5 Biggest Misconceptions About The Singapore Property Market In 2025

March 18, 2025

Most of us don’t buy property very often, unless we’re very lucky and affluent. For most of us, we might buy two or three times in our lives, and some even less than that. So unless you’re an industry professional, have a real passion for real estate, or are the aforementioned lucky person, it can be hard to keep track of this dynamic, constantly shifting market. For those of you buying in 2025, you might find things are quite different from even five years ago, let alone in the past decade or more. Do be wary of these common misconceptions, that trip up newcomers to the property market:

- Misconception 1: It often looks like you have more options than you really do

- Misconception 2: A lower price per square foot means the property is cheaper

- Misconception 3: Engaging a property agent works the same way as a decade ago

- Misconception 4: Prime area condos are always more luxurious than mass-market counterparts

- Misconception 5: En-bloc sales are always a huge windfall

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Misconception 1: It often looks like you have more options than you really do

When you search for a project or location, you’ll often get a huge list of properties that can take several minutes to scroll through. This often lends the impression that:

- There are plenty of units available in the project or location

- You don’t need to rush since “there will be one when you need it”

- Loads of people are putting up fresh resale listings every day

If you visit a show flat, you may also be struck by the sheer number of units in a mega-development today, like Parktown Residence (1,193 units).

This often leads to some nasty shocks, when you suddenly realise that a single day can turn things around. In the case of Parktown, for instance, the launch weekend finished with 87 per cent of the units (1,041 units) sold. If you had visited but left earlier in the weekend, you’ve likely missed out on the unit you had your eye on.

For property portals, there may appear to be a lot of listings. But it’s often the case that only a small number – or sometimes only one listing – has the right floor, size, or layout that you need. It’s also possible for the same listing to have been put up by more than one realtor (this tends to happen when there’s no exclusive deal with any one realtor). This means that your number of options is far more limited than it would appear.

It’s also possible for the supply of resale listings, in any one project, to suddenly slow to a trickle, or to drastically change price. Sellers might notice recent transactions going against them (i.e., too low for their liking), and pull their listing; or they might see a recent transaction go for a much higher price, which now busts your budget.

Simply put, the constant evolution of PropTech has made the market move much faster. It’s ironic, but the increased connectivity and price transparency can mean your opportunities are more fleeting, rather than more abundant.

2. Misconception 2: A lower price per square foot means the property is cheaper

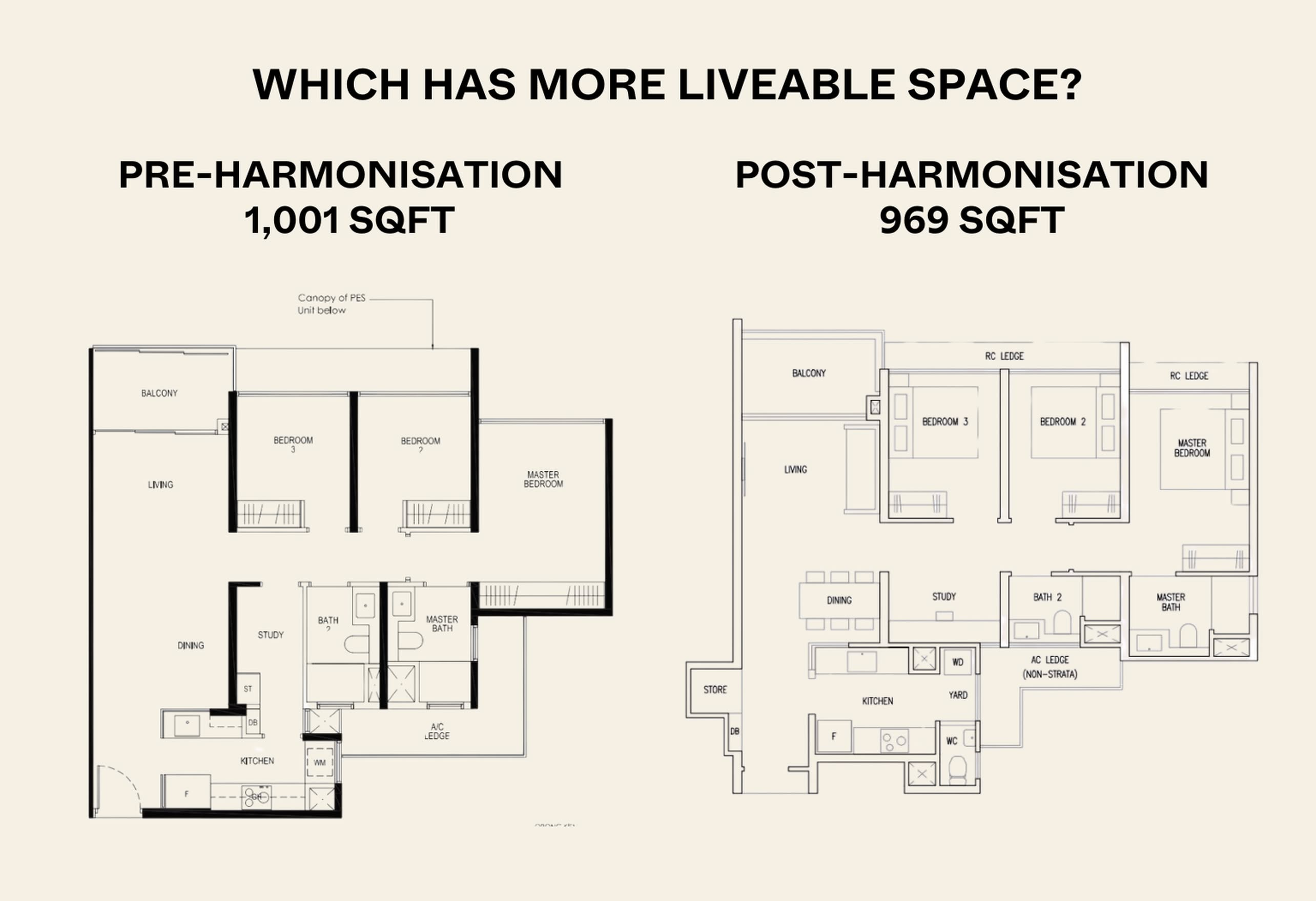

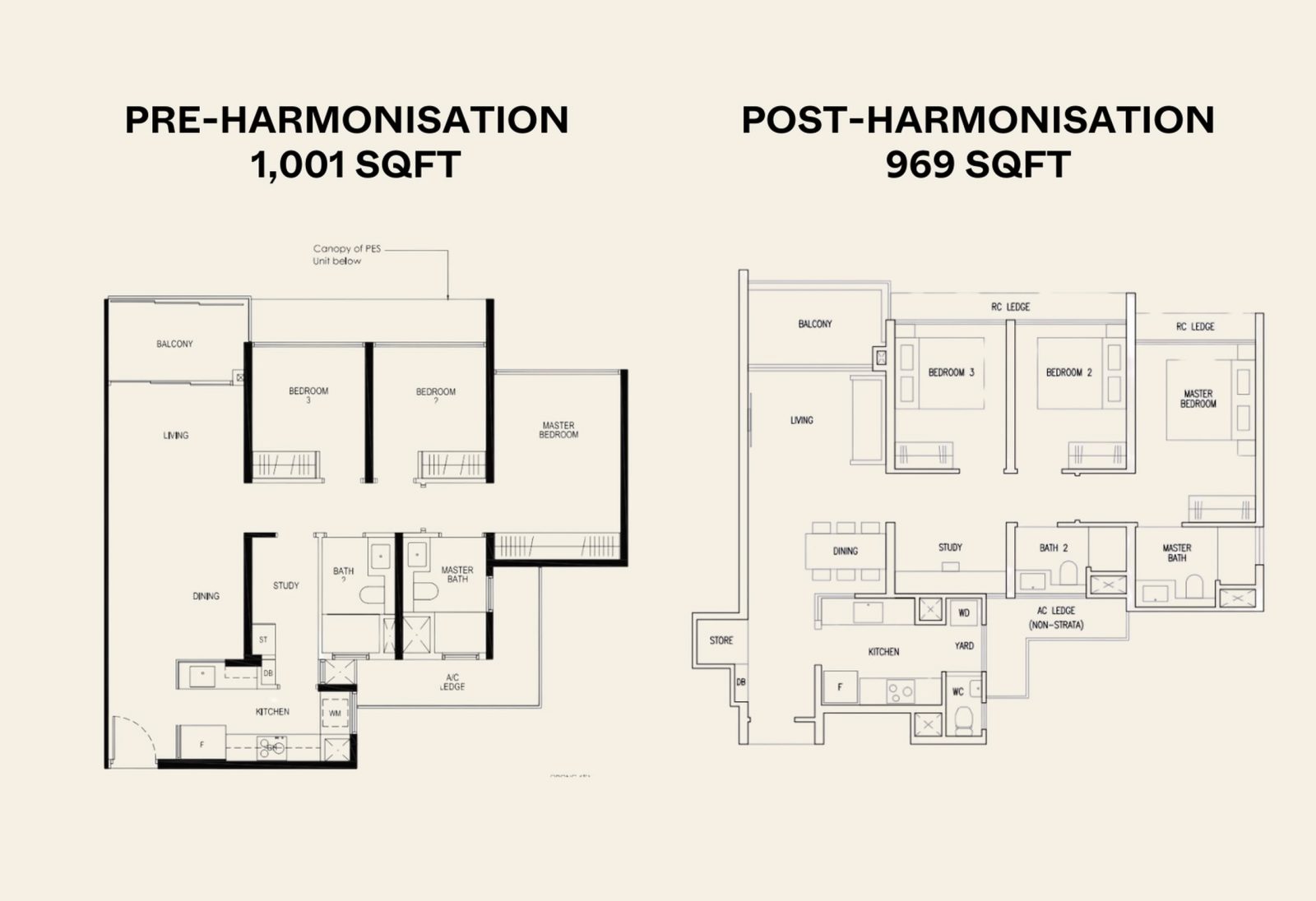

To be blunt, price-per-square-foot comparisons are in something of a chaotic mess right now. In June 2023, the government instituted Gross Floor Area (GFA) harmonisation, to standardise the way GFA is calculated.

In condos built before the harmonisation came into effect, developers could add features like strata void spaces or air-con ledges to the total square footage. In condos built after the harmonisation, these spaces aren’t added to the square footage. So a 900 sq. ft. unit today may have the same livable space as a 1,200 sq. ft. unit built before harmonisation.

This also results in misperceptions of pricing. In the above example, if both properties cost $1.8 million, the post-harmonisation unit costs $2,000 psf. The pre-harmonisation unit, despite being the same price and effectively the same size, would cost $1,500 psf.

This makes it rather difficult to compare between a new and old project, so you’ll have to go through the floor plans and check.

3. Misconception 3: Engaging a property agent works the same way as a decade ago

It can sometimes still be a case of a two per cent commission, and the agent simply listing the property for you. But especially since Covid, there’s been a lot of innovation in this space.

There are property agents who now go to more elaborate lengths for you, including staging your property for videos. This may involve a higher commission, or some variation of the service fee (e.g., you need to pay a sum upfront, and that sum is forfeit if you then drop the agent or listing, but it gets rolled into the service fee if your unit successfully sells.) Some agents work on fixed commissions, with more limited service (e.g., you pay less, but you also have to handle the viewings on your own).

More from Stacked

We Spend Our $3k Rent Budget (While Waiting For Our BTO) On Travelling The World Instead: Here’s How We Do It

Given the wait times for a BTO flat in Singapore, many Singaporeans have to look for alternative accommodation in the…

The upside is that these differences help you tailor the approach to your needs. If you feel you need to sell quicker, or that you can get a better deal, you might want to get an agent with a bigger marketing spend, although this could mean paying a bit more than the usual two per cent. Conversely, if you have time to kill, you might want to handle your own viewings and engage a fixed-fee agent.

The downside is that, with the more novel approaches, you also need to do more homework. Not all agents are good at making videos even if they offer the service, for example; and it helps if you can identify an agent with more online clout.

The various possible arrangements are likely going to get more complex over time, as more realtors find ways to innovate.

4. Misconception 4: Prime area condos are always more luxurious than mass-market counterparts

If you’re comparing condos of the same age, this may be true. But for older condos in prime areas like Orchard, Holland Village, Bukit Timah, etc., you may be surprised by how newer, mass-market condos can match or outclass them.

It remains true that older projects, from before the 2000’s, still tend to have more raw square footage (with the caveat that they’re pre-harmonisation, as mentioned above). But the quality, facilities, and layout of newer condos now outshine many former luxury icons.

One example of this change is in unit layouts: dumbbell layouts eliminate the need for corridor spaces, thus providing better ventilation and more livable square footage (the living/dining area is used as the connecting point between bedrooms, rather than a corridor). Unit layouts also tend to be more versatile, with more movable partitions and optional rooms. E..g., rather than standard one-bedders, there are now more 1+1 Study units, which can be used for two tenants in a pinch.

Facilities in some larger (supposedly less exclusive) condos also make some older luxury condos pale in comparison. Mega-developments (1,000+ units) were once viewed with skepticism and considered too crowded; but today they’re popular, because their large land space allows for more lavish facilities, and the supposed overcrowding hasn’t been experienced by most.

Some facilities that were once the hallmark of luxury condos – such as concierge services or private lifts – are also increasingly available even in fringe region condos. But this is a double-edged sword, as some homebuyers still view these as a waste of money.

5. Misconception 5: En-bloc sales are always a huge windfall

An en-bloc sale could still be a huge windfall, but there are greater risks as of 2025. The main issue today is the cost of a replacement property; because even an OCR three-bedder can reach $2 million, there’s an increasing concern that en-bloc sale proceeds won’t cover the cost of an equal-sized replacement.

This is most problematic for older Singaporeans who don’t intend to downsize: when you’re near retirement age, financing can be tough to secure. But given today’s prices, you might still need a loan when purchasing the replacement home. This can mean extreme inconvenience for little tangible gain, or that you need to settle for a much smaller new home.

For landlords who see their second or subsequent property go en-bloc, finding a replacement rental asset may be off the cards. There’s now an added 20 per cent ABSD on the second property, and 30 per cent on the third; so it may not be worth getting another rental property.

Perhaps the worst affected group are foreigners who lose their property to an en-bloc, as the cost of a replacement unit now comes with a 60 per cent ABSD. So whilst an en-bloc can still be beneficial, certain demographics will find it more of a hassle (or even a loss) than the lottery win it used to be.

As an aside, the cost of a replacement property is also making collective sales less popular; so buying in expectation of an en-bloc sale is definitely an outdated tactic.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments