$2 Million Dollar HDB: Is The Agent Really To Blame?

May 12, 2024

If you have an unrealistic boss, ask a realtor how to cope.

The often-overlooked benefit(?) of being a property agent is that, after a while, you learn to accommodate a wide range of delusions. Realtors have, for instance, the ability to believe that someone is in a “rush to sell,” whilst also believing that person wants to “take their time to find a better offer.” I’m not sure how they reconcile this kind of client request, but they somehow do.

Perhaps the pinnacle of it is when it comes to asking prices. You know what I’m getting at right? The two flats that were listed for $2 million recently: a DBSS unit and a jumbo flat respectively. I can’t link you to them now, because they’ve been taken down, following a CEA investigation no less.

Mind you, it could never have been a $2 million unit anyway – the “jumbo flat” turned out to be two adjacent units that couldn’t be merged; and the DBSS flat hadn’t even been registered with intent to sell. It’s a little beyond me why the agent would even bother to put up the listings.

But this situation does make me wonder: did the asking prices and listing method come at the suggestion of a property agent, or does it reflect the instructions of a seller? And if a seller insists that an agent list their property at an outrageous price, are there going to be restrictions on whether an agent’s allowed to go ahead?

In this immediate situation, the government is fast to respond because it involves HDB flats. There are major political and social ramifications for this housing segment, and I can see how these listings could push the narrative that flats are super-unaffordable.

(You and I may be aware that resale flat prices don’t reflect BTO prices, etc., but you’d be surprised how many people outside the industry don’t know the difference, or think the two are really close).

But would we see the same brutally fast crackdown, if it was a listing for private properties? I doubt there’ll be as much concern if some highly-disconnected seller (and their overly-agreeable agent) decides to market a resale one-bedder for $3 million, or something equally absurd.

This does raise the question of whether there should be similar meddling in the private market, when it comes to listings. After all, allowing for exaggerated listing prices – if enough people do it or perhaps even collaborate to do it – can artificially drive up the price of private housing.

More from Stacked

Humility Is The Greatest Investment Strategy. Here’re 5 Reasons Why.

I listened to the story with fascination as the property agent shared with me the story about how his seller…

In any case, I see some ominous shadows for property portals here; they might end up having to do additional policing on resale flat listings.

(If I were the government, I would require that property portals have a little tag that says “average prices in this HDB town were XYZ,” placed within every resale flat listing. I think that little bit would make a huge difference).

Above all though, the one who has to bear the brunt of all this is the realtor. If they accommodate their client, they get slammed by the internet and possibly CEA, because their name is on the listing. If they insist on having a more reasonable price, the client drops them, and they’re left desperately looking for something to sell (and in market situations like 2024, finding sellers can be much harder than finding buyers).

Meanwhile, in other property news…

- When is it time to finally lower your asking price? After a month? Two months? Before CEA notices? Here’s some advice from property agents.

- Rare high-ceiling HDB units are not always as expensive as you may think; we found some that start from $480,000.

- It’s one of the most prevalent home ownership questions: Get your BTO as early as you can in your 30s, or wait till you’re more comfortable?

- Small condos tend to skip over the tennis court, but there are some where you can still get your weekly matches in.

Weekly Sales Roundup (29 April – 05 May)

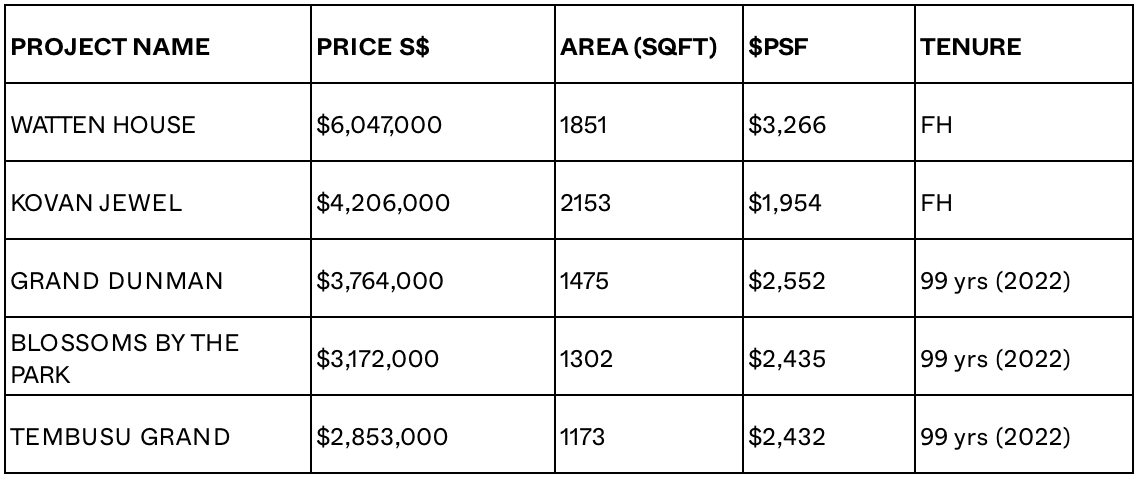

Top 5 Most Expensive New Sales (By Project)

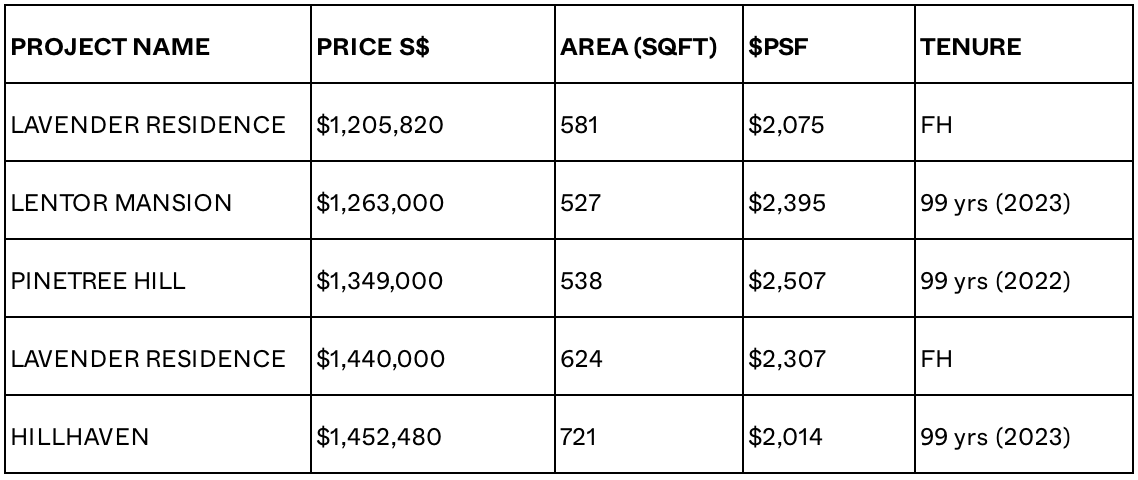

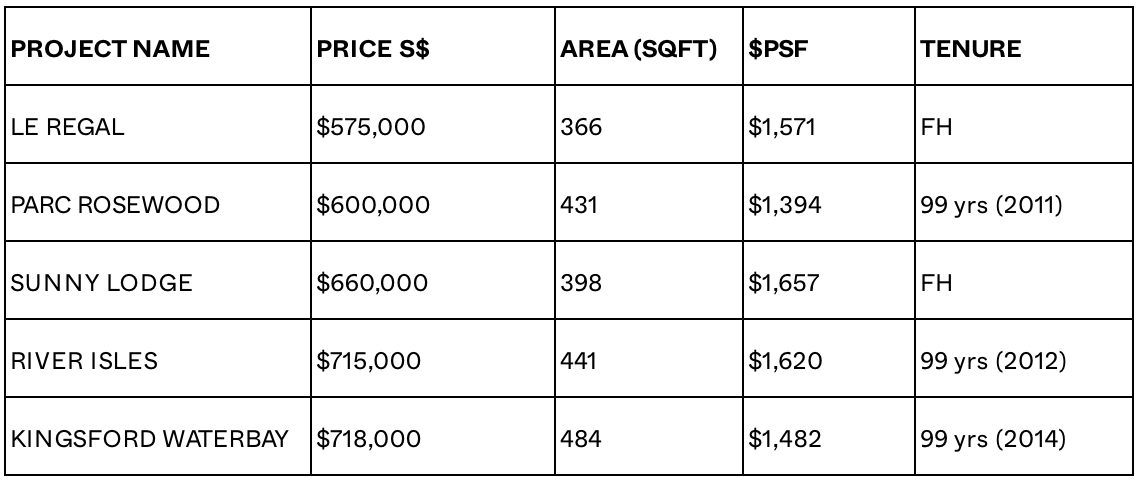

Top 5 Cheapest New Sales (By Project)

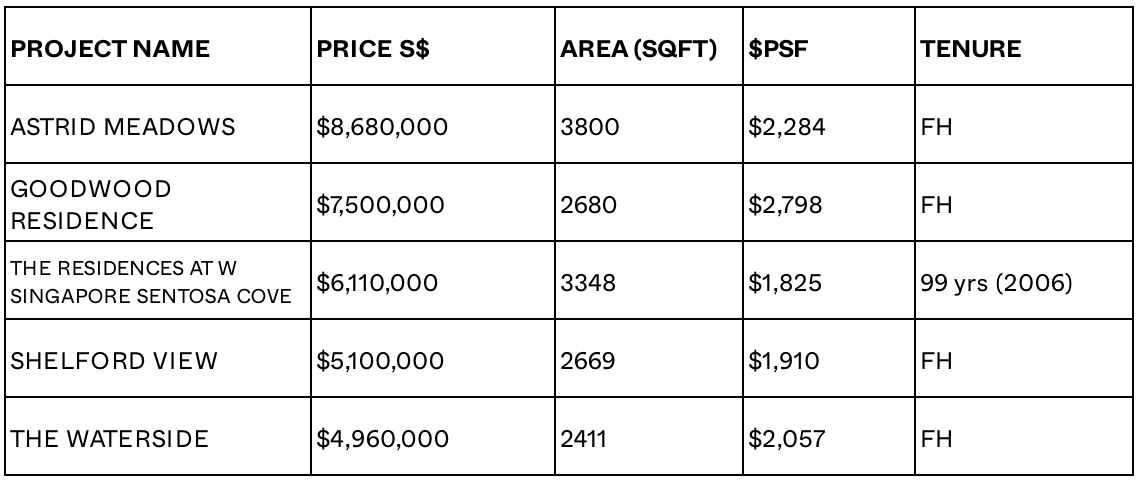

Top 5 Most Expensive Resale

Top 5 Cheapest Resale

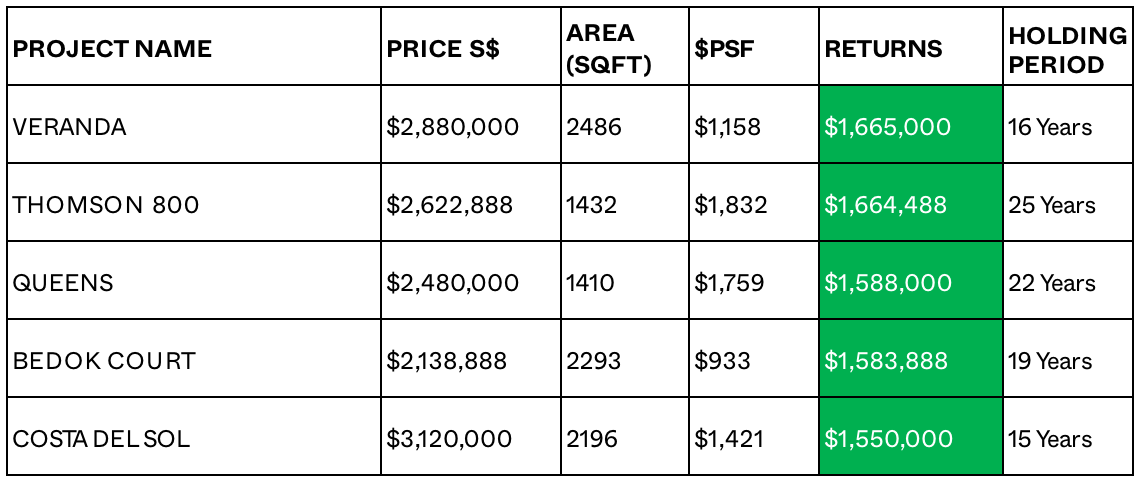

Top 5 Biggest Winners

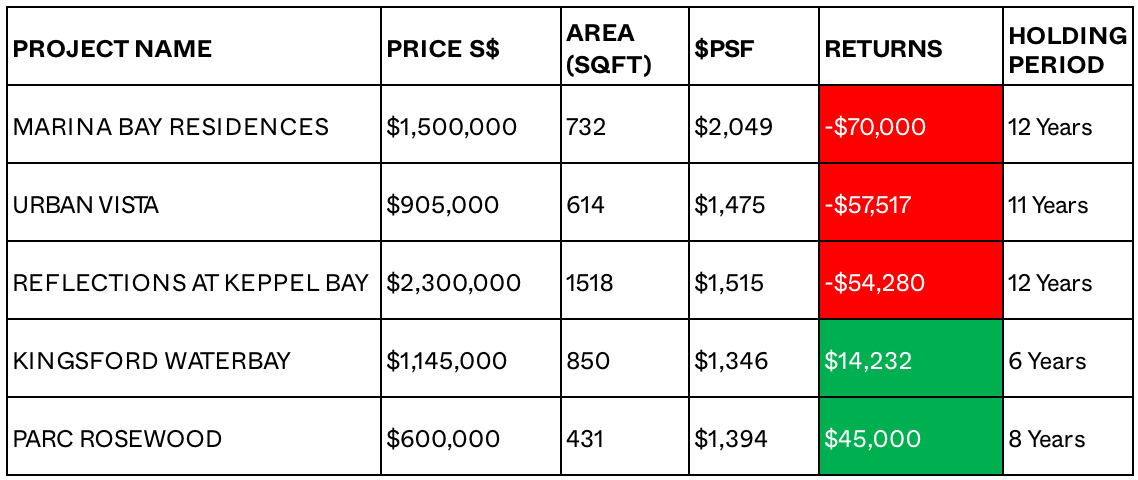

Top 5 Biggest Losers

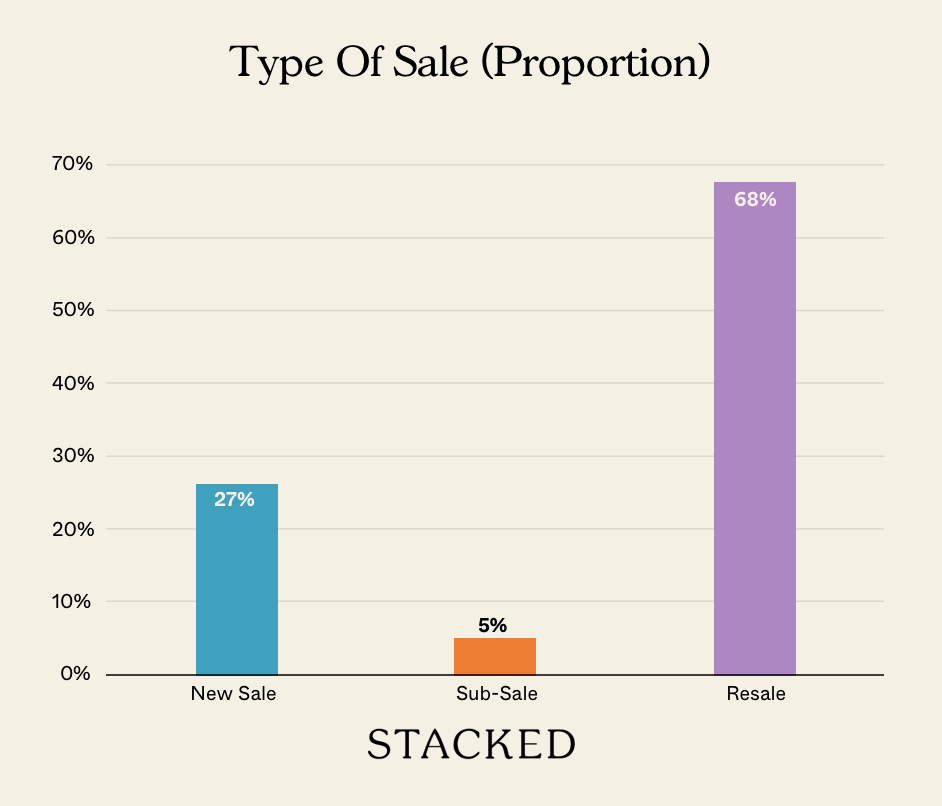

Transaction Breakdown

For news on the Singapore property market, as well as reviews of new and resale projects, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Are property agents responsible for listing prices that are too high or unrealistic?

Why did the government take down the $2 million flat listings?

Should property portals regulate resale flat listings to prevent inflated prices?

What happens to real estate agents if they try to push for reasonable prices?

Is there a difference in how the government responds to inflated listings for HDB flats versus private properties?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

0 Comments