7 New Residential Sites Near MRT Stations In URA’s Latest Master Plan Update (And What To Expect)

May 16, 2025

The URA Master Plan 2019 saw some notable amendments on 24th April and 7th May. A slew of new residential sites is being prepared, and they share a common thread: proximity to MRT stations. This is part of the ongoing vision: decentralised, accessible, car-lite communities. In the meantime though, here’s what you need to know about the proposed site areas and what to look forward to:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

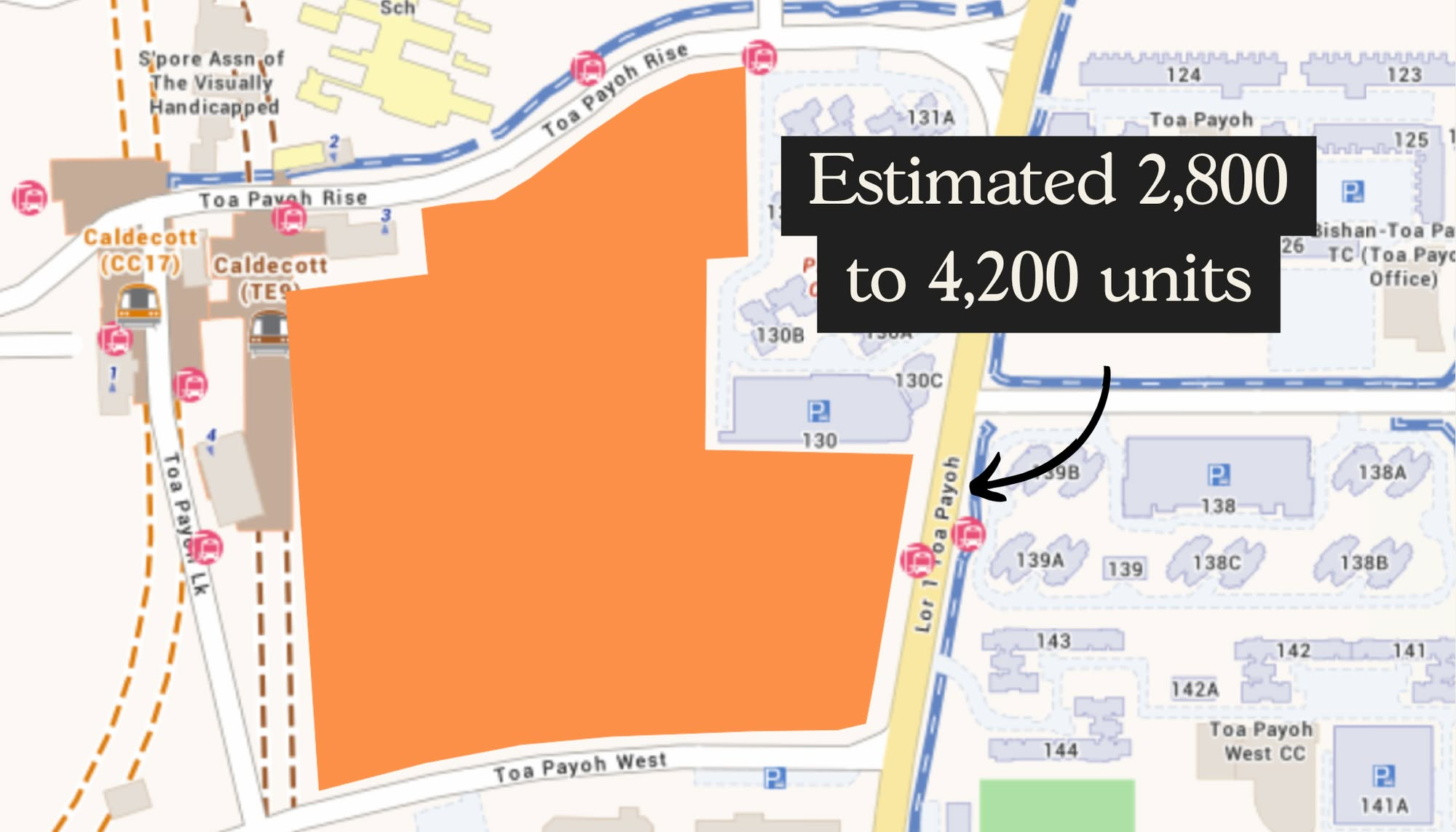

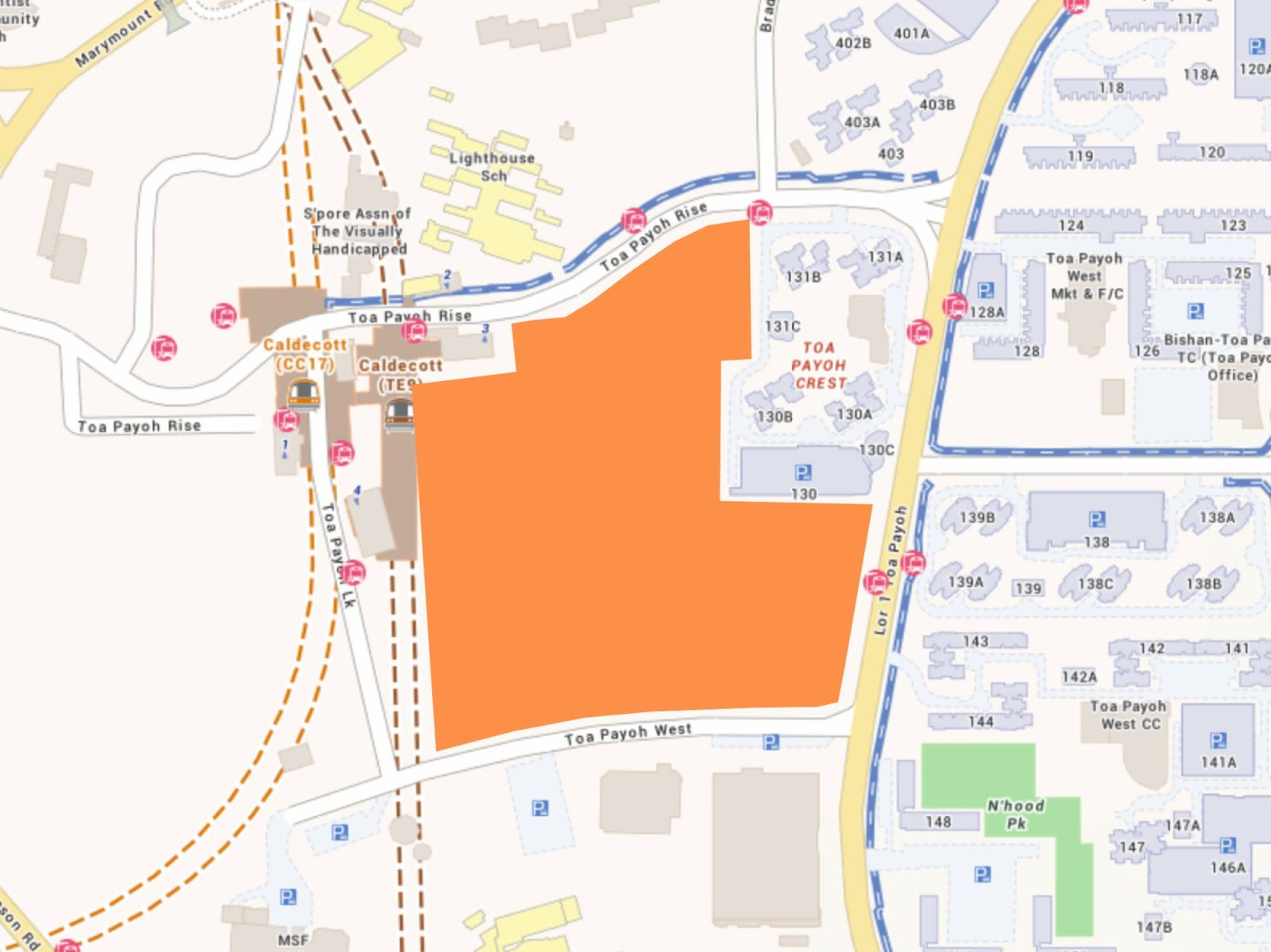

1. Caldecott/Toa Payoh

- Nearest MRT Station: Caldecott (Circle Line & Thomson-East Coast Line)

- Size: Approximately 78,500 sqm

- Estimated New Homes: 2,800 to 4,200 units (probably a mix of private and HDB

- Plot Ratio: 4.7

This is probably the most attention-grabbing site. It was formerly an industrial plot used by Philips, but it’s now rezoned for mixed use: that is, residential with commercial amenities on the ground floor.

Due to the high plot ratio, it seems likely that this will become a major residential enclave. A plot ratio of 4.7 means it can have tower blocks above 50 storeys, which, from the map, suggests unblocked views of nearby greenery. The area is also close to Caldecott MRT (CCL, TEL), which would put residents four stops from Orchard on the TEL, and two stops from Bishan on the CCL.

This site has all the kinds of green flags developers love. If there are private projects, there will likely be strong upgrader interest from the Toa Payoh Crest, Toa Payoh Ridge, and other nearby HDB projects. This is also a very mature area, with a lot of heartland amenities nestled in the surrounding blocks.

2. Upper Changi/Singapore Expo

- Nearest MRT Stations: Upper Changi (Downtown Line) and Expo (East-West Line)

- Number of Sites: 2

- Site Sizes: Approximately 33,000 sqm and 42,000 sqm

- Estimated Yield: 1,250 to 2,000 units across both sites

- Plot Ratio: 2.1

There are some boundary adjustments going on for these plots, but it won’t change that they’re residentially zoned. The plots are adjacent to each other, and are situated on a long stretch facing the Singapore Expo; just next to ITE College East (roughly speaking, one plot will yield about 1,200+ units, while the adjacent one might yield somewhere around 850 units).

This site is something of a mixed bag to us. On the one hand, there’s very little in the way of amenities here, unless you happen to consider the Singapore Expo an amenity. On the flip side, this area has a landed facing, and the MRT station provides relatively quick access to Changi airport. Couple that with proximity to Changi Business Park, and it could be very convenient for those in aviation.

We do think public housing is likely to feature prominently here, especially as Simei has seen few new launches in recent years. This seems like an attempt to invigorate the Upper Changi Road stretch, which has been lacking in lifestyle amenities and conveniences for some time. That does suggest though, that first movers here need to be patient while the area gets built up. As it stands right now, it’s not a particularly exciting plot.

3. Upper Thomson/Marymount

- Nearest MRT: Marymount (Circle Line)

- Number of Sites: 3

- Site Sizes: Ranging from 12,000 to 35,000 sqm

- Estimated Yield: 200 to 1,700 units total

- Plot Ratios: 1.8 to 3.9

This is actually three parcels:

The largest parcel is the former Lakeview Shopping Centre and Hawker Hub. If you don’t remember this place, it’s because it was closed down sometime in 1999; and it’s beyond us why it just sat vacant for over two decades, given the location is excellent.

The land plot is about 35,000 sqm., and has the highest plot ratio of 3.9. This site can yield between 1,100 to 1,200 flats, or possibly 1,600 to 1,700 condo units. We’d say it’s the best of the three sites, due to its proximity to Marymount MRT station (CCL). Being just a stop away from Bishan or Caldecott, which link to the NSL or TEL respectively, this can be an accessible and convenient area.

There’s a lot that can be done in this area, and it’s definitely one to watch.

The second parcel sits behind Shunfu Gardens Estate. It’s separated from Shunfu Gardens by an intervening canal, and it’s quite small. At 13,500 sqm. and a plot ratio of 1.8, this might yield between 200 to 250 flats, or 300 to 350 condo units.

Our bet is on HDB flats for this location though, as a natural extension of the existing public housing cluster. We suggest you check out our review of JadeScape, which is next to Shunfu Gardens and near this general vicinity, for a sense of the area.

The third parcel is close to St. Theresa’s Home, along Upper Thomson Road. This is a 12,000 sqm. site with a plot ratio of 2.4, and the expected yield is close to the Shunfu site (about 200 to 250 flats, or 300 to 350 condo units).

This site will appeal to those who love the outdoors; and it would be reasonable to capitalise on the greenery view of nearby MacRitchie Reservoir. The other residential units are also mostly low rise or landed, so there’s a good sense of privacy for this plot. Given the small land parcel though, we’ll probably see either some mid-rise HDB housing, or some small-to-boutique condos.

More from Stacked

Which Is A Suitable 2 Bedroom Apartment In Thomson? (Meadows At Peirce, Thomson Grand, Thomson Impressions)

Hi,

4. Dover Road/One North

- Nearest MRT: One-North (Circle Line)

- Site Size: 13,500 sqm

- Estimated Yield: 440 to 650 units

- Plot Ratio: 4.2

This was the former SERS site involving blocks 30 to 32, and 34 to 39 of the older Dover Estate; they were demolished sometime in 2018/19.

The main highlight here is the Dover Knowledge District. This is an extension of the current One-North tech and media hub, and you can check the details here. The district will be an integrated live-work-learn-play environment, combining residential housing, research facilities, and elements of NUS and Singapore Polytechnic.

Given it’s an extension of One-North, we think a condo will be more likely than an HDB project (the land parcel is not especially huge anyway.) This may result in yet another mid-sized condo, to provide further alternatives to the likes of One-North Eden or Bloomsbury.

We feel any development here – assuming it’s private – might interest investors as much as owner-occupiers. It can cater not only to the foreign workers in One-North, but also to foreign students and faculty members in NUS and Singapore Polytechnic.

5. Woodlands South

- Nearest MRT: Woodlands South (Thomson-East Coast Line)

- Site Size: 27,500 sqm

- Estimated Yield: 450 to 700 units

- Plot Ratio: 2.1

To be blunt, this is not one of the more impressive sites on the list. This site was rezoned from reserve to residential use, but there are issues – a prime one being the proximity to Sembawang Air Base. It does look like the site may fall within a noise-sensitive zone, and we’d keep an ear out for that as more details become available.

Second, it’s close to the upcoming Woodlands Health Campus. This is as much a plus as it is a negative. The Health Campus integrates a general hospital, community hospital, nursing home, and polyclinic. That’s great if you need such facilities, but some buyers may dismiss it due to taboos or fear of the potential noise.

We think an HDB development is much more likely, as URA continues to try and polish up this area.

6. Kallang

- Nearest MRT: Kallang (East-West Line)

- Number of Sites: 2

- Site Sizes: 11,000 and 23,500 sqm

- Estimated Yield: 1,100 to 1,500 units combined

- Plot Ratio (upgraded): From 2.8 to 3.5

Both plots are within 500 metres of Kallang MRT station (EWL), so interest is likely to be strong. If the project here ends up being an HDB flat, we’d bet on it being a Plus or Prime rather than just standard flats.

The first site, approximately 11,000 sqm., is situated adjacent to Boon Keng Road. The second larger plot, around 23,500 sqm., is located just off Kallang Road, closer to the bend of the Kallang River. The two sites frame a segment of the riverbank, which holds potential for waterfront living.

We’re quite sure that any developer, public or private, will capitalise on the unblocked views of the river. These future projects will likely align with developments such as Verandah @ Kallang, a recent PLH launch, to form part of a revitalised waterfront precinct.

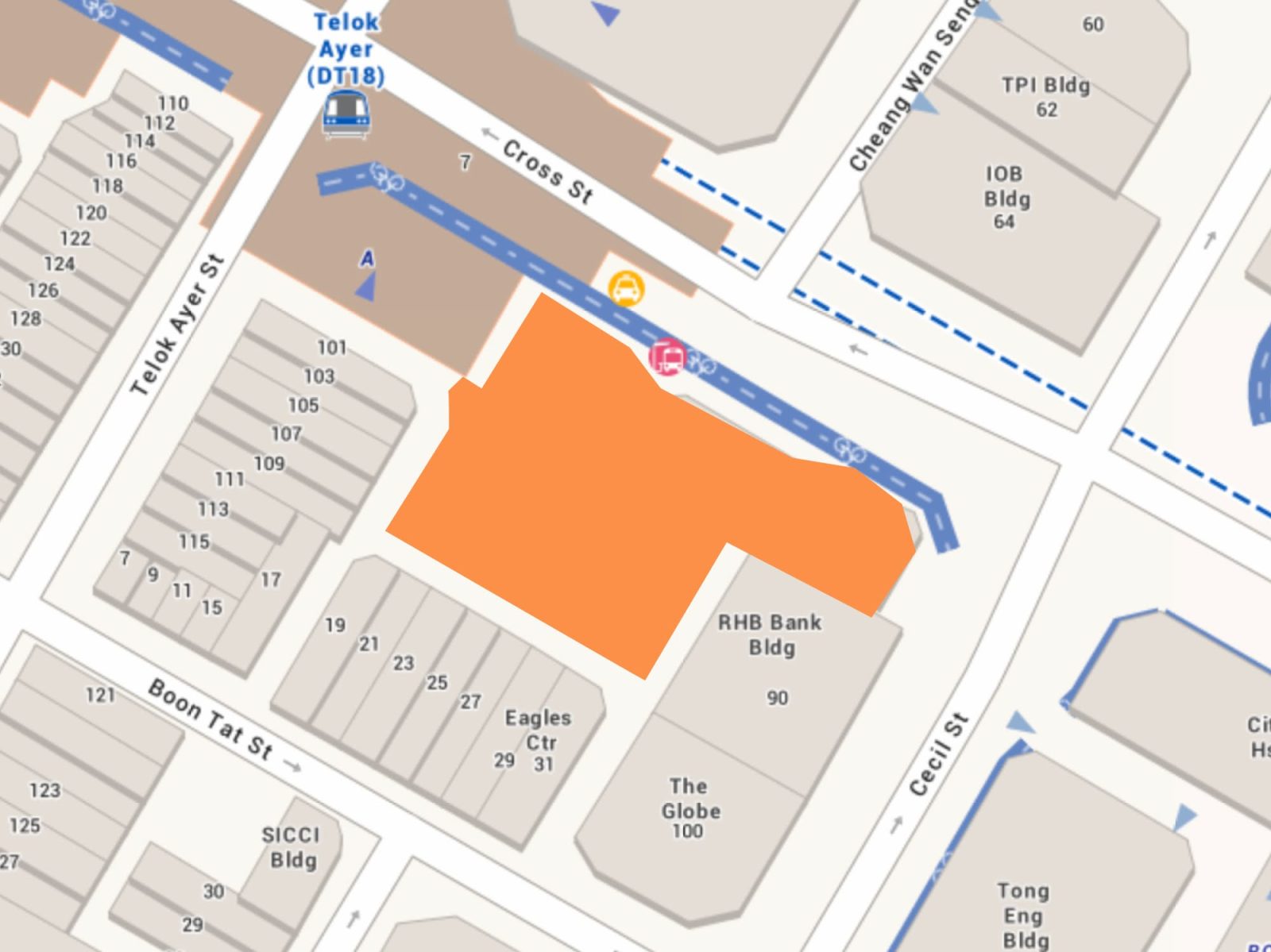

7. Telok Ayer (within the CBD)

- Nearest MRT: Telok Ayer (Downtown Line)

- Site Size: 2,000 sqm

- Estimated Yield: ~200 units

- Plot Ratio: 6.2

The temporary Market Street Hawker Centre (2017 to 2022) is finally gone, and the small 2,000 sqm. site it sat on is now slated for residential use. This is almost certain to be a Prime flat if it’s HDB, as it’s directly beside Telok Ayer MRT (DTL). If it’s a private project built here, the convenient location will be a huge draw to investors.

Between the two though, we’re quite certain small or boutique condos will be the ones to appear here. The plot is just too small to make much sense for HDB. We’re also certain any project here will be strongly skewed toward the investor crowd, as the middle of the CBD is not exactly a great family area (e.g., too crowded, too much traffic, and fewer schools nearby).

The Singapore property market is always changing, and these recent sites mark a strong ramp-up in housing supply. At Stacked, we want to keep you updated so you can always make the most informed housing decision, whatever the situation.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

0 Comments