Which Condos Made the Most Money In Singapore Over the Past 10 Years? The Results May Surprise You

November 19, 2025

If there’s one thing the past decade has taught us, it’s that the Singapore condo market never stays still. Between multiple rounds of cooling measures, a pandemic, construction delays, the rental surge, and now a more measured 2024–2025 environment, some units have quietly pulled far ahead of the pack.

So this week, we took a long look back at actual performance: not project-level averages, but individual unit types, sorted by the metrics buyers care about most: percentage gains, quantum gains, and rental yield. The methodology is simple: we analysed condos bought between 2014 and 2024, and sold by 2024, filtering only for projects with meaningful transaction volume.

The result? A clear picture of the best-performing one, two, three, and four-bedder segments this decade, from ECs that rode the subsidy wave to old freehold properties that still deliver six-figure profits. Here’s what stood out.

And as clear as these results look on paper, many buyers discover that interpreting them for a real-world purchase is far less straightforward. If you want to make sure you’re reading the signals correctly, beyond just percentage gains or yield, reach out here and we’ll connect you with a partner agent we trust.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How we devised the following

We found our top units by examining those that were purchased between 2014 and 2024, and also sold by 2024.

To avoid having results skewed by one-off transactions, we only included projects with at least five sales records. Next, we broke the data down by the factors buyers care about most:

- Percentage gains by $PSF

- Quantum (total cost in absolute dollars)

- Rental yield

Finally, we compared these across one, two, three, and four-bedder segments. Here are the results:

1-bedroom units

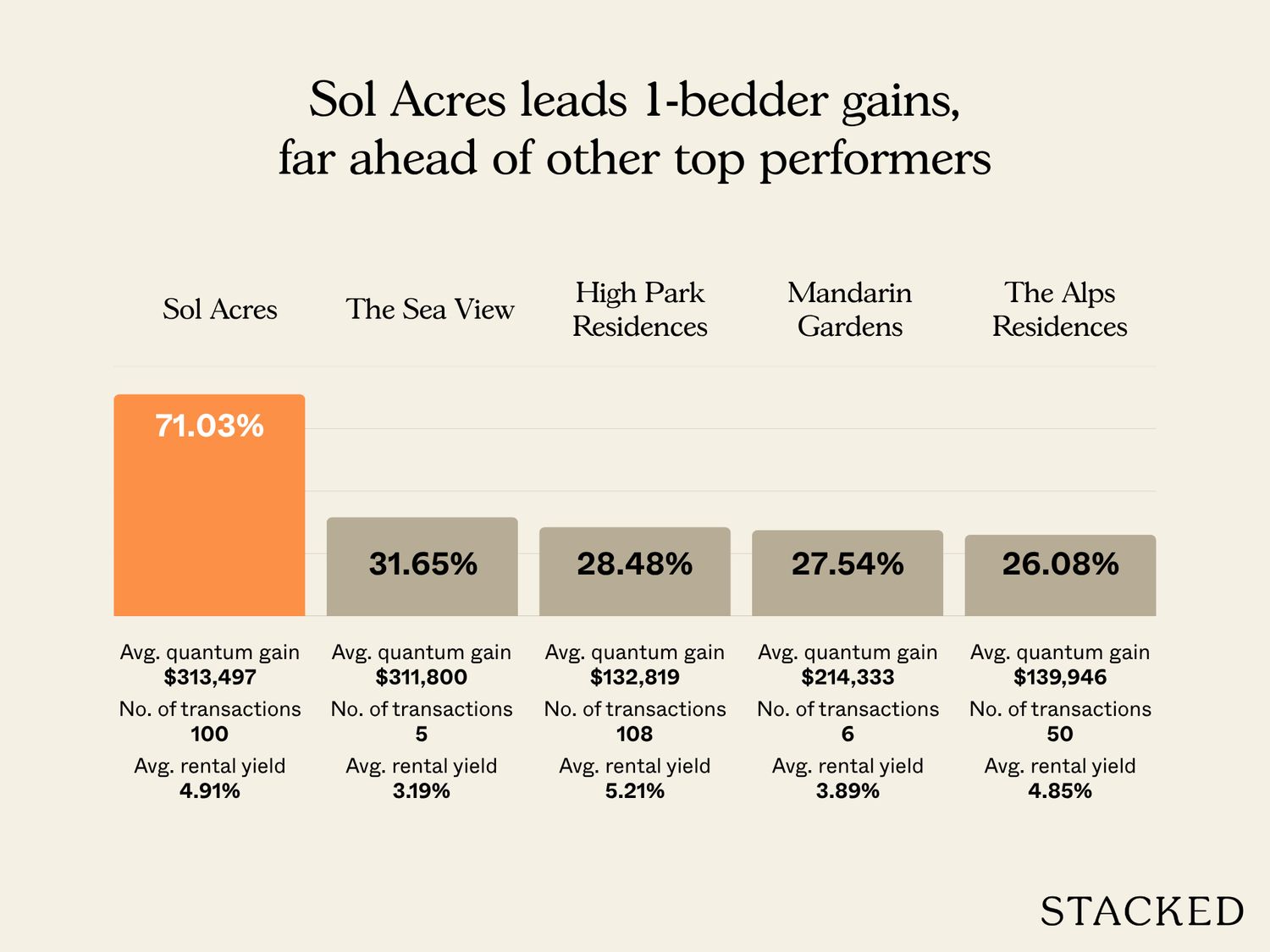

Highest average gains

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

| SOL ACRES | 71.03% | $313,497 | 100 | 4.91% |

| THE SEA VIEW | 31.65% | $311,800 | 5 | 3.19% |

| HIGH PARK RESIDENCES | 28.48% | $132,819 | 108 | 5.21% |

| MANDARIN GARDENS | 27.54% | $214,333 | 6 | 3.89% |

| THE ALPS RESIDENCES | 26.08% | $139,946 | 50 | 4.85% |

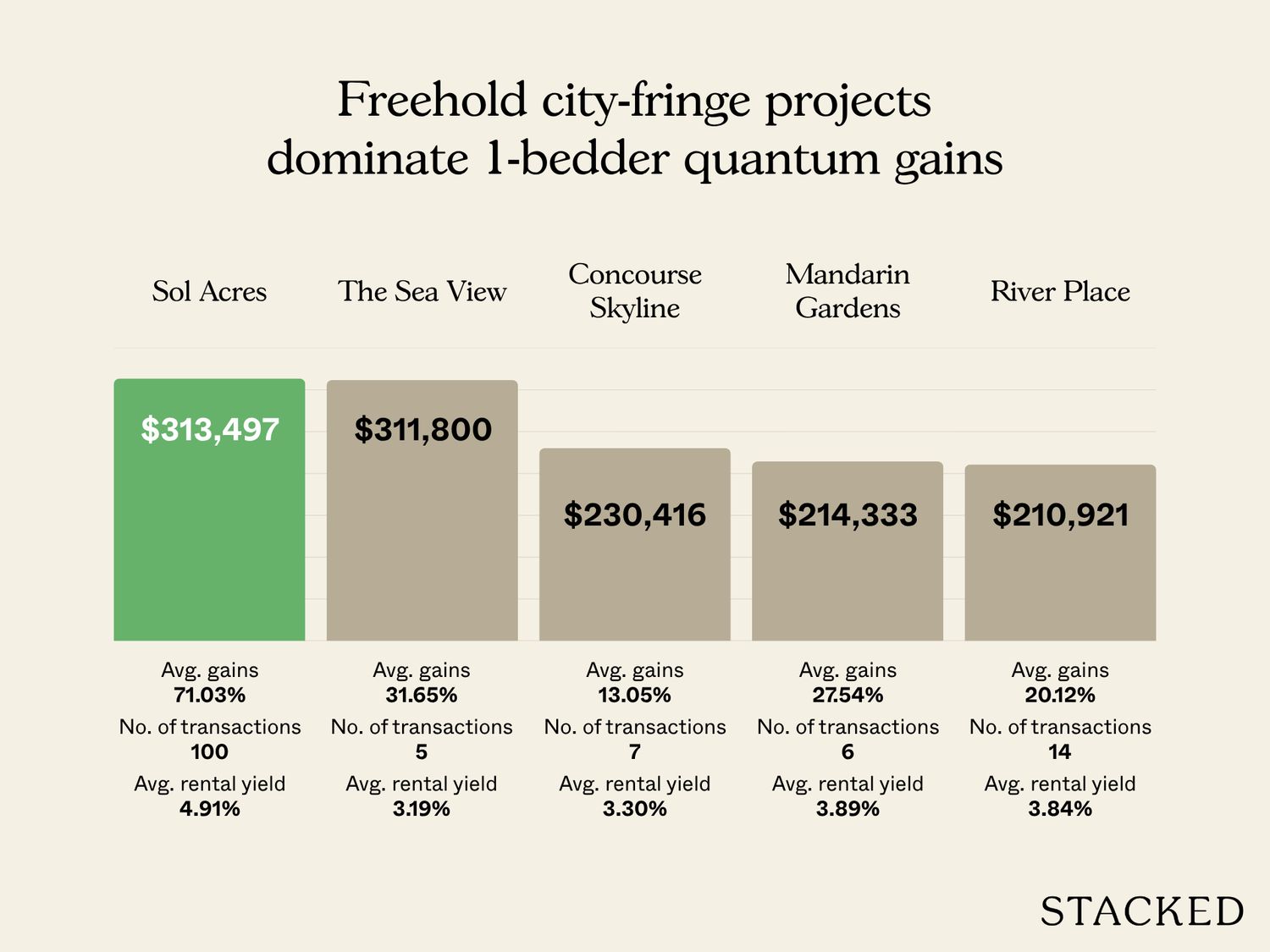

Highest average quantum

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

| SOL ACRES | 71.03% | $313,497 | 100 | 4.91% |

| THE SEA VIEW | 31.65% | $311,800 | 5 | 3.19% |

| CONCOURSE SKYLINE | 13.05% | $230,416 | 7 | 3.30% |

| MANDARIN GARDENS | 27.54% | $214,333 | 6 | 3.89% |

| RIVER PLACE | 20.12% | $210,921 | 14 | 3.84% |

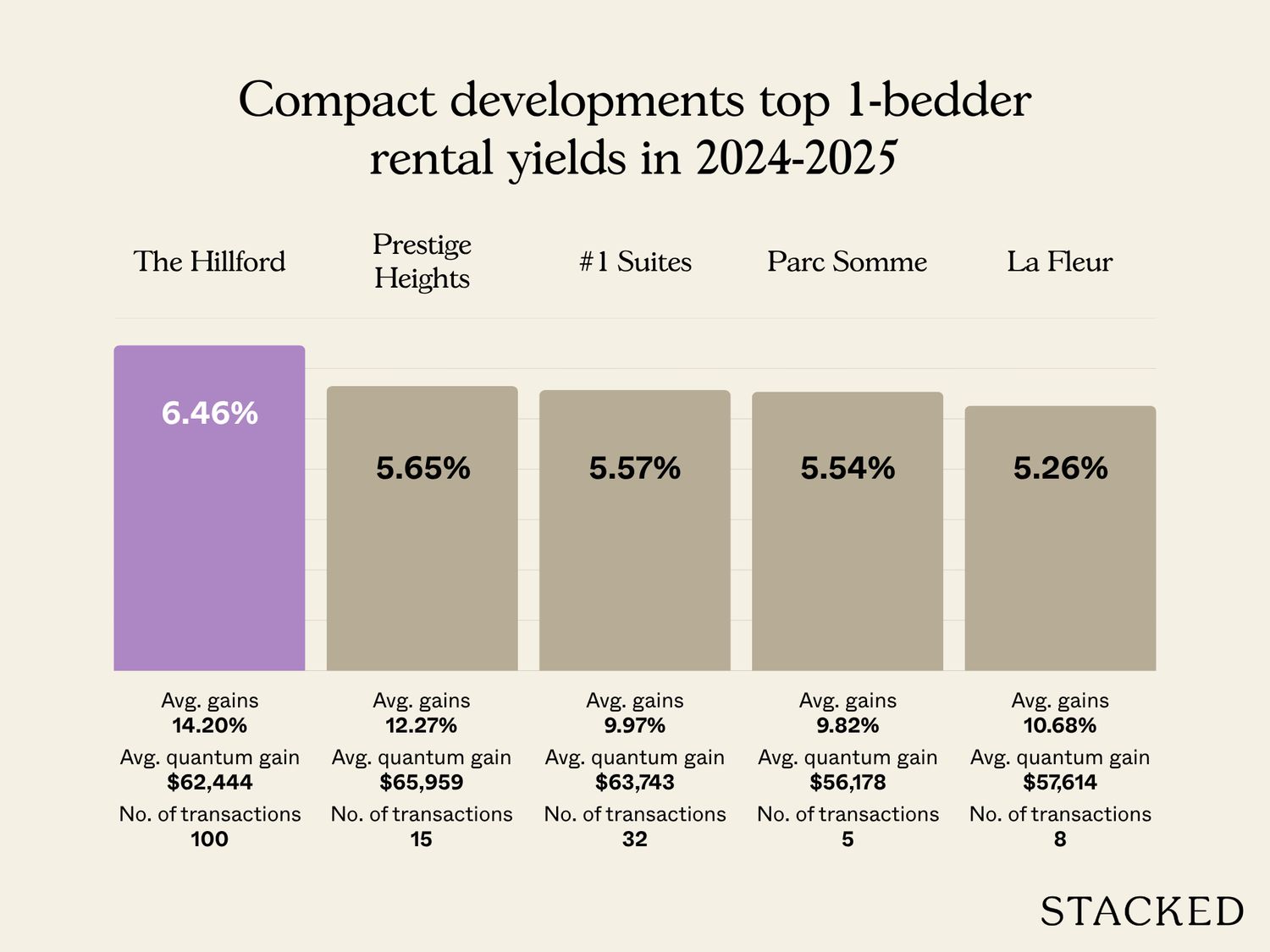

Highest average rental yield

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

| THE HILLFORD | 14.20% | $62,444 | 100 | 6.46% |

| PRESTIGE HEIGHTS | 12.27% | $65,959 | 15 | 5.65% |

| # 1 SUITES | 9.97% | $63,743 | 32 | 5.57% |

| PARC SOMME | 9.82% | $56,178 | 5 | 5.54% |

| LA FLEUR | 10.68% | $57,614 | 8 | 5.26% |

There’s nothing surprising here. As far as gains go, Sol Acres is an Executive Condominium (EC), so that’s already an unfair advantage for gains (ECs are subsidised and start out cheaper).

Sol Acres’ one-bedders posted the strongest numbers in this segment, with average gains of 71.03 per cent and profits of around $313,497. Even as an EC, Sol Acres was competitively priced from the get-go, being one of the biggest ECs in Singapore (1,327 units). In fact, Sol Acres is still the largest condo in Choa Chu Kang today.

Besides the low price point – which allowed for such strong percentage gains – it’s near the Keat Hong and Teck Whye HDB enclaves. Whilst Choa Chu Kang is not a mature estate, these two HDB enclaves are older and very built-up, with multiple supermarkets, coffee shops, and daily amenities. A one-bedder here isn’t just alright for rental, it’s feasible for retirees who want to right-size into a condo instead of a flat. So Sol Acres remains good value for a fringe region condo.

Among private condos, The Sea View has excellent one-bedder profits, averaging $311,800. This is partly due to its location in an established expat enclave (the Katong area), and its accessibility has been greatly improved by the recent Marine Parade MRT station (TEL).

Older developments with larger one-bedroom layouts, such as Mandarin Gardens and River Place, show up strongly on the quantum charts as well. Don’t be fooled by the percentage gains: these large, high quantum units have absolute profits that are in the $200,000+ range. For these projects, the one-bedders in these old-school condos are large enough to function as true owner-occupier homes, not just rental assets.

For rental yields, The Hillford cheats its way to the top of the chart at 6.46 per cent yield. We say “cheats” because The Hillford is a 60-year lease condo, originally meant for retirees. The short lease, coupled with small unit sizes, gives it a very low quantum and a near-unbeatable gross rental yield. It also helps that it’s near the desirable Beauty World area.

This was followed by Prestige Heights and #1 Suites. These developments combine small quantums with consistent tenant demand, so there’s nothing unexpected here – they embody the one-bedder qualities that new landlords should look for.

2-bedroom units

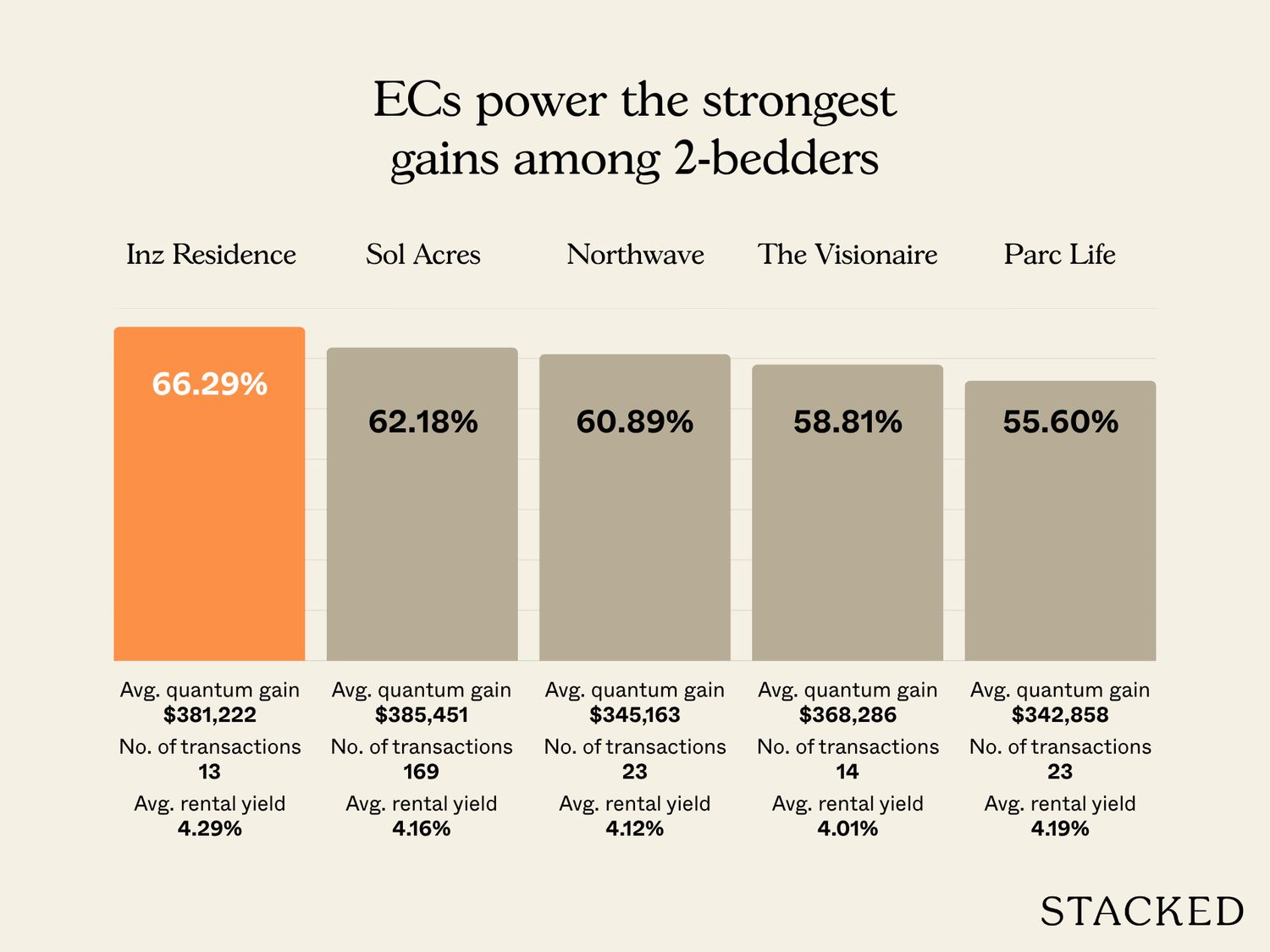

Highest average gains

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

| INZ RESIDENCE | 66.29% | $381,222 | 13 | 4.29% |

| SOL ACRES | 62.18% | $385,451 | 169 | 4.16% |

| NORTHWAVE | 60.89% | $345,163 | 23 | 4.12% |

| THE VISIONAIRE | 58.81% | $368,286 | 14 | 4.01% |

| PARC LIFE | 55.60% | $342,858 | 23 | 4.19% |

Highest average quantum

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

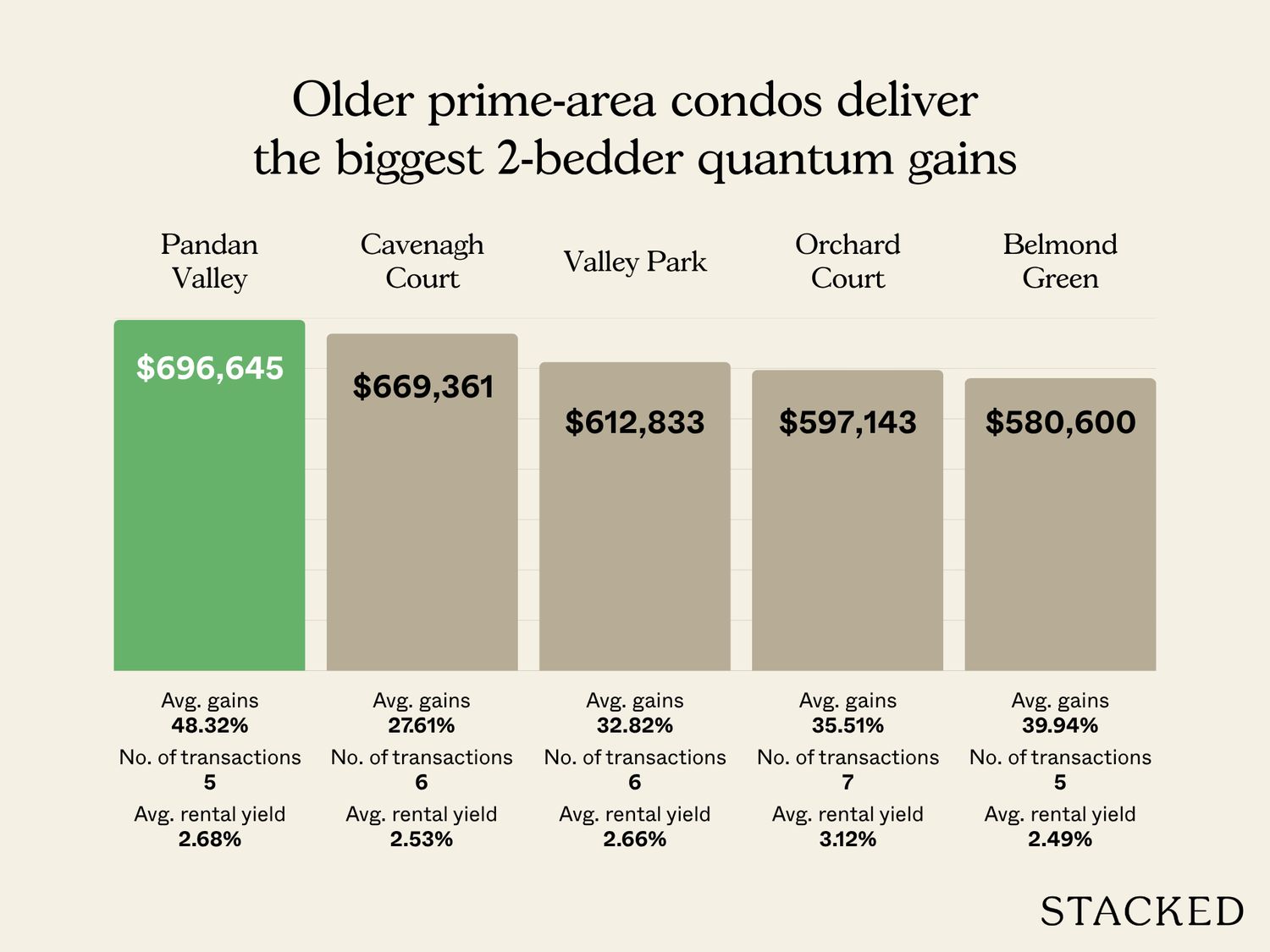

| PANDAN VALLEY | 48.32% | $696,645 | 5 | 2.68% |

| CAVENAGH COURT | 27.61% | $669,361 | 6 | 2.53% |

| VALLEY PARK | 32.82% | $612,833 | 6 | 2.66% |

| ORCHARD COURT | 35.51% | $597,143 | 7 | 3.12% |

| BELMOND GREEN | 39.94% | $580,600 | 5 | 2.49% |

Highest average rental yield

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

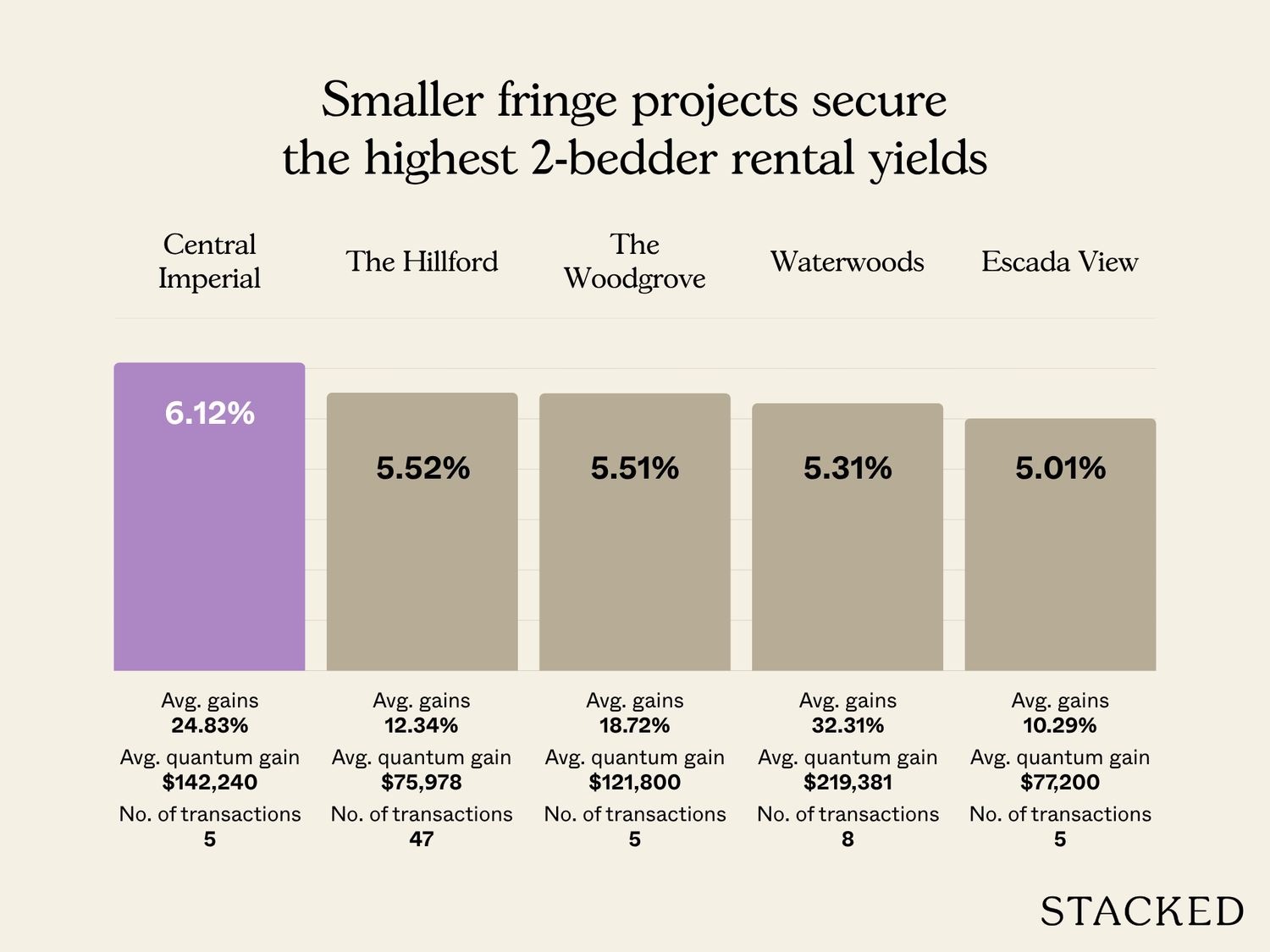

| CENTRAL IMPERIAL | 24.83% | $142,240 | 5 | 6.12% |

| THE HILLFORD | 12.34% | $75,978 | 47 | 5.52% |

| THE WOODGROVE | 18.72% | $121,800 | 5 | 5.51% |

| WATERWOODS | 32.31% | $219,381 | 8 | 5.31% |

| ESCADA VIEW | 10.29% | $77,200 | 5 | 5.01% |

Once again, it’s no surprise that the top spot is taken by an EC: this time, INZ Residence. INZ’s two-bedders take the top spot with 66.29 per cent gains, averaging $381,222 per seller. This is again a simple function of lower prices, giving a lot of room to appreciate. But we will admit that, given the rather ulu location (somewhere between Tengah and Choa Chu Kang), this EC has done better than we gave it credit for.

Right behind it is Sol Acres again, with an average profit of $385,451, and Sol Acres actually wins out in absolute profit.

Further down, there are more ECs: Northwave, The Visionaire, and Parc Life all cluster in the same ballpark: gains between 55 to 61 per cent, with profits around $340,000 to $368,000.

But when it comes to quantum, we see a completely different segment taking the lead for two-bedders: older condos.

Pandan Valley, one of the last remaining first-generation condos from the 1970s, sits comfortably at the top with a massive $696,645 average profit. Pandan Valley is practically a neighbourhood in itself though, and not a normal condo; you can see the details here.

More from Stacked

The Surprising Truth About Dual-Key Homes In Singapore: 3 Homeowners Share Their Stories

Dual-key units are undeniably a niche property type, with many developers struggling to move these units in recent new launches.…

Cavenagh Court, Valley Park, Orchard Court, and Belmond Green follow close behind, all with absolute gains well above $550,000.

These older condos rarely top percentage gains, because their quantum tends to be huge. But this also translates to bigger absolute profits; and their two-bedders can do well for the same reason older one-bedders can: they were designed as true homes for own-stay use. This makes them much more spacious than later era one or two-bedders, many of which were seen more as compact rental assets.

As for rental yield, Central Imperial leads at 6.12 per cent. This is quite an unusual project on paper, as it’s freehold and has only 63 units; but this is common to some parts of the Geylang area (in this case, Geylang Lorong 14). Here, rental demand is strong due to proximity to town as well as the hub of Paya Lebar. At the same time though, prices tend to be low, as many projects here are specifically angled at rental.

You do have to watch out for financing issues though, as some banks won’t provide loans for properties near certain Lorongs where they feel vice activities are too close.

The Hillford makes yet another appearance at 5.52 per cent, followed closely by The Woodgrove, Waterwoods, and Escada View. These are textbook investor picks: low quantum and steady tenant base.

As an interesting aside, you can see that rental yields for two-bedders are not significantly higher than one-bedders. This is an interesting consideration for landlords: whilst a two-bedder does incur a higher capital commitment, they don’t necessarily fare worse in terms of gross yield.

If you then add the qualitative advantages – such as better rentability as tenants can have roommates, or you can rent to young families or use it as a home in a pinch – it may end up being a stronger choice than a one-bedder. It’s just something to think about.

3-bedroom units

Highest average gains

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

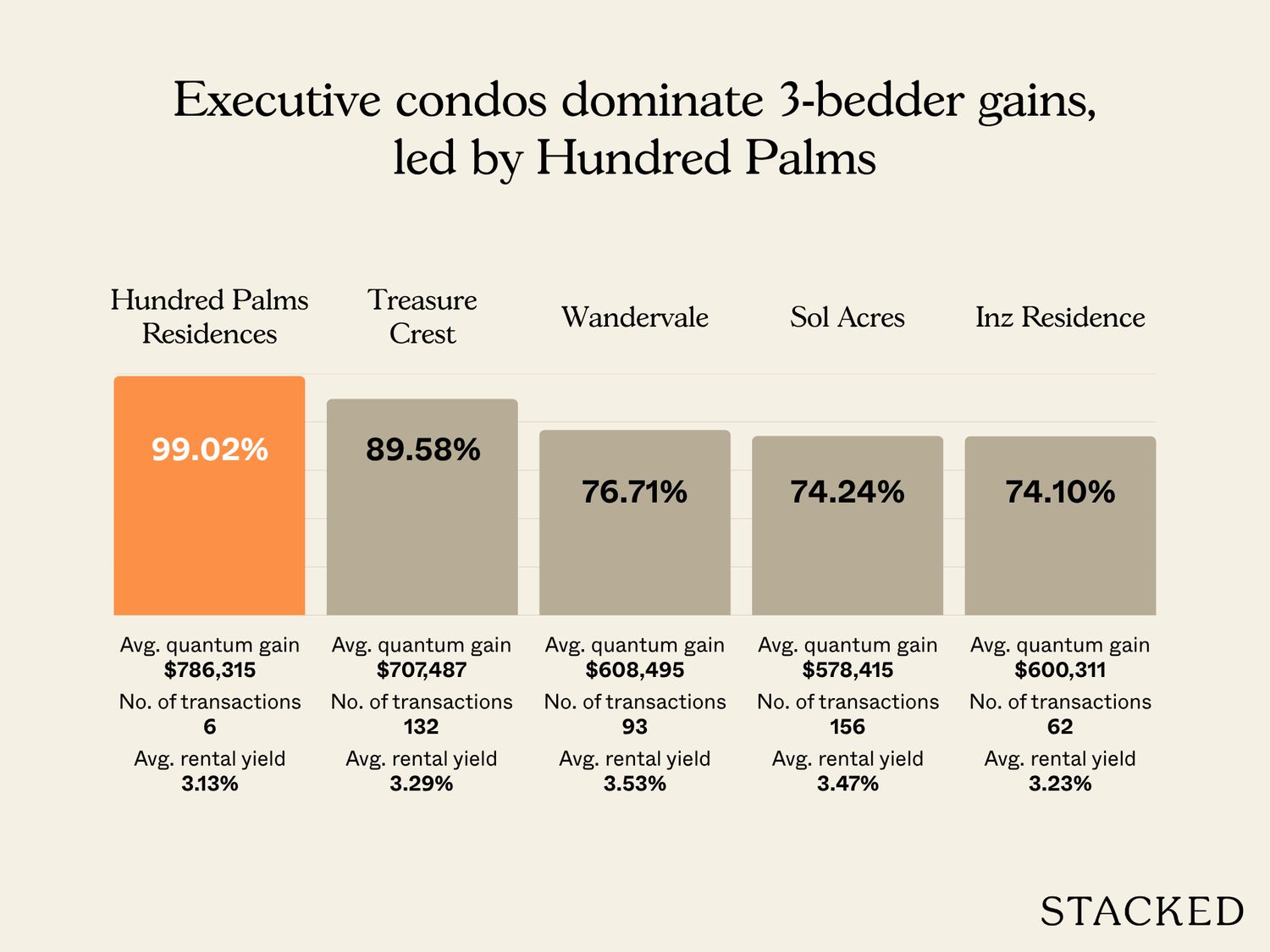

| HUNDRED PALMS RESIDENCES | 99.02% | $786,315 | 6 | 3.13% |

| TREASURE CREST | 89.58% | $707,487 | 132 | 3.29% |

| WANDERVALE | 76.71% | $608,495 | 93 | 3.53% |

| SOL ACRES | 74.24% | $578,415 | 156 | 3.47% |

| INZ RESIDENCE | 74.10% | $600,311 | 62 | 3.23% |

Highest average quantum

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

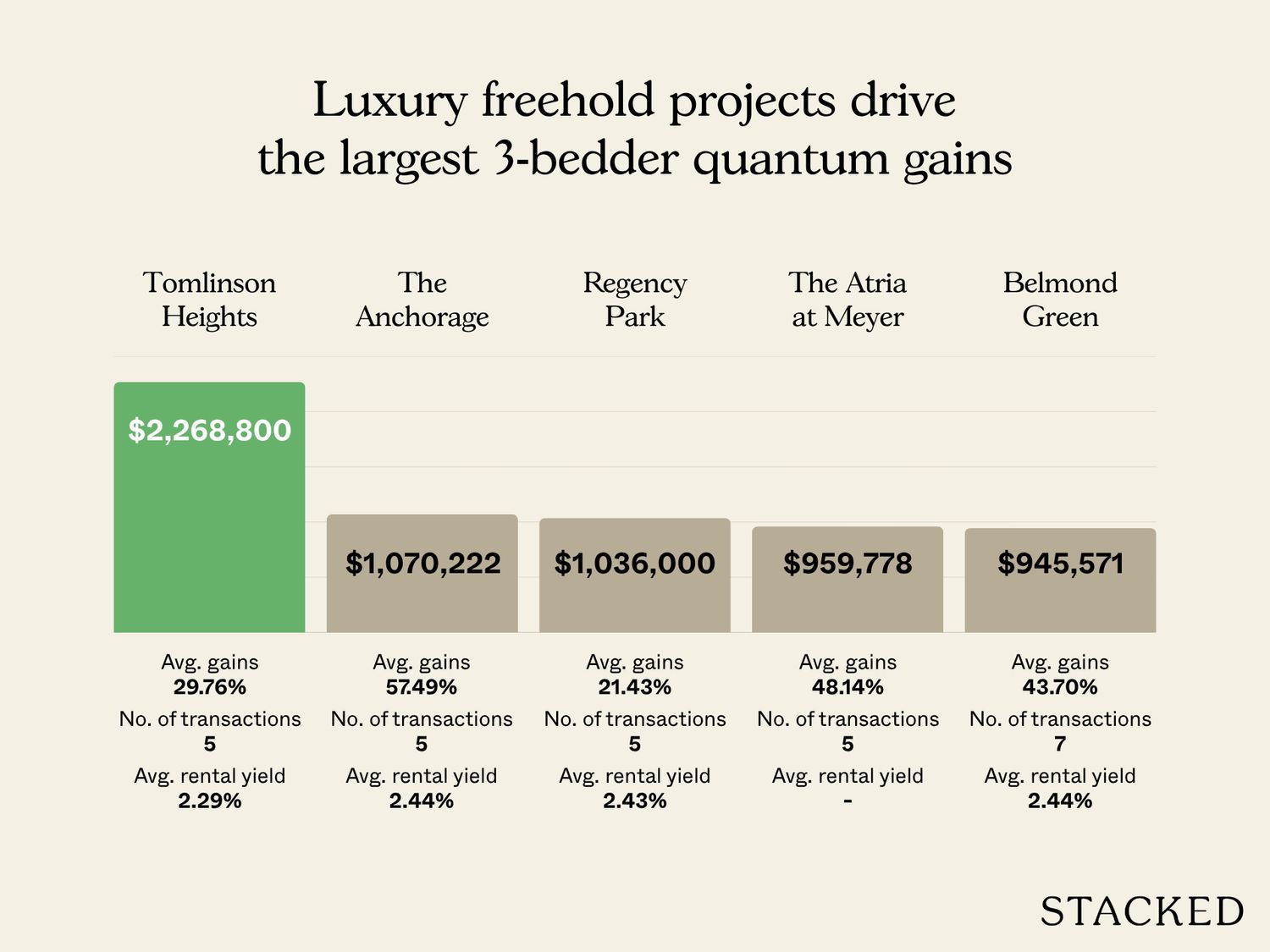

| TOMLINSON HEIGHTS | 29.76% | $2,268,800 | 5 | 2.29% |

| THE ANCHORAGE | 57.49% | $1,070,222 | 5 | 2.44% |

| REGENCY PARK | 21.43% | $1,036,000 | 5 | 2.43% |

| THE ATRIA AT MEYER | 48.14% | $959,778 | 5 | – |

| BELMOND GREEN | 43.70% | $945,571 | 7 | 2.44% |

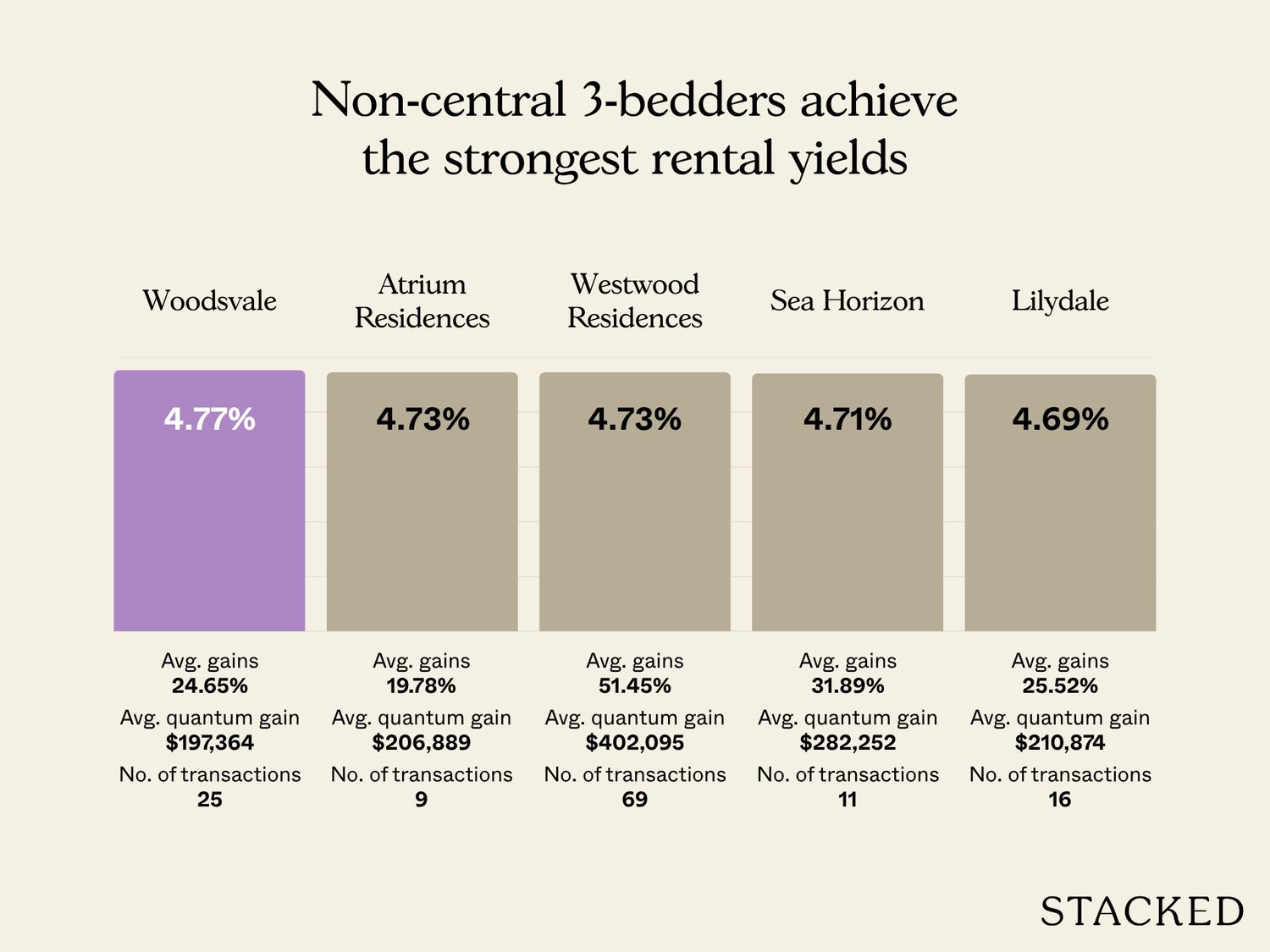

Highest average rental yield

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

| WOODSVALE | 24.65% | $197,364 | 25 | 4.77% |

| ATRIUM RESIDENCES | 19.78% | $206,889 | 9 | 4.73% |

| WESTWOOD RESIDENCES | 51.45% | $402,095 | 69 | 4.73% |

| SEA HORIZON | 31.89% | $282,252 | 11 | 4.71% |

| LILYDALE | 25.52% | $210,874 | 16 | 4.69% |

As is the pattern, let’s start with ECs parading their percentage gains again. Hundred Palms is the EC equivalent of not just hitting the jackpot, but hitting it multiple times if you were the earliest buyers. It wasn’t even unexpected then, as the launch weekend was already wild in its day (it sold out in seven hours).

Hundred Palms is currently the only EC to have ever breached the $3.05 million mark.

Treasure Crest comes in right after, and honestly, this project has been a silent monster for years. Three-bedders here averaged $707,487 in profits, and Wandervale follows with $608,495 in gains. Besides being ECs, these two projects have another secret ingredient:

They launched in 2016. At the time, two things happened: the property market was in a trough due to constant cooling measures, and there was serious concern over EC oversupply. This led to cautious developers and the first batch of buyers getting rock-bottom prices. So if you bought an EC in 2016, congratulations: you rode one of the biggest upcycles of the decade with likely zero drama.

On the quantum side, we leave the world of sensible family condos, and enter the realm of freehold giants.

Tomlinson Heights sits at the top with an eye-watering $2.27 million average profit. This is a super-sized luxury product in Tanglin, within walking distance to Orchard Boulevard MRT (TEL).

The Anchorage, Regency Park, The Atria at Meyer, and Belmond Green complete the list, all posting quantum gains close to (or above) the $950,000 to $1 million range. These sprawling older developments are enormous by today’s standards, with units sometimes reaching over 2,000 sq ft.

However, it remains to be seen if the performance will keep up over the next decade: the new shift in the CCR is toward smaller units with a more palatable quantum.

For rental yield, three-bedders and a bit uncommon for landlords. Few investors will buy something as large and capital-intensive as a three-bedder just to rent it out; but we do see some OCR projects with decent yields.

Woodsvale leads with 4.77 per cent, followed very closely by Atrium Residences, Westwood Residences, Sea Horizon, and Lilydale. These are fairly priced OCR projects with large family units, and tenants get good value for space.

From word on the ground, we also understand that – starting sometime during the COVID recovery period – there was a brief trend of co-living spaces renting these larger units and then subletting them. We’re not certain if this trend is ongoing, as the rental market has softened since; but this may have led to more leases being signed for three-bedders or other larger units (it’s easier to subdivide the larger units, to take in more unrelated tenants).

4-bedroom units

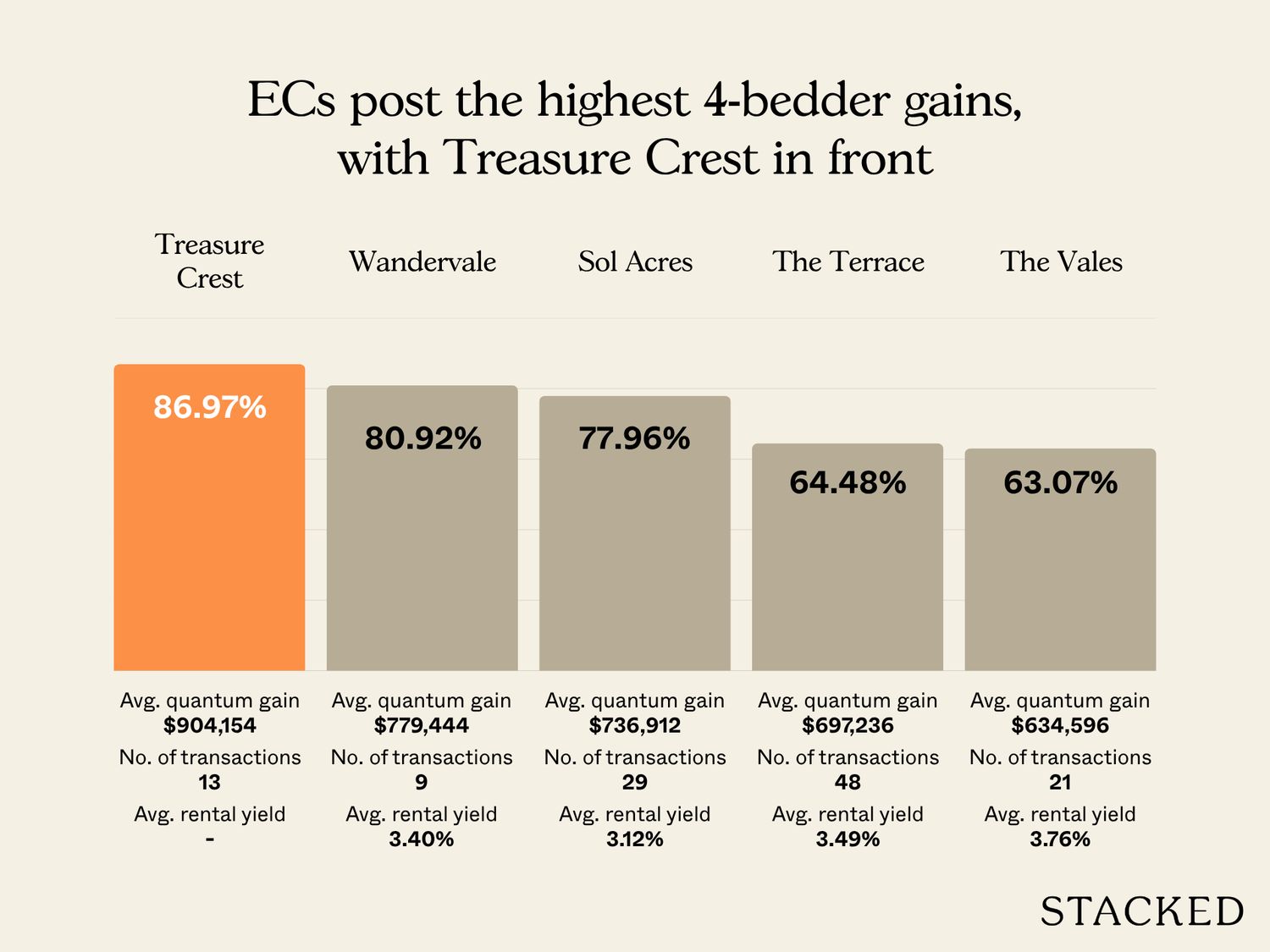

Highest average gains

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

| TREASURE CREST | 86.97% | $904,154 | 13 | #N/A |

| WANDERVALE | 80.92% | $779,444 | 9 | 3.40% |

| SOL ACRES | 77.96% | $736,912 | 29 | 3.12% |

| THE TERRACE | 64.48% | $697,236 | 48 | 3.49% |

| THE VALES | 63.07% | $634,596 | 21 | 3.76% |

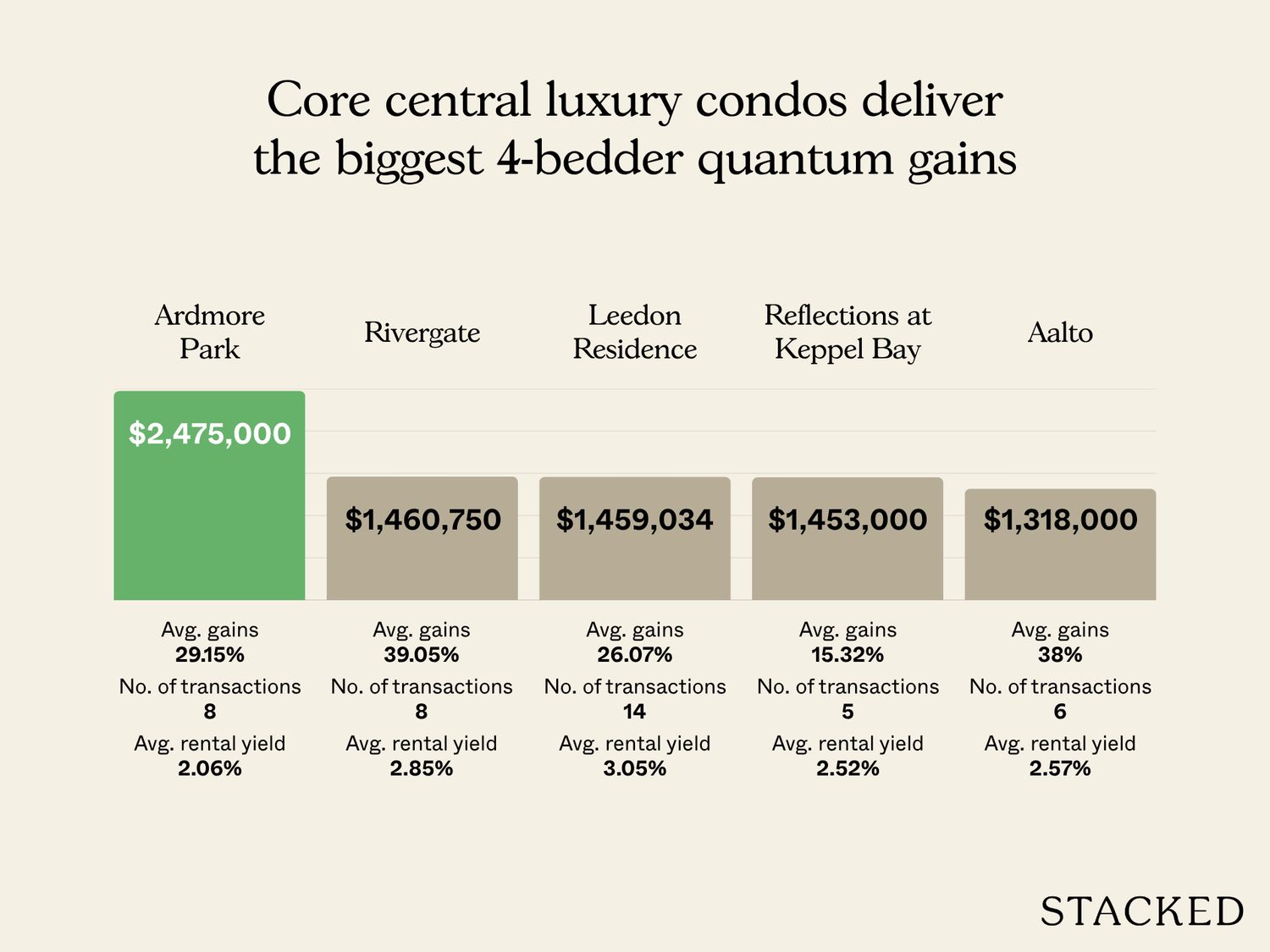

Highest average quantum

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

| ARDMORE PARK | 29.15% | $2,475,000 | 8 | 2.06% |

| RIVERGATE | 39.05% | $1,460,750 | 8 | 2.85% |

| LEEDON RESIDENCE | 26.07% | $1,459,034 | 14 | 3.05% |

| REFLECTIONS AT KEPPEL BAY | 15.32% | $1,453,000 | 5 | 2.52% |

| AALTO | 38.00% | $1,318,000 | 6 | 2.57% |

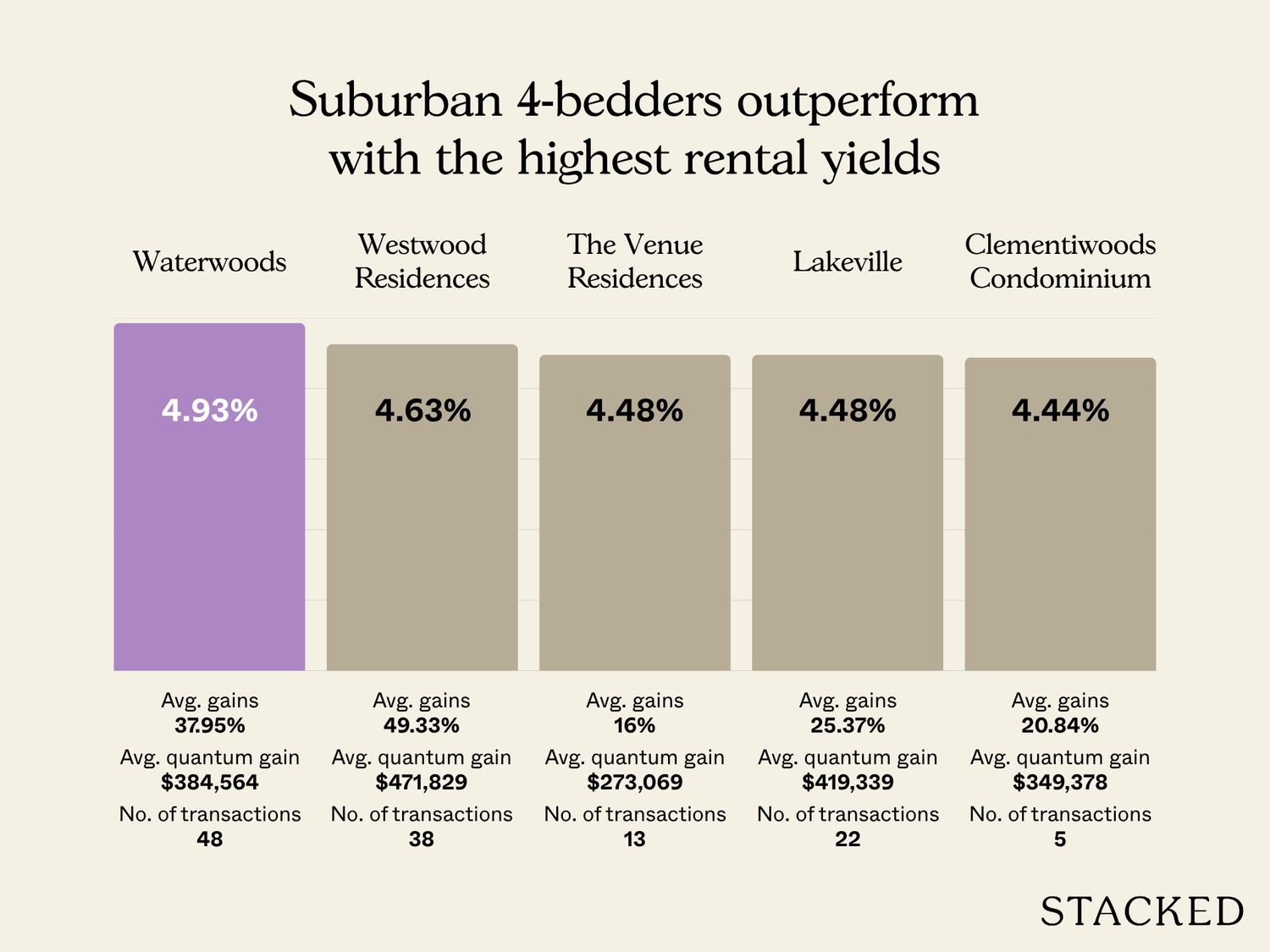

Highest average rental yield

| Project | Average gains | Average quantum gain | No. of transactions | Average rental yield (based on rental tnx from June 2024 to June 2025) |

| WATERWOODS | 37.95% | $384,564 | 48 | 4.93% |

| WESTWOOD RESIDENCES | 49.33% | $471,829 | 38 | 4.63% |

| THE VENUE RESIDENCES | 16.00% | $273,069 | 13 | 4.48% |

| LAKEVILLE | 25.37% | $419,339 | 22 | 4.48% |

| CLEMENTIWOODS CONDOMINIUM | 20.84% | $349,378 | 5 | 4.44% |

ECs still lead the charge, even for these very large units. In fact, for many, ECs represent the only shot at getting something as huge as a four-bedder. Treasure Crest leads the charge, with four-bedder gains averaging 86.97 per cent and absolute profits of around $904,154.

Wandervale follows with a hefty $779,444 in profits: again, note that this was from 2016. Sol Acres, being a mega-EC, sits close behind at $736,912.

For absolute quantum, it’s probably not a shock that this just reads like a list of really expensive condos. The famed Ardmore Park towers over the segment with an average profit of $2.475 million: this is one of the most prestigious addresses in Singapore, and shows how ultra-luxury freehold is a different beast altogether.

Rivergate and Leedon Residence sit next, both comfortably clearing $1.45 million per four-bedder transaction. These are huge units in highly desirable Districts 9 and 10, with the land, space, and tenant profile to match.

For rental yields, we don’t have any comment, as many of these may be unique cases. It’s not as common that something as big as a four-bedder is rented out; the only observation here is that it does happen from time to time, and it can surprisingly still be in the four to five per cent yield range even for such large units.

This is just a quick snapshot of where we are in 2025, but do follow us for more in-depth looks at specific projects or districts. We’ll also provide you with in-depth reviews of new and resale properties alike on Stacked. Also, if you live or have lived in any of the properties above, we’d love to hear your experiences. Yes, even the one about a rude security guard.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Latest Posts

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

0 Comments