The Best Condo Rental Yields Near International Schools In Singapore Isn’t Where You’d Expect

October 4, 2025

If you’re buying a rental asset, this unchallenged nugget of “insight” will be dropped by the seller: it’s near the international school, so it’s surely good for rental. It’s a bit of a Singaporean bias: just because we consider school proximity to be a big deal, we assume foreigners from other cultures will think the same. It’s quite easy to forget that, from some perspectives, Singapore is so compact that our distances may not seem like much to them. Also, they don’t have the urgent need to be “within one kilometre” like we do for priority enrolment.

All this led us to ask: exactly how much does being near international schools help with rental yield? Is proximity the “common sense” advantage that so many realtors claim it is? We did a deep dive into the data to find out:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The schools we’ve chosen for this study

Tanglin Trust School (Portsdown/One-North area)

Tanglin is one of the oldest and most prestigious, offering both A-Levels and IB. The neighbourhood around Tanglin (Wessex, One-North, Holland) is already prime, with condos like One-North Residences, Rochester Residences, etc. Rental demand here is strong regardless of the school, as it’s also near the Biopolis/One-North work cluster.

Singapore American School (Woodlands)

SAS is a sprawling campus up north, with an authentic American-suburban vibe. Condos near SAS (e.g. Woodgrove, Rosewood, Parc Rosewood) are much more affordable than CCR/RCR counterparts, and the school is a major driver of demand since the area is otherwise less popular for locals.

UWC South East Asia (Dover & Tampines campuses)

UWC is globally recognised, attracting expats across Europe, the Americas, and Asia. Its Dover campus sits in District 10, alongside already-expensive projects like Dover Parkview or Heritage View. The Tampines campus is different: condos there (e.g. The Tropica, Waterview) are OCR, so international school demand adds a layer of support in an otherwise mass-market area.

Dulwich College (Bukit Batok/Hillview area)

Dulwich is newer compared to Tanglin or SAS, but is fast-rising in reputation. The surrounding neighbourhood (Bukit Batok, Hillview, Dairy Farm) is a mix of HDB and more affordable condos, so Dulwich is one of the few demand anchors for expats here.

Stamford American International School (Potong Pasir/Woodleigh)

Stamford is centrally located and offers a broad international curriculum. Condos nearby (e.g. Woodleigh Residences, Park Colonial, Poiz Residences) already benefit from city-fringe positioning and MRT access.

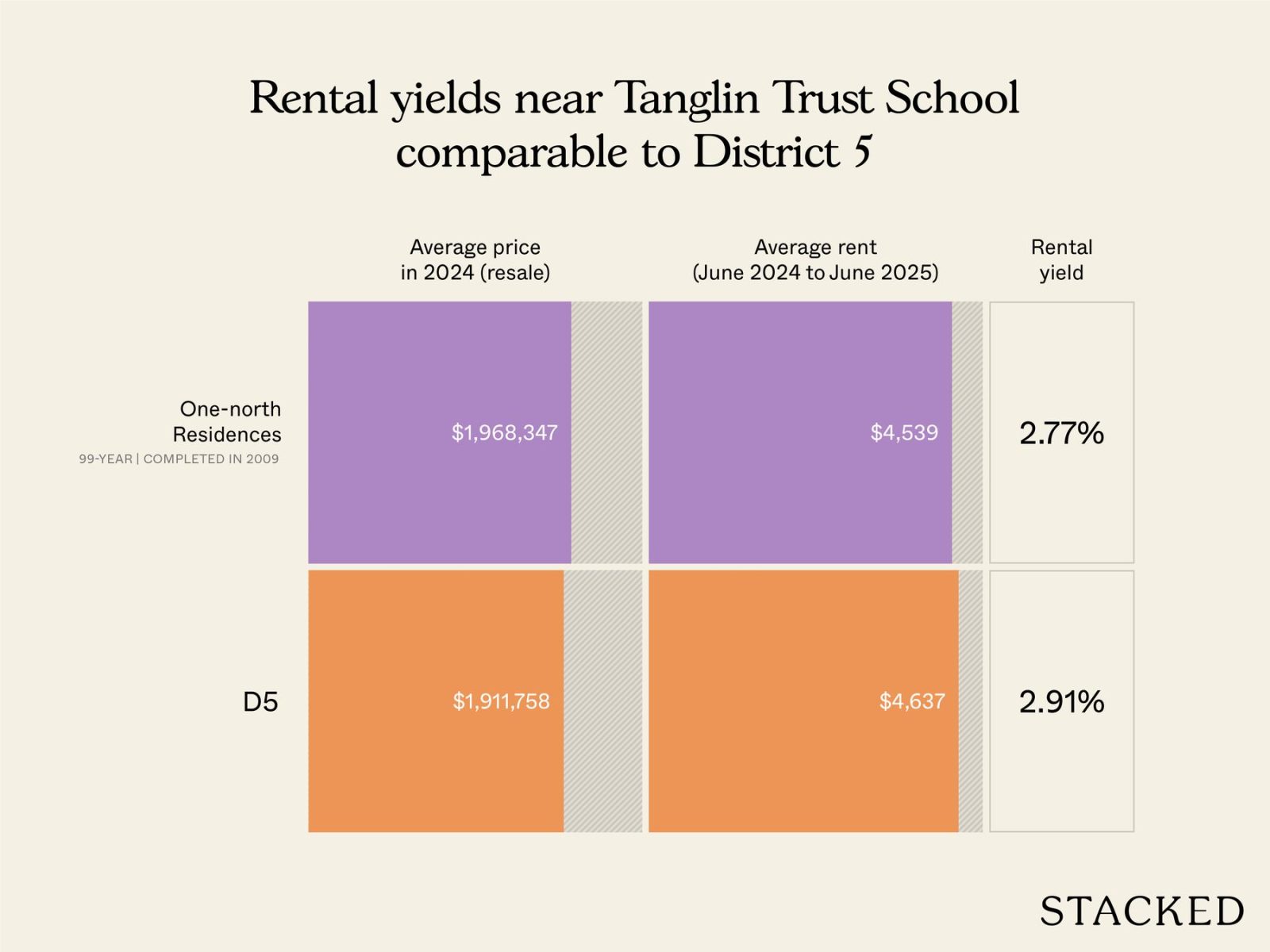

Now, let’s look at rental yields near these schools, starting with Tanglin Trust School

Projects in the vicinity

| Project | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| One-north Residences | $1,968,347 | $4,539 | 2.77% |

Let’s compare it to the district average

| District | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| D5 | $1,911,758 | $4,637 | 2.91% |

Despite being practically next door to Tanglin, One-North Residences actually shows a slightly lower rental yield than the district as a whole (2.77 per cent vs. 2.91 per cent).

However, we can see that One-North Residences’ performance isn’t actually bad per se, in the context of District 5; the difference from the district average is marginal. So it’s not really worse off from being near the international school either; it’s just that there’s no real impact.

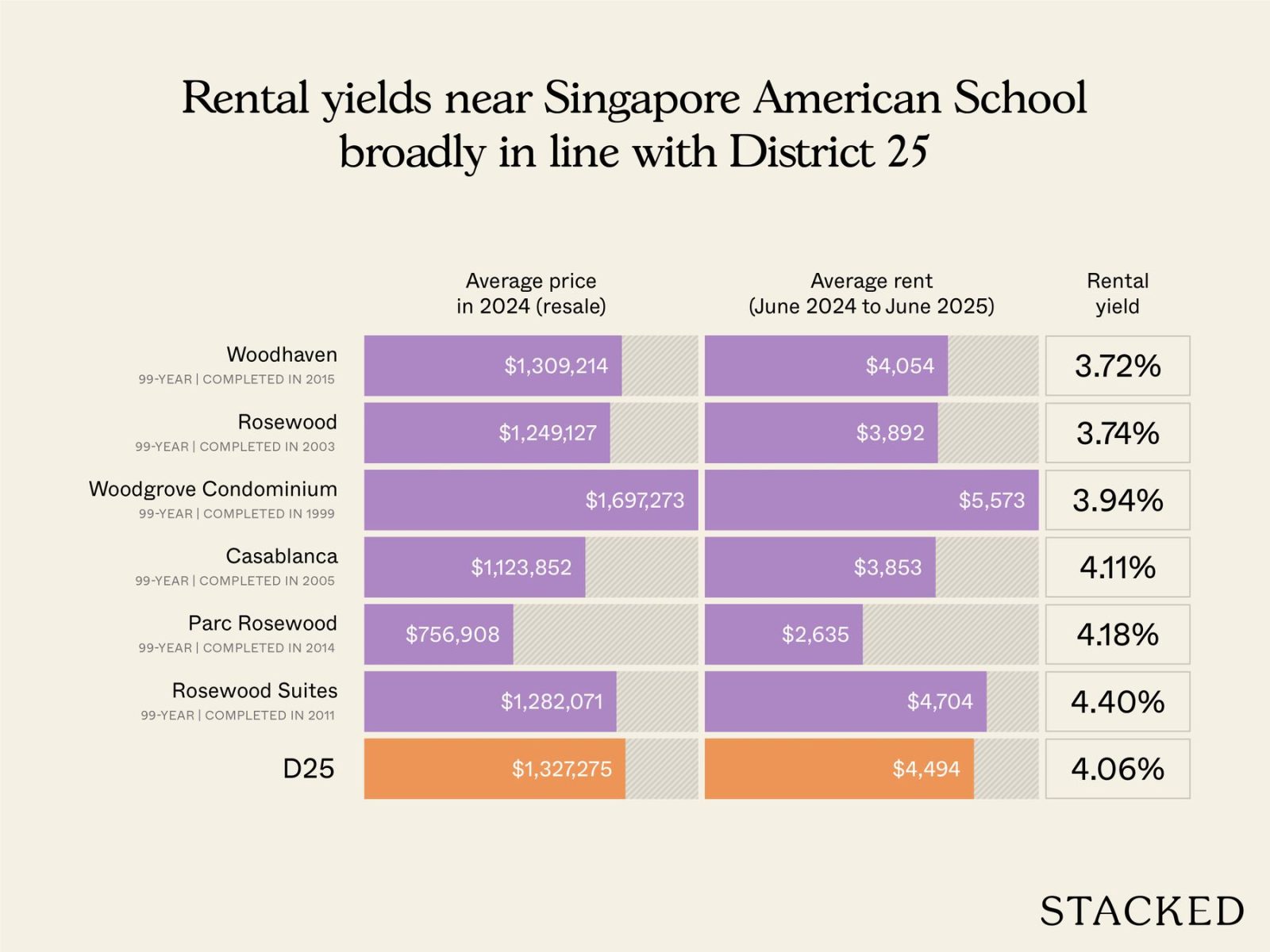

Next, let’s look at the Singapore American School

Projects in the vicinity

| Project | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| Woodhaven | $1,309,214 | $4,054 | 3.72% |

| Rosewood | $1,249,127 | $3,892 | 3.74% |

| Woodgrove Condominium | $1,697,273 | $5,573 | 3.94% |

| Casablanca | $1,123,852 | $3,853 | 4.11% |

| Parc Rosewood | $756,908 | $2,635 | 4.18% |

| Rosewood Suites | $1,282,071 | $4,704 | 4.40% |

Let’s compare it to the district average

| District | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| D25 | $1,327,275 | $4,494 | 4.06% |

Woodlands isn’t a natural rental hotspot for expatriates. It’s far from the CBD (although it’s becoming a regional centre in and of itself). That said, families who want their children in SAS sometimes prioritise proximity, and the condos clustered nearby are the obvious choices.

Overall though, the yields in these projects are not dramatically higher than the district norm. Most hover in the mid–three per cent range, with a few edging just above four per cent. The overall District 25 average sits at around 4.06 per cent, and the projects near SAS are broadly comparable; some slightly lower, some slightly higher.

Similar to what we saw with Tanglin Trust above, rental yields are neither better nor worse. There’s just no visible effect.

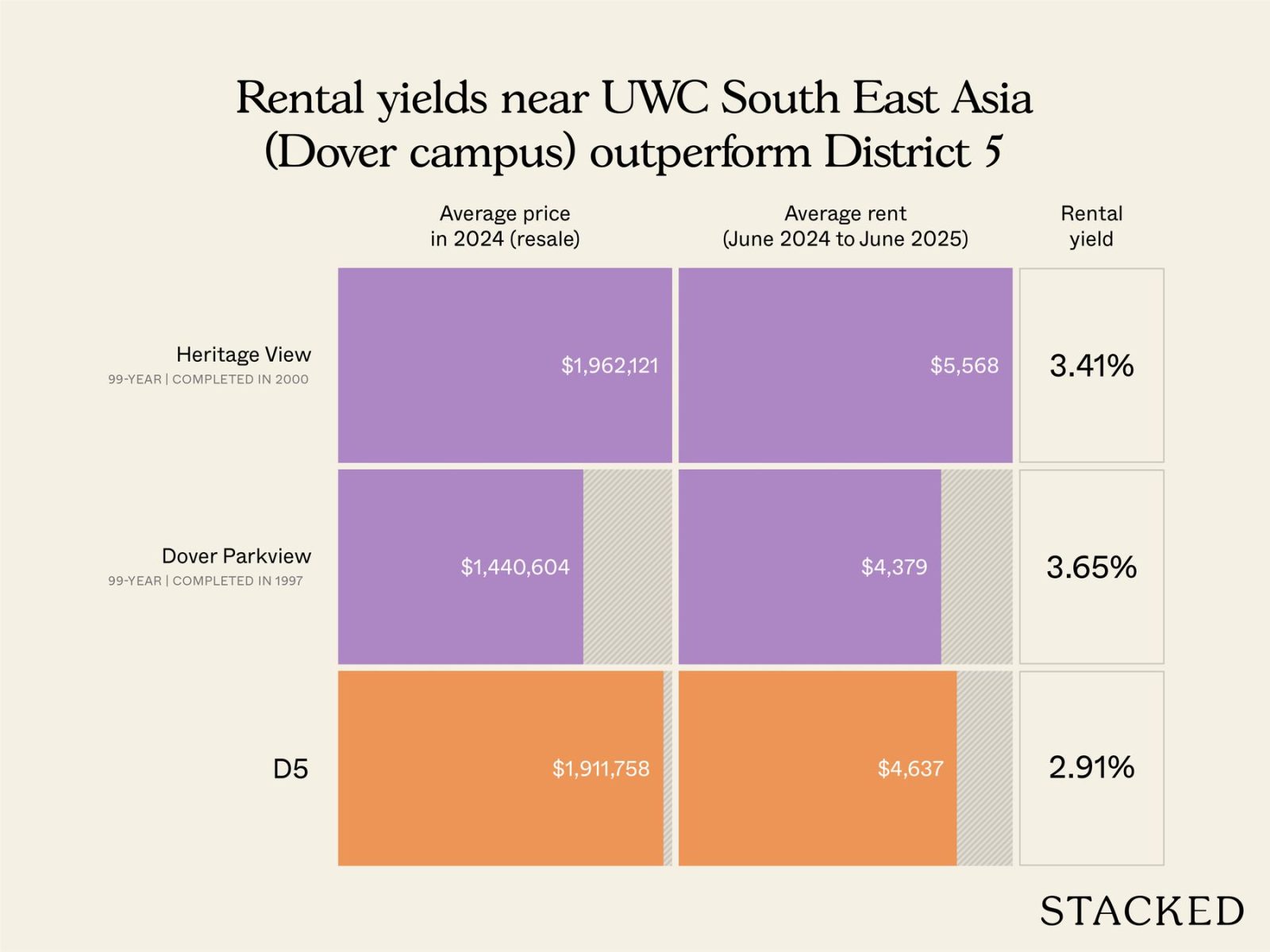

UWC South East Asia (Dover) is up next

Projects in the vicinity

| Project | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| Heritage View | $1,962,121 | $5,568 | 3.41% |

| Dover Parkview | $1,440,604 | $4,379 | 3.65% |

More from Stacked

The Surprising Truth About Dual-Key Homes In Singapore: 3 Homeowners Share Their Stories

Dual-key units are undeniably a niche property type, with many developers struggling to move these units in recent new launches.…

Let’s compare it to the district average

| District | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| D5 | $1,911,758 | $4,637 | 2.91% |

With UWC Dover, we’ve got our first clear case where proximity to an international school does coincide with noticeably higher yields than the district average.

Both Heritage View and Dover Parkview record stronger rental yields than the District 5 average: around 3.4 to 3.6 per cent versus the broader 2.9 per cent.

Before we celebrate this as proof though, there may be other reasons. While Dover is right next to UWC, it’s also near NUS, Biopolis, and One-North, creating a steady demand pool; and one that extends beyond just expat parents. The effect of UWC here is more additive than anything: it stacks on top of already strong rental fundamentals.

Nonetheless, it does actually correlate with above-average yields in Dover’s case.

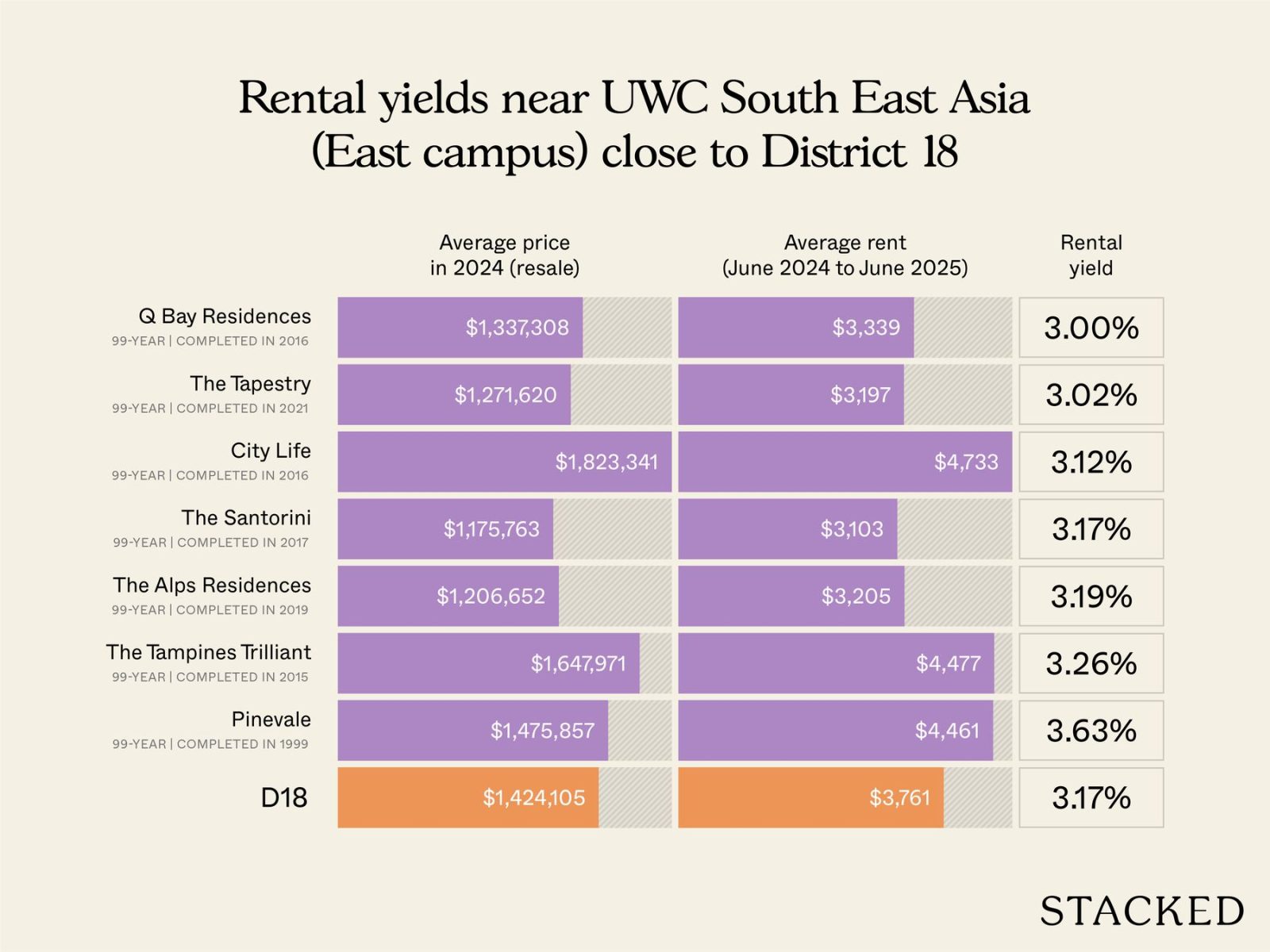

Next up, we look at the East Coast campus of UWC South East Asia

Projects in the vicinity

| Project | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| Q Bay Residences | $1,337,308 | $3,339 | 3.00% |

| The Tapestry | $1,271,620 | $3,197 | 3.02% |

| City Life | $1,823,341 | $4,733 | 3.12% |

| The Santorini | $1,175,763 | $3,103 | 3.17% |

| The Alps Residences | $1,206,652 | $3,205 | 3.19% |

| The Tampines Trilliant | $1,647,971 | $4,477 | 3.26% |

| Pinevale | $1,475,857 | $4,461 | 3.63% |

Let’s compare it to the district average

| District | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| D18 | $1,424,105 | $3,761 | 3.17% |

Tampines is another unusual location for expatriate families, even if it is the regional centre of the east. The surrounding condos near the campus – Q Bay Residences, The Tapestry, and The Santorini – show rental yields in the three per cent range, Pinevale a little bit higher at 3.6 per cent.

Compared to the wider District 18 average of 3.17 per cent, these differences are negligible. It is a tiny premium over the average, but not something that would entice a landlord.

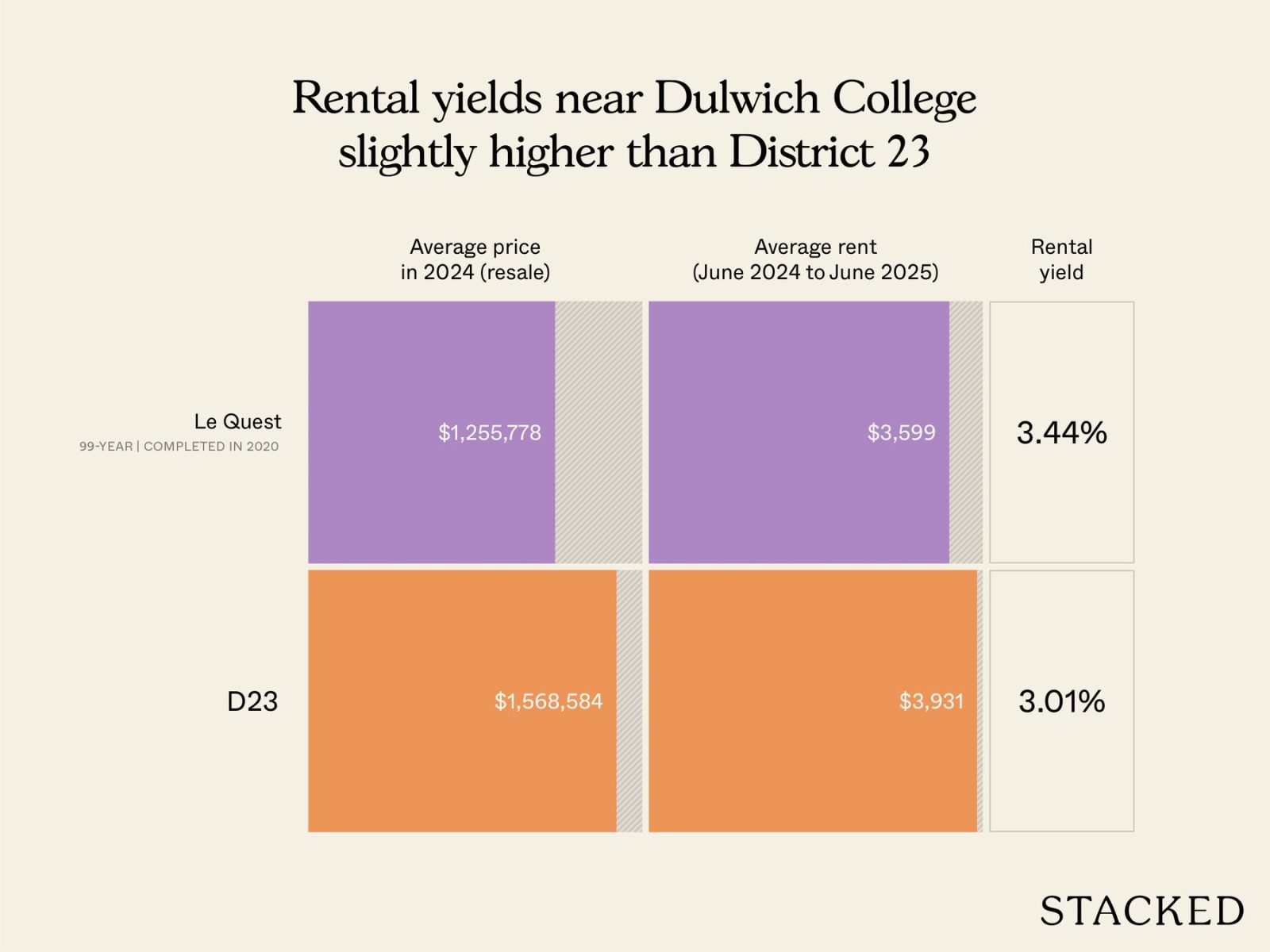

Next, we look at Dulwich College

Projects in the vicinity

| Project | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| Le Quest | $1,255,778 | $3,599 | 3.44% |

Let’s compare it to the district average

| District | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| D23 | $1,568,584 | $3,931 | 3.01% |

Le Quest shows a rental yield of about 3.4 per cent. That’s a touch higher than the broader District 23 average of three per cent; but this is balanced out by the fact that Le Quest is cheaper than the district average. As such, the slight yield premium is really from a lower property price; not proximity to Dulwich College.

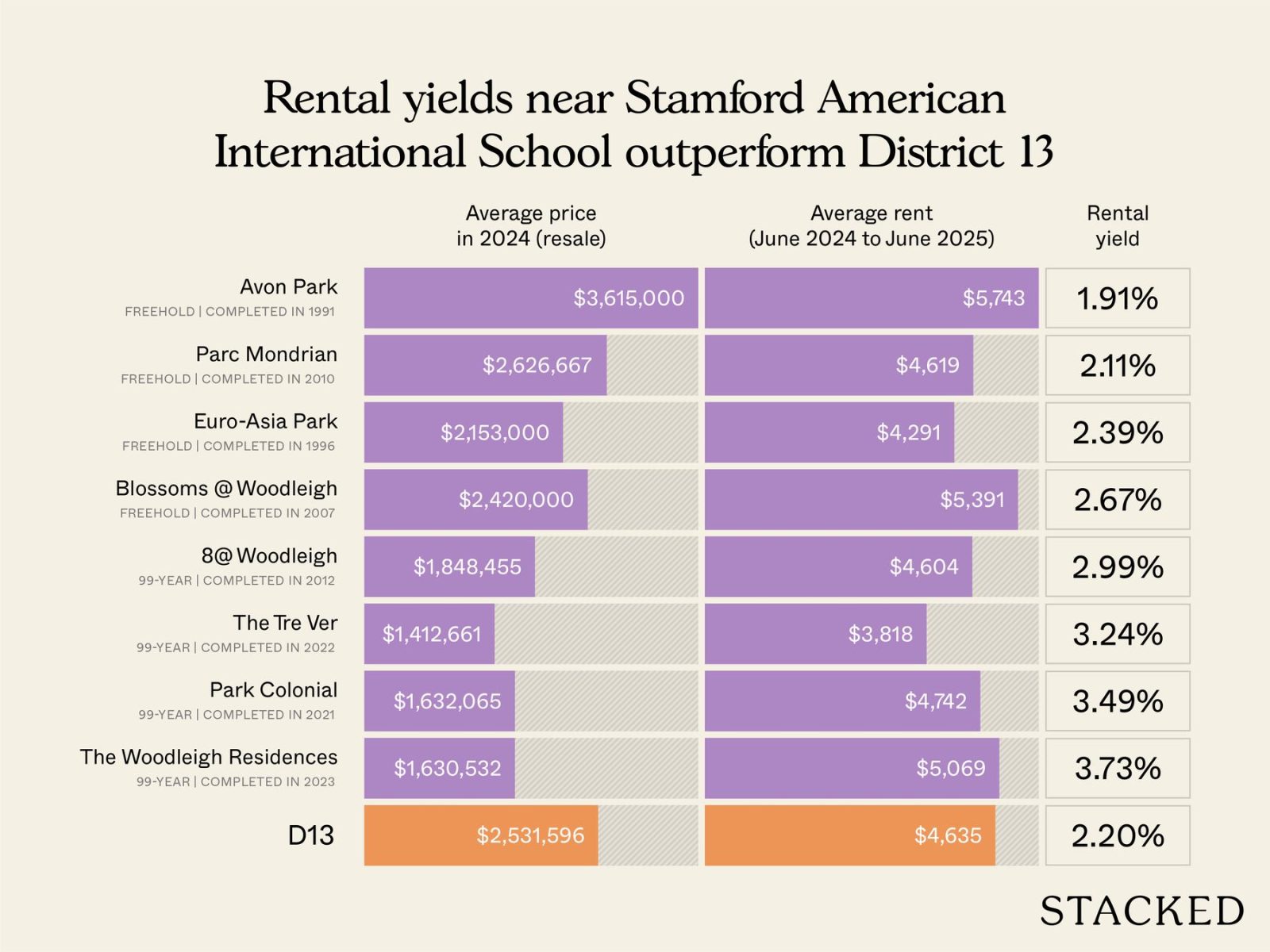

Next, let’s look at Stamford American International School

Projects in the vicinity

| Project | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| Avon Park | $3,615,000 | $5,743 | 1.91% |

| Parc Mondrian | $2,626,667 | $4,619 | 2.11% |

| Euro-Asia Park | $2,153,000 | $4,291 | 2.39% |

| Blossoms @ Woodleigh | $2,420,000 | $5,391 | 2.67% |

| 8@ Woodleigh | $1,848,455 | $4,604 | 2.99% |

| The Tre Ver | $1,412,661 | $3,818 | 3.24% |

| Park Colonial | $1,632,065 | $4,742 | 3.49% |

| The Woodleigh Residences | $1,630,532 | $5,069 | 3.73% |

Let’s compare it to the district average

| District | Average price in 2024 (resale) | Average rent (June 2024 to June 2025) | Rental yield |

| D13 | $2,531,596 | $4,635 | 2.20% |

Stamford sits in the Woodleigh/Potong Pasir area, where new condos have already transformed the neighbourhood into a city-fringe hub. This is a location that attracts tenants even without an international school.

Still, the data shows a notable contrast with the rest of District 13. While the district average sits at just 2.2 per cent, most condos near Stamford push well above this. Older projects like Avon Park and Parc Mondrian lag behind, but newer developments such as The Tre Ver, Park Colonial, and The Woodleigh Residences are comfortably in the 3 to 3.7 per cent range.

While the area is already inherently strong for rentals, Stamford could indeed be adding an extra layer of expatriate demand. Unlike Tanglin or Dover, where school proximity simply blends into already-premium districts, condos around Stamford also outperform the district average.

Conclusion

Looking across Tanglin, SAS, UWC, Dulwich, and Stamford, the results are mixed at best. In some cases – like UWC Dover or the cluster around Stamford – condos near the schools did post higher yields than their districts. But in other cases, yields were broadly comparable, or even slightly lower.

It’s hard to say that international schools alone make the difference. Other factors (e.g., MRT access, proximity to malls and lifestyle hubs, or simply being in an established district) can play just as big a role in shaping rental demand. Where schools are in more remote areas, the lack of transport links or limited condo supply can also dampen demand, even if the tenant pool exists.

As such, the upside may be more about rentability than rental yield. Being near an international school may prevent vacancies or make it quicker to find a tenant; but it doesn’t necessarily mean they’ll pay a lot more.

For investors, the smarter move is to weigh the full context – location, pricing, and tenant mix – and not place too much trust in the international school helping your bottom line.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Does living near international schools in Singapore guarantee higher rental yields?

Which international schools in Singapore are associated with better rental yields?

Is proximity to international schools more about rentability or rental yield in Singapore?

Are condos near international schools in Singapore more affordable or expensive?

What should investors consider besides international school proximity when buying rental properties in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

0 Comments