A Record 259 Million Dollar HDBs + 10.6% Price Increase In 2021: A Roundup Of The Property Market

January 28, 2022

The Singapore private property market remains on the side of sellers, despite hopes over the recent cooling measures. A combination of lower supply, plus fear of continually rising prices, is pushing more Singaporeans to purchase homes sooner – at prices that have now beat the 2013 peak. And as we’ve just now learned, Q4 2021 showed the year ended with prices even higher:

What happened in end-2021?

New cooling measures aside, private home prices continued their steady climb past the 2013 peak. URA’s private home price index was up five per cent between Q3 and Q4 of 2021, and private home prices ended the year 10.6 per cent higher than 2020.

This would mean that 2021 saw the highest annual growth in around 10 years, beating even the previous peak of 2013. It’s no wonder the cooling measures had to be swiftly imposed.

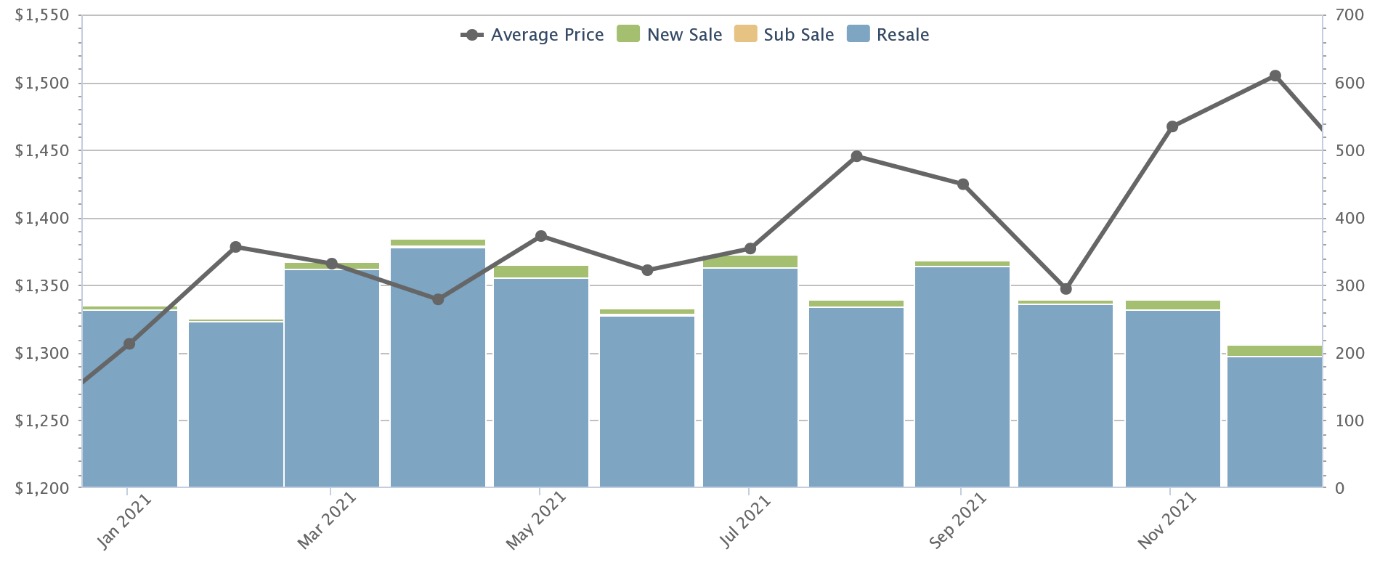

Condos did not lead in terms of the highest rising prices for the year, however. According to monthly data from Square Foot, landed homes actually saw the highest pick up over 2021, ending December up by over 15 per cent:

Across the board, landed home prices rose from an average of $1,307 psf in January, to about $1,505 psf in December.

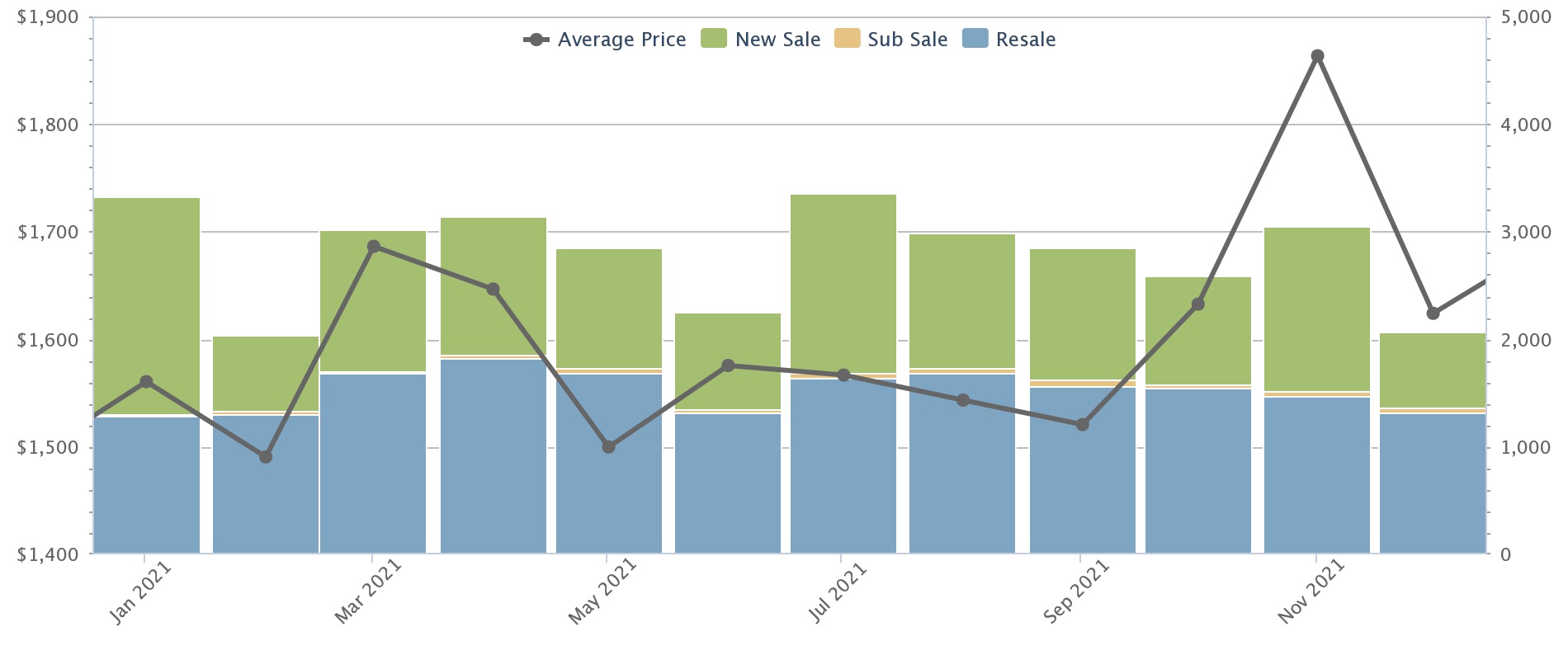

Non-landed private homes saw a more modest rise across the board:

Prices rose from about $1,561 psf in January to about $1,624 psf by December. This is roughly a four per cent increase over the year.

Realtors we spoke to said the numbers were largely in line with predictions. As to the cooling measures introduced on 15th December 2021, they noted that these came too late in the year to have any visible effect. We were told, for example, that about half of the new launch transactions last month were already concluded before 16th December.

One realtor ascribed the rising prices in the final months of 2021 to more transactions being in the RCR and CCR. She noted that:

“There were no new launches in the OCR for the whole of last month, and if you check for December there are only around 220 new sales for the whole region. But the OCR is where you find more affordable units; so when more of the transactions are taking place in the RCR and CCR, it’s quite reasonable that the overall price seems to rise for December.”

