Times are tough and our nation is about to be tested; but one of those tests is going to be a test of patience.

As any property agent can tell you right now, the challenge is in finding people willing to sell. With property prices in the upper stratosphere (for both public and private housing), 2025 is the best example of the saying “If you sell high, you buy high.” And right now, the cost of a replacement property is so frightening, fewer are contemplating an upgrade. This isn’t helped by an escalating trade war, which sows further doubt.

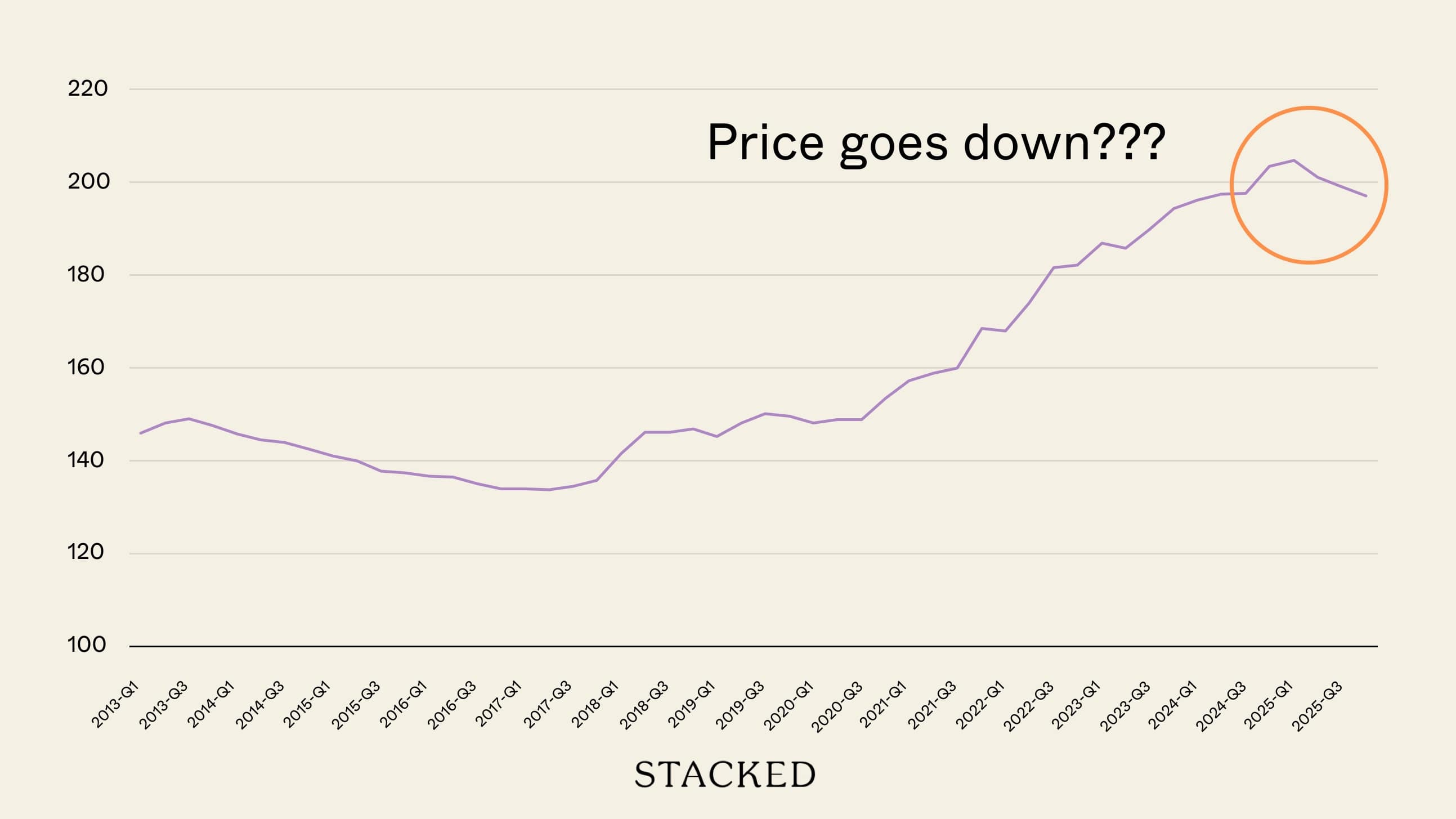

All of this makes it harder for home prices to moderate, let alone come down.

A good number of Singaporeans have expressed surprise that, with million-dollar flats grabbing the news, and condo prices reaching the $2 million+ mark for three-bedders, we haven’t seen yet another round of cooling measures. This might give the impression that nothing is being done, but recent news suggests otherwise:

There are statements that flat prices will stabilise as more flats reach their Minimum Occupancy Period (MOP). In case you didn’t know, the number of flats reaching MOP has been falling in recent years: from 30,920 units in 2022, to a mere 6,974 units in 2025. This was the lowest number since 2014. This number is expected to rise next year to around 13,500, and possibly hit 19,500 by 2028.

The increased supply is expected to ease demand, and I think that’s straightforward.

Meanwhile in the private property segment, Government Land Sales (GLS) sites are ramping up, which could also help to moderate prices – but it’s a tightrope in the private segment right now, as developers need to navigate the hazards of tariffs, a 60 per cent ABSD on foreign buyers, and possibly higher interest rates.

How is this a test of patience?

Well, let’s start with the HDB sector: for those who can wait for a BTO flat and tolerate repeated attempts at balloting, there isn’t much of an issue right now. BTO flats are still subsidised and affordable, and it’s the resale segment that’s seeing very high prices.

For those who need a place to move into quickly, you’re pretty much stuck with options like renting.

So it may not come as a big relief to know that, if you wait “just” another year or two, there may be more flats available to you in a relevant area. Flat prices “stabilising” doesn’t mean flat prices going down either, it may just mean prices rise at a slower pace – but you could still end up paying more, the longer that you wait.

More from Stacked

Are The Ang Mo Kio And Tengah Residential GLS Sites Worth Waiting For?

Perhaps you’ve seen all of 2020’s launches and nothing appeals to you; or perhaps your timeline for getting that condo…

So, is it a relief to hear more flats will reach MOP next year or after? No doubt. Is it a big relief? I doubt so. It’s like being told to relax because your Grab prices will go down once the rain stops: it’s useless in a desperate hurry, when you absolutely have to act now.

The same goes for building more HDB flats by the way. That will certainly help further down the road, but it does little to assuage the seething anger of people forced to rent, or sometimes live in dysfunctional situations.

It’s also a little worse in the private sector, because of where all the upcoming launches are

Since no one is selling, you’re pretty much stuck with the expensive new launch market. And while GLS sites are ramping up supply, it does nothing for the fact that 14 of the roughly 22 remaining launches are going to be in the Core Central Region: the least affordable part of Singapore.

If you missed out on the recent batch of non-central new launches, like ELTA or Parktown Residences, there may not be much to look forward to for the rest of 2025. Unless you can handle the prices of projects like One Marina Gardens, Aurea, whatever crops up at the Zion Road plots, etc., you may be adrift for the year; a ramp-up of supplies does little to alleviate your situation.

There are plans in motion to help, but as a homebuyer in 2025, it feels like you’d need the patience of a Saint to get through all this.

Meanwhile in other housing news…

- A $270,000 profit, from a condo bought during COVID: here’s the series of decisions that made it possible.

- Is freehold status always worth the premium? The truth…gets a bit complicated.

- Think opening a convenience store in a condo is easy money? A former owner of such a business says it’s unlikely in the current era.

- A monochrome open-concept home does a lot for spaciousness, especially with the smaller homes we have today.

Follow us on Stacked for more updates, and news on the ground.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

0 Comments