Buying Land At A 30% Discount At Marina South: A Good Deal Or A Sign Of Weak Demand?

January 28, 2024

Sometimes, winning comes with a sense of apprehension

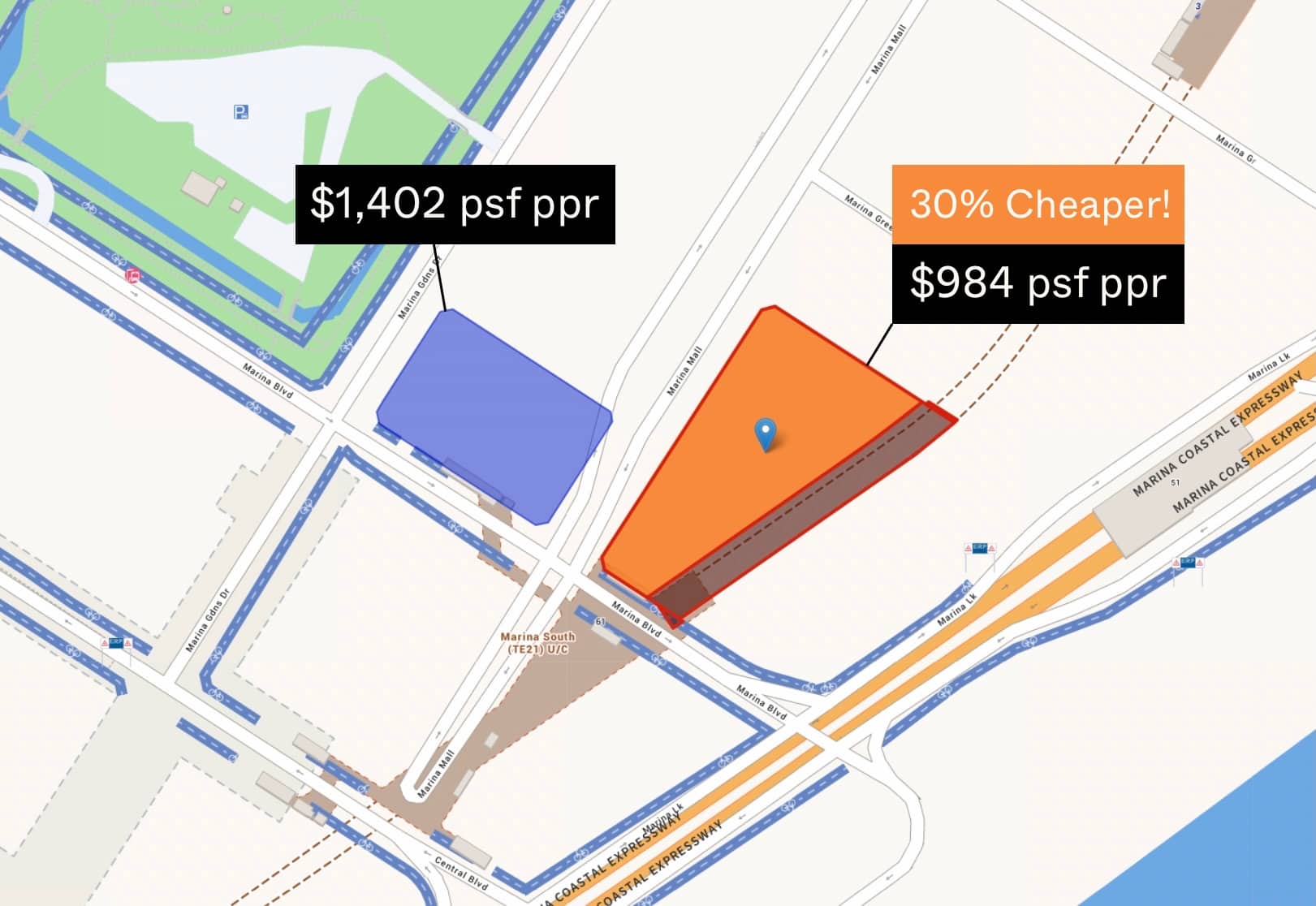

That’s how I would feel, if I were the consortium of developers that won the recent bid for a Marina white site. GuocoLand, Intrepid Investments and TID Residential recently put in a bid for $984 psf for a leasehold plot at Marina Gardens Crescent.

This land parcel, which is expected to yield around 775 new homes plus a commercial segment, has a waterfront view of the Strait; and it’s within close proximity of Marina Bay Sands. Under normal circumstances, a bid of $984 psf would get you nothing more than a transcript of a government agent laughing.

But in this case, the consortium has more or less won the bid, because of a major factor called “no one else bothered.”

And some may say that winning this may come with the sort of prize you “win” during BMT in Tekong (i.e., the reward is 200 extra push-ups). While it is not yet known if the Government will award the site at $984 psf ppr, they may be more hesitant now knowing that there’s basically zero interest here right now.

2024 is a risky time to be taking on prime location projects.

As of April last year, the Additional Buyer Stamp Duty (ABSD) rate on foreigners was raised to 60 per cent. Assuming a modest $2 million for a Marina area project, the stamp duty alone comes to $1.2 million; that’s enough to buy a whole other house (or perhaps several other houses) in neighbouring regions like Australia or Hong Kong.

We also need to consider economic headwinds, with conflicts in Gaza and Ukraine, and another contentious election coming up in US politics. When large corporations experience falling revenues, it’s not uncommon for them to use cost-cutting measures like reducing the number of expatriates, or shrinking housing allowances. Those expatriates, by the way, are the ones most likely to be renting a unit in a place like Marina Bay.

All of this bodes ill for landlords holding central region rental assets; and this is a further challenge for a future project to overcome.

And if we rule out foreigners because of the high tax, how many locals will buy there? The Marina area is ritzy for sure – but there are no schools nearby (at least, as of yet), and there’s intense competition from equally strong locations like Orchard (and the properties there are more likely freehold to boot).

In an environment of steep Land Betterment Charges, narrowing margins, and higher home loan rates, taking on prime region projects is an audacious move; but perhaps the lower land price now justifies the risk.

A lot of eyes will be on the future project that comes up at Marina Crescent; and it will be interesting to see if the lower land price means a more palatable launch price (hint: probably not). If anything, the lower price here means that they have a higher margin of error – and can afford to take the risk to create a more attractive product.

More from Stacked

Are Resale Executive Condos No Longer “Affordable” Compared To Condos In 2024? Here’s The Surprising Answer

Executive Condominiums (ECs) are intended as a stepping stone between HDB housing and private condos; a sort of “sandwich class…

As a balancing factor, it’s possible the Marina area hasn’t seen the full impact of changes yet

Usually, when the government marks out a white site, it comes with some stringent requirements; they want to see things that fit their vision for the area. This also means that, quite possibly, the government is gearing up to invest quite a bit, and fundamentally change the area.

This calls to mind the Bugis area, which was also a bit slow going at the start. Bugis used to be a pretty seedy area in the 1970s and even up till the mid ‘80s; and while the “air-con street” sanitised the area, it wasn’t until well into the 2010s that Bugis truly took off as a future contender even against Orchard.

So we suspect that Marina Bay, as impressive as it is now, might be that anime guy who can yell THIS ISN’T EVEN HIS FINAL FORM.

Meanwhile in other property news…

- 4-bedder condos under $1.68 million? They do exist, here’s where.

- Some older condo facilities are, from today’s perspective, perhaps a bit of a liability

- The MOP doesn’t just slow down the pace of upgrading; there are effects beyond the financial, that you should brace for

- Are million-dollar flats going to be the norm in this country? Let’s find out.

- Watch out for these upcoming residential sites, which look pretty ideal for family homes.

Weekly Sales Roundup (15 January – 21 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE RESERVE RESIDENCES | $5,292,199 | 1916 | $2,762 | 99 yrs (2021) |

| 35 GILSTEAD | $3,828,000 | 1615 | $2,371 | FH |

| ENCHANTE | $3,503,400 | 1281 | $2,735 | FH |

| THE ARCADY AT BOON KENG | $3,303,000 | 1281 | $2,579 | FH |

| PINETREE HILL | $3,238,000 | 1292 | $2,507 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE MYST | $1,207,000 | 517 | $2,336 | 99 yrs (2023) |

| THE ARCADY AT BOON KENG | $1,316,000 | 527 | $2,495 | FH |

| THE LAKEGARDEN RESIDENCES | $1,317,200 | 592 | $2,225 | 99 yrs (2023) |

| THE ARDEN | $1,348,000 | 721 | $1,869 | 99 yrs (2023) |

| HILLHAVEN | $1,367,010 | 678 | $2,016 | 99 yrs |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LADYHILL | $8,700,000 | 3810 | $2,283 | FH |

| CAPE ROYALE | $5,661,000 | 2508 | $2,257 | 99 yrs (2008) |

| VILLA DELLE ROSE | $5,400,000 | 3261 | $1,656 | FH |

| RESIDENCES @ EVELYN | $3,758,000 | 1539 | $2,441 | FH |

| D’LEEDON | $3,380,000 | 1722 | $1,963 | 99 yrs (2010) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| EDENZ SUITES | $685,000 | 474 | $1,446 | FH |

| CENTRA SUITES | $715,000 | 452 | $1,582 | FH |

| THE SANTORINI | $735,000 | 527 | $1,394 | 99 yrs (2013) |

| PARC IMPERIAL | $745,000 | 398 | $1,871 | FH |

| EUHABITAT | $750,000 | 549 | $1,366 | 99 yrs (2010) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| KERRISDALE | $3,200,000 | 2422 | $1,321 | $2,214,000 | 18 Years |

| VILLA DELLE ROSE | $5,400,000 | 3261 | $1,656 | $1,750,536 | 4 Years |

| AMARANDA GARDENS | $2,400,000 | 1163 | $2,064 | $1,620,704 | 22 Years |

| COSTA DEL SOL | $3,000,000 | 1755 | $1,710 | $1,570,000 | 23 Years |

| GILSTEAD COURT | $2,650,000 | 1389 | $1,908 | $1,562,000 | 28 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| 120 GRANGE | $1,760,000 | 570 | $3,085 | -$84,000 | 6 Year |

| CORALS AT KEPPEL BAY | $2,570,000 | 1378 | $1,865 | -$80,000 | 6 Years |

| THE SAIL @ MARINA BAY | $1,330,000 | 678 | $1,961 | -$59,900 | 14 Years |

| THE FORESTA @ MOUNT FABER | $890,000 | 431 | $2,067 | $0 | 8 Years |

| NEWEST | $2,480,000 | 2400 | $1,033 | $34,669 | 10 Years |

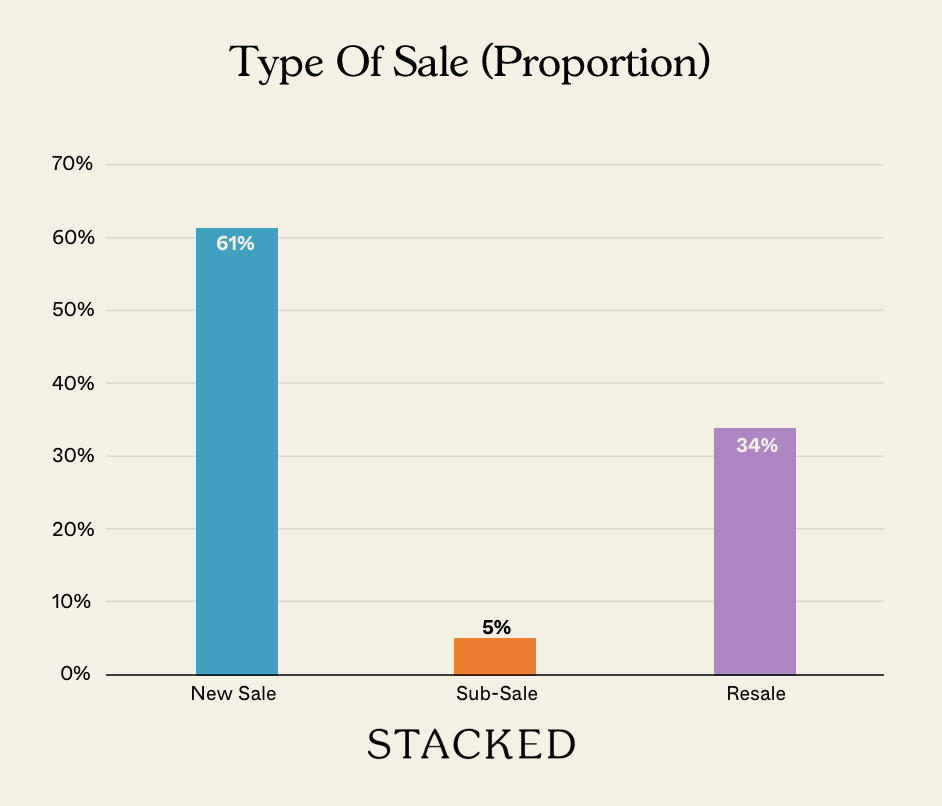

Transaction Breakdown

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Is buying land at Marina South a good investment right now?

Why was the bid for the Marina South land so low compared to normal prices?

What are the risks of investing in property in the Marina Bay area now?

Could the lower land price at Marina South lead to more affordable property options?

Is the Marina Bay area likely to develop further in the future?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments