just build up on a naturally existing one.

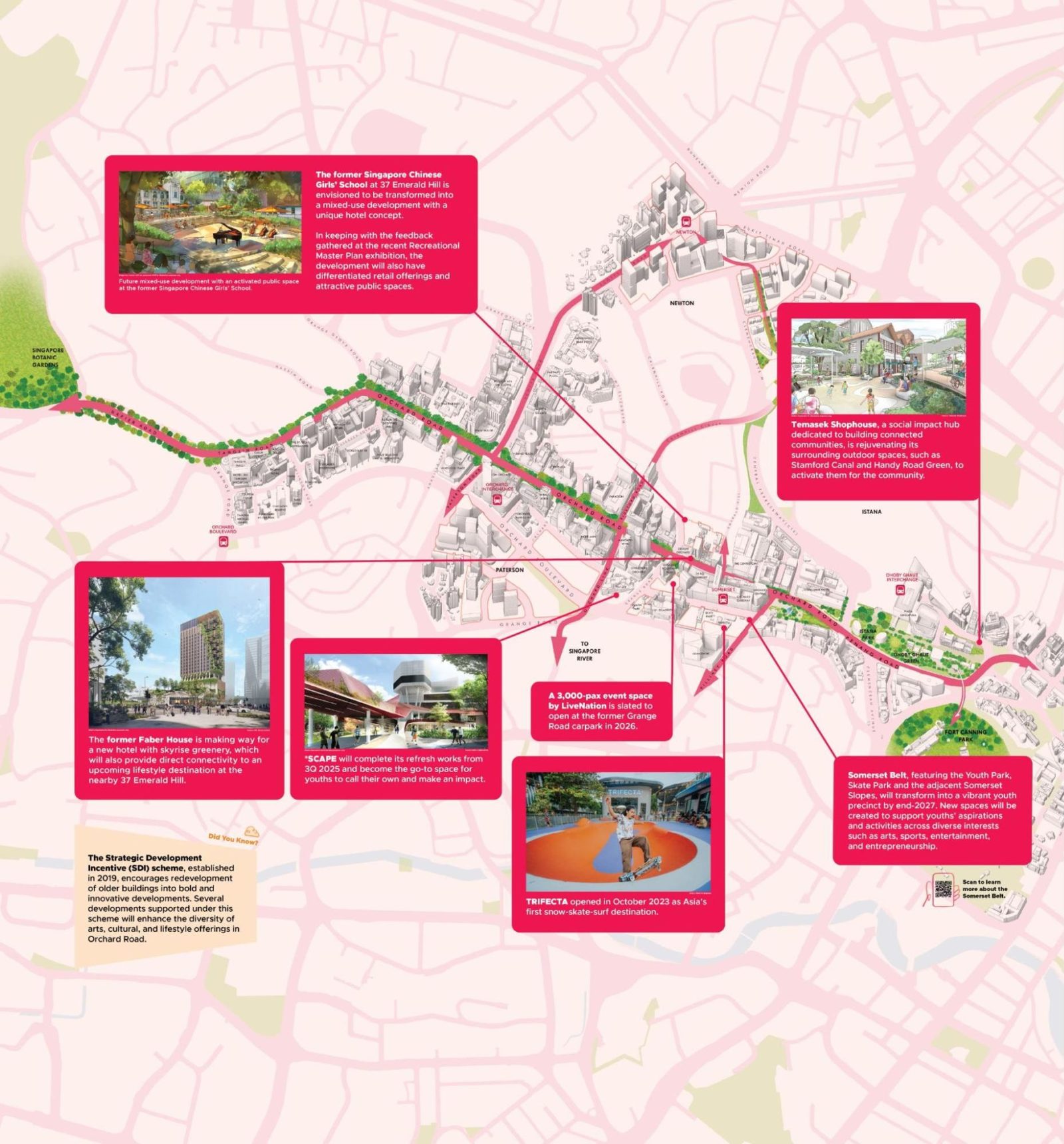

Since the latest Master Plan was unveiled last year, we also have a better sense of where urban rejuvenation plans for Singapore’s premier shopping belt will take it. Private developers are already trying to get ahead of this, and there are several landmark redevelopments in the Somerset area lined up.

This year, a new 3,000-capacity music hall will open at the site of a former open-air car park on Grange Road. Jointly developed by Australian-based property development group Lendlease and concert promoter Live Nation, it will be the first purpose-built venue by Live Nation in Asia.

Lendlease has also partnered with local telco Singtel to redevelop the iconic Comcentre. The project broke ground last July and will be developed into the largest integrated Grade A office space in Orchard Road. It will also have a sheltered arcade, public urban spaces, new lifestyle and retail spaces, F&B offerings, medical suites, and an auditorium.

The first NoMad hotel in Asia Pacific will also land at the site of the former Faber House – this is next to Design Orchard, at the junction of Cairnhill Road and Orchard Road. The 137-room luxury hotel is a brand by international hotelier Hilton, and will welcome its first guests next year.

So as Orchard tilts ever further toward being a live-work-play zone, pedestrian footfall and interest in Cuppage Terrace are likely to grow. This property is already primed to take advantage of future changes.

“For the first time in over 20 years, Cuppage Terrace – Orchard Road’s beloved and iconic F&B and lifestyle enclave – is finally on the market. This is a truly generational asset, rarely brought to market,” says Clemence Lee, executive director, Capital Markets at CBRE.

What comes next

He adds that Cuppage Terrace is one of Singapore’s largest conservation shophouse offerings. “This is critical because large, contiguous shophouse portfolios are exceptionally rare and almost never remain long on the market”.

Over the last five years, this type of commercial asset has been snapped up by family offices, private wealth funds, and high-net-worth investors.

Examples of collections of shophouses going up for sale include Hotel 1900, a row of 12 shophouses at 46-50 Mosque Street that was put up for sale last year with an estimated $170 million price tag, a row of 12 shophouses at 46-50 Mosque Street for over $110 million in 2022, and Weave Midtown on Jalan Sultan priced from $105 million.

With ownership of Cuppage Terrace potentially changing, the commercially sensible path is to build on what already works. Cuppage Terrace’s appeal has long stemmed from its social, street-facing character; it has an identity that differentiates it within Orchard and sustains footfall beyond traditional retail hours.

That means, however, that the significance of this sale goes beyond another routine redevelopment. It reflects on the parts of Orchard’s character that are worth carrying forward into the area’s next chapter. This is likely to factor into pricing considerations and – for some entities – may also be a brand consideration.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from On The Market

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments