This New 706-Unit Integrated Condo near River Valley Starts From $1.298M – And the Price Raises a Big Question for Buyers

October 8, 2025

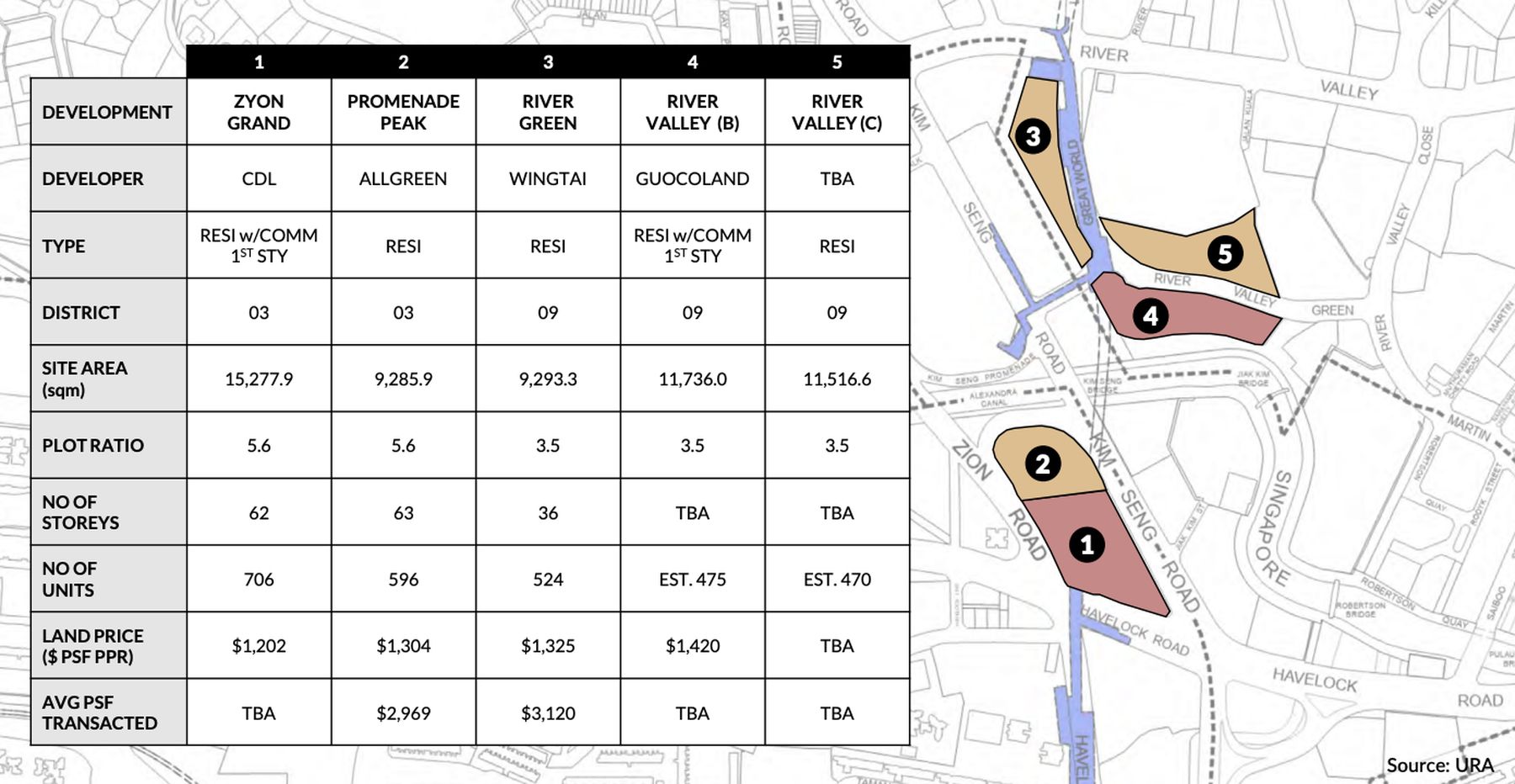

Long associated with high-end projects, River Valley has become one of the busiest launch zones in 2025. A wave of new developments has arrived in quick succession, often at prices not far off from recent OCR launches like Parktown Residence.

The latest is Zyon Grand: a 706-unit integrated development with retail at the base and direct MRT access, located beside Promenade Peak. It represents an almost perfect combination of what Singaporeans love most, the scale of a near-mega development paired with the convenience of an integrated project. And it lands at an interesting moment for the neighbourhood.

With all these new entrants to the area, questions of oversupply are inevitable. And with decentralised living now well established, where families in Tampines or Punggol enjoy near-equivalent convenience, the old draw of “city living” faces new scrutiny.

Even so, River Valley retains advantages that are difficult to replicate: riverfront walks at Robertson Quay, the daily ease of Great World City, and proximity to River Valley Primary. These continue to underpin demand, even as lifestyle preferences evolve elsewhere.

Zyon Grand adds a new layer to that story. As Singapore’s first SA2 pilot project with an integrated component, its site at Zion Road Parcel A was awarded at $1,202 psf ppr; the second-lowest land rate among recent RCR plots.

Yet despite its integrated nature, early prices are unexpectedly accessible: two-bedroom units start from about $1.468 million (~$2,730 psf), on par with Parktown Residence in Tampines. Smaller 1 Bedroom + Study units begin at around $1.298 million.

And if there were any doubts about demand, recent launches suggest otherwise: River Green’s affordable entry point saw it almost sell out, while Promenade Peak has also achieved healthy take-up. Together, they underline that buyers are still willing to commit to River Valley, provided the positioning and pricing are right.

Here’s a closer look at what we know about Zyon Grand so far.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Overview of Zyon Grand

| Project Name | Zyon Grand |

| Location | 3 & 5 Kim Seng Road |

| Developer | JV between CDL & Mitsui Fudosan |

| Tenure | 99-year Leasehold |

| Site area | 15,277.9 sqm (est. 164,450 sq ft) |

| GFA Harmonised? | Yes |

| No. of Units | 706 Residential Units |

| Est. TOP | 2030 |

Zyon Grand is the third of five new launches in the Great World–River Valley area, and currently the only one released with an integrated residential component (the other being River Valley Parcel B nearby, which has yet to be launched).

Sitting between Kim Seng Road and Zion Road, the project is surrounded by a wide mix of HDBs, condominiums, malls, hotels, and lifestyle amenities.

It offers 706 residential units on a 99-year leasehold plot, and will come with a supermarket, an early childhood development centre, and 23 commercial units for rent, which allows the developer to curate the tenant mix and avoid less relevant trades. (e.g. travel agency).

While the retail vendors have not been confirmed, word is that some of the 23 units will be F&B outlets. Given its proximity to Zion Riverside Food Centre, Great World City, and Robertson Quay (all already strong F&B destinations), these outlets are likely to serve as a complement rather than a core draw. Residents will also benefit from direct access to Havelock MRT (TEL), with Great World MRT (TEL) just a short walk away.

The development comprises three towers: two residential blocks rising 62 storeys, and one SA2 block of 36 storeys. The overall site spans about 164,450 sq ft, bigger than Promenade Peak’s 99,953 sq ft site.

As for the developers, CDL needs little introduction.

They are behind recent launches such as Norwood Grand, Tembusu Grand, The Myst, CanningHill Piers, Irwell Hill Residences, Boulevard 88, and Whistler Grand.

Mitsui Fudosan, by contrast, is not a household name in Singapore’s residential scene, though it is a major Japanese real estate developer with a global portfolio. Locally, Mitsui has typically partnered with other players, most notably through TID (a Hong Leong–Mitsui JV) with projects like Lentoria and Lentor Hills, and as part of the consortium for the Jurong Lake District master planning.

Zyon Grand is expected to TOP in 2030.

Unit mix & configurations

At Zyon Grand, the unit mix spans from 1+Study- to 5-bedroom units. Here’s a quick overview:

| Unit Type | Est. Size (sq ft) | Total Units | Unit Breakdown |

| 1 Bedroom + Study | 474 | 59 | 8.4% |

| 2 Bedroom | 538 | 59 | 33.4% |

| 2 Bedroom Premium | 646 | 59 | |

| 2 Bedroom Premium + Study | 721 | 118 | |

| 3 Bedroom | 818 | 59 | 41.5% |

| 3 Bedroom Deluxe | 861 | 118 | |

| 3 Bedroom Premium + Study | 1,055 / 1,076 | 116 | |

| 4 Bedroom Premium (w/ Private Lift) | 1,421 | 40 | 13.9% |

| 4 Bedroom Supreme (w/ Private Lift) | 1,518 | 40 | |

| 4 Bedroom Supreme + Study (w/ Private Lift) | 1,615 | 18 | |

| 5 Bedroom Supreme (w/ Private Lift) | 1,819 | 18 | 2.8% |

| Penthouse (w/ Private Lift) | 2,659 / 2,756 | 2 | |

| 706 | 100% | ||

At a glance, Zyon Grand’s unit mix looks similar to Promenade Peak, offering everything from 1+Study to 5-bedroom units. But once you dive deeper, the spread is quite different.

Promenade Peak has a heavier focus on 2-bedders, which make up more than half its total. Zyon Grand, though, takes a different approach. 42 per cent of the unit mix are 3-bedders, suggesting a stronger emphasis on family living. While the sizes are a little more compact for each of the unit types, it does signal the developer’s confidence in the location for families.

Interestingly, what stands out most is how few 1-bedders there are (less than 10 per cent of the unit mix!), which goes to show how the appeal of such small unit types has shifted in that market. That said, both projects are GFA-harmonised, which means layouts are generally more efficient than older resale counterparts. At Zyon Grand, only the 2-bedroom premium units and above will come with balconies, which some may see as a positive (more indoor space).

On the other hand, 4-bedders and larger will be fitted with private lifts, adding a touch of exclusivity.

In terms of facilities, Zyon Grand comes with the full suite, including a tennis/pickleball court, a 50-metre lap pool, a dedicated pets’ area, and a range of kids-themed amenities.

To make the most of its height, communal spaces are also planned on the 22nd and 43rd floors, giving residents the chance to take in neighbourhood views from above. Importantly, these facilities are reserved for Zyon Grand residents only, so you won’t need to worry about sharing them with occupants from the SA2 block.

More from Stacked

This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

The development of Newport Residences marks some firsts for a new luxury residential project in the CBD. It's a redevelopment…

The location of Zyon Grand

The River Valley–Zion area has always attracted buyers for a few simple reasons: its proximity to town and Orchard, the breadth of amenities nearby, from Zion Riverside Food Centre and Great World to Robertson Quay and Clarke Quay, and the ease of accessing green spaces while still being in the city centre.

As an added note on the location, both Zion Road Parcels A and B were just empty plots, with much of the supporting infrastructure already in place. So even with Zyon Grand’s addition, little has changed in terms of day-to-day convenience. That’s the advantage of moving into an established estate: the amenities are already here.

In fact, here’s a snapshot that I managed to take of the empty Zion Road Parcels A&B before they were boarded up for construction.

What also makes this pocket interesting is its variety. You’ll find HDB flats alongside hotels, luxury condos, and even conserved sites, a mix that gives the neighbourhood character and distinction from your average neighbourhood in Singapore. All of this forms the backdrop to Zyon Grand’s own positioning.

Integrated project + the first SA2 pilot project in Singapore

Beyond being just another condo in River Valley, it comes with two defining features: an integrated retail podium with direct MRT access, and the fact that it is Singapore’s first SA2 pilot project.

For those unfamiliar, SA2 refers to long-stay serviced apartments; essentially, rental units designed for tenants who want to stay a few months or longer. Think of it as a middle ground between conventional condos and short-term serviced apartments: you’ll still get your own en-suite space, but layouts can vary, with some units sharing common facilities like kitchens and living areas.

Unlike typical condominiums, these apartments are intended solely for rental and will be managed by a single operator. For now, though, there’s no word yet on who that will be.

As this is the first SA2 project in Singapore, its implications are still unclear. There’s naturally some uncertainty over how well it will be received, and buyers who prefer a quieter, purely residential environment may wonder how the mix of serviced apartments and private condos will play out in practice.

On the other hand, a steady stream of long-stay tenants could help sustain footfall for the retail podium and contribute to the overall vibrancy of the development. With a minimum stay of three months, it also avoids the constant turnover that comes with short-term rentals.

Lowest acquired land price in the RCR, but what does it mean for buyers?

As mentioned, Zyon Grand’s site was acquired at just $1,202 psf ppr, making it one of the most affordable RCR plots in recent years.

On paper, that looks like a strong starting point for pricing, especially for an integrated project with direct MRT access.

That said, the comparison isn’t entirely straightforward. Since the site includes a commercial component, its breakeven costs aren’t directly comparable to pure residential plots nearby. Much will depend on how the developers decide to balance their pricing strategy against other launches in the area.

For context:

- Promenade Peak (Zion Road Parcel B): $1,304 psf ppr (54 per cent sold, average of $3,343 psf),

- River Green: $1,325 psf ppr (88 per cent sold, average of $3,130 psf), and

- Skye at Holland: $1,285 psf ppr (yet to launch, though its preview drew 8,000 visitors).

Zyon Grand’s land cost even came in lower than the second Chuan Grove site ($1,376 psf ppr) and Bayshore’s first GLS plot ($1,388 psf ppr); all strong indicators that this is, at least on paper, an attractively priced site.

How Zyon Grand is Priced

Despite those initial concerns, launch prices at Zyon Grand are surprisingly digestible for a centrally integrated project. Prices are as such:

- 1-Bedroom + Study: Starts from $1,298m (~$2,738 psf)

- 2-Bedroom: Starts from $1.468m (~$2,729 psf)

- 3-Bedroom: Starts from $2.2m (~$2,689 psf)

- 4-Bedroom Premium: Starts from $3.968m (~$2,792 psf)

- 5-Bedroom Supreme: Starts from $5.988m (~$3,292 psf)

For context, these figures aren’t far off from Parktown Residence in Tampines North and are certainly competitive for an integrated project in the city centre.

That said, buyers should temper expectations. These are typically headline prices and are often for one or two lower-floor units. It’s not far-fetched to expect prices to move upwards through launch day, given how high the project goes in terms of height.

Even so, the starting points here are undeniably attractive. Zyon Grand offers one of the more accessible entry prices for new homes in River Valley, at least for now. And recent launches suggest the market has already accepted higher benchmarks.

Promenade Peak launched from $2,600 psf and averaged $3,343 psf on launch day, while River Green started from $2,846 psf and averaged $3,130 psf.

On the other hand, here’s a look at how the resale options are performing in the vicinity:

| Project | Tenure | TOP | Average $PSF |

| The Avenir | Freehold | 2024 | $3,431 |

| Rivergate | Freehold | 2009 | $2,675 |

| Rivière | 99 LH | 2023 | $2,814 |

| Irwell Hill Residences | 99 LH | 2024 | $2,941 |

| Martin Modern | 99 LH | 2021 | $2,727 |

Broadly speaking, prices for resale options start from around $2,600 psf, with the market already showing acceptance of the $3,000 psf mark, particularly with freehold projects like The Avenir. This pocket of River Valley has long been known for its older freehold stalwarts (The Trillium, The Cosmopolitan, Tiara), which continue to hold their value well.

Rental demand is also healthy, as this stretch remains a hotspot for expatriates seeking proximity to the city and the river.

And when you consider that some of Zyon Grand’s starting prices sit below certain resale 99-year leasehold developments nearby (and that it comes with an integrated component), it does start to look like a rather compelling proposition, especially for those who’ve always had their eye on this neighbourhood.

Our take

On paper, Zyon Grand ticks many of the right boxes: it’s central, MRT-linked, comes with integrated retail, and was acquired at one of the lowest land prices in the RCR.

At launch, what stands out most is the pricing.

For an integrated project in River Valley starting from $1.298 million for a one-bedder plus study, and $1.468 million for a two-bedder, is surprisingly reasonable. It’s not cheap, but it’s a price point that puts city living back on the table for those who have long written it off (stay tuned for our full review and pricing review).

And if CDL’s track record (they were also behind the successful Irwell Hill Residences) is anything to go by, it’s fair to expect they know what works for this neighbourhood.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

2 Comments

This project certainly ticks many boxes but I am wondering how a single private lift can cope with 62 floors for the 4/5 bedders. I stay in a 26F condo with single private lift and I think that’s the minimum ratio. It can get a bit busy in the morning when many families send their kids to school all around the same time. For comparison, Perfect Ten Condo has 24 floors and it comes with 2 private lifts per unit.

Also a shame there is no view of MBS fireworks due to North-South orientation. Not even from the sky terraces. Promenade Peak does a better job in this regard.

Will there be a detailed analysis of Zyon (like what has been done for Skye and Penrith)?