How We Saved $300K And Got Our 4-Room Toa Payoh Flat in Just 7 Months

November 21, 2025

Sale of Balance Flats (SBF) exercises used to have a bad rep. In the past, it was often dismissed as buying the “leftovers nobody wants.” Some even whispered that such flats were possibly unlucky, because they were returned due to financial issues or divorces. But by the late 2010s, buyers have been more grounded and rational – and one of the reasons is how you can get a very good flat, whilst even skipping the long construction time involved. Here’s how one couple got lucky with a great SBF flat:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why they chose SBF, rather than BTO or resale

The couple, N & F, said their choice came down mainly to timing and cost. Their search began in July 2024 when they got married. Since the next SBF exercise was coming up in early 2025, they decided to try their luck there before exploring BTO or resale options. A stroke of luck helped too: their queue number was four, which effectively guaranteed them a strong pick for the SBF exercise.

When compared to resale, the couple noted that their SBF flat was around $300,000 lower than many equivalent 4-room resale flats in Toa Payoh. But the biggest advantage was that the SBF flat was already built*. Waiting years for a BTO no longer felt practical to them, since they wanted their own space soon.

Besides being able to move in sooner, it also meant they could walk the corridors, inspect the common spaces, check noise levels, and even chat with neighbours before committing. This made the process far more tangible compared to BTO flats, where buyers have to commit without seeing the actual surroundings.

Even if you can visit a BTO launch site, you cannot be forewarned of issues like noisy neighbours, or nearby amenities not being suited to your lifestyle.

*Note that this varies by flat, and not all SBF flats are necessarily completed. Some are fully built (e.g., older returned flats), but construction may still be underway for others.

Application, selection, and receiving the keys

The couple says they might have turned to the resale market had they failed to get the SBF flat. But this was unnecessary. The application process felt structured, efficient, and surprisingly exciting: they felt it was much faster-paced, so decisions had to be made quickly. Unlike resale flats, where timelines are often negotiated, SBF buyers follow HDB’s schedule.

Even so, their entire journey from application to key collection took only seven months, which they feel is as fast as – if not faster than – resale flat hunting.

Picking the flat: what mattered and what didn’t

Like many buyers, N & F initially avoided corridor units. But this block had an unusual perk: only one household passes through their section of the corridor. After a brief chat and a good first impression with this future neighbour, their worries eased. “We ended up being friendly and on good terms with them,” they said.

Neighbour checks, as mentioned, were a major part of their decision-making. The couple were mainly on the lookout for signs of noise or messiness, and they chatted briefly with nearby residents as a “vibe check.”

They weren’t concerned about the “history” of SBF units being returned to HDB, nor were they particular about floor height. But in a stroke of luck, they ended up with a mid-to-high floor unit anyway: somewhere between the fifteenth and twentieth storeys that is “super windy.”

The end result: a 1,087 sq ft. 4-room flat, in a mature environment

The couple’s flat is in the mature town of Toa Payoh; so, surrounding amenities include markets, playgrounds, coffee shops, hairdressers, etc., all within a few minutes’ walk.

Their flat is also close to an ActiveSG gym, and if you know Toa Payoh, you’ll know that the network of bike paths is very developed in this estate. The couple also noted that “several MRT stations” are nearby; so wherever they work now (or will end up working in future), commuting should be easier.

More from Stacked

En Bloc news in Singapore – All your questions answered here

Source

“Everything we need is really just downstairs,” they said. “We didn’t feel like we were compromising on anything by choosing an older estate.”

The couple had walked the corridors, courtyards, and void decks before applying, and liked what they saw. Even though the block was just over 20 years old (there’s still a significant 70-odd years left on the least), the environment felt lived-in but orderly.

The flat was also one of the better-kept and more spacious units available in the exercise.

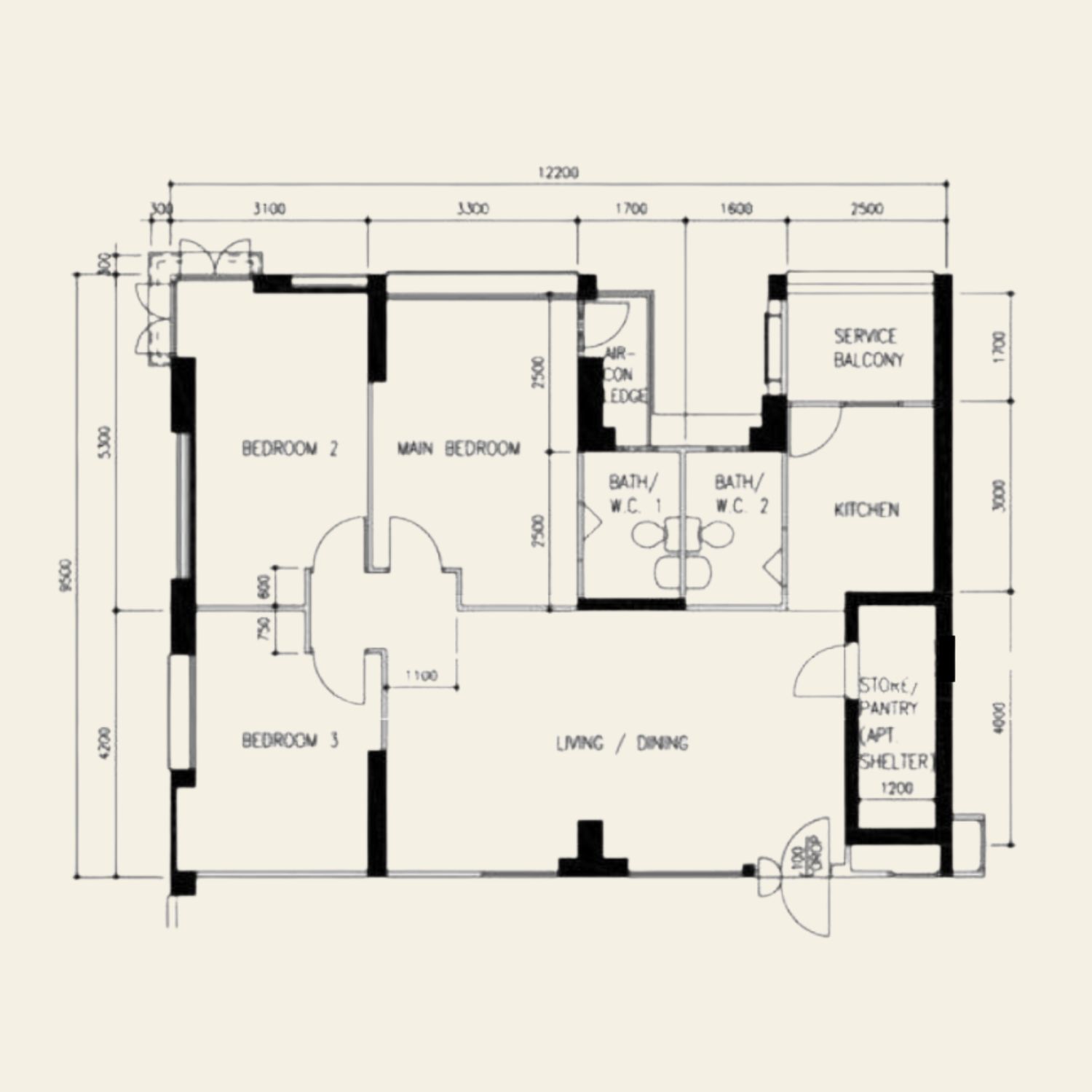

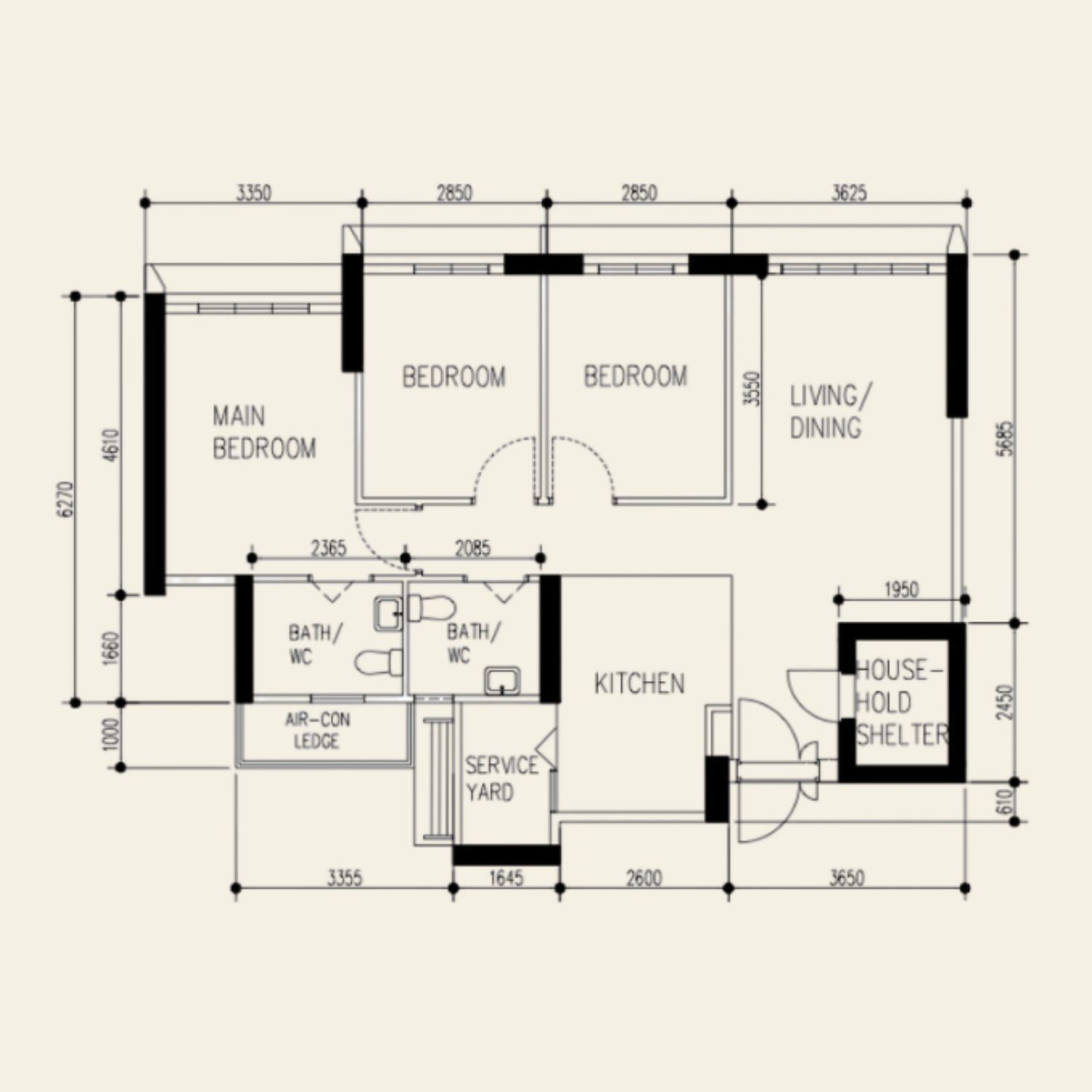

Newer 4-room flats can be a bit smaller; some might only be about 960 sq ft, compared to the couple’s 1,087 sq ft unit. They liked the flat from the moment they saw it: Instead of the compact nature of many newer BTOs, this unit had a wide, open rectangular living and dining space. “

Open Layout:

Comparison with BTO standard layout:

The open layout just made the whole house feel spacious and comfortable,” they said. “We felt like we could have large and separate living and dining areas, which is not possible in new four-room BTO layouts.”

(Well, we wouldn’t say it’s impossible for newer flats, but it could require quite a bit of work, like extending the living room area. -Editor)

There is also no refuse chute inside the unit, something they both count as a plus. While some homeowners prefer the old chute-in-the-kitchen, more buyers these days consider it less hygienic, as it’s a common source of pests.

Budgeting and financing the flat

With less than six years of combined working experience, the couple’s CPF balances were modest. This meant relying more on cash upfront, so they planned early.

They used HDB’s online calculators to estimate affordability. They also spoke to contractors early to get renovation quotations, and furnishing mainly involved browsing Taobao to get a sense of overall costs.

Family support helped with certain parts of the renovation and furniture. It was not required, but it allowed them to upgrade specific finishes and buy pieces they really liked. Overall, the finances were described as challenging but manageable. In this sense, being able to avoid the substantially higher price of a resale flat helped a lot – another good reason to seriously consider SBF offerings.

Advice for future buyers considering SBF, resale, or BTO

For buyers torn between the three routes, the couple believes it really comes down to practical timing, tolerance for older flats, and how much you value certainty.

Their biggest takeaway was how helpful it was to actually visit the block before choosing (if it’s an SBF flat that’s already completed). While you could also do this for resale, they note that SBF is a good middle ground if you want your own place soon, but don’t want to pay resale prices.

However, they also warn that SBF buyers need to be mentally prepared for older layouts, older blocks, and any quirks that come with them. Some SBF units are returned for reasons that may not always be clear. “We’re not superstitious, so the unit’s history didn’t matter to us,” they said, “but everyone has different comfort levels.”

The couple also says the most important element is to be flexible, when considering SBF units. “The flat might not tick every box on paper,” they said, “but seeing it in person can change your mind.”

For more insights into their journey, do follow them on Instagram.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments