5 Mistakes You Make When Comparing Condo Prices – Your ‘Good Deal’ Might Be Hiding a Secret

August 13, 2025

Ask about how to compare properties, and almost everyone says something along the lines of performance and transaction history. But as it happens, this is one of the hardest things to evaluate in real estate. Given the huge range of factors that drive property prices, it’s easy to mistake correlation for causation, and it’s important to use ROI the right way (i.e., reading in context with other details, and not just by itself.) In this article, we highlight some of the most common mistakes to keep in mind – especially when you’re looking at a well-made chart or video:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

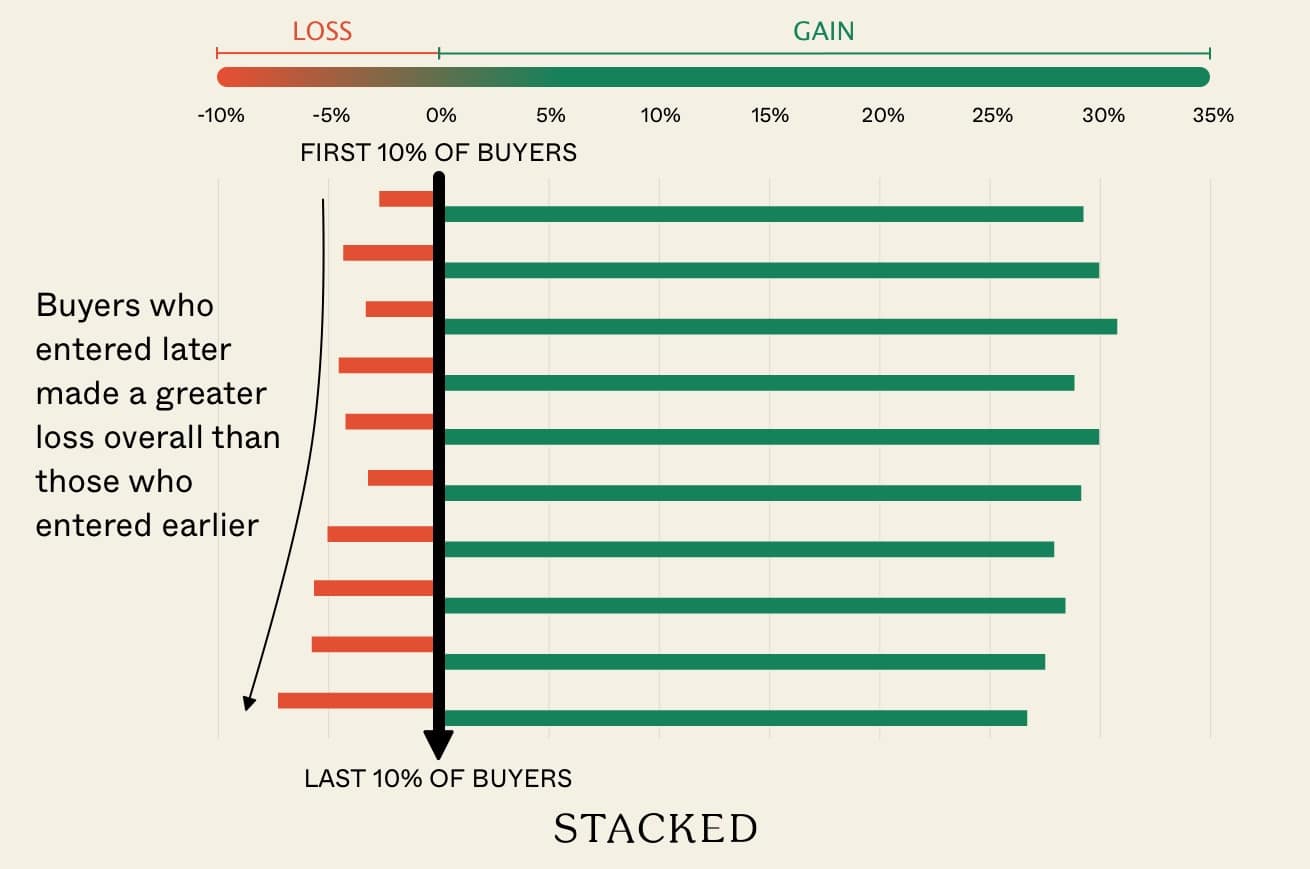

Mistake #1: Forgetting that different batches of buyers would have experienced different price movements, gains, and losses

If you buy a condo unit from the developer, you’ll probably see a much higher return or absolute gain, but that’s only if you buy early. Developers often raise prices as more units are sold, so buyers who come in at the tail end pay more and see weaker returns.

