Are 3Gen HDB Flats Still A Good Buy Versus Executive Flats In 2024?

December 21, 2024

3Gen flats are designed for extended families; they’re bigger, but come with a tough restriction: you’re only going to be able to sell back to other extended families. As we write this, it’s been roughly a decade since 3Gen flats were first introduced. Now’s a good time to ask the question: has the drawback really been a big deal after all? And given the spaciousness, are they a better pick over executive flats?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The rundown on 3Gen flats

3Gen flats were built for multi-family living, such as children living with their parents. These flats were first introduced in 2013. At the time, a common belief was that these flats were purely for home ownership and not resale gain.

That’s because 3Gen flats can only be sold to other multi-generational homeowners. Prospective buyers must be families with at least one Singapore citizen and two or more generations living together (e.g., married couple living with parents, and parents with at least one child – that’s inclusive of single parents). This is on top of other usual eligibility requirements.

Note that the parents must be registered as occupiers. Registered occupiers can’t own another residential property, so that means the parent can’t own a condo unit, another flat, etc.

This has led to a lot of warnings about limited resale potential; some realtors will tell you to avoid 3Gen flats if you have any thoughts of upgrading. They’re not entirely wrong, as the added resale restriction means there’s a smaller prospective pool of buyers.

Why not just get an executive flat?

Let’s start with size, where we found something puzzling: our observed transactions (see below) contradict common sources of information. Online searches, as well as realtors, claimed 3Gen flats range between 1,237 to 1,400 sq. ft., whereas most executive flats are between 1,292 sq. ft. to over 1,610 sq. ft.

This would suggest executive flats are generally bigger, a fact that we did not observe in the transactions below.

Nonetheless, some details are clear:

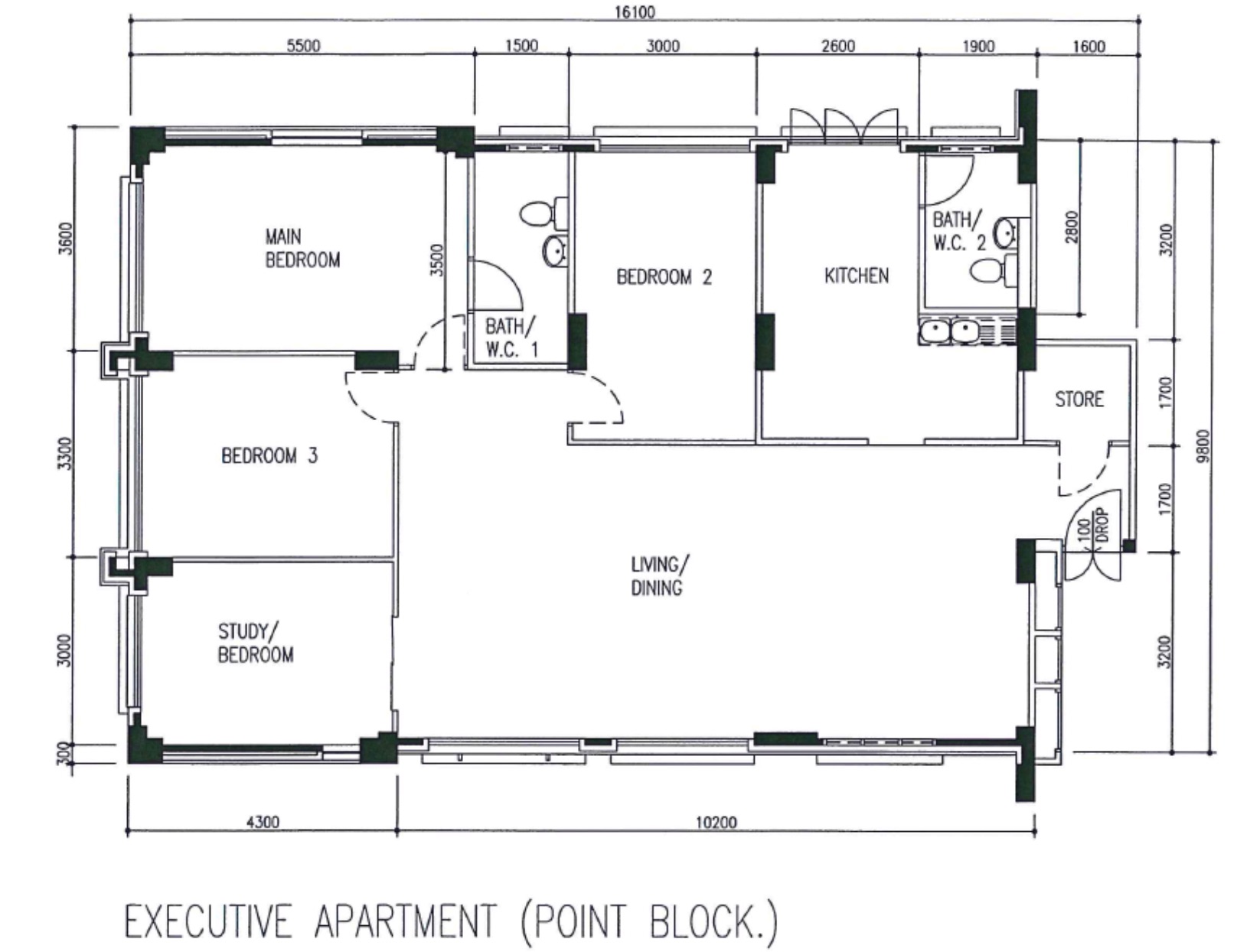

First, executive flats still use floor plans with three bedrooms and two bathrooms, much like regular 5-room flats. A 3Gen flat, on the other hand, will still incorporate an additional master bedroom and bathroom (the added bathroom is an en-suite for the second master bedroom).

Barring a few DBSS projects, jumbo flats, and maisonettes, 3Gen flats are the only HDB flat type with three bathrooms.

Availability and efficiency are two other key factors.

Some realtors pointed out that executive flats are no longer built, and the latest ones you can find date back to 1995 – none were built after that. 3Gen flats are still being built, so you do have a chance of getting one as a BTO flat. This matters to buyers who care about lease decay, and who don’t want to pay the high COV rates common to 2024.

That said, we observed from the transactions below that most resale 3Gen flats are about the same age as their executive counterparts. That’s not too surprising though, as these are usually bought as long-term homes.

The older executive flat layouts also tend to be less efficient, with more wasted hallway space. The latest 3Gen BTO flats are more likely to use newer layouts; some are quite “dumbbell” like, with the two master bedrooms on either end of the unit, connected via the living/dining area instead of a hallway.

More from Stacked

7 Key Questions To Ask About Condo Facilities

This is Part 12 of our 18-part first-time home buyer series. You may refer to the full table below:

So whilst 3Gen flats might be harder to resell, they may be more efficient, and may still be available as BTO flats (if you’re lucky with the ballot).

How are resale gains compared to Executive HDB flats?

The following shows the gains of 3Gen flats compared to executive flats, between 1992 to 2024. Note that there were just three towns with 3Gen flats:

| Year | BISHAN | TAMPINES | YISHUN | Volume |

| 1992 | $292,667 | $231,667 | $213,244 | 22 |

| 1993 | $349,083 | $287,750 | $270,885 | 50 |

| 1994 | $462,375 | $386,455 | $377,889 | 37 |

| 1995 | $545,000 | $475,000 | $469,358 | 27 |

| 1996 | $682,167 | $601,563 | $591,250 | 46 |

| 1997 | $696,000 | $575,700 | $583,895 | 37 |

| 1998 | $588,698 | $485,714 | $499,188 | 30 |

| 1999 | $533,667 | $436,444 | $445,769 | 28 |

| 2000 | $535,500 | $514,000 | $455,714 | 20 |

| 2001 | $490,000 | $503,167 | $437,144 | 23 |

| 2002 | $530,000 | $411,450 | $428,250 | 7 |

| 2003 | $533,500 | $421,667 | $406,286 | 12 |

| 2004 | $507,500 | $423,000 | $407,250 | 12 |

| 2005 | $488,000 | $445,000 | $391,667 | 5 |

| 2006 | $493,333 | $350,000 | $378,125 | 13 |

| 2007 | $410,000 | $441,375 | $387,091 | 21 |

| 2008 | $660,000 | $490,000 | $454,778 | 15 |

| 2009 | $620,000 | $528,000 | $493,571 | 9 |

| 2010 | $690,333 | $492,000 | $605,486 | 12 |

| 2011 | $780,000 | $640,000 | $666,250 | 10 |

| 2012 | $877,000 | $771,250 | $702,667 | 12 |

| 2013 | $855,000 | $731,978 | 7 | |

| 2014 | $702,000 | 3 | ||

| 2015 | $805,000 | 1 | ||

| 2016 | $818,000 | $691,000 | 4 | |

| 2017 | $910,000 | $830,000 | $697,500 | 4 |

| 2018 | $849,333 | $769,432 | 15 | |

| 2019 | $915,972 | $845,000 | $764,347 | 14 |

| 2020 | $940,000 | $742,500 | $752,000 | 8 |

| 2021 | $895,200 | $764,375 | $836,600 | 18 |

| 2022 | $820,722 | $902,063 | 12 | |

| 2023 | $996,667 | 3 | ||

| 2024 | $980,000 | $1,044,000 | $1,075,333 | 6 |

| ROI (1994 – 24) | 2.5% | 4.2% | 3.9% | |

| ROI (2004 – 24) | 3.3% | 6.7% | 5.9% | |

| ROI (2019 – 24) | 1.4% | 7.3% | 8.9% |

Here’s how Executive flats performed in these same HDBs:

