HDB Resale Prices Finally Slowed in 2025 — Will It Continue in 2026?

January 2, 2026

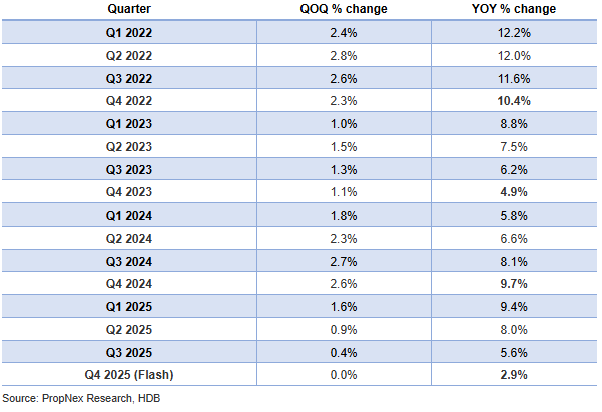

Resale prices in the HDB market recorded nearly zero quarterly growth over the last three months of 2025. This means that for the whole of 2025, resale prices in the public housing market only recorded a yearly increase of 2.9%, according to the latest housing market estimates published by HDB on Jan 2.

The yearly price growth is significantly less compared to 2024 when prices grew by 9.7% y-o-y, as well as the 10.4% y-o-y increase the market recorded in 2022. The latest quarterly price result also ends 22 consecutive quarters of price growth in the resale HDB market, which has seen quarterly increases since 1Q2020.

All in, there were 5,129 resale flats that changed hands in 4Q2025, which is less than the 7,221 resale flats sold in 3Q2025. Collectively, there would be about 26,042 resale flat transactions for the whole of 2025, a sales volume lower than the 28,986 resale flats sold in 2024, according to transaction data compiled by PropNex.

It is a gentle landing for the HDB resale market and an unsurprising result considering that overall price growth had been slowing over the past year. For example, in 3Q2025 prices rose by 0.4% q-o-q, and in 2Q2025 prices were up 0.9% q-o-q.

The more subdued price movement and stabilsation in the HDB resale market helps to maintain affordability for homebuyers and support confidence in the resale flat market, says Wong Siew Ying, head of research and content at PropNex.

“The moderation in price growth in 2025 is positive for the overall market, and perhaps may reduce the likelihood of further cooling measures on the HDB resale segment – policy stability, in turn will enable buyers and sellers to act with greater clarity,” she says.

In our year-end article where we rounded up the performance of the HDB market in 2025, we cited several market watchers who noted that the slower pace in price growth in the past year is largely attributed to a cooling demand for resale flats.

Christine Sun, chief researcher & strategist of Realion (OrangeTee & ETC) Group, says that many buyers opted for Build-to-Order (BTO) and Sale of Balance Flats (SBF) last year. The three sales exercises last year drew in more than 110,000 applicants, marking a three-year high. In comparison, there were around 80,000 applicants in 2023 and 82,000 applicants in 2024.

“The high number of applicants (in 2025) was mainly driven by policy changes that made it more favourable for Singaporeans to buy new flats. Many flats at highly desirable locations and with short waiting times were also released for sale,” says Sun.

The flat performance of the resale market in 4Q2025 also resulted in price declines across most flat types, according to transaction data compiled by Realion (OrangeTee &ETC) Group. Smaller-sized flats registered the steepest quarterly price declines. For example, the average price of two-room flats fell 1.6%, while the average price of three-room flats fell 0.8%.

More from Stacked

7 Close To TOP New Launch Condos In 2026/27 For Those Looking To Move In Quick

The projects completing in 2026–2027 were bought at a strange, high-octane moment: that jittery post-Covid rebound in 2021–2022, when the…

On the other hand, the average price of larger-sized flats was more resilient, with five-room flats seeing a 1.3% q-o-q increase, and executive flats registering a 2.7% q-o-q increase.

In 4Q2025, 16 towns saw average prices fall, eight towns had price gains, and two towns recorded nearly zero price growth, according to Realion. The most significant price drops were:

- Central Area (-11.1% q-o-q)

- Ang Mo Kio (-7.6% q-o-q)

- Woodlands (-4.8% q-o-q)

- Geylang (-4.4% q-o-q)

- Bukit Batok (-3.8% q-o-q)

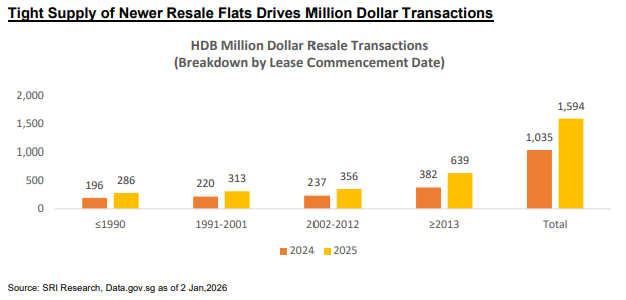

Mohan Sandrasegeran, head of research & data analytics at SRI, adds that the relatively minted number of newly eligible MOP flats that entered the resale market in 2025 played a “catalytic” role in shaping buyer competition and pricing dynamics in 2025.

“With only an estimated 6,973 flats reaching MOP in 2025 and with about 1,338 of these newer units transacted in 2025, buyers faced a tight supply of flats with long remaining leases. This scarcity created stronger competition for newer resale flats,” says Sandrasegeran.

The relative scarcity of new MOP flats also contributed to the uptick in million-dollar flat transactions last year. There were 1,594 deals of flats that sold for more than a million dollars in 2025, up from the 1,035 million-dollar sales in 2024.

Most of the million-dollar flats sold last year were in estates with lease commencement dates from 2013 onwards, the proportion of deals from flats in this category increased from 382 in 2024 to 639 in 2025.

“As a result, even though the broader resale market saw some moderation in activity, newer flats maintained firm pricing due to the competition generated by limited supply. Looking ahead, the significantly larger MOP cohorts in 2026 are expected to ease this supply tightness and offer buyers a wider selection of newer flats,” says Sandrasegeran.

Despite the uptick in the proportion of million-dollar deals last year, HDB resale prices remained relatively affordable in 4Q2025, with about 73% of transactions taking place below the $750,000 price point, says Eugene Lim, key executive officer of ERA Singapore.

He adds that million-dollar flats made up only 6.9% of all transactions in the quarter. “These higher-value transactions remained concentrated in mature estates, which accounted for around 91% of all million-dollar deals over 4Q 2025”.

In 2026, ERA forecasts that HDB resale transactions might range between 26,000 and 27,000 units, driven by a larger pipeline of about 13,840 MOP flats entering the resale market and steady price growth.

Meanwhile, PropNex estimates that HDB resale prices could rise by 3% to 4% in 2026, continuing the trend of increased stability and moderate price growth.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

0 Comments