For a more detailed description of this, you can check out the deep dive we did in this article. Analysing 20,000 transactions since 2011, we found the first 30 per cent of buyers (i.e., those who bought early at a new launch) saw average returns of 29 to 31 per cent. By contrast, the last 10 per cent of buyers saw lower returns, around 26.7 per cent.

Subsequently, performance changes again for subsale units (i.e., bought from the first buyer before completion) and resale units (i.e., bought from a previous owner after TOP).

But what does this mean for you?

From time to time, sellers may try to cherry-pick results and mislead you with this. For example, they might compare the performance of new transactions in one condo with subsale or resale transactions in another condo, thus making the former look like a better performer.

To be fair, you need to compare performance between similar transaction types (new, subsale, or resale), and not just look at simplified returns overall.

Mistake #2: Not checking the specific years when the projects were bought and sold

Not all years are equal in the property market. When comparing performance, you also need to pay attention to when the compared units were bought and sold, because certain years may have had a massive impact on the outcome.

For example, buyers who sold their units around the 2013 peak often saw weaker gains; not because their condos were bad investments, but because that was the height of the property market, before government cooling measures sent prices crashing down in subsequent years.

For the same reasons, buyers who purchased during 2016 to 2017 – when cooling measures drove down property prices – tended to see stronger gains as the market recovered.

For projects sold in these “interesting times,” weak and strong gains may not be reflective of the compared condos’ quality. It may just be luck, with the previous owners buying at just the right or wrong time.

In short: you’re not comparing apples to apples unless you account for the entry and exit years.

Mistake #3: Looking only at average condo performances, and not the performances of specific unit layouts/sizes

When comparing condos, it’s easy to quote a single ROI or average gain for the whole project, and assume that’s what you can expect. But that’s not how it works.

In reality, the performance of individual layouts or unit types can vary quite a bit. Some configurations might hold their value or outperform, whilst the rest of the condo layouts struggle. We saw this pattern at Reflections at Keppel Bay in our case study:

Two-bedders at Reflections held up better, with annualised growth of around 1.61 per cent; but three-bedders significantly underperformed, barely breaking even at just 0.08 per cent annualised, while four-bedders fared only slightly better at 1.12 per cent.

The problem? Reflections’ larger units were oversized for the market, pushing up absolute prices and scaring off buyers – even though the PSF looked attractive. But in any case, you can see that if you’re comparing performance, it makes more sense to compare the performance of the given layout, rather than just project averages.

Mistake #4: Failing to compare against appropriate benchmarks

It’s easy to look at a condo’s price growth – say, 25 per cent over a decade – and assume it’s doing fine. But without comparing that to similar projects nearby, you might be applauding a deeply average or even underwhelming performer.

Take The Interlace, for example. If you only saw that it achieved a 3.05 per cent annualised return between 2009 and 2024, you might think that’s respectable. But that same 3.05 per cent is below the Singapore-wide average of 5.87 per cent, for 99-year leasehold condos. Even compared to other projects launched the same year, like Double Bay Residences or Ascentia Sky, The Interlace is lagging, as we describe in this article.

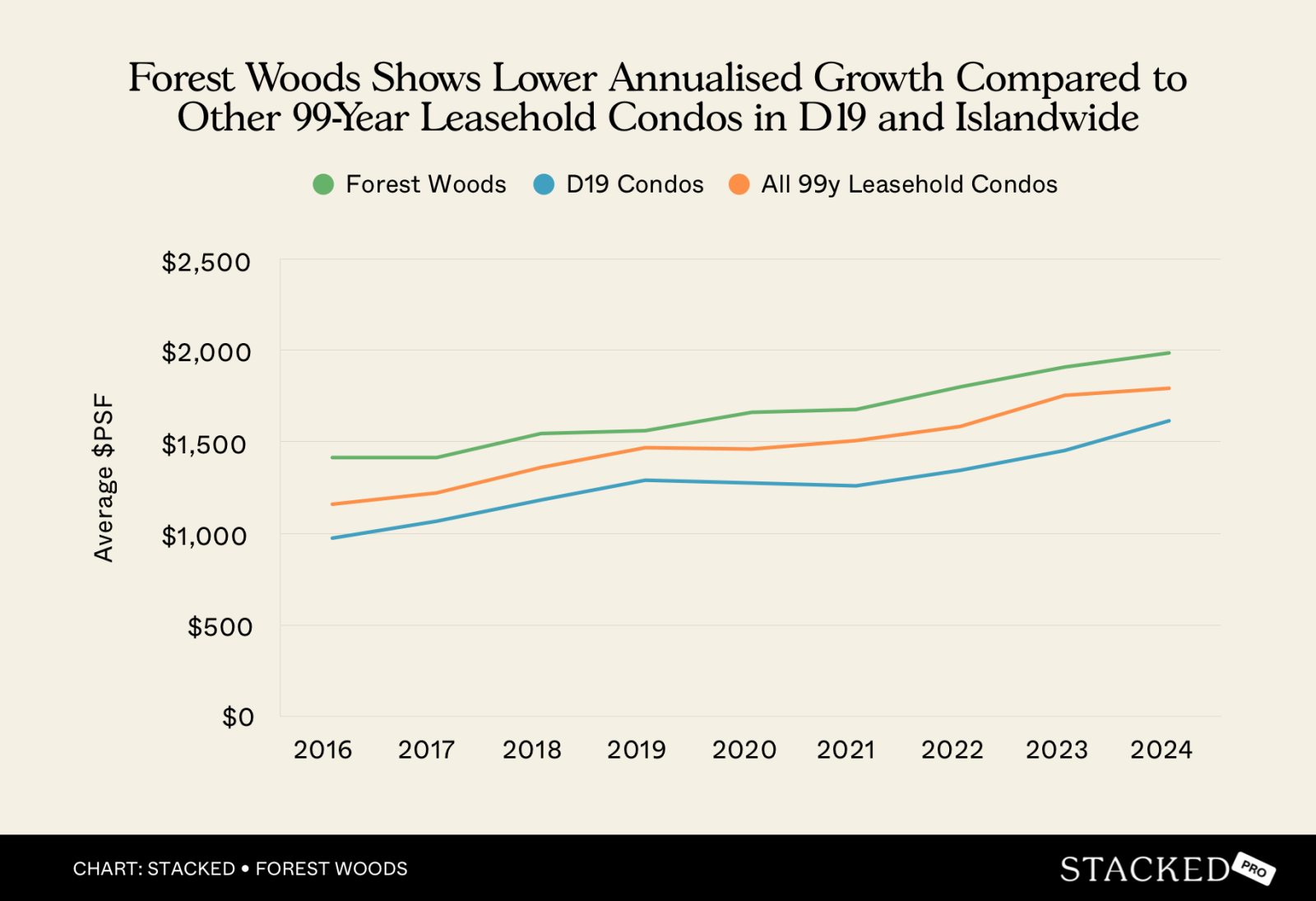

Forest Woods is another case where surface-level ROI can be misleading. From 2016 to 2024, Forest Woods saw an annualised return of 4.39 per cent, which sounds decent. Also, it has had zero unprofitable resale transactions. But benchmark it properly, and you’ll realise there are cracks. In the same time frame it achieved that ROI, its district average grew by 7.81 per cent annually. We have a complete description of the situation here.

Using the right benchmark is essential in making sense of the ROI.

Mistake #5: Ignoring that different condos started at different baselines

In property, comparing appreciation or returns is tough because it’s not like a race. Not all projects start at the same point along the track. Sometimes, a project with weak percentage gains may actually be faring very well, within the context of a high starting price and better facilities, or larger layouts.

We’ve seen this with Reflections at Keppel Bay, for example: many buyers today dismiss it as underperforming. But Reflections was already priced at a significant premium when it launched, thanks to its prize-winning architecture and oversized units. Comparing it to ordinary condos with much lower starting points, and concluding that it’s “bad,” misses the point entirely: buyers at Reflections paid for lifestyle and exclusivity, not just maximum percentage upside. If it’s to be compared, it should at least be compared to a similar premium project.

We’ve seen this play out regarding a condo’s age as well. A new launch is always priced higher than surrounding resale options, simply because it’s the newest. As a result, it also tends to show the weakest appreciation if you look at short-term periods (e.g., just five years) within that specific area.

Judging a premium project against resale units purely on price alone is like comparing a brand-new car to a five-year-old one just because they have the same number of seats—it ignores the differences that justify the premium in the first place.

To make a fair comparison, ensure you’re comparing projects of similar tier, positioning, and starting points. Otherwise, you might be in for disappointment when you realise the condo with higher percentage gains has poorer finishing and fewer facilities (i.e., the gains were stronger just because it started out cheaper.)

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments