9,800 New Homes Across 11 GLS Sites In 2H 2025: What To Know About Tanjong Rhu, Dover, And Bedok

June 15, 2025

Here we go again. Another GLS cycle, another round of spreadsheets to squint at, and another batch of sites where we all measure the distances to MRT stations and schools! This latest round – the 2H 2025 GLS programme – is serious business though. The Government has kept up its supply-side marathon, releasing 4,725 private homes in this round alone (including 990 EC units). Add that to the 1H 2025 numbers, and you’re looking at close to 9,800 units for the year; the most in a single year since 2014.

They’re also fattening the Reserve List with another 4,475 units, in case developers feel extra optimistic. Interestingly, we’re getting a small army’s worth of commercial space and 880 hotel rooms. This along with the expansion of Terminal 5 points towards the push for tourism in Singapore.

But you’re not here for GDP numbers and planning philosophy. Let’s look at the sites, and see whether there’s anything worth waiting for:

The overall summary of GLS sites:

- 10 Confirmed List sites (4,725 homes)

- 12 Reserve List sites (4,475 potential homes)

- Two Executive Condo (EC) plots, pushing 2025’s EC supply to five sites (nearly 2,000 units, the most in over a decade)

- Plus 178,315 sqm of commercial space and 880 hotel rooms for good measure

Headliners among the 10 new GLS sites

We’ll focus a little more on these, as they’re likely to be the most in-demand sites on the list; as well as the hotter developments once the condos are ready to launch:

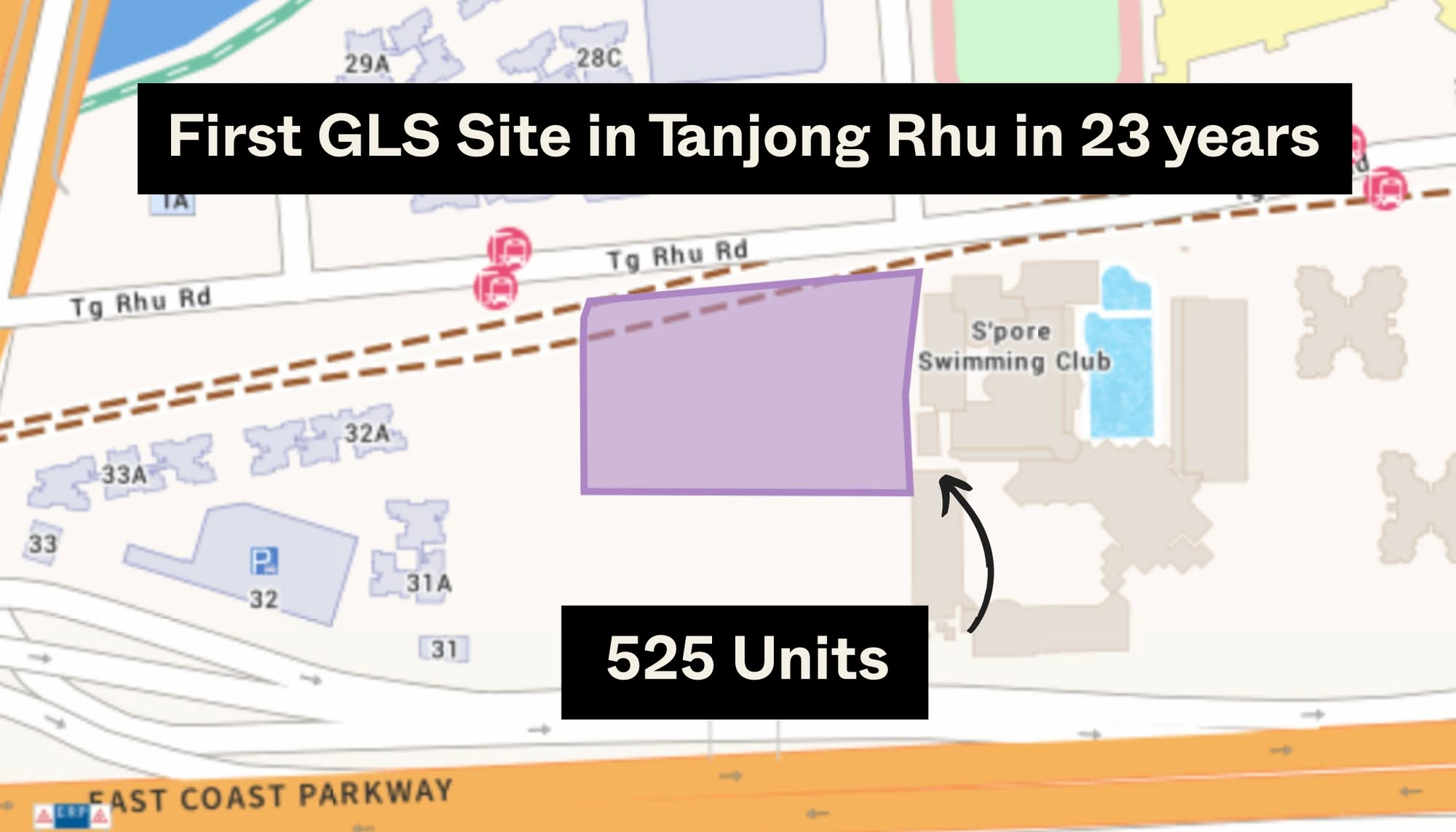

1. Tanjong Rhu Road

- Units: ~525

- Launch: Nov 2025

- Near: Katong Park MRT

- Size: 1.23 hectares (approx. 12,300 sqm)

This land parcel is also close to the Singapore Swimming Club and Dunman High School, and it’s the first GLS parcel here since 1997. The proximity of Katong Park doesn’t just add greenery: from Katong Park MRT (TEL), it’s just three train stops to Marina Bay.

There’s also good proximity to the Kallang Sports Hub – and given the government’s intent to make this a new family area, there will also be a mandatory childcare centre nearby.

This fulfills a trinity of requirements for strong demand: MRT access, proximity to Kallang and the city centre alike, and the promise of future improvements as around 5,000 new homes move in (see the link above.)

In addition, many of the older condos here, like The Waterside, Sanctuary Green, and Tanjong Ria, are within a 300 to 600 metre radius of the site. The age contrast with a newer condo could benefit any project here.

2. Dover Road

- Units: ~625

- Launch: Dec 2025

- Near: One-North MRT

- Size: 1.35 hectares (approx. 13,500 sqm)

This is the largest of the land parcels, with the highest expected yield in terms of new homes. An interesting element is that it includes 3,000 sqm (about 32,292 sq ft) of commercial space as well.

Developments in this land parcel will please buyers of projects like Bloomsbury Residences, even if it does mean future competition. This is because the large commercial component is much needed: while places like Fusionopolis do add a food court, supermarket, etc., One-North residents are still primarily getting retail and entertainment needs from nearby Buona Vista (The Star Vista Mall) or Holland V. This aspect of One-North still needs improvement.

That said, you can expect that some developers may still be eyeing this parcel with a desire to cater for investment rental units. Since One-North is a tech and media hub – and this parcel is so close to Fusionopolis and the JTC LaunchPad – it seems reasonable to cater to an expatriate workforce.

3. Kallang Avenue

Units: ~450

Launch: Oct 2025

Near: Kallang MRT, Sports Hub, city centre

Size: 1.12 hectares (approx. 11,200 sqm)

450 is not a high unit count, so it will be quite the fight to secure a unit here; and we do see this parcel being very desirable. The Sports Hub, for those who don’t know, isn’t just for sports – it also means access to the nearby Kallang Wave Mall, and retail and food amenities.

More so than the convenience is the easy access to the city centre: Kallang MRT station is just three stops to City Hall, and two stops to Paya Lebar in the other direction; overall, just about any amenity you need is nearby.

There’s also a small commercial space (about 1,238 sq ft), which strikes us as strange. That’s not really big enough to be significant, and Kallang already has food and retail within easy reach; it should probably just have been given over to more residential units.

4. Bukit Timah Road (Newton)

- Units: ~340

- Launch: Nov 2025

- Near: Newton MRT Interchange

- Size: 0.59 hectares (approx. 5,900 sqm)

This is the smallest of the land parcels on the list, with room for just around 340 units. But note that some high-end, high-profile condos have made their mark nearby, like Pullman Residences and Kopar at Newton.

Proximity to the Newton MRT station (NSL, DTL) means this project is only one stop from Orchard; and the surroundings are already packed with amenities like Velocity @ Novena Square and United Square Mall. This area is also known for being close to Anglo Chinese School (ACS) Junior, but we’d rather wait until the postal codes are out to determine if it’s within one kilometre (it is for condos like Kopar at Newton).

More from Stacked

The Rare Condos With Almost Zero Sales for 10 Years In Singapore: What Does It Mean for Buyers?

Most condos in Singapore change hands frequently, with some units transacting every few years as owners upgrade, cash out, or…

Either way, this site is tailor-made for buyers who want core central living, without living in Orchard proper. The main drawback here is, and has always been, traffic; packed roads are part and parcel of living in Newton, and it’s not everyone’s cup of tea. For that reason, we expect some buyers will eye development on this parcel as rental units, rather than homes.

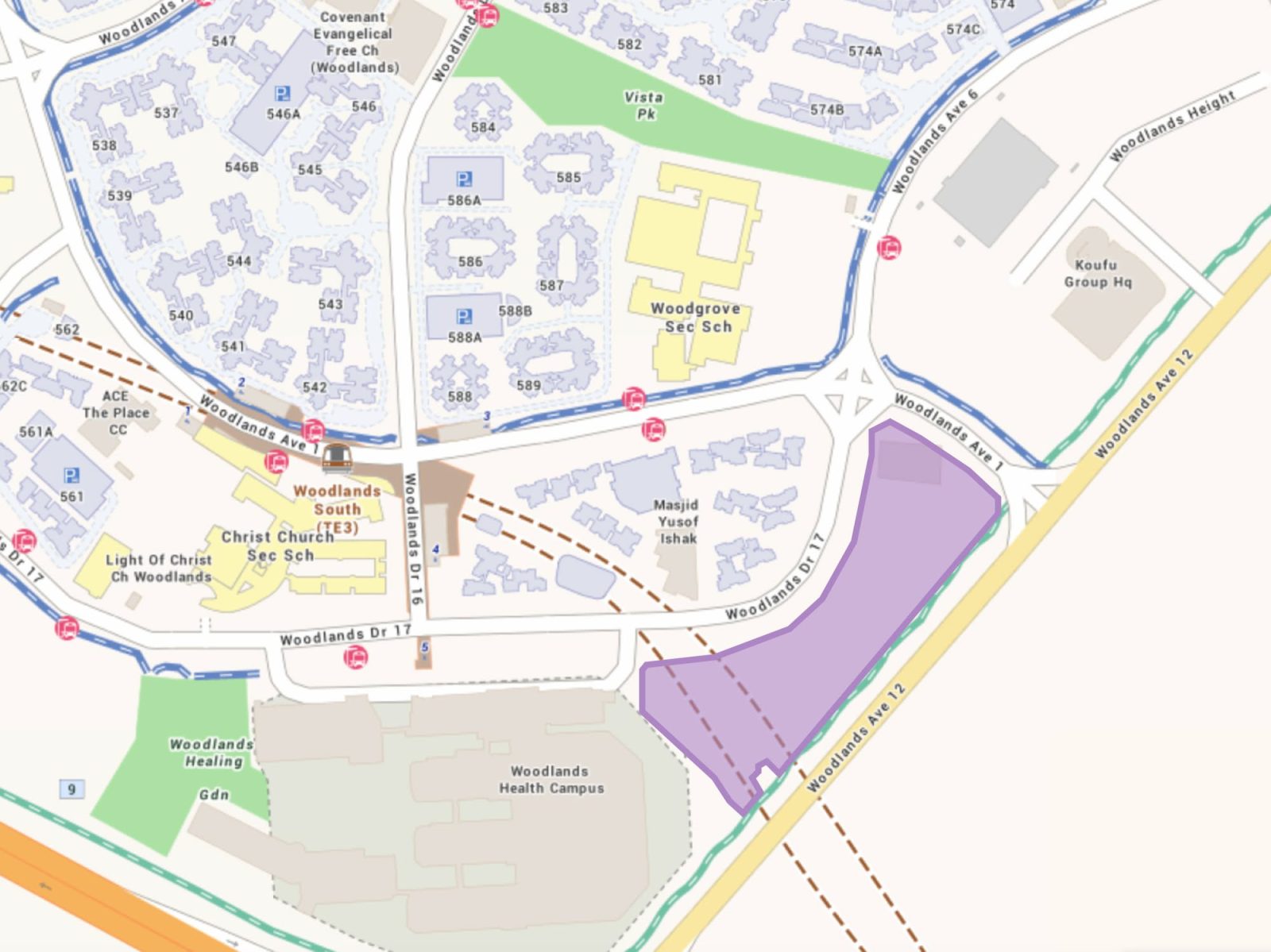

5. Woodlands Drive 17 (EC)

- Units: ~560

- Launch: Oct 2025

- Near: Woodlands South MRT

- Size: 2.7 hectares (approx. 27,000 sqm)

Here’s one to watch if you’re an upgrader living in the North, or a first-time buyer priced out of the East and West.

The Woodlands Drive 17 EC site is the fourth EC in this precinct, and that’s no coincidence. This parcel joins a wave of EC supply in 2025, which looks set to break a long-standing norm: five EC sites in one year is more than double the usual. Besides Miltonia Close below, we covered the other three in our 1H 2025 GLS site list; and one of them was the recent Aurelle of Tampines, which nearly sold out on its launch weekend.

Proximity to Woodlands South MRT (TEL) puts it ahead of most legacy ECs in the region, which tend to be buried deeper in heartland territory. It’s also close to the emerging Woodlands Regional Centre, a future growth node that includes business parks, retail, and cross-border transit links to Johor via the RTS.

Like many ECs in their early days though, this plot features lots of future upside, not much built yet. Buyers here aren’t paying for what’s already in place, they’re buying into what’s coming.

It’s worth noting this is also one of the few GLS sites planned with an integrated childcare centre, which tends to be a very welcome feature for young families.

6. Miltonia Close (EC)

- Units: ~430

- Launch: Dec 2025

- Near: Not near an MRT station

- Size: 1.54 hectares (approx. 15,400 sqm)

To be blunt, this is a headliner for the simple reason that it’s an EC, and ECs are always popular (especially given private property prices in 2025.) So despite this location being very non-mature, we expect good demand anyway.

This parcel is an unusually serene EC plot, which borders Lower Seletar Reservoir and the Orchid Country Club. Note that the country club will not have its lease renewed after 2030, so there’s room for a lot of future development here.

For now though, this site will appeal to buyers who prioritise lifestyle and quietude, and who don’t mind driving (or waiting) for transport infrastructure to catch up. There’s no immediate MRT access, but this is not unusual for new ECs in general; consider it one of the reasons for the subsidised pricing.

A quick round-up of the remaining sites

Rounding out the rest of the Confirmed List are a few familiar precincts. Lentor Central returns for what feels like the millionth time – this will be the eighth site released in the area since 2022, continuing the rapid build-up of the Lentor enclave. With just around 100 units unsold across earlier launches, developers may still see value here, especially with direct MRT access via the TEL.

If you check out our many reviews of Lentor area properties, they already cover most of what you can expect from the area. We will, however, update you with another review of whatever project appears here next.

Dairy Farm Walk offers a greenery-forward lifestyle near Hillview MRT, and Dairy Farm Nature Park. This zone saw decent response at The Botany back in 2023, and this next project could cater to buyers seeking a quieter, low-density setting.

Bedok Rise is small, offering 360 units and stands out for one reason: it’s the last site near Tanah Merah MRT with direct station access. Proximity to the upcoming, mixed-use Sceneca Residence and the MRT line (this is where the EWL switches and takes you to Changi Airport) should make it a straightforward crowd-pleaser, especially since besides Sceneca, it will be a lot newer than surrounding condos.

Finally, a small site along Dunearn Road will also contain a commercial component. Spanning about 19,100 sqm, it’s next to the former Turf Club Grandstand. The site is projected to yield 335 new homes along with about 15,000 sq ft of commercial space.

The Dunearn Road GLS site is the second site to be offered in the new Turf City housing estate, and will be located in the unfolding Stables Commune neighbourhood. While this area is still developing, it is close to the Sixth Avenue MRT Station (DTL), and will appeal to those who like privacy and are in it for the long haul.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the main highlights of the Tanjong Rhu GLS site in 2H 2025?

Why is the Dover Road GLS site considered significant in the 2H 2025 plan?

What makes the Kallang Avenue GLS site attractive to buyers?

What is special about the Bukit Timah Road (Newton) GLS site?

Who might be interested in the Woodlands Drive 17 EC site?

What are the key features of the Miltonia Close EC site in the 2H 2025 GLS programme?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments