Are Singaporeans Moving Away From Property As A Retirement Strategy?

November 23, 2025

You’d think by now, the idea of using polls to push a point would be obsolete; but it’s still going strong among insurers and property agencies. I’m talking about polls that are thinly veiled sponsored messages, along the lines of “nine out of 10 doctors prefer…etc.” style persuasiveness (or lack thereof.)

Take, for instance, this report on a Manulife survey: it says that among Singapore respondents (1,021 people, part of around 9,000 surveyed across nine Asian markets), only 35 per cent consider property as a key tool for retirement preparation. 65 per cent previously considered property as a key retirement tool, it says. It’s a boomer thing. Dead or dying.

But then check out this poll by ERA, which says that “…over 64 per cent of respondents indicated a preference for investing in real estate over fixed deposits, bonds, commodities, cryptocurrencies, and stocks.”

Then there’s this poll by PropNex that says the second most popular response, when asked about what the flat is for, is “a retirement nest egg,” alongside a lot more details about how many are planning to upgrade (about half of the respondents). Quite different from this other poll from Manulife Asia Care Survey 2025, where only 19 per cent of respondents cite property investment as the most important tool for retirement planning.

Who’s right? Well, probably neither.

A lot depends on issues like how the questions are phrased, how the survey tallies the results, etc. For example:

- “Given that property requires ongoing tax, maintenance and mortgage payments, do you consider it suitable for retirement?” is a question that leads away from property investment.

- “Do you prefer an asset you can live in, rather than intangible investments?” is a question that pushes toward property investment.

It also matters where exactly the survey happened. In my experience, online surveys tend to draw younger and more frustrated respondents; singles who are blocked from getting a flat, or graduates struggling to find a job, have opinions formed from being locked out of most property investments. Not only is real estate a less practical (or even possible) investment choice for them, but they may also resent the idea of more people buying homes for investment, thus worsening their situation.

Conversely, if you conduct a survey offline, among older folks who have paid up flats and have less awareness of today’s prices, or who personally witnessed the boom in flat prices from the ‘70s or ‘80s to the present, there will be a more favourable response toward real estate as a long-term asset.

A bit of an anecdote:

Earlier this year, I ran into one such poll where I was asked if I was looking for a property first; and then the subsequent questions came: did I think property could still be a viable long-term asset, etc. I noticed that when my associate said he wasn’t currently looking for a property, he only got about three or four more abrupt questions.

Well, if you’re going to ask people already looking for a property whether they think it’s a good investment, retirement asset, etc., then newsflash: a greater proportion of them are going to say yes. That’s like a poll asking people wearing jeans whether they like jeans.

Yes, I know, using anecdotal evidence is not very data-driven of me. But my point is that a lot of these polls could be using these tactics, hence the huge divergence in what each of them is saying.

Insurers arguably have an incentive to downplay property as a retirement tool. Every dollar a client sinks into real estate is a dollar not going into insurance products like annuities, endowments, and ILPs.

More from Stacked

We analysed 87 en bloc condos. Here’s what we learnt.

En bloc condos were all the rage in 2017 and 2018, which isn't surprising at all given that you could…

Property also competes with these products because it offers leveraged capital gains and potential rental income. While insurance returns are definitely important and can also be solid, they do result from long-term policy commitments and fees, and without a solid, tangible property to look at, they can feel less satisfying.

The inverse is true on the real estate side, where agencies are trying to persuade buyers despite rising costs, cooling measures, increasing capital commitment (from lowered Loan To Value ratios) and so forth.

So these polls aren’t really describing Singaporean attitudes, they’re describing the incentives of whoever is paying for them.

I do wonder how long it will be, before they catch on that this “poll” trick is better off just being replaced by ads. The polls are slower and more expensive to do, and aren’t substantially more persuasive. And for the marketers of insurers and property agencies reading this, here’s something often overlooked: you can repeat ads again and again, but publications aren’t going to run your poll editorial more than once.

So if it’s going to be a sponsored editorial, better make it something besides these “poll” stories that are really just clunkier ads.

Meanwhile in other property news…

- Buying a new launch condo is just not the same in 2025; here’s why and how

- Where are the cheapest three-bedroom condos near top schools, and in Bukit Timah? Here’s the list.

- What’s it like getting a flat from the Sale of Balance Flats (SBF) exercise? Here’s the experience of one couple who got their home earlier this way.

- The Sen is one of the most affordable RCR launches to date; but how does it compare to nearby options? Here’s a deep dive before you buy.

Weekly Sales Roundup (10 – 16 November)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARK NOVA | $6,388,000 | 1432 | $4,462 | FH |

| MEYER BLUE | $5,423,000 | 1733 | $3,129 | FH |

| GRAND DUNMAN | $5,237,000 | 2131 | $2,457 | 99 yrs (2022) |

| ZYON GRAND | $4,523,000 | 1421 | $3,183 | 99 yrs (2024) |

| THE SEN | $3,664,100 | 1453 | $2,522 | 99 years |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE SEN | $993,900 | 452 | $2,198 | 99 years |

| ZYON GRAND | $1,439,000 | 474 | $3,038 | 99 yrs (2024) |

| OTTO PLACE | $1,515,000 | 872 | $1,738 | 99 yrs (2024) |

| THE LAKEGARDEN RESIDENCES | $1,590,000 | 678 | $2,345 | 99 yrs (2023) |

| BLOOMSBURY RESIDENCES | $1,778,000 | 689 | $2,581 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE BOTANIC ON LLOYD | $6,015,000 | 2594 | $2,319 | FH |

| GRANGE HEIGHTS | $5,338,000 | 3025 | $1,765 | FH |

| PARVIS | $4,430,000 | 1701 | $2,605 | FH |

| MARINA BAY SUITES | $4,255,000 | 2056 | $2,070 | 99 yrs (2007) |

| ST THOMAS SUITES | $4,220,000 | 1819 | $2,320 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KOVAN GRANDEUR | $639,088 | 388 | $1,649 | 99 yrs (2010) |

| KENSINGTON SQUARE | $728,888 | 431 | $1,693 | FH |

| Q BAY RESIDENCES | $743,000 | 527 | $1,409 | 99 yrs (2012) |

| KINDOL GARDENS | $750,000 | 1367 | $549 | 999 yrs (1885) |

| HIGH PARK RESIDENCES | $760,000 | 441 | $1,722 | 99 yrs (2014) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SOMMERVILLE PARK | $4,200,000 | 1948 | $2,156 | $2,765,000 | 30 Years |

| SANCTUARY GREEN | $2,675,000 | 1572 | $1,702 | $1,907,000 | 21 Years |

| THE TRILLIUM | $3,800,000 | 1399 | $2,716 | $1,409,000 | 18 Years |

| THE BOTANIC ON LLOYD | $6,015,000 | 2594 | $2,319 | $1,265,000 | 10 Years |

| THE VIEW @ MEYER | $4,000,888 | 1690 | $2,367 | $1,250,888 | 12 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE OCEANFRONT @ SENTOSA COVE | $2,050,000 | 1216 | $1,685 | -$442,800 | 16 Years |

| MARINA BAY SUITES | $4,255,000 | 2056 | $2,070 | -$425,000 | 11 Years |

| SKYSUITES@ANSON | $1,548,000 | 700 | $2,213 | -$132,300 | 14 Years |

| EON SHENTON | $1,170,000 | 538 | $2,174 | -$46,000 | 14 Years |

| 76 SHENTON | $2,100,000 | 980 | $2,144 | -$30,200 | 16 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| SANCTUARY GREEN | $2,675,000 | 1572 | $1,702 | 248.31% | 21 Years |

| SOMMERVILLE PARK | $4,200,000 | 1948 | $2,156 | 192.68% | 30 Years |

| YEW MEI GREEN | $1,390,000 | 1292 | $1,076 | 175.25% | 19 Years |

| GRANDE VISTA | $1,818,000 | 1238 | $1,469 | 143.05% | 28 Years |

| KINDOL GARDENS | $750,000 | 1367 | $549 | 135.11% | 20 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| THE OCEANFRONT @ SENTOSA COVE | $2,050,000 | 1216 | $1,685 | -17.76% | 16 Years |

| MARINA BAY SUITES | $4,255,000 | 2056 | $2,070 | -9.08% | 11 Years |

| SKYSUITES@ANSON | $1,548,000 | 700 | $2,213 | -7.87% | 14 Years |

| EON SHENTON | $1,170,000 | 538 | $2,174 | -3.78% | 14 Years |

| 76 SHENTON | $2,100,000 | 980 | $2,144 | -1.42% | 16 Years |

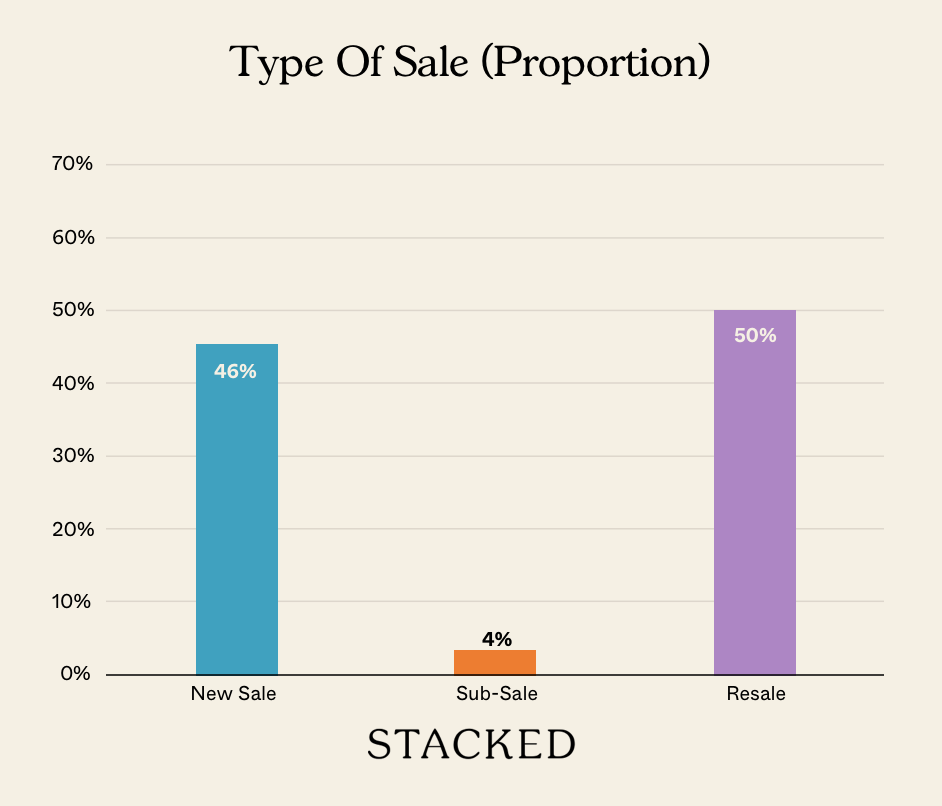

Transaction Breakdown

Follow us on Stacked for more on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are Singaporeans still using property for retirement planning?

Do most Singaporeans prefer investing in property over stocks or fixed deposits?

How does the age or flat status of Singaporeans affect their views on property as a retirement asset?

Why do different surveys show conflicting views on property as a retirement tool?

Are property polls influenced by who pays for them?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments