Are Singapore Property Prices Set To Drop In 2024? Here’s A “Surprising” Prediction

February 12, 2024

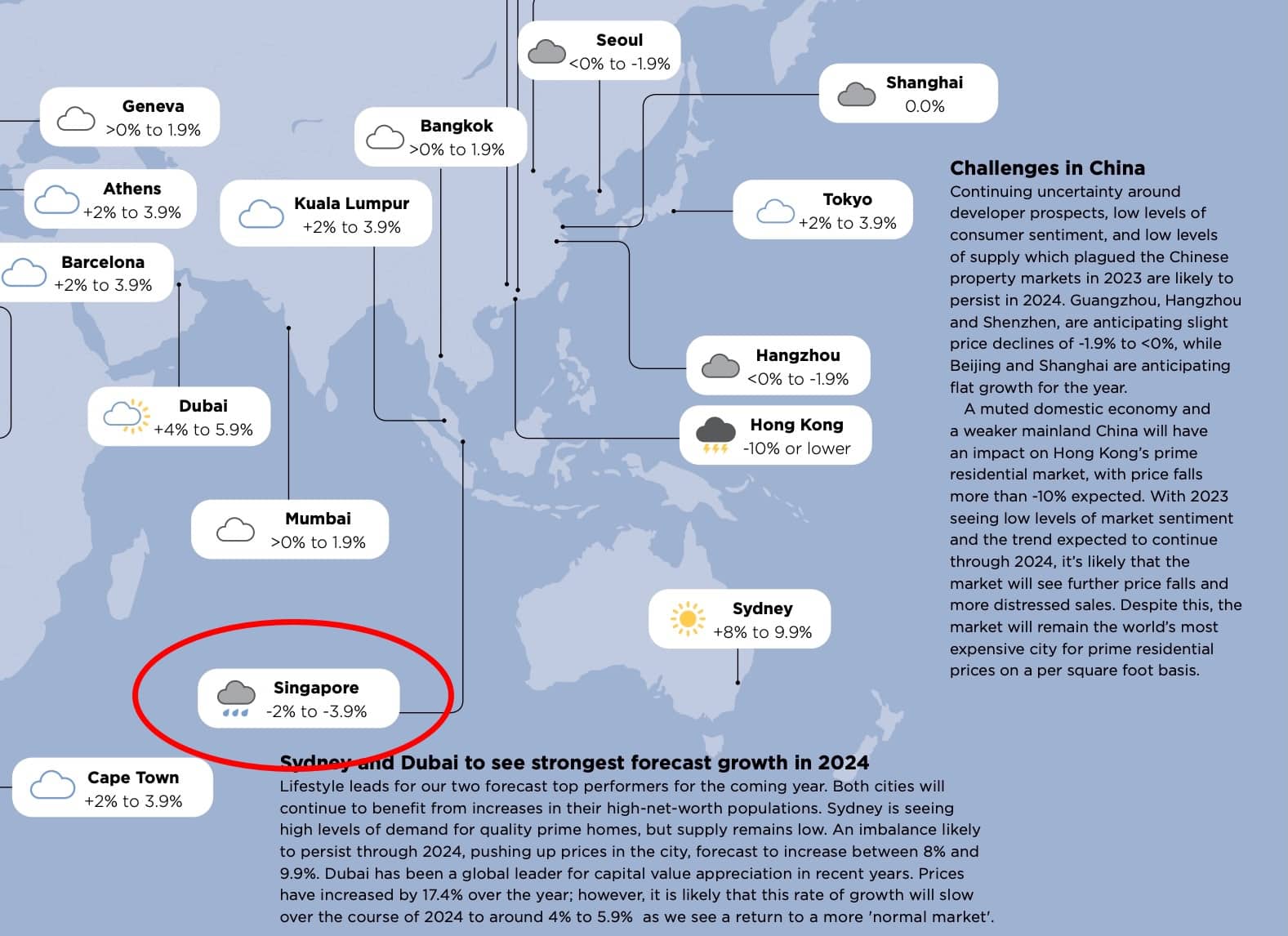

This may not come as a surprise to most, but according to a report by Savills prime properties (e.g., the high-end luxury stuff, like you’ll find in our Core Central Region) might dip by around 3.9 per cent this year. This is on the back of higher interest rates, which we also explained here.

Now this is a bit counterintuitive; because as far as interest rates go, I would imagine that has a bigger impact on the fringe regions than the prime area. Let’s face it, the people buying $10 million penthouses could probably use less in the way of loans if they wanted – some might even be able to buy with no loan, they just want the leverage.

But it’s not like a regular home buyer can pull $1.6 million out of their back pocket for a resale condo. The average Singaporean needs a loan – and a sizeable one at that – to make that leap into private property. So if interest rates alone could cause prime region properties to fall in price, then it would be doubly true for non-prime areas, where the typical buyer is even more dependent on loans, and even more susceptible to rising interest rates.

I think if prime region properties do see a price drop, it will be more related to our ABSD rates than to bank loan rates. The ABSD on foreigners is now at 60 per cent, which is a far bigger concern than the interest rate creeping up a percentage point or two; and if this does deter foreigners, the prime regions are where we’ll see the first effects.

The economic headwinds may also be a much bigger factor

There’s sometimes a lag between events in the wider economy, and the impact on the property market. Right now, I think we haven’t fully processed the impact of rising geopolitical tensions, and the (metaphorical) massacre going on with tech companies.

Also, it looks as if higher interest rates are here to stay, which means companies tend to put the brakes on growth. All of this, in short, turns employers cautious.

I was in the property game during the last financial crisis, and I remember how sudden things can change: One day an expat has their pick of any River Valley condo, the next they’re haggling over the price of a walk-up in Geylang.

As housing allowances shrink, and companies replace expatriate workers with locals (hooray!), we might see a quicker general exodus from the prime regions into city fringe or even fringe areas. And I suspect in the coming years it will be this issue, rather than higher interest rates, that puts downward pressure on prime property prices.

In any case, this all represents an opportunity to the prepared. If you’ve been sitting on huge savings and waiting, well, now’s the time when the price gap between CCR and RCR might significantly narrow. Just be careful not to use too much of a loan, when you upgrade.

In related news, the Marina Gardens Crescent site was not awarded to the consortium

Last week – and I guess at the top of this newsletter, heh – I mentioned how certainty in the CCR is dropping. This was what allowed a single bid for the Marina Gardens Crescent site to win. The offer was $770.5 million, or $984 psf; an amount that’s been matched or exceeded by even non-central sites.

This has caused some people to ask if it’s right. After all, if the bid is lower, the developer can charge less; and that makes properties more affordable. The government, or so the opinion goes, could stand to make less. And it’s not a perspective that the government hasn’t considered.

More from Stacked

Resale Condo vs New Launch vs HDB Resale: A Case Study On Which Is The Best Option

Of the numerous large-scale purchasing options we go through in life, setting aside the downpayment for your new house (whether…

The issue is that, even if that consortium of developers had gotten the site for cheap, the property wouldn’t be cheaper than other Marina Bay area properties. In the end, the developer is a profit-driven entity; and the prices will still be based on prices in the surrounding area, regardless of what price they got the land for.

What it does give though, is more leeway for the developer to take risks. Especially with a developer like GuocoLand, who has shown with Midtown and Lentor that they are able to add in a certain amount of transformation to an area. And it’s also telling already that besides the bullish Kingsford bid, the weak demand from the developers for the Marina sites have not been a vote of confidence that this would be an area of growth.

Perhaps on the flipside, turning down the bid is a sign of confidence that URA has in the area in the future. What do you guys think? Let us know.

Meanwhile, in other property news:

- Here’s a quick check on where home prices have risen or fallen the most, to help your post-CNY house hunting.

- Let’s face it, Frank Lloyd Wright is probably the only architect most of us can name. But that just makes homes like this one all the more iconic.

- Looking for an affordable HDB maisonette? I too, would like to find such mythical things, alongside unicorns and affordable Mexican food in Singapore. But in the meantime, here are some maisonettes at $750,000 or below.

- Would you give up the $20,000 Proximity Housing Grant? For some people, distance from parents isn’t just desirable, it can be worth losing the grant.

STACKED WISHES ALL OF YOU A VERY HAPPY AND PROSPEROUS CHINESE NEW YEAR!

May you have a long life, good health, and a property that sells for so high it appears on agent’s flyers (sometimes even with your permission).

Weekly Sales Roundup (22 January – 28 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 19 NASSIM | $6,000,000 | 1733 | $3,462 | 99 yrs (2019) |

| TERRA HILL | $5,161,150 | 1894 | $2,724 | FH |

| THE RESERVE RESIDENCES | $4,247,192 | 1625 | $2,613 | 99 yrs (2021) |

| WATTEN HOUSE | $3,212,000 | 990 | $3,244 | FH |

| THE LANDMARK | $2,957,800 | 1141 | $2,592 | 99 yrs (2020) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| NORTH GAIA | $1,210,112 | 969 | $1,249 | 99 yrs (2021) |

| THE ARDEN | $1,233,000 | 657 | $1,878 | 99 yrs (2023) |

| LUMINA GRAND | $1,379,000 | 936 | $1,473 | 99 yrs |

| MIDTOWN MODERN | $1,540,440 | 409 | $3,766 | 99 yrs (2019) |

| THE MYST | $1,595,000 | 700 | $2,280 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE GLYNDEBOURNE | $7,338,000 | 3563 | $2,060 | FH |

| CORALS AT KEPPEL BAY | $6,300,000 | 2573 | $2,449 | 99 yrs (2007) |

| RIVERGATE | $5,050,000 | 1798 | $2,809 | FH |

| MARINA BAY SUITES | $5,000,000 | 2680 | $1,866 | 99 yrs (2007) |

| THE COSMOPOLITAN | $4,600,000 | 1679 | $2,739 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| RIZ HAVEN | $620,000 | 452 | $1,371 | 946 yr (1938) |

| METRO LOFT | $668,000 | 452 | $1,478 | FH |

| VIVA VISTA | $685,000 | 323 | $2,121 | FH |

| THE SANTORINI | $732,000 | 527 | $1,388 | 99 yrs (2013) |

| CARISSA PARK CONDOMINIUM | $788,000 | 646 | $1,220 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| HAWAII TOWER | $4,000,000 | 2239 | $1,787 | $3,225,000 | 25 Yrs |

| THE COSMOPOLITAN | $4,600,000 | 1679 | $2,739 | $2,975,567 | 19 Yrs |

| SOMMERVILLE GRANDEUR | $3,800,000 | 1830 | $2,077 | $2,550,000 | 19 Yrs |

| RIVERGATE | $5,050,000 | 1798 | $2,809 | $1,777,640 | 14 Yrs |

| SPRING GROVE | $2,500,000 | 1389 | $1,800 | $1,580,000 | 26 Yrs |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| MARINA BAY SUITES | $5,000,000 | 2680 | $1,866 | -$1,288,000 | 14 Yrs |

| ROBINSON SUITES | $1,800,000 | 936 | $1,922 | -$983,555 | 11 Yrs |

| OUE TWIN PEAKS | $3,200,000 | 1399 | $2,287 | -$600,000 | 7 Yrs |

| SPOTTISWOODE SUITES | $1,080,000 | 441 | $2,447 | -$185,000 | 10 Yrs |

| ONE SHENTON | $1,350,000 | 872 | $1,548 | -$150,240 | 17 Yrs |

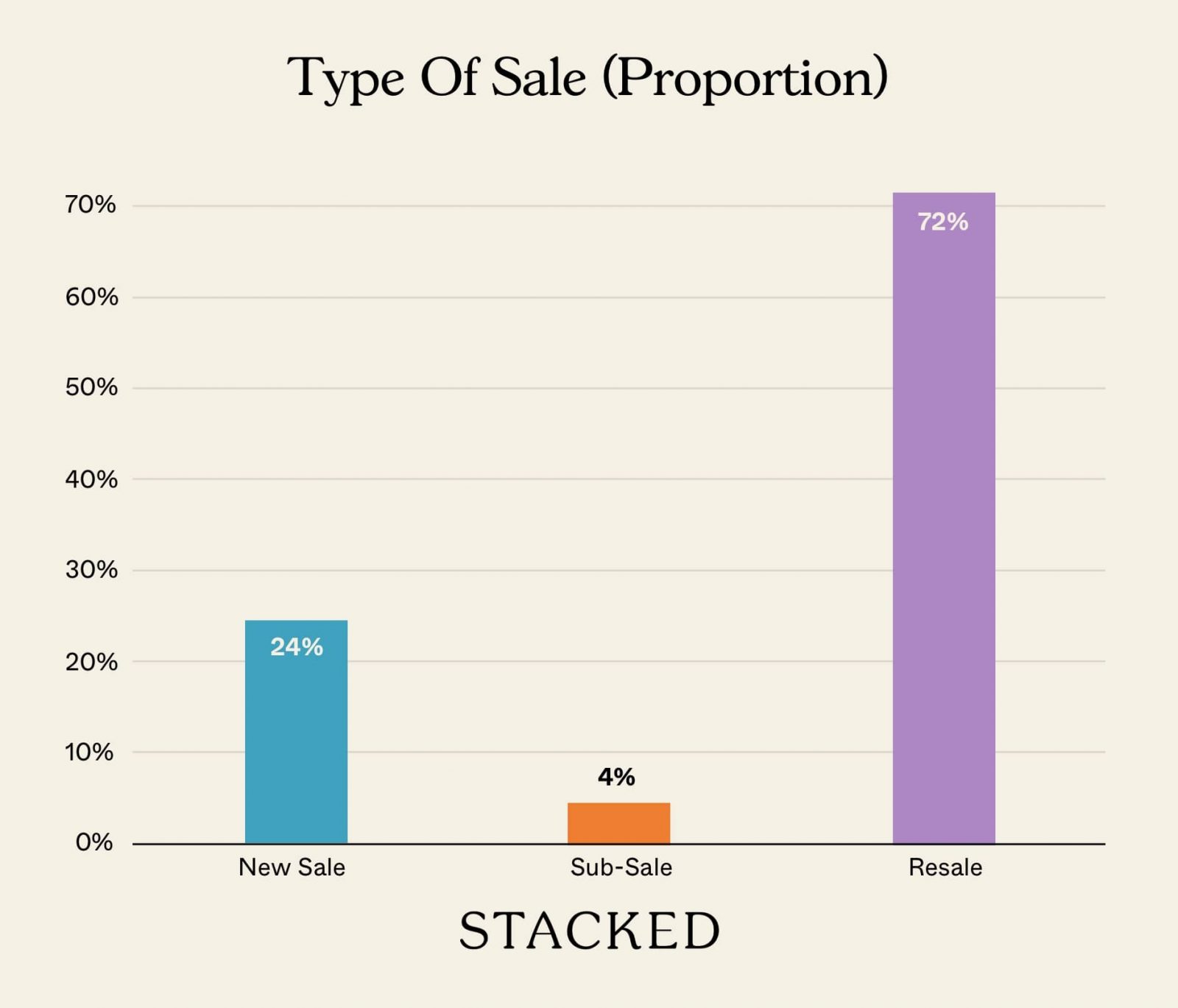

Transaction Breakdown

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Will Singapore property prices drop in 2024?

What factors could cause property prices to fall in Singapore next year?

Are luxury property prices in Singapore expected to decrease in 2024?

How might changes in government policies affect Singapore property prices in 2024?

Could economic conditions impact Singapore's property market in 2024?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

7 Comments

I find the author’s comment about locals replacing expats (“hooray”) naive and bigoted especially in a publication that focuses on the economic impact of various factors that affect the housing market in Singapore. I wonder how Singaporean landlords would feel about the loss of expat workers who are paying them a handsome income each month for the privilege of living in their second or third home? Funny that the author of this article also alluded to this point in a separate article the author wrote in December 2022 as well. You might want to consider your readership’s perspective a little more deeply in future. Unsubscribed.

Let’s see what happens to the Singapore property market if companies replace expats with locals. Who’s gets housing allowance these days anyway? Not very many! Get with the times, mate.

Assumption is wrong. Data incorrect. Expat package increased by 4% in most recent data. Number of foreign workers on EP increased 18.6% 2021 to 2023.

https://www.straitstimes.com/singapore/politics/budget-debate-spore-must-not-let-anti-foreigner-sentiments-take-root-or-become-inward-looking-lawrence-wong

Hooray?! Why is it a hooray, Ryan? Care to elaborate? Or shall I call this xenophobic article out in other forums?