| Year | BISHAN | TAMPINES | YISHUN | Volume |

| 1992 | $271,000 | $204,961 | $191,801 | 216 |

| 1993 | $346,455 | $304,712 | $284,052 | 515 |

| 1994 | $439,557 | $380,968 | $358,813 | 666 |

| 1995 | $554,339 | $457,922 | $440,738 | 627 |

| 1996 | $663,256 | $602,566 | $560,171 | 737 |

| 1997 | $658,005 | $586,533 | $545,118 | 589 |

| 1998 | $565,846 | $497,293 | $455,682 | 1005 |

| 1999 | $533,213 | $465,710 | $418,807 | 1278 |

| 2000 | $562,356 | $513,080 | $430,501 | 436 |

| 2001 | $536,403 | $481,935 | $398,045 | 634 |

| 2002 | $522,821 | $452,013 | $369,654 | 477 |

| 2003 | $496,685 | $428,957 | $364,568 | 282 |

| 2004 | $466,845 | $402,281 | $348,537 | 273 |

| 2005 | $434,229 | $378,372 | $336,892 | 308 |

| 2006 | $428,151 | $373,657 | $328,756 | 364 |

| 2007 | $496,876 | $405,993 | $341,523 | 404 |

| 2008 | $592,512 | $487,082 | $387,122 | 340 |

| 2009 | $597,313 | $491,496 | $423,934 | 363 |

| 2010 | $677,747 | $540,129 | $477,989 | 461 |

| 2011 | $746,175 | $610,486 | $534,698 | 260 |

| 2012 | $838,654 | $665,815 | $600,182 | 286 |

| 2013 | $857,856 | $698,285 | $622,596 | 195 |

| 2014 | $860,512 | $682,807 | $581,600 | 169 |

| 2015 | $883,225 | $673,990 | $600,589 | 201 |

| 2016 | $885,676 | $672,735 | $589,501 | 212 |

| 2017 | $905,026 | $662,850 | $589,592 | 259 |

| 2018 | $910,042 | $685,669 | $581,155 | 298 |

| 2019 | $883,344 | $677,849 | $567,527 | 254 |

| 2020 | $891,591 | $689,166 | $599,154 | 314 |

| 2021 | $963,708 | $733,143 | $669,486 | 420 |

| 2022 | $1,046,216 | $830,908 | $787,355 | 348 |

| 2023 | $1,088,284 | $870,442 | $823,621 | 226 |

| 2024 | $1,245,423 | $910,516 | $859,990 | 255 |

| ROI (1994 – 24) | 3.5% | 2.9% | 3.0% | |

| ROI (2004 – 24) | 5.0% | 4.2% | 4.6% | |

| ROI (2019 – 24) | 7.1% | 6.1% | 8.7% |

Unfortunately, the low transaction volume makes it tough to conclude

3Gen flat transactions are rare. Since 2008, there were usually fewer than 20 transactions across the three estates we monitored. Buyers of 3Gen flats are often told to buy it as a long-term family home (perhaps even for life), so it’s not surprising that the transaction volume is low.

But we do note two interesting things:

First, the 3Gen flats that were transacted were bigger than their executive counterparts. Perhaps it’s a quirk of age: older flats tended to be bigger, so maybe if the transactions involved more recent 3Gen flats, they’d lose out in size to their executive counterparts.

Regardless, buyers in the market for resale 3Gen/executive flats shouldn’t assume the former are always smaller than the latter.

Second, taking what we can from limited transactions, the return is not substantially worse than executive flats. In fact, it’s quite often better: Between 2004 to 2024, during which time 3Gen flats saw a notably higher ROI of 5.9 per cent. Between 2019 to 2024, however, there was virtually no difference in gains.

Finally, note that on the resale market, a lot of the 3Gen flats weren’t much newer than their executive counterparts; they both tended to have 62 to 65 years remaining. This age disparity is bound to widen at some point though, simply because construction of executive flats stopped in 1995, while new 3Gen flats are still being built.

The concern for 3Gen flats may have been overblown

Again, it’s tough to draw an absolute conclusion due to the low transaction volume; but the market may have an exaggerated notion of how “bad” 3Gen flats are for resale. They may take a bit longer to sell, or have a more limited pool of buyers; but so far, performance hasn’t been too divergent from resale executive flats.

While it’s still definitely an own-stay asset (as some might argue all HDB flats ought to be), it’s not going to ruin your chances at upgrading either.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

1 Comments

This article is terribly written. 3Gen flats were first introduced in 2013, so how is it possible that you can have resale transactions dating back to 1992?