We Analyse “Safer” Resale Condos in Singapore to See If They’re Actually Worth Buying: A New Series

January 20, 2026

When the Stacked editorial team were brainstorming ideas for the first new PRO series of 2026, I can truthfully say that none of us were aware of the ‘2026 Is The New 2016’ trend making waves on social media today.

If you haven’t heard about this trend, a wave of nostalgia for the 2016s is captivating users on TikTok and Instagram. That era was only a decade ago, but some of us can look back at that time through a rose-tinted Snapchat filter.

For Singaporeans, it’s been a decade since we celebrated Joseph Schooling’s Olympic gold medal feat, and many of us had Pokémon Go on our phones. In the property market, Punggol’s Waterway Point opened, Funan DigitaLife Mall closed, and plans for the new Tengah HDB town were unveiled.

I suppose a similar sense of nostalgia permeates those of us who covered Singapore’s property market at the time.

This was before a series of property cooling measures that first hit in July 2018, which rocked the residential market. At the time, interest rates were lower, overall housing affordability ceilings were higher, and the housing market faced an oversupply situation.

Helping you understand the market

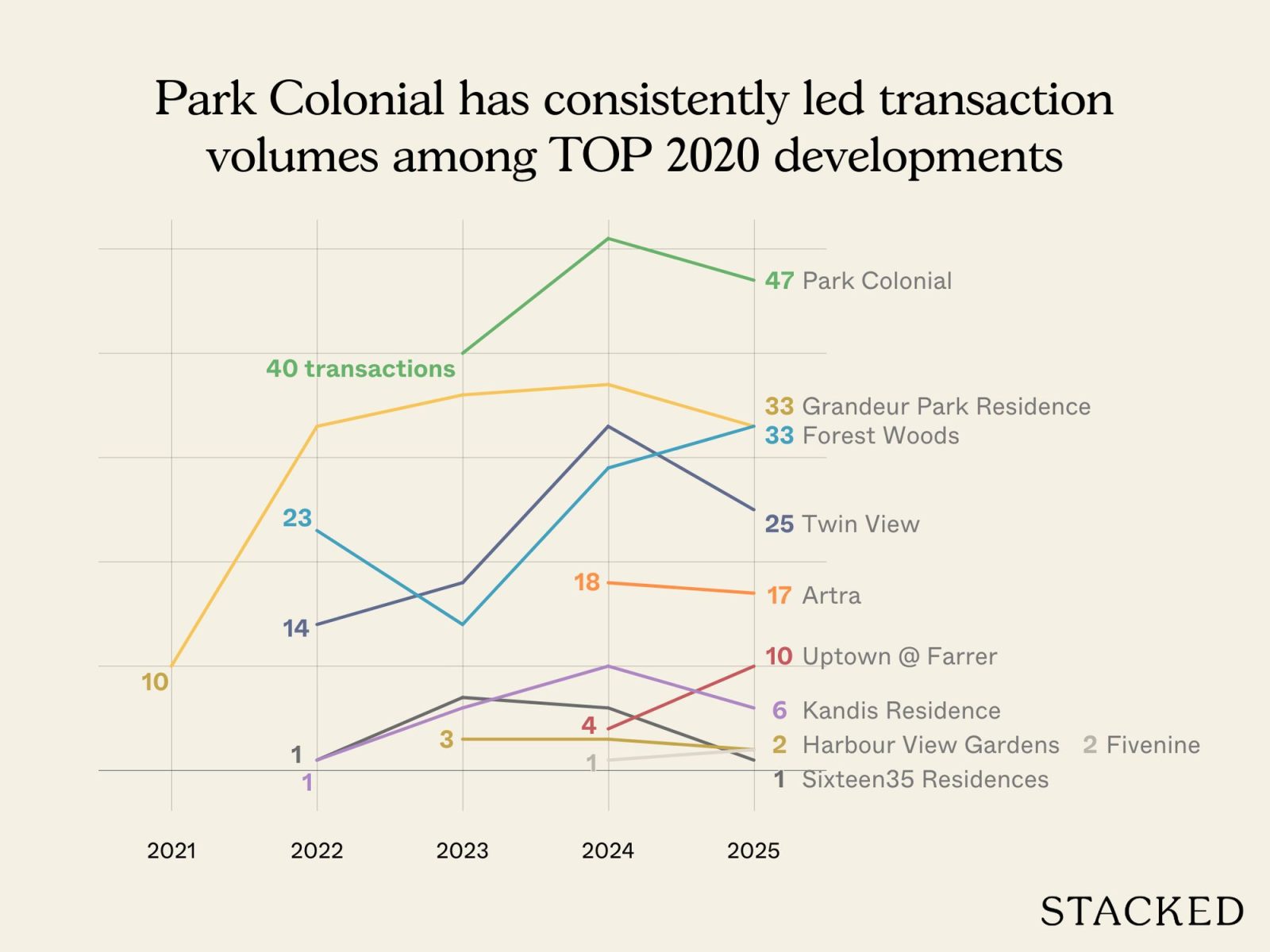

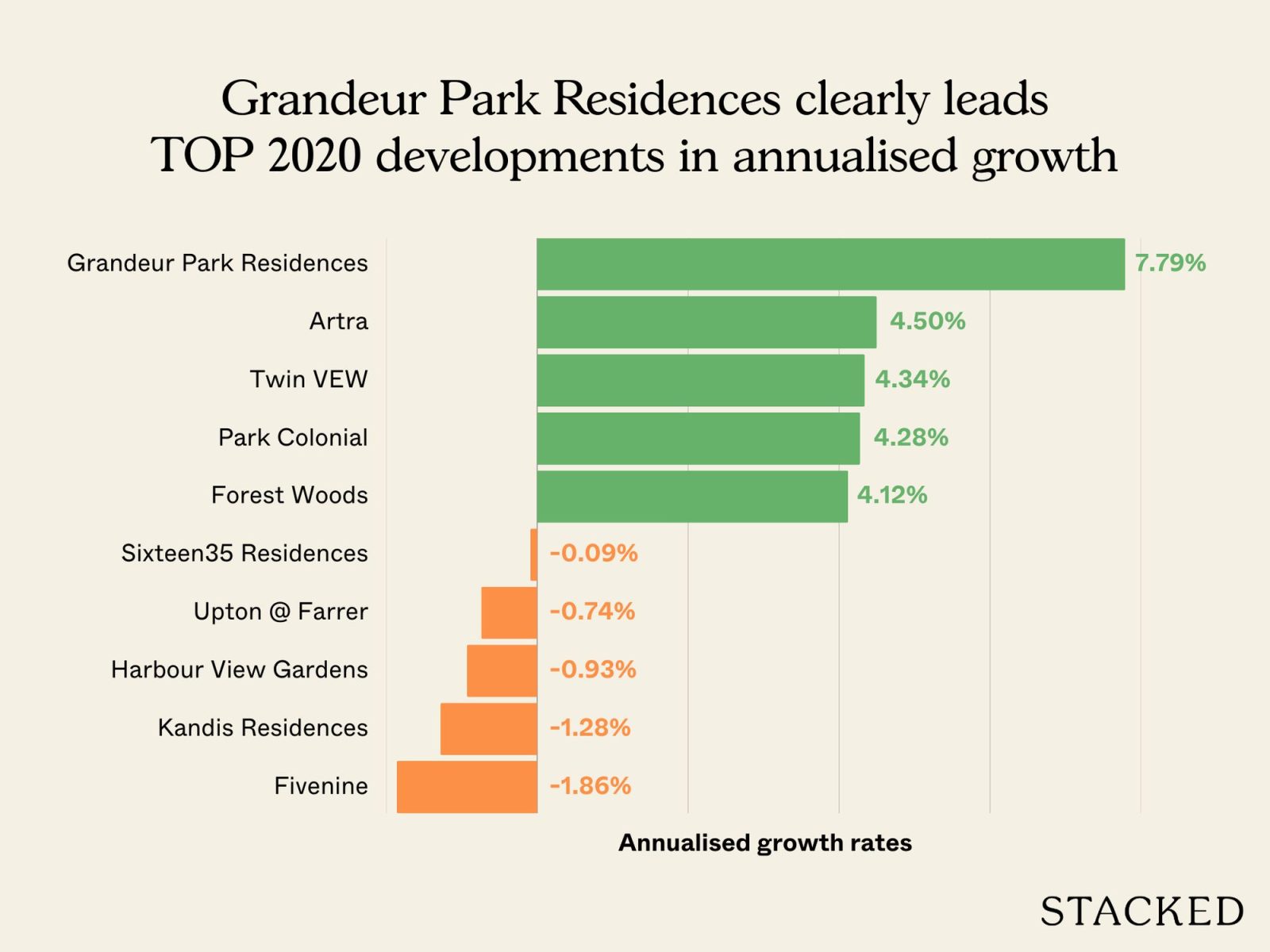

Over the next few weeks, the focus of our PRO articles will be an analytical and forensic examination of a specific group of condominiums that launched between 2016 and 2018, completed between 2020 and 2021, and are now properly entering the resale market.

These aren’t newly launched projects, nor are they ageing legacy developments.

We think this basket of condos presents an insightful perspective to help you better understand how the private residential market has evolved in the past few years, and what this means if you’re a house-hunter today.

The developments we have shortlisted sit in an awkward middle ground that some buyers may assume are ‘safe’ properties. This means they are relatively new enough to feel modern, old enough for launch pricing to moderate, and often marketed as proven developments with MRT accessibility and condo facilities.

But as resale data starts to pile up, we’re beginning to see that not all of these projects have aged equally well. This PRO series is our attempt to understand why.

But before we plunge into the data with you, we also want to give you an insider’s look at the analytical framework our data team uses to help us craft each PRO article.

Shifting buyer assumptions: 2016 to 2026

Condo buyers who entered the private residential market between 2016 and 2018 faced a very different landscape compared to prevailing market conditions.

In 2016, the appreciation of the Singapore Dollar against the US Dollar largely helped to keep interest rates in Singapore relatively low.

Floating rates like the Singapore Interbank Offered Rate (SIBOR) dipped, with the one-month SIBOR dropping to about 0.62%. The three-month average slipped to 0.87% by August that year from just over 1% at the start of the year.

This translated into lower overall borrowing rates for homebuyers, which buoyed confidence and sentiment in the residential market.

The favourable interest rate environment coincided with a fall in private housing prices, which decreased 12% over 15 quarters from 2013 to 2017. Coupled with a nearly 15% growth in household income during this period, purchasing a private home was very much affordable for most locals.

This exuberance was abruptly cut short in July 2018 when the government hiked the additional buyers’ stamp duty (ABSD). For locals buying their second private property, it rose from 7% to 12%; permanent residents (PRs) saw their rate go up from 10% to 15%; and the ABSD on foreign buyers jumped from 15% to 20%.

Since then, the government has stepped in twice more to raise the ABSD rates across the board – they did it in December 2021 and again in April 2023.

For the condos we’ll be examining in this PRO series, their buyers are being judged by a resale market that is far less forgiving compared to the housing market when they entered. Overall, we see that buyers are much more price sensitive, financing costs are higher, and resale competition (from new launches and other resale condos) is far more intense.

As a result, we’ll dive into what we see as a growing disconnect between how our basket of condos was initially priced and positioned, and how they are performing on the resale market today.

Understanding this gap and potential mismatched pricing expectation is exactly where informed buyers can position themselves to make a more informed decision, or an expensive mistake down the road.

More from Stacked

4 Handy Tips to Decorate a Tiny Apartment

As the cost of housing continues to rise in cities, as well as the trend of reducing our carbon footprint,…

What will we examine?

You might be familiar with some of the condos we’ll be discussing in the coming weeks: Projects like 720-unit Grandeur Park Residences, a 99-year leasehold development at Bedok South Ave 3; the 400-unit ARTRA, a 99-year leasehold condo on Alexandra View; and Uptown @ Farrer, part of a mixed-use development in Farrer Park.

On the face of it, most of the condos on our shortlist should be straightforward to access.

They have a relatively modern design, completed developments, and we have insights into their facilities and unit layouts. And we have resale data to help ground our analysis.

But it’s possible to misunderstand these projects. We mean that some buyers may approach them with different assumptions – like being a new condo means it’s a future-proof project, or assuming proximity to an MRT station guarantees good resale opportunities, or its immediate post-launch success translates into resale price resilience.

At Stacked, our goal has always been to provide buyers and sellers with an independent and data-driven perspective. Our PRO series is our most in-depth way for us to cut through the branding and brochure narratives, which enable us to examine the aspects that matter the most to you – the unit mix, buyer catchment, stack orientation, and the conditions for a profitable exit strategy.

These factors don’t turn up in the marketing materials, but they reveal themselves when we interrogate the data.

Each of our articles in this series will apply the same analytical framework, so readers can compare projects meaningfully rather than digest these insights as isolated project reviews.

Some of the key data points we rely on include:

- Caveated resale transaction data from URA, including rental transactions

- Stacked internal database, our collection of references and data that enables us to dissect performance by unit type and layout.

- A scrutiny of the development site plans, stack orientations, and surrounding developments

- Unbiased on-the-ground considerations such as noise, heat, privacy, and nearby competing projects

Specifically for this series, we will examine the following:

- What buyers in each of the projects were pitched, against what the resale data shows us

- Which unit types have held up, and which haven’t

- Where profits and losses are concentrated

- How stack and layout choices may affect resale price outcomes

- Whether resale liquidity in that area is strengthening or narrowing

- How each condo compares to its true competitors, not just nearby projects

- What kind of buyer would each development be most suitable for today

The goal of our PRO articles and series is not to pass judgment on specific developments, and you should do your own review to gauge any projects you might be considering.

Instead, our PRO articles bring to the surface many of the decision-level insights that are helpful when making an informed purchasing decision. The conclusions we draw will differ from project to project, and we hope the questions we’re asking help you build the same degree of intuition.

In other words, this series isn’t about understanding the condos we’ll feature – it’s about learning how to think more clearly about any resale condo.

Early patterns we’re already seeing

Our data team has started their analysis, and we’d like to share some of their initial findings without getting too ahead of ourselves.

- Larger-sized family units often demonstrate more price resilience compared to more compact, investor-friendly units

- Stack orientation and surrounding conditions can create significant price differences within the same development

- Liquidity, meaning to say who is buying, how often, and at what price, often matters more than the headline psf price

We’ll reiterate that this is not a ranking exercise, nor is it a buy or sell recommendation, nor a price forecast. We hope that this helps our readers understand why outcomes might differ within the same development and identify risks that might be easily overlooked.

Overall, we want to smash the assumptions that no longer hold true in today’s property market. This is important since buyers commit hard-earned money in a far less forgiving property market than one into which these were launched.

We hope you enjoy exploring this series with us in the week ahead.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments