Additional Buyer Stamp Duty: How does this affect you?

July 6, 2018

Unless you have been living under a rock, you would have heard by now of the new cooling measures that were announced on July 5th. Although we cannot say we are surprised that measures have been taken to counter the rise in prices of private property, it must be said that it is still shocking that the moves have been so swift and are actually quite significant. So much so that crowds of potential buyers thronged showflats across Singapore yesterday, in hopes that their purchases can be squeezed in before the new rates come into effect on July 6th.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

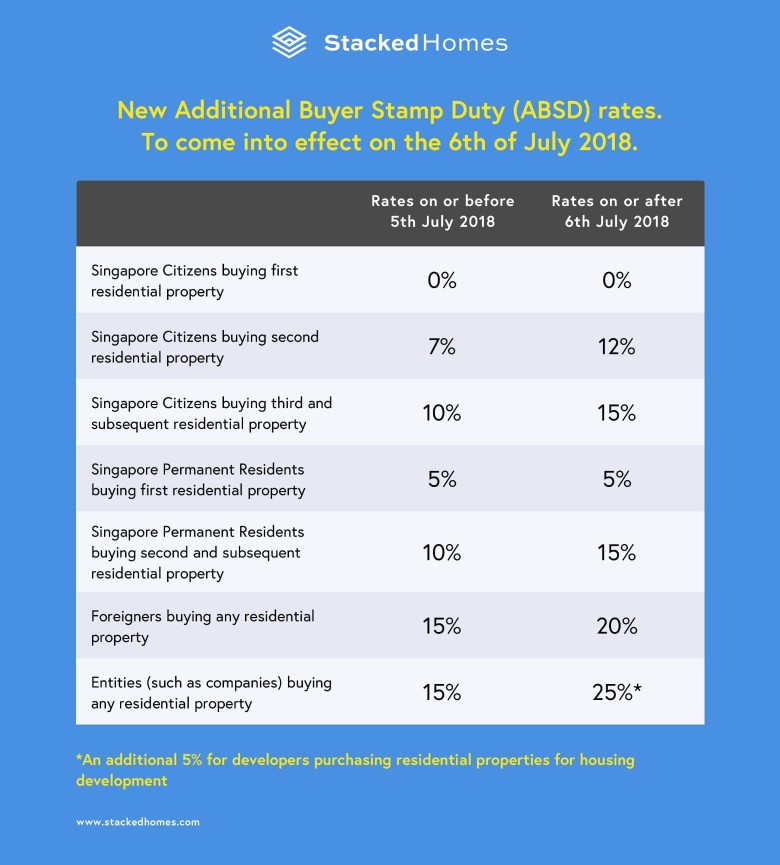

Additional Buyer Stamp Duty – So what are the changes?

As you can see, for SC buying their first residential property, there will be no additional buyer stamp duty, which is rightly so. So no changes there. Don’t forget additional buyer stamp duty is payable on top of the normal buyers stamp duty. If you have forgotten the existing BSD rates, here you go:

Buyers stamp duty

First $180,000 1%

Next $180,000 2%

Next $640,000 3%

Remaining Amount 4%

For SC buying their second, or third and subsequent properties, the increase of 5% is really substantial. Let us show you an example of how this new cooling measures will affect any future purchases.

SC buying second residential property of $1 million

Before

Buyers stamp duty = $24,600

Additional buyer stamp duty (7%) = $70,000

Total stamp duty = $94,600

After this new round of cooling measures

Buyers stamp duty = $24,600

Additional buyer stamp duty (12%) = $120,000

Total stamp duty = $144,600

This means an increase of $50,000 in ABSD rates.

IMPORTANT:

If you signed your sale and purchase agreement in Singapore, the BSD and ABSD have to be paid within 14 days of the agreement being signed.

If you signed it overseas, you have a bigger leeway of 30 days after the agreement was received in Singapore.

Lastly, and please do not forget this. If the BSD and ABSD is not paid by the due date, the penalties are:

- Delay in payment for up to 3 months – $10 or an amount equal to the BSD and ABSD payable, whichever is higher

- Delay in payment exceeding 3 months – $25 or an amount equal to 4 times the BSD and ABSD payable, whichever is higher

So based on our previous figures, if you are late in payment beyond 3 months, this will result in a maximum penalty of $578,400! Which is clearly not an amount to be trifled with.

Property Market CommentaryABSD remission in Singapore – Everything you need to know

by Druce TeoSo how does the additional buyer stamp duty changes affect me?

More from Stacked

Why The Rising Number Of Property Agents In 2026 Doesn’t Tell The Full Story

As reported by the Straits Times of late, the scene for agencies continues to consolidate. Most industry watchers already know…

With this new round of cooling measures, it is abundantly clear that the Government is looking to put a check on the rising prices in the property market. Prices in Singapore were slated to rise 8% in this year and again in 2019. So perhaps in their view, if left unchecked, prices could actually get out of hand.

Not to mention, HDB resale flat prices are falling, and the supply of Build-to-Order (BTO) flats will be cut to about 16,000 from 17,000 previously. So this move was possibly done to combat the dropping resale HDB flat prices. This was also not helped by the earlier announcement that not all old HDB flats will be eligible for the Selective En bloc Redevelopment Scheme (SERS).

So you may be asking here, why would we be talking about HDB?

It’s quite simple.

It matters because if HDB resale flat prices are falling and private homes are rising, this would create a wider and wider price gap, which is not favoured by the Government. This is because should the price gap continue to widen, it will get tougher for Singaporeans to upgrade from an HDB to a private property. Also this would mean a worse income inequality for Singapore, which is already one of the highest in the world. Obviously Singaporeans would not be happy with such a situation which would in turn create problems for the Government.

Lastly, property developers will also be affected by this current round of changes. They will now have to pay 25 per cent on any en bloc purchase based on the land cost instead of the 15 per cent previously. Although this is remissible if they manage to sell all the units within the 5 years. If not, there will be a new additional 5 per cent ABSD tax. This will definitely tamper the enthusiasm for en bloc deals as this means more upfront capital costs for developers as well as more risks in the event all the units are not cleared. So you can expect a more muted response from the developers in this regard.

As always, you can leave a comment down below or feel free to reach out to us at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How does the new Additional Buyer Stamp Duty affect second and subsequent property buyers in Singapore?

When must buyers pay the BSD and ABSD after signing a property agreement in Singapore?

What are the penalties for late payment of BSD and ABSD in Singapore?

Why are the recent property cooling measures significant for Singaporeans?

How do the new rules impact property developers in Singapore?

Druce Teo

Druce is one of the co-founders at the Stacked Editorial. He was first interested in property since university but never had any aspiration to become an agent, so this is probably the next best thing.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Property Advice Should I Pay $500K More For A New Launch — Or Buy A Resale Condo Instead?

Singapore Property News A Rare Freehold CBD Office Unit Is Up For Sale At $20.5M — And Foreigners Can Buy It

Pro This Popular 520-Unit Condo Sold 85% At Launch — Here’s What Happened To Prices After

2 Comments

Great write up. I am looking to invest in a 2nd property. Given the current crisis do you think it’s worth waiting and seeing if the ABSD rule would be relaxed? TIA