Singapore Property News10-Year MOP For Prime Region HDB Flats: All You Need To Know About The New PLH Model

by Ryan J. OngAnd here’s what happened in the HDB market

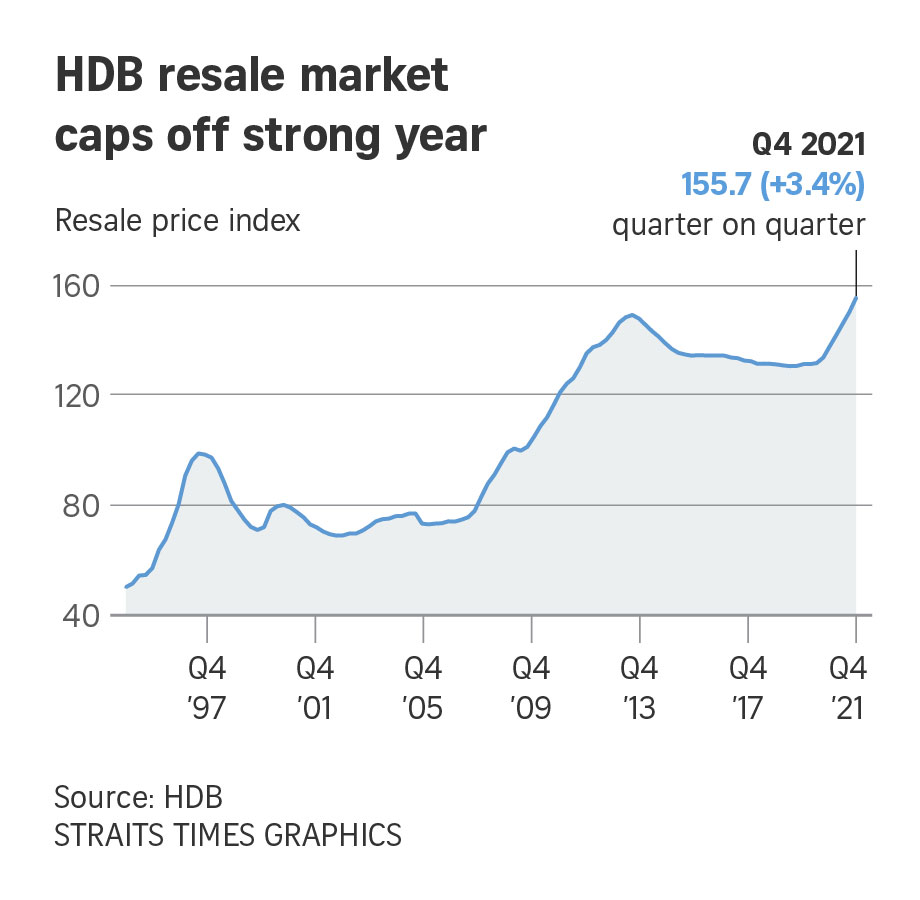

By and large, the HDB market was just as buoyant, with prices rising 12.7 per cent, which represents the highest climb since 2010.

And in accordance with the high prices came a record 259 HDB resale flats hitting the once rare $1 million mark. To put things into perspective, this is more than 3 times 2020’s numbers (82 back then). As you might expect, prices were overall higher as well, with 40 of the units transacting for at least $1.2 million in 2021, as compared to a single digit of 7 in 2020.

Despite the higher prices, HDB resale volume also increased with 31,017 resale flats sold in 2021, an 11-year high.

This is as a result of delays in the construction from Covid-19, which impacts both the Build-to-Order (BTO) projects as well as condo new launches. Hence, estimated waiting times may now be as long as 5.9 years, as compared to the previous average of 4.3 years. The extended waiting times have been a major factor in the rise of resale HDB prices and volumes, and this is likely to continue even in 2022.

The highlight of the year, however, is Singapore’s rental market

In an earlier article, we noted that rental rates were at a six-year high, and showed no sign of slowing. Overall, rental rates ended Q4 up by 2.6 per cent and were up about 9.9 per cent over the year.

We’ve detailed most of the reasons in the linked article above. It’s down to a combination of higher ABSD for foreigners (which may cause them to rent instead of buy) and locals needing to rent as well (due to Covid-related construction delays or high home prices).

It’s also possible that, given the increased ABSD, cashflow issues might prompt some Singaporeans to sell their current home, before buying a new one.

More from Stacked

Can Resale Condos Maintain Their Momentum For The Rest Of 2021?

First-time buyers and upgraders were hit by more bad news, for end-June 2021. It was expected that a return to…

This is because, if they were to buy a new home first, they would face the upfront ABSD of 17 per cent on their new home. While this is remissible for most, they might struggle with having to pay such a large sum within two weeks of the purchase.

As such, more HDB upgraders might opt to sell first, and be spared the ABSD. However, this often means needing temporary accommodation, while they wait on a new home – and this could add to rental demand.

Regardless of the numbers, most realtors are expecting a quiet Q1 2022

Most realtors were certain that Q1 of this year would see a further drop in transaction volumes, as well as slower price increases.

One contributing reason is cyclical: during the Chinese New Year period, most buyers tend to hold off on viewings, and property sales tend to slow.

The other reason is buyers switching to a wait-and-see approach. This behaviour is quite consistent and tends to follow every cooling measure. However, it’s unlikely that sellers are going to budge on the price. One realtor observed that:

“The majority of buyers are not looking at owning a second or third property, and the majority are still Singaporean. An increase in ABSD is not significant to this group*, who make up the larger part of the market; so sellers have no shortage of viewing appointments or offers.”

There’s a growing debate about the impact of cooling measures, on prime region investment properties

Opinions were divided, on whether a prime region shoebox unit is still a viable investment.

Properties in areas like District 9 or District 10 tend to attract more investors than locals, as buyers are often looking for low quantum shoebox units to rent to expatriates.

One argument is that the increased ABSD makes these units less attractive.

For example, 17 per cent ABSD on a $900,000 shoebox unit would raise the price to $1.05 million.

Let’s assume a typical rental rate of $4.27 psf, if the condo is in District 9. We’ll also assume a size of 500 sq. ft., typical of most shoebox units. This comes to a rental income of about $25,620 per annum.

This makes for a gross rental yield of about 2.4 per cent; typical of a mass-market three or four-bedder unit (shoebox units can usually reach as high as three to four per cent, on the basis of a lower quantum).

Given such numbers, most investors are likely to ponder buying a larger unit in a more fringe location. This is with an eye toward later resale potential since the market is dominated by HDB upgraders who are family units (they won’t consider buying over the shoebox, as it’s too small for them).

However, the other argument is that the ABSD for foreigners is now at 30 per cent, the highest we’ve ever seen. This will prompt some foreigners to rent rather than buy, and the end of Work From Home (WFH) for some is prompting a return to the office. Proponents of this viewpoint at rising office rental rates, which were up 1.9 per cent over the whole of 2021.

Coupled with rising rental rates, smaller CCR properties might still be tempting investment options.

It’s a little bit early to know who’s right here, as we’ve yet to see the impact of cooling measures. However, the general agreement is that prices are not likely to rise as fast from 2020 to 2021, and that home buyers should see less competition with pure investors this year.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with the most in-depth reviews of new and resale properties alike, so you can make a better-informed decision.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How did the private property prices in Singapore change in 2021?

What was the trend in HDB resale prices and volume in 2021?

How did the rental market perform in Singapore in 2021?

What impact did the December 2021 cooling measures have on the property market?

What are the expectations for the Singapore property market in early 2022?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

2 Comments

1) Will HDB flats be worth zero at the end of the 99-year lease?

2) If yes, WHEN will the rapid decline to zero likely begin?

3) Will a large number of old flats (whose value is declining to zero and increasing between 10,000 and 20,000 annually as leased is used) create a market overhang depressing the price of all types of residential